Professional Documents

Culture Documents

1CO2000A0717

Uploaded by

NewYorkObserverOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1CO2000A0717

Uploaded by

NewYorkObserverCopyright:

Available Formats

Postings

26%: While average rental rates are up

across the board, it was Midtown South that

once again saw huge increases, in particular

among Class A properties, where rents jumped

26 percent to $66.19. On the one hand,

they are the best buildings in that particular

or those who saw signs of improvement in the market earlier this month, look

market, but you cant compare them to, like,

a Bank of America Tower or something like

again. While not neccessarily worse than the previous reporting period, secondthattheyre not top-tier buildings in that

quarter office leasing was propped up primarily by a pair of big renewal deals

sense, said Mr. McCarthy. But theyre in

inked for Viacom and Morgan & Stanley. A closer look at the numbers, meanwhile, seem

the right

place at the right time, so theyre

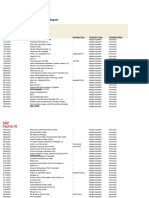

MANHATTAN OFFICE MARKET - SECOND QUARTER

2012

definitely commanding premiums.

to suggest that leasing in nearly every asset class is down, down, downnot least of

2nd Quarter Blues

all in Midtown, where Class A office leasing plummeted by 50 percent. With the help

MANHATTAN

OFFICE

MARKET

- SECOND QUARTER 2012 -49.0%: The year-over-year change in Midtown

of Cushman & Wakefields first-quarter statistics,

and the firms

lead researcher

Ken

office leasing this quarter looks particularly bleak

Quarter 2012

MANHATTAN

OFFICE

MARKET

- SECOND QUARTER 2012 thanks to a notably flush office market 12 Second

months

McCarthy, The Commercial Observer took a look

at Manhattans

three primary

office

MANHATTAN OFFICE MARKET

Class A Statistical Summary

Submarket

Downtown

Total

Direct

Y-o-Y

Sublease

Direct

Sublease

Total

Y-o-Y

Direct

Midtown South

Totals

Submarket

Downtown

Inventory

Space

Space

Space

Rate

Rate

Rate

Available

Available

Vacancy

Vacancy

Vacancy

3,416,364

Direct

Direct

Available

Available

Space

19,720,062

15,640,935

Space

819,781

Sublease

Sublease

Available

Available

Space

4,596,780

3,713,249

Space

7.2%

Direct

Direct

Vacancy

Vacancy

Rate

8.1%

8.6%

Rate

1.7%

Sublease

Sublease

Vacancy

Vacancy

Rate

1.9%

2.1%

Rate

9.0%

Total

Total

Vacancy

Vacancy

Rate

10.0%

10.7%

Rate

662,763

15,640,935

3,416,364

3,495,341

Direct

Direct

662,763

Available

1,389,505

Available

Space

19,720,062

3,416,364

Space

Direct

2,303,304

Direct

Available

Available

Space

15,640,935

19,720,062

3,495,341

7,188,150

Space

662,763

1,389,505

15,640,935

3,416,364

3,495,341

2,303,304

Direct

662,763

1,389,505

Available

19,720,062

3,416,364

7,188,150

Space

2,303,304

Direct

Direct

Available

19,720,062

Available

Space

7,188,150

3,495,341

Space

63,750

3,713,249

819,781

221,388

Sublease

Sublease

63,750

Available

230,804

Available

Space

4,596,780

819,781

Space

Sublease

419,462

Sublease

Available

Available

Space

3,713,249

4,596,780

221,388

871,654

Space

63,750

230,804

3,713,249

819,781

221,388

419,462

Sublease

63,750

230,804

Available

4,596,780

819,781

871,654

Space

419,462

Sublease

Sublease

Available

4,596,780

Available

Space

871,654

221,388

Space

4.6%

8.6%

7.2%

7.8%

Direct

Direct

4.6%

Vacancy

4.7%

Vacancy

Rate

8.1%

7.2%

Rate

Direct

8.3%

Direct

Vacancy

Vacancy

Rate

8.6%

8.1%

7.8%

7.1%

Rate

4.6%

4.7%

8.6%

7.2%

7.8%

8.3%

Direct

4.6%

4.7%

Vacancy

8.1%

7.2%

7.1%

Rate

8.3%

Direct

Direct

Vacancy

8.1%

Vacancy

Rate

7.1%

7.8%

Rate

0.4%

2.1%

1.7%

0.5%

Sublease

Sublease

0.4%

Vacancy

0.8%

Vacancy

Rate

1.9%

1.7%

Rate

Sublease

1.5%

Sublease

Vacancy

Vacancy

Rate

2.1%

1.9%

0.5%

0.9%

Rate

0.4%

0.8%

2.1%

1.7%

0.5%

1.5%

Sublease

0.4%

0.8%

Vacancy

1.9%

1.7%

0.9%

Rate

1.5%

Sublease

Sublease

Vacancy

1.9%

Vacancy

Rate

0.9%

0.5%

Rate

5.1%

10.7%

9.0%

8.3%

Total

Total

5.1%

Vacancy

5.5%

Vacancy

Rate

10.0%

9.0%

Rate

Total

9.8%

Total

Vacancy

Vacancy

Rate

10.7%

10.0%

8.3%

7.9%

Rate

5.1%

5.5%

10.7%

9.0%

8.3%

9.8%

Total

5.1%

5.5%

Vacancy

10.0%

9.0%

7.9%

Rate

9.8%

Total

Total

Vacancy

10.0%

Vacancy

Rate

7.9%

8.3%

Rate

1,389,505

3,495,341

2,303,304

667,205

Direct

Direct

1,389,505

Available

1,506,108

Available

Space

7,188,150

2,303,304

Space

Direct

642,963

Direct

Available

Available

Space

3,495,341

7,188,150

667,205

2,816,276

Space

1,389,505

1,506,108

3,495,341

2,303,304

667,205

642,963

Direct

1,389,505

1,506,108

Available

7,188,150

2,303,304

2,816,276

Space

642,963

Direct

Direct

Available

7,188,150

Available

Space

2,816,276

667,205

Space

1,506,108

667,205

642,963

19,803,481

Direct

Direct

1,506,108

Available

3,558,376

Available

Space

2,816,276

642,963

Space

Direct

6,362,631

Direct

Available

Available

Space

667,205

2,816,276

19,803,481

29,724,488

Space

1,506,108

3,558,376

667,205

642,963

19,803,481

6,362,631

Direct

1,506,108

3,558,376

Available

2,816,276

642,963

29,724,488

Space

6,362,631

Direct

Available

2,816,276

Space

29,724,488

19,803,481

230,804

221,388

419,462

45,306

Sublease

Sublease

230,804

Available

100,426

Available

Space

871,654

419,462

Space

Sublease

5,407

Sublease

Available

Available

Space

221,388

871,654

45,306

151,139

Space

230,804

100,426

221,388

419,462

45,306

5,407

Sublease

230,804

100,426

Available

871,654

419,462

151,139

Space

5,407

Sublease

Sublease

Available

871,654

Available

Space

151,139

45,306

Space

100,426

45,306

5,407

3,979,943

Sublease

Sublease

100,426

Available

394,980

Available

Space

151,139

5,407

Space

Sublease

1,244,650

Sublease

Available

Available

Space

45,306

151,139

3,979,943

5,619,573

Space

100,426

394,980

45,306

5,407

3,979,943

1,244,650

Sublease

100,426

394,980

Available

151,139

5,407

5,619,573

Space

1,244,650

Sublease

Available

151,139

Space

5,619,573

3,979,943

4.7%

7.8%

8.3%

4.2%

Direct

Direct

4.7%

Vacancy

7.1%

Vacancy

Rate

7.1%

8.3%

Rate

Direct

6.2%

Direct

Vacancy

Vacancy

Rate

7.8%

7.1%

4.2%

5.9%

Rate

4.7%

7.1%

7.8%

8.3%

4.2%

6.2%

Direct

4.7%

7.1%

Vacancy

7.1%

8.3%

5.9%

Rate

6.2%

Direct

Direct

Vacancy

7.1%

Vacancy

Rate

5.9%

4.2%

Rate

7.1%

4.2%

6.2%

8.2%

Direct

Direct

7.1%

Vacancy

5.5%

Vacancy

Rate

5.9%

6.2%

Rate

Direct

7.5%

Direct

Vacancy

Vacancy

Rate

4.2%

5.9%

8.2%

7.6%

Rate

7.1%

5.5%

4.2%

6.2%

8.2%

7.5%

Direct

7.1%

5.5%

Vacancy

5.9%

6.2%

7.6%

Rate

7.5%

Direct

Vacancy

5.9%

Rate

7.6%

8.2%

0.8%

0.5%

1.5%

0.3%

Sublease

Sublease

0.8%

Vacancy

0.5%

Vacancy

Rate

0.9%

1.5%

Rate

Sublease

0.1%

Sublease

Vacancy

Vacancy

Rate

0.5%

0.9%

0.3%

0.3%

Rate

0.8%

0.5%

0.5%

1.5%

0.3%

0.1%

Sublease

0.8%

0.5%

Vacancy

0.9%

1.5%

0.3%

Rate

0.1%

Sublease

Sublease

Vacancy

0.9%

Vacancy

Rate

0.3%

0.3%

Rate

0.5%

0.3%

0.1%

1.6%

Sublease

Sublease

0.5%

Vacancy

0.6%

Vacancy

Rate

0.3%

0.1%

Rate

Sublease

1.5%

Sublease

Vacancy

Vacancy

Rate

0.3%

0.3%

1.6%

1.4%

Rate

0.5%

0.6%

0.3%

0.1%

1.6%

1.5%

Sublease

0.5%

0.6%

Vacancy

0.3%

0.1%

1.4%

Rate

1.5%

Sublease

Vacancy

0.3%

Rate

1.4%

1.6%

5.5%

8.3%

9.8%

4.5%

Total

Total

5.5%

Vacancy

7.6%

Vacancy

Rate

7.9%

9.8%

Rate

Total

6.3%

Total

Vacancy

Vacancy

Rate

8.3%

7.9%

4.5%

6.2%

Rate

5.5%

7.6%

8.3%

9.8%

4.5%

6.3%

Total

5.5%

7.6%

Vacancy

7.9%

9.8%

6.2%

Rate

6.3%

Total

Total

Vacancy

7.9%

Vacancy

Rate

6.2%

4.5%

Rate

7.6%

4.5%

6.3%

9.8%

Total

Total

7.6%

Vacancy

6.1%

Vacancy

Rate

6.2%

6.3%

Rate

Total

8.9%

Total

Vacancy

Vacancy

Rate

4.5%

6.2%

9.8%

9.0%

Rate

7.6%

6.1%

4.5%

6.3%

9.8%

8.9%

Total

7.6%

6.1%

Vacancy

6.2%

6.3%

9.0%

Rate

8.9%

Total

Vacancy

6.2%

Rate

9.0%

9.8%

Rental Rate

Available

46

47,141,922

Number of

Buildings

Inventory

393

242,519,670

46

47,141,922

Buildings

Inventory

57

27,758,202

Number of

Number

of

Buildings

Midtown

320 MARKET

180,995,042

Submarket

Inventory

Totals

393

242,519,670

MANHATTAN

OFFICE

Midtown

328

44,581,134

Totals

569

101,655,838

Buildings

Inventory

Submarket

Midtown

27

14,382,706

Class BSouth

Statistical Summary

Midtown

South

184

29,316,502

Midtown

320

180,995,042

MANHATTAN

Downtown

46 MARKET

47,141,922

MANHATTAN OFFICE

OFFICE

Midtown

328

44,581,134

Downtown

57 MARKET

27,758,202

Midtown

South

27

14,382,706

Class

B

Statistical

Summary

Class CSouth

Statistical

Summary

Midtown

184 of

29,316,502

Number

Totals

393

242,519,670

Downtown

46

47,141,922

Totals

569

101,655,838

Buildings

Inventory

Submarket

Downtown

57

27,758,202

Submarket

Totals

Downtown

Submarket

Downtown

Number of

MANHATTAN

OFFICE

Totals

393MARKET

242,519,670

Number

of

Buildings

MANHATTAN

OFFICE

Inventory

Submarket

Totals

569

101,655,838

Midtown

328 MARKET

44,581,134

Submarket

Class B StatisticalBuildings

Summary Inventory

Class CSouth

Statistical Summary

Midtown

184

29,316,502

MANHATTAN OFFICE MARKET

Midtown

328

44,581,134

MANHATTAN OFFICE

Downtown

57 MARKET

27,758,202

Midtown

150

15,930,081

Class BSouth

Statistical Summary

Midtown

184

29,316,502

Number

of

Class CSouth

Statistical

Summary

Midtown

215 of

21,252,007

Number

Buildings

Inventory

Submarket

Totals

569

101,655,838

Downtown

57

27,758,202

Buildings

Inventory

Submarket

Downtown

74

10,352,397

Number of

Number

of

Buildings

Midtown

328 MARKET

44,581,134

Inventory

Submarket

Totals

569

101,655,838

MANHATTAN

OFFICE

Midtown

150

15,930,081

Totals

439

47,534,485

Buildings

Inventory

Submarket

Midtown

184

29,316,502

Class CSouth

Statistical Summary

Midtown

South

215

21,252,007

Midtown

328

44,581,134

MANHATTAN

Downtown

57 MARKET

27,758,202

MANHATTAN OFFICE

OFFICE

Midtown

150

15,930,081

Downtown

74 MARKET

10,352,397

Midtown

South

184

29,316,502

Class

C

Statistical

Summary

OverallSouth

Statistical

Summary

Midtown

215 of

21,252,007

Number

Totals

569

101,655,838

Downtown

57

27,758,202

Totals

439

47,534,485

Buildings

Inventory

Submarket

Downtown

74

10,352,397

Number of

MANHATTAN

OFFICE

Totals

569MARKET

101,655,838

Number

of

Buildings

MANHATTAN

OFFICE

Inventory

Submarket

Totals

439

47,534,485

Midtown

150 MARKET

15,930,081

Submarket

Class C StatisticalBuildings

Summary Inventory

OverallSouth

Statistical Summary

Midtown

215

21,252,007

MANHATTAN OFFICE MARKET

Midtown

150 MARKET

15,930,081

MANHATTAN OFFICE

Downtown

74

10,352,397

Midtown

798

241,506,257

Class

C

Statistical

Summary

Midtown

South

215

21,252,007

Number

OverallSouth

Statistical

Summary

Midtown

426 of

64,951,215

Number

of

Buildings

Inventory

Submarket

Totals

439

47,534,485

Downtown

74

10,352,397

Buildings

Submarket

Inventory

Downtown

177

85,252,521

Number of

Number

of

Buildings

Midtown

150 MARKET

15,930,081

Inventory

Submarket

Totals

439

47,534,485

MANHATTAN

OFFICE

Midtown

798

241,506,257

Totals

1401

391,709,993

Buildings

Submarket

Inventory

Midtown

South

215

21,252,007

OverallSouth

Statistical Summary

Midtown

426

64,951,215

Midtown

150

15,930,081

MANHATTAN OFFICE

Downtown

74 MARKET

10,352,397

Midtown

798

241,506,257

Downtown

177

85,252,521

Midtown

South

215

Overall Statistical Summary 21,252,007

Midtown South

426 of

64,951,215

Number

Totals

439

47,534,485

Downtown

74

10,352,397

Totals

1401

391,709,993

Buildings

Submarket

Inventory

Downtown

177

85,252,521

4,236,145

Total

Total

Available

Available

Space

24,316,842

19,354,184

Space

726,513

19,354,184

4,236,145

3,716,729

Total

Total

726,513

Available

1,620,309

Available

Space

24,316,842

4,236,145

Space

Total

2,722,766

Total

Available

Available

Space

19,354,184

24,316,842

3,716,729

8,059,804

Space

726,513

1,620,309

19,354,184

4,236,145

3,716,729

2,722,766

Total

726,513

1,620,309

Available

24,316,842

4,236,145

8,059,804

Space

2,722,766

Total

Total

Available

24,316,842

Available

Space

8,059,804

3,716,729

Space

1,620,309

3,716,729

2,722,766

712,511

Total

Total

1,620,309

Available

1,606,534

Available

Space

8,059,804

2,722,766

Space

Total

648,370

Total

Available

Available

Space

3,716,729

8,059,804

712,511

2,967,415

Space

1,620,309

1,606,534

3,716,729

2,722,766

712,511

648,370

Total

1,620,309

1,606,534

Available

8,059,804

2,722,766

2,967,415

Space

648,370

Total

Total

Available

8,059,804

Available

Space

2,967,415

712,511

Space

1,606,534

712,511

648,370

23,783,424

Total

Total

1,606,534

Available

3,953,356

Available

Space

2,967,415

648,370

Space

Total

7,607,281

Total

Available

Available

Space

712,511

2,967,415

23,783,424

35,344,061

Space

1,606,534

3,953,356

712,511

648,370

23,783,424

7,607,281

Total

1,606,534

3,953,356

Available

2,967,415

648,370

35,344,061

Space

7,607,281

Total

Available

2,967,415

Space

35,344,061

23,783,424

-3.5%

Y-o-Y

Y-o-Y

% Change

% Change

0.3%

1.5%

-7.6%

1.5%

-3.5%

-6.1%

Y-o-Y

Y-o-Y

-7.6%

%-14.4%

Change

% Change

0.3%

-3.5%

Y-o-Y

1.2%

% Y-o-Y

Change

% 0.3%

Change

1.5%

-6.1%

-5.6%

-7.6%

-14.4%

1.5%

-3.5%

-6.1%

1.2%

-7.6%

Y-o-Y

%-14.4%

Change

0.3%

-3.5%

-5.6%

1.2%

Y-o-Y

Y-o-Y

% Change

% 0.3%

Change

-5.6%

-6.1%

-14.4%

-6.1%

1.2%

3.7%

Y-o-Y

Y-o-Y

%-14.4%

Change

%-18.9%

Change

-5.6%

1.2%

Y-o-Y

-49.4%

% Y-o-Y

Change

%-5.6%

Change

-6.1%

3.7%

-24.9%

-14.4%

-18.9%

-6.1%

1.2%

3.7%

-49.4%

-14.4%

Y-o-Y

%-18.9%

Change

-5.6%

1.2%

-24.9%

-49.4%

Y-o-Y

Y-o-Y

% Change

%-5.6%

Change

-24.9%

3.7%

-18.9%

3.7%

-49.4%

0.3%

Y-o-Y

Y-o-Y

-18.9%

%-15.2%

Change

% Change

-24.9%

-49.4%

Y-o-Y

-9.0%

Y-o-Y

% Change

%-24.9%

Change

3.7%

0.3%

-3.8%

-18.9%

-15.2%

3.7%

-49.4%

0.3%

-9.0%

-18.9%

Y-o-Y

-15.2%

%-24.9%

Change

-49.4%

-3.8%

-9.0%

Y-o-Y

% Change

-24.9%

-3.8%

0.3%

Number of

OFFICE

439MARKET

47,534,485

As for whether the second quarter

Buildings

Inventory

1401

391,709,993

798 $58.86:

241,506,257

Overall Statistical Summary

Midtown South

426

64,951,215

3,953,356

-15.2% quarter

3,558,376

saw

improvements

over the first

of this 394,980

MANHATTAN OFFICE

MARKET

Midtown

798

241,506,257

23,783,424

0.3%

19,803,481

3,979,943

Downtown

177

85,252,521

7,607,281

-9.0%

6,362,631

1,244,650

Total

Direct

Y-o-Y

Mr.64,951,215

McCarthy3,953,356

suggested

that the3,558,376

previous Sublease

Overall Statisticalyear,

Summary

Midtown South

426

-15.2%

394,980

MANHATTAN

Totals

Submarket

Totals

Midtown

Midtown South

Midtown

Downtown

Midtown South

Totals

Downtown

Totals

Total

Rental

Rate

$31.91

Sublease

Wtd. Avg.

$59.55

$54.44

Rental

Rate

Rental

Rate

$45.29

Total

Wtd. Avg.

$71.67

$66.91

Rental

Rate

$46.10

Direct

Direct

Wtd. Avg.

Wtd. Avg.

Rental

Rate

$68.71

$73.67

Rental

Rate

$68.10

$73.67

$46.10

$45.43

Direct

Direct

$68.10

Wtd.

Avg.

$47.58

Wtd.

Avg.

Rental

Rate

$68.71

$46.10

Rental

Rate

Direct

$35.38

Direct

Wtd. Avg.

Wtd.

Avg.

Rental

Rate

$73.67

$68.71

$45.43

$42.63

Rental

Rate

$68.10

$47.58

$73.67

$46.10

$45.43

$35.38

Direct

$68.10

$47.58

Wtd.

Avg.

$68.71

$46.10

$42.63

Rental

Rate

$35.38

Direct

Direct

Wtd. Avg.

$68.71

Wtd.

Avg.

Rental

Rate

$42.63

$45.43

Rental

Rate

$31.91

Sublease

Sublease

Wtd. Avg.

Wtd. Avg.

Rental

Rate

$54.44

$59.55

Rental

Rate

$46.76

$59.55

$31.91

$42.55

Sublease

Sublease

$46.76

Wtd.

Avg.

$52.17

Wtd.

Avg.

Rental

Rate

$54.44

$31.91

Rental

Rate

Sublease

$32.93

Sublease

Wtd. Avg.

Wtd.

Avg.

Rental

Rate

$59.55

$54.44

$42.55

$40.47

Rental

Rate

$46.76

$52.17

$59.55

$31.91

$42.55

$32.93

Sublease

$46.76

$52.17

Wtd.

Avg.

$54.44

$31.91

$40.47

Rental

Rate

$32.93

Sublease

Sublease

Wtd. Avg.

$54.44

Wtd.

Avg.

Rental

Rate

$40.47

$42.55

Rental

Rate

$45.29

Total

Total

Wtd. Avg.

Wtd. Avg.

Rental

Rate

$66.91

$71.67

Rental

Rate

$66.19

$71.67

$45.29

$45.33

Total

Total

$66.19

Wtd.

Avg.

$48.19

Wtd.

Avg.

Rental

Rate

$66.91

$45.29

Rental

Rate

Total

$35.10

Total

Wtd. Avg.

Wtd.

Avg.

Rental

Rate

$71.67

$66.91

$45.33

$42.45

Rental

Rate

$66.19

$48.19

$71.67

$45.29

$45.33

$35.10

Total

$66.19

$48.19

Wtd.

Avg.

$66.91

$45.29

$42.45

Rental

Rate

$35.10

Total

Total

Wtd. Avg.

$66.91

Wtd.

Avg.

Rental

Rate

$42.45

$45.33

Rental

Rate

$47.58

$45.43

$35.38

$36.46

Direct

Direct

$47.58

Wtd.

Avg.

$42.69

Wtd.

Avg.

Rental

Rate

$42.63

$35.38

Rental

Rate

Direct

$30.81

Direct

Wtd.

Avg.

Wtd.

Avg.

Rental

Rate

$45.43

$42.63

$36.46

$38.50

Rental

Rate

$47.58

$42.69

$45.43

$35.38

$36.46

$30.81

Direct

$47.58

$42.69

Wtd.

Avg.

$42.63

$35.38

$38.50

Rental

Rate

$30.81

Direct

Direct

Wtd. Avg.

$42.63

Wtd.

Avg.

Rental

Rate

$38.50

$36.46

Rental Rate

$42.69

$36.46

$30.81

$67.55

Direct

Direct

$42.69

Wtd.

Avg.

$49.38

Wtd.

Avg.

Rental

Rate

$38.50

$30.81

Rental

Rate

Direct

$40.66

Direct

Wtd.

Avg.

Wtd.

Avg.

Rental

Rate

$36.46

$38.50

$67.55

$59.62

Rental

Rate

$42.69

$49.38

$36.46

$30.81

$67.55

$40.66

Direct

$42.69

$49.38

Wtd.

Avg.

$38.50

$30.81

$59.62

Rental

Rate

$40.66

Direct

Wtd. Avg.

$38.50

Rental

Rate

$59.62

$67.55

$52.17

$42.55

$32.93

$33.69

Sublease

Sublease

$52.17

Wtd.

Avg.

$46.43

Wtd.

Avg.

Rental

Rate

$40.47

$32.93

Rental

Rate

Sublease

$35.76

Sublease

Wtd.

Avg.

Wtd.

Avg.

Rental

Rate

$42.55

$40.47

$33.69

$42.23

Rental

Rate

$52.17

$46.43

$42.55

$32.93

$33.69

$35.76

Sublease

$52.17

$46.43

Wtd.

Avg.

$40.47

$32.93

$42.23

Rental

Rate

$35.76

Sublease

Sublease

Wtd. Avg.

$40.47

Wtd.

Avg.

Rental

Rate

$42.23

$33.69

Rental Rate

$46.43

$33.69

$35.76

$58.41

Sublease

Sublease

$46.43

Wtd.

Avg.

$49.93

Wtd.

Avg.

Rental

Rate

$42.23

$35.76

Rental

Rate

Sublease

$32.54

Sublease

Wtd.

Avg.

Wtd.

Avg.

Rental

Rate

$33.69

$42.23

$58.41

$52.08

Rental

Rate

$46.43

$49.93

$33.69

$35.76

$58.41

$32.54

Sublease

$46.43

$49.93

Wtd.

Avg.

$42.23

$35.76

$52.08

Rental

Rate

$32.54

Sublease

Wtd. Avg.

$42.23

Rental

Rate

$52.08

$58.41

$48.19

$45.33

$35.10

$36.29

Total

Total

$48.19

Wtd.

Avg.

$42.85

Wtd.

Avg.

Rental

Rate

$42.45

$35.10

Rental

Rate

Total

$30.85

Total

Wtd.

Avg.

Wtd.

Avg.

Rental

Rate

$45.33

$42.45

$36.29

$38.65

Rental

Rate

$48.19

$42.85

$45.33

$35.10

$36.29

$30.85

Total

$48.19

$42.85

Wtd.

Avg.

$42.45

$35.10

$38.65

Rental

Rate

$30.85

Total

Total

Wtd. Avg.

$42.45

Wtd.

Avg.

Rental

Rate

$38.65

$36.29

Rental Rate

$42.85

$36.29

$30.85

$66.44

Total

Total

$42.85

Wtd.

Avg.

$49.43

Wtd.

Avg.

Rental

Rate

$38.65

$30.85

Rental

Rate

Total

$40.06

Total

Wtd.

Avg.

Wtd.

Avg.

Rental

Rate

$36.29

$38.65

$66.44

$58.86

Rental

Rate

$42.85

$49.43

$36.29

$30.85

$66.44

$40.06

Total

$42.85

$49.43

Wtd.

Avg.

$38.65

$30.85

$58.86

Rental

Rate

$40.06

Total

Wtd. Avg.

$38.65

Rental

Rate

$58.86

$66.44

4,236,145

-3.5%

3,416,364

819,781

7.2%

1.7%

9.0%

-0.3%

$46.10

27: One 47,141,922

reason Class

in Midtown

South

such demand

now is because

of the

TotalA properties

Direct

Sublease are inDirect

Sublease rightTotal

Direct

Y-o-Y

Y-o-Y

Number of

MANHATTAN OFFICE

NumberMARKET

of

Buildings

MANHATTAN

OFFICE

Submarket

Inventory

Totals

393

242,519,670

Midtown

320 MARKET

180,995,042

Submarket

Class A StatisticalBuildings

Summary Inventory

Class BSouth

Statistical Summary

Midtown

27

14,382,706

MANHATTAN

OFFICE

MARKET

Midtown

320 MARKET

180,995,042

MANHATTAN

OFFICE

Downtown

46

47,141,922

Midtown

328

44,581,134

Class ASouth

Statistical Summary

Midtown

27 of

14,382,706

Number

Class

B

Statistical

Summary

Midtown South

184

29,316,502

Midtown

Submarket

Totals

Sublease

Year-to-Date

Activity

Ratemillion (123,701)

Rate

average

market, an

quarter is-56.4%

about three

2.3%

1,397,269

262,269

Year-to-Date

Year-to-Date

Year-to-Date

Y-o-Y

Y-o-Y

Leasing

Direct

Absorption

Total Absorption

Change and so

%

Changehalf

square%feet,

for

the

first

you

would

4.7%

4,646,202

-49.0%

171,300

(432,894)

5.2%

6,161,518

-51.2%

451,655

(538,509)

Activity

Rate

Rate

to be right

around six

MANHATTAN OFFICE MARKET - SECOND QUARTER

2012 $66.19 expect26.0%

$46.76

118,047

-62.9%million square

18,086

18,086

$59.55

$71.67

4.7%

4,646,202

-49.0%

171,300

(432,894)

$31.91

$45.29

2.3%Mr. McCarthy.

1,397,269

-56.4%

262,269

(123,701)

feet, said

Instead,

we

saw just Year-to-Date

Sublease

Total

Year-to-Date

Year-to-Date

Y-o-Y

Y-o-Y

MANHATTAN

-%

SECOND

QUARTER

2012 Wtd.

Second Quarter

2012

27 of

14,382,706

726,513

662,763

63,750

4.6% OFFICE

0.4% MARKET

5.1%

-0.5%

$68.10

$46.76

$66.19

118,047

18,086

Number

Available

Available

Available

Vacancy

Vacancy

Vacancy

Wtd.

Avg.

Wtd.

Avg.

Avg. 4.6 million

Leasing

Direct

Absorption

Total18,086

Absorption

% -7.6%

Change

Pt.

Change

%26.0%

Change square

%-62.9%

Change

feet [in

the first

half].

393where

242,519,670

24,316,842

19,720,062

4,596,780

8.1%

1.9%

10.0%

$68.71

$54.44

$66.91

5.2%

6,161,518

-51.2%

451,655

(538,509)

Buildings

Space

Space

Space

Ratein if they

Rate

Rate

Rental

Rate

Rental

Rate

Rental

Rate

Activity

Rate

Rate

building

Google isthats

the0.3%

everyone

wants to be

can right

now, he0.0%

added.

Inventory

Buildings

46

Number of

Wtd. Avg.

% Change

% Pt. Change

MANHATTAN

OFFICE

markets

relatively24,316,842

small

stock0.3%

of just 27

buildings,

noted Mr.

McCarthy.

like the

Midtown

320 MARKET

180,995,042

19,354,184

1.5%

15,640,935

3,713,249

8.6%

2.1% Properties

10.7%

0.1%

$73.67

Totals

393

242,519,670

19,720,062

4,596,780

8.1%

1.9%

10.0%

0.0%

$68.71

Buildings

Space

Space

Space

Rate

Rate

Rate

Rental

Rate

Highline

Submarket

Inventory

Class ASouth

Statistical Summary

Midtown

27

14,382,706

726,513

-7.6% 200 662,763

63,750near Madison

4.6%

0.4%

5.1%

-0.5% most$68.10

Building

at

415

West

14th

Street,

Fifth

Avenue

Square

Park

and,

perhaps

MANHATTAN OFFICE

OFFICE MARKET

MARKET

MANHATTAN

Midtown

320

180,995,042

19,354,184

1.5%

15,640,935

3,713,249

8.6%

2.1%

10.7%

0.1%

$73.67

Downtown

46

47,141,922

4,236,145

-3.5%

3,416,364

819,781

7.2%

1.7%

9.0%

-0.3%

$46.10

Total

Direct

Direct

Sublease

Direct

Y-o-Y

Y-o-YAvenue,

111 Eighth

Avenue,

are all

in high Sublease

demand among

tech

startups.Total

111 Eighth

Class B

A Statistical

Summary

Class

Statisticalconspicuously,

Summary

Submarket

Totals

Downtown

Year-to-Date

Year-to-Date

ago thatY-o-Y

included

a 1.046-million-square-foot

Y-o-Y

Available the%

Available out Available

Vacancy

Wtd. Avg.

Wtd. Avg.

Wtd. Avg.

Leasing

Direct Absorption

Total Absorption

Change to figure

% Pt. Change

% Change

% Change

markets and read between

lines

what

it allVacancy

means. Vacancy

transaction

Nast anda 902,000-squareSpace

Space

Space

Rate

Rate

Rate

Rental Rate

Rental Rate

Rental

Rate

Activity

Rate

Rate

by Cond

MANHATTAN OFFICE MARKET - SECOND QUARTER 2012 foot transaction by Nomura Holding. If you look

19,354,184

1.5%

15,640,935

3,713,249

8.6%

2.1%

10.7%

0.1%

$73.67

$59.55

$71.67

4.7%

4,646,202

-49.0%

171,300

(432,894)

Total

Direct

Sublease

Direct

Sublease

Total

Direct

Sublease

Total

Year-to-Date

Year-to-Date

Year-to-Date

Y-o-Y

Y-o-Y

Y-o-Yhalf of

Y-o-Y

at the first

2012 in the

Midtown

Class

AQuarter

Second

2012

MANHATTAN

-%

SECOND

QUARTER

2012 Wtd.

726,513

662,763

63,750

4.6% OFFICE

0.4% MARKET

5.1%

-0.5%

$68.10

$46.76

$66.19

118,047

Number of

Available

Available

Available

Vacancy

Vacancy

Vacancy

Wtd.

Avg.

Wtd.

Avg.

Avg.

Leasing

Direct18,086

Absorption

Total18,086

Absorption

% -7.6%

Change

Pt.

Change

%26.0%

Change

%-62.9%

Change

Number of

MANHATTAN OFFICE

MARKET

Buildings

Inventory

Class A Statistical Summary

MANHATTAN OFFICE

MARKET

Midtown

320

180,995,042

Class ASouth

Statistical Summary

Midtown

27

14,382,706

Submarket

Number of

Buildings

1401

177

Available

% Change

Available

Available

Space

Space

Space

Inventory

quarter

may have

a slightly -3.8%

more

compelling

391,709,993

35,344,061

29,724,488

5,619,573

85,252,521

7,607,281

-9.0%

6,362,631

1,244,650

Total

Direct

Sublease

Y-o-Y

Available

Available wereAvailable

Number

of

% Change

argument.

While

he

noted

that

asking

rents

Space

Space

Space

Buildings

798

241,506,257

23,783,424

0.3%

19,803,481

3,979,943

Inventory

1401

391,709,993

35,344,061

-3.8%

29,724,488

5,619,573

down

in64,951,215

the second

quarter, -15.2%

he also pointed

to 394,980

426

3,953,356

3,558,376

798

241,506,257

23,783,424

0.3%

19,803,481

177

85,252,521 rents

7,607,281

-9.0%

6,362,631

1,244,650

overall

asking

across asset

classes,

which 3,979,943

426

64,951,215

3,953,356

-15.2%

3,558,376

394,980

this

quarter

clocked

in

at

an

average

of

$58.86,

a

1401

391,709,993

35,344,061

-3.8%

29,724,488

5,619,573

177

85,252,521

7,607,281

-9.0%

6,362,631

1,244,650

slight decrease from last quarters $58.90. What

1401

391,709,993

35,344,061

29,724,488

we

saw was

a continuation

of-3.8%

this slower

level of5,619,573

activity leading to basically flat rental rates and

pretty low vacancy rates, too, said Mr. McCarthy.

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

Source: Cushman and Wakefield Research Services

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

Source: Cushman and Wakefield Research Services

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

Source: Cushman and Wakefield Research Services

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

Source: Cushman and Wakefield Research Services

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

Source: Cushman and Wakefield Research Services

20|July 17, 2012|The Commercial Observer

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

Source: Cushman and Wakefield Research Services

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

Source: Cushman and Wakefield Research Services

-0.3%

Y-o-Y

Y-o-Y

% Pt. Change

% Pt. Change

0.0%

0.1%

-0.5%

0.1%

-0.3%

-0.5%

Y-o-Y

Y-o-Y

-0.5%

% Pt.

Change

-0.8%

% Pt.

Change

0.0%

-0.3%

Y-o-Y

0.3%

Y-o-Y

% Pt.

Change

% Pt.

Change

0.1%

0.0%

-0.5%

-0.4%

-0.5%

-0.8%

0.1%

-0.3%

-0.5%

0.3%

-0.5%

Y-o-Y

-0.8%

% Pt.

Change

0.0%

-0.3%

-0.4%

0.3%

Y-o-Y

Y-o-Y

% Pt. Change

0.0%

% Pt.

Change

-0.4%

-0.5%

-0.8%

-0.5%

0.3%

0.1%

Y-o-Y

Y-o-Y

-0.8%

% Pt.

Change

-1.9%

% Pt.

Change

-0.4%

0.3%

Y-o-Y

-5.3%

Y-o-Y

% Pt.

Change

% Pt.

Change

-0.5%

-0.4%

0.1%

-2.0%

-0.8%

-1.9%

-0.5%

0.3%

0.1%

-5.3%

-0.8%

Y-o-Y

-1.9%

% Pt.

Change

-0.4%

0.3%

-2.0%

-5.3%

Y-o-Y

Y-o-Y

% Pt. Change

-0.4%

% Pt.

Change

-2.0%

0.1%

-1.9%

0.1%

-5.3%

0.0%

Y-o-Y

Y-o-Y

-1.9%

% Pt.

Change

-1.1%

% Pt.

Change

-2.0%

-5.3%

Y-o-Y

-0.8%

Y-o-Y

% Pt. Change

% Pt.

Change

0.1%

-2.0%

0.0%

-0.3%

-1.9%

-1.1%

0.1%

-5.3%

0.0%

-0.8%

-1.9%

Y-o-Y

-1.1%

% Pt.

Change

-2.0%

-5.3%

-0.3%

-0.8%

Y-o-Y

% Pt. Change

-2.0%

-0.3%

0.0%

-41.9%: In comparison to year-over-year

0.6%

6.1%

-1.1% and Downtown,

$49.38

$49.93

office leasing

in Midtown

South

1.6%

9.8%

0.0%

$67.55

$58.41

1.5%

8.9%

-0.8%

$40.66

$32.54

Sublease

Total

Direct

Sublease

Y-o-Y

overall leasing

activity

in Midtown

across

all three

0.6%

6.1%

-1.1%

$49.38

$49.93

Vacancy

Vacancy

Wtd.

Avg.

Wtd.

Avg.

% Pt.

Change

Rate

Rate

Rental

Rate

Rental

Rate

asset classes

was positively

sluggish.

Midtown

1.4%

9.0%

-0.3%

$59.62

$52.08

1.5%

8.9%

-0.8%

$40.66

$32.54

Sublease

Total

Direct

Sublease

Y-o-Y

Vacancy by large

Vacancycorporate,

Wtd. Avg.

Wtd. Avg.

% Pt. Change

is occupied

institutional

Rate

Rate

Rental

Rate

Rental

Rate

1.6%

9.8%

0.0%

$67.55

$58.41

1.4%

9.0%

-0.3%

$59.62

$52.08

tenantslaw

firms,

financial-1.1%

firms, consulting

5.5%

0.6%

6.1%

$49.38

$49.93

8.2%

1.6%

9.8%

0.0%

$67.55

7.5%

1.5%

8.9%

$40.66

$32.54

firms,

accounting

firms,

all of -0.8%

these

kinds

of large$58.41

5.5%

0.6%

6.1%

-1.1%

$49.38

$49.93

corporate

users,

said

Mr.

McCarthy,

who

added

7.6%

1.4%

9.0%

-0.3%

$59.62

$52.08

7.5%

1.5%

8.9%

-0.8%

$40.66

$32.54

that those kind of institutional groups pay close

7.6%

1.4%

9.0%

-0.3%

$59.62

$52.08

attention to the global economy and, say, the

European debt crises. And those are just the kinds

of companies that are extremely cautious right

now in an uncertain economic environment.

5.5%

8.2%

7.5%

Direct

5.5%

Vacancy

Rate

7.6%

7.5%

Direct

Vacancy

Rate

8.2%

7.6%

2.3%

Y-o-Y

Y-o-Y

% Change

% Change

5.2%

4.7%

26.0%

4.7%

2.3%

4.3%

Y-o-Y

Y-o-Y

%26.0%

Change

% 8.0%

Change

5.2%

2.3%

Y-o-Y

0.8%

% Y-o-Y

Change

% 5.2%

Change

4.7%

4.3%

3.6%

26.0%

8.0%

4.7%

2.3%

4.3%

0.8%

26.0%

Y-o-Y

8.0%

% 5.2%

Change

2.3%

3.6%

0.8%

Y-o-Y

Y-o-Y

% Change

% 5.2%

Change

3.6%

4.3%

8.0%

4.3%

0.8%

10.5%

Y-o-Y

Y-o-Y

% 8.0%

Change

% 5.2%

Change

3.6%

0.8%

Y-o-Y

-5.9%

% Y-o-Y

Change

% 3.6%

Change

4.3%

10.5%

5.1%

8.0%

5.2%

4.3%

0.8%

10.5%

-5.9%

8.0%

Y-o-Y

5.2%

% 3.6%

Change

0.8%

5.1%

-5.9%

Y-o-Y

Y-o-Y

% Change

% 3.6%

Change

5.1%

10.5%

5.2%

10.5%

-5.9%

4.9%

Y-o-Y

Y-o-Y

5.2%

%10.8%

Change

% Change

5.1%

-5.9%

Y-o-Y

1.7%

Y-o-Y

% Change

%10.5%

Change

5.1%

4.9%

6.0%

5.2%

10.8%

10.5%

-5.9%

4.9%

1.7%

5.2%

Y-o-Y

%10.8%

Change

5.1%

-5.9%

6.0%

1.7%

Y-o-Y

% Change

5.1%

6.0%

4.9%

1,397,269

Year-to-Date

Year-to-Date

Leasing

Leasing

Activity

6,161,518

4,646,202

Activity

118,047

4,646,202

1,397,269

1,430,184

Year-to-Date

Year-to-Date

118,047

Leasing

1,079,979

Leasing

Activity

6,161,518

1,397,269

Activity

Year-to-Date

774,770

Year-to-Date

Leasing

Leasing

Activity

4,646,202

6,161,518

1,430,184

3,284,933

Activity

118,047

1,079,979

4,646,202

1,397,269

1,430,184

774,770

Year-to-Date

118,047

1,079,979

Leasing

6,161,518

1,397,269

3,284,933

Activity

774,770

Year-to-Date

Year-to-Date

Leasing

6,161,518

Leasing

Activity

3,284,933

1,430,184

Activity

1,079,979

1,430,184

774,770

390,701

Year-to-Date

Year-to-Date

1,079,979

Leasing

661,697

Leasing

Activity

3,284,933

774,770

Activity

Year-to-Date

641,688

Year-to-Date

Leasing

Leasing

Activity

1,430,184

3,284,933

390,701

1,694,086

Activity

1,079,979

661,697

1,430,184

774,770

390,701

641,688

Year-to-Date

1,079,979

661,697

Leasing

3,284,933

774,770

1,694,086

Activity

641,688

Year-to-Date

Year-to-Date

Leasing

3,284,933

Leasing

Activity

1,694,086

390,701

Activity

661,697

390,701

641,688

6,467,087

Year-to-Date

Year-to-Date

661,697

Leasing

1,859,723

Leasing

Activity

1,694,086

641,688

Activity

Year-to-Date

2,813,727

Year-to-Date

Leasing

Leasing

Activity

390,701

1,694,086

6,467,087

11,140,537

Activity

661,697

1,859,723

390,701

641,688

6,467,087

2,813,727

Year-to-Date

661,697

1,859,723

Leasing

1,694,086

641,688

11,140,537

Activity

2,813,727

Year-to-Date

Leasing

1,694,086

Activity

11,140,537

6,467,087

-56.4%

Y-o-Y

Y-o-Y

% Change

% Change

-51.2%

-49.0%

262,269

Year-to-Date

Year-to-Date

Direct Absorption

Direct Absorption

Rate

451,655

171,300

Rate

-62.9%

-49.0%

-56.4%

-6.7%

Y-o-Y

Y-o-Y

%-62.9%

Change

%-11.9%

Change

-51.2%

-56.4%

Y-o-Y

4.7%

% Y-o-Y

Change

%-51.2%

Change

-49.0%

-6.7%

-6.1%

-62.9%

-11.9%

-49.0%

-56.4%

-6.7%

4.7%

-62.9%

Y-o-Y

-11.9%

%-51.2%

Change

-56.4%

-6.1%

4.7%

Y-o-Y

Y-o-Y

% Change

%-51.2%

Change

-6.1%

-6.7%

-11.9%

-6.7%

4.7%

-21.0%

Y-o-Y

Y-o-Y

%-11.9%

Change

% 8.3%

Change

-6.1%

4.7%

Y-o-Y

54.6%

% Y-o-Y

Change

%-6.1%

Change

-6.7%

-21.0%

11.4%

-11.9%

8.3%

-6.7%

4.7%

-21.0%

54.6%

-11.9%

Y-o-Y

8.3%

%-6.1%

Change

4.7%

11.4%

54.6%

Y-o-Y

Y-o-Y

% Change

%-6.1%

Change

11.4%

-21.0%

8.3%

-21.0%

54.6%

-41.9%

Y-o-Y

Y-o-Y

8.3%

%-13.7%

Change

% Change

11.4%

54.6%

Y-o-Y

-35.4%

Y-o-Y

% Change

%11.4%

Change

-21.0%

-41.9%

-36.9%

8.3%

-13.7%

-21.0%

54.6%

-41.9%

-35.4%

8.3%

Y-o-Y

-13.7%

%11.4%

Change

54.6%

-36.9%

-35.4%

Y-o-Y

% Change

11.4%

-36.9%

-41.9%

18,086

171,300

262,269

(23,812)

Year-to-Date

Year-to-Date

18,086

Direct

Absorption

Second

178,490

Direct

Absorption

Rate

451,655

262,269

Rate

Year-to-Date

243,338

Year-to-Date

Direct Absorption

Direct

Absorption

Rate

171,300

451,655

(23,812)

398,016

Rate

18,086

178,490

171,300

262,269

(23,812)

243,338

Year-to-Date

18,086

Second

178,490

Direct

Absorption

451,655

262,269

398,016

Rate

243,338

Year-to-Date

Year-to-Date

Direct Absorption

451,655

Direct

Absorption

Rate

398,016

(23,812)

Rate

178,490

(23,812)

243,338

11,817

Year-to-Date

Year-to-Date

178,490

Direct

Absorption

Second

163,027

Direct

Absorption

Rate

398,016

243,338

Rate

Year-to-Date

481,267

Year-to-Date

Direct

Absorption

Direct(23,812)

Absorption

Rate

398,016

11,817

656,111

Rate

178,490

163,027

(23,812)

243,338

11,817

481,267

Year-to-Date

178,490

Second

163,027

Direct

Absorption

398,016

243,338

656,111

Rate

481,267

Year-to-Date

Year-to-Date

Direct Absorption

398,016

Direct

Absorption

Rate

656,111

11,817

Rate

163,027

11,817

481,267

159,305

Year-to-Date

Year-to-Date

163,027

Direct

Absorption

Second

359,603

Direct

Absorption

Rate

656,111

481,267

Rate

Year-to-Date

986,874

Year-to-Date

Direct

Absorption

Direct11,817

Absorption

Rate

656,111

159,305

1,505,782

Rate

163,027

359,603

11,817

481,267

159,305

986,874

Year-to-Date

163,027

359,603

Direct

Absorption

656,111

481,267

1,505,782

Rate

986,874

Year-to-Date

Direct Absorption

656,111

Rate

1,505,782

159,305

(123,701)

Year-to-Date

Year-to-Date

Total Absorption

Total Absorption

Rate

(538,509)

(432,894)

Rate

18,086

(432,894)

(123,701)

(74,706)

Year-to-Date

Year-to-Date

18,086

Total212,067

Absorption

Quarter

2012

Total Absorption

Rate

(538,509)

(123,701)

Rate

Year-to-Date

219,672

Year-to-Date

Total

Absorption

Total(432,894)

Absorption

Rate

(538,509)

(74,706)

357,033

Rate

18,086

212,067

(432,894)

(123,701)

(74,706)

219,672

Year-to-Date

18,086

Quarter

2012

212,067

Total

Absorption

(538,509)

(123,701)

357,033

Rate

219,672

Year-to-Date

Year-to-Date

Total Absorption

(538,509)

Total

Absorption

Rate

357,033

(74,706)

Rate

212,067

(74,706)

219,672

23,404

Year-to-Date

Year-to-Date

Total212,067

Absorption

Quarter

2012

Total124,278

Absorption

Rate

357,033

219,672

Rate

Year-to-Date

491,602

Year-to-Date

Total

Absorption

Total(74,706)

Absorption

Rate

357,033

23,404

639,284

Rate

212,067

124,278

(74,706)

219,672

23,404

491,602

Year-to-Date

212,067

Quarter

2012

124,278

Total

Absorption

357,033

219,672

639,284

Rate

491,602

Year-to-Date

Year-to-Date

Total Absorption

357,033

Total

Absorption

Rate

639,284

23,404

Rate

124,278

23,404

491,602

(484,196)

Year-to-Date

Year-to-Date

124,278

Total354,431

Absorption

Quarter

2012

Total Absorption

Rate

639,284

491,602

Rate

Year-to-Date

587,573

Year-to-Date

Total

Absorption

Total23,404

Absorption

Rate

639,284

(484,196)

457,808

Rate

124,278

354,431

23,404

491,602

(484,196)

587,573

Year-to-Date

124,278

354,431

Total

Absorption

639,284

491,602

457,808

Rate

587,573

Year-to-Date

Total Absorption

639,284

Rate

457,808

(484,196)

457,808: Overall, absorptionor, the net-change

$49.43

10.8%

1,859,723 positive

-13.7%this quarter,

359,603

in

occupied

spacewas

which354,431

$66.44

4.9%

6,467,087

-41.9%

159,305

(484,196)

$40.06

1.7%

2,813,727

-35.4%

986,874

587,573

Total

Year-to-Date

Year-to-Date

Y-o-Y

Y-o-Y

was

not the

caseYear-to-Date

four

months

ago. Indeed,

while

$49.43

1,859,723

359,603

Wtd.

Avg.

Leasing

Direct

Absorption

Total354,431

Absorption

%10.8%

Change

%-13.7%

Change

Rental

Rate

Activity

Rate

Rate

-370,000

last yearY-o-Y

saw

absorption

fall-36.9%

to

square

$58.86

6.0%

11,140,537

1,505,782

457,808

$40.06

1.7%

2,813,727

-35.4%

986,874

587,573

Total

Year-to-Date

Year-to-Date

Year-to-Date

Y-o-Y

Wtd. feet,

Avg.

Leasing

Direct Absorption

Total Absorption

% Change

% to

Change

this

quarter

saw

it

rise

457,808.

So

the

Rental

Rate

Activity

Rate

Rate

$66.44

4.9%

6,467,087

-41.9%

159,305

(484,196)

$58.86

6.0%

11,140,537

-36.9%

1,505,782

457,808

net-positive

second quarter

was 354,431

$49.43

10.8%absorption

1,859,723 in the

-13.7%

359,603

$66.44

4.9%

6,467,087

-41.9%

$40.06

1.7%

2,813,727

-35.4%

986,874

587,573

about 800,00

square

feet, which

is not159,305

fantastic, (484,196)

$49.43

10.8%

1,859,723

-13.7%

359,603

354,431

but

its

a

good

quarter

for

absorption,

which

is

$58.86

6.0%

11,140,537

-36.9%

1,505,782

457,808

$40.06

1.7%

2,813,727

-35.4%

986,874

587,573

a surprise given the flat vacancy and given the

$58.86

6.0%

11,140,537

-36.9%

1,505,782

457,808

slower level of general economic activity, said

Mr. McCarthy, who noted that the change can be

attributed to Class A office leasing in Midtown.

You might also like

- Selling to the Government: What It Takes to Compete and Win in the World's Largest MarketFrom EverandSelling to the Government: What It Takes to Compete and Win in the World's Largest MarketRating: 1 out of 5 stars1/5 (1)

- Dsp-Unit 5.1 Analog FiltersDocument67 pagesDsp-Unit 5.1 Analog FiltersMaheswaraNo ratings yet

- I Used To Be A Desgin StudentDocument256 pagesI Used To Be A Desgin StudentMLNo ratings yet

- Winning in Growth Cities 2012Document54 pagesWinning in Growth Cities 2012Gen ShibayamaNo ratings yet

- Sample Business Report FormatDocument1 pageSample Business Report FormatmironkoprevNo ratings yet

- Latin America Gri Real Estate 2023Document22 pagesLatin America Gri Real Estate 2023Tiago Pedroso FonsecaNo ratings yet

- Case StudyDocument10 pagesCase StudyJessica FolleroNo ratings yet

- Learning Recovery Continuity Plan LRCPDocument5 pagesLearning Recovery Continuity Plan LRCPCATHERINE SIONEL100% (1)

- 1CO1800A1016Document1 page1CO1800A1016Jotham SederstromNo ratings yet

- For Immediate Release (4 Pages) Contact: Monday July 8, 2013 James Delmonte (212) 729-6973 EmailDocument4 pagesFor Immediate Release (4 Pages) Contact: Monday July 8, 2013 James Delmonte (212) 729-6973 EmailAnonymous Feglbx5No ratings yet

- Midtown South, Northbound Rents: PostingsDocument1 pageMidtown South, Northbound Rents: Postingsjotham_sederstr7655No ratings yet

- Commercial Power 2013Document103 pagesCommercial Power 2013NewYorkObserverNo ratings yet

- Fall 09 MailerDocument1 pageFall 09 Mailerjddishotsky100% (2)

- Bizjrnl Nov2011B SectionDocument12 pagesBizjrnl Nov2011B SectionThe Delphos HeraldNo ratings yet

- SF Off 4Q09Document4 pagesSF Off 4Q09Justin BedecarreNo ratings yet

- LA Times - Reporte de Bajas de Precios en El Área - Julio 2009Document2 pagesLA Times - Reporte de Bajas de Precios en El Área - Julio 2009Nando FuentevillaNo ratings yet

- Miami Office Insight Q3 2013Document4 pagesMiami Office Insight Q3 2013Bea LorinczNo ratings yet

- Extra Credit 3-2Document7 pagesExtra Credit 3-2api-741800996No ratings yet

- Corcoran Report-Q2 2009Document13 pagesCorcoran Report-Q2 2009Norman OderNo ratings yet

- CompStak Effective Rent ReportDocument2 pagesCompStak Effective Rent ReportCRE ConsoleNo ratings yet

- What's The (Downtown) Story, Morning Glory?: Downtown New York Office Market-February 2013Document1 pageWhat's The (Downtown) Story, Morning Glory?: Downtown New York Office Market-February 2013jotham_sederstr7655No ratings yet

- The Wright Report:: Sacramento's Residential Investment AnalysisDocument26 pagesThe Wright Report:: Sacramento's Residential Investment AnalysisWright Real EstateNo ratings yet

- Economists Give Construction Outlook For Rest of 2013 PDFDocument3 pagesEconomists Give Construction Outlook For Rest of 2013 PDFMike KarlinsNo ratings yet

- Summer 09 MailerDocument2 pagesSummer 09 MailerjddishotskyNo ratings yet

- Philadelphia 3Q11 RetDocument4 pagesPhiladelphia 3Q11 RetAnonymous Feglbx5No ratings yet

- Sunday Business Post 29.03.2015Document2 pagesSunday Business Post 29.03.2015constructionfed2No ratings yet

- TheSun 2008-12-26 Page22 Bursa To Launch Relaxe Framework For Short-SellingDocument1 pageTheSun 2008-12-26 Page22 Bursa To Launch Relaxe Framework For Short-SellingImpulsive collectorNo ratings yet

- High Rents Low EconomyDocument5 pagesHigh Rents Low Economybob smithNo ratings yet

- Microsoft Word - News Item - Will Property Prices Fall 03.06 (Http://reliancepropertysolutions - Blogspot.com/)Document4 pagesMicrosoft Word - News Item - Will Property Prices Fall 03.06 (Http://reliancepropertysolutions - Blogspot.com/)reliancerpsNo ratings yet

- 1CO2000A1106Document1 page1CO2000A1106Jotham SederstromNo ratings yet

- 1CO2200A1008Document1 page1CO2200A1008jotham_sederstr7655No ratings yet

- Orange County: Housing Growth Is On The WayDocument4 pagesOrange County: Housing Growth Is On The Wayapi-25886701No ratings yet

- Annual State of The Residential Mortgage Market in CanadaDocument63 pagesAnnual State of The Residential Mortgage Market in CanadaMortgage ResourcesNo ratings yet

- San Diego County: Housing Growth Is On The WayDocument4 pagesSan Diego County: Housing Growth Is On The WaymiguelnunezNo ratings yet

- Office Q2 2016 FullReportDocument17 pagesOffice Q2 2016 FullReportWilliam HarrisNo ratings yet

- Miami-Dade LAR 3Q16Document4 pagesMiami-Dade LAR 3Q16Anonymous Feglbx5No ratings yet

- Nearly 8 Years Later The Number of Subprime Auto Loans Sinking Into Delinquency Hit Their Highest Level Since 2010 in The Third QuarterDocument3 pagesNearly 8 Years Later The Number of Subprime Auto Loans Sinking Into Delinquency Hit Their Highest Level Since 2010 in The Third QuarterVidit HarsulkarNo ratings yet

- Turning Your CRA Program From A Cost Center Into A Profit Center.Document3 pagesTurning Your CRA Program From A Cost Center Into A Profit Center.geodatavision100% (2)

- N, NJLKJKLDocument9 pagesN, NJLKJKLjjajNo ratings yet

- Reducê%Document2 pagesReducê%Tri ChauNo ratings yet

- TCR Commercial Real Estate ZHBDocument4 pagesTCR Commercial Real Estate ZHBZerohedgeNo ratings yet

- Article - Strategic Choices For Newly Opened Market - CleanedDocument9 pagesArticle - Strategic Choices For Newly Opened Market - CleanedAniesh Singh SijapatiNo ratings yet

- NYC Co Op Sales NYC Condo Sales Miller SamuelDocument2 pagesNYC Co Op Sales NYC Condo Sales Miller SamuelDavid BriggsNo ratings yet

- Ukmi Winter 2019 2020 - FinalDocument8 pagesUkmi Winter 2019 2020 - FinalVishal ShahNo ratings yet

- RE/MAX Bayside May NewsletterDocument1 pageRE/MAX Bayside May NewsletterremaxbaysideNo ratings yet

- BostonDocument4 pagesBostonAnonymous Feglbx5No ratings yet

- Merger Market League Tables Financial Advisers Q3 2009 (Read in "Fullscreen")Document37 pagesMerger Market League Tables Financial Advisers Q3 2009 (Read in "Fullscreen")DealBook100% (2)

- Owners Mag 9-2011Document60 pagesOwners Mag 9-2011casey1936No ratings yet

- Manhattan Q32013Document16 pagesManhattan Q32013Joseph DimaNo ratings yet

- An Office Market in Transition? The Urban vs. Suburban DebateDocument3 pagesAn Office Market in Transition? The Urban vs. Suburban DebateKevin ParkerNo ratings yet

- Real Estate Investing: Comparative Market Analysis HandbookFrom EverandReal Estate Investing: Comparative Market Analysis HandbookNo ratings yet

- JLL Pulse NYC 08Document4 pagesJLL Pulse NYC 08Anonymous Feglbx5No ratings yet

- RR Case Study-20210225-V11Document64 pagesRR Case Study-20210225-V11WXYZ-TV Channel 7 DetroitNo ratings yet

- India Residential Market Review Q309Document56 pagesIndia Residential Market Review Q309Abhyudaya KanoriaNo ratings yet

- Bob Chapman The Fed S Policy of Near Zero Interest Rates 16 11 09Document8 pagesBob Chapman The Fed S Policy of Near Zero Interest Rates 16 11 09sankaratNo ratings yet

- VietRees Newsletter 65 Week2 Month1 Year09Document10 pagesVietRees Newsletter 65 Week2 Month1 Year09internationalvrNo ratings yet

- D N - T W, P T D: Espite EAR ERM Eakness Ositive Rends EvelopingDocument4 pagesD N - T W, P T D: Espite EAR ERM Eakness Ositive Rends EvelopingevansthNo ratings yet

- 06 03 08 NYC JMC UpdateDocument9 pages06 03 08 NYC JMC Updateapi-27426110No ratings yet

- Miami Americas Market BeatOfficeDocument2 pagesMiami Americas Market BeatOfficenmmng2011No ratings yet

- Mortgage 2.0: Executive SummaryDocument10 pagesMortgage 2.0: Executive Summarycharger1234No ratings yet

- Housing Is Already in A Slump. So It (Probably) Can't Cause A Recession. - The New York TimesDocument6 pagesHousing Is Already in A Slump. So It (Probably) Can't Cause A Recession. - The New York TimessalvareaNo ratings yet

- How To Think About China P03 Real EstateDocument28 pagesHow To Think About China P03 Real Estatejake freiNo ratings yet

- Co 07-13-2016Document72 pagesCo 07-13-2016NewYorkObserverNo ratings yet

- Plan 82112Document1 pagePlan 82112NewYorkObserverNo ratings yet

- 1CO3800A0911Document1 page1CO3800A0911NewYorkObserverNo ratings yet

- 1CO1800A0911Document1 page1CO1800A0911NewYorkObserverNo ratings yet

- 1CO1800A0814Document1 page1CO1800A0814NewYorkObserverNo ratings yet

- 1CO1800A0821Document1 page1CO1800A0821NewYorkObserverNo ratings yet

- Plan 9-4-2012Document1 pagePlan 9-4-2012NewYorkObserverNo ratings yet

- Tennis: Isner in ControlDocument16 pagesTennis: Isner in ControlNewYorkObserverNo ratings yet

- Postings 9-4-2012Document1 pagePostings 9-4-2012NewYorkObserverNo ratings yet

- 1CO3000A0717Document1 page1CO3000A0717NewYorkObserverNo ratings yet

- LUO July 2012Document100 pagesLUO July 2012NewYorkObserverNo ratings yet

- 1CO2600A0814Document1 page1CO2600A0814NewYorkObserverNo ratings yet

- Scene August 2012Document108 pagesScene August 2012NewYorkObserverNo ratings yet

- 1CO1800A0731Document1 page1CO1800A0731NewYorkObserverNo ratings yet

- The Plan 8-13-2012Document1 pageThe Plan 8-13-2012NewYorkObserverNo ratings yet

- Living There MagDocument101 pagesLiving There MagnatefriedmanNo ratings yet

- 1CO3000A0724AAAADocument1 page1CO3000A0724AAAANewYorkObserverNo ratings yet

- 1CO3000A0717Document1 page1CO3000A0717NewYorkObserverNo ratings yet

- Sensational Travel Escapes: The Observer'SDocument19 pagesSensational Travel Escapes: The Observer'SNewYorkObserverNo ratings yet

- Scene JulyDocument84 pagesScene JulyNewYorkObserver0% (2)

- 1CO1800A0710Document1 page1CO1800A0710NewYorkObserverNo ratings yet

- Ellen Pao V Kleiner Perkins - June 13,2012Document7 pagesEllen Pao V Kleiner Perkins - June 13,2012NewYorkObserverNo ratings yet

- Yue Magazine Summer 2012Document124 pagesYue Magazine Summer 2012NewYorkObserverNo ratings yet

- Hamptons June 2012Document12 pagesHamptons June 2012NewYorkObserverNo ratings yet

- June SceneDocument91 pagesJune SceneNewYorkObserverNo ratings yet

- 1CO1800A0612Document1 page1CO1800A0612NewYorkObserverNo ratings yet

- Occupational Noise Hazard Assessment: A Case Study of Bangladesh Rail Transport SystemDocument27 pagesOccupational Noise Hazard Assessment: A Case Study of Bangladesh Rail Transport SystemShuvashish RoyNo ratings yet

- Design and Optimization of Spur Gear: Final ReviewDocument41 pagesDesign and Optimization of Spur Gear: Final ReviewVirat KiranNo ratings yet

- TTMA RP 32 EngDocument3 pagesTTMA RP 32 Englinh caca huynhNo ratings yet

- MAN 6266 - Interview Assignment PDFDocument2 pagesMAN 6266 - Interview Assignment PDFjoseNo ratings yet

- nomination-form-6873-MAZAHIR HUSSAINDocument3 pagesnomination-form-6873-MAZAHIR HUSSAINMazahir HussainNo ratings yet

- PA-STARNet Overview and Fact SheetDocument2 pagesPA-STARNet Overview and Fact SheetDaryl JonesNo ratings yet

- Ultrapad: Graphics Tablets For Cad and DTP ProfessionalsDocument4 pagesUltrapad: Graphics Tablets For Cad and DTP ProfessionalsOluwatomi AdewaleNo ratings yet

- Chemical EquationsDocument22 pagesChemical EquationsSiti Norasikin MuhyaddinNo ratings yet

- Four Daewoo Motors Ex-Executives Acquitted of Fraud Charges - The Economic TimesDocument1 pageFour Daewoo Motors Ex-Executives Acquitted of Fraud Charges - The Economic TimescreateNo ratings yet

- UBG 04LX F01 Datasheet2Document6 pagesUBG 04LX F01 Datasheet2malirezazadeh5549No ratings yet

- Fra Fra CSV .NETFramework2.0SP1Document949 pagesFra Fra CSV .NETFramework2.0SP1Bruno VrielynckNo ratings yet

- Q8-Auto-JK - en PDSDocument1 pageQ8-Auto-JK - en PDSagnovNo ratings yet

- Formatting TextsDocument3 pagesFormatting TextsCelestineNo ratings yet

- Bredent GBDocument24 pagesBredent GBumeshgcNo ratings yet

- Research Work08072021 01Document41 pagesResearch Work08072021 01Mohammad AliNo ratings yet

- Usiness Aluation: DigestDocument28 pagesUsiness Aluation: Digestgioro_miNo ratings yet

- Saved-20220203 1028 25955Document14 pagesSaved-20220203 1028 25955Akshay GautamNo ratings yet

- Struts 2 InterceptorsDocument14 pagesStruts 2 InterceptorsRamasamy GoNo ratings yet

- Python in A Nutshell: Python's Whys & HowsDocument4 pagesPython in A Nutshell: Python's Whys & Howstvboxsmart newNo ratings yet

- Final ProjectDocument80 pagesFinal ProjectMinkal PatelNo ratings yet

- Hussain 2020Document13 pagesHussain 2020Prince RajputNo ratings yet

- The Effects On Customer Satisfaction Emerald 1Document27 pagesThe Effects On Customer Satisfaction Emerald 1ari gunawanNo ratings yet

- IT & Tekecom TransactionsDocument20 pagesIT & Tekecom TransactionsRohil0% (1)

- L1 - Introduction-Underground StructuresDocument38 pagesL1 - Introduction-Underground Structuresroxcox216No ratings yet

- Michael Torres ResumeDocument2 pagesMichael Torres Resumeapi-263470871No ratings yet