Professional Documents

Culture Documents

Procedure in Business Registration

Uploaded by

Dennis YuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Procedure in Business Registration

Uploaded by

Dennis YuCopyright:

Available Formats

Procedure in Business Registration.

Step 1: Verify the availability of the company name Apply for a company name in the SEC. If the applied name is approved then file for an application for incorporation to the SEC to extend the deadline for another month. Step 2: Obtain a bank certificate of deposit for the paid-in capital Proceed to a preferred bank that will cater your service. Step 3: Prepare and register incorporation papers Submit the verification slip (from Step 1), bank certificate of deposit (from Step 2), articles of incorporation and by-laws, treasurers affidavit and many other documents. Forms and check list available at the SEC. Step 4: Obtain a company Community Tax Certificate (CTC) Can be obtained at the barangay office or city hall. Step 5: Apply for a Barangay or District clearance Can be done barangay office and payment. Step 6: Obtain a mayors business permit Done at the City Hall Business Licensing Office Step 7: Register for taxes Done at the Bureau of Internal Revenue (BIR) office. You will obtain your company Tax Identification Number (TIN), authority to print receipt/invoices and other documents. Step 8: Buy accounting books Buy from any bookstore. Spending around P500 for a cash receipts account, a disbursements account, a ledger and the general journal. Consult the local BIR office for specific requirements on the books. Step 9: Print your receipts Done with any print shop accredited by the BIR. Step 10: Have your receipts and books stamped Done at the BIR office. At this point, one can now legally operate business. Step 11: Register your employees Done at various offices. As required by law, company will need to enroll your employees with the Social Security System (SSS), Department of Labor and Employment (DOLE), Home Development Mutual Fund (HDMF) and Philippine Health Insurance Corp. (PhilHealth).

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- List Cults and OccultsDocument3 pagesList Cults and OccultsDennis Yu100% (1)

- Family Deliverance PrayerDocument1 pageFamily Deliverance PrayerDennis Yu100% (2)

- JOINT VENTURE AGREEMENT To Construct A SubdivisionDocument3 pagesJOINT VENTURE AGREEMENT To Construct A SubdivisionDennis Yu100% (1)

- Special Power of Atty To Sell PropertyDocument2 pagesSpecial Power of Atty To Sell PropertyDennis Yu87% (15)

- Bengzon Vs Senate Blue Ribbon CommitteeDocument1 pageBengzon Vs Senate Blue Ribbon CommitteeDennis YuNo ratings yet

- Forgiveness PrayerDocument1 pageForgiveness PrayerDennis YuNo ratings yet

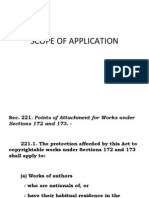

- Scope of ApplicationDocument10 pagesScope of ApplicationDennis YuNo ratings yet

- Ang Vs American Steamship Agencies, 19 Scra 631Document3 pagesAng Vs American Steamship Agencies, 19 Scra 631Dennis YuNo ratings yet