Professional Documents

Culture Documents

Summery of California Pizza Kitchen Case

Uploaded by

Abid UllahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summery of California Pizza Kitchen Case

Uploaded by

Abid UllahCopyright:

Available Formats

Summary: California Pizza Kitchen

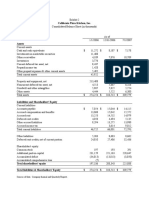

The California Pizza Kitchen was founded by Larry Flax and Rick Rosenfield in 1985. CFK operates a casual dining chain which mostly focuses on pizza segment. It is well renowned for barbecue chicken pizza as well as the designer pizza. By the end of 2007, the company had 213 restaurants in 28 states and 6 in foreign countries. But the real financial condition of CFK was severely problematic. The companys share price declined at the rate of 10% making a current value of $22.10. For the fact, the company decided to buy back the shares. But the company current cash and cash equivalents are only 2.11% to its total cash. Hence the company has no potential to buy back the shares. But the company had no debt so they had the strong potential of borrowing debt but the interest rates were not in the favor of the CPK, so due to this fact the company was hesitating to take the loan. There are three principal situations lead to stock repurchases. A company may decide to increase its leverage by issuing debt and using the proceeds to repurchase stock. Secondly, many firms have given their employees stock options, and they repurchase stock for use when employees exercise the options. Thirdly, a company may have excess cash. But with CFK the only option is to increase its leverage by issuing debt and from that it should repurchase the stocks. To find out that whether it will be beneficial for the company issue debt or not we have to go through finding out the ROE for the company. ROE is useful for comparing the profitability of a company to that of other firms in the same industry. We have to calculate ROE on the basis of actual, 10%, 20% and 30%. By calculation we can see that interest expense is increase and the earnings are decreasing. Because for paying back the debt the interest should be paid, this will increase the interest expense by decreasing the net earning. Secondly, calculate the CAPM the more the CAPM the more the business risk. After calculating the CAPM at rate of 10% 20% and 30% we get the following figures for CAPM i.e. 0.871 at 10%, 0.042 at 20% and 0.065 at 30%. So the low CAPM is at 20%. So, it is more favorable for the company to go for 20%. But as we found the WACC, it was found that WACC is decreasing with increase in interest rate because the cost of capital is increasing. But it will be good for the company to go for 30% because at this rate the debt amount is higher. The higher debt will decrease the price of stock to $20 dollars. So it will be beneficial for the company to repurchase the stocks at this rate.

You might also like

- California Pizza Kitchen - AnalysisDocument6 pagesCalifornia Pizza Kitchen - AnalysisVasili RabshtynaNo ratings yet

- CPK CaseDocument12 pagesCPK Casejohncaleb100% (5)

- California Pizza Kitchen-Rev2Document7 pagesCalifornia Pizza Kitchen-Rev2amit ashish100% (2)

- Word Note California Pizza KitchenDocument7 pagesWord Note California Pizza Kitchenalka murarka100% (16)

- California Kitchen Case StudyDocument9 pagesCalifornia Kitchen Case StudyBYQNo ratings yet

- CPK Share Buyback Strategy to Address Falling Stock PricesDocument14 pagesCPK Share Buyback Strategy to Address Falling Stock PricesPatcharanan Sattayapong100% (1)

- California Pizza KitchenDocument4 pagesCalifornia Pizza KitchenMarvi Ahmad100% (2)

- California Pizza Kitchen Case SolnDocument8 pagesCalifornia Pizza Kitchen Case Solnkiller dramaNo ratings yet

- Midterm Case California Pizza KitchenDocument2 pagesMidterm Case California Pizza KitchenAhmed El Khateeb100% (1)

- California Pizza KitchenDocument3 pagesCalifornia Pizza KitchenTommy HaleyNo ratings yet

- California Pizza Kitchen Rev2Document7 pagesCalifornia Pizza Kitchen Rev2ahmed mahmoud100% (1)

- Mergers & AcquisitionsDocument2 pagesMergers & AcquisitionsRashleen AroraNo ratings yet

- TN33 California Pizza KitchenDocument8 pagesTN33 California Pizza KitchenChittisa CharoenpanichNo ratings yet

- TN33 California Pizza KitchenDocument8 pagesTN33 California Pizza KitchenToday100% (2)

- Chapter 7Document36 pagesChapter 7Mai PhamNo ratings yet

- AutoZone financial analysis and stock repurchase impactDocument1 pageAutoZone financial analysis and stock repurchase impactmalimojNo ratings yet

- AutoZone case study on share repurchases and alternativesDocument1 pageAutoZone case study on share repurchases and alternativesVoramon PolkertNo ratings yet

- California Pizza Kitchen Financial ReportsDocument12 pagesCalifornia Pizza Kitchen Financial Reportsxinz1313No ratings yet

- California PizzaDocument4 pagesCalifornia PizzaMaria Fe Callejas0% (1)

- California Pizza KitchenDocument13 pagesCalifornia Pizza KitchenKhaled Al-Bousairi100% (3)

- California Pizza Chicken Share Repurchase AnalysisDocument13 pagesCalifornia Pizza Chicken Share Repurchase AnalysisBerni RahmanNo ratings yet

- AutoZone S Stock PDFDocument3 pagesAutoZone S Stock PDFGeorgina AlpertNo ratings yet

- DuPont QuestionsDocument1 pageDuPont QuestionssandykakaNo ratings yet

- California Pizza KitchenDocument13 pagesCalifornia Pizza Kitchendewimachfud100% (1)

- Wacc Mini CaseDocument12 pagesWacc Mini CaseKishore NaiduNo ratings yet

- Nike Inc. Case StudyDocument3 pagesNike Inc. Case Studyshikhagupta3288No ratings yet

- Case 42 West Coast DirectedDocument6 pagesCase 42 West Coast DirectedHaidar IsmailNo ratings yet

- Jetblue Airways Ipo ValuationDocument6 pagesJetblue Airways Ipo ValuationXing Liang HuangNo ratings yet

- Finance Chapter 15Document34 pagesFinance Chapter 15courtdubs100% (1)

- JetBlue IPO Valuation Case StudyDocument2 pagesJetBlue IPO Valuation Case Studyweichieh1986No ratings yet

- Integrative Case 10 1 Projected Financial Statements For StarbucDocument2 pagesIntegrative Case 10 1 Projected Financial Statements For StarbucAmit PandeyNo ratings yet

- Case 5Document15 pagesCase 5Qiao LengNo ratings yet

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- Case 75 The Western Co DirectedDocument10 pagesCase 75 The Western Co DirectedHaidar IsmailNo ratings yet

- DCF Case StudyDocument17 pagesDCF Case StudyVivekananda RNo ratings yet

- The Body Shop Plc 2001: Historical Financial AnalysisDocument13 pagesThe Body Shop Plc 2001: Historical Financial AnalysisNaman Nepal100% (1)

- Uv6790 PDF EngDocument20 pagesUv6790 PDF EngRicardo BuitragoNo ratings yet

- Nike Case - Team 5 Windsor - FinalDocument10 pagesNike Case - Team 5 Windsor - Finalalosada01No ratings yet

- Worldwide Paper CompanyDocument1 pageWorldwide Paper CompanyendiaoNo ratings yet

- Homework Assignment 1 KeyDocument6 pagesHomework Assignment 1 KeymetetezcanNo ratings yet

- Cobalt Systems planning documentDocument2 pagesCobalt Systems planning documentAndrea Moreno0% (1)

- Time Value of Money Solutions Chapter 5Document26 pagesTime Value of Money Solutions Chapter 5Tamir Al Balkhi100% (1)

- Arcadian Business CaseDocument20 pagesArcadian Business CaseHeniNo ratings yet

- Star River PembahasanDocument8 pagesStar River PembahasanGloria Lisa SusiloNo ratings yet

- JetBlue Airways IPO ValuationDocument15 pagesJetBlue Airways IPO ValuationThossapron Apinyapanja0% (2)

- Word Note The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument9 pagesWord Note The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka100% (2)

- FIM Anthony CH End Solution PDFDocument287 pagesFIM Anthony CH End Solution PDFMosarraf Rased50% (6)

- Case 33 California Pizza Kitchen ExhibitsDocument10 pagesCase 33 California Pizza Kitchen ExhibitsmhogomanNo ratings yet

- Case 32 - CPK AssignmentDocument9 pagesCase 32 - CPK AssignmentEli JohnsonNo ratings yet

- China Fire Case AssignmentDocument3 pagesChina Fire Case AssignmentTony LuNo ratings yet

- MCQ Financial RatiosDocument9 pagesMCQ Financial RatiosMoamar Dalawis IsmulaNo ratings yet

- O.M. Scott & SonsDocument7 pagesO.M. Scott & Sonsstig2lufetNo ratings yet

- 07 - Capital - Structure ProblemsDocument5 pages07 - Capital - Structure ProblemsRohit KumarNo ratings yet

- ACC222 EXAM: FINANCIAL MANAGEMENT QUESTIONSDocument5 pagesACC222 EXAM: FINANCIAL MANAGEMENT QUESTIONSmaica G.No ratings yet

- California Pizza Kitchen Group 1Document4 pagesCalifornia Pizza Kitchen Group 1Pratik ChavanNo ratings yet

- Capital Structure and Leverage Quiz # 3Document4 pagesCapital Structure and Leverage Quiz # 3Maurice Hanellete EspirituNo ratings yet

- Coca Cola Inc and Pepsico IncDocument8 pagesCoca Cola Inc and Pepsico IncmosesNo ratings yet

- Exercises-SClast SolvedDocument7 pagesExercises-SClast SolvedSarah GherdaouiNo ratings yet

- Blaine Kitchenware CaseDocument4 pagesBlaine Kitchenware Caseskyhannan80% (5)

- Boston Chicken Critical Success Factors Risks Accounting PoliciesDocument4 pagesBoston Chicken Critical Success Factors Risks Accounting PoliciesArindam PalNo ratings yet

- Shariah Disclosure and Readability of Islamic Banks in PakistanDocument17 pagesShariah Disclosure and Readability of Islamic Banks in PakistanAbid UllahNo ratings yet

- Lecture 2-Overview of Islamic Economic SystemDocument21 pagesLecture 2-Overview of Islamic Economic SystemAbid UllahNo ratings yet

- Lecture 3 Sources of ShariahDocument43 pagesLecture 3 Sources of ShariahAbid UllahNo ratings yet

- 3-MJH 1515-Ok PDFDocument18 pages3-MJH 1515-Ok PDFAbid UllahNo ratings yet

- Assignment No.1 Submitted By: Abid Ullah, Huang Zhe, SarawananDocument6 pagesAssignment No.1 Submitted By: Abid Ullah, Huang Zhe, SarawananAbid UllahNo ratings yet

- 3-MJH 1515-Ok PDFDocument18 pages3-MJH 1515-Ok PDFAbid UllahNo ratings yet

- The Malay Economy and Exploitation: An Insight Into The PastDocument12 pagesThe Malay Economy and Exploitation: An Insight Into The PastAbid UllahNo ratings yet

- Islamic Microfinance For Rural Farmers: A Proposed Contractual Framework For Amanah Ikhtiar MalaysiaDocument16 pagesIslamic Microfinance For Rural Farmers: A Proposed Contractual Framework For Amanah Ikhtiar MalaysiaAbid UllahNo ratings yet

- Takaful in PakistanDocument18 pagesTakaful in PakistanAbid UllahNo ratings yet

- Om PresentationDocument14 pagesOm PresentationAbid UllahNo ratings yet

- The Malay Economy and Exploitation: An Insight Into The PastDocument12 pagesThe Malay Economy and Exploitation: An Insight Into The PastAbid UllahNo ratings yet

- Concept of Time Value of Money in Islamic EconomicsDocument2 pagesConcept of Time Value of Money in Islamic EconomicsAbid UllahNo ratings yet

- Determinants of Household Financial Vulnerability in Malaysia and Its Effect On Low-Income GroupsDocument12 pagesDeterminants of Household Financial Vulnerability in Malaysia and Its Effect On Low-Income GroupsAbid UllahNo ratings yet

- Benchmarking in Islamic Finance: Issues and ChallengesDocument5 pagesBenchmarking in Islamic Finance: Issues and ChallengesAbid Ullah100% (1)

- Islamic Baking in Pakistan A Case of Deposit and Investment AccountsDocument5 pagesIslamic Baking in Pakistan A Case of Deposit and Investment AccountsAbid UllahNo ratings yet

- John Ervin Bonilla Bsba Fm2B 1. Admission by Purchase of InterestDocument8 pagesJohn Ervin Bonilla Bsba Fm2B 1. Admission by Purchase of InterestJohn Ervin Bonilla100% (4)

- Financial Accounting Test Bank and Solution ManualDocument12 pagesFinancial Accounting Test Bank and Solution ManualStudentt SaverrNo ratings yet

- M & A Regulations Takeover Code: Amity Global Business SchoolDocument56 pagesM & A Regulations Takeover Code: Amity Global Business SchoolAnkita DhimanNo ratings yet

- Project Report Icsi - 1Document43 pagesProject Report Icsi - 1ALI ASGARNo ratings yet

- BÀI TẬP ÁP DỤNGDocument6 pagesBÀI TẬP ÁP DỤNGNguyễn ThươngNo ratings yet

- FlyByU AG Balance Sheet and Profit and Loss StatementDocument1 pageFlyByU AG Balance Sheet and Profit and Loss StatementChiara AnindaNo ratings yet

- Journal of International Accounting, Auditing and Taxation: Mattias Hamberg, Leif-Atle BeislandDocument15 pagesJournal of International Accounting, Auditing and Taxation: Mattias Hamberg, Leif-Atle BeislandAndry YadisaputraNo ratings yet

- DA4387 Level I CFA Mock Exam 2018 Morning ADocument37 pagesDA4387 Level I CFA Mock Exam 2018 Morning AAisyah Amatul GhinaNo ratings yet

- Tax GuideDocument10 pagesTax GuideossymbengwaNo ratings yet

- Tally Trading and Profit Loss Acc Balance SheetDocument14 pagesTally Trading and Profit Loss Acc Balance Sheetsuresh kumar10No ratings yet

- Ratio AnalysisDocument8 pagesRatio AnalysisEngy SabryNo ratings yet

- Bank StatementDocument24 pagesBank StatementJames PeterNo ratings yet

- Ibiz 040301778899563 20231001 20231021 1697900022059734617.Document3 pagesIbiz 040301778899563 20231001 20231021 1697900022059734617.rezkykiky043No ratings yet

- Security Market and Stock Exchange: March 2023Document6 pagesSecurity Market and Stock Exchange: March 2023Aman BaigNo ratings yet

- Intangible AssetsDocument26 pagesIntangible Assetslee jong suk100% (1)

- Solution Manual For Cost Accounting 16th Edition Horngren Datar RajanDocument53 pagesSolution Manual For Cost Accounting 16th Edition Horngren Datar RajanLo Wingc0% (2)

- Ind AS 16 Property, Plant and Equipment AccountingDocument20 pagesInd AS 16 Property, Plant and Equipment AccountingSandeepPusarapuNo ratings yet

- Financial Accounting and Reporting Mock Board 2022Document8 pagesFinancial Accounting and Reporting Mock Board 2022Kenneth DiabordoNo ratings yet

- Bba Fin Stock MarketDocument76 pagesBba Fin Stock MarketPradyumnNo ratings yet

- Cma DataDocument13 pagesCma DataJoseph LunaNo ratings yet

- CH 6Document32 pagesCH 6Zead MahmoodNo ratings yet

- CH 4Document21 pagesCH 4Amir HussainNo ratings yet

- Interim Financial ReportingDocument3 pagesInterim Financial ReportingPaula De RuedaNo ratings yet

- Sources of Finance (Equity)Document10 pagesSources of Finance (Equity)Dayaan ANo ratings yet

- BNLIDocument3 pagesBNLIsisalim nurNo ratings yet

- Quizzer 1Document4 pagesQuizzer 1Arvin John MasuelaNo ratings yet

- Cambridge International AS and A Level Accounting Workbook (David Horner)Document97 pagesCambridge International AS and A Level Accounting Workbook (David Horner)Tanvia67% (3)

- Financial Accounting in An Economic Context 9th Edition Pratt Solutions ManualDocument39 pagesFinancial Accounting in An Economic Context 9th Edition Pratt Solutions Manualgwynethhanh9p6100% (29)

- MS-4 Dec 2012 PDFDocument4 pagesMS-4 Dec 2012 PDFAnonymous Uqrw8OwFWuNo ratings yet

- 1 637143432596402245 2273042 - AnswerDocument2 pages1 637143432596402245 2273042 - Answerfayyasin99No ratings yet