Professional Documents

Culture Documents

1CO2200A1023

Uploaded by

Jotham SederstromOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1CO2200A1023

Uploaded by

Jotham SederstromCopyright:

Available Formats

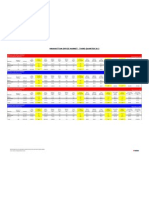

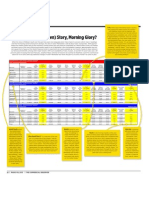

DOWNTOWN NEW YORK OFFICE MARKET - THIRD QUARTER 2012

OFFICE MARKET

DOWNTOWN NEW YORK OFFICE MARKET

Class A Statistical Summary

POSTINGS

Y-o-Y

Total

Available

DOWNTOWN

Inventory SubmarketSpace

Direct

Sublease

Total

% Change

Number

Available

Available

NEW

YORKofOFFICE

MARKET Available

Buildings

Space

Space

Space

Inventory

Class A Statistical Summary

OFFICE

MARKET

DOWNTOWN

NEW

YORK

OFFICE

MARKET

6,298,488 City Hall 70,492

26.4% 7

9,489

6,298,488

61,003

70,492

Statistical Summary

11,902,802 Class

World A

Financial

445,816

7.4% 7

351,232

11,902,802

94,584

445,816

Total

Number

Available

663,315 Financial West

72,625

-51.3%

2 of

44,180

663,315

28,445

72,625

Buildings

Space

Submarket

Inventory

23,074,388 Financial3,352,077

East

-2.1% 21

2,782,300

23,074,388

569,777

3,352,077

Y-o-Y

Total

Direct

Sublease

Total

% Change

Number

Available

Available

Available

5,202,929 DOWNTOWN

Insurance

378,347

9 of

258,116

5,202,929

120,231

378,347

NEW 6.4%

YORK

OFFICE

MARKET Available

City Hall Space

7

6,298,488

70,492

Buildings

Space

Space

Space

Inventory Submarket

Inventory

Class

Statistical Summary

World A

Financial

7

11,902,802

445,816

47,141,922 Totals 4,319,357

-1.8%46

3,445,317

47,141,922

874,040

4,319,357

Financial

663,315

72,625

6,298,488 City

Hall West

70,492

26.4% 72

9,489

6,298,488

61,003

70,492

Y-o-Y

Direct

% Change

Vacancy

Rate

Sublease

Direct

Vacancy

Available

Rate

Space

Total

Sublease

Vacancy

Available

Rate

Space

Y-o-Y

Direct

% Pt.Vacancy

Change

Rate

Direct

Sublease

Wtd.

Vacancy

Avg.

RentalRate

Rate

Sublease

Total

Wtd.

Vacancy

Avg.

RentalRate

Rate

Y-o-Y

Total

% Pt.Avg.

Change

Wtd.

Rental

Rate

Y-o-Y

Direct

% Change

Wtd. Avg.

Rental

Rate

Lower Manhattan Leasing

0.2%

26.4%

Year-to-Date

Sublease

Leasing

Wtd. Avg.

Activity

Rental Rate

Y-o-Y

Total

% Change

Wtd. Avg.

Rental

Rate

DOWNTOWN

NEW

YORK

OFFICE

MARKET

- THIRD

QUARTER

2012

1.0%

9,489

1.1%

61,003

0.2%

0.2%

$42.00

1.0%

$41.75

1.1%

$41.89

0.2%

0.1%

$42.00

72,462

$41.75

13.5%

$41.89

3.0%

7.4%

Y-o-Y

% Change

6.7%

-51.3%

0.8%

351,232

Direct

Available

4.3%

44,180

Space

2.5%

2,782,300

Sublease

Direct

Vacancy

Available

2.3%

258,116

9,489

Rate

Space

12.1%

-2.1%

Y-o-Y

Direct

%

Change

Vacancy

5.0%

6.4%

26.4%

Rate

3.7%

94,584

Sublease

Available

10.9%

28,445

Space

14.5%

569,777

Total

Sublease

Vacancy

Available

7.3%

120,231

0.3%

3.0%

Direct

Vacancy

-11.5%

6.7%

Rate

-0.3%

12.1%

Y-o-Y

Direct

% Pt.0.4%

Change

Vacancy

5.0%

0.2%

Rate

$54.19

0.8%

Sublease

Vacancy

$35.82

4.3%

Rate

$45.74

2.5%

Direct

Sublease

$32.71

3.7%

Total

Vacancy

$31.49

10.9%

Rate

$31.01

14.5%

Sublease

Total

Wtd.

Vacancy

Avg.

$39.47

2.3%

Wtd.

Vacancy

Avg.

$38.75

7.3%

$51.66

0.3%

Y-o-Y

% Pt. Change

$35.28

-11.5%

$45.04

-0.3%

Y-o-Y

Total

%$39.41

Pt.Avg.

Change

Wtd.

0.4%

Rental 0.2%

Rate

0.3%

$45.19

-0.2%

-11.5%

$41.89

0.2%

-6.5%

$54.19

Direct

Wtd.

Avg.

0.6%

$35.82

Rental Rate

4.7%

$45.74

Y-o-Y

Direct

% Change

Wtd.

Avg.

5.5%

$39.47

$42.00

Rental

Rate

$54.19

4.6%

$45.99

$35.82

0.1%

$42.00

694,603

$32.71

Sublease

Wtd.

Avg.

31,808

$31.49

Rental Rate

1,131,045

$31.01

Year-to-Date

Sublease

Leasing

Wtd.

Avg.

150,685

$38.75

Totals

46

47,141,922

4,319,357

5,202,929 Insurance378,347

6.4% 9

258,116

5,202,929

120,231

378,347

Y-o-Y

Direct

Sublease

Total

City Hall Total

7

6,298,488

70,492

% Change

Available

Available

Available

Available

Number of

World Financial

7

11,902,802

445,816

DOWNTOWN

NEW

YORK

OFFICE

MARKET

Space

Space

Space

Space

Buildings

47,141,922

Totals 4,319,357

-1.8%

46

3,445,317

47,141,922

874,040

4,319,357

Inventory Submarket

Inventory

Financial

2

663,315

72,625

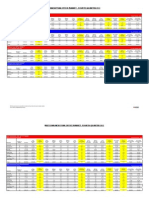

Class

B West

Statistical Summary

Financial

East

21

23,074,388

OFFICE

MARKET

DOWNTOWN

NEW-37.8%

YORK

OFFICE

MARKET

3,192,893

City

Hall 106,516

8

94,764

3,192,893

Insurance

5,202,929

3,618,654 Class

World

Financial

409,477

7.1% 49

266,091

3,618,654

B

Statistical Summary

3,352,077

11,752

106,516

378,347

143,386

409,477

Total

Available

Number

3,962,787 Financial 766,032

West

9.0%

9 of

761,175

3,962,787

4,857

766,032

Space

Buildings

Totals

46

47,141,922

4,319,357

Submarket

Inventory

11,271,101 Financial1,298,240

East

3.8% 26

1,017,690

11,271,101

280,550

1,298,240

Y-o-Y

Total

Direct

Sublease

Total

% Change

Available

Available

Available

Available

Number

5,712,767 Insurance

406,417

12.6%

10 of

387,514

5,712,767

18,903

406,417

City

Hall

8

3,192,893

106,516

DOWNTOWN

NEW YORK

MARKET Space

Space

Space

Space

BuildingsOFFICE

Inventory Submarket

Inventory

World Financial

4

3,618,654

409,477

Class

Statistical Summary

27,758,202

Totals B2,986,682

57 OFFICE

2,527,234

27,758,202

2,986,682

OFFICE

MARKET

DOWNTOWN

NEW 4.1%

YORK

MARKET 459,448

West

3,962,787

766,032

3,192,893 Financial

City Hall 106,516

-37.8% 98

94,764

3,192,893

11,752

106,516

DOWNTOWN

Class

A409,477

Statistical Summary

Financial

East

26

11,271,101

3,618,654

World Financial

4

266,091

3,618,654

OFFICE

MARKET

DOWNTOWN

NEW 7.1%

YORK

OFFICE

MARKET

Number

Insurance

10

5,712,767

3,962,787 Class

Financial

766,032

West

9.0%

9 of

761,175

3,962,787

C

Statistical

Summary

Buildings

Submarket

Inventory

-1.8%

5.0%

6.4%

Y-o-Y

Direct

26.4%

% Change

Vacancy

7.4%

Rate

7.3%

-1.8%

As

$45.19:

-51.3%

3,445,317

874,040

7.3%

1.9%

2.3%

258,116

7.3%

120,231

0.4%

5.0%

$39.47

2.3%

Y-o-Y

Sublease

Direct

Total

Sublease

Direct

Direct

Sublease

9,489

61,003

0.2%

1.0%

% Pt.Vacancy

Change

Vacancy

Available

Vacancy

Available

Wtd.

Vacancy

Avg.

351,232

94,584

3.0%

0.8%

Space tenants Rate

Space

Rental

Rate

Rate

1.9%

3,445,317

9.2%

874,040

-0.2%

7.3%

$45.99

1.9%

Rate

proofRate

that

exploring

lower

Manhattan

prefer

44,180

28,445

6.7%

4.3%

9.2%

-0.2%

$45.99

$38.75

7.3%

$39.41

0.4%

5.5%

$39.47

Y-o-Y

Y-o-Y

Sublease

Total

Total

Direct

1.1%

0.2%

$42.00

% Pt.Avg.

Change

% Change

Wtd.

Vacancy

Avg.

Wtd.

Wtd. Avg.

3.7%

0.3%

$54.19

Rental

Rate

Rate

Rental

Rate

Rental

Rate

$32.50

9.2%

$45.19

-0.2%

4.6%

$45.99

new,

more-efficient

office

space

over

10.9%

-11.5%

$35.82

-13.9%

111.0%

-37.1%

-71.7%

Y-o-Y

Wtd.

Vacancy

Avg.

$34.29

0.3%

0.4%

RentalRate

Rate

4.0%

$34.74

1.7%

0.1%

$37.25

0.4%

Wtd.

Vacancy

Avg.

$0.00

7.1%

3.3%

RentalRate

Rate

11.3%

$33.34

10.8%

19.3%

$0.00

3.3%

%$34.29

Pt.Avg.

Change

Wtd.

1.2%

Rental-2.0%

Rate

0.8%

$34.61

0.6%

1.6%

$37.25

-2.0%

% Change

Wtd.

Avg.

-4.4%

$34.29

$37.25

Rental

Rate

$38.64

-1.4%

$34.74

$32.81

3.1%

$37.25

Leasing

Wtd.

Avg.

128,112

$0.00

$0.00

Activity

Rental

Rate

$30.39

1,165,263

$33.34

$0.00

126,180

% Change

Wtd.

Avg.

-2.9%

$34.29

$37.25

Rental

Rate

$37.10

10.8%

$34.61

$32.81

111.0%

$37.25

3.8%

7.4%

7.1%

Y-o-Y

280,550

11.3%

143,386

Sublease

Available

18,903

19.3%

4,857

Space

11.5%

280,550

Total

Sublease

459,448

Vacancy

Available

7.1%

18,903

Rate

Space

11,752

Total

Sublease

Vacancy

Available

143,386

10.8%

459,448

Rate

Space

1.1%

61,003

4,857

9.0%

0.8%

7.4%

Direct

Vacancy

6.8%

1.6%

19.2%

Rate

Y-o-Y

0.4%

9.0%

Direct

% Pt.Vacancy

Change

9.1%

1.2%

6.8%

Y-o-Y

Rate

3.0%

Direct

% Pt.Vacancy

Change

7.4%

0.6%

9.1%

Rate

0.2%

0.2%

19.2%

2.5%

$38.64

4.0%

Sublease

Vacancy

0.3%

$32.81

0.1%

Rate

$35.08

2.5%

Direct

Sublease

1.7%

Wtd.

Vacancy

Avg.

$34.29

0.3%

Rental

Rate

Rate

0.4%

Direct

Sublease

Wtd.

Vacancy

Avg.

4.0%

$34.74

1.7%

Rental

Rate

Rate

$42.00

1.0%

0.1%

11.5%

$30.39

11.3%

Total

Vacancy

7.1%

$0.00

19.3%

Rate

$34.35

11.5%

Sublease

Total

10.8%

Wtd.

Vacancy

Avg.

$0.00

7.1%

Rental

Rate

Rate

3.3%

Sublease

Total

Wtd.

Vacancy

Avg.

11.3%

$33.34

10.8%

Rental

Rate

Rate

$41.75

1.1%

19.3%

0.4%

$37.10

0.8%

Y-o-Y

%$32.81

Pt.1.6%

Change

1.2%

$35.08

0.2%

$38.64

Direct

Wtd.

Avg.

$34.29

-3.1%

$32.81

Rental Rate

Y-o-Y

0.6%

$35.08

Direct

% Change

$34.74

Wtd.

Avg.

-4.4%

$34.29

Y-o-Y

Rental

Rate

$37.25

Direct

% Change

Wtd. Avg.

$38.64

-1.4%

$34.74

Rental

Rate

0.1%

$42.00

$32.81

$34.35

73,847

$30.39

Sublease

Wtd.

Avg.

170,762

$0.00

Rental Rate

666,362

$34.35

Year-to-Date

Sublease

$33.34

Leasing

Wtd.

Avg.

128,112

$0.00

Activity

Rental

Rate

$0.00

Year-to-Date

Sublease

Leasing

Wtd. Avg.

$30.39

1,165,263

$33.34

Activity

Rental

Rate

72,462

$41.75

$0.00

$34.97

-71.7%

$37.10

Total

Wtd.

Avg.

$34.29

-1.0%

$32.81

Rental Rate

Y-o-Y

56.2%

$34.97

Total

% Change

$34.61

Wtd.

Avg.

-2.9%

$34.29

Y-o-Y

Rental

Rate

$37.25

Total

% Change

Wtd. Avg.

$37.10

10.8%

$34.61

Rental

Rate

13.5%

$41.89

$32.81

Y-o-Y

Year-to-Date

%

Change

Leasing

-4.4%

128,112

(60,613)

-3.1%Third Quarter

170,762

(65,470)2012

Activity

Y-o-Y

56,242

0.6%

666,362

67,500

Year-to-Date

Year-to-Date

Year-to-Date

Change

-1.4%

1,165,263

Direct%

Absorption

Total

Leasing

Absorption

(59,115)

-4.4%

128,112

(16,515)

Y-o-Y

Rate

Activity

Rate

3.1%

126,180

Year-to-Date

Year-to-Date

Year-to-Date

Change

Direct%Absorption

Total

Leasing

Absorption

0.2%

73,847

29,800

-1.4%

1,165,263

(54,011)

Rate

Activity

Rate

22,060

0.1%

72,462

30,607

-3.1%

170,762

-6.5%

$54.19

$35.08

-5.4%

$35.84

0.6%

$35.82

$34.29

N/A

$0.00

Direct

4.7%

$45.74

Wtd.

Avg.

-4.8%

$34.51

$34.74

Rental

Rate

5.5%

$39.47

1.3%

$28.23

Y-o-Y

Direct

% Change

Wtd.

Avg.

-3.5%

$31.96

4.6%

$45.99

$35.84

Rental

Rate

$0.00

-7.1%

$31.74

$34.51

-5.4%

$35.84

694,603

$32.71

$34.35

371,174

$35.32

31,808

$31.49

0$0.00

$0.00

Sublease

1,131,045

$31.01

Wtd.

Avg.

156,246

$38.50

$33.34

Rental

Rate

150,685

$38.75

63,347

$0.00

Year-to-Date

Sublease

Leasing

Wtd.

Avg.

137,566

$0.00

2,080,603

$32.50

$35.32

Activity

Rental

Rate

$0.00

728,333

$36.59

$38.50

371,174

$35.32

-72.0%

$51.66

$34.97

25.4%

$35.83

-29.7%

$35.28

$34.29

N/A

$0.00

Total

-13.9%

$45.04

Wtd.

Avg.

90.8%

$34.66

$34.61

Rental

Rate

-37.1%

$39.41

160.5%

$28.23

Y-o-Y

Total

% Change

Wtd.

Avg.

16.4%

$31.96

-49.7%

$45.19

$35.83

Rental

Rate

$0.00

40.0%

$31.80

$34.66

25.4%

$35.83

324,782

4.7%

% Change

52,367

-4.8%

-1.4%

17,842

5.5%

33,017

1.3%

Y-o-Y

Year-to-Date

Change

Direct%

Absorption

52,943

-3.5%

326,100

4.6%

-5.4%

Rate

N/A

491,561

-7.1%

-4.8%

353,234

-5.4%

Y-o-Y

Total

$28.23

-3.4%

% Pt.-5.5%

Change

Wtd.

Avg.

$31.96

-4.2%

Rental

Rate

Y-o-Y

-7.6%

Total

% Pt.Avg.

Change

Wtd.

0.0%

$31.80

-5.5%

Rental

Rate

$37.25

-2.0%

-3.5%

$28.23

N/A

$0.00

Direct

Wtd.

Avg.

$31.96

-4.8%

$34.51

Rental Rate

Y-o-Y

Direct

1.3%

$28.23

% Change

Wtd.

Avg.

$31.74

-3.5%

$31.96

Rental

Rate

Y-o-Y

$35.84

Direct

% Change

Wtd.

Avg.

$0.00

-7.1%

$31.74

Rental

Rate

3.1%

$37.25

$34.51

0$0.00

Sublease

Wtd.

Avg.

$0.00

156,246

$38.50

Rental Rate

Year-to-Date

Sublease

63,347

$0.00

Leasing

Wtd.

Avg.

$36.59

137,566

$0.00

Activity

Rental

Rate

$35.32

Year-to-Date

Sublease

Leasing

Wtd.

Avg.

$0.00

728,333

$36.59

Activity

Rental

Rate

126,180

$0.00

$38.50

$28.23

N/A

$0.00

Total

Wtd.

Avg.

$31.96

90.8%

$34.66

Rental Rate

Y-o-Y

Total

160.5%

$28.23

% Change

Wtd.

Avg.

$31.80

16.4%

$31.96

Rental

Rate

Y-o-Y

$35.83

Total

% Change

Wtd.

Avg.

$0.00

40.0%

$31.80

Rental

Rate

111.0%

$37.25

$34.66

63,347

01.3%

N/A Third Quarter

00 2012

Y-o-Y

Year-to-Date

% Change

Leasing

-3.5%

137,566

52,367

-4.8%Third Quarter

156,246

56,472 2012

Activity

Y-o-Y

Year-to-Date

Year-to-Date

Year-to-Date

33,017

1.3%

63,347

35,017

Change

Direct%Absorption

Total

Leasing

Absorption

-7.1%

728,333

52,943

-3.5%

137,566

57,450

Rate

Activity

Rate

Y-o-Y

-5.4%

371,174

Year-to-Date

Year-to-Date

Year-to-Date

Change

Direct%Absorption

Total

Leasing

Absorption

N/A

0

491,561

-7.1%

728,333

497,958

Rate

Activity

Rate

45,239

3.1%

126,180

35,763

-4.8%

156,246

$37.10

0.8%

-3.4%

$36.76

-2.9%

$32.81

1.6%

-4.2%

$45.09

0.4%

Y-o-Y

%$34.97

Pt.0.4%

Change

$33.12

-1.0%

-5.5%

$34.29

1.2%

$41.32

-0.2%

Y-o-Y

Total

%$35.57

Pt.-0.3%

Change

Wtd.

Avg.

$34.61

0.6%

Rental-2.9%

Rate

0.4%

$39.83

-0.6%

-1.0%

$36.76

-2.9%

0.2%

$38.64

$28.23

-2.1%

$36.62

-3.1%

$32.81

$31.96

0.6%

$47.49

Direct

0.6%

$35.08

Wtd.

Avg.

-3.7%

$33.11

$31.74

-4.4%

$34.29

Rental

Rate

2.6%

$41.98

Y-o-Y

Direct

% Change

Wtd.

Avg.

0.5%

$35.49

-1.4%

$34.74

$36.62

Rental

Rate

$47.49

1.9%

$40.31

$33.11

-2.1%

$36.62

73,847

$30.39

$0.00

569,816

$39.41

170,762

$0.00

$0.00

768,450

$31.40

Sublease

666,362

$34.35

Wtd.

Avg.

358,816

$33.81

$36.59

128,112

$0.00

Rental

Rate

1,860,754

$32.91

Year-to-Date

Sublease

Leasing

Wtd.

Avg.

416,363

$38.75

1,165,263

$33.34

$39.41

Activity

Rental

Rate

$31.40

3,974,199

$33.00

$33.81

569,816

$39.41

-71.7%

$37.10

$28.23

35.8%

$36.76

-1.0%

$32.81

$31.96

-71.9%

$45.09

Total

56.2%

$34.97

Wtd.

Avg.

19.8%

$33.12

$31.80

-2.9%

$34.29

Rental

Rate

5.5%

$41.32

Y-o-Y

Total

% -15.0%

Change

Wtd.

Avg.

$35.57

10.8%

$34.61

$36.76

Rental

Rate

$45.09

-30.4%

$39.83

$33.12

35.8%

$36.76

48,047

0.2%

73,847

(75,289)

1.3%

63,347

420,533

-2.1%

569,816

415,389

(60,613)

-3.1%

170,762

(65,470)

-3.5%

137,566

2012

2,367

0.6% Third Quarter

768,450

(155,359)

Y-o-Y

Year-to-Date

56,242

0.6%

666,362

67,500

%

Change

Leasing

(1,150)

-3.7%

358,816

21,962

-7.1%

728,333

(59,115)

-4.4%

128,112

(16,515)

Activity

414,041

2.6%

1,860,754

61,581

Y-o-Y

Year-to-Date

Year-to-Date

Year-to-Date

Change

Direct%

Absorption

Total

Leasing

Absorption

11,670

0.5%

416,363

2,922

29,800

-1.4%

1,165,263

(54,011)

-2.1%

569,816

Rate

Activity

Rate

0.6%

768,450

847,461

1.9%

3,974,199

346,495

-3.7%

358,816

420,533

-2.1%

569,816

415,389

2.4%

13.7%

-0.2%

$41.98

$47.49

1.5%

$31.40

5.5%

$45.09

0.4%

0.6%

$47.49

Y-o-Y

Sublease

Total

Direct

%$33.12

Pt.-0.3%

Change

Vacancy

Vacancy

Wtd.

Avg.

1.0%

6.8%

$35.49

$33.11

0.7%

$33.81

15.4%

-1.0%

-3.7%

$33.11

Rate

Rate

Rental

Rate

Y-o-Y

Y-o-Y

Direct

Sublease

Sublease

Total

Total

Direct

-30.4%: Nearly

square

feet 2.6%

of

$41.98

2.4%

$32.91

13.7% 4 million

$41.32

-0.2%

$41.98

% Pt.-0.6%

Change

% Change

Wtd.

Vacancy

Avg.

Wtd.

Vacancy

Avg.

Wtd.

Avg.

Wtd.

Avg.

1.6%

9.3%

$40.31

$35.49

1.0%

$38.75

6.8%

$35.57

-0.3%

0.5%

$35.49

office

space

was

leased

in

the

past

year,

Rental

Rate

Rate

Rental

Rate

Rate

Rental

Rate

Rental

Rate

0.5%

2.3%

-2.9%

$36.62

$32.91

768,450

$31.40

Sublease

Wtd.

Avg.

$38.75

358,816

$33.81

Rental Rate

Year-to-Date

Sublease

1,860,754

$32.91

Leasing

Wtd.

Avg.

$33.00

416,363

$38.75

Activity

Rental

Rate

$39.41

$41.32

-71.9%

$45.09

Total

Wtd.

Avg.

$35.57

19.8%

$33.12

Rental

Rate

Y-o-Y

Total

5.5%

$41.32

% Change

Wtd.

Avg.

$39.83

-15.0%

$35.57

Rental

Rate

$36.76

$31.40

3,974,199

$33.00

371,174

$35.32

$33.81

$45.09

-30.4%

$39.83

25.4%

$35.83

$33.12

3.0%

7.4%

3.8%

3.0%

-71.8%

6.7%

-51.3%

12.6%

0.0%

N/A

Y-o-Y

12.1%

-2.1%

% Change

5.8%

-36.1%

4.1%

5.0%

6.4%

18.9%

-17.1%

Y-o-Y

Direct

%

Change

Vacancy

5.5%

-51.3%

7.3%

-1.8%

-71.8%

Rate

N/A

6.0%

-50.4%

-36.1%

3.0%

-71.8%

0.8%

351,232

1,017,690

0.1%

142,497

4.3%

44,180

387,514

0.0%

0

Direct

2.5%

2,782,300

Available

0.4%

78,741

2,527,234

Space

2.3%

258,116

0.0%

238,726

Sublease

Direct

Vacancy

Available

0.0%

165,432

1.9%

3,445,317

142,497

Rate

Space

0

0.1%

625,396

78,741

0.1%

142,497

3.7%

94,584

280,550

3.1%

4,560

10.9%

28,445

18,903

0.0%

0

Sublease

14.5%

569,777

Available

6.2%

5,955

459,448

Space

7.3%

120,231

18.9%

0

Total

Sublease

Vacancy

Available

5.5%0

9.2%

874,040

4,560

Rate

Space

0

6.1%

10,515

5,955

3.1%

4,560

0.3%

3.0%

9.0%

-7.6%

3.0%

-11.5%

6.7%

6.8%

0.0%

0.0%

Direct

-0.3%

12.1%

Vacancy

-3.5%

5.8%

9.1%

Rate

0.4%

5.0%

-3.4%

18.9%

Y-o-Y

Direct

% Pt.-4.2%

Change

Vacancy

5.5%

-0.2%

7.3%

3.0%

Rate

0.0%

-5.5%

6.0%

5.8%

-7.6%

3.0%

$54.19

0.8%

2.5%

$35.84

0.1%

$35.82

4.3%

0.3%

$0.00

0.0%

Sublease

$45.74

2.5%

Vacancy

$34.51

0.4%

1.7%

Rate

$39.47

2.3%

$28.23

0.0%

Direct

Sublease

Wtd.

Vacancy

Avg.

$31.96

0.0%

$45.99

1.9%

0.1%

RentalRate

Rate

0.0%

$31.74

0.1%

0.4%

$35.84

0.1%

$32.71

3.7%

11.5%

$35.32

3.1%

$31.49

10.9%

7.1%

$0.00

0.0%

Total

$31.01

14.5%

Vacancy

$38.50

6.2%

10.8%

Rate

$38.75

7.3%

$0.00

18.9%

Sublease

Total

Wtd.

Vacancy

Avg.

$0.00

5.5%

$32.50

9.2%

3.1%

RentalRate

Rate

0.0%

$36.59

6.1%

6.2%

$35.32

3.1%

-17.1%

0.0%

N/A

Y-o-Y

% -51.3%

Change

5.8%

-36.1%

238,726

0.0%

0

Direct

Available

165,432

0.4%

78,741

Space

Sublease

Direct

0.0%

238,726

Vacancy

Available

625,396

0.0%

165,432

Rate

Space

142,497

Sublease

Direct

Vacancy

Available

0

0.1%

625,396

Rate

Space

0.4%

94,764

78,741

0

0.0%

Sublease

Available

0

6.2%

5,955

Space

Total

Sublease

18.9%

0

Vacancy

Available

10,515

5.5%0

Rate

Space

4,560

Total

Sublease

Vacancy

Available

0

6.1%

10,515

Rate

Space

3.3%

11,752

5,955

11.3%

143,386

0

2.3%

77,315

19.3%

4,857

0

5.5%

237,970

Sublease

11.5%

280,550

Available

15.4%

39,257

10,515

7.1%

18,903

Space

13.7%

850,327

Total

Sublease

18.9%

0.0%

0.0%

Direct

Vacancy

5.5%

-3.5%

5.8%

Rate

Y-o-Y

Direct

-3.4%

18.9%

% Pt.Vacancy

Change

6.0%

-4.2%

5.5%

Rate

Y-o-Y

3.0%

Direct

% Pt.Vacancy

Change

0.0%

-5.5%

6.0%

Rate

-2.0%

3.0%

5.8%

0.0%

$0.00

Sublease

Vacancy

0.0%

$34.51

0.4%

Rate

Direct

Sublease

$28.23

0.0%

Wtd.

Vacancy

Avg.

0.1%

$31.96

0.0%

Rental

Rate

Rate

0.1%

Direct

Sublease

Wtd.

Vacancy

Avg.

0.0%

$31.74

0.1%

Rental

Rate

Rate

$37.25

0.4%

0.4%

18.9%

$0.00

0.0%

Total

Vacancy

5.5%

$38.50

6.2%

Rate

Sublease

Total

$0.00

18.9%

Wtd.

Vacancy

Avg.

6.1%

$0.00

5.5%

Rental

Rate

Rate

3.1%

Sublease

Total

Wtd.

Vacancy

Avg.

0.0%

$36.59

6.1%

Rental

Rate

Rate

$0.00

3.3%

6.2%

0.8%

7.4%

18.9%

-2.9%

1.7%

1.6%

19.2%

5.5%

0.4%

4.0%

Direct

0.4%

9.0%

Vacancy

-1.0%

14.8%

6.0%

1.2%

6.8%

Rate

-0.2%

11.3%

Y-o-Y

Direct

% Pt.-0.3%

Change

Vacancy

5.8%

0.6%

9.1%

1.7%

Rate

$38.64

4.0%

0.0%

$36.62

0.5%

$32.81

0.1%

0.0%

$47.49

1.5%

Sublease

$35.08

2.5%

Vacancy

$33.11

0.7%

0.1%

$34.29

0.3%

Rate

$41.98

2.4%

Direct

Sublease

$30.39

11.3%

18.9%

$39.41

2.3%

$0.00

19.3%

5.5%

$31.40

5.5%

Total

$34.35

11.5%

Vacancy

$33.81

15.4%

6.1%

$0.00

7.1%

Rate

$32.91

13.7%

Sublease

Total

Wtd.

Vacancy

Avg.

$35.49

1.0%

$34.74

1.7%

0.5%

RentalRate

Rate

1.5%

$40.31

1.6%

0.7%

$36.62

0.5%

Wtd.

Vacancy

Avg.

$38.75

6.8%

$33.34

10.8%

2.3%

RentalRate

Rate

5.5%

$33.00

9.3%

15.4%

$39.41

2.3%

Y-o-Y

Direct

18.9%

-17.1%

% -50.4%

Change

Vacancy

5.5%

-51.3%

Rate

Y-o-Y

-71.8%

Direct

% Change

Vacancy

N/A

6.0%

-50.4%

Rate

3.0%

-37.8%

-36.1%

7.4%

7.1%

-17.1%

1.7%

-56.7%

19.2%

9.0%

-51.3%

4.0%

7.3%

Y-o-Y

9.0%

3.8%

%

Change

14.8%

-6.2%

-50.4%

6.8%

12.6%

11.3%

-1.5%

Y-o-Y

Direct

%

Change

Vacancy

5.8%

-10.0%

9.1%

4.1%

-56.7%

Rate

7.3%

7.7%

-7.1%

-6.2%

1.7%

-56.7%

4.0%

266,091

238,726

0.5%

246,750

0.1%

761,175

165,432

1.5%

617,323

Direct

2.5%

1,017,690

Available

0.7%

884,096

625,396

0.3%

387,514

Space

2.4%

4,038,716

Sublease

Direct

Vacancy

Available

1.0%

811,062

1.7%

2,527,234

246,750

Rate

Space

617,323

1.6%

6,597,947

884,096

0.5%

246,750

35,611,455

4,889,043

7.3% 56

12

617,323

15,570,956

237,970

855,293

Total

Available

Number

43

13,897,097

950,196

5,986,809 Insurance

Financial 923,353

West

-6.2%

15 of

884,096

5,986,809

39,257

923,353

85,252,521:

In

total,

lower

Manhattan

boasts

Space

Buildings

Submarket

Inventory

Y-o-Y

Total

Direct

Sublease

Total

35,611,455 Financial4,889,043

East

-1.5% 56

4,038,716

35,611,455

850,327

4,889,043

85,252,521

feet

of of

officeAvailable

inventory,

orAvailable

% Change

Number

Available square

Available

Totals

177

85,252,521

7,941,950

13,897,097 Insurance950,196

-10.0%

43

811,062

13,897,097

139,134

950,196

Buildings

Space

Space

Space

Inventory Submarket

Inventory

City

Hall a

51stock of Space

14,186,204

324,065

about

third of the office

Midtown.

With

-1.5%

4.0%

7.3%

Y-o-Y

% -10.0%

Change

14.8%

-6.2%

Y-o-Y

Direct

11.3%

-1.5%

% Change

Vacancy

-7.1%

5.8%

-10.0%

Rate

-56.7%

4,038,716

1.5%

617,323

Direct

Available

811,062

0.7%

884,096

Space

Sublease

Direct

2.4%

4,038,716

Vacancy

Available

6,597,947

1.0%

811,062

Rate

Space

246,750

850,327

5.5%

237,970

Sublease

Available

139,134

15.4%

39,257

Space

Total

Sublease

13.7%

850,327

Vacancy

Available

1,344,003

6.8%

139,134

Rate

Space

77,315

World Financial

12

15,570,956

855,293

85,252,521 Totals

-7.1%177

6,597,947

85,252,521

1,344,003

7,941,950

that in7,941,950

mind, the markets

inventory

is down from

4,694,823 City

Hall 147,057

-71.8%15

36

142,497

4,694,823

4,560

147,057

Financial

West

5,986,809

923,353

2005,

back

before

a

surge

of

conversions

trans49,500

World Financial

0

N/A 56

1

049,500

0 0

Financial

East

35,611,455

4,889,043

7.3%

7.7%

-7.1%

3.0%

-71.8%

617,323

1.6%

6,597,947

0.1%

142,497

237,970

9.3%

1,344,003

3.1%

4,560

Summary

Vacancy

Available

6.8%

139,134

10.8%

459,448

77,315

Rate

Space

237,970

9.3%

1,344,003

39,257

2.3%

77,315

4.0%

-0.6%

7.7%

14.8%

-2.9%

1.7%

11.3%

0.4%

4.0%

Direct

Vacancy

5.8%

-1.0%

14.8%

Rate

Y-o-Y

Direct

-0.2%

11.3%

% Pt.Vacancy

Change

7.7%

-0.3%

5.8%

Rate

1.7%

4.0%

-0.6%

7.7%

-7.6%

3.0%

-6.2%

884,096

39,257

14.8%

9.3%:

Compared0.0%

with

Midtown

and

Midtown

0.0%

N/A

0

0.0%

0

0.0%

0.0%

-1.5%

4,038,716

850,327

11.3%

South,

formedWest

many poorly-36.1%

performing

office

buildings5,955

1,360,707 Insurance

Financial

84,696

4

78,741

1,360,707

84,696

5.8%

-36.1%where vacancy

0.4%

78,741 rates inched

6.2%

5,955 upward

-3.5%

5.8%

43

13,897,097

950,196

-10.0%

811,062

139,134

5.8%

within six months from the end ofNOTE:

the current

Only space

monththat

is included

can be occupied

in statistics.

within six months from the end of the current month is included in statistics.

ever

so slightly,0.0%

lower

into 238,726

upscale residential

But over 238,726

1,265,966 Financial

East

-17.1% 9 properties.

238,726

1,265,966

0

18.9%

-17.1%

238,726 Manhattan

18.9%0 alone suc-3.4%

18.9%

Totals

177

85,252,521

-7.1% whittled

6,597,947

1,344,003

7.7%

2,981,401 Insurance

165,432

-51.3%

24Research

165,432

2,981,401inven- 7,941,950

165,432

0

5.5%

-51.3%

0.0%

165,432

0

-4.2%

5.5%

cessfully

away at the5.5%

vacancies.

If

the next

two

orand

three

years,

the

current

ch Services

Source:

Cushman

Wakefield

Services

you look at both Midtown and Midtown South,

tory will surpass 2005, because the new World

10,352,397 Totals 635,911

-50.4%74

625,396

10,352,397

10,515

635,911

6.0%

-50.4%

0.1%

625,396

6.1%

10,515

-5.5%

6.0%

and Manhattan overall, vacancy is up from a

Trade Center buildings alone represent close to

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

year ago, said Mr. McCarthy. So, again, the

5 million square

feet,

said OFFICE

Mr. McCarthy.

And

OFFICE MARKET

DOWNTOWN

NEW

YORK

MARKET

Source:

Cushman

and

Wakefield

Research Services

Downtown market is performing better in

the ones

that

were

converted

have helped to

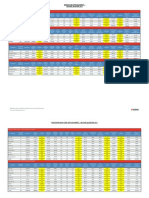

Overall

Statistical

Summary

within six months from the end ofNOTE:

the current

Only space

monththat

is included

can be occupied

in statistics.

within six months from the end of the current month is included in statistics.

terms of vacancy.

increase the residential inventory, so across the

ch Services

Source: Cushman and Wakefield Research Services

Y-o-Y has more

Y-o-Y

Y-o-Y

board,

Lower Manhattan

inventory.Sublease

Total

Direct

Total

Direct

Sublease

Direct

Total

Sublease

Direct

Available

Inventory SubmarketSpace

% Change

Number of

Buildings

Available

Space

Inventory

Available

Available

Space

Space

% Change

Vacancy

Rate

Vacancy

Available

Rate

Space

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

There

14,186,204 City 177:

Hall 324,065

5,986,809

13,897,097

85,252,521

22|OCTOBER 23, 2012|THE COMMERCIAL OBSERVER

within six months from the end ofNOTE:

the current

Only space

monththat

is included

can be occupied

in statistics.

within six months from the end of the current month is included in statistics.

ch Services

% Pt.Vacancy

Change

Rate

are 177-56.7%

office

across all five

submarkets1.7%

in-56.7%

lower Manhattan,

them, the-2.9%

51 buildings

246,750

14,186,204

77,315

324,065

0.5%

246,750 and among

2.3%

77,315

1.7%

at 76

years. In Midtown

average age5.5%

is closer to 100

237,970

855,293

4.0%

7.3% South, the

1.5%

617,323

237,970

0.4%

4.0%

years 923,353

old, while Midtown

at 70, said Mr.

McCarthy.

One

of the things

we talk about

Financial

West

-6.2% 15is comparatively

884,096

5,986,809 young

39,257

923,353

14.8%

-6.2%

0.7%

884,096

15.4%

39,257

-1.0%

14.8%

Financial

4,889,043

East when we talk

-1.5% 56

4,038,716

35,611,455

850,327

4,889,043

11.3%

-1.5%

2.4%

4,038,716

13.7%

850,327

-0.2%

11.3%

frequently

about new

development

is that the stock

of buildings

in Manhattan

is old, he said.

Insurance

950,196

-10.0%

43 A skyscrapers,

811,062

13,897,097 like the

139,134

950,196

5.8%

-10.0%

6.8%

139,134

-0.3%

5.8%

I mean,

what we call

Class

one occupied

by Citibank 1.0%

at811,062

601 Lexington

Avenuethat

building was built

so its 45 years

old, and thats

one of the1.6%

citys top-tier9.3%

buildings. -0.6%

Totals 7,941,950

-7.1%in

177the 1970s,

6,597,947

85,252,521

1,344,003

7,941,950

7.7%

-7.1%

6,597,947

1,344,003

7.7%

Source:

Cushman

and Wakefield

Services

average

age

of the

property

stock

clocks in

15,570,956 World

Financial

855,293

7.3% 12Research

617,323

15,570,956

35,611,455

Vacancy

Available

Rate

Space

Source: Cushman and Wakefield Research Services

Y-o-Y

$34.97

0.4%

Total

% Pt.0.6%

Change

Wtd.

Avg.

$34.29

1.2%

Y-o-Y

Rental

Rate

-2.0%

Total

% Pt.Avg.

Change

Wtd.

0.8%

$34.61

0.6%

Rental

Rate

$41.89

0.2%

1.6%

$51.66

0.3%

0.4%

$35.83

-7.6%

$35.28

-11.5%

1.2%

$0.00

0.0%

Y-o-Y

%$45.04

Pt.-0.3%

Change

$34.66

-3.5%

0.6%

$39.41

0.4%

$28.23

-3.4%

Y-o-Y

Total

%$31.96

Pt.-4.2%

Change

Wtd.

Avg.

$45.19

-0.2%

-7.6%

Rental

Rate

0.0%

$31.80

-5.5%

-3.5%

$35.83

-7.6%

-3.4%

$0.00

0.0%

Y-o-Y

% Pt.-4.2%

Change

$34.66

-3.5%

which,

under normal

circumstances,

would

1.5%

5.5%

0.4%

$47.49

$40.31

1.6%

$33.00

9.3%

$39.83

-0.6%

1.9%

$40.31

$35.84

0.1%admirable.

$35.32

3.1%

-7.6% similar data

-5.4%

$35.84

be

Compared$35.83

with

0.7%

15.4%

-1.0%

$33.11

$0.00

0.0%

0.0%

$0.00

0.0%

N/A

$0.00

2.4%

13.7%

-0.2%

$41.98

from a year$0.00

ago,

when 1.7

million square

$34.51

0.4%

$38.50

6.2%

$34.66

-3.5%

-4.8%

$34.51

1.0%

6.8%

$35.49

feet

in deals by

Cond Nast-0.3%

and New York

$28.23

0.0%

$0.00

18.9%

$28.23

-3.4%

1.3%

$28.23

City were recorded,

activity

appears lacklus9.3%

-0.6%

$40.31

$0.00

5.5%

$31.96

-4.2%

-3.5%

$31.96

ter, to be sure. But if you examine quarterly

$31.74

0.1%

$36.59

6.1%

$31.80

-5.5% leasing

-7.1%

$31.74

averages over

the past decade,

in

lower Manhattan was at its strongest last

year. Its down 30 percent from a year ago,

for sure, but a year ago was very strong,

said Mr. McCarthy. I think Y-o-Y

its more imporY-o-Y

Direct

Sublease

Sublease

Total

Total

Direct

% Pt.to

Change

% Change

tant

at

it compared

the long-term

Wtd.

Vacancy

Avg. to look

Wtd.

Vacancy

Avg.

Wtd.

Avg.

Wtd. Avg.

RentalRate

Rate

RentalRate

Rate

Rental

Rate

Rental

Rate

average. The 10-year average leasing for the

first

three quarters

of the$36.76

year

is 3.4 million

$36.62

0.5%

$39.41

2.3%

-2.9%

-2.1%

$36.62

square feet,

so the numbers

$47.49

1.5%

$31.40

5.5%

$45.09

0.4%are looking

0.6%

$47.49

despite the$33.12

percentage.

$33.11

0.7% positive,

$33.81

15.4%

-1.0%

-3.7%

$33.11

1.6%

$31.96

0.0%

Third Quarter

2012

0.6%

666,362

48,047

0.2%

73,847

(75,289)

(45,680)

-6.5%

0.6%

353,234

-5.4%

7,096

0.6%

-4.4%

0N/A Third

Y-o-Y

694,603

(80,070)

666,362

371,174

349,019

31,808

30,960

128,112

00 2012

Quarter

Year-to-Date

1,131,045

(40,936)

Leasing

156,246

56,472

1,165,263

Activity

150,685

(38,013)

63,347

35,017

Year-to-Date

Year-to-Date

Total

Leasing

Absorption

137,566

57,450

2,080,603

(97,452)

371,174

Activity

Rate

0

728,333

497,958

156,246

371,174

349,019

2012

2.6%

1,860,754

2,367

0.6% Third Quarter

768,450

(155,359)

Y-o-Y

Year-to-Date

%(1,150)

Change

Leasing

0.5%

416,363

-3.7%

358,816

21,962

Activity

Y-o-Y

Year-to-Date

Year-to-Date

Year-to-Date

414,041

2.6%

1,860,754

61,581

Change

Direct%Absorption

Total

Leasing

Absorption

1.9%

3,974,199

11,670

0.5%

416,363

2,922

Rate

Activity

Rate

-2.1%

569,816

0.6%

847,461

1.9%

353,234

-5.4%

-3.7%

768,450

3,974,199

346,495

371,174

349,019

358,816

-72.0%

Y-o-Y

% Change

-29.7%

-13.9%

Y-o-Y

% -37.1%

Change

13.5%

-72.0%

-49.7%

-29.7%

13.5%

-13.9%

-49.7%

-37.1%

Y-o-Y

13.5%

% Change

-72.0%

-49.7%

-29.7%

% Change

-1.0%

-49.7%

56.2%

Y-o-Y

% Change

-2.9%

111.0%

-71.7%

10.8%

-1.0%

111.0%

56.2%

-71.7%

Y-o-Y

% Change

-2.9%

-1.0%

Y-o-Y

56.2%

% Change

10.8%

-2.9%

Y-o-Y

111.0%

% Change

-71.7%

10.8%

13.5%

-1.0%

-72.0%

56.2%

25.4%

-29.7%

-2.9%

N/A

Y-o-Y

-13.9%

% Change

90.8%

10.8%

-37.1%

160.5%

Y-o-Y

% Change

16.4%

-49.7%

25.4%

N/A

40.0%

90.8%

25.4%

160.5%

N/A

Y-o-Y

% Change

16.4%

90.8%

Y-o-Y

160.5%

% Change

40.0%

16.4%

Y-o-Y

25.4%

% Change

N/A

40.0%

111.0%

90.8%

-71.7%

160.5%

35.8%

-1.0%

16.4%

-71.9%

Y-o-Y

56.2%

% Change

19.8%

40.0%

-2.9%

5.5%

Y-o-Y

% -15.0%

Change

10.8%

35.8%

-71.9%

-30.4%

19.8%

35.8%

5.5%

-71.9%

Y-o-Y

% -15.0%

Change

19.8%

Y-o-Y

5.5%

% -30.4%

Change

-15.0%

35.8%

-71.9%

-30.4%

25.4%

19.8%

0$0.00 346,495:

N/A

$0.00

02.6%

N/A total absorp00

The year-to-date

$32.91

$41.32

1,860,754

156,246

$38.50

$34.66

52,367

-4.8%

156,246

56,472

$38.75

$35.57

0.5%as the change

416,363

tion rate, 90.8%

otherwise

known

in

63,347

$0.00

160.5%

$28.23

33,017

1.3%

63,347

35,017

N/A

5.5%

90.8%

-15.0%

160.5%

$33.00

137,566

$0.00

-30.4%

16.4%

occupied space, has remained positive since

$39.83

1.9%

3,974,199

16.4%

$31.96

52,943

-3.5%

137,566

57,450

December at 346,495 square feet, despite

negative absorption

in Midtown.

The728,333

fact that

728,333

$36.59

40.0%

$31.80

491,561

-7.1%

497,958

its positive is a big story because, you know,

weve seen in the Midtown market some softThird Quarter 2012

ness, said Mr. McCarthy. Weve heard about

softness in the market, but were still seeing

Y-o-Y

Y-o-Y

Year-to-Date

Sublease

Total

Year-to-Date

Year-to-Date

Year-to-Date

space being

takenDirect

off %the

market,Total

which

is

% Change

Change

Leasing

Wtd. Avg.

Wtd. Avg.

Absorption

Leasing

Absorption

Activity

Rental Rate

Rental

Rate

Rate

Rate a good

thing. Activity

obviously

13.5%

$45.19

-37.1%

$39.41

Y-o-Y

Total

$41.89

% Change

Wtd. Avg.

$51.66

Rental

Rate

-49.7%

$45.19

$35.28

% Pt.1.2%

Change

Vacancy

6.8%

3.0%

Rate

7.4%

0.6%

9.1%

19.2%

-2.0%

3.0%

-13.9%

-72.0%

Y-o-Y

% -37.1%

Change

-29.7%

Vacancy

Available

7.1%

18,903

11,752

Rate

Space

143,386

10.8%

459,448

4,857

3.3%

11,752

% Change

12.6%

19.2%

9.0%

Y-o-Y

% Change

4.7%

1,131,045

(45,680)

-6.5%

694,603

(80,070)

Y-o-Y

Year-to-Date

% Change

Leasing

5.5%

150,685

7,096

0.6% Third Quarter

31,808

30,960 2012

Activity

324,782

4.7%

1,131,045

(40,936)

4.6%

2,080,603

17,842

5.5%

150,685

(38,013)

Y-o-Y

Year-to-Date

Year-to-Date

Year-to-Date

0.1%

72,462

Change

Direct%Absorption

Total

Leasing

Absorption

-6.5%

694,603

Rate

Activity

Rate

326,100

4.6%

2,080,603

(97,452)

0.6%

31,808

Vacancy

Available

0.3%

387,514

94,764

Rate

Space

266,091

1.7%

2,527,234

761,175

0.4%

94,764

94,584

445,816

1,298,240

4,560

147,057

28,445

72,625

406,417

0Total

0

23,074,388 Financial3,352,077

East

-2.1%

21 of

2,782,300

23,074,388

569,777

3,352,077

Number

Available

1,360,707 Financial West

84,696

-36.1%

4

78,741

1,360,707

5,955

84,696

Totals

57

27,758,202

2,986,682

Buildings

Space

Inventory

5,202,929 Submarket

Insurance378,347

6.4% 9

258,116

5,202,929

120,231

378,347

1,265,966 Financial 238,726

East

-17.1% 9

238,726

1,265,966

238,726

0Total

Y-o-Y

Total

Direct

Sublease

% -51.3%

Change

Number

Available

Available

Available

Available

2,981,401 Insurance

165,432

24 of

165,432

2,981,401

165,432

0

DOWNTOWN

NEW

YORK

OFFICE

MARKET

47,141,922

Totals

4,319,357

-1.8%

46

3,445,317

47,141,922

874,040

4,319,357

City

Hall

36

4,694,823

147,057

Buildings

Space

Space

Space

Inventory SubmarketSpace

Inventory

World C

Financial

1

49,500

0

Class

Statistical Summary

10,352,397 Totals 635,911

-50.4%74

625,396

10,352,397

10,515

635,911

OFFICE

MARKET

DOWNTOWN

NEW

YORK

OFFICE

MARKET

West

4

1,360,707

84,696

4,694,823 Financial

City Hall 147,057

-71.8%36

142,497

4,694,823

4,560

147,057

Statistical

Financial

East

15,570,956 Class

World C

Financial

855,293

72,462

30,607

%

Change

Vacancy

6.8%

12.6%

-37.8%

Rate

7.1%

9.1%

4.1%

9.0%

3.0%

-37.8%

Y-o-Y

9.0%

3.8%

Direct

% Change

4.1%

Vacancy

6.8%

12.6%

Y-o-Y

Rate

-37.8%

Direct

% Change

Vacancy

7.1%

9.1%

4.1%

Rate

0.2%

26.4%

9.0%

238,726

0Total

0

Available

165,432

5,955

84,696

Space

Y-o-Y

Total

Direct

Sublease

1,265,966 Financial 238,726

East

-17.1% 9

238,726

1,265,966

238,726

0Total

% Change

Available

Available

Available

Number

Totals Available

74 of

10,352,397

635,911

2,981,401 Insurance165,432

-51.3%24

165,432

2,981,401

165,432

0

Space

Space

Space

Buildings

Y-o-Y

Inventory Submarket

Inventory

City Hall Space

36

4,694,823

147,057

Total

Direct

Sublease

Total

% Change

Available

Available

Available

Number

World Financial

1 of

49,500

0

DOWNTOWN

NEW-50.4%

YORK

MARKET Available

10,352,397

Totals 635,911

74 OFFICE

625,396

10,352,397

10,515

635,911

Space

Space

Space

Space

Buildings

Inventory Submarket

Inventory

3,192,893 Financial

City Hall 106,516

-37.8% 48

94,764

3,192,893

11,752

106,516

1,360,707

84,696

Overall West

Statistical Summary

3,618,654 World

Financial

409,477

7.1% 49

266,091

3,618,654

143,386

409,477

Financial

East

1,265,966

238,726

OFFICE

MARKET

DOWNTOWN

NEW-56.7%

YORK

MARKET 77,315

14,186,204

City Hall 324,065

51 OFFICE

246,750

14,186,204

324,065

3,962,787 Insurance

Financial 766,032

West

9.0% 24

9

761,175

3,962,787

4,857

766,032

2,981,401

165,432

Statistical Summary

15,570,956 Overall

World Financial

855,293

7.3% 12

617,323

15,570,956

237,970

855,293

Total

11,271,101 Financial1,298,240

East

3.8% 26

1,017,690

11,271,101

280,550

1,298,240

Available

Number

5,986,809 Financial 923,353

West

-6.2%

15 of

884,096

5,986,809

39,257

923,353

Totals

74

10,352,397

635,911

5,712,767 Submarket

Insurance406,417

12.6%

10

387,514

5,712,767

18,903

406,417

Space

Buildings

Inventory

35,611,455 Financial4,889,043

East

-1.5% 56

4,038,716

35,611,455

850,327

4,889,043

Y-o-Y

Total

Direct

Sublease

Total

% Change

Available

Available

Available

Available

Number

13,897,097 DOWNTOWN

Insurance

950,196

43 of

811,062

13,897,097

139,134

950,196

27,758,202

Totals

4.1%

57

2,527,234

27,758,202

2,986,682

NEW-10.0%

YORK

MARKET 459,448

City Hall2,986,682

51 OFFICE

14,186,204

324,065

Space

Space

Space

Space

Buildings

Inventory Submarket

Inventory

Overall

Statistical Summary

World Financial

12

15,570,956

855,293

85,252,521 Totals 7,941,950

-7.1%177

6,597,947

85,252,521

1,344,003

7,941,950

OFFICE

MARKET

DOWNTOWN

NEW-56.7%

YORK

OFFICE

MARKET 77,315

West

15

5,986,809

923,353

14,186,204 Financial

City Hall 324,065

51

246,750

14,186,204

324,065

22,060

0.1%

4.7%

1,131,045

45,239

3.1%

126,180

35,763

5.5% Third Quarter

150,685

48,047

0.2%

73,847

(75,289)2012

Y-o-Y

Year-to-Date

% Change

Leasing

(60,613)

-3.1%

170,762

(65,470)

Activity

4.6%

2,080,603

56,242

0.6%

666,362

67,500

Y-o-Y

Year-to-Date

Year-to-Date

Year-to-Date

Change

Direct%

Absorption

Total

Leasing

Absorption

(59,115)

-4.4%

128,112

(16,515)

3.1%

126,180

Rate

Activity

Rate

0.2%

73,847

29,800

-1.4%

1,165,263

(54,011)

-3.1%

170,762

45,239

3.1%

126,180

35,763

1,017,690

4.0%

266,091

Direct

Available

387,514

0.1%

761,175

Space

2.5%

1,017,690

Sublease

Direct

2,527,234

Vacancy

Available

0.3%

387,514

Rate

Space

94,764

Sublease

Direct

Vacancy

Available

266,091

1.7%

2,527,234

Rate

Space

1.0%

9,489

761,175

Class

Statistical

Summary

Financial

East

9

1,265,966

World B

Financial

0

N/A

1

049,500

OFFICE49,500

MARKET

DOWNTOWN

NEW

YORK

OFFICE

MARKET

Number

Insurance

24

2,981,401

1,360,707 Overall

Financial West

84,696

-36.1%

4 of

78,741

1,360,707

Statistical

Summary

Buildings

Submarket

Inventory

Year-to-Date

Year-to-Date

Total

Leasing

Absorption

Activity

Rate

(45,680)

-6.5%Third Quarter

694,603

(80,070)2012

Y-o-Y

Year-to-Date

% Change

Leasing

7,096

0.6%

31,808

30,960

Activity

324,782

4.7%

1,131,045

(40,936)

Y-o-Y

Year-to-Date

Year-to-Date

Year-to-Date

Change

Direct%

Absorption

Total

Leasing

Absorption

17,842

5.5%

150,685

(38,013)

0.1%

72,462

Rate

Activity

Rate

-6.5%

694,603

326,100

4.6%

2,080,603

(97,452)

0.6%

31,808

22,060

0.1%

72,462

30,607

its aging

inventory,

one need569,777

only to look at

the total weighted

average

rental rates-0.3%

across Class

A

-2.1%

2,782,300

12.1%

2.5%

14.5%

$45.74

$31.01

$45.04

3.0%

-37.8%

0.4%

94,764

3.3%

11,752

-2.0%

3.0%

$37.25

0.4%

$0.00

3.3%

$37.25

-2.0%

3.1%

$37.25

126,180

$0.00

111.0%

$37.25

buildings,

experienced

a143,386

4.6 percent0.8%

increase

from

last

as rates for

Class B and0.2%

Class

6.4% which 4.0%

258,116

120,231

5.0%

2.3% year, even

7.3%

0.4%

$39.47

$38.75

$39.41

7.4%

7.1%

266,091

11.3%

7.4%

$38.64

4.0%

$30.39

11.3%

$37.10

0.8%

$38.64

73,847

$30.39

-71.7%

$37.10

Y-o-Y

Y-o-Y

Direct

Sublease

Direct

Sublease

Total

Direct

Sublease

Total

NEW

YORK

DOWNTOWN

OFFICE

MARKET

-YORK

THIRD

OFFICE

QUARTER

MARKET

2012

- THIRD

2012

%buildings

Change

% Pt.that

Change

C19.2%

dropped.

They19.3%

want

the NEW

new1.6%

product,

said

Mr.

McCarthy,

who

noted

much

of

it,Avg. QUARTER

Available

Available

Vacancy

Vacancy

Vacancy

Wtd.

Wtd.

Avg.

Wtd.

Avg.

9.0%

0.1%

761,175

4,857

19.2%

$32.81

0.1%

$0.00

19.3%

$32.81

1.6%

-3.1%

$32.81

170,762

$0.00

-1.0%

$32.81

Space

Space

Rate

Rate

Rate

Rental

Rate

Rental

Rate

Rental

Rate

-1.8%

3,445,317

874,040

7.3%

1.9%

9.2%

-0.2%

$45.99

$32.50

$45.19

including

1 World

Trade Center,

available

until

late next year.

9.0%

3.8%

2.5%

1,017,690

11.5%

280,550

0.4%

9.0%wont be

$35.08

2.5%

$34.35

11.5%

$34.97

0.4%

0.6%

$35.08

666,362

$34.35

56.2%

$34.97

Y-o-Y

Y-o-Y

Y-o-Y

Y-o-Y

Y-o-Y

Direct

Sublease

Direct

Total

Sublease

Direct

Direct

Sublease

Sublease

Total

Total

Direct

Year-to-Date

Sublease

Total

1,298,240

143,386

409,477

Total

Available

406,417

4,857

766,032

Space

Y-o-Y

3.8% 26

1,017,690

11,271,101

280,550

1,298,240

Direct

Sublease

Total

% Change

57 of

27,758,202

2,986,682

Number

Available

Available

Available

12.6%

10

387,514

5,712,767

18,903

406,417

Y-o-Y

Buildings

Space

Space

Space

8

3,192,893

106,516

Direct

Sublease

Total

Inventory

% Change

Number of

Available

Available

Available

4

3,618,654

409,477

NEW 4.1%

YORK

MARKET 459,448

57 OFFICE

2,527,234

27,758,202

2,986,682

Buildings

Space

Space

Space

Inventory

26.4% 97

9,489

6,298,488

61,003

70,492

3,962,787

766,032

Class C Statistical Summary

11,902,802 Financial

World Financial

445,816

7.4% 26

7

351,232

11,902,802

East

11,271,101

OFFICE

MARKET

DOWNTOWN

NEW-71.8%

YORK

MARKET

4,694,823

City Hall 147,057

36 OFFICE

142,497

4,694,823

663,315 Insurance

Financial West

72,625

-51.3%10

2

44,180

663,315

5,712,767

49,500 Class

World C

Financial

0

N/A 1

049,500

Statistical

Summary

$32.50

150,685

$38.75

Year-to-Date

Sublease

$41.75

Leasing

Wtd. Avg.

$32.71

Activity

Rental

Rate

2,080,603

$32.50

$31.49

Y-o-Y

Year-to-Date

Change

Direct%Absorption

Rate

-72.0%

$51.66

Total

Wtd.

Avg.

-29.7%

$35.28

Rental Rate

-13.9%

$45.04

Y-o-Y

Total

% -37.1%

Change

Wtd.

Avg.

$39.41

$41.89

Rental

Rate

$51.66

-49.7%

$45.19

$35.28

13.5%

$41.89

61,003will experience a leasing

1.0%

1.1%

$41.75

Rate

Space

RentalRate

Rateanomaly:

RentalRate

Rate

Activity

Rental

Rate

Over the course of the next three years, lower Manhattan

as new and more-efficient office space

hits the market,

7.4%

351,232

94,584

3.0%

0.8%

3.7%

$32.71

supply and rental rates are expected

to escalate

For

real estate

analysts,

who

have estimated that vacancy rates2,080,603

could

7.3%

-1.8%

1.9%

3,445,317 simultaneously.

9.2%

874,040

-0.2%

7.3%

$45.99

1.9%

$32.50

9.2%

$32.50 skyrocket to as

-51.3%

44,180

28,445

6.7%

4.3%

10.9%

$31.49

26.4%

1.0%

9,489

1.1%

61,003

0.2%

0.2%

1.0%

$41.75

1.1%

$41.75

high as 17.5 percent by 2015,0.2%

the

prospect

of more product

is exciting,

if a bit $42.00

unnerving.

As

for

right now, Ken McCarthy, a senior72,462

economist

at CushFinancial

East

21

23,074,388

3,352,077

-2.1%

2,782,300

569,777

12.1%

2.5%

14.5%

-0.3%

$45.74

$31.01

$45.04

11,902,802

World

Financial

445,816

7

351,232

11,902,802

445,816

3.0%

7.4%

0.8%

351,232

3.7%

94,584

0.3%

3.0%

$54.19

0.8%

$32.71

3.7%

$51.66

0.3%

-6.5%

$54.19

694,603

$32.71

-72.0%

$51.66

Y-o-Y

Y-o-Y

OFFICE

MARKET

DOWNTOWN

NEW 7.4%

YORK

OFFICE

MARKET 94,584

Total

Direct

Sublease

Direct

Sublease

Total

Direct

Sublease

Total

man

&

Wakefield,

reviewed

Manhattans

third-quarter

stats

with

The

Commercial

Observer

and

which

data

points

could

affect

the

% lower

Change

% discussed

Pt.0.4%

Change

Number

of

Available

Available

Available

Vacancy

Vacancy

Vacancy

Wtd.

Avg.

Wtd.

Avg.

Wtd.

Avg.

Insurance

9

5,202,929

378,347

6.4%

258,116

120,231

5.0%

2.3%

7.3%

$39.47

$38.75

$39.41

663,315 Class

Financial

West

72,625

-51.3% 2

44,180

663,315

28,445

72,625

6.7%

-51.3%

4.3%

44,180

10.9%

28,445

-11.5%

6.7%

$35.82

4.3%

$31.49

10.9%

$35.28

-11.5%

0.6%

$35.82

31,808

$31.49

-29.7%

$35.28

B

Statistical

Summary

Buildings

Space

Space

Space

Rate

Rate

Rate Properties

Rate

Rental Rate

Rental

Rate

that Silverstein

WorldRental

Submarket

Inventory

short-term

health

of

the

market

Properties

1

World

Trade

Center

and

Brookfield

Financial

Center

both

call

home.

23,074,388 Financial3,352,077

East

-2.1% 21

2,782,300

23,074,388

569,777

3,352,077

12.1%

-2.1%

2.5%

2,782,300

14.5%

569,777

-0.3%

12.1%

$45.74

2.5%

$31.01

14.5%

$45.04

-0.3%

4.7%

$45.74

1,131,045

$31.01

-13.9%

$45.04

11,271,101 Financial1,298,240

East

Total

Totals Available

5,712,767 Insurance

406,417

City Hall Space

Total

Inventory Submarket

Available

World Financial

DOWNTOWN

27,758,202

Totals 2,986,682

Space

Inventory Submarket

6,298,488 Financial

City Hall West

70,492

Third Quarter 2012

DOWNTOWN NEW YORK

DOWNTOWN

OFFICE MARKET

NEW-YORK

THIRDOFFICE

QUARTER

MARKET

2012 - THIRD QUARTER 2012

40.0%

Y-o-Y

% Change

569,816

$39.41

35.8%

$36.76

420,533

-2.1%

569,816

415,389

35.8%

768,450

$31.40

-71.9%

$45.09

2,367

0.6%

768,450

(155,359)

-71.9%

19.8%

358,816

$33.81

19.8%

$33.12

(1,150)

-3.7%

358,816

21,962

$41.98

2.4%

$32.91

13.7%

$41.32

-0.2%

2.6%

$41.98

1,860,754

$32.91

5.5%

$41.32

414,041

2.6%

1,860,754

61,581

5.5%

$35.49

1.0%

$38.75

6.8%

$35.57

-0.3%

0.5%

$35.49

416,363

$38.75

-15.0%

$35.57

11,670

0.5%

416,363

2,922

-15.0%

$40.31

1.6%

$33.00

9.3%

$39.83

-0.6%

1.9%

$40.31

3,974,199

$33.00

-30.4%

$39.83

847,461

1.9%

3,974,199

346,495

-30.4%

You might also like

- Investment Analysis - Polar Sports (A)Document9 pagesInvestment Analysis - Polar Sports (A)pratyush parmar100% (13)

- Investment Banking: Valuation, Leveraged Buyouts, and Mergers and AcquisitionsFrom EverandInvestment Banking: Valuation, Leveraged Buyouts, and Mergers and AcquisitionsRating: 5 out of 5 stars5/5 (2)

- Tax Quiz 1Document4 pagesTax Quiz 1Peng GuinNo ratings yet

- Atlanta Office Market Report Q3 2011Document2 pagesAtlanta Office Market Report Q3 2011Anonymous Feglbx5No ratings yet

- NYC Stats 3Q12Document5 pagesNYC Stats 3Q12Anonymous Feglbx5No ratings yet

- NYC Stats 4Q12Document5 pagesNYC Stats 4Q12Anonymous Feglbx5No ratings yet

- Bloomberg Q1 2012 M&a Global League TablesDocument39 pagesBloomberg Q1 2012 M&a Global League TablesMandeep SoorNo ratings yet

- 2012 EOY Industrial-OfficeDocument32 pages2012 EOY Industrial-OfficeWilliam HarrisNo ratings yet

- Exchange Summary Volume and Open Interest Equity Index FuturesDocument2 pagesExchange Summary Volume and Open Interest Equity Index FuturesavadcsNo ratings yet

- Charlotte Web AMERICAS Market Beat Industrial 3page Q12012Document3 pagesCharlotte Web AMERICAS Market Beat Industrial 3page Q12012Anonymous Feglbx5No ratings yet

- Nyc PDFDocument5 pagesNyc PDFAnonymous Feglbx5No ratings yet

- What's The (Downtown) Story, Morning Glory?: Downtown New York Office Market-February 2013Document1 pageWhat's The (Downtown) Story, Morning Glory?: Downtown New York Office Market-February 2013jotham_sederstr7655No ratings yet

- WR IndustrialMarketReport 2015Q4Document8 pagesWR IndustrialMarketReport 2015Q4Ron JansenNo ratings yet

- South Q2 2012 IND ReportDocument3 pagesSouth Q2 2012 IND ReportAnonymous Feglbx5No ratings yet

- 2013 2Q Industrial SnapshotDocument2 pages2013 2Q Industrial SnapshotCassidy TurleyNo ratings yet

- Underwriting Report November 2012Document6 pagesUnderwriting Report November 2012CredsureNo ratings yet

- MD-Baltimore August DataDocument2 pagesMD-Baltimore August DataAnonymous Feglbx5No ratings yet

- NorthernVA IND 3Q11Document2 pagesNorthernVA IND 3Q11Anonymous Feglbx5No ratings yet

- Eco Project Sem 3Document22 pagesEco Project Sem 3Parul JindalNo ratings yet

- Penn Ads Income StatementsDocument4 pagesPenn Ads Income StatementsconsorNo ratings yet

- Exchange Summary Volume and Open Interest Equity Index FuturesDocument2 pagesExchange Summary Volume and Open Interest Equity Index FuturesavadcsNo ratings yet

- MD-Baltimore July DataDocument2 pagesMD-Baltimore July DataAnonymous Feglbx5No ratings yet

- Accounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsDocument14 pagesAccounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsRex Tang100% (1)

- 2Q14 Atlanta Industrial Market ReportDocument4 pages2Q14 Atlanta Industrial Market ReportBea LorinczNo ratings yet

- Office Market Snapshot: Northern VirginiaDocument2 pagesOffice Market Snapshot: Northern VirginiaAnonymous Feglbx5No ratings yet

- Chpater 4 SolutionsDocument13 pagesChpater 4 SolutionsAhmed Rawy100% (1)

- Global Ma h1 LeagDocument39 pagesGlobal Ma h1 LeagSohini Mo BanerjeeNo ratings yet

- Exchange Summary Volume and Open Interest Equity Index FuturesDocument2 pagesExchange Summary Volume and Open Interest Equity Index FuturesavadcsNo ratings yet

- BaltimoreOfficeSnapshot Q32012Document2 pagesBaltimoreOfficeSnapshot Q32012Anonymous Feglbx5No ratings yet