Professional Documents

Culture Documents

Key Formulae 1

Uploaded by

theultimate100%(1)100% found this document useful (1 vote)

559 views3 pagesKEY FORMULAE 1 Total Cost Contribution p / u = Fixed Cost + Variable Cost. = selling price - Variable Cost p/u. = OR Profit = Margin of safety = Current output - Break-even output. Total revenue - Total cost Average annual profit x 100% _______________________________ investment Average investment: Initial investment at start + Amount Recovered at end. Capital Employed = Long-Term Liabilities + Capital + Reserves Net Profit

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentKEY FORMULAE 1 Total Cost Contribution p / u = Fixed Cost + Variable Cost. = selling price - Variable Cost p/u. = OR Profit = Margin of safety = Current output - Break-even output. Total revenue - Total cost Average annual profit x 100% _______________________________ investment Average investment: Initial investment at start + Amount Recovered at end. Capital Employed = Long-Term Liabilities + Capital + Reserves Net Profit

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC or read online from Scribd

100%(1)100% found this document useful (1 vote)

559 views3 pagesKey Formulae 1

Uploaded by

theultimateKEY FORMULAE 1 Total Cost Contribution p / u = Fixed Cost + Variable Cost. = selling price - Variable Cost p/u. = OR Profit = Margin of safety = Current output - Break-even output. Total revenue - Total cost Average annual profit x 100% _______________________________ investment Average investment: Initial investment at start + Amount Recovered at end. Capital Employed = Long-Term Liabilities + Capital + Reserves Net Profit

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC or read online from Scribd

You are on page 1of 3

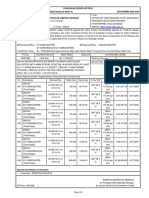

KEY FORMULAE 1

Total Cost = Fixed Cost + Variable Cost.

Contribution p/u = Selling price – Variable cost p/u.

Fixed cost

Break-even point (in units) = -----------------------

Contribution p/u

Margin of safety = Current output – Break-even output.

Total revenue = Output sold x selling price p/u.

Profit = Total revenue – Total cost

OR

Profit = Margin of safety x contribution p/u.

LDR + LRNPV x (HDR – LDR)

IRR = ________________________

(LRNPV – HRNPV)

ARR = Average annual profit x 100%

________________________

Investment

Average investment: Initial investment at start + Amount

Recovered at end

_______________________________________

2

Return on Capital Employed = Profit before Interest and Tax x 100%

_______________________________

(ROCE) Capital Employed

Capital Employed = Long-Term Liabilities + Capital + Reserves

ROCE = Net Profit Margin x Asset Turnover Ratio

Net Profit Margin = Profit before Interest and Tax x 100%

______________________________

Sales

Asset Turnover Ratio = Sales

_______________

Capital Employed

Gross Profit Margin = Gross Profit

___________ x 100%

Sales

Current Ratio = Current Assets

_______________

Current Liabilities

Quick Ratio (Acid Test) = Current Assets – Stock

___________________

Current Liabilities

Stock Turnover Ratio = Cost of Sales (no. of times)

_________________________

Inventory Held

Stock Holding Period = Inventory Held x 365 days (no. of days)

______________________

Cost of Sales

Debtor Collection Period = Trade Debtors x 365 days

_____________

(Debtor Days) Total Credit Sales

Creditor Payment Period = Trade Creditors x 365 days

_____________

(Creditor Days) Total Credit Purchases

Debt to Equity = Long-Term Liabilities

___________________

Capital + Reserves

Debt to Capital Employed = Long-Term Liabilities

__________________

Capital Employed

Interest Cover = Profit before Interest

__________________

Annual Interest Charge

Dividend Cover = Net Profit before Ordinary Dividends

_______________________________

Ordinary Dividends paid and proposed

Dividend Yield = Dividend per Share x 100%

_________________________

Market Price per Share

Earnings per Share = Net Profit Before Ordinary Dividends

______________________________

(EPS) Number of Ordinary Shares in Issue

Price Earnings Ratio = Market Price per Share

____________________

(PE Ratio) Earnings per Share

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- 1.ethics, Integrity & Aptitude by SK Mishra (Byju Classes) .RK Part 1 of 5Document66 pages1.ethics, Integrity & Aptitude by SK Mishra (Byju Classes) .RK Part 1 of 5theultimate0% (1)

- 2010 UPSC Main Exam Expected Important TopicsDocument14 pages2010 UPSC Main Exam Expected Important TopicstheultimateNo ratings yet

- Chronicle Tips Booklet For DownloadDocument36 pagesChronicle Tips Booklet For DownloadtheultimateNo ratings yet

- Fullysolved Ib Acio General Awareness PDFDocument10 pagesFullysolved Ib Acio General Awareness PDFBoss BaskaranNo ratings yet

- Practice Question: Cash Flow StatementDocument4 pagesPractice Question: Cash Flow Statementtheultimate74% (19)

- Sharpe, Tom - Wilt in NowhereDocument86 pagesSharpe, Tom - Wilt in NowheretheultimateNo ratings yet

- Standard CostingDocument3 pagesStandard Costingtheultimate100% (2)

- Calculation of InterestDocument2 pagesCalculation of Interesttheultimate100% (1)

- Basic Financial Statement - CorporationDocument2 pagesBasic Financial Statement - Corporationtheultimate100% (1)

- Basic Steps-Master BudgetDocument2 pagesBasic Steps-Master Budgettheultimate100% (2)

- Control AccountDocument2 pagesControl Accounttheultimate100% (9)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Managerial AccountingDocument38 pagesManagerial AccountingLEA100% (1)

- Recto Law and Maceda Law (Draft)Document15 pagesRecto Law and Maceda Law (Draft)Lordson RamosNo ratings yet

- Accounting Cycle: 4. Preparation of The Trial BalanceDocument8 pagesAccounting Cycle: 4. Preparation of The Trial BalanceAda Janelle Manzano0% (1)

- PDFDocument2 pagesPDFH R Viswanath NaiduNo ratings yet

- Consumer Behaviour For Online Shopping"Document12 pagesConsumer Behaviour For Online Shopping"Nishpakash Lakhanpal0% (1)

- Chapter 4-QUESTIONSDocument6 pagesChapter 4-QUESTIONSDanica GravitoNo ratings yet

- New Product Design ProcessDocument4 pagesNew Product Design Processsonam katiyarNo ratings yet

- Purchases-Adlaw (Month of February 2019)Document121 pagesPurchases-Adlaw (Month of February 2019)Giann Fritz AlvarezNo ratings yet

- Channel Behavior and OrganizationDocument4 pagesChannel Behavior and OrganizationJen Lyanne Gomez80% (5)

- Alternative Choices and DecisionsDocument29 pagesAlternative Choices and DecisionsAman BansalNo ratings yet

- Unit 1 Fundamentals of MarketingDocument23 pagesUnit 1 Fundamentals of Marketingreddysham4uNo ratings yet

- The Foreign Exchange MarketDocument26 pagesThe Foreign Exchange Marketmandy_t06No ratings yet

- Public GoodDocument33 pagesPublic GoodZek RuzainiNo ratings yet

- Soal Asistensi AK1 Pertemuan 7Document3 pagesSoal Asistensi AK1 Pertemuan 7Afrizal WildanNo ratings yet

- Impact of Advertisement On Consumer BehaviorDocument6 pagesImpact of Advertisement On Consumer BehaviorAymen SaeedNo ratings yet

- Jugaad As Frugal Innovation in Street Entrepreneurship at The Bottom of The Pyramid PDFDocument25 pagesJugaad As Frugal Innovation in Street Entrepreneurship at The Bottom of The Pyramid PDFVarun GaneshNo ratings yet

- FinMan Chapter 16 and 17 ProblemsDocument3 pagesFinMan Chapter 16 and 17 ProblemsJufel Ramirez100% (1)

- FAQ On GST - Overview of Goods and Services TaxDocument8 pagesFAQ On GST - Overview of Goods and Services TaxRajula Gurva ReddyNo ratings yet

- One Bata, One World: Presented By: Rajni S. AnkamDocument18 pagesOne Bata, One World: Presented By: Rajni S. AnkamKishorekumar NadigatlaNo ratings yet

- Admati Pfleiderer 1986 JoT Economic Market For InformationDocument39 pagesAdmati Pfleiderer 1986 JoT Economic Market For InformationsonalzNo ratings yet

- SR No Fee Head Fees : Fee Schedule For Portfolio Investment Scheme - Nri CustomersDocument2 pagesSR No Fee Head Fees : Fee Schedule For Portfolio Investment Scheme - Nri CustomersDesikanNo ratings yet

- Chapter 3-Demand, Supply and Market EquilibriumDocument51 pagesChapter 3-Demand, Supply and Market EquilibriumNuriIzzatiNo ratings yet

- Bowling Entertainment Center Business PlanDocument14 pagesBowling Entertainment Center Business Plansiang_lui100% (1)

- Hindustan Unilever LTD OOH Division SIP ReportDocument42 pagesHindustan Unilever LTD OOH Division SIP ReportSudip Dutta60% (5)

- Pindyck PPT CH02Document50 pagesPindyck PPT CH02Muthia KhairaniNo ratings yet

- Distribution BritanniaDocument5 pagesDistribution Britanniaarun0% (1)

- 25 Business Books That You Won't See On Most BookshelvesDocument10 pages25 Business Books That You Won't See On Most Bookshelvesjburns1980100% (5)

- For Bookkeeping ProblemDocument2 pagesFor Bookkeeping ProblemDanica TomasNo ratings yet

- Simple Interest and Simple Discount PDFDocument29 pagesSimple Interest and Simple Discount PDFandisetiawan90100% (5)

- A Research Proposal On Application of Theories of Economics in Retail Super Shop Chain Business in Bangladesh: A Case Study On Agora™Document6 pagesA Research Proposal On Application of Theories of Economics in Retail Super Shop Chain Business in Bangladesh: A Case Study On Agora™Zubayer Mahmud HasanNo ratings yet