Professional Documents

Culture Documents

New Doll

Uploaded by

Juyt HertCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Doll

Uploaded by

Juyt HertCopyright:

Available Formats

New Heritage Doll Company: Capital Budgeting

Solution Sheet 1

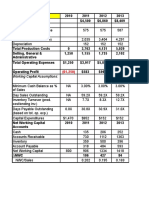

NPV Analysis for Match My Doll Clothing Line Extension

2010

2011

4 500

NA

2012

6 860

52,44%

2013

8 409

22,58%

2014

9 082

8,00%

2015

9 808

8,00%

2016

10 593

8,00%

2017

11 440

8,00%

2018

12 355

8,00%

2019

13 344

8,00%

2020

14 411

8,00%

0

1 250

1 250

575

2 035

152

2 762

1 155

3 917

575

3 404

152

4 131

1 735

5 866

587

4 291

152

5 029

2 102

7 132

598

4 669

152

5 419

2 270

7 690

610

5 078

164

5 853

2 452

8 305

622

5 521

178

6 321

2 648

8 969

635

6 000

192

6 827

2 860

9 687

648

6 519

207

7 373

3 089

10 462

660

7 079

224

7 963

3 336

11 299

674

7 685

242

8 600

3 603

12 203

-1 250

583

994

1 277

1 392

1 503

1 623

1 753

1 893

2 045

2 209

3,0%

59,2x

7,7x

30,8x

3,0%

59,2x

8,3x

30,9x

3,0%

59,2x

12,7x

31,0x

3,0%

59,2x

12,7x

31,0x

3,0%

59,2x

12,7x

31,0x

3,0%

59,2x

12,7x

31,0x

3,0%

59,2x

12,7x

31,0x

3,0%

59,2x

12,7x

31,0x

3,0%

59,2x

12,7x

31,0x

3,0%

59,2x

12,7x

31,0x

952

152

152

334

361

389

421

454

491

530

2011

135

729

360

317

907

107

20,15%

2012

206

1 112

500

484

1 334

427

19,45%

2013

252

1 363

396

593

1 418

84

16,87%

2014

272

1 472

427

640

1 531

113

16,86%

2015

294

1 590

461

692

1 653

122

16,86%

2016

318

1 717

498

747

1 786

132

16,86%

2017

343

1 855

538

807

1 929

143

16,86%

2018

371

2 003

581

871

2 083

154

16,86%

2019

400

2 163

627

941

2 250

167

16,86%

2020

432

2 336

677

1 016

2 429

180

16,86%

2010

-1 250

-500

-750

0

800

1 470

-3 020

2011

583

233

350

152

107

952

-557

2012

994

398

596

152

427

152

169

2013

1 277

511

766

152

84

152

682

2014

1 392

557

835

152

113

334

541

2015

1 503

601

902

164

122

361

583

2016

1 623

649

974

178

132

389

630

2017

1 753

701

1 052

192

143

421

680

2018

1 893

757

1 136

207

154

454

735

2019

2 045

818

1 227

224

167

491

793

2020

2 209

883

1 325

242

180

530

857

16 345

0

1,0000

-3020

7 150

-146

1

0,9225

-514

2

0,8510

144

3

0,7851

536

4

0,7242

392

5

0,6681

390

6

0,6163

388

7

0,5686

387

8

0,5245

385

9

0,4839

384

10

0,4464

383

7296

2010

-3 020

7,64%

-3020

23,99%

2011

-557

2012

169

2013

682

2014

541

2015

583

2016

630

2017

680

2018

735

2019

793

2020

857

2010

-3 020

-3 020

2018, that is the 8th after initial investment

2011

-557

-3 577

Revenue

Revenue Growth

Production Costs

Fixed Production Expense (excl depreciation)

Variable Production Costs

Depreciation

Total Production Costs

Selling, General & Administrative

Total Operating Expenses

Operating Profit

Working Capital Assumptions:

Minimum Cash Balance as % of Sales

Days Sales Outstanding

Inventory Turnover (prod. cost/ending inv.)

Days Payable Outstanding (based on tot. op. exp.)

NA

NA

NA

0,0x

Capital Expenditures

1 470

Net Working Capital Accounts

Cash (=as a % of Sales Revenue)

Accounts Receivable (=Revenue/365*Days Sales Outstanding)

Inventory (=Prodctn Costs/Inventory Turnover)

Accounts Payable (=Total Op Expenses/365*Days Payable Outstanding)

Net Working Capital

DNWC

NWC/Sales

2010

800

NPV Analysis

Free Cash Flows

EBIT

Taxes

Net Income

plus depreciation

less DNWC

less capital expenditures

Free Cash Flow

Terminal value

40%

3,00%

Initial Outlays

Net working capital

Net property, plant & equipment

PERIOD

Discount factor

Present value

Net Present Value

NPV without Terminal Value

8,40%

IRR Analysis

Cash Flows

IRR w/o Terminal Value

Cash Flows with Terminal Value

IRR with Terminal Value

Payback Analysis

Cash flows

Cumulative cash flow

Payback period

-557

169

2012

169

-3 408

682

2013

682

-2 726

541

2014

541

-2 185

583

2015

583

-1 602

630

2016

630

-972

680

735

2017

680

-291

2018

735

443

X

793

2019

793

1 237

17202

2020

857

2 094

2021

883

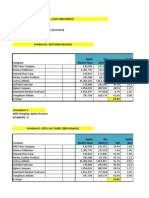

New Heritage Doll Company: Capital Budgeting

Solution Sheet 2

NPV Analyss for Design Your Own Doll

2010

2012

6 000

NA

2013

14 360

139,33%

1 650

1 683

1 717

1 751

1 786

1 822

1 858

1 895

1 933

0

1 201

1 201

0

0

0

0

0

2 250

310

4 210

1 240

5 450

7 651

310

9 644

2 922

12 566

11 427

310

13 454

4 044

17 498

12 182

436

14 369

4 287

18 656

12 983

462

15 231

4 544

19 775

13 833

490

16 145

4 817

20 962

14 736

520

17 113

5 106

22 219

15 694

551

18 140

5 412

23 553

16 712

584

19 229

5 737

24 966

-1 201

550

1 794

2 724

2 779

2 946

3 123

3 310

3 508

3 719

NA

NA

NA

NA

3,0%

59,2x

12,2x

33,7x

Revenue

Revenue Growth

Production Costs

Fixed Production Expense (excl depreciation)

Additional development costs (IT personnel)

Variable Production Costs

Depreciation

Total Production Costs

Selling, General & Administrative

Total Operating Expenses

Operating Profit

Working Capital Assumptions:

Minimum Cash Balance as % of Sales

Days Sales Outstanding

Inventory Turnover (prod. cost/ending inv.)

Days Payable Outstanding (based on tot. op. exp.)

NA

NA

NA

NA

Capital Expenditures

Net Working Capital Accounts

Cash (=as a % of Sales Revenue)

Accounts Receivable (=Revenue/365*Days Sales Outstanding)

Inventory (=Prodctn Costs/Inventory Turnover)

Accounts Payable (=Total Op Expenses/365*Days Payable Outstanding)

Net Working Capital

DNWC

NWC/Sales

2011

0

4 610

2010

2011

0

1 000

1 000

310

3,0%

59,2x

12,3x

33,8x

310

2014

20 222

40,82%

3,0%

59,2x

12,6x

33,9x

2 192

2015

21 435

6,00%

3,0%

59,2x

12,7x

33,9x

826

2016

22 721

6,00%

3,0%

59,2x

12,7x

33,9x

875

2017

24 084

6,00%

3,0%

59,2x

12,7x

33,9x

928

2018

25 529

6,00%

3,0%

59,2x

12,7x

33,9x

983

2019

27 061

6,00%

3,0%

59,2x

12,7x

33,9x

2020

28 685

6,00%

2021

3,0%

59,2x

12,7x

33,9x

1 043

1 105

2012

180

973

346

474

1 024

24

17,07%

2013

431

2 328

786

1 135

2 410

1 386

16,78%

2014

607

3 278

1 065

1 598

3 352

942

16,57%

2015

643

3 475

1 130

1 694

3 553

202

16,58%

2016

682

3 683

1 197

1 796

3 766

213

16,58%

2017

723

3 904

1 269

1 904

3 992

226

16,58%

2018

766

4 139

1 345

2 018

4 232

240

16,58%

2019

812

4 387

1 426

2 139

4 486

254

16,58%

2020

861

4 650

1 512

2 267

4 755

269

16,58%

NPV Analysis

Free Cash Flows

EBIT

Taxes

Net Income

plus depreciation

less DNWC

less capital expenditures

Free Cash Flow

Terminal value

2010

-1 201

-480

-721

0

0

4 610

-5 331

2011

0

0

0

0

1 000

0

-1 000

2012

550

220

330

310

24

310

306

2013

1 794

718

1 077

310

1 386

310

-309

2014

2 724

1 089

1 634

310

942

2 192

-1 190

2015

2 779

1 112

1 667

436

202

826

1 076

2016

2 946

1 178

1 767

462

213

875

1 141

2017

3 123

1 249

1 874

490

226

928

1 210

2018

3 310

1 324

1 986

520

240

983

1 283

2019

3 508

1 403

2 105

551

254

1 043

1 359

2020

3 719

1 488

2 231

584

269

1 105

1 441

24 737

0

1,0000

-5 331

7 298

-3 152

1

0,9174

-917

2

0,8417

258

3

0,7722

-239

4

0,7084

-843

5

0,6499

700

6

0,5963

681

7

0,5470

662

8

0,5019

644

9

0,4604

626

10

0,4224

609

10 449

2010

-5 331

-0,024%

-5331

18,33%

2011

-1 000

2012

306

2013

-309

2014

-1 190

2015

1 076

2016

1 141

2017

1 210

2018

1 283

2019

1 359

2020

1 441

2010

-5 331

-5 331

2021, that is the 11th year after initial investment

2011

-1 000

-6 331

40%

3,00%

2021

1 484

Initial Outlays

Net working capital

Net property, plant & equipment

PERIOD

Discount factor

9,00%

Present value

Net Present Value

NPV without Terminal Value

IRR Analysis

Cash Flows

IRR

Cash Flows with Terminal Value

IRR with Terminal Value

-1000

306

-309

-1190

1076

1141

1210

1283

1359

1 484

26178

Payback Analysis

Cash flows

Cumulative cash flow

Payback period

2012

306

-6 025

2013

-309

-6 334

2014

-1 190

-7 523

2015

1 076

-6 447

2016

1 141

-5 305

2017

1 210

-4 096

2018

1 283

-2 813

2019

1 359

-1 454

2020

1 441

-13

1 484

1 472

X

You might also like

- Heritage CaseDocument3 pagesHeritage CaseGregory ChengNo ratings yet

- NHDC Solution EditedDocument5 pagesNHDC Solution EditedShreesh ChandraNo ratings yet

- Final Solution - New Heritage Doll CompanyDocument6 pagesFinal Solution - New Heritage Doll CompanyRehan Tyagi100% (2)

- New Heritage DollDocument8 pagesNew Heritage DollJITESH GUPTANo ratings yet

- NHDC SolutionDocument5 pagesNHDC SolutionShivam Goyal71% (24)

- PGP Heritage Doll ExcelDocument5 pagesPGP Heritage Doll ExcelPGP37 392 Abhishek SinghNo ratings yet

- New Heritage Doll CompanyDocument12 pagesNew Heritage Doll CompanyRafael Bosch60% (5)

- New Heritage DollDocument26 pagesNew Heritage DollJITESH GUPTANo ratings yet

- New Heritage ExhibitsDocument4 pagesNew Heritage ExhibitsBRobbins12100% (16)

- New Heritage Doll (NHD) : Figure 1: The Current ProcessDocument2 pagesNew Heritage Doll (NHD) : Figure 1: The Current Processrath3477100% (4)

- Case AnalysisDocument11 pagesCase AnalysisSagar Bansal50% (2)

- New Heritage Doll Company:: Capital BudgetingDocument27 pagesNew Heritage Doll Company:: Capital BudgetingInêsRosário100% (8)

- New Heritage Doll - SolutionDocument4 pagesNew Heritage Doll - Solutionrath347775% (4)

- New Heritage Doll CompanyDocument5 pagesNew Heritage Doll CompanyAnonymous xJLJ4CKNo ratings yet

- New Heritage Doll CoDocument3 pagesNew Heritage Doll Copalmis2100% (5)

- New Heritage Doll Company Case SolutionDocument42 pagesNew Heritage Doll Company Case SolutionRupesh Sharma100% (6)

- Group6 - Heritage Doll CaseDocument6 pagesGroup6 - Heritage Doll Casesanket vermaNo ratings yet

- Heritage Doll CompanyDocument11 pagesHeritage Doll CompanyDeep Dey0% (1)

- New Heritage Doll CompanyDocument5 pagesNew Heritage Doll CompanyRahul LalwaniNo ratings yet

- New Heritage Doll CompanDocument9 pagesNew Heritage Doll CompanArima ChatterjeeNo ratings yet

- RESUELTO New Heritage Doll Company Student SpreadsheetDocument13 pagesRESUELTO New Heritage Doll Company Student SpreadsheetDaniel InfanteNo ratings yet

- New Heritage Doll Capital Budgeting Case SolutionDocument5 pagesNew Heritage Doll Capital Budgeting Case Solutionalka murarka50% (14)

- New Heritage Doll Company Case SolutionDocument31 pagesNew Heritage Doll Company Case SolutionSoundarya AbiramiNo ratings yet

- Mercury Athletic SlidesDocument28 pagesMercury Athletic SlidesTaimoor Shahzad100% (3)

- New Heritage Doll Company Capital BudgetDocument27 pagesNew Heritage Doll Company Capital BudgetCarlos100% (1)

- New Heritage Doll CaseDocument9 pagesNew Heritage Doll Caseapi-30934141185% (13)

- Finance - WK 4 Assignment TemplateDocument31 pagesFinance - WK 4 Assignment TemplateIsfandyar Junaid50% (2)

- HBS Mercury CaseDocument4 pagesHBS Mercury CaseDavid Petru100% (1)

- Flash Memory IncDocument3 pagesFlash Memory IncAhsan IqbalNo ratings yet

- Group 3-Case 1Document3 pagesGroup 3-Case 1Yuki Chen100% (1)

- Mercuryathleticfootwera Case AnalysisDocument8 pagesMercuryathleticfootwera Case AnalysisNATOEENo ratings yet

- Assignment 8 - W8 Hand in (Final Project)Document3 pagesAssignment 8 - W8 Hand in (Final Project)Rodrigo Montechiari33% (6)

- Mercury AthleticDocument8 pagesMercury AthleticVaidya Chandrasekhar100% (1)

- New Heritage Doll Company Capital Budgeting SolutionDocument10 pagesNew Heritage Doll Company Capital Budgeting SolutionBiswadeep royNo ratings yet

- Pacific Grove Spice Company Case Write UpDocument3 pagesPacific Grove Spice Company Case Write UpVaishnavi Gnanasekaran100% (4)

- Online AnswerDocument4 pagesOnline AnswerYiru Pan100% (2)

- New Heritage Doll Company Student SpreadsheetDocument4 pagesNew Heritage Doll Company Student SpreadsheetGourav Agarwal73% (11)

- Hansson Private LabelDocument4 pagesHansson Private Labelsd717No ratings yet

- AirThread Class 2020Document21 pagesAirThread Class 2020Son NguyenNo ratings yet

- MercuryDocument5 pagesMercuryமுத்துக்குமார் செNo ratings yet

- New Heritage Doll Capital BudgetingDocument9 pagesNew Heritage Doll Capital Budgetingpalmis20% (1)

- HPL CaseDocument2 pagesHPL Caseprsnt100% (1)

- New Heritage DoolDocument9 pagesNew Heritage DoolVidya Sagar KonaNo ratings yet

- Mercury Athletic Case SectionBDocument15 pagesMercury Athletic Case SectionBVinith VemanaNo ratings yet

- Group19 Mercury AthleticDocument11 pagesGroup19 Mercury AthleticpmcsicNo ratings yet

- New Heritage Doll CompanyDocument2 pagesNew Heritage Doll CompanyP3 PowersNo ratings yet

- NHDC-Solution-xls Analisis VPN TIR NHDCDocument4 pagesNHDC-Solution-xls Analisis VPN TIR NHDCDaniel Infante0% (1)

- Financial Modelling - ExcelDocument39 pagesFinancial Modelling - ExcelEric ChauNo ratings yet

- CTC - Corporate Update - 10.02.2014Document6 pagesCTC - Corporate Update - 10.02.2014Randora LkNo ratings yet

- BVADocument15 pagesBVAJasonNo ratings yet

- Flash Inc Financial StatementsDocument14 pagesFlash Inc Financial Statementsdummy306075% (4)

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlNo ratings yet

- New Heritage Doll CompanyDocument11 pagesNew Heritage Doll CompanyLightning SalehNo ratings yet

- ATH Technologies: Case-3 Strategic ImplementationDocument8 pagesATH Technologies: Case-3 Strategic ImplementationSumit RajNo ratings yet

- Análisis Caso New Heritage - Nutresa LinaDocument27 pagesAnálisis Caso New Heritage - Nutresa LinaSARA ZAPATA CANONo ratings yet

- Key RatiosDocument2 pagesKey RatiosKhalid MahmoodNo ratings yet

- Sourcebook 2071 72 - 20140713015447Document54 pagesSourcebook 2071 72 - 20140713015447praveendehsarNo ratings yet

- Tarea Heritage Doll CompanyDocument6 pagesTarea Heritage Doll CompanyFelipe HidalgoNo ratings yet

- Table A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)Document30 pagesTable A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)rooptejaNo ratings yet

- FM09-CH 10.... Im PandeyDocument19 pagesFM09-CH 10.... Im Pandeywarlock83% (6)

- MS MCQS - WatermarkDocument55 pagesMS MCQS - WatermarkHari SoloNo ratings yet

- BCC103 Fundamental Accounting I AssignmentDocument4 pagesBCC103 Fundamental Accounting I AssignmentParth VyasNo ratings yet

- Music Business Management AcademyDocument32 pagesMusic Business Management AcademyAhuma Bosco Ocansey100% (1)

- Uber Vs GrabDocument10 pagesUber Vs GrabZijian ZhuangNo ratings yet

- Safety Catalog 2015 Arrange - WurthDocument52 pagesSafety Catalog 2015 Arrange - WurthNithin Basheer50% (2)

- Vice President Sales in San Diego Phoenix Dallas Resume Marian WilsonDocument2 pagesVice President Sales in San Diego Phoenix Dallas Resume Marian WilsonMarianWilsonNo ratings yet

- How Does A Letter of Credit WorkDocument9 pagesHow Does A Letter of Credit WorkAnju KumariNo ratings yet

- Developing Business/IT StrategiesDocument55 pagesDeveloping Business/IT Strategiesmotz100% (8)

- CH 1 CRM Test Bank StatMethDocument2 pagesCH 1 CRM Test Bank StatMethshafiq80% (5)

- World Ventures Singapore Compensation Plan Detailed CommissionDocument25 pagesWorld Ventures Singapore Compensation Plan Detailed CommissionErika OwensNo ratings yet

- Porter Five Force DataDocument23 pagesPorter Five Force DatarobinkumarNo ratings yet

- Accounting For InventoriesDocument32 pagesAccounting For InventoriesShery HashmiNo ratings yet

- Sullivan Ford Auto WorldDocument2 pagesSullivan Ford Auto WorldAnonymous jFkV7Rz49No ratings yet

- Project Report On Consumer Preference Between Sports Shoes of Adidas & NikeDocument40 pagesProject Report On Consumer Preference Between Sports Shoes of Adidas & NikePAnkaj DHull0% (1)

- Kimberly Carter - Resume - 2 Page 091109Document3 pagesKimberly Carter - Resume - 2 Page 091109kacarterNo ratings yet

- Amazon Order ReceiptDocument1 pageAmazon Order ReceiptRidhi KhuranaNo ratings yet

- 1.entrepreneurs Are Great Part 2 - Support PackDocument2 pages1.entrepreneurs Are Great Part 2 - Support PackElena MartínNo ratings yet

- Letter of Intent For A Business TransactionDocument3 pagesLetter of Intent For A Business TransactionArielNicoleCaballeroZaragoza100% (6)

- India Exercise Notebook Market Report - 2020Document17 pagesIndia Exercise Notebook Market Report - 2020kenresearch12No ratings yet

- Break Even AnalysisDocument39 pagesBreak Even AnalysisRon PascualNo ratings yet

- W.A.T.C.H. 10 Worst Toys of 2017Document12 pagesW.A.T.C.H. 10 Worst Toys of 2017NewsChannel 9 StaffNo ratings yet

- 00 Memorial de Réplica EnglDocument81 pages00 Memorial de Réplica EnglcefuneslpezNo ratings yet

- LetterDocument1 pageLetterMay Anne BarlisNo ratings yet

- Distribution DecisionsDocument53 pagesDistribution Decisionssamrulezzz100% (3)

- Hindalco'S Acquisition of Novelis: The Making of A GiantDocument11 pagesHindalco'S Acquisition of Novelis: The Making of A GiantHarshShahNo ratings yet

- Accounting EndtermDocument4 pagesAccounting EndtermNow OnwooNo ratings yet

- Economics For Managers GTU MBA Sem 1 Chapter 05Document38 pagesEconomics For Managers GTU MBA Sem 1 Chapter 05Rushabh VoraNo ratings yet

- 01 Inventory Management IntroductionDocument22 pages01 Inventory Management Introductionkavish09No ratings yet

- Industrial MarketingDocument44 pagesIndustrial MarketingK.b. MisraNo ratings yet

- Sale Deed EngDocument2 pagesSale Deed EngSureshNo ratings yet