Professional Documents

Culture Documents

Al Kharaj Bi Al Daman

Uploaded by

Nik FatinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Al Kharaj Bi Al Daman

Uploaded by

Nik FatinCopyright:

Available Formats

Al-kharaj bi al-daman refers to benefit from a certain thing is in return for the liability that accompanies that thing.

In other words, the return that one gets should be proportional to the risk assumed. Another similar maxim is gain accompanies loss (al-ghunm bi al-ghurm). Its opposite is (al-ghurm bi al-ghunm) which means that detriment is as a return for the benefit. From the Islamic finance terminology through jazaa.org, al-kharaj bi al-daman is an exposure link to a risk. Meaning to say, someone can claim profit only if someone is ready to bear the business risk, if any. The principle in Islamic jurisprudence that entitlement to return or yield (alkharaj) is for the one who bears the liability (daman) for something, say an asset, and one who does not bear the liability has no claim to the yield. Furthermore, any gain in transactions should observe the liability that comes with the profits.

According to Monzer Kahf and Tariqullah Khan from his survey on the principles of Islamic Finance, he defined Al-Kharaj Bi Al-Daman as entitlement of the return of assets to carry the risks resulting from its possession. It means any benefits lies a liability. According to Mohamed Ali Elgari on Islamic Economic Studies under the title Credit Risk in Islamic Banking and Finance Vol. 10, No. 2, March 2003, Al-kharaj bi al-daman deals with a kind of risk that is inherent in all commutative contracts. This is the risk of destruction of the item prior to its possession by the buyer. The principle al-kharaj bi al-daman is a rule for ensuring justice in relationships between people arising from commutative contracts, while the concept of risk is wider than this and more general. From another aspect, the direct relationship between profit and risk is an established proposition in all financial decisions. As for al-kharaj bi al-daman, it is a legal text that determines the rights of the parties to specific financial dealings and is related to the liability arising from destruction that may afflict the goods that are the subject matter of a contract. Those who uphold this principle have linked the entitlement to profit with the bearing of this liability so that no injustice is caused to one party by the other party.

One of the Shariah concerns regarding this principle is hedging. Hedging is a risk strategy used to limit or offset probability of loss from fluctuation in the prices of securities like a futures contract. However, from the early Shariah opinion, hedging is not permissible and it is violated the principle of al-kharaj bi al-daman.

Besides that, this maxim has a number of interpretations and applications. One sense is that if a party derives the full benefit from an object, then that party should bear the risk of the true owner. In the gratuitous contract of non-fungible loan (ariya), the borrower earns all profits from the loaned property. The maxim then suggests that the borrower should assume the risk of loss. Other contracts such as agency, deposit and pledge also gratuitous, usually do not permit the party holding property (the agent, the bailee, the pledgee) to derive benefit from it. In such cases, the holder not having the profit also does not bear the risk of loss or daman, and remains an amin, trustee, liable not for misadventures but only to abide by the contract and to exercise due care. In partnership, the partner is only amin as to partnership property beyond his share. In contrast, in lease (ijara), since the user has to pay a rental in return for obtaining the benefits from property, the owner continues tobear the risk of loss. Here the rent is seen as the profit, and the risk of loss stays with the lessor; thus the maxim rent and ability for loss do not coincide. These rules affect Islamic banking and finance most in leases and in partnership. For example, the working partner in mudaraba agrees to guarantee the capital of the non-working capital partners, the agreement is void. Since the capital partners investment yields profit, then it must be also liable to loss. The working partner risks only his labor. He becomes liable for capital loss only if he is shown to have been negligent or to have breached the agreement between the parties. Since in leases the tenant cannot be made to bear risk of loss of the property, the provision commonly found in conventional financial leases that imposes all risks on the lessee is unacceptable. In conclusion, to illustrate the concept of al-kharaj bi al-daman in investment, investors need to bear certain risk to gain certain profit from the investment. The higher the risk that investors are willing to pay, the higher gain they will obtain from that investment. However, investors would like to mitigate risk as minimal as possible to gain maximized return. Therefore, they need to find the optimum portfolio from the selected companies. An investor who understands the fundamental principles and analytical aspects of portfolio management has a better chance of earning higher returns. An investor invests his funds in a portfolio expecting to get good returns consistent with the risk that he has to bear. Creation of an optimum portfolio helps to reduce risk, without sacrificing returns.

You might also like

- Takaful Operations: Issues and Recommendations On Marketing Takaful SuccessfullyDocument14 pagesTakaful Operations: Issues and Recommendations On Marketing Takaful SuccessfullyAzah Atikah Anwar Batcha100% (7)

- Bai Al UrbunDocument8 pagesBai Al UrbunSiti Hajar Ghazali100% (2)

- Bai Inah N TawaruqDocument16 pagesBai Inah N TawaruqDayana Syafiqah100% (1)

- Bay' Al-Dayn: Understanding Debt Sales in Islamic FinanceDocument9 pagesBay' Al-Dayn: Understanding Debt Sales in Islamic FinancemhfxtremeNo ratings yet

- MudharabahDocument17 pagesMudharabahShyla92No ratings yet

- Islamic Finance Project On TawarruqDocument23 pagesIslamic Finance Project On Tawarruqmahakanwal.96100% (1)

- Introduction to Takaful: Islamic Alternative to InsuranceDocument3 pagesIntroduction to Takaful: Islamic Alternative to Insuranceadorable_babyzNo ratings yet

- IjarahDocument23 pagesIjarahProf. Dr. Mohamed Noorullah100% (2)

- Application of Funds - Financing Facilities and The Underlying Shariah ConceptsDocument40 pagesApplication of Funds - Financing Facilities and The Underlying Shariah ConceptsMahyuddin Khalid100% (1)

- MudharabahDocument21 pagesMudharabahMahyuddin Khalid100% (2)

- Islamic Law of Banking and Takaful Models LAB3073Document22 pagesIslamic Law of Banking and Takaful Models LAB3073Nadia RosmanNo ratings yet

- Ijarah: Muhammad Ayman Bin A Yazid (1011065)Document20 pagesIjarah: Muhammad Ayman Bin A Yazid (1011065)Ummu Atiqah ZainulabidNo ratings yet

- IJARAH - THE ISLAMIC LEASING SYSTEMDocument39 pagesIJARAH - THE ISLAMIC LEASING SYSTEMAngela MaymayNo ratings yet

- Issue On Bay Bithaman AjilDocument14 pagesIssue On Bay Bithaman AjilJelena CientaNo ratings yet

- Bay' Al-TawarruqDocument12 pagesBay' Al-TawarruqMahyuddin Khalid67% (3)

- Case Studies MurabahaDocument4 pagesCase Studies MurabahajmfaleelNo ratings yet

- Difference Between Takaful and Conventional InsurencaaaaaaaaaaaDocument6 pagesDifference Between Takaful and Conventional InsurencaaaaaaaaaaaAyesha ShafiNo ratings yet

- Bay' Al-SalamDocument22 pagesBay' Al-SalamMahyuddin Khalid100% (2)

- Wadi'ahDocument20 pagesWadi'ahMahyuddin Khalid100% (2)

- Concept, Principles and Models of TakafulDocument30 pagesConcept, Principles and Models of Takafulchao yang100% (1)

- Bay Al-DaynDocument12 pagesBay Al-DaynNurHafizahNasirNo ratings yet

- Issues in Bay InahDocument10 pagesIssues in Bay InahShukri Omar AliNo ratings yet

- Difference Between Islamic and Conventional InsuranceDocument6 pagesDifference Between Islamic and Conventional Insuranceمحمد اصغر شہزاد83% (6)

- Introduction To Isb653Document21 pagesIntroduction To Isb653Mahyuddin KhalidNo ratings yet

- Difference between Family and General Takaful (38Document2 pagesDifference between Family and General Takaful (38Ibn Bashir Ar-Raisi100% (5)

- Bai' Istijrar (Supply Contract)Document12 pagesBai' Istijrar (Supply Contract)Urfi Achyuta0% (1)

- Takaful and Conventional InsuranceDocument7 pagesTakaful and Conventional Insurancezoom05tsaleem123No ratings yet

- Court allows appeals on Islamic financing contractsDocument19 pagesCourt allows appeals on Islamic financing contractsAlae KieferNo ratings yet

- MUDHARABAHDocument18 pagesMUDHARABAHPerantau Negeri LainNo ratings yet

- The Issue and Delimma of The Bai Bithaman Ajil Contract As Mode of Islamic FinanceDocument18 pagesThe Issue and Delimma of The Bai Bithaman Ajil Contract As Mode of Islamic FinanceFaizalAhamad75% (4)

- Essentials of Islamic Finance - Riba and its TypesDocument21 pagesEssentials of Islamic Finance - Riba and its TypesAbid RazaNo ratings yet

- Takaful Chapter 3Document29 pagesTakaful Chapter 3Ganesan SaseetharanNo ratings yet

- Assignment On MurabahahDocument4 pagesAssignment On Murabahahjazi_4u67% (3)

- Case StudiesDocument3 pagesCase StudiesjmfaleelNo ratings yet

- Issue On TawarruqDocument7 pagesIssue On TawarruqKHALIDA SALMIZA BINTI MUHAMAD HASSANNo ratings yet

- Isb540 - MudharabahDocument15 pagesIsb540 - MudharabahMahyuddin Khalid100% (1)

- Islamic Banking and Finance Institute MalaysiaDocument5 pagesIslamic Banking and Finance Institute MalaysiaNurShamNo ratings yet

- An Analysis of The Courts' Decisions On Islamic Finance DisputesDocument23 pagesAn Analysis of The Courts' Decisions On Islamic Finance DisputesMahyuddin KhalidNo ratings yet

- Islamic Banks Fund Sources: Capital, Deposits, FinancingDocument2 pagesIslamic Banks Fund Sources: Capital, Deposits, FinancingAkma AseriNo ratings yet

- Critical Issues and Success Factors For TakafulDocument6 pagesCritical Issues and Success Factors For TakafulhatimabbasmNo ratings yet

- Murabaha Part 1Document40 pagesMurabaha Part 1sjawaidiqbal100% (3)

- Credit Risk Issue in Partnership Contract The Case of MusyarakahDocument28 pagesCredit Risk Issue in Partnership Contract The Case of MusyarakahhisyamstarkNo ratings yet

- Al Ijarah Thumma Al Bay'Document15 pagesAl Ijarah Thumma Al Bay'ibnusina2013No ratings yet

- FIN546Document11 pagesFIN546zurelyanajwaNo ratings yet

- IjarahDocument26 pagesIjarahMohsen SirajNo ratings yet

- Islamic Forex ForwardDocument10 pagesIslamic Forex Forwardjmfaleel100% (1)

- Islamic Financial System Principles and Operations PDF 901 944Document44 pagesIslamic Financial System Principles and Operations PDF 901 944Asdelina R100% (1)

- Principles of Islamic Capital MarketDocument6 pagesPrinciples of Islamic Capital MarketSyahrul EffendeeNo ratings yet

- Islamic Equity Market PDFDocument96 pagesIslamic Equity Market PDFShuq Faqat al-Fansuri100% (1)

- Understanding Takaful: An Islamic alternative to insuranceDocument10 pagesUnderstanding Takaful: An Islamic alternative to insuranceAhmed AdnanNo ratings yet

- Takaful ReviewDocument10 pagesTakaful ReviewFarhain Sarmin100% (1)

- Different Between Islamic Letter of Credit and Conventional Letter of CreditDocument4 pagesDifferent Between Islamic Letter of Credit and Conventional Letter of Creditfatinchegu78% (9)

- Type of Kafalah - Docx1Document1 pageType of Kafalah - Docx1Mohamed ThiernoNo ratings yet

- Wa'ad and Muwa'adah (G2, Kenny Lim Yong Hui)Document10 pagesWa'ad and Muwa'adah (G2, Kenny Lim Yong Hui)kenny lim19No ratings yet

- Islamic Banking and Shari'Ah ComplianceDocument15 pagesIslamic Banking and Shari'Ah Compliancesiddiq elzar100% (1)

- Istisna' - Mira&nadDocument11 pagesIstisna' - Mira&nadknadhirah100% (2)

- WadiahDocument22 pagesWadiahazmi_rahman0% (2)

- The Islamic Money Market: March 2013Document23 pagesThe Islamic Money Market: March 2013Farah EgalNo ratings yet

- OBSERVATIONS - IqtisadunaDocument6 pagesOBSERVATIONS - Iqtisadunamsb65No ratings yet

- L. Ron Hubbard - Manual of Justice 1959Document11 pagesL. Ron Hubbard - Manual of Justice 1959Wilfried HandlNo ratings yet

- ARNEL SISON y ESCUADRO Vs People of The PhilDocument2 pagesARNEL SISON y ESCUADRO Vs People of The PhilAlbert CaranguianNo ratings yet

- Election Law AssignmentDocument4 pagesElection Law AssignmentPranav SharmaNo ratings yet

- EDITED Reviewer For ITC (Finals)Document50 pagesEDITED Reviewer For ITC (Finals)Shen SorianoNo ratings yet

- Bail Format India Under Section 437 of Code of Criminal ProcedureDocument10 pagesBail Format India Under Section 437 of Code of Criminal ProcedureAdv. Ibrahim Deshmukh100% (1)

- Registration Form FormatDocument6 pagesRegistration Form FormatnarenderreddychNo ratings yet

- Ritter v. Sarasota Herald-Tribune Motion To DismissDocument72 pagesRitter v. Sarasota Herald-Tribune Motion To DismissAnonymous 7FpEsAvNo ratings yet

- Junta de Supervisión Fiscal Apoya Petición de La AEEDocument16 pagesJunta de Supervisión Fiscal Apoya Petición de La AEEMetro Puerto RicoNo ratings yet

- Law of LabourDocument10 pagesLaw of LabourHafeni tulongeni HamukotoNo ratings yet

- Unfair Labor PracticeDocument14 pagesUnfair Labor PracticeApril AbesamisNo ratings yet

- Compounding, Plea Bargaining, and Withdrawal From ProsecutionDocument59 pagesCompounding, Plea Bargaining, and Withdrawal From Prosecutionjon snow snowNo ratings yet

- Marital Rape in IndiaDocument4 pagesMarital Rape in IndiaYuktaNo ratings yet

- Call NoticeDocument2 pagesCall NoticeJBS RINo ratings yet

- Eric Lim MPR Draft (Jan 15)Document9 pagesEric Lim MPR Draft (Jan 15)Lumaniog & Associates LitigationNo ratings yet

- Answer to Interrogatories Dismissal UpheldDocument10 pagesAnswer to Interrogatories Dismissal Upheldjanica246No ratings yet

- Salient Features: Transfer of PropertyDocument10 pagesSalient Features: Transfer of PropertyparishaNo ratings yet

- SALVADOR FLORDELIZ Y ABENOJAR v. PEOPLEDocument14 pagesSALVADOR FLORDELIZ Y ABENOJAR v. PEOPLEChatNo ratings yet

- 2013 and 2014 Supreme Court Decisions On Political Law - by Jacinto D. JimenezDocument35 pages2013 and 2014 Supreme Court Decisions On Political Law - by Jacinto D. JimenezJolas E. BrutasNo ratings yet

- para 9,12,18,19 Praveen Saini Vs Reetu KapurDocument13 pagespara 9,12,18,19 Praveen Saini Vs Reetu Kapurvivek303crNo ratings yet

- Copyright in MalaysiaDocument3 pagesCopyright in MalaysiaMohd Irfan Rusyaidi ShahidanNo ratings yet

- Derivative SuitsDocument13 pagesDerivative SuitsOlé LaibutaNo ratings yet

- Zarah Notes CorpoDocument48 pagesZarah Notes CorpoTinn ApNo ratings yet

- PRC Allowable CalculatorsDocument3 pagesPRC Allowable CalculatorsbbacissejNo ratings yet

- Elizabeth v. Bogosian v. James H. Wollohojian, Woloohojian Realty Corp., 86 F.3d 1146, 1st Cir. (1996)Document3 pagesElizabeth v. Bogosian v. James H. Wollohojian, Woloohojian Realty Corp., 86 F.3d 1146, 1st Cir. (1996)Scribd Government DocsNo ratings yet

- BIR S1905 - Registration Update SheetDocument1 pageBIR S1905 - Registration Update SheetAron Garcia100% (1)

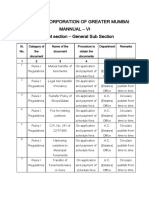

- Rules for Mumbai Municipal Corporation DocumentsDocument15 pagesRules for Mumbai Municipal Corporation DocumentsArbaz KhanNo ratings yet

- Andaldu NoticeDocument8 pagesAndaldu Noticeachyuth babuNo ratings yet

- Assignment ON History and Nature of Precedents: Subject: Judicial ProcessDocument7 pagesAssignment ON History and Nature of Precedents: Subject: Judicial ProcessSarikaPallathNo ratings yet

- Odin Security Agency Vs SernaDocument12 pagesOdin Security Agency Vs SernayourcupofcoffeeandteaNo ratings yet

- Parker Wheel & Brake IPCDocument297 pagesParker Wheel & Brake IPCTerry Lee67% (3)