Professional Documents

Culture Documents

Chap 003

Uploaded by

dbjnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 003

Uploaded by

dbjnCopyright:

Available Formats

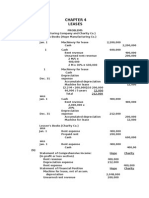

Student Name: Instructor Class: McGraw-Hill/Irwin Problem 03-03 ALMWAY CORPORATION Balance Sheet At December 31, 2011 Assets

Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net of allowance for uncollectible accounts of $8,000 Inventories Prepaid insurance Total current assets Investments: Marketable securities Land held for sale Bond sinking fund Total investments Property, plant, and equipment: Land Buildings Equipment Less: Accumulated depreciation Net property, plant, and equipment Intangibles: Patents Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Interest payable Note payable Current maturities of long-term debt Total current liabilities Long-term liabilities: Notes payable Bonds payable Total long-term liabilities Shareholders' equity: Common stock, no par value; 500,000 shares authorized; 100,000 shares issued and outstanding Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 75,000 20,000 30,000 10,000 135,000 $ 30,000 80,000 60,000 200,000 9,000 379,000

30,000 25,000 15,000 70,000

65,000 420,000 110,000 595,000 (160,000) 435,000

10,000 894,000

Correct!

90,000 240,000 330,000

300,000 129,000 $ 429,000 894,000

Correct!

Given Data P03-03: ALMWAY CORPORATION Post-Closing Trial Balance December 31, 2011 Account Title Cash Investments Accounts receivable Inventories Prepaid insurance Land Buildings Accumulated depreciation - buildings Equipment Accumulated depreciation - equipment Patents (net of amortization) Accounts payable Notes payable Interest payable Bonds payable Common stock Retained earnings Totals Additional Information: Common stock investment Intention to hold (years) Land cost Cash set aside to pay bonds payable Cash set aside in 3-month treasury bill Note due in six months Note due in six years Note due in five annual installments Installments amounts beginning 2/15/2012 Accounts Receivable balance Allowance for uncollectible accounts Shares of common stock Shares of common stock authorized Debits 45,000 110,000 60,000 200,000 9,000 90,000 420,000 110,000 60,000 10,000 75,000 130,000 20,000 240,000 300,000 129,000 1,054,000 Credits

100,000

1,054,000

$ $ $ $ $ $ $ $ $ $

30,000 3 25,000 15,000 23,000 30,000 50,000 50,000 10,000 60,000 8,000 100,000 500,000

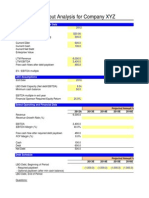

Student Name: Instructor Class: McGraw-Hill/Irwin Problem 03-04 WIESMULLER PUBLISHING COMPANY Balance Sheet At December 31, 2011 Assets Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net of allowance for uncollectible accounts of $16,000 Inventories Prepaid expenses Total current assets Property, plant, and equipment: Machinery and equipment Less: Accumulated depreciation Net property, plant, and equipment Other assets: Prepaid expenses Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Interest payable Unearned revenues Taxes payable Note payable Current maturities of long-term debt Total current liabilities Long-term liabilities: Notes payable Shareholders' equity: Common stock, no par value; 800,000 shares authorized; 400,000 shares issued and outstanding Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 60,000 20,000 80,000 30,000 40,000 20,000 250,000 $ 95,000 110,000 144,000 285,000 88,000 722,000

320,000 (110,000) 210,000

60,000 992,000

Correct!

140,000

400,000 202,000 $ 602,000 992,000

Correct!

Given Data P03-04: WIESMULLER PUBLISHING COMPANY Post-Closing Trial Balance December 31, 2009 Account Title Cash Accounts receivable Inventories Prepaid expenses Machinery and equipment Accumulated depreciation - equipment Investments Accounts payable Interest payable Unearned revenue Taxes payable Notes payable Allowance for uncollectible accounts Common stock Retained earnings Totals Additional Information: Prepaid 2 yr lease paid on 12/31/2011 Treasury bills purchased 11/30/2011 Treasury bill maturity Investments intended for sale next year Prepaid subscriptions of 1 year or less Note due in six months Note due in six years Note due in three annual installments Installments amount Shares of common stock Shares of common stock authorized Debits 65,000 160,000 285,000 148,000 320,000 140,000 60,000 20,000 80,000 30,000 200,000 16,000 400,000 202,000 1,118,000 Credits

110,000

1,118,000

$ $ $ $ $ $ $ $

120,000 30,000 1/30/2010 110,000 80,000 40,000 100,000 60,000 20,000 400,000 800,000

Student Name: Instructor Class: McGraw-Hill/Irwin Problem 03-05 EXCELL COMPANY Balance Sheet At June 30, 2009 Assets Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net of allowance for uncollectible accounts of $15,000 Interest receivable Prepaid expenses Total current assets Investments: Note receivable Land held for sale Property, plant, and equipment: Land Buildings Equipment Less: Accumulated depreciation Net property, plant, and equipment Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Accrued expenses Note payable Current maturities of long-term debt Total current liabilities Long-term liabilities: Note payable Mortgage payable Total long-term liabilities Shareholders' equity: Common stock, no par value; 500,000 shares authorized; 200,000 shares issued and outstanding Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 173,000 45,000 50,000 10,000 278,000 $ 101,000 47,000 210,000 5,000 32,000 395,000

65,000 25,000

90,000

50,000 320,000 265,000 635,000 (280,000) $ 355,000 840,000

Correct!

50,000 240,000 290,000

100,000 172,000 $ 272,000 840,000

Correct!

Given Data P03-05: EXCELL COMPANY Post-Closing Trial Balance June 30, 2011 Account Title Cash Short-term investments Accounts receivable Prepaid expenses Land Buildings Accumulated depreciation - buildings Equipment Accumulated depreciation - equipment Accounts payable Accrued expenses Notes payable Mortgage payable Common stock Retained earnings Totals Debits 83,000 65,000 280,000 32,000 75,000 320,000 265,000 120,000 173,000 45,000 100,000 250,000 100,000 172,000 1,120,000 Credits

160,000

1,120,000

Additional Information: U.S. treasury bill purchased in May Accounts receivable: Amounts owed by customers Allowance for uncollectible accounts-trade customers Nontrade note receivable (due in 3 years) Interest receivable on note (due in 4 months) Total Note payable due on 9/30/2011 Note payable due on 11/30/2012 Mortgage payable semiannually (excluding interest) Shares of common stock Shares of common stock issued and outstanding Land account with office building (cost) Cost of land

$ $

18,000 225,000 (15,000) 65,000 5,000 280,000 50,000 50,000 5,000 500,000 200,000 50,000 25,000

$ $ $ $

$ $

Student Name: Instructor Class: McGraw-Hill/Irwin Problem 03-10 MELODY LANE MUSIC COMPANY Balance Sheet At December 31, 2009 Assets Current assets: Cash Inventories Prepaid rent Total current assets Property, plant and equipment: Equipment and furniture Less: Accumulated depreciation Net property, plant, and equipment Total assets $ 167,000 100,000 3,000 270,000

40,000 (4,000) $ 36,000 306,000

Correct!

Liabilities and Shareholders' Equity Current liabilities: Accounts payable Interest payable Loan payable Total current liabilities Shareholders' equity: Common stock, no par value, 100,000 shares authorized 20,000 shares issued and outstanding Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 21,000 9,000 100,000 130,000

100,000 76,000 $ 176,000 306,000

Correct!

Given Data P03-10: MELODY LANE MUSIC COMPANY Cash receipts: From customers From issue of common stock From bank loan Cash disbursements: Purchase of inventory Rent Salaries Utilities Insurance Purchase of equipment and furniture Interest rate of bank loan Furniture and equipment: Useful life (years) Depreciation per year Inventories on hand at end of year Amounts owed 12/31/2011: To suppliers of inventory To the utility company Building rent per month Months of rent paid in advance Net income for year Shares of common stock Shares of common stock issued and outstanding

360,000 100,000 100,000

300,000 15,000 30,000 5,000 3,000 40,000 12% 10 4,000 100,000 20,000 1,000 1,000 4 76,000 100,000 20,000

$ $ $ $ $ $

You might also like

- Lease Accounting ProblemsDocument27 pagesLease Accounting ProblemsElijah Lou ViloriaNo ratings yet

- Chapter 11 Capital Budgeting SolutionsDocument10 pagesChapter 11 Capital Budgeting SolutionssaniyahNo ratings yet

- RAMON MAGSAYSAY TECHNOLOGICAL UNIVERSITY MANAGEMENT ADVISORY SERVICESDocument4 pagesRAMON MAGSAYSAY TECHNOLOGICAL UNIVERSITY MANAGEMENT ADVISORY SERVICESPrincess Claris ArauctoNo ratings yet

- CHAPTER 9 Without AnswerDocument6 pagesCHAPTER 9 Without AnswerlenakaNo ratings yet

- Abe Advanced Accounting Publication 11Document123 pagesAbe Advanced Accounting Publication 11Hussen AbdulkadirNo ratings yet

- Vertical Analysis To Financial StatementsDocument8 pagesVertical Analysis To Financial StatementsumeshNo ratings yet

- MAS NotesDocument3 pagesMAS NotesMaricon Rillera PatauegNo ratings yet

- Justa Corporation US market analysisDocument11 pagesJusta Corporation US market analysisMohsin Rehman0% (1)

- ACC209 Assignment 2 AlternateDocument14 pagesACC209 Assignment 2 Alternatehtet aungNo ratings yet

- Man Econ Ass. Module 6Document2 pagesMan Econ Ass. Module 6Trisha Mae AbocNo ratings yet

- Auditing Theory and Problems (Qualifying Round) : Answer: DDocument15 pagesAuditing Theory and Problems (Qualifying Round) : Answer: DJohn Paulo SamonteNo ratings yet

- AUDCIS Problems PrelimDocument16 pagesAUDCIS Problems PrelimLian GarlNo ratings yet

- Chatto Interim Financial ReportingDocument6 pagesChatto Interim Financial ReportingLabLab ChattoNo ratings yet

- Garfield Company bonus calculation and Kaila Corporation debt restructuring journal entriesDocument2 pagesGarfield Company bonus calculation and Kaila Corporation debt restructuring journal entriesvenice cambryNo ratings yet

- Assignment 2 PDFDocument10 pagesAssignment 2 PDFvamshiNo ratings yet

- Syllabus (Notes & Tut QS) - FMDocument62 pagesSyllabus (Notes & Tut QS) - FMFrank El NinoNo ratings yet

- AP 59 FinPB - 5.06Document8 pagesAP 59 FinPB - 5.06Anonymous Lih1laaxNo ratings yet

- SC PracticeDocument6 pagesSC Practicefatima airis aradais100% (1)

- QMB9 15Document54 pagesQMB9 15Sarankumar Reddy DuvvuruNo ratings yet

- Cash flow questions on investments, convertible bonds, direct method, and statement preparationDocument5 pagesCash flow questions on investments, convertible bonds, direct method, and statement preparationAsif IqbalNo ratings yet

- Unit 7 Audit of IntangiblesDocument10 pagesUnit 7 Audit of IntangiblesVianca Isabel PagsibiganNo ratings yet

- Homework On Statement of Cash FlowsDocument2 pagesHomework On Statement of Cash FlowsAmy SpencerNo ratings yet

- Acctg For Business Combination - Second Evaluation PDFDocument2 pagesAcctg For Business Combination - Second Evaluation PDFDebbie Grace Latiban Linaza100% (1)

- AppppDocument3 pagesAppppMaria Regina JavierNo ratings yet

- 2012 EE enDocument76 pages2012 EE enDiane MoutranNo ratings yet

- Chapter 7 Problems Speed and Refrigerator StatsDocument2 pagesChapter 7 Problems Speed and Refrigerator StatsEhab hoba100% (1)

- Intermediate Accounting 2 Quiz #3Document4 pagesIntermediate Accounting 2 Quiz #3Claire Magbunag AntidoNo ratings yet

- Constraint Management: Eleventh EditionDocument38 pagesConstraint Management: Eleventh EditionOmer ChowdhuryNo ratings yet

- Pamantasan ng Cabuyao Auditing and Assurance Services, Part 2 (ACCTG29&30) comprehensive incomeDocument2 pagesPamantasan ng Cabuyao Auditing and Assurance Services, Part 2 (ACCTG29&30) comprehensive incomeMimi YayaNo ratings yet

- Bs T Partners Has Developed A New Hubcap With The ModelDocument1 pageBs T Partners Has Developed A New Hubcap With The ModelAmit PandeyNo ratings yet

- Security Market Indices ExplainedDocument7 pagesSecurity Market Indices ExplainedborritaNo ratings yet

- Tax Problem SolutionDocument5 pagesTax Problem SolutionSyed Ashraful Alam RubelNo ratings yet

- Quiz#1 MaDocument5 pagesQuiz#1 Marayjoshua12No ratings yet

- Amortization of Intangible AssetsDocument2 pagesAmortization of Intangible Assetsemman neriNo ratings yet

- 07 - Chapter 1 PDFDocument37 pages07 - Chapter 1 PDFAishwarya JoyNo ratings yet

- Responsibility Accounting and Reporting: Multiple ChoiceDocument23 pagesResponsibility Accounting and Reporting: Multiple ChoiceARISNo ratings yet

- Answers - Chapter 1 Vol 2rvsedDocument8 pagesAnswers - Chapter 1 Vol 2rvsedjamflox50% (2)

- DocDocument20 pagesDochis dimples appear, the great lee seo jinNo ratings yet

- Financial Statement Analysis Tools and TechniquesDocument11 pagesFinancial Statement Analysis Tools and TechniquesKarlo D. ReclaNo ratings yet

- Cost Accounting Chapter 11Document6 pagesCost Accounting Chapter 11Random100% (1)

- Chap 1 Test BankDocument22 pagesChap 1 Test BankMike SerafinoNo ratings yet

- Download slides, ebook, solutions and test bankDocument2 pagesDownload slides, ebook, solutions and test bankdindaNo ratings yet

- Chapter 15 (Partnerships Formation, Operation and Ownership Changes) PDFDocument58 pagesChapter 15 (Partnerships Formation, Operation and Ownership Changes) PDFAbdul Rahman SholehNo ratings yet

- FinAcc 1 Quiz 6Document10 pagesFinAcc 1 Quiz 6Kimbol Calingayan100% (1)

- Test 5Document2 pagesTest 5Kim LimosneroNo ratings yet

- Solved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofDocument1 pageSolved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofAnbu jaromiaNo ratings yet

- 04 Pricing QuestionsDocument6 pages04 Pricing QuestionsWynie AreolaNo ratings yet

- Divide by Average Number of Shares OutstandingDocument11 pagesDivide by Average Number of Shares OutstandingJo FenNo ratings yet

- Ex3 Accounting For FOHDocument7 pagesEx3 Accounting For FOHLemuel ReñaNo ratings yet

- Assignment 1 - Chapter 2Document6 pagesAssignment 1 - Chapter 2Ho Thi Phuong ThaoNo ratings yet

- ADM3346 Assignment 2 Fall 2019 Revised With Typos CorrectdDocument3 pagesADM3346 Assignment 2 Fall 2019 Revised With Typos CorrectdSam FishNo ratings yet

- PDF PDFDocument7 pagesPDF PDFMikey MadRatNo ratings yet

- Chapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyDocument33 pagesChapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyRafaelDelaCruz50% (2)

- GRACECORP BookDocument312 pagesGRACECORP BookJoshua ComerosNo ratings yet

- Ch14 Suggested HWDocument21 pagesCh14 Suggested HWLalangelaNo ratings yet

- Chap 002Document26 pagesChap 002dbjnNo ratings yet

- AaaaamascpaDocument12 pagesAaaaamascpaRichelle Joy Reyes BenitoNo ratings yet

- Chapter 2 NotesDocument6 pagesChapter 2 NotesZain ZaighamNo ratings yet

- Classified Example Company Balance SheetDocument1 pageClassified Example Company Balance Sheetchitranjan10No ratings yet

- Quick LBO ModelDocument10 pagesQuick LBO ModeldbjnNo ratings yet

- Risk-Neutral Skewness - Evidence From Stock OptionsDocument24 pagesRisk-Neutral Skewness - Evidence From Stock OptionsdbjnNo ratings yet

- Dynamics of Implied Volatility SurfacesDocument16 pagesDynamics of Implied Volatility SurfacesdbjnNo ratings yet

- BMA 20 8eDocument11 pagesBMA 20 8edbjnNo ratings yet

- Chap 006Document95 pagesChap 006dbjnNo ratings yet

- Smiles, Bid-Ask Spreads and Option Pricing ModelsDocument24 pagesSmiles, Bid-Ask Spreads and Option Pricing ModelsdbjnNo ratings yet

- Option Hapiness and LiquidityDocument53 pagesOption Hapiness and LiquiditydbjnNo ratings yet

- Of Smiles and SmirksDocument30 pagesOf Smiles and SmirksdbjnNo ratings yet

- Introduction To Variance SwapsDocument6 pagesIntroduction To Variance Swapsdbjn100% (1)

- Extra Credit Fall '12Document4 pagesExtra Credit Fall '12dbjnNo ratings yet

- Final Exam Fall '12Document7 pagesFinal Exam Fall '12dbjnNo ratings yet

- Brealey. Myers. Allen Chapter 17 TestDocument13 pagesBrealey. Myers. Allen Chapter 17 TestMarcelo Birolli100% (2)

- Bloomberg ExcelDocument52 pagesBloomberg Exceldbjn100% (2)

- BMA TB 33 8eDocument8 pagesBMA TB 33 8edbjnNo ratings yet

- Chap 002Document75 pagesChap 002dbjnNo ratings yet

- EXCEL TEMPLATES OPERATIONS GUIDEDocument31 pagesEXCEL TEMPLATES OPERATIONS GUIDEmondew99No ratings yet

- Chap 011Document81 pagesChap 011dbjnNo ratings yet

- Answer Key QuizDocument4 pagesAnswer Key QuizdbjnNo ratings yet

- Chap 020Document10 pagesChap 020dbjnNo ratings yet

- 2013 World Economic Situation and ProspectsDocument37 pages2013 World Economic Situation and ProspectsdbjnNo ratings yet

- Excel Short CutsDocument42 pagesExcel Short CutsdbjnNo ratings yet

- Annual Report 2011 Current OPECDocument65 pagesAnnual Report 2011 Current OPECdbjnNo ratings yet

- On The Properties of Equally-Weighted Risk Contributions PortfoliosDocument23 pagesOn The Properties of Equally-Weighted Risk Contributions PortfoliosdbjnNo ratings yet

- Chap 021Document122 pagesChap 021dbjnNo ratings yet

- Erc SlidesDocument56 pagesErc SlidesdbjnNo ratings yet

- Chap 019Document11 pagesChap 019dbjnNo ratings yet

- Acadian Portfolio RiskDocument14 pagesAcadian Portfolio RiskdbjnNo ratings yet

- Chap 018Document19 pagesChap 018dbjnNo ratings yet

- Chap 021Document18 pagesChap 021dbjnNo ratings yet

- Chap 013Document8 pagesChap 013dbjnNo ratings yet

- Higher Acadmic Books 2012-13Document32 pagesHigher Acadmic Books 2012-13Heather CarterNo ratings yet

- Case Pantene FinalDocument6 pagesCase Pantene Finalapi-241899000100% (1)

- Campaign Performance Analytics and Recommendations For DabbafiDocument18 pagesCampaign Performance Analytics and Recommendations For DabbafiJANANINo ratings yet

- Booth Rental Agreement 1Document2 pagesBooth Rental Agreement 1priscillaNo ratings yet

- Auto Cash Rule SetDocument4 pagesAuto Cash Rule SetSingh Anish K.No ratings yet

- FINAL-FS (Checked Format)Document109 pagesFINAL-FS (Checked Format)Kueency RoniNo ratings yet

- Contoh PPT Business Plan Makanan Ringan - Compress - Id.enDocument17 pagesContoh PPT Business Plan Makanan Ringan - Compress - Id.enita miftahussaidahNo ratings yet

- Trust Finance Ltd.Document15 pagesTrust Finance Ltd.Nelsi RiosNo ratings yet

- Telangana eDistrict Managers GuideDocument21 pagesTelangana eDistrict Managers GuideAbhandra ChaudharyNo ratings yet

- Temporary National Economic CommitteeDocument364 pagesTemporary National Economic CommitteerwdavisNo ratings yet

- Lecture1 Etourism HKG.11 13.aug.2016 GeorgiosDocument27 pagesLecture1 Etourism HKG.11 13.aug.2016 GeorgiosGeorgios PalaiologosNo ratings yet

- Ep 9187343Document2 pagesEp 9187343shafiq khanNo ratings yet

- Solutions to Brief ExercisesDocument61 pagesSolutions to Brief ExercisesDang ThanhNo ratings yet

- Forex Exchange Reserves WordDocument14 pagesForex Exchange Reserves WordHamid RehmanNo ratings yet

- Lab Manual - Analysis Phase in SDLCDocument7 pagesLab Manual - Analysis Phase in SDLCSohil VohraNo ratings yet

- PMP QDocument59 pagesPMP QJackNo ratings yet

- Factors to Consider When Choosing a Business StructureDocument7 pagesFactors to Consider When Choosing a Business StructureRehmani MehboobNo ratings yet

- SAP Production Planning TutorialDocument83 pagesSAP Production Planning TutorialRamanpal Singh Anand89% (9)

- Financial Management: M Y Khan - P K JainDocument29 pagesFinancial Management: M Y Khan - P K JainPrashant Kumbar29% (7)

- Journal of Business Research 96 (2019) 343-354Document12 pagesJournal of Business Research 96 (2019) 343-354huyen vuNo ratings yet

- Online Shopping Habits and Attitudes of UNP StudentsDocument12 pagesOnline Shopping Habits and Attitudes of UNP StudentsReotutar, Michelle Angela T.No ratings yet

- The Project Work Has Been Undertaken With A View To Study The Quality ofDocument5 pagesThe Project Work Has Been Undertaken With A View To Study The Quality ofDelsy KrishnanNo ratings yet

- Marketing PlanDocument30 pagesMarketing PlanMinhas Khan100% (1)

- Raising Capital Through Investment Banking in IndiaDocument13 pagesRaising Capital Through Investment Banking in IndiaGuneet SaurabhNo ratings yet

- April Tam ResumeDocument1 pageApril Tam Resumeapi-599299090No ratings yet

- Quiz On Understanding of Lean & Six Sigma SC LeongDocument3 pagesQuiz On Understanding of Lean & Six Sigma SC LeongLeong Swee ChinNo ratings yet

- Advantages and Uses of Annual WorthII)Document46 pagesAdvantages and Uses of Annual WorthII)my.nafi.pmp5283100% (1)

- BabaempDocument91 pagesBabaempshravan AnvekarNo ratings yet

- Importance of Direct Item FunctionalitiesDocument12 pagesImportance of Direct Item FunctionalitiesSivaKumaran V AnbalaganNo ratings yet