Professional Documents

Culture Documents

UGC Pay Calculator

Uploaded by

RajeshjeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UGC Pay Calculator

Uploaded by

RajeshjeCopyright:

Available Formats

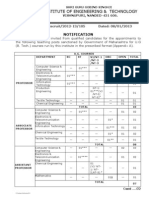

Revised Pay, Arrears and Tax Calculator

NAME: Dr Xyz New Desi: Associate Professor 3

Sex: Female 2 PAN No.: Getting Tpt All? Getting HRA?

Old Basic Pay: 16620 Select PB: 37400-67000

INPUT DATA FOR

16620 1 Yes 1 Yes 1

Revised BP: 42120 AGP: 29000 Incr. Month: Apr

RED COLOR

FIELDS

NAME: Dr Xyz Associate Professor Software Version 20.02.2009

REVISED PAY IN PB4 37400-67000

Date Revised Pay GP Total Gross Pay % Change

1.01.2006 42120 9000 51120 51120 65.37

1.09.2008 46870 9000 55870 85282 76.67

INPUT FOR INCOME TAX CALCULATIONS Total Arrears

Tax + Cess Paid up to Dec 2008: 25000 From Jan 2006 to Aug 2008 698441

Savings U/S 80C (Max 100000): 100000 ARREARS AND INCOME TAX

Interest Paid on Housing Loan: 100000 FY Arr. to be Paid FY Income Tax

Interest Paid on Education Loan: 0 2008-09 279376 169898

Income from other Sources: 0 2009-10 419065 Not Calculated

NEW TAX CALCULATIONS

TOTAL Tax+ Cess Paid upto Jan 2009 25000

Balance Tax to be recovered 144898

Tax Deduction From Arrears 0

Balance Tax Recovery Feb 2009 144898

Summary: Implementation of 6th Pay commission

Name: Dr Xyz Designation: Associate Professor Office: DU College

New Scale: 37400-67000

Date BandPay GradePay Total DA HRA TPT Add.Incr/Pay Gross Pay

1.1.2006 42120 9000 51120 0 0 0 0 51120

1.4.2006 43660 9000 52660 0 0 0 0 52660

1.4.2007 45240 9000 54240 3254 0 0 0 57494

1.4.2008 46870 9000

0 55870 6704 0 0 0 62574

1.9.2008 46870 9000 55870 8939 16761 3712 0 85282

PAYMENTS OF ARREARS TAX CALCULATIONS

Total Arrears (1.1.06 to 1.8.09) 698441 Total Tax for 08-09 with arrears 169898

To be paid in FY 08-09 (40%) 279376 Tax deducted from March 08 to Jan 09 25000

To be paid in FY 09-10 (60%) 419065 Tax Deducted from Arrears 0

Arrears of Sep08-Jan09 185054 Balance Tax to be paid 144898

Tax on arrears +Cees @ 0

Net Arrears Due in 08-09 464430 Tax deduction Feb-09 144898

NAME: Dr Xyz Associate Professor DU College

DRAWN [A] DUE [B]

DATE

TOTAL Band TPT+DA TOTAL Diff

BP DP DA Spl Pay HRA TPT AGP Spl Pay DA HRA

(A) Pay there on (B) (B-A)

1-Jan-2006 16620 8310 5983 0 0 0 30913

### 42120 9000 0 0 0 0 51120 20207

1-Feb-2006 16620 8310 5983 0 0 0 30913

### 42120 9000 0 0 0 0 51120 20207

1-Mar-2006 16620 8310 5983 0 0 0 30913

### 42120 9000 0 0 0 0 51120 20207

1-Apr-2006 17040 8520 6134 0 0 0 31694

### 43660 9000 0 0 0 0 52660 20966

1-May-2006 17040 8520 6134 0 0 0 31694

### 43660 9000 0 0 0 0 52660 20966

1-Jun-2006 17040 8520 6134 0 0 0 31694

### 43660 9000 0 0 0 0 52660 20966

1-Jul-2006 17040 8520 7412 0 0 0 32972

### 43660 9000 0 1053 0 0 53713 20741

1-Aug-2006 17040 8520 7412 0 0 0 32972

### 43660 9000 0 1053 0 0 53713 20741

1-Sep-2006 17040 8520 7412 0 0 0 32972

### 43660 9000 0 1053 0 0 53713 20741

1-Oct-2006 17040 8520 7412 0 0 0 32972

### 43660 9000 0 1053 0 0 53713 20741

1-Nov-2006 17040 8520 7412 0 0 0 32972

### 43660 9000 0 1053 0 0 53713 20741

1-Dec-2006 17040 8520 7412 0 0 0 32972

### 43660 9000 0 1053 0 0 53713 20741

1-Jan-2007 17040 8520 8946 0 0 0 34506

### 43660 9000 0 3160 0 0 55820 21314

1-Feb-2007 17040 8520 8946 0 0 0 34506

### 43660 9000 0 3160 0 0 55820 21314

1-Mar-2007 17040 8520 8946 0 0 0 34506

### 43660 9000 0 3160 0 0 55820 21314

1-Apr-2007 17460 8730 9167 0 0 0 35357

### 45240 9000 0 3254 0 0 57494 22138

1-May-2007 17460 8730 9167 0 0 0 35357

### 45240 9000 0 3254 0 0 57494 22138

1-Jun-2007 17460 8730 9167 0 0 0 35357

### 45240 9000 0 3254 0 0 57494 22138

1-Jul-2007 17460 8730 10738 0 0 0 36928

### 45240 9000 0 4881 0 0 59121 22193

1-Aug-2007 17460 8730 10738 0 0 0 36928

### 45240 9000 0 4882 0 0 59122 22194

1-Sep-2007 17460 8730 10738 0 0 0 36928

### 45240 9000 0 4882 0 0 59122 22194

1-Oct-2007 17460 8730 10738 0 0 0 36928

### 45240 9000 0 4882 0 0 59122 22194

1-Nov-2007 17460 8730 10738 0 0 0 36928

### 45240 9000 0 4882 0 0 59122 22194

1-Dec-2007 17460 8730 10738 0 0 0 36928

### 45240 9000 0 4882 0 0 59122 22194

1-Jan-2008 17460 8730 12309 0 0 0 38499

### 45240 9000 0 6509 0 0 60749 22250

1-Feb-2008 17460 8730 12309 0 0 0 38499

### 45240 9000 0 6509 0 0 60749 22250

1-Mar-2008 17460 8730 12309 0 0 0 38499

### 45240 9000 0 6509 0 0 60749 22250

1-Apr-2008 17880 8940 12605 0 0 0 39425

### 46870 9000 0 6704 0 0 62574 23149

1-May-2008 17880 8940 12605 0 0 0 39425

### 46870 9000 0 6704 0 0 62574 23149

1-Jun-2008 17880 8940 12605 0 0 0 39425

### 46870 9000 0 6704 0 0 62574 23149

1-Jul-2008 17880 8940 12605 0 0 0 39425

### 46870 9000 0 8939 0 0 64809 25384

1-Aug-2008 17880 8940 12605 0 0 0 39425

### 46870 9000 0 8939 0 0 64809 25384

1-Sep-2008 17880 8940 12605 0 8046 800 48271

### 46870 9000 0 8939 16761 3712 85282 37011

1-Oct-2008 17880 8940 12605 0 8046 800 48271 46870 9000 0 8939 16761 3712 85282 37011

1-Nov-2008 17880 8940 12605 0 8046 800 48271 46870 9000 0 8939 16761 3712 85282 37011

1-Dec-2008 17880 8940 12605 0 8046 800 48271 46870 9000 0 8939 16761 3712 85282 37011

1-Jan-09 17880 8940 12605 0 8046 800 48271 46870 9000 0 8939 16761 3712 85282 37011

### Arrear Till August 2008= 698441

40% of Arrears= 279376

Arrears of Sept 08 to Jan 09= 185054

###

### Total 464430

ESTIMATES OF INCOME TAX for - FY 2008-09: Claiming Relief U/s 89(1) [Ref Annexure-I]

NAME: Dr Xyz PAN: Desig: Associate Prof Office: DU College

TPT All +

BP DP/GP DA CCA HRA Arrears Addl Pay TOTAL

Month DA Rate DA on TPT GPF+CGEIS

(a) (b) (c) (d) (e) (g) (h) Sum of (a) to (h)

(f)

March-08 17460 8730 47 12309 300 7857 800 0 0 0 47456

April-08 17880 8940 47 12605 300 8046 800 4714 0 0 53286

May-08 17880 8940 47 12605 300 8046 800 0 0 0 48571

June-08 17880 8940 47 12605 300 8046 800 0 0 0 48571

July-08 17880 8940 47 12605 300 8046 800 0 0 0 48571

August-08 17880 8940 47 12605 300 8046 800 0 0 0 48571

September-08 46870 9000 16 8939 0 16761 3712 0 0 0 85282

October-08 46870 9000 16 8939 0 16761 3712 0 0 0 85282

November-08 46870 9000 16 8939 0 16761 3712 0 0 0 85282

December-08 46870 9000 16 8939 0 16761 3712 0 0 0 85282

January-09 46870 9000 16 8939 0 16761 3712 0 0 0 85282

February-09 46870 9000 16 8939 0 16761 3712 279376 0 0 364659

Total= 1086097

Projected Income

AMOUNT BALANCE

TOTAL SALARY including Transport Allowance 1086097

(-) Transport Allowance @ Rs 800/- pm 9600 1076497

GROSS SALARY 1076497

OTHER INCOME (LeaveSalary) 0 1076497

SETTING OFF LOSS - HOUSE 100000 976497

LESS SAVINGS U/S 80C (Max 100000) : (GPF+CGEIS) 100000 876497

LESS U/S 80D,80DD,80DDB (Mediclame, Handicap,Chronic Disease) 0 876497

LESS Recovery 0 876497

LESS U/S 80G (PM Relief Fund) 0 876497

NET TAXABLE INCOME 876497

Income Tax 164949

Cess 4948

Surcharge (If income > 1000000) 0

Total Tax Payable 169898

[ - ] Tax from Arrear 0

TAX DUE for JAN/FEB 2009

Tax+ Cess Paid upto Dec 2008 from Regular Pay Bills 25000

Tax deducted from Arrear 0

Balance Tax + Cess to be recovered 144898

Tax Cess Total

Balance Recovery (Tax + Cess) pm Jan-09 0 0 0

Feb-09 0 0 144898

UGC Old BP Rev BP

Old BP Value SET 50 1 8000 15600 1

2 8275 15600 2

3 8550 15910 3

4 8825 16420 4

5 9100 16930 5

6 9375 17440

7 9650 17950

8 9925 18470

9 10200 18980

10 10475 19490

11 10750 20000

12 11025 20510

13 11300 21020

14 11575 21530

15 11850 22050

16 12125 22560

17 12400 23070

18 12675 23580

19 12950 24090

20 13225 24600

21 13500 25110

22 10000 18600

23 10325 19210

24 10650 19810

25 10975 20420

26 11300 21020

27 11625 21630

28 11950 22230

29 12275 22840

30 12600 23440

31 12925 24050

32 13250 24650

33 13575 25250

34 13900 25860

35 14225 26460

36 14550 27070

37 14875 27670

38 15200 28280

39 12000 22600

40 12420 23590

41 12840 24000

42 13260 37400

43 13680 37400

44 14100 38530

45 14520 38530

46 14940 39690

47 15360 39690

48 15780 40890

49 16200 40890

50 16620 42120

51 17040 42120

52 17460 43390

53 17880 43390

54 18300 44700

55 18720 44700

56 19140 46050

57 19560 46050

GP Incre Month Designation:

10000 1 Jan 1 Assistant Professor

9000 2 Feb 2 Reader/Sr Lecturer

8000 3 Mar 3 Associate Professor

7000 4 Apr 4 Professor

6000 5 May Value Set= 3

6 Jun

7 July

8 Aug

9 Sep

10 Oct

11 Nov

12 Dec

Value Set= 4

HRA/ TPT Opt:

1 Yes

2 No

HRA Velue Set= 1

TPT Value Set= 1

For Tax Relief under Sec 89(1) for Arrears received during the year 2008-09

Dr Xyz Associate Professor PAN No.: 0

ANNEXURE-I

1. Total net taxable Income excluding Salary received in arrears of previous Fys

2. Salary received in arrears of previous FYs

3. Total income (as increased by salary received in arrears (1)+(2)

4. Tax+Cess on total income (as per item 3)

5. Tax+Cess on total income (as per item 1)

6. Tax+Cess on salary received in arrears of previous FYs (4)-(5) (Refer Table-A below)

TABLE -A

Previous Total Net Taxable Salary received Tax on Total

Total Income for Tax on Total Difference in

Financial Income of relevant in arrears for Income as per

the relevant FY Income as per Tax+Cess

Years year in col (1) relevant FY col (2)

Col (4) (6)-(5)

(1) (2) (3) (4) (5) (6) (7)

2005-06 0

2006-07 0

2007-08 0

Total 0

You might also like

- ICTACT Journal TemplateDocument3 pagesICTACT Journal TemplatekavithagowriNo ratings yet

- A Macro Mobility Scheme Using Post Handover Techniques For Optimization of Handover and RoamingDocument12 pagesA Macro Mobility Scheme Using Post Handover Techniques For Optimization of Handover and RoamingJournal of ComputingNo ratings yet

- Universal Human Values-II: Department of Electronics & Communication EngineeringDocument2 pagesUniversal Human Values-II: Department of Electronics & Communication EngineeringGanga Yadav CNo ratings yet

- MBA OU Syllabus 2010Document60 pagesMBA OU Syllabus 2010shahissh100% (1)

- Research and Publication EthicsDocument4 pagesResearch and Publication EthicsHemalatha SivakumarNo ratings yet

- Fitment - Ugc 6th Pay CommissionDocument10 pagesFitment - Ugc 6th Pay CommissionJoseph Anbarasu100% (3)

- Hedu e 19 2020Document43 pagesHedu e 19 2020D Venkatesan D Venkatesan100% (1)

- Iit - Bombay Annual ReportDocument96 pagesIit - Bombay Annual Reportfirefist_ashNo ratings yet

- Anna University Information BroucherDocument38 pagesAnna University Information BroucherVinitgaNo ratings yet

- CSC PHD ListDocument70 pagesCSC PHD ListAli AzamNo ratings yet

- Writing Research Paper PPT (Compatibility Mode)Document10 pagesWriting Research Paper PPT (Compatibility Mode)moonis14No ratings yet

- SJVN ProDocument82 pagesSJVN Prodalip kumarNo ratings yet

- TSPSC AE NotificationDocument24 pagesTSPSC AE NotificationAlmas Da ConstructionLegendNo ratings yet

- English Class Notes on Parts of Speech, Subject-Verb Agreement and PronounsDocument221 pagesEnglish Class Notes on Parts of Speech, Subject-Verb Agreement and PronounsEasy learningNo ratings yet

- Internships For Mechanical Engineering StudentsDocument2 pagesInternships For Mechanical Engineering StudentsDon BoscoNo ratings yet

- Automatic Question Paper Generation, According To Bloom's Taxonomy, by Generating Questions From Text Using Natural Language ProcessingDocument7 pagesAutomatic Question Paper Generation, According To Bloom's Taxonomy, by Generating Questions From Text Using Natural Language ProcessingInternational Journal of Innovative Science and Research Technology100% (4)

- UGC Pay For College Teachers - Salary CalculatorDocument6 pagesUGC Pay For College Teachers - Salary CalculatorPudhuvai madhi97% (34)

- B.ed Semester System 2014 2015 PDFDocument110 pagesB.ed Semester System 2014 2015 PDFSanjay ChandwaniNo ratings yet

- Lpu Brochure PDFDocument46 pagesLpu Brochure PDFAshok KumarNo ratings yet

- Kannur University BSC Computer ScienceDocument86 pagesKannur University BSC Computer ScienceJinu Madhavan50% (2)

- MyConnect (An Alumni Website) 2Document17 pagesMyConnect (An Alumni Website) 2api-3742339100% (1)

- University of Engineering and Technology Result CardDocument1 pageUniversity of Engineering and Technology Result CardMuhammad Arsalan TariqNo ratings yet

- Revised PCD ProformaDocument6 pagesRevised PCD ProformaAftab TabasamNo ratings yet

- Syllabus IBMDocument28 pagesSyllabus IBMManas KhareNo ratings yet

- Sggs Nanded Faculty AdvertiseDocument10 pagesSggs Nanded Faculty AdvertiseShankar GuptaNo ratings yet

- External Examiner Appointment LetterDocument2 pagesExternal Examiner Appointment LetterJesse VincentNo ratings yet

- Ece 5th Semester SyllabusDocument10 pagesEce 5th Semester SyllabusANIRUDDHA PAULNo ratings yet

- Sketch The Architecture of Iot Toolkit and Explain Each Entity in BriefDocument9 pagesSketch The Architecture of Iot Toolkit and Explain Each Entity in BriefprabhaNo ratings yet

- Apsrtc.... Trafic SupervisorDocument15 pagesApsrtc.... Trafic SupervisorsatishbalneNo ratings yet

- REDESIGNATION OF AE As AEE PDFDocument2 pagesREDESIGNATION OF AE As AEE PDFVeera ChaitanyaNo ratings yet

- Applied Mathematics-I L T P C 4 1 0 4.5: Unit-I 1. Partial DifferentiationDocument68 pagesApplied Mathematics-I L T P C 4 1 0 4.5: Unit-I 1. Partial DifferentiationShivam LakhwaraNo ratings yet

- Cep Micro2 170857Document13 pagesCep Micro2 170857Ramsha MalikNo ratings yet

- 2006 Sloan PHD HandbookDocument48 pages2006 Sloan PHD Handbookboka987No ratings yet

- Zifo Associate Analyst Chennai JobDocument2 pagesZifo Associate Analyst Chennai Jobshanu50% (2)

- Application BuetDocument5 pagesApplication BuetLeo da LeonNo ratings yet

- BSC ITDocument34 pagesBSC ITUmesh ChandraNo ratings yet

- E-Yantra Robotics Competition E-Yantra+ Caretaker Robot ThemeDocument7 pagesE-Yantra Robotics Competition E-Yantra+ Caretaker Robot ThemeMayank NagpalNo ratings yet

- C++ Lab ManualDocument26 pagesC++ Lab ManualMayankNo ratings yet

- JNTUK Academic Calendar MBADocument4 pagesJNTUK Academic Calendar MBATulasi Nadh MtnNo ratings yet

- Cas GRDocument9 pagesCas GRprasadNo ratings yet

- Undergraduate Statistics Curriculum StructureDocument26 pagesUndergraduate Statistics Curriculum StructurepjpawaskarNo ratings yet

- ATAL FDP CertificateDocument1 pageATAL FDP CertificateAbid HussainNo ratings yet

- Distributed Systems - Final MaterialsDocument181 pagesDistributed Systems - Final MaterialsGaneshNo ratings yet

- Rules & Regulations For AESI EXAMDocument25 pagesRules & Regulations For AESI EXAMsuryaameNo ratings yet

- Odisha Postal CircleDocument41 pagesOdisha Postal CircleNDTV100% (10)

- Elements of Infrared Detection SystemDocument6 pagesElements of Infrared Detection SystemMonikaPuniaNo ratings yet

- Research ProposalDocument2 pagesResearch ProposalGhulam HussainNo ratings yet

- Se AssigDocument6 pagesSe Assigmaryam_jamilahNo ratings yet

- Notes-Unit 5 Reflective Middle WareDocument11 pagesNotes-Unit 5 Reflective Middle WareNeema100% (1)

- JNTU (NR) M.TECH 2-Semester FAULT TOLERANT SYSTEM DESIGN March-2009 Exam Question Paper - Indian ShoutDocument3 pagesJNTU (NR) M.TECH 2-Semester FAULT TOLERANT SYSTEM DESIGN March-2009 Exam Question Paper - Indian Shoutramanaidu1No ratings yet

- Please Select The Proper Value From List in The White Boxes by Clicking On BoxDocument11 pagesPlease Select The Proper Value From List in The White Boxes by Clicking On BoxrajnanNo ratings yet

- Please Select The Proper Value From List in The White Boxes by Clicking On BoxDocument14 pagesPlease Select The Proper Value From List in The White Boxes by Clicking On Boxayushsingh96100% (4)

- HTTP Myhr - Bsnl.co - in Portal Pay IncomeTaxDetailsDocument1 pageHTTP Myhr - Bsnl.co - in Portal Pay IncomeTaxDetailssudhakar9v2807No ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document10 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- Page No.: Financial YearDocument10 pagesPage No.: Financial Yearprofessional gamersNo ratings yet

- Project Report: Tapdiya WinesDocument6 pagesProject Report: Tapdiya WinesAshutosh TapdiyaNo ratings yet

- Page No.: Financial YearDocument3 pagesPage No.: Financial YearWwe Full matchesNo ratings yet

- Pay and Arrear Calculator For UGC Pay Package: Rs 8000-275-13500 Rs 10000-325-15200 Rs12000-420-18300Document30 pagesPay and Arrear Calculator For UGC Pay Package: Rs 8000-275-13500 Rs 10000-325-15200 Rs12000-420-18300prayushmiNo ratings yet

- Tax CalculaterDocument2 pagesTax CalculaterMahimaNo ratings yet

- Page No.: Financial YearDocument2 pagesPage No.: Financial YearSitaram MeenaNo ratings yet

- Chapter 3 IFRS 10 Consolidated Financial Statements Part 2Document122 pagesChapter 3 IFRS 10 Consolidated Financial Statements Part 2Nanya BisnestNo ratings yet

- African Economic Outlook Aeo 2023Document238 pagesAfrican Economic Outlook Aeo 2023Lmv 2022No ratings yet

- Lesson 4Document4 pagesLesson 4Anh MinhNo ratings yet

- Final Internship Report - Amber DasDocument19 pagesFinal Internship Report - Amber DasAmber DasNo ratings yet

- Room Assignment: Tuguegarao City Science High SchoolDocument6 pagesRoom Assignment: Tuguegarao City Science High SchoolPhilBoardResultsNo ratings yet

- History of Cepu Oil Field ExplorationDocument2 pagesHistory of Cepu Oil Field ExplorationWellaNo ratings yet

- 2017 To 2022 (Customer List)Document3 pages2017 To 2022 (Customer List)Min ThuNo ratings yet

- Lean ProductionDocument3 pagesLean ProductionSyed Zayan AndrabiNo ratings yet

- CRM 4Document25 pagesCRM 4Zankhana BhosleNo ratings yet

- Boarding Pass (BLR MAA)Document1 pageBoarding Pass (BLR MAA)Rakendu BhattacharjeeNo ratings yet

- DRC-Uganda Cross-Border Road ProjectsDocument28 pagesDRC-Uganda Cross-Border Road ProjectsasdasdNo ratings yet

- Class 9 Economics Chapter 2 Ncert NotesDocument2 pagesClass 9 Economics Chapter 2 Ncert NoteshariharanrevathyNo ratings yet

- Shutdown SIS Previous ScreenDocument2 pagesShutdown SIS Previous ScreenArmando Vara ChavezNo ratings yet

- Culligan Mark 89-812Document20 pagesCulligan Mark 89-812jaydub911No ratings yet

- Final Exam: Dual Degree Programme - DDPDocument16 pagesFinal Exam: Dual Degree Programme - DDPHoàng Vũ HuyNo ratings yet

- Ultra Tech Cement Internal AssessmentDocument10 pagesUltra Tech Cement Internal AssessmentDarsh KansalNo ratings yet

- Measuring and Evaluating The Performance of Banks and Their Principal CompetitorsDocument22 pagesMeasuring and Evaluating The Performance of Banks and Their Principal CompetitorsMarwa HassanNo ratings yet

- Support PV systems for flat roofsDocument28 pagesSupport PV systems for flat roofsoctavvvianNo ratings yet

- Relevant CostingDocument11 pagesRelevant CostingHero CourseNo ratings yet

- Dissertation On Foreign Exchange RateDocument6 pagesDissertation On Foreign Exchange RatePaySomeoneToWriteYourPaperHighPoint100% (1)

- Tax Invoice/Retail Invoice: OptivalDocument1 pageTax Invoice/Retail Invoice: Optivalrangasamy.tnstcNo ratings yet

- The Relationship Between Food and Fuel PricesDocument2 pagesThe Relationship Between Food and Fuel PricesSamieNo ratings yet

- Toyota Operations Management As A Competitive AdvantageDocument8 pagesToyota Operations Management As A Competitive AdvantageGodman KipngenoNo ratings yet

- Technology Terhadap Aplikasi Electronic Wallet Milik BUMN)Document15 pagesTechnology Terhadap Aplikasi Electronic Wallet Milik BUMN)ROVITA NILASARINo ratings yet

- International Business The New Realities 4th Edition Cavusgil Solutions ManualDocument39 pagesInternational Business The New Realities 4th Edition Cavusgil Solutions Manualcrastzfeiej100% (16)

- Saving Account Salary Account Current AccountDocument32 pagesSaving Account Salary Account Current AccountSamdarshi KumarNo ratings yet

- Economics ActivitiesDocument5 pagesEconomics ActivitiesDaisy OrbonNo ratings yet

- Wyckoff Trading Method Summary Cheat SheetDocument2 pagesWyckoff Trading Method Summary Cheat SheetRbmanikandan100% (1)

- Us Consumer Discretionary Equities PreferenceDocument52 pagesUs Consumer Discretionary Equities PreferenceTung NgoNo ratings yet

- 5a - Valuation of Bonds and DebenturesDocument19 pages5a - Valuation of Bonds and DebenturesSudha AgarwalNo ratings yet