Professional Documents

Culture Documents

Mortgage Paper For Math 1030 Final Draft

Uploaded by

api-192510247Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mortgage Paper For Math 1030 Final Draft

Uploaded by

api-192510247Copyright:

Available Formats

Buchanan/Hawthorne 1

Jackie Buchanan Michael Hawthorne Math 1030-Group Project #1 Buying a House March 2, 2013

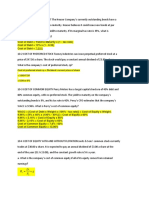

Buchanan/Hawthorne 2 The home we chose for this project was a lovely 6 bedroom, 3.5 bath rambler on Carlquist Drive in Draper, UT. The listing price for this home was $429,900.00. Assuming we made a 20% down payment of $85,980, we would be left with a mortgage of $343,920. The two lending institutions we compared were Jordan Credit Union and Zions Bank. Jordon Credit Union was less expensive for both the 15-year and the 30-year mortgage, so we decided to use them. The rate that Jordon quoted on Feb 25, 2013 was 2.75% for a 15-year fixed rate mortgage, and 3.375% for a 30-year fixed rate mortgage. We decided to begin our mortgage payments on May 1, 2013. After we entered the data into the amortization schedule for both time frames we made some interesting discoveries. We outlined our findings in the table below: 15-Year Fixed Rate Mortgage Pros and Cons 1. (Pro) You get a much lower interest rate. (2.75% instead of 3.375%) 2. (Pro) You save over $127,000 in interest over the life of the loan. 3. (Pro) You begin the loan paying more in principal each month than interest. 4. (Con) The monthly payment is considerably higher; you wind up paying about $813 more each month. 30-Year Fixed Rate Mortgage Pros and Cons 1. (Pro) Your monthly payment is quite a bit smaller ($1520 instead of $2333) which makes the home more affordable. 2. (Con) The interest rate is higher (3.375%) 3. (Con) You pay much more interest over the life of the loan 4. (Con) You pay more interest than principal until the 115th payment.

Mortgage Amount: $343,920.00/Begins May 1, 2013 15-Year Fixed Interest Rate Monthly Payment Total Amount Paid Total Interest Relative Difference Between Total Amount Paid and the Mortgage Pay-Off Date: 2.75% $2333.91 $420,102.91 $76,184.80 22.2% 30-Year Fixed 3.375% $1520.46 $547,364.09 $203,444.68 59.2% Actual Difference -.625% $813.45 $-127,261.18 $-127,259.88 -37%

April/2028

May/2043

-15 Years, 1 Month

Source: Jordan Credit Union Rates as of 2/25/13

Buchanan/Hawthorne 3 Looking at the blue table that compares the 15-Year fixed rate mortgage to the 30-Year fixed rate mortgage, we immediately see that in every category, the 15-Year rate comes out ahead, with the exception of the much higher monthly payment. For the purpose of this assignment, we are assuming that we cannot afford to commit to a $2300 monthly house payment, but we like the idea of saving some of the huge amount of interest accrued on the 30-Year loan. Therefore, we will compare other, more affordable, options to see if we can get our total interest payment brought down to a more reasonable level.

Mortgage Amount: $343,920.00/Begins May 1, 2013 15-Year Fixed 30-Year Fixed (+$100/mo.) 3.375% $1620.46 $524,242.01 $180,322.01 Actual Difference

Interest Rate Monthly Payment Total Amount Paid Total Interest

2.75% $2333.91 $420,102.91 $76,184.80

-.625% +713.45 $-104,139.10 $-104,137.21

Relative Difference Between Total Amount Paid and the Mortgage Pay-Off Date

22.2%

52.4%

-30.2%

April/2028

May/2040

-12 Years, 1 Month

Source: Jordan Credit Union Rates as of 2/25/13

The pink table compares the regular 15-year fixed rate to the 30-year fixed rate plus an extra monthly payment of $100. By making this extra payment, we take 3 years off the life of the 30 year loan, making the pay-off date difference between the two loans 12 years and 1 month.

Mortgage Amount: $343,920.00/Begins May 1, 2013 15-Year Fixed 30-Year Fixed (+938/mo.) 3.375% $2458.46 $437,642.59 $93,722.59 Actual Difference

Interest Rate Monthly Payment Total Amount Paid Total Interest

2.75% $2333.91 $420,102.91 $76,184.80

-.625% -$124.55 -$17,539.68 $-17,537.79

Buchanan/Hawthorne 4 Relative Difference Between Total Amount Paid and the Mortgage. Pay-Off Date 22.2% 27.3% -5.1%

April/2028

April/2028

Source: Jordan Credit Union Rates as of 2/25/13

The green table compares a 15-Year fixed rate to that of a 30-Year fixed rate plus an additional monthly payment to bring the payoff date down 15 years. By comparing these two types of loans, we see that the 15-Year still comes out ahead, due to the lower fixed interest rate. However, the difference isnt that big. The monthly payment of the 30-Year fixed with the extra $938 payment is only $124 dollars more than the first loan, and over the 15 years you pay an additional $17,000. While you do wind up paying more this way than if you just took the original 15-Year fixed mortgage the extra cost is worth the security of knowing that if you couldnt afford to make such a large additional monthly payment, you werent obligated to do so.

Mortgage: $343,920.00/Begins May 1, 2013 30-Year Fixed 30-Year Fixed (+$20,000 on 05/2018) 3.375% $1520.46 $522,743.96 $178,823.96 52% Actual Difference

Interest Rate Monthly Payment Total Amount Paid Total Interest Relative Difference Between Total Amount Paid and the Mortgage Pay-Off Date

3.375% $1520.46 $547,364.09 $203,444.68 59.2%

0 0 $24,620.13 $24,620.72 7.2%

May/2043

Dec/2040

2 Years, 5 Months

Source: Jordan Credit Union Rates as of 2/25/13

With the orange table, we decided to compare the difference between the 30-Year fixed rate mortgage, and the same 30-Year fixed rate mortgage with an additional one-time payment of $20,000 on year 5 of the loan. We were surprised to see that even by paying such a large extra payment, we only saved 2 years and 5 months off the life of the loan.

Buchanan/Hawthorne 5

Mortgage: $343,920.00/Begins May 1, 2013 30-Year Fixed 30-Year Fixed (+$100/mo.) 3.375% $1620.46 $524,242.01 $180,322.01 Actual Difference

Interest Rate Monthly Payment Total Amount Paid Total Interest

3.375% $1520.46 $547,364.09 $203,444.68

0 $-100.00 $23,122.08 $23,122.67

Relative Difference Between Total Amount Paid and the Mortgage

59.2%

52.4%

6.8%

Pay-Off Date

May/2043

May/2040

3 Years, 0 Months

Source: Jordan Credit Union Rates as of 2/25/13

With the purple table, we decided to compare the regular 30-Year fixed rate mortgage to the 30-Year Fixed Rate plus an extra $100 per month. Simply by paying an extra $100 per month, we saved 3 years While the information presented in these tables is helpful when you are considering a new mortgage, they dont tell the entire story. There are other factors that play into a mortgage that affect the monthly payment. Some of those factors include: lender fees (appraisal fee, credit report fee, tax service fee, underwriting fee, origination fee, processing fee, flood certification fee, commitment fee, application fee, loan lock fee, broker fee, inspection fee, administration fees, lawyer fees) mortgage insurance, homeowners insurance, and taxes. Not all lenders will charge all these fees, so it is a good idea to shop around and find out what extra fees will be included with each lender you look at. These fees are customarily added into the life of the loan, and they can raise the monthly payment hundreds of dollars. For example, when I entered my homes purchase price into the loan calculator, I was given a monthly payment that is $400 less than what I actually pay per month. Another important factor to think about when considering a mortgage is discount points. Discount points are a form of pre-paid interest. One point equals one percent of the loan. Borrowers can offer to pay a lender points in order to reduce the interest on the mortgage. For each point purchased, the loan rate is typically reduced by 0.125%. A new homebuyer needs to consider these factors before buying a home in order to make sure that their actual monthly payment will be manageable.

Buchanan/Hawthorne 6 (Jackie) This project was eye-opening for me and helped me to realize, for the first time, just how effective making extra payments on your mortgage can be. Now that I understand how interest is calculated, and how to use amortization schedules, I plan on putting my new skills to use by making extra payments on my mortgage and watching to see how much money those extra payments save me. (Michael) After doing the assignment, I have found that there are a number of different factors that come into play when getting a mortgage. I can see that these are maybe there to make it easier to get a loan for when buying a house. There are as well numerous factors that may benefit you as well as make it hard or have you spending too much of your money. The pros and cons of the above assignment is a great idea on how you can make the loan more beneficial for your needs. I like how with a little research of your lender you can find something that fits you. One thing that I would say to be careful of is that the numbers can get confusing and to watch the math involved. I have found that this kind of investigation and footwork can pay off in the end and help you so that you will not be so financially strapped and able to build a budget within your means. This kind of assignment would be good for any kind of loan that may take some time paying off.

http://www.bankrate.com/calculators/mortgages/amortizationcalculator.aspx?ec_id=m1082526&ef_id=Px1QHGT6-zsAAB3j%3a20130304035932%3as

You might also like

- Project 1 Buying A House FinalDocument5 pagesProject 1 Buying A House Finalapi-241644834No ratings yet

- Home Buying 101: A Handbook and Guide While Buying Your Dream Home!From EverandHome Buying 101: A Handbook and Guide While Buying Your Dream Home!No ratings yet

- MortgageDocument9 pagesMortgageapi-314054986No ratings yet

- Finance Project - Adrian Arturo NinaDocument6 pagesFinance Project - Adrian Arturo Ninaapi-253521109No ratings yet

- Buyingahouse 1Document4 pagesBuyingahouse 1api-251852099100% (1)

- Finance Project Final 1Document5 pagesFinance Project Final 1api-332608130No ratings yet

- Finance ProjectDocument5 pagesFinance Projectapi-309268752No ratings yet

- Buying A House Math 1030-1Document3 pagesBuying A House Math 1030-1api-341229603No ratings yet

- Math Reflective Writing - Mortgage LabDocument4 pagesMath Reflective Writing - Mortgage LabJacob AndersonNo ratings yet

- Math Reflective Writing - Mortgage LabDocument4 pagesMath Reflective Writing - Mortgage LabJacob AndersonNo ratings yet

- CFPB Loan-EstimateDocument3 pagesCFPB Loan-EstimateRichard VetsteinNo ratings yet

- Understanding Mortgage Systems in US and IndiaDocument63 pagesUnderstanding Mortgage Systems in US and IndiaAnkit SinghNo ratings yet

- Document 1Document4 pagesDocument 1api-525321076No ratings yet

- Down Payments: Tighter Lending StandardsDocument10 pagesDown Payments: Tighter Lending StandardsraqibappNo ratings yet

- CFPB Loan EstimateDocument3 pagesCFPB Loan EstimateRichard VetsteinNo ratings yet

- Mortgage CalculatorDocument4 pagesMortgage Calculatorapi-246390576No ratings yet

- Consumer Math Chapter 3.5Document9 pagesConsumer Math Chapter 3.5William ShevchukNo ratings yet

- Fincance ProjectDocument3 pagesFincance Projectapi-302073423No ratings yet

- Finance - Mortgage Lab Reflective WritingDocument3 pagesFinance - Mortgage Lab Reflective Writingapi-272876382No ratings yet

- 1050 WordDocument6 pages1050 Wordapi-352291519No ratings yet

- Home Mortgage - College AlgebraDocument11 pagesHome Mortgage - College AlgebraDebalina Dass100% (1)

- Buying A HouseDocument3 pagesBuying A Houseapi-242207683No ratings yet

- Finance ProjectDocument5 pagesFinance Projectapi-436951596No ratings yet

- Credit and CollectionDocument17 pagesCredit and CollectionDia Cessianne VillarolaNo ratings yet

- Document 6 Mortgage AssigmentDocument6 pagesDocument 6 Mortgage Assigmentapi-272576393No ratings yet

- Buying A HouseDocument4 pagesBuying A Houseapi-325824593No ratings yet

- BuyingahouseDocument5 pagesBuyingahouseapi-2530972880% (1)

- Mortgage Lab Signature AssignmentDocument9 pagesMortgage Lab Signature Assignmentapi-548277318No ratings yet

- Math Project 1Document3 pagesMath Project 1api-2883186290% (1)

- Math Spring Final ProjectDocument4 pagesMath Spring Final Projectapi-355397592No ratings yet

- Finance ProjectDocument4 pagesFinance Projectapi-240285550No ratings yet

- Budget Basics For Modular Home Buyers - How Much Home Can I Afford?Document3 pagesBudget Basics For Modular Home Buyers - How Much Home Can I Afford?SEAN NNo ratings yet

- Periodic Payments: AmortizationDocument4 pagesPeriodic Payments: AmortizationRutvi Shah RathiNo ratings yet

- CBA HomeLoan Key Fact SheetDocument2 pagesCBA HomeLoan Key Fact Sheet3zarez14No ratings yet

- 41w 5.25% 2250:mo 30yr 7yr2mo 25wDocument3 pages41w 5.25% 2250:mo 30yr 7yr2mo 25w俞悅No ratings yet

- Interest Rates - What Every Investor Needs To KnowDocument5 pagesInterest Rates - What Every Investor Needs To KnowricharddunneNo ratings yet

- Buyhouse 1030 MathDocument3 pagesBuyhouse 1030 Mathapi-260610944No ratings yet

- Example Amortization ScheduleDocument3 pagesExample Amortization SchedulePankil R ShahNo ratings yet

- Mortgage Markets 2 1Document9 pagesMortgage Markets 2 1Janine Bad-angNo ratings yet

- Hauer MortgagesDocument5 pagesHauer Mortgagesapi-280201481No ratings yet

- Jeri Thurman EportfolioDocument2 pagesJeri Thurman Eportfolioapi-253807127No ratings yet

- Understanding Credit Cards and Using Them WiselyDocument8 pagesUnderstanding Credit Cards and Using Them Wiselyasmat ullah khanNo ratings yet

- GFE SummaryDocument3 pagesGFE SummaryAmit KumarNo ratings yet

- Finance Project-2Document4 pagesFinance Project-2api-242736484No ratings yet

- Good Faith Estimate As of 2010-01-01Document3 pagesGood Faith Estimate As of 2010-01-01Darrell1573No ratings yet

- Closing Costs Calculator - Estimate Closing CostsDocument5 pagesClosing Costs Calculator - Estimate Closing CostsgullipalliNo ratings yet

- How Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentDocument2 pagesHow Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentbootybethathangNo ratings yet

- Finance ProjectDocument4 pagesFinance Projectapi-316142758No ratings yet

- Sample GFEDocument3 pagesSample GFEcmoscoolNo ratings yet

- Types of LoansDocument9 pagesTypes of LoansSanjay VaruteNo ratings yet

- Refinancing GuideDocument4 pagesRefinancing GuideSteven Mah Chun HoNo ratings yet

- Business LoansDocument25 pagesBusiness LoansMai TiếnNo ratings yet

- Mortgage Lab Reflective WritingDocument5 pagesMortgage Lab Reflective Writinghailey richmanNo ratings yet

- Finance Project FinalDocument5 pagesFinance Project Finalapi-356639260No ratings yet

- Planning For Homeownership GuideDocument20 pagesPlanning For Homeownership Guideapi-295818061No ratings yet

- Home BuyerDocument75 pagesHome Buyerva5ilisNo ratings yet

- Finance ProjectDocument5 pagesFinance Projectapi-337714189No ratings yet

- Finance Project Math 1030Document5 pagesFinance Project Math 1030api-241289407No ratings yet

- Finance ProjectDocument4 pagesFinance Projectapi-302141157No ratings yet

- Kristen Taylor Reference LetterDocument1 pageKristen Taylor Reference Letterapi-192510247No ratings yet

- Jackiewacreflection 1Document2 pagesJackiewacreflection 1api-192510247No ratings yet

- Jackies Final ResumeDocument1 pageJackies Final Resumeapi-192510247No ratings yet

- Gabe LorDocument2 pagesGabe Lorapi-192510247No ratings yet

- Occupational Therapy Revised 2Document24 pagesOccupational Therapy Revised 2api-192510247No ratings yet

- FW Project PediatricsDocument4 pagesFW Project Pediatricsapi-192510247No ratings yet

- Pta On Site Clinic BrochureDocument2 pagesPta On Site Clinic Brochureapi-192510247No ratings yet

- TreatmentplanDocument1 pageTreatmentplanapi-192510247No ratings yet

- FW I Peds Roundtable ReportDocument4 pagesFW I Peds Roundtable Reportapi-192510247No ratings yet

- Bio Lab Research Paper SummaryDocument8 pagesBio Lab Research Paper Summaryapi-192510247No ratings yet

- FW I Service Project Reflection RevisedDocument1 pageFW I Service Project Reflection Revisedapi-192510247No ratings yet

- The Neuronal Impact of NutritionDocument9 pagesThe Neuronal Impact of Nutritionapi-192510247No ratings yet

- Final Draft of Interview MemoDocument4 pagesFinal Draft of Interview Memoapi-192510247No ratings yet

- Final Project For Math 1030 PDFDocument6 pagesFinal Project For Math 1030 PDFapi-192510247No ratings yet

- Danayi Kachere CVDocument3 pagesDanayi Kachere CVNokutenda KachereNo ratings yet

- PG-QP-44: Question Booklet No.Document12 pagesPG-QP-44: Question Booklet No.nayan pareekNo ratings yet

- General Principles of LendingDocument3 pagesGeneral Principles of LendingSNo ratings yet

- Cenon Cervantes in His Own Behalf. Office of The Solicitor General Pompeyo Diaz and Solicitor Felix V. Makasiar For RespondentDocument7 pagesCenon Cervantes in His Own Behalf. Office of The Solicitor General Pompeyo Diaz and Solicitor Felix V. Makasiar For RespondentPrinceNo ratings yet

- Asset Liability Management in YES Bank: A Final Project ReportDocument68 pagesAsset Liability Management in YES Bank: A Final Project ReportUjwal JaiswalNo ratings yet

- Credit Card Ownership Cheat Sheet TemplateDocument2 pagesCredit Card Ownership Cheat Sheet TemplateRoxanne Santos JimenezNo ratings yet

- Bengal Money Lenders Act, 1940 PDFDocument27 pagesBengal Money Lenders Act, 1940 PDFSutirtha BanerjeeNo ratings yet

- Rich Poor Foolish ExcerptDocument35 pagesRich Poor Foolish ExcerptRahul SharmaNo ratings yet

- General and Subsidiary Ledgers ExplainedDocument57 pagesGeneral and Subsidiary Ledgers ExplainedSavage NicoNo ratings yet

- ACCTG 8D (Week 4-7)Document36 pagesACCTG 8D (Week 4-7)Tepan CarloNo ratings yet

- Clearing-Settlement and Risk Management of BATS at ISLAMABADDocument4 pagesClearing-Settlement and Risk Management of BATS at ISLAMABADhafsa1989No ratings yet

- Its Just Time Martin ArmstrongDocument87 pagesIts Just Time Martin ArmstrongkgsbhavaniprasadNo ratings yet

- Shapiro CHAPTER 3 Altered SolutionsDocument17 pagesShapiro CHAPTER 3 Altered Solutionsjimmy_chou1314100% (1)

- RBI - ROI FormatDocument9 pagesRBI - ROI Formatranajoy biswasNo ratings yet

- What Do Financial Managers DoDocument5 pagesWhat Do Financial Managers DoSerena Van Der WoodsenNo ratings yet

- Bonus Assignment 1Document4 pagesBonus Assignment 1Zain Zulfiqar100% (2)

- Buscom SPDocument16 pagesBuscom SPCatherine Joy Vasaya100% (1)

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument33 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRahul RaoNo ratings yet

- GSPC BillDocument1 pageGSPC BillGauravSaxenaNo ratings yet

- Quiz 562Document5 pagesQuiz 562Haris NoonNo ratings yet

- Finman Financial Ratio AnalysisDocument26 pagesFinman Financial Ratio AnalysisJoyce Anne SobremonteNo ratings yet

- c4613 Sample OutputDocument3 pagesc4613 Sample OutputSaravanan DhandapaniNo ratings yet

- Review Test in General Mathematics 11: Clara Mae Macatangay 1Document5 pagesReview Test in General Mathematics 11: Clara Mae Macatangay 1Clara Mae0% (1)

- IGCSE Year 11 Mock Exam - Accounting Paper 2Document15 pagesIGCSE Year 11 Mock Exam - Accounting Paper 2Voon Chen WeiNo ratings yet

- Transaction Confirmation: SpotDocument1 pageTransaction Confirmation: SpotMary Anne JamisolaNo ratings yet

- E-Stamp: Government of RajasthanDocument11 pagesE-Stamp: Government of RajasthanAnil kumarNo ratings yet

- Investment Banking - Securities Dealing in The US Industry ReportDocument42 pagesInvestment Banking - Securities Dealing in The US Industry ReportEldar Sedaghatparast SalehNo ratings yet

- Development Power of Attorny After Registration of Development AgreementDocument12 pagesDevelopment Power of Attorny After Registration of Development AgreementAchyut Bhattacharya100% (1)

- Acct Statement XX6669 23062023Document66 pagesAcct Statement XX6669 23062023Suraj KoratkarNo ratings yet

- Assignment 1: Submitted byDocument9 pagesAssignment 1: Submitted byzarin tasnimNo ratings yet

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)