Professional Documents

Culture Documents

Merchant Banking PDF

Uploaded by

satishiitrOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Merchant Banking PDF

Uploaded by

satishiitrCopyright:

Available Formats

MERCHANT BANKING: NATURE AND SCOPE

ORIGIN OF MERCHANT BANKING

The origin of merchant banking is to be traced to Italy in late medieval times and France during the seventeenth and eighteenth centuries. The Italian merchant bankers introduced into England not only the bill of exchange but also all the institutions and techniques connected with an organised money market. Merchant banking consisted initially of merchants who assisted in financing the transactions of other merchants in addition to their own trade. In France, during seventeenth and eighteenth centuries a merchant banker (le merchand Banquer) was not merely a trader but an entrepreneur par excellence. He invested his accumulated profits in all kinds of promising activities. He added banking business to his merchant activities and became a merchant banker.

MONEY CHANGER AND EXCHANGER1

In the late medieval to early modern times, a distinction existed in banking systems between money changer and exchanger. Money changers concentrated on the manual change of different currencies, operated locally and later accepted deposits for security reasons. In course of time, money changers evolved into public or deposit banks; exchangers who operated internationally, engaged in bill-broking, raising foreign exchange and provision of long-term capital for public borrowers. The exchangers were remitters and merchant bankers. In the seventeenth century, a merchant banker was a dealer in bills of exchange who operated with correspondents abroad and speculated on the rate of exchange.

1.

The most famous was Cosimo de Medici who in the mid-fifteenth century established a network of operations beyond Italy with offices in London, Bruges (Belgium) and Avignon (France).

D:/Pravesh/March2009/Merchant Banking/ Final Proof/ Dated-30-04-2009

Merchant Banking

Initially, merchant banks were not banks at all and a distinction was drawn between banks, merchant banks and other financial institutions. Among all these institutions, it was only banks that accepted deposits from public.

MERCHANT BANKS IN THE UNITED KINGDOM

In the United Kingdom, merchant banks came on the scene in the late eighteenth century and early nineteenth century. Industrial revolution made England into a powerful trading nation. Rich merchant houses who made their fortunes in colonial trade diversified into banking. Their principal activity started with the acceptance of commercial bills pertaining to domestic as well as international trade. The acceptance of the trade bills and their discounting gave rise to acceptance houses, discount houses and issue houses. Merchant banks initially included acceptance houses, discount houses and issue houses. A merchant banker was primarily a merchant rather than a banker but he was entrusted with funds by his customers. The term merchant bank is used in the United Kingdom (the oldest merchant bank in London was Baring Brothers and it was very prominent in Europe during the nineteenth century, and it had considerable representation in North and South America) to denote banks that are not merchants, sometimes for merchants who are not bankers and sometimes for business houses that are neither merchants nor banks.2 The confusion has arisen because modern merchant banks have a wide range of activities. Merchant banks in the United Kingdom (a) finance foreign trade, (b) issue capital, (c) manage individual funds, (d) undertake foreign security business and (e) foreign loan business. Many major merchant banking activities (money-market lending, corporate finance and investment management), are also performed by moneymarket dealers, commercial banks and finance companies, share brokers and investment consultants, and unit trust managers.3 They also used to finance sovereign governments through grant of longterm loans. They financed the British government to purchase shares of the Suez Canal, helped America purchase the State of Louisiana from Napoleon by raising loans from money market in London; and Lazard Brothers granted loan to Government of India for Durgapur Steel Plant. A merchant bank should contain some eleven characteristics: high proportion of decision makers as a percentage of total staff; quick decision

2.

3.

Reid, Sir Edward, The Role of Merchant Banks Today, the Presidential address given to the Institute of Bankers, London, 15 May, 1963. Michael T. Skully, Merchant Banking, The Bankers Magazine of Australasia, June 1977.

Nature and Scope

process; high density of information; intense contact with the environment; loose organisational structure, concentration of short and medium term engagements; emphasis on fee and commission income; innovative instead of repetitive operations; sophisticated services on a national and international level; low rate of profit distribution; and high liquidity ratio.4 Since the end of the second world war commercial banks in Western Europe have been offering multiple services including merchant banking services to their individual and corporate clients. British banks set up divisions or subsidiaries to offer their customers merchant banking services.

MERCHANT BANKING IN INDIA

As planning and industrial policy envisaged the setting up of new industries and technology, greater financial sophistication and financial services are required. According to Goldsmith, there is a well proven link between economic growth and financial technology.5 Economic development requires specialist financial skills: savings banks to marshal individual savings; finance companies for consumer lending and mortgage finance; insurance companies for life and property cover; agricultural banks for rural development; and a range of specialised government or government sponsored institutions. As new units were set up and businesses expanded, they required additional financial services which were then not provided by the banking system. Like the local banking system and the trade before, the local system of family enterprises was unsuited for raising large amounts of capital. A public equity or debt issue was the logical source of funds. Merchant banks serve a dual role within the financial sector. Through deposits or sales of securities they obtain funds for lending to their clients (SEBI forbids lending by them): a function similar to most institutions. Their other role is to act as agents in return for fee. SEBI envisages a mandatory role for merchant banks in exercising due diligence apart from issue management, in buy-backs and public offer in take over bids. Their underwriting and corporate financial services are all fee rather than fund based and their significance is not reflected in their total assets of the industry. SEBI has been pressing for merchant banks to be primarily fee based institutions.

4. 5.

Hans. Peter Bauer, What is a Merchant Bank, The Banker, July 1976, p. 795. Goldsmith, R., Financial Structure and Development, 1969, Yale University Press, New Haven. Meckinnon, R.I., Money and Capital in Economic Development, The Brookings Institution, Washington, DC.

Merchant Banking

BANKING COMMISSION REPORT, 1972

The Banking Commission in its Report in 1972 has indicated the necessity of merchant banking service in view of the wide industrial base of the Indian economy. The Commission was in favour of a separate institutions (as distinct from commercial banks and term lending institutions) to render merchant banking services. The Commission suggested that they should offer investment management and advisory services particularly to the medium and small savers. The Commission also suggested that they should be able to manage provident funds, pension funds and trusts of various types. Merchant banking activity was formally initiated into the Indian capital markets when Grindlays Bank received the license from Reserve Bank in 1967. Grindlays which started with management of capital issues, recognised the needs of emerging class of entrepreneurs for diverse financial services ranging from production planning and systems design to market research. Apart from meeting specially, the needs of small scale units, it provided management consultancy services to large and medium size companies. Following Grindlays Bank, Citibank set up its merchant banking division in 1970. The division took up the task of assisting new entrepreneurs and existing units in the evaluation of new projects and raising funds through borrowing and issue of equity. Management consultancy services were also offered. Consequent to the recommendations of Banking Commission in 1972, that Indian banks should start merchant banking services as part of their multiple services they could offer their clients, State Bank of India started the Merchant Banking Division in 1972. In the initial years the SBIs objective was to render corporate advice and assistance to small and medium entrepreneurs. The commercial banks that followed State Bank of India in setting up merchant banking units were Central Bank of India, Bank of India and Syndicate Bank in 1977; Bank of Baroda, Standard Chartered Bank and Mercantile Bank in 1978; and United Bank of India, United Commercial Bank, Punjab National Bank, Canara Bank and Indian Overseas Bank in late seventies and early 80s. Among the development banks, ICICI started merchant banking activities in 1973, followed by IFCI (1986) and IDBI (1991).

SERVICES RENDERED BY MERCHANT BANKS

The working of merchant banking agencies and units formed subsequently to offer merchant banking services has shown that merchant banks are rendering diverse services and functions, such as organising and extending finance for investment in projects, assistance in financial management, acceptance house business, raising Eurodollar loans and issue of foreign currency bonds, financing

Nature and Scope

of local authorities, financing export of capital goods, ships, hydropower installation, railways, financing of hire-purchase transactions, equipment leasing, mergers and takeovers, valuation of assets, investment management and promotion of investment trusts. Not all merchant banks offer all these services. Different merchant bankers specialise in different services. Merchant banking may cover a wide range of financial activities and in the process include a number of different financial institutions. In the last 35 years new services and functions apart from issue management have been added.

ORGANISATION OF MERCHANT BANKING UNITS

The structure of organisation of merchant banks reveals certain similar characteristics: a high proportion of professionals to total staff; a substantial delegation of decision making; a short chain of command; rapid decision making; flexible organisation structure; innovative approaches to problem solving; and high level of financial sophistication. In the words of Skully, a merchant bank could be best defined as a financial institution conducting money market activities and lending, underwriting and financial advice, and investment services whose organisation is characterised by a high proportion of professional staff able to approach problems in an innovative manner and to make and implement decisions rapidly.6 Merchant banking activities are regulated by (1) Guidelines of SEBI and Ministry of Finance, (2) Companies Act, 1956 and (3) Listing Guidelines of Stock Exchange and (4) Securities Contracts (Regulation) Act, 1956.

INVESTMENT BANKING

Investment banks in USA are the most important participants in the direct market by bringing financial claims for sale. They specialise in helping businesses and governments sell their new security issues, whether debt or equity in the primary market to finance capital expenditures. Once the securities are sold, investment bankers make secondary markets for the securities as brokers and dealers. In 1990, there were 2500 investment banking firms in USA doing underwriting business. About 100 firms are so large that they dominate the

6.

Skully, Michael T., Merchant Banking in ASEAN, 1983, Oxford University Press, Kuala Lampur.

Merchant Banking

industry. In recent years some investment banking firms have diversified or merged with other financial firms to become full service financial firms.

INVESTMENT BANKS AND COMMERCIAL BANKS

Early investment banks in USA differed from commercial banks which accepted deposits and made commercial loans. Commercial banks were chartered exclusively to issue bank notes and make short-term business loans. On the other hand, early investment banks were partnerships and were not subject to regulations that apply to corporations. Investment banks were referred to as private banks and engaged in any business they liked and could locate their offices anywhere. While investment banks could not issue notes, they could accept deposits as well as underwrite and trade in securities. The distinction between commercial banking and investment banking is unique and confined to the United States, where legislation separates them. In countries where there is no legislated separation, banks provide investment banking services as part of their normal range of business activities. Countries where investment banking and commercial banking are combined have universal banking system. European countries have universal banking system which accept deposits, make loans, underwrite securities, engage in brokerage activities and offer financial services.

RESTRICTIONS ON COMMERCIAL BANKS

In India, commercial banks are restricted from buying and selling securities beyond five per cent of their net incremental deposits of the previous year. They can subscribe to securities in the primary market and trade in shares and debentures in the secondary market. Issue management activities which are not fund based are managed by wholly owned subsidiaries and distinct from the banks operations. Further, acceptance of deposits is limited to commercial banks. Non-bank financial intermediaries accept deposits for fixed term and are restricted to financing leasing/hire purchase, investment and loan activities and housing finance. They cannot act as issue managers or merchant banks. Only merchant bankers registered with Securities and Exchange Board of India can undertake issue management and underwriting, arrange mergers and offer portfolio services. Merchant banking in India is non-fund based except underwriting.

INVESTMENT BANKING IN USA

English and European merchant banks played a prominent role in the United States until indigenous investment bankers emerged in the 1880s. In the early nineteenth century English and European merchant bankers met the requirements of finance for rail road construction and international trade. Later

Nature and Scope

they opened their own offices in USA. Kidder, Peabody & Co. was set up in 1824 and John Eliot Thayar banking firm in 1857. During 185060 several merchant banks were set up to arrange capital and enterprise to promote railways, industrial projects and trade and commerce. In the late 1890s and early 1900s investment bankers replaced brokers and promoters who earlier played a prominent role in the issue of securities. Investment bankers apart from launching and organising industrial units and mergers helped transform privately held companies into publicly owned companies. Investment banking largely remained unregulated until the Blue Sky Laws were introduced in Kansas to protect investors from fraudulent promoters and security salesman. However, their growth was facilitated by the enactment of Federal Act in 1914, emergence of US dollar as leading international currency and expansion of activities of US banking system. Prominent investment bankers in 1920s were Kidder, Peabody, Drexel, Morgan & Co., Brown Bros and T.P. Morgan who bought and sold corporate bonds and stocks on commission, dealt in federal, state and municipal securities, trading and investing in securities on their own account, originating and distributing new issues and participating in the management of corporations whose securities they had helped distribute or in which they invested.

GLASS-STEGALL BANKING ACT, 1933

After the great crash of 1929 and the depression, investment banking business considerably contracted and experienced heavy financial losses. The federal government enacted several laws, called New Deal Enactments, to reform Wall Street practices to protect the interests of investors. Officially called the Banking Act of 1933 the Glass-Stegall Banking Act separated investment banking and commercial banking and prohibited depositories from underwriting. The Act, however, does allow commercial banks some security activities such as underwriting and trading in US government securities and some state and local government bonds. Securities Exchange Act of 1934 sought of correct practices in securities trading. The Glass-Stegall Banking Act prohibits commercial banks from acting as investment banks or owning a firm dealing in securities. The Act has been challenged by banks offering money market mutual funds and other investment services and is expected to be the subject of reform. The US Federal Reserve Board decided in January, 1997 to issue a sweeping proposal (subject to a 60day comment period) that would loosen restrictions on banks activities in the securities business. Under the proposal bank holding companies and their securities industry affiliates can offer one stop shopping for their customers. The securities activities of banks are allowed under a special provision in Glass-Stegall Act to be conducted by separately capitalised subsidiaries. In

Merchant Banking

1987 when the Federal Reserve first bagan allowing the existence of such subsidiaries, it subjected them to strict provisions, including a series of barriers or firewalls separating the activities of the bank and the affiliate. As a part of the recent changes to those provisions the Fed has voted to allow the security affiliates of banks to generate as much as a quarter of their revenue from the underwriting and dealing of securitiesan increase from the previous limit of 10 per cent. Regulation of Investment Banking in USA Investment banking in USA as compared to merchant banking in the United Kingdom is subject to the following regulations: 1. The Securities Exchange Commission (SEC) exercises advisory and regulatory role on investment bankers. 2. Investment bankers were restricted from undertaking reorganisation of public corporations under the Chandler Act. The task was assigned to distinguished trustees. 3. Association of trustee with either the issue or its investment banker is prohibited under the Trustee Indenture Act, 1939. To protect the interests of security holders the trust indenture had to be filed with SEC. 4. The investment and portfolio activities became subject to SEC supervision. The increased regulation and control of domestic operations gave a fillip to large US banks to undertake merchant banking functions in international capital markets. The US investment banks have extended their operations to the international level. They are largely responsible for the development of the Eurodollar market in securities and globalisation of capital markets. They have a prominent presence in London and other European financial centres. Investment banks have today a strong parent, a strong balance sheet and a strong international network to play a global role.

ACTIVITIES OF INVESTMENT BANKS IN USA

Investment banks make the primary markets in USA, arrange mergers and acquisitions, undertake global custody, proprietary trading and market making, niche business, fund management and advisory services to governments and firms. The five largest investment banks were Bear Stearns, Lehman Brothers, Merrill Lynch Goldman Sachs and Morgan Stanley. Issue of Securities Investment banks make the primary markets in the USA. They are responsible for finding investors for initial public offerings (IPOs) of securities sold in the

Nature and Scope

primary market. By bringing the buyers and sellers together, they create a market. Such sales can take the form of best offers or agency arrangement. Best offers activity is resorted to in the case of either new or small companies in whose case underwriting would be risky or established and popular companies whose issues are enthusiastically received. Investment bankers may also help as a finder for private placement of securities with institutions. They also purchase new issues from security issuers and arrange for their resale to the investing public. Investment bankers buy the new issue at an agreed price and hope to resell it at a higher price. In this capacity they are said to underwrite, or guarantee, an issue. A group of investment bankers join together to underwrite a security offering and form what is called an underwriting syndicate. The commission received by the investment bankers consists of the differential or spread between purchase and resale prices. The underwriting risk would be that the issue may not attract buyers at a positive differential. Some of the investment banking firms like Merrill Lynch and Fenner and Smith perform brokerage services. Merrill Lynch provides real estate financing and investment advisory services. Firms like Salomon Brothers and Goldman Sachs are investment banking firms that limit their retail brokerage activities. Before the underwriting process is completed the issuer and the investment bank have to comply with the Securities Act, 1933 dealing with new or primary issue of securities, a companion legislative piece to the Securities and Exchange Act, 1934. The purpose of these two laws is to require security issuers to fully disclose all information that affects the value of their securities. Under the Act the issuer has to file a registration statement with SEC prior to the sale and a red herring or preliminary prospectus to the issue. The registration statement must contain all relevant financial information about the issue and prospectus. The exemptions to SEC Act are: (a) securities issued by US federal government; (b) private placements; (c) interstate offerings; and (d) commercial paper. SEC Rule 415 now permits experienced issuers the advantage of shelf registration provided they meet certain criteria with regard to pre-registration offering. Mergers and Acquisitions (M & A) For investment bankers M&A encompasses anything that affects the fundamental structure of the companies, the business of acquisitions, disposals, and the shape of the balance sheet in terms of long-term debt and equity. It is essentially what used to be called Corporate Finance. The M&A wave in middle nineties, which has hit the markets around the globe is fortunately based on fundamentals with greater focus by companies

10

Merchant Banking

on strategic restructuring and the urge to earn global stature. Corporate mergers around the globe numbering 22,000 during 1996 were propelled by record stock prices and low interest rates. The value of mergers in 1996 at a record $1.04 trillion surpassed by 25 per cent the record of $866 billion in 1995. Regulatory changes and the threat of increased global competition are expected to encourage in 1997 telecommunication companies, broadcasters, utilities and financial service companies among others to merge in order to reduce costs and increase revenue. Further, interest rates are expected to stay at a relatively low level to enable companies to borrow to buy other companies. To realise economies of scale in technology and cut costs in administration, banks, fund companies and insurers resorted to mergers. Three of the top five mergers in Europe in 1996 were of financial services companies. In USA, telecommunications industry accounted for $120 billion in mergers. Radio and Television mergers, totalling $37 billion were the second largest. Merger activity in utilities industry on account to deregulation allowing electric companies to join natural gas providers at $32 billion was the third largest. Merger mania has struck the investment banks too leading to removal of barriers between investment banking and other financial services. Investment banks have been traditionally wholesale banks and avoided dealing with public. The mergers have, however, involved the adoption of a retail approach. Apart from mergers of investment banks with others, investment banks and brokers are teaming up. After merger, giant investment banks are emerging with fund management, securities trading and credit card business. The changes in the activities of investment banks are influenced by the need to diversify the source of their earnings to compete in share and bond underwriting which is quite lucrative with securities market firms. Further, fund management business is a regular source of income and is more highly valued by the market than trading and underwriting which is quite volatile. Investment banks have also adopted a retail approach to exploit the boom in mutual funds and retirement assets controlled by individuals sweeping across America and Europe in the nineties. Global Custody Global custody is a service provided by investment banks to local fund managers for cross border settlement and administration. It involves receipt of dividends and interest, subscribing to rights, issues and adjusting portfolios. Custody is the unglamorous aspect of investment banking, the prosaic back office work of settling trades, making payments, keeping records and such related tasks. Investment banks provide this service for a fee to large investors such as mutual funds, pension funds and insurance companies,

Nature and Scope

11

enabling fund managers to buy and sell securities at home and abroad. It is a hi-tech, hi-volume, low margin business, revolutionised by advances in computer technology and information exchange. Global custody is growing at the rate of 1520 per cent a year and exceeds $3 trillion of the $17 trillion of international securities investment. The primary reason for such growth is the growing need to diversify beyond domestic markets to reduce risk and boost returns. Custody fees are based on the value of assets under consideration. With increased competition, bank fees are falling to levels insufficient to cover operating expenses. This is forcing a shake out in the industry with big names such as J.P. Morgan, Bank of America and the US Trust Corporation throwing in the towel on their custody business and deploying their energy and capital elsewhere. Proprietary Trading and Market Making The big changes in investment banking in the 90s have increased competition, the advent of new technology and globalisation of capital markets. Increased competition and new technology have set the margins to be earned from traditional financial mediation and compelled many investment banks to undertake proprietary trading. Several of the worlds largest investment banks have $56 billion of equity which enables them to undertake proprietary trading. Globalisation demands large worldwide network to service governments and large firms. Some investment banks have proprietary trading desks which make straightforward wagers on financial markets by buying and selling securities. Secondly, market makers who buy and sell securities on behalf of customers often hold an inventory of securities. If investment banks expect markets to rise, they can take a bet by holding bigger inventories and by not hedging them against falling prices. Shareholders have put pressure on investment banks to mend their ways by discounting the risks, since proprietary trading leads to wild swings in profits from quarter to quarter and from year to year. Some investment banks, such as Goldman Sachs and Salomon Brothers who want to stay in proprietary trading have invested heavily in complex risk management systems that should aid their understanding and control of trading risks. Others are taking risks of a different sort by moving into loan business, underwriting huge chunks of debt for companies to finance acquisitions and selling them later to other banks. Some investment banks are using their capital to buy long-term stakes in companies to sell them later at a profit. Securitisation consisting of buying

12

Merchant Banking

such assets as mortgages and consumer loans, repacking them as bonds and selling them at a profit is another activity. But securitisation has landed some banks, among them Bear Stearns, Lehman Brothers, and Salomon in losses when the prices of their inventories and of mortgages fell in 1994. In 1980s some banks such as First Boston (since renamed CS First Boston) came unstuck when the values of its portfolio of bridge loans to finance leveraged buyouts collapsed. Niche Business Some investment banks have a clutch on niche business such as trading in gold bullion (Rothchild has a franchise since the early 19th century), financing mining houses in America and Australia (again Rothchild), advising governments on privatisation (Schroders and Rothchild), and trading in bonds denominated in Australian and New Zealand dollars (Hombros). Fund Management Investment banks provide fund management services. Funds under management of Schroders have swollen five-fold to 74 billion pounds in the ten years to the end of 1995. Fund management contributes to nearly half of Schroders annual profits. Flemings manages 60 billion pounds, Rothchild 17 billion pounds and Hombros, 8 billion pounds. Advisory Services Several investment banks have long standing relationships with governments and firms. Their advise is sought because these banks are not big traders and distributors of securities (Hombros) or do not have a commercial bank parent (e.g. Schroders and Flemings). Extension of Credit After the stock market crash and consequent drop in M&A and equities transactions since 2000 the extension of credit through loans; bonds and commercial paper has returned to the centre stage of the investment banking business. A fallout of the credit crisis in 2007 and 2008 and the collapse of the securitised debt and housing mortgages was the implosion of investment banking model. There are no investment banks on Wall street. Two universal banks have taken the place of the two survivors, Goldman Sachs and Morgan Stanley. After the infusion of government capital they have become banks.

UNIVERSAL BANKING

A good deal of interest is generated in India in the concept of universal banking in view of the expansion of the activities of all India development banks into

Nature and Scope

13

traditional commercial banking activity such as working capital finance and the participation of commercial banks in project finance, an area earlier confined to all India as well as state level financial institutions. Further, the reforms in the financial sector since 1992 have ushered in significant changes in the operating environment of banks and financial institutions driven by deregulation of interest rates and emergence of disintermediation pressures arising from liberalised capital markets. In the light of these developments, the Reserve Bank appointed a Working Group (Chairman Shri S.H. Khan) in December 1997 to examine and suggest policy measures for harmonising the role and operations of development finance institutions and banks.

DEFINITION OF UNIVERSAL BANKING

Universal banking refers to the combination of commercial banking and investment banking including securities business. Universal banking can be defined as the conduct of range of financial services comprising deposit taking and lending, trading of financial instruments and foreign exchange (and their derivatives) underwriting of new debt and equity issues, brokerage, investment management and insurance.7 The concept of universal banking envisages multiple business activities. Universal banking can take a number of forms ranging from the true universal bank represented by the German model with few restrictions to the UK model providing a broad range of financial activities through separate affiliates of the bank and the US model with a holding company structure through separately capitalised subsidiaries.

REFERENCES

Bauer, Hans-Peter, What is a Merchant Bank, The Banker, London, July 1976, pp. 795799. Bloch, Earnest, Inside Investment Banking, Dow Jones-Irwin, Illinois, 1986. Commerce, Momentum of Merchant Banking in India Commerce, June 5, 1976, pp. 835837 and 857. Francis, Jack Clark, Management of Investment, Second Edn., McGrawHill International.

7.

Saunders, Anthony, A and Walter, Ingo, Universal Banking in the United States, Oxford University Press, New York, 1994, p. 84.

14

Merchant Banking

Government of India, Report of the Banking Commission, 1972, pp. 396398. Ramachandra Rao B., Merchant Banking, Eastern Economist. February, 1974, pp. 165168. Saunders, Anthony and Walter, Ingo Universal Banking in the United States, Oxford University Press, New York, 1997. Skully, Michael, T., Merchant Banking in ASEAN, 1983, Oxford University Press, Kuala Lampur. Warren, Law, Investment Banking, in Altman, Edward I, Editor, Handbook of Financial Markets and Institutions, Sixth Edn., Wiley, New York, 1987.

You might also like

- Merchant Banking in India: IndexDocument51 pagesMerchant Banking in India: IndexMuumini De Souza NezzaNo ratings yet

- Merchant Banking in IndiaDocument51 pagesMerchant Banking in IndiaAadhish PathareNo ratings yet

- Merchant Banking:: Genesis, Evolution & The Current Plight in IndiaDocument13 pagesMerchant Banking:: Genesis, Evolution & The Current Plight in IndiasharikaNo ratings yet

- Chapter-1: Introduction of Merchant BankingDocument47 pagesChapter-1: Introduction of Merchant BankingKritika IyerNo ratings yet

- Deccan Bank 1Document57 pagesDeccan Bank 1KINJALNo ratings yet

- Main Contents - 2007Document57 pagesMain Contents - 2007Arjun KhuntNo ratings yet

- Merchant Banking in India: An OverviewDocument43 pagesMerchant Banking in India: An OverviewAbhishek Sanghvi100% (1)

- Merchant Banking in IndiaDocument61 pagesMerchant Banking in IndiarimpyanitaNo ratings yet

- Merchant Banking in India: "Liberalization, Privatization and Globalization"Document52 pagesMerchant Banking in India: "Liberalization, Privatization and Globalization"Aarzoo AroraNo ratings yet

- Merchant Banking in IndiaDocument80 pagesMerchant Banking in IndiaSachin KajaveNo ratings yet

- Unit 3 Term PaperDocument57 pagesUnit 3 Term PaperSaurav BurnwalNo ratings yet

- Merchant Banking in IndiaDocument66 pagesMerchant Banking in IndiaNitishMarathe80% (40)

- Merchant Banking Cha-1 by Saidul AlamDocument3 pagesMerchant Banking Cha-1 by Saidul AlamSaidul AlamNo ratings yet

- Merchant BankingDocument43 pagesMerchant BankingIrisha AnandNo ratings yet

- UNIT-3 Merchant Banking:: Commercial BanksDocument26 pagesUNIT-3 Merchant Banking:: Commercial BanksTeja SwiNo ratings yet

- Original Definition: A Merchant Bank Is A British Term For A Bank Providing VariousDocument15 pagesOriginal Definition: A Merchant Bank Is A British Term For A Bank Providing VariousMalay ShahNo ratings yet

- Merchant Banking in IndiaDocument52 pagesMerchant Banking in IndiaKrishna ThapaNo ratings yet

- 08 Chapter 1Document33 pages08 Chapter 1PritipawarNo ratings yet

- History of Banking and Commercial BanksDocument21 pagesHistory of Banking and Commercial BanksAbhijit WankhedeNo ratings yet

- Investment Banking ProjectDocument51 pagesInvestment Banking ProjectSajid Anotherson100% (1)

- Merchant Banks: Securities Exchange Board of IndiaDocument17 pagesMerchant Banks: Securities Exchange Board of IndiaRangoli NagendraNo ratings yet

- Over View of Merchant Banking System: Introduction-Chinmoy GhoshDocument4 pagesOver View of Merchant Banking System: Introduction-Chinmoy Ghoshchin_lord8943No ratings yet

- Merchandise BankingDocument11 pagesMerchandise BankingChandu SutharNo ratings yet

- Investment Banking ProjectDocument51 pagesInvestment Banking ProjectpbasanagoudaNo ratings yet

- Indian Banking Industry AnalysisDocument80 pagesIndian Banking Industry AnalysisAbhijeet MohantyNo ratings yet

- Internship - Report 9097676765677Document80 pagesInternship - Report 9097676765677Abhijeet MohantyNo ratings yet

- Indian BankingDocument7 pagesIndian BankingMONIKA RUBINNo ratings yet

- Chapter I - Merchant BankingDocument4 pagesChapter I - Merchant BankingSam ChinthaNo ratings yet

- Merchant Banking Vs Commercial BankingDocument73 pagesMerchant Banking Vs Commercial BankingUditSawantNo ratings yet

- Merchant Banking NotesDocument24 pagesMerchant Banking NotesSharada KadurNo ratings yet

- Bank of Maharashtra1Document49 pagesBank of Maharashtra1Aamey PawarNo ratings yet

- IJCRT21X0102Document52 pagesIJCRT21X0102Gaurav GhareNo ratings yet

- Unit IDocument11 pagesUnit IShahid AfreedNo ratings yet

- Investment Banking EvolutionDocument50 pagesInvestment Banking EvolutionSharayu BavkarNo ratings yet

- Merchant Banking in India: A GuideDocument65 pagesMerchant Banking in India: A Guideprathamesh kaduNo ratings yet

- Merchant Banking 2Document68 pagesMerchant Banking 2city cyberNo ratings yet

- The Project On Pragathi BankDocument85 pagesThe Project On Pragathi BankPrashanth PBNo ratings yet

- 2023 Baf 414 Investment Banking NotesDocument58 pages2023 Baf 414 Investment Banking NotesEneji ClementNo ratings yet

- Regulations, 1992 Merchant Banker Means Any Person Who Is Engaged in The Business ofDocument3 pagesRegulations, 1992 Merchant Banker Means Any Person Who Is Engaged in The Business ofParul PrasadNo ratings yet

- PART - I ThesisDocument5 pagesPART - I ThesisRizvi KhanalNo ratings yet

- Merchant Banking History and FunctionsDocument80 pagesMerchant Banking History and Functionsdk6666No ratings yet

- Ok Merchant BankingDocument80 pagesOk Merchant BankingMOHITKOLLINo ratings yet

- FullDocument12 pagesFullArnold BruntonNo ratings yet

- Mendoza Lance - 1st AssignmentDocument5 pagesMendoza Lance - 1st AssignmentLance Jimwell MendozaNo ratings yet

- Aditya Institute of Management Studies and Research: Banking & InsuranceDocument14 pagesAditya Institute of Management Studies and Research: Banking & InsuranceAnkita TrivediNo ratings yet

- Introduction to Merchant BankingDocument3 pagesIntroduction to Merchant BankingK-Ayurveda WelexNo ratings yet

- Banking and Financial Institutions ReviewerDocument7 pagesBanking and Financial Institutions ReviewerFranchezca Venice S. SianghioNo ratings yet

- Group 2Document11 pagesGroup 2eranyigiNo ratings yet

- Karnataka Bank ProjectDocument72 pagesKarnataka Bank ProjectBalaji70% (10)

- Investment Banking Paradigm: Concepts and DefinitionsDocument10 pagesInvestment Banking Paradigm: Concepts and DefinitionsSachin SinghNo ratings yet

- Open Innovation Ecosystems: Creating New Value Constellations in the Financial ServicesFrom EverandOpen Innovation Ecosystems: Creating New Value Constellations in the Financial ServicesNo ratings yet

- International Trade Finance: A NOVICE'S GUIDE TO GLOBAL COMMERCEFrom EverandInternational Trade Finance: A NOVICE'S GUIDE TO GLOBAL COMMERCENo ratings yet

- Blockchain: The Ultimate Guide to Understanding the Technology Behind Bitcoin and CryptocurrencyFrom EverandBlockchain: The Ultimate Guide to Understanding the Technology Behind Bitcoin and CryptocurrencyRating: 5 out of 5 stars5/5 (1)

- Break EvenDocument11 pagesBreak EvensatishiitrNo ratings yet

- Behavioral BiasDocument10 pagesBehavioral BiasDarman TadulakoNo ratings yet

- 8 The Relatioaaaanship Between CapitalDocument9 pages8 The Relatioaaaanship Between CapitalsatishiitrNo ratings yet

- India Captial MarketDocument36 pagesIndia Captial MarketShaik AshrafNo ratings yet

- Hilton7e SM CH5Document66 pagesHilton7e SM CH5satishiitr0% (1)

- Reliance Power Fund Offer DocDocument137 pagesReliance Power Fund Offer DocsatishiitrNo ratings yet

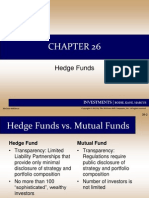

- Chap 026sddDocument33 pagesChap 026sddsatishiitrNo ratings yet

- Journal of Management Education-2008-Napier-792-819 PDFDocument30 pagesJournal of Management Education-2008-Napier-792-819 PDFsatishiitrNo ratings yet

- Invoation in Srevice - CMR PDFDocument0 pagesInvoation in Srevice - CMR PDFsatishiitrNo ratings yet

- 17a Marginal Costing & Breakeven AnalysisDocument20 pages17a Marginal Costing & Breakeven Analysissatishiitr100% (1)

- BehaviourDocument6 pagesBehavioursatishiitrNo ratings yet

- Survey Instrument PDFDocument3 pagesSurvey Instrument PDFDigonto ChowdhuryNo ratings yet

- CHASE 11-30-23Document6 pagesCHASE 11-30-23Riad HossainNo ratings yet

- History of Central Bank of JordanDocument8 pagesHistory of Central Bank of JordanFarah KurdiNo ratings yet

- Types of Bank Accounts in IndiaDocument3 pagesTypes of Bank Accounts in IndiaVasudev GovindanNo ratings yet

- Fel Multipurporse Request FormDocument2 pagesFel Multipurporse Request Formdabster7000No ratings yet

- Mohammadpur Model School & College Mohammadpur Model School & College Mohammadpur Model School & CollegeDocument1 pageMohammadpur Model School & College Mohammadpur Model School & College Mohammadpur Model School & CollegeSahadot Hasan EthonNo ratings yet

- Calculating Cash and Cash EquivalentsDocument120 pagesCalculating Cash and Cash Equivalentsryan100% (1)

- Top 500 Financial QuestionsDocument104 pagesTop 500 Financial QuestionsRanjeeth KNo ratings yet

- Understanding Repo Rate and Reverse Repo RateDocument11 pagesUnderstanding Repo Rate and Reverse Repo RateVishal KhandelwalNo ratings yet

- CH 14Document42 pagesCH 14maxhaakeNo ratings yet

- Foreclosure BrochureDocument6 pagesForeclosure BrochureAnnMarie BelairNo ratings yet

- Merged DocumentDocument93 pagesMerged DocumentsurekhaNo ratings yet

- INFORMASI REKENING December 2022Document13 pagesINFORMASI REKENING December 2022Haris DarnisNo ratings yet

- R Lokesh's ZestMoney account statementDocument4 pagesR Lokesh's ZestMoney account statementRlokesh LokeshNo ratings yet

- 2015-11-30 Letter From Berton To Schneider Re. S & A CapitalDocument6 pages2015-11-30 Letter From Berton To Schneider Re. S & A Capitallarry-612445No ratings yet

- Chap 8 - Money Supply - Part 2Document30 pagesChap 8 - Money Supply - Part 2Linh TrangNo ratings yet

- History: Maharashtra Fifteenth Largest Employer in IndiaDocument2 pagesHistory: Maharashtra Fifteenth Largest Employer in IndiaromaNo ratings yet

- KPLC - Prepaid - Vendors - List of Easy Pay Partners 23 - 05 - 2017Document1 pageKPLC - Prepaid - Vendors - List of Easy Pay Partners 23 - 05 - 2017Reagan MbitiruNo ratings yet

- Ratio Analysis of Bank of BarodaDocument14 pagesRatio Analysis of Bank of BarodaSimran MehrotraNo ratings yet

- Program On Finacle 10Document95 pagesProgram On Finacle 10Mudit100% (1)

- Ba Credit Card Funding, LLC Bank of America, National AssociationDocument30 pagesBa Credit Card Funding, LLC Bank of America, National AssociationishfaqqqNo ratings yet

- Enquiry Regarding Token Numbers of Outstanding Pre-Check BillsDocument3 pagesEnquiry Regarding Token Numbers of Outstanding Pre-Check BillsARAVIND K100% (1)

- Syllabus of CDCSDocument4 pagesSyllabus of CDCSShawn Barnes100% (4)

- 53RD Personal Bank StatementDocument3 pages53RD Personal Bank StatementKelvin Dominic50% (2)

- Private BanksDocument2 pagesPrivate BanksOkka100% (1)

- IFMR Capital: Securitizing Microloans For Non-Bank InvestorsDocument30 pagesIFMR Capital: Securitizing Microloans For Non-Bank Investorsakash srivastavaNo ratings yet

- PNB Vs CUA GR 199161Document1 pagePNB Vs CUA GR 199161butter peanutsNo ratings yet

- Relief International® Admin/Finance Payment Voucher: Voucher No. Date Country/LocationDocument1 pageRelief International® Admin/Finance Payment Voucher: Voucher No. Date Country/LocationVassay KhaliliNo ratings yet

- RMC No 9-2016 - Clarification On Taxability of NSSLA For Income Tax, GRT and DSTDocument3 pagesRMC No 9-2016 - Clarification On Taxability of NSSLA For Income Tax, GRT and DSTdignaNo ratings yet

- Capital One Credit Cards Important DisclosuresDocument5 pagesCapital One Credit Cards Important DisclosuresrevrakNo ratings yet

- Accounts Receivables OracleDocument76 pagesAccounts Receivables OracleDhananjay KasthuriNo ratings yet