Professional Documents

Culture Documents

Labor Law Case Digest

Uploaded by

Drew CabigaoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Labor Law Case Digest

Uploaded by

Drew CabigaoCopyright:

Available Formats

respondent Philippine Musicians Guild (FFW) is a duly registered legitimate labororganization. LVN Pictures, Inc., Sampaguita Pictures, Inc.

, and Premiere Productions, Inc 1arecorporations, duly organized under the Philippine laws, engaged in the making of motion pictures andin the processing and distribution thereof. Petitioner companies employ musicians for the purpose of making music recordings for title music, background music, musical numbers, finale music and otherincidental music, without which a motion picture is incomplete.Ninety-five (95%) percent of all the musicians playing for the musical recordings of saidcompanies are members of the Guild. The Guild has no knowledge of the existence of any otherlegitimate labor organization representing musicians in said companies. Premised upon theseallegations, the Guild prayed that it be certified as the sole and exclusive bargaining agency for allmusicians working in the aforementioned companies. In their respective answers, the latter deniedthat they have any musicians as employees, and alleged that the musical numbers in the filing of thecompanies are furnished by independent contractors.The lower court sustained the Guild s theory. A reconsideration of the order complained of having been denied by the Court en banc,LVN Pictures, inc., and Sampaguita Pictures, Inc., filed thesepetitions for review for certiorari . ISSUE: Whether the musicians in question(Guild members) are employeesof the petitioner filmcompanies. RULING: YES The Court agreed with the lower courts decision , to wit:Lower court resorted to apply R.A. 875 and US Laws and jurisprudence from which saidAct was patterned after. (Since statutes are to be construed in the light of purposes achievedand the evils sought to be remedied). It ruled that the work of the musical director andmusicians is a functional and integral part of the enterprise performed at the same studio substatially under the direction and control of the company. In other words, to determine whether a person who performs work for another is thelatter's employee or an independent contractor, the National Labor Relations relies on 'theright to control' test . Under this test an employer-employee relationship exist where the person for whom the services are performed reserves the right to control not only the end to

be achieved, but also the manner and means to be used in reaching the end. (United Insurance Company, 108, NLRB No. 115.). Notwithstanding that the employees are called independent contractors', the Board will hold them to be employees under the Act where the extent of theemployer's control over them indicates that the relationship is in reality one of employment.(John Hancock Insurance Co., 2375-D, 1940, Teller, Labor Dispute Collective Bargaining, Vol.).The right of control of the film company over the musicians is shown (1) by calling themusicians through 'call slips' in 'the name of the company; (2) by arranging schedules in itsstudio for recording sessions; (3) by furnishing transportation and meals to musicians; and(4) by supervising and directing in detail, through the motion picture director, theperformance of the musicians before the camera, in order to suit the music they are playing tothe picture which is being flashed on the screen. The musical directors have no such control over the musicians involved in the present case. Said musical directors control neither the music to be played, nor the musicians playing it. Th film companies summon the musicians to work, through the musical directors. The film companies,through the musical directors, fix the date, the time and the place of work. The film companies, not themusical directors, provide the transportation to and from the studio. The film companies furnish mealat dinner time.It is well settled that "an employer-employee relationship exists . . .where the person for whom the services are performed reserves a right to controlnot only the end to be achieved but also the means to be used in reaching such end . . . ." (Alabama Highway Express Co., Express Co., v. Local 612 108S. 2d. 350.) The decisive nature of said control over the "means to be used", is illustrated in the case of Gilchrist Timber Co., et al., in which, by reason of said control, the employer-employee relationshipwas held to exist between the management and the workers, notwithstanding the intervention of analleged independent contractor,who had, and exercise, the power to hire and fire said workers. The aforementioned control over the means to be used" in reading the desired end is possessed and exercised by the film companies over the musicians in the cases before us. WHEREFORE, the order appealed from is hereby affirmed,

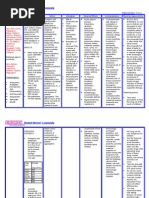

Rosario Bros v. OpleFACTS: Private respondents are tailors hired by the petitioner in its tailoring department. They were paid weeklywages on piece-work basis, minus the withholding tax of BIR. They were registered with SSS as employees of petitioner. They were required to report for work and stay in the shop for no less than 8 hours a day. A mastercutter distributed job orders equally.Private respondents filed a complaint for violation of PD 851(13th month pay) and PD 525 (EmergencyLiving Allowance) against petitioner. ISSUE: WN an employer-employee relationship exists between petitioner and private respondents HELD: Yes. The existence of ER-EE relationship is determined by:1.the selection and engagement of employee2.payment of wages3.power of dismissal4.power to control employees conductAlthough the fourth element is the most important.An independent contractor is the one who exercises independent employment and contracts to do a pieceof work according to his own methods without being subjected to control of his employer except as to the result of his work.In the case at bar, the selection and hiring of respondents was done by petitioner through the mastercutter. Respondents received their weekly wages from petitioner on piecework basis within the meaning of theterm wage under the Labor Code, which defined as the remuneration or earnings. However, designated, whetherfixed on a time, task, piece or commission basis, payable by an employer to an employee under a written orunwritten contact for work done or to be done or for services rendered or to be rendered.Petitioner also had the power to dismiss respondents, thus, the latters conduct was controlled bypetitioner. Respondents were allowed to register with SSS and withholding taxes were also deducted from theirwages.Wherefore, petition is dismissed

Manila Golf & Country Club, Inc., vs IAC and F ermin Llamar (1994) G.R. 64948 F acts: Respondents were caddies and employees of Manila Golf & Country Club who originally filed a petition withthe S ocial S ecurity Commission ( SS C) for coverage and availment of benefits under the S ocial S ecurity A ct.They alleged that although the petitioners were employees of the Manila Golf and Country Club, a domesticcorporation, the latter had not registered them as such with the SSS . I n the case before the SS

C, the respondent Club alleged that the petitioners, caddies by occupation, wereallowed into the Club premises to render services as such to the individual members and guests playing theClub's golf course and who themselves paid for such services; that as such caddies, the petitioners were notsubject to the direction and control of the Club as regards the manner in which they performed their work;and hence, they were not the Club's employees. Issue: WON there exist an employer -employee relationship between the cadies and the Golf Club? Held: No existence of employer -employee relationship. In the very nature of things, caddies must submit to some supervision of their conduct while enjoying theprivilege of pursuing their occupation within the premises and grounds of whatever club they do their workin. For all that is made to appear, they work for the club to which they attach themselves on sufferance but,on the other hand, also without having to observe any working hours, free to leave anytime they please, tostay away for as long they like. It is not pretended that if found remiss in the observance of said rules, anydiscipline may be meted them beyond barring them from the premises which, it may be supposed, the Clubmay do in any case even absent any breach of the rules, and without violating any right to work on their part. All these considerations clash frontally with the concept of employment.The

IAC would point to the fact that the Club suggests the rate of fees payable by the players to the caddiesas still another indication of the latter's status as employees. It seems to the Court, however, that theintendment of such fact is to the contrary, showing that the Club has not the measure of control over theincidents of the caddies' work and compensation that an employer would possess. Court agree that thegroup rotation system so -called, is less a measure of employer control than an assurance that the work isfairly distributed, a caddy who is absent when his turn number is called simply losing his turn to serve

andbeing assigned instead the last number for the day.Moreover, as pointed out by petitioner which was never refuted that: has no means of compelling thepresence of a caddy. Acaddy is not required to exercise his occupation in the premises of petitioner. He maywork with any other golf club or he may seek employment a caddy or otherwise with any entity or individualwithout restriction by petitioner.

DEALCO FARMS vs. NLRC DEALCO FARMS, INC. vs. NATIONAL LABOR RELATIONS COMMISSION (5th DIVISION), CHIQUITO BASTIDA, and ALBERT CABAN GR No. 153192 January 30, 2009

FACTS:

Petitioner Dealco Farms is a corporation engaged in the business of importation, production, fattening and distribution of live cattle for sale to meat dealers, meat traders, meat processors, canned good manufacturers and other dealers in Mindanao and in Metro Manila. Petitioner imports cattle by the boatload from Australia into the ports of General Santos City, Subic, Batangas, or Manila. In turn, these imported cattle are transported to, and housed in, petitioners farms in Polomolok, South Cotabato, or in Magalang, Pampanga, for fattening until the cattle individually reach the market weight of 430 to 450 kilograms.

Respondents Albert Caban and Chiquito Bastida were hired by petitioner on June 25, 1993 and October 29, 1994, respectively, as escorts or "comboys" for the transit of live cattle from General Santos City to Manila. Respondents work entailed tending to the cattle during transportation. It included feeding and frequently showering the cattle to prevent dehydration

and to develop heat resistance. On the whole, respondents ensured that the cattle would be safe from harm or death caused by a cattle fight or any such similar incident.

Upon arrival in Manila, the cattle are turned over to and received by the duly acknowledged buyers or customers of petitioner, at which point, respondents work ceases. For every round trip travel which lasted an average of 12 days, respondents were each paid P1,500.00. The 12day period is occasionally extended when petitioners customers are delayed in receiving the cattle. In a month, respondents usually made two trips.

On August 19, 1999, respondents were told by Dealcos hepe de viaje that their replacement had been effected immediately, but no reason was given for their replacement. Respondents attempted to meet with petitioner but failed. Petitioner denies the existence of an employer-employee relationship with respondents, claiming that: (a) respondents are independent contractors who offer "comboy" services to various shippers and traders of cattle, not only to petitioner; (b) in the performance of work on board the ship, respondents are free from the control and supervision of the cattle owner since the latter is interested only in the result thereof; (c) in the alternative, respondents can only be considered as casual employees performing work not necessary and desirable to the usual business or trade of petitioner, i.e., cattle fattening to market weight and production; and (d) respondents likewise failed to complete the one-year service period, whether continuous or broken, set forth in Article 280 of the Labor Code, as petitioners shipments were substantially reduced in 1998-1999, thereby limiting the escort or "comboy" activity for which respondents were employed.

ISSUE:

Whether or not an employer-employee relationship existed between petitioner and respondents and therefore the latters termination was illegal.

HELD:

Complainants task of escorting the livestock shipped to Manila, taking care of the livestock in transit, is an activity which is necessary and desirable in the usual business or trade of respondent. It is of judicial notice that the bulk of the market for livestock of big livestock raisers such as respondent is in Manila. Hogs do not swim, they are shipped. The caretaker is a component of the business, a part of the scheme of the operation.

More, it also appears that respondents had rendered service for more than one year doing the same task repeatedly, thus, even assuming they were casual employees they may be considered regular employees with respect to the activity in which they were employed and their employment shall continue while such activity exists (last par. of Art. 280).

In the case at bench, both the Labor Arbiter and the NLRC were one in their conclusion that respondents were not independent contractors, but employees of petitioner. In determining the existence of an employer-employee relationship between the parties, both the Labor Arbiter and the NLRC examined and weighed the circumstances against the four-fold test which has the following elements: (1) the power to hire, (2) the payment of wages, (3) the power to dismiss, and (4) the power to control the employees conduct, or the so -called "control test." Of the four, the power of control is the most important element. More importantly, the control test merely calls for the existence of the right to control, and not necessarily the exercise thereof.

The presence of the four (4) elements in the determination of an employer-employee relationship has been clearly established by the facts and evidence on record, starting with the admissions of petitioner who acknowledged the engagement of respondents as escorts of their cattles shipped from General Santos to Manila, and the compensation of the latter at a fee of P1,500.00 per trip.

The element of control, jurisprudentially considered the most essential element of the four, has not been demolished by any evidence to the contrary. The branch has noticed that the preparation of the shipment of cattle, manning and feeding them while in transit, and making a report upon their return to General Santos that the cattle shipped and which reached Manila actually tallied were all indicators of instructions, supervision and control by [petitioner] on *respondents+ performance of work as escorts for which they were hired. This we agree on all

fours. The livestock shipment would cost thousands of pesos and the certainty of it reaching its destination would be the only thing any operator would consider at all time and under all circumstances. It is illogical for [petitioner] to argue that the shipment was not necessary or desirable to their business, as their business was mainly livestock production, because they were undeniably the owners of the cattle escorted by respondents. Should losses of a shipment occur due to respondents neglect these would still be petitioners loss, and nobody elses.

Considering that we have sustained the Labor Arbiters and the NLRCs finding of an employer employee relationship between the parties, we likewise sustain the administrative bodies finding of respondents illegal dismissal. Accordingly, we are not wont to dist urb the award of separation pay, claims for COLA and union service fees fixed at 10% of the total monetary award, as these were based on the finding that respondents were dismissed without just or authorized cause.

Charlie Jao vs. BCC Products Sales and Terrance Ty, G.R, 163700

PETITIONER Charlie Jao alleged that respondents BCC Product Sales, Inc. (BCC) and Terrance Ty employed him as a comptroller. On Oct. 19, 1995, the security guards of BCC barred him from entering its premises. Respondent BCC countered that petitioner was not its employee but that of Sobien Food Corp. (SFC), its major creditor and supplier. SFC had posted him as its comptroller in BCC to oversee BCCs finance and business operations and to look after SFCs interests or investments in BCC. Which contention is more meritorious? Ruling: That of BCC. The Supreme Courts (SC) perusal of the affidavit of petitioner compels a conclusion similar to that reached by the Court of Appeals (CA) and the Labor Arbiter to the effect that the affidavit supported the contention that petitioner had really worked in BCC as SFCs representative. It does seem more natural and more believable that petitioners affidavit was referring to his employment by SFC even while he was reporting to BCC as a comptroller in behalf of SFC. As respondents pointed out, it was implausible for SFC to still post him to oversee and supervise the collections of accounts receivables due from BCC beyond December 1995 if, as he insisted, BCC had already illegally dismissed him and had even prevented him from entering the premises of BCC. Given the patent animosity and strained relations between him and respondents in such circumstances, indeed, how could he still efficiently perform in behalf of SFC the essential responsibility to oversee and supervise collections at BCC? Surely, respondents would have vigorously objected to any arrangement with SFC involving him. We note that petitioner executed the affidavit in March 1996 to refute a statement Ty himself made in his own affidavit dated Dec. 11, 1995 to the effect that petitioner had illegally appropriated some checks without authority from BCC.

Petitioner thereby sought to show that he had the authority to receive the checks pursuant to the arrangements between SFC and BCC. This showing would aid in fending off the criminal charge respondents filed against him arising from his mishandling of the checks. Naturally, the circumstances petitioner adverted to in his March 1996 affidavit concerned those occurring before December 11, 1995, the same period when he actually worked as comptroller in BCC (Charlie Jao vs. BCC Products Sales Inc. and Terrance Ty, G.R. No. 163700, April 18, 2012)

TONGCO VS MANUFACTURERS LIFE The case arose from a complaint for illegal dismissal with various claims filed by Tongko against Manulife. Tongko alleged that he was an employee of the company since the latter exercised control over him. Of course, Manulife claims otherwise insisting that he was an agent.

The Labor Arbiter dismissed the case not finding any employer-employee relationship. This was reversed by the NLRC. On appeal to the CA, the latter ruled in favor of Manulife finding no employer-employee relationship. Hence, Tongko appealed to the Supreme Court. Central to the resolution of the Supreme Court in the appeal was the disquisition on the existence of employer-employee relationship. The significance of this finding is that if it is found that no such relationship exists, the labor courts have no jurisdiction over this case. The employeremployee relationship is established by the four-fold test, as follows:

(a) the selection and engagement of the employee;

(b) the payment of wages;

(c) the power of dismissal; and

(d) the employers power to control the employees conduct.

As foundation for its decision, the Supreme Court held that if the specific rules and regulations that are enforced against insurance agents or managers are such that would directly affect the means and methods by which such agents or managers would achieve the objectives set by the insurance company, they are employees of the insurance company. Applying said standard, the Court held that Tongko was an employee of Manulife since the latter had the power of control over the former.

The Court accorded much weight on the various codes of conduct that Tongko had to observe pursuant to the agency agreement. It held:

Thus, with the company regulations and requirements alone, the fact that Tongko was an employee of Manulife may already be established. Certainly, these requirements controlled the means and methods by which Tongko was to achieve the companys goals.

More importantly, Manulifes evidence establishes the fact that Tongko was tasked to perform administrative duties that establishes his employment with Manulife.

In short, the Supreme Court ruled in favor of Tongko which prompted Manulife to file its Motion for Reconsideration.

You might also like

- Brotherhood Labor Unity Movement of The Philippines V. ZamoraDocument19 pagesBrotherhood Labor Unity Movement of The Philippines V. ZamoraChing ApostolNo ratings yet

- THE LABOUR LAW IN UGANDA: [A TeeParkots Inc Publishers Product]From EverandTHE LABOUR LAW IN UGANDA: [A TeeParkots Inc Publishers Product]No ratings yet

- Labor Law 1Document39 pagesLabor Law 1thereseNo ratings yet

- Sunripe Coconut Product vs. CIR, 83 Phil 518Document16 pagesSunripe Coconut Product vs. CIR, 83 Phil 518Ellen DebutonNo ratings yet

- Labor Law I Case Digest CompilationDocument28 pagesLabor Law I Case Digest CompilationMyco MemoNo ratings yet

- Labor Law Digests - Atty. Magsino's Class.Document21 pagesLabor Law Digests - Atty. Magsino's Class.Ansfav PontigaNo ratings yet

- Labor Case Digest 5671be437b417 PDFDocument13 pagesLabor Case Digest 5671be437b417 PDFGreghvon MatolNo ratings yet

- Labor Case DigestDocument13 pagesLabor Case DigestTurboyNavarroNo ratings yet

- BodyDocument448 pagesBodyreese93No ratings yet

- Manila Golf Club Vs IACDocument2 pagesManila Golf Club Vs IACMyra Mae J. DuglasNo ratings yet

- Case Digest Part 1Document29 pagesCase Digest Part 1Charlotte Gallego80% (5)

- Midterm Labor Case DigestDocument224 pagesMidterm Labor Case Digestanaruto_041609100% (2)

- 12 LVN Pictures Vs Philippine Musicians GuildDocument1 page12 LVN Pictures Vs Philippine Musicians GuildlucasNo ratings yet

- Labor Midterm Case DigestsDocument203 pagesLabor Midterm Case DigestsebenezermanzanormtNo ratings yet

- Employer-Employee Relationship - DigestDocument26 pagesEmployer-Employee Relationship - DigestJosiebethAzuelo0% (1)

- LVN Pictures Vs FFWDocument2 pagesLVN Pictures Vs FFWMacNo ratings yet

- Labor Standards Case Digests in SyllabusDocument73 pagesLabor Standards Case Digests in SyllabusBuzz Beekeeping Supplies AtlantaNo ratings yet

- Brotherhood Laborhood Unity Movement of The Philippines Et Al. V. Honorable Ronaldo B. Zamora G.R. No. L-48645, 7 June, 1987, SECOND DIVISION, (GUTIERREZ, JR., J.) Doctrine of The CaseDocument53 pagesBrotherhood Laborhood Unity Movement of The Philippines Et Al. V. Honorable Ronaldo B. Zamora G.R. No. L-48645, 7 June, 1987, SECOND DIVISION, (GUTIERREZ, JR., J.) Doctrine of The CaseKarl CabarlesNo ratings yet

- Brotherhood Laborhood Unity Movement of The Philippines Et Al. V. Honorable Ronaldo B. Zamora G.R. No. L-48645, 7 June, 1987, SECOND DIVISION, (GUTIERREZ, JR., J.) Doctrine of The CaseDocument38 pagesBrotherhood Laborhood Unity Movement of The Philippines Et Al. V. Honorable Ronaldo B. Zamora G.R. No. L-48645, 7 June, 1987, SECOND DIVISION, (GUTIERREZ, JR., J.) Doctrine of The CaseKarl CabarlesNo ratings yet

- Labor Midterm CasesDocument147 pagesLabor Midterm CasesLing EscalanteNo ratings yet

- Digest of Labor Cases Week 1Document20 pagesDigest of Labor Cases Week 1Jazztine ArtizuelaNo ratings yet

- Group1 Employee Employer Relationship Case DigestsDocument20 pagesGroup1 Employee Employer Relationship Case DigestsJulio HarrisNo ratings yet

- Labor Law Review - Midterms - Case DigestsDocument87 pagesLabor Law Review - Midterms - Case DigestsYrna CañaNo ratings yet

- Manila Golf and Country Club vs. IacDocument4 pagesManila Golf and Country Club vs. IacOlan Dave LachicaNo ratings yet

- Unfair Labor PracticeDocument28 pagesUnfair Labor PracticeNicco AcaylarNo ratings yet

- Labor Cases - Digest (Four Fold Test)Document11 pagesLabor Cases - Digest (Four Fold Test)Anonymous zDh9ksn100% (1)

- Anglo-American Tobacco Corp. vs. Clave, G.R. No. 50915, August 30, 1990, 189 SCRA 127Document2 pagesAnglo-American Tobacco Corp. vs. Clave, G.R. No. 50915, August 30, 1990, 189 SCRA 127Lizzy Liezel100% (1)

- LabRel-Basic Concepts CasesDocument39 pagesLabRel-Basic Concepts CasesLiz ZieNo ratings yet

- LVN Pictures v. Philippine Musicians GuildDocument9 pagesLVN Pictures v. Philippine Musicians GuildBaring CTCNo ratings yet

- Manila Golf & Country Club v. Intermediate Appellate Court and Fermin LlamarDocument3 pagesManila Golf & Country Club v. Intermediate Appellate Court and Fermin LlamarFoxtrot AlphaNo ratings yet

- Case DigestsDocument22 pagesCase DigestsStephen John Sison SantosNo ratings yet

- LVN Pictures Case DigestDocument2 pagesLVN Pictures Case DigestJose MendozaNo ratings yet

- LVN Pictures v. Phil Musicians GuildDocument6 pagesLVN Pictures v. Phil Musicians GuildDexter LingbananNo ratings yet

- Laborsss Sta MariaDocument11 pagesLaborsss Sta Mariacarlos codizalNo ratings yet

- Labor CasesDocument141 pagesLabor CasesOlek Dela CruzNo ratings yet

- Manila Golf and Country Club, Inc. v. IACDocument3 pagesManila Golf and Country Club, Inc. v. IACJug Head100% (1)

- Begino vs. ABS CBN Corporation (Formerly ABS CBN Broadcasting Corporation)Document16 pagesBegino vs. ABS CBN Corporation (Formerly ABS CBN Broadcasting Corporation)Camille Yasmeen SamsonNo ratings yet

- Labor Case DigestDocument34 pagesLabor Case DigestJustin Eriel Paglinawan LaygoNo ratings yet

- Labor Digests - CarlaDocument9 pagesLabor Digests - CarlaMatthew WittNo ratings yet

- Ching Labor DigestDocument96 pagesChing Labor DigestRuel Jr. LaguitanNo ratings yet

- LabRev 1st CompileDocument24 pagesLabRev 1st CompileCesyl Patricia BallesterosNo ratings yet

- Practice Against Respondent SMC On The Ground of IllegalDocument3 pagesPractice Against Respondent SMC On The Ground of Illegalcode4saleNo ratings yet

- EE Relationship Cases (LABOR)Document10 pagesEE Relationship Cases (LABOR)Martin MartelNo ratings yet

- Filcro-Yuzon, Jayson MLCDocument7 pagesFilcro-Yuzon, Jayson MLCJayson YuzonNo ratings yet

- BROTHERHOOD LABOR UNITY MOVEMENT OF THE PHILIPPINES V ZAMORADocument3 pagesBROTHERHOOD LABOR UNITY MOVEMENT OF THE PHILIPPINES V ZAMORACZARINA ANN CASTRONo ratings yet

- Labor Cases Week 3 Final EnriquezDocument11 pagesLabor Cases Week 3 Final EnriquezDarla GreyNo ratings yet

- G.R. No. L-12582Document8 pagesG.R. No. L-12582Inter_vivosNo ratings yet

- Gamboa, Joelyn Marie G. (Week 2)Document4 pagesGamboa, Joelyn Marie G. (Week 2)Agnes GamboaNo ratings yet

- Manila Golf & Country Club, Inc. vs. IACDocument12 pagesManila Golf & Country Club, Inc. vs. IACTherese ReyesNo ratings yet

- Sameer Overseas Placement v. Cabiles (2014)Document11 pagesSameer Overseas Placement v. Cabiles (2014)delayinggratificationNo ratings yet

- 1st Batch Digest LaborDocument38 pages1st Batch Digest LaborCaleb Josh PacanaNo ratings yet

- MANILA GOLF & COUNTRY CLUB Vs IADocument2 pagesMANILA GOLF & COUNTRY CLUB Vs IAFAUSTO JR. SAPALONGNo ratings yet

- LaborDocument16 pagesLaborEve SaltNo ratings yet

- Zanotte Shoes v. NLRC DigestDocument10 pagesZanotte Shoes v. NLRC DigestNin BritanucciNo ratings yet

- Citizens' League of Freeworkers And/Or Balbino Epis, Nicolas Rojo, Et Al. vs. Hon. Macapanton Abbas, Judge of The Court of First Instance of Davao and TEOFILO GERONIMO and EMERITA MendezDocument21 pagesCitizens' League of Freeworkers And/Or Balbino Epis, Nicolas Rojo, Et Al. vs. Hon. Macapanton Abbas, Judge of The Court of First Instance of Davao and TEOFILO GERONIMO and EMERITA MendezLizzette Dela PenaNo ratings yet

- 23 Allan Bazar Vs Carlos Ruizol G.R. No. 198782, October 19, 2016Document4 pages23 Allan Bazar Vs Carlos Ruizol G.R. No. 198782, October 19, 2016Robelle RizonNo ratings yet

- MANILA GOLF CaseDocument1 pageMANILA GOLF CaseGeremae MataNo ratings yet

- T&H Shopfitters Corp. V. T&H Shopfitters Corp. Workers UnionDocument55 pagesT&H Shopfitters Corp. V. T&H Shopfitters Corp. Workers UnionChino CubiasNo ratings yet

- Case Labor 2Document5 pagesCase Labor 2Rhaymark ParraNo ratings yet

- Hernia and LutzDocument4 pagesHernia and LutzDrew CabigaoNo ratings yet

- Cholecystitis With CholelithiasisesDocument15 pagesCholecystitis With CholelithiasisesDrew CabigaoNo ratings yet

- Community ImmersionDocument3 pagesCommunity ImmersionMichael Allen FadriquelNo ratings yet

- UP08 EthicsDocument74 pagesUP08 Ethicsjojitus67% (3)

- Congenial Hip DysplasiaDocument6 pagesCongenial Hip DysplasiaDrew CabigaoNo ratings yet

- Case Pres MeningitisDocument25 pagesCase Pres MeningitisDrew CabigaoNo ratings yet

- Crim 2 Case DigestDocument9 pagesCrim 2 Case DigestDrew CabigaoNo ratings yet

- CIR Vs CA, Central Vegetable Manufacturing Co and Court of Tax AppealsDocument5 pagesCIR Vs CA, Central Vegetable Manufacturing Co and Court of Tax AppealsDrew CabigaoNo ratings yet

- Page 1 of 4Document4 pagesPage 1 of 4Benitez GheroldNo ratings yet

- Ethics LeadershipDocument9 pagesEthics LeadershipNursafika BahiraNo ratings yet

- Richmond Community Schools To Resume Classes Friday After Police Investigate ThreatDocument3 pagesRichmond Community Schools To Resume Classes Friday After Police Investigate Threatbrandon carrNo ratings yet

- 5Document3 pages5Ali Ghahreman0% (2)

- Sohrabudin Encounter CaseDocument9 pagesSohrabudin Encounter CaseNDTVNo ratings yet

- Commission On Human Rights Employees' Association (Chrea) vs. Commission On Human Rights DigestDocument4 pagesCommission On Human Rights Employees' Association (Chrea) vs. Commission On Human Rights DigestilovetwentyonepilotsNo ratings yet

- Position Paper of Climate Change Finance From Pakistan For UNFCCC-COP18 DohaDocument7 pagesPosition Paper of Climate Change Finance From Pakistan For UNFCCC-COP18 DohaEnviro_PakNo ratings yet

- New 2019 Passport Renewal Form AdultDocument2 pagesNew 2019 Passport Renewal Form AdultTopal FerhatNo ratings yet

- 1892 Merrill Law of MandamusDocument554 pages1892 Merrill Law of MandamusEdward kabunduNo ratings yet

- Leadership Styles Master TemplateDocument3 pagesLeadership Styles Master Templateapi-339947189No ratings yet

- Site in The First MassDocument60 pagesSite in The First MassBlaiseadajane ReclaNo ratings yet

- Grade 6 - History - Practice Paper 2020Document2 pagesGrade 6 - History - Practice Paper 2020Anonymous QWLHRPddKNo ratings yet

- Just Think, Rajya Sabha For Naresh KadyanDocument66 pagesJust Think, Rajya Sabha For Naresh KadyanNaresh Kadyan Pfa HaryanaNo ratings yet

- XYRILL-JAN Ge2 CRY OF BALINTAWAKDocument21 pagesXYRILL-JAN Ge2 CRY OF BALINTAWAKJaylord MañagoNo ratings yet

- M C M C M C: Unit 11 Let's Hear ! Unit 13 Zure Is Sick Unit 12 My Best Friend Claire Unit 14 The Mermaid's TailDocument16 pagesM C M C M C: Unit 11 Let's Hear ! Unit 13 Zure Is Sick Unit 12 My Best Friend Claire Unit 14 The Mermaid's TailNurHamizahNo ratings yet

- Ecological EconomicsDocument541 pagesEcological Economicsphilanthropistxmidget9110100% (6)

- Ashis NandyDocument20 pagesAshis NandySreenanti BanerjeeNo ratings yet

- B3 FormDocument2 pagesB3 FormMavoco Marvin100% (2)

- Notes On Althusser: Ideology and Interpellation: January 2017Document4 pagesNotes On Althusser: Ideology and Interpellation: January 2017Cristina RaileanuNo ratings yet

- THE SPECIAL MARRIAGE ACtDocument7 pagesTHE SPECIAL MARRIAGE ACtArsh DeepNo ratings yet

- 5 Year Resistance PDFDocument27 pages5 Year Resistance PDFOmsNo ratings yet

- U.S. v. Unimex, IncDocument6 pagesU.S. v. Unimex, IncMonica SalvadorNo ratings yet

- Exhibitionist #10Document85 pagesExhibitionist #10Cecilia Lee100% (1)

- Masculinity Studies and Feminism: Othering The SelfDocument4 pagesMasculinity Studies and Feminism: Othering The SelfDevyani JaiswalNo ratings yet

- RegisterOfSuppliers PartOne NetSupplies 2019aDocument98 pagesRegisterOfSuppliers PartOne NetSupplies 2019aAleksandr ShnyrovNo ratings yet

- City Star December 2022Document16 pagesCity Star December 2022city star newspaperNo ratings yet

- Brahimi Report Exec SummaryDocument7 pagesBrahimi Report Exec SummaryMirela BaigusNo ratings yet

- 5 6100167382225912130 PDFDocument132 pages5 6100167382225912130 PDFSusmitha YarraNo ratings yet

- Appellees BriefDocument16 pagesAppellees Briefjem0210No ratings yet

- mg343 AllDocument24 pagesmg343 AllsyedsrahmanNo ratings yet

![THE LABOUR LAW IN UGANDA: [A TeeParkots Inc Publishers Product]](https://imgv2-2-f.scribdassets.com/img/word_document/702714789/149x198/ac277f344e/1706724197?v=1)