Professional Documents

Culture Documents

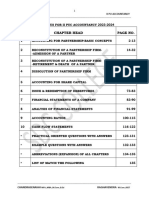

Chapter 12 in Class Problems

Uploaded by

amu_scribdCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 12 in Class Problems

Uploaded by

amu_scribdCopyright:

Available Formats

ACCT 304

Chapter 12 In-Class Practice 1. ELO Corporation purchased a patent for $180,000 on September 1, 2010. It had a useful life of 10 years. On January 1, 2012, ELO spent $44,000 to successfully defend the patent in a lawsuit. ELO feels that as of that date, the remaining useful life is 5 years. What amount should be reported for patent amortization expense for 2012?

2. ELO Corporation purchased a patent for $250,000 on January 1, 2010. It had a useful life of 10 years. On January 1, 2012, ELO spent $44,000 to unsuccessfully defend the patent in a lawsuit. ELO feels that as of that date, the remaining useful life is 5 years. What amount should be reported for patent amortization expense for 2012?

3. Blue Sky Company's balance sheet reports assets of $5,000,000 and liabilities of $2,000,000. All of Blue Sky's assets' book values approximate their fair value, except for land, which has a fair value that is $300,000 greater than its book value. Horace Wimp Corporation paid $5,100,000 to acquire Blue Sky. What amount of goodwill should Horace Wimp record as a result of this purchase?

4. ABC bought XYZ. XYZ had the following assets (at fair value): Accounts Receivable Inventory PP&E Liabilities $100,000 $500,000 $200,000 $400,000

If ABC paid $350,000 for XYZ, what is the correct journal entry for this purchase?

5. Twilight Corporation acquired End-of-the-World Products on January 1, 2012 for $2,000,000, and recorded goodwill of $375,000 as a result of that purchase. At December 31, 2012, the End-of-theWorld Products Division had a fair value of $1,700,000. The net identifiable assets of the Division (excluding goodwill) had a book value of $1,450,000 at that time. What amount of loss on impairment of goodwill should Twilight record in 2012?

6. Q12-27 Garfunkel has incurred $6 million in developing a computer software program to be sold. $4.5 million of the costs were capitalized. The product generated $2 million in revenue in 2010, and is anticipated to generate another $8 million in future years. The estimated useful life of the product is 4 years. What amount should be amortized?

ACCT 304

You might also like

- Chapter 06 Intercompany Profit Transactions Plant AssetsDocument28 pagesChapter 06 Intercompany Profit Transactions Plant AssetsJonathan VidarNo ratings yet

- Soal Kuis Asistensi AK1 Setelah UTSDocument6 pagesSoal Kuis Asistensi AK1 Setelah UTSManggala Patria WicaksonoNo ratings yet

- In y Ter CompanyDocument6 pagesIn y Ter CompanyEllenNo ratings yet

- Test Bank CH 3Document32 pagesTest Bank CH 3rathaloz777100% (4)

- Chapter 06 - Intercompany Profit Transactions - Plant AssetsDocument28 pagesChapter 06 - Intercompany Profit Transactions - Plant AssetsTina Lundstrom100% (1)

- ch06 Beams10e TBDocument28 pagesch06 Beams10e TBKenneth Jay AcideraNo ratings yet

- An Introduction To Consolidated Financial Statements LO1: Chapter 3 Test BankDocument32 pagesAn Introduction To Consolidated Financial Statements LO1: Chapter 3 Test BankKaren MagsayoNo ratings yet

- QuizDocument14 pagesQuizYusuf Khan0% (3)

- 202 Practice Exam SOLUTIONS Spring 2016Document25 pages202 Practice Exam SOLUTIONS Spring 2016MaxNo ratings yet

- Intangible AssetsDocument10 pagesIntangible AssetsMiguel Angelo JoseNo ratings yet

- ACC 577 Quiz Week 3Document12 pagesACC 577 Quiz Week 3Mary100% (2)

- PPE HandoutsDocument12 pagesPPE HandoutsChristine Joy PamaNo ratings yet

- Latihan Soal Chapter 5 SD 7Document6 pagesLatihan Soal Chapter 5 SD 7Andy warholNo ratings yet

- Test Bank CH 3Document32 pagesTest Bank CH 3Sharmaine Rivera MiguelNo ratings yet

- UntitledDocument9 pagesUntitledPriya NairNo ratings yet

- Test 1Document4 pagesTest 1Abdul Majid Ghanjera0% (1)

- Practice Exam Chapters 1-5 (2) Income StatementDocument5 pagesPractice Exam Chapters 1-5 (2) Income StatementJohn Arvi ArmildezNo ratings yet

- Making a profitable sale on credit effectsDocument3 pagesMaking a profitable sale on credit effectsEmiraslan MhrrovNo ratings yet

- Problem Set 5 and Formative AssignmentDocument9 pagesProblem Set 5 and Formative AssignmentPatt PanayongNo ratings yet

- PPE HandoutsDocument12 pagesPPE HandoutsAries BautistaNo ratings yet

- D. A Space in The Building Is Rented To Other FirmsDocument4 pagesD. A Space in The Building Is Rented To Other FirmsEmiraslan MhrrovNo ratings yet

- Acct101 Financial Accounting: Instructions To CandidatesDocument26 pagesAcct101 Financial Accounting: Instructions To CandidatesYing Sheng ÖNo ratings yet

- Historical CostDocument4 pagesHistorical CostEmiraslan MhrrovNo ratings yet

- Bab 3 Chapter 12 PDFDocument4 pagesBab 3 Chapter 12 PDFGrifyn IfyNo ratings yet

- ACCT101 Sample Paper - With SolutionDocument24 pagesACCT101 Sample Paper - With SolutionBryan Seow100% (1)

- ExcelDocument7 pagesExcellorrynorryNo ratings yet

- Intermediate Accounting Exam 11Document2 pagesIntermediate Accounting Exam 11BLACKPINKLisaRoseJisooJennieNo ratings yet

- Sabre Corporation Which Reports Under Ifrs Has The Following InvestmentsDocument1 pageSabre Corporation Which Reports Under Ifrs Has The Following InvestmentsBube KachevskaNo ratings yet

- Mid-Term Test QuestionDocument6 pagesMid-Term Test QuestionCYNo ratings yet

- Mid Advanced Acc. First09-10Document4 pagesMid Advanced Acc. First09-10Carl Adrian ValdezNo ratings yet

- Solved Pitt Reported The Following Information For 2018 and 2019 Required Compute Pitt SDocument1 pageSolved Pitt Reported The Following Information For 2018 and 2019 Required Compute Pitt SAnbu jaromiaNo ratings yet

- Ch9 12 6eDocument9 pagesCh9 12 6eAtif RehmanNo ratings yet

- Advanced Accounting Beams Anthony 11th Edition Test BankDocument38 pagesAdvanced Accounting Beams Anthony 11th Edition Test BankStevenRichardsdesk100% (33)

- Audit of InvestmentDocument5 pagesAudit of InvestmentRodwin DeunaNo ratings yet

- BADVAC1X - 1T 2122 Q2 Finals PD (Preview) Microsoft FormsDocument12 pagesBADVAC1X - 1T 2122 Q2 Finals PD (Preview) Microsoft FormsJopnerth Carl CortezNo ratings yet

- Chapter 11-Part 1 Share Transaction Soal 1Document2 pagesChapter 11-Part 1 Share Transaction Soal 1Nicko Arisandiy0% (1)

- Modern Advanced Accounting in Canada Canadian 7Th Edition Hilton Test Bank Full Chapter PDFDocument36 pagesModern Advanced Accounting in Canada Canadian 7Th Edition Hilton Test Bank Full Chapter PDFgeorge.banister430100% (10)

- Trắc nghiệmDocument8 pagesTrắc nghiệmHồ Đan Thục0% (1)

- Investment Practice ProblemsDocument14 pagesInvestment Practice ProblemsmikeNo ratings yet

- Int AccDocument37 pagesInt AccjoeywuykNo ratings yet

- Chap 003Document37 pagesChap 003ChuyuZhang100% (2)

- Problem 2Document5 pagesProblem 2Rommel RoyceNo ratings yet

- Quiz InvestmentsDocument2 pagesQuiz InvestmentsstillwinmsNo ratings yet

- Advanced Accounting Testbank For Final 6eDocument35 pagesAdvanced Accounting Testbank For Final 6etoto100% (1)

- Modern Advanced Accounting in Canada Canadian 7th Edition Hilton Test Bank 1Document27 pagesModern Advanced Accounting in Canada Canadian 7th Edition Hilton Test Bank 1nicholasmcdowellqzogitybxs100% (24)

- IAS 36 Impairment of AssetsDocument7 pagesIAS 36 Impairment of AssetsMazni Hanisah0% (1)

- Discontinued Operations Acctg. Test BankDocument12 pagesDiscontinued Operations Acctg. Test BankDalrymple CasballedoNo ratings yet

- Review Sw4tgession 5 TEXTDocument9 pagesReview Sw4tgession 5 TEXTMelissa WhiteNo ratings yet

- 08 Audit of InvestmentsDocument10 pages08 Audit of InvestmentsAryando Mocali TampubolonNo ratings yet

- Send Tutor 1Document3 pagesSend Tutor 1mystupidNo ratings yet

- Equity method accounting questions and answersDocument3 pagesEquity method accounting questions and answersricty0% (1)

- MidTerm ExamDocument15 pagesMidTerm ExamYonatan Wadler100% (2)

- P2 Reviewer PDFDocument64 pagesP2 Reviewer PDFBeef TestosteroneNo ratings yet

- Holly Hocks Inc Had Cash Sales of 225 000 For 2012Document1 pageHolly Hocks Inc Had Cash Sales of 225 000 For 2012M Bilal SaleemNo ratings yet

- Homework Week 1Document9 pagesHomework Week 1ela kikay100% (1)

- Accounting Textbook Solutions - 67Document19 pagesAccounting Textbook Solutions - 67acc-expertNo ratings yet

- Quiz II (Chapters 3 and 4) Consolidated Financial StatementsDocument5 pagesQuiz II (Chapters 3 and 4) Consolidated Financial Statements820090150% (2)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- auditing-CH 2 NotesDocument4 pagesauditing-CH 2 Notesamu_scribdNo ratings yet

- auditing-CH 2 NotesDocument4 pagesauditing-CH 2 Notesamu_scribdNo ratings yet

- Chapter 1 - Test Bank Auditing UICDocument15 pagesChapter 1 - Test Bank Auditing UICLana Bustami100% (4)

- CH 11Document6 pagesCH 11amu_scribdNo ratings yet

- Chapter 13 In-Class PracticeDocument3 pagesChapter 13 In-Class Practiceamu_scribdNo ratings yet

- Chapter 17 OutlineDocument2 pagesChapter 17 Outlineamu_scribdNo ratings yet

- Chapter 11 Quiz Sect 903 SolutionsDocument4 pagesChapter 11 Quiz Sect 903 Solutionsamu_scribdNo ratings yet

- Chap 00183Document29 pagesChap 00183amu_scribdNo ratings yet

- Outline of Important Points For Chapter 13Document1 pageOutline of Important Points For Chapter 13amu_scribdNo ratings yet

- CH 1Document8 pagesCH 1amu_scribdNo ratings yet

- CH 3-AuditDocument2 pagesCH 3-Auditamu_scribdNo ratings yet

- Chapter 10 Quiz SolutionsDocument3 pagesChapter 10 Quiz Solutionsamu_scribd100% (1)

- Corporate Capital ChecklistDocument2 pagesCorporate Capital Checklistamu_scribdNo ratings yet

- Solutions CH 18Document65 pagesSolutions CH 18amu_scribdNo ratings yet

- Solutions CH 18Document65 pagesSolutions CH 18amu_scribdNo ratings yet

- US GAAP Vs IFRSDocument52 pagesUS GAAP Vs IFRSSumair ShahidNo ratings yet

- CH 11Document6 pagesCH 11amu_scribdNo ratings yet

- CH 12Document4 pagesCH 12amu_scribd100% (1)

- Revision Checklist For As Accounting 9706 FINALDocument28 pagesRevision Checklist For As Accounting 9706 FINALhopeaccaNo ratings yet

- Valuation of Goodwill and Shares - Methods, Calculations and WorkingsDocument12 pagesValuation of Goodwill and Shares - Methods, Calculations and Workingsrani26octNo ratings yet

- #23 Intangible Assets (Notes For 6208)Document6 pages#23 Intangible Assets (Notes For 6208)jaysonNo ratings yet

- Qbank 23-24 Npo RemovedDocument135 pagesQbank 23-24 Npo Removedramu gowdaNo ratings yet

- Indian Accounting Standard (Ind AS) 27 Consolidated and Separate Financial StatementsDocument44 pagesIndian Accounting Standard (Ind AS) 27 Consolidated and Separate Financial Statementsmchauhan1991No ratings yet

- IFRS 5, Non-Current Assets Held For Sale and Discontinued Operations: Practical Guide To Application and Expected ChangesDocument42 pagesIFRS 5, Non-Current Assets Held For Sale and Discontinued Operations: Practical Guide To Application and Expected ChangesJahidul ShahNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument32 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalseShaindra SinghNo ratings yet

- Ffa12efmq A Low ResDocument34 pagesFfa12efmq A Low ResAdi StănescuNo ratings yet

- Advanced Accounting Exam QuestionsDocument24 pagesAdvanced Accounting Exam QuestionsGeorge PopescuNo ratings yet

- Financial Reporting in The Mining IndustryDocument192 pagesFinancial Reporting in The Mining IndustryhewoNo ratings yet

- 3 Module 3 - Notes To Financial Statements AE 17 Intermediate Accounting 3Document14 pages3 Module 3 - Notes To Financial Statements AE 17 Intermediate Accounting 3CJ Granada100% (1)

- ReSA B43 AFAR First PB Exam Questions, Answers & SolutionsDocument22 pagesReSA B43 AFAR First PB Exam Questions, Answers & SolutionsBella Choi100% (1)

- FAR - RQ - Investment in AssociatesDocument2 pagesFAR - RQ - Investment in AssociatesKriane Kei50% (2)

- D6Document11 pagesD6lorenceabad07No ratings yet

- Scott 062006Document6 pagesScott 062006Kian TuckNo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- Quiz 1.07 Revaluation To Intangible Assets Submissions: Standalone AssignmentDocument15 pagesQuiz 1.07 Revaluation To Intangible Assets Submissions: Standalone AssignmentJohn Lexter Macalber100% (1)

- Hilton6e SM08Document70 pagesHilton6e SM08Eych MendozaNo ratings yet

- Practical Accounting 2 1Document24 pagesPractical Accounting 2 1NCTNo ratings yet

- CPA Review School ConsolidationDocument18 pagesCPA Review School ConsolidationMellaniNo ratings yet

- Chapter 10, Modern Advanced Accounting-Review Q & ExrDocument26 pagesChapter 10, Modern Advanced Accounting-Review Q & Exrrlg4814100% (2)

- Panera Bread Financial Analysis Spring2015Document6 pagesPanera Bread Financial Analysis Spring2015Cinthia SantosNo ratings yet

- Master QuestionsDocument5 pagesMaster QuestionsSumit VermaNo ratings yet

- CH 19Document45 pagesCH 19Abdulrahman Alotaibi100% (1)

- CAPITALIZING INTERESTDocument35 pagesCAPITALIZING INTERESTTornike JashiNo ratings yet

- Multiple Choice QuestionsDocument10 pagesMultiple Choice QuestionsnicahNo ratings yet

- October 2016 Advanced Financial Accounting Reporting Final Pre BoardDocument18 pagesOctober 2016 Advanced Financial Accounting Reporting Final Pre BoardhellokittysaranghaeNo ratings yet

- Impairment or Disposal of Long-Lived Assets PDFDocument94 pagesImpairment or Disposal of Long-Lived Assets PDFJJ_942947426No ratings yet

- Adv Acct CH 6 HoyleDocument76 pagesAdv Acct CH 6 Hoylewaverider750% (2)

- Financial Accounting Problems ExplainedDocument12 pagesFinancial Accounting Problems Explainedshanaya valeza80% (10)