Professional Documents

Culture Documents

Multiple Choice Questions: Section-I

Uploaded by

sah108_pk796Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Multiple Choice Questions: Section-I

Uploaded by

sah108_pk796Copyright:

Available Formats

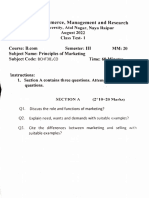

THE INSTITUTE OF BANKERS PAKISTAN

ISQ Examination (Winter-2011) Branch Banking Stage-I

Section-I

Multiple Choice Questions

Number of Questions: 30 Marks: 45 Allotted Time: 60 minutes Section-II Constructed Response Questions

Number of Questions: 09 Marks: 55 Allotted Time: 120 minutes

Q.31 List FIVE documents which a banker must obtain before opening an account of joint stock company. Q.32 A) Q.32 B) Write the importance of maintaining secrecy of a customers account. Under what circumstances is a bank justified in divulging the affairs of its customers to anyone?

Q.33 List at least TEN services offered by banks to their customers? Q.34 A) Q.34 B) Q.35 A) What is meant by Unclaimed Deposits? Describe the cases where deposits/instruments cannot be classified as Unclaimed. Explain the concept of internal control.

Page 1 of 2

Q.35 B)

Describe the objectives and components of internal control.

Q.36 List at least FIVE powers conferred upon the Pakistan . Q.37 A)

Q.37 B)

Banking

Mohtasib in

What is meant by branch-less banking?

What are its different models and the permissible activities?

Q.38 Differentiate between walk-in customer and solicited customer. Which one of the two is more important for a bank and why? Q.39 A) Q.39 B) Q.39 C) Define promissory note and a bill of exchange citing relevant sections of the Negotiable Instrument Act-1881. Write THREE significant differences between them. Give ONE example of each transaction and where they are used.

-.-.-.-.-.-

Page 2 of 2

You might also like

- BBA III-Banking Theory & Practices-QP IIDocument2 pagesBBA III-Banking Theory & Practices-QP IINazif SamdaniNo ratings yet

- M.B.A. Degree Examination, May 2015 (Financial Management) : 230: Financial Analysis and Industrial FinancingDocument3 pagesM.B.A. Degree Examination, May 2015 (Financial Management) : 230: Financial Analysis and Industrial FinancingRavi KrishnanNo ratings yet

- All Que papers (1)Document13 pagesAll Que papers (1)yashs.2124No ratings yet

- Financial Management For Agri. Business - Sum-2010Document1 pageFinancial Management For Agri. Business - Sum-2010THE MANAGEMENT CONSORTIUM (TMC) ‘All for knowledge, and knowledge for all’No ratings yet

- MF0004Document2 pagesMF0004Tenzin KunchokNo ratings yet

- Section ADocument4 pagesSection ADheeraj KumarNo ratings yet

- All BooksDocument6 pagesAll BooksKiran BhoirNo ratings yet

- ISQ Exam Economics Stage II QuestionsDocument2 pagesISQ Exam Economics Stage II Questionssah108_pk796No ratings yet

- Multiple Choice Questions: Section-IDocument2 pagesMultiple Choice Questions: Section-IMuhammad MuaviaNo ratings yet

- Acharya'S Bangalore B-School Ii Internal Assessment Entrepreneurship and New Venture Creation III Semester M.B.ADocument2 pagesAcharya'S Bangalore B-School Ii Internal Assessment Entrepreneurship and New Venture Creation III Semester M.B.ARam Krishna KrishNo ratings yet

- IIMMDocument24 pagesIIMMarun1974No ratings yet

- Qme 3Document2 pagesQme 3anufacebookNo ratings yet

- Time: 3 Hours Maximum Marks: 100Document2 pagesTime: 3 Hours Maximum Marks: 100Haladharaa TombaNo ratings yet

- MNE Question Bank 2Document1 pageMNE Question Bank 2Anala MNo ratings yet

- Jan 2020 AA1 QuestionsDocument7 pagesJan 2020 AA1 QuestionsSarah RanduNo ratings yet

- Merchant Banking and Financial Services Exam QuestionsDocument2 pagesMerchant Banking and Financial Services Exam QuestionsKiran SoniNo ratings yet

- CLL305 2021 2Document2 pagesCLL305 2021 2deNo ratings yet

- Btech 7 Sem Entrepreneurship Development Noe 071 2018 19Document2 pagesBtech 7 Sem Entrepreneurship Development Noe 071 2018 19127 -ME 54-Sumit SinghNo ratings yet

- MA0034Document2 pagesMA0034Tenzin KunchokNo ratings yet

- Credit Risk Assessment 1 May 2011Document5 pagesCredit Risk Assessment 1 May 2011Basilio MaliwangaNo ratings yet

- PAM 1st Sem Final-2016 (03.09.16)Document2 pagesPAM 1st Sem Final-2016 (03.09.16)Sarjeel Ahsan NiloyNo ratings yet

- Commerce (Business Studies)Document4 pagesCommerce (Business Studies)Riktesh GuptaNo ratings yet

- Master of Business Administration-MBA Semester 3 MF0001 - Security Analysis and Portfolio Management - 2 CreditsDocument7 pagesMaster of Business Administration-MBA Semester 3 MF0001 - Security Analysis and Portfolio Management - 2 CreditsSiddharth Saurabh SinghNo ratings yet

- Assignments Jan June2013Document13 pagesAssignments Jan June2013Dharmesh MistryNo ratings yet

- Consumer Banking - BNK603 Spring 2010 Final Term PaperDocument4 pagesConsumer Banking - BNK603 Spring 2010 Final Term PaperBint e HawaNo ratings yet

- January 2020 AA2 QuestionsDocument8 pagesJanuary 2020 AA2 QuestionsSarah RanduNo ratings yet

- Part-II (Semester III & IV) 12.3.18Document23 pagesPart-II (Semester III & IV) 12.3.18Asif KhanNo ratings yet

- CLASS TEST - II (2018-19) Bachelor of Business Administration - VI Sem Fundamentals of E-Commerce (BBA-N-606) Time: 1.5Hrs. M.M.: 30Document2 pagesCLASS TEST - II (2018-19) Bachelor of Business Administration - VI Sem Fundamentals of E-Commerce (BBA-N-606) Time: 1.5Hrs. M.M.: 30Himanshu DarganNo ratings yet

- Assignments MB 0034 Research Methodology (3 Credits) Set II MarksDocument20 pagesAssignments MB 0034 Research Methodology (3 Credits) Set II Marksrahulthakurmba880% (1)

- Economics: B. Com - IDocument2 pagesEconomics: B. Com - IRashidAliNo ratings yet

- MS-3 Management Programme Term-End Examination June, 2015 Ms-3: Economic and Social EnvironmentDocument2 pagesMS-3 Management Programme Term-End Examination June, 2015 Ms-3: Economic and Social Environmentdebaditya_hit326634No ratings yet

- Macro Economics Trimester II Mba Ktu 2017Document1 pageMacro Economics Trimester II Mba Ktu 2017PAVAN KUMARNo ratings yet

- ICMA Questions Dec 2011Document54 pagesICMA Questions Dec 2011Asadul HoqueNo ratings yet

- Andhra University MBA Assignments 2019-20Document9 pagesAndhra University MBA Assignments 2019-20girijaNo ratings yet

- BBA111 Sem AssignmentDocument7 pagesBBA111 Sem Assignmentjaat2627No ratings yet

- CEG SET - 30 MBA - III Sem Assignment QuestionsDocument11 pagesCEG SET - 30 MBA - III Sem Assignment QuestionsKathiresan NarayananNo ratings yet

- GCC Academy Class Xi Accountancy Test: Fundamentals of Accounting Max Marks: 25 Time: 60 MinsDocument1 pageGCC Academy Class Xi Accountancy Test: Fundamentals of Accounting Max Marks: 25 Time: 60 MinsVinaya VenkatNo ratings yet

- BBA 6th Sem SyllabusDocument13 pagesBBA 6th Sem SyllabusSreenivasulu reddyNo ratings yet

- 5 - (S2) Aa MP PDFDocument3 pages5 - (S2) Aa MP PDFFlow RiyaNo ratings yet

- Business Administration CSS 2000 2020Document32 pagesBusiness Administration CSS 2000 2020Jelly FishNo ratings yet

- B.B.A. Semester V Investment Management Max Marks: 40 BBA-512 Time Allowed-1:30 HrsDocument1 pageB.B.A. Semester V Investment Management Max Marks: 40 BBA-512 Time Allowed-1:30 HrsCharuNo ratings yet

- Industrial Relations 2021Document2 pagesIndustrial Relations 2021Thomas RajuNo ratings yet

- Introduction To BusinessDocument1 pageIntroduction To BusinessAiman KhanNo ratings yet

- MF0008Document2 pagesMF0008Tenzin KunchokNo ratings yet

- 120 - ECO-1 - ENG D18 - CompressedDocument2 pages120 - ECO-1 - ENG D18 - CompressedJdjdj JsjdjdNo ratings yet

- Central Bank Regulation of Kenyan Commercial BanksDocument3 pagesCentral Bank Regulation of Kenyan Commercial BanksWesleyNo ratings yet

- 2012 Business - Riverview Trial With SolutionsDocument31 pages2012 Business - Riverview Trial With SolutionsArpit KumarNo ratings yet

- h101 Economics, Accountancy & ManagementDocument2 pagesh101 Economics, Accountancy & ManagementbhkedarNo ratings yet

- MF0013-Internal Audit and ControlDocument2 pagesMF0013-Internal Audit and ControlAshi MittalNo ratings yet

- Assignment 1 Total Marks: 20: Introduction To Accounting and FinanceDocument1 pageAssignment 1 Total Marks: 20: Introduction To Accounting and Financeilyas muhammadNo ratings yet

- Legal Framework For Business Model QuestionsDocument11 pagesLegal Framework For Business Model QuestionsTitus ClementNo ratings yet

- FRA Test Papers: Archive - Sem VDocument32 pagesFRA Test Papers: Archive - Sem VBharatSirveeNo ratings yet

- ICMA Questions Apr 2011Document55 pagesICMA Questions Apr 2011Asadul HoqueNo ratings yet

- Exam Roll No. for Financial Management ExamDocument2 pagesExam Roll No. for Financial Management ExamAbhishek MittalNo ratings yet

- TAMIL NADU OPEN UNIVERSITY spot assignment questionsDocument5 pagesTAMIL NADU OPEN UNIVERSITY spot assignment questionssivasundaram anushanNo ratings yet

- Advanced Accounting AssignmentDocument3 pagesAdvanced Accounting AssignmentGurteg SinghNo ratings yet

- EntreprenuershipDocument1 pageEntreprenuershipKommineni Ravie KumarNo ratings yet

- Research Methodology Exam QuestionsDocument5 pagesResearch Methodology Exam QuestionsJyoti SinghNo ratings yet

- MA0043Document2 pagesMA0043Tenzin KunchokNo ratings yet

- Intangible Finance Standards: Advances in Fundamental Analysis and Technical AnalysisFrom EverandIntangible Finance Standards: Advances in Fundamental Analysis and Technical AnalysisNo ratings yet

- SCH 1Document18 pagesSCH 1sah108_pk796No ratings yet

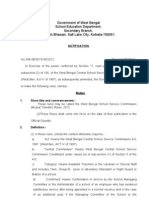

- West Bengal School Service Commission notifies rules for mutual transfer of teachers and staffDocument9 pagesWest Bengal School Service Commission notifies rules for mutual transfer of teachers and staffAbsinaNo ratings yet

- 1115 MassAnalyzers-1Document37 pages1115 MassAnalyzers-1sah108_pk796No ratings yet

- Keeler Chapters PDFDocument124 pagesKeeler Chapters PDFsah108_pk796No ratings yet

- Better to Reign in Hell than Serve in Heaven: The Spirit of FreedomDocument2 pagesBetter to Reign in Hell than Serve in Heaven: The Spirit of Freedomsah108_pk796100% (2)

- Simon CommissionDocument3 pagesSimon Commissionsah108_pk796100% (1)

- Explain The Maxim "Equity Follows The Law."Document1 pageExplain The Maxim "Equity Follows The Law."sah108_pk796No ratings yet

- Mass PDFDocument19 pagesMass PDFsah108_pk796No ratings yet

- Bio253 3Document53 pagesBio253 3sah108_pk796No ratings yet

- Statistics Subject Paper-2014Document2 pagesStatistics Subject Paper-2014Zohaib PervaizNo ratings yet

- Explain The Maxim "Equity Follows The Law."Document1 pageExplain The Maxim "Equity Follows The Law."sah108_pk796No ratings yet

- Keep SmilingDocument1 pageKeep Smilingsah108_pk796No ratings yet

- TNPSC MathsDocument303 pagesTNPSC MathsSantosh KumarNo ratings yet

- Coming Events Cast Their Shadow BeforeDocument2 pagesComing Events Cast Their Shadow Beforesah108_pk796No ratings yet

- Hamoodur Rahman CommissionDocument4 pagesHamoodur Rahman Commissionsah108_pk796100% (1)

- Sindh University KhairpurDocument5 pagesSindh University Khairpursah108_pk796No ratings yet

- We Should Respect EldersDocument1 pageWe Should Respect Elderssah108_pk796No ratings yet

- Alternative Energy by PHD Atta Ur RahmanDocument58 pagesAlternative Energy by PHD Atta Ur Rahmansah108_pk796No ratings yet

- Ad IB 2012Document30 pagesAd IB 2012sah108_pk796No ratings yet

- Death Keeps No CalendarDocument1 pageDeath Keeps No Calendarsah108_pk796No ratings yet

- Check List1Document1 pageCheck List1sah108_pk796No ratings yet

- Day of ResurrectionDocument1 pageDay of Resurrectionsah108_pk796No ratings yet

- Never Tell A LieDocument1 pageNever Tell A Liesah108_pk796No ratings yet

- We Are All MortalDocument1 pageWe Are All Mortalsah108_pk796No ratings yet

- Idealism in EducationDocument21 pagesIdealism in EducationV.K. Maheshwari87% (23)

- Marxism in EducationDocument4 pagesMarxism in Educationmaddygpn100% (1)

- We Are All The Creatures of AllahDocument1 pageWe Are All The Creatures of Allahsah108_pk796No ratings yet

- South AfricaDocument1 pageSouth Africasah108_pk796No ratings yet

- Rousseau As A NaturalistDocument12 pagesRousseau As A NaturalistLalit JoshiNo ratings yet

- QAU GAT General FormDocument3 pagesQAU GAT General FormJawad AminNo ratings yet