Professional Documents

Culture Documents

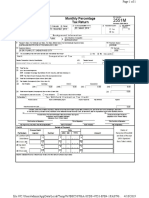

P.Tax Return F-III

Uploaded by

Satyam mishraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P.Tax Return F-III

Uploaded by

Satyam mishraCopyright:

Available Formats

FORM III

[Sec rule 12]

Return of tax payable by registered employers under the West Bengal State Tax on

Pro fession, Trades, Calling and Employment Act, 1979

( Please type or use capital letters / figures while furnishing the following information.)

Period

From……..… to….……

(a) Registration Certification No.

[In the first three boxes, please insert zone prefix,e.g., RCN, RCE,etc.]

(b)Enrolment Certificate No.

[In the first three boxes, please insert zone prefix,e.g., ECN, ECE,etc.]

(c) Name of the employer :

(d) Trade Name :

(e) Address (including Room No., Floor No.,Police Station, Sub-division and

postal Index No., i.e.PIN ) :.

(f) Telephone No. (if any) :

(g) E-mail I.D.(if any) :

(h) Website (if any) :

(i))Tax payable for the * quarter / *year………. :

Tax paid for the * quarter /* year…………… :

Tax payable / paid in excess for the * quarter /* year………… :

(j) Interest payable for the * quarter/* year…………….. :

Interest paid for the * quarter /* year…………. :

Interest payable / paid in excess for the * quarter /* year……… :

Summary of payments made for the quarter/year

Interest

Challan Date of Name of Challan Date of Name of

Month Tax (Rs.) (in

No. payment bank No. payment bank

Rs.)

April

May

Jun

July

August

September

October

November

December

January

February

March

Total payment

for the year

A separate statement showing the amount of tax deduction in accordance with the rate of tax specified in the Schedule to the Act in

respect of the number of employees belonging to each salary-slab as specified in column against serialof the said Schedule is furnished

herewith.

The above statements are trun to the best of my knowledge and belief.

Place : ………………………………. Signature……………………………………..

Date : ………………………………… Status…………………………………………

* Strike out whichever is not applicable. [Please see the reverse]

Employees whose monthly Number of Employees Amount of tax deducted

Rate of tax Total

salaries or wages are MONTHS* MONTH*

Apr May June July Aug Sep Oct Nov Dec Jan Feb Mar Apr May June July Aug Sep Oct Nov Dec Jan Feb Mar

(i) Rs. 3000 or less Nil

(ii) Rs. 3001….below 5001 Rs. 30 per month

(iii) Rs. 5001 '' '' 6001 Rs. 40 '' ''

(iv) Rs. 6001 '' '' 7001 Rs. 45 '' ''

(v) Rs. 7001 '' '' 8001 Rs. 50 '' ''

(vi) Rs. 8001 '' '' 9001 Rs. 90 '' ''

(vii)Rs. 9001 '' '' 15001 Rs.110 '' ''

(viii)Rs.15001 '' '' 25001 Rs.130 '' ''

(ix) Rs. 25001 '' '' 40001 Rs.150 '' ''

(x) Rs. 40001 and above Rs.200 '' ''

GRAND TOTAL 2710.00

* In case of quarterly / annual returns, Particulars in respect of the relevant month of every quarter / year only are required to be furnished.

Signature…………………………………………...………

( With date )

Status………………………………………………………..

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- U.S. Tax Return For Seniors Filing StatusDocument16 pagesU.S. Tax Return For Seniors Filing StatusJonathan Mahe100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Kim Gilbert 2018 PDFDocument25 pagesKim Gilbert 2018 PDFKim Gilbert50% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tax Credit Certificate 2023 9553776791212Document2 pagesTax Credit Certificate 2023 9553776791212Mariana SurduNo ratings yet

- Champak Aug (First) 09Document84 pagesChampak Aug (First) 09indianebooks100% (2)

- Sample Exam Questions For Law Enforcement AdministrationDocument20 pagesSample Exam Questions For Law Enforcement AdministrationSatyam mishra100% (14)

- Personality Types Perceptions Matrix DISCDocument2 pagesPersonality Types Perceptions Matrix DISCSatyam mishra100% (1)

- Prelim TaxDocument5 pagesPrelim TaxDonna Zandueta-TumalaNo ratings yet

- Cash Budget Problem 1. Mercury Shoes IncDocument7 pagesCash Budget Problem 1. Mercury Shoes IncMaritess Munoz100% (1)

- Manpower Planning SheetDocument1 pageManpower Planning SheetSatyam mishra75% (4)

- Manpower Planning SheetDocument1 pageManpower Planning SheetSatyam mishra75% (4)

- HR GlossaryDocument75 pagesHR Glossarydenesfiona100% (15)

- Objectives: at The Completion of This Module, Participants Will Be Able ToDocument22 pagesObjectives: at The Completion of This Module, Participants Will Be Able ToSatyam mishra100% (2)

- WWW Studocu Com en Au Document Queensland University of Technology Introduction To Taxation Law Lecture Notes Tax Law Exam Notes Final 195771 ViewDocument2 pagesWWW Studocu Com en Au Document Queensland University of Technology Introduction To Taxation Law Lecture Notes Tax Law Exam Notes Final 195771 ViewSudip AdhikariNo ratings yet

- 6 - Availing Interest Free Loan-FormatDocument3 pages6 - Availing Interest Free Loan-FormatSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್100% (1)

- Experience & Relieving Letter FormatDocument4 pagesExperience & Relieving Letter FormatNisha_Yadav_627780% (25)

- Tax Computations SampleDocument5 pagesTax Computations Samplelcsme tubodaccountsNo ratings yet

- Law Career Services Presents:: Resume & Cover Letter Writing WorkshopDocument42 pagesLaw Career Services Presents:: Resume & Cover Letter Writing WorkshopSatyam mishraNo ratings yet

- Employment El Civics Soft SkillsDocument6 pagesEmployment El Civics Soft SkillsSatyam mishraNo ratings yet

- Attrition CalculationDocument18 pagesAttrition Calculationkapoor@manish100% (1)

- Contract Labour ActDocument18 pagesContract Labour ActSatyam mishraNo ratings yet

- Certificate of AppreciationDocument1 pageCertificate of AppreciationSatyam mishraNo ratings yet

- Introduction To Industrial RelationDocument16 pagesIntroduction To Industrial RelationSatyam mishra100% (3)

- Leader TypesDocument25 pagesLeader Typesdaywalker100% (2)

- Emotional IntelligenceDocument36 pagesEmotional Intelligenceiva_17No ratings yet

- Human Resource Ethics - Power Point PresentationDocument21 pagesHuman Resource Ethics - Power Point PresentationSatyam mishra100% (1)

- Communication SkillsDocument16 pagesCommunication SkillsShah MohitNo ratings yet

- Indian Fundamental RightsDocument6 pagesIndian Fundamental Rightssent.navy100% (12)

- To Our ReadersDocument113 pagesTo Our ReadersSatyam mishra50% (2)

- Form D, Annual Return Under Payement of Bonus ActDocument2 pagesForm D, Annual Return Under Payement of Bonus ActSatyam mishraNo ratings yet

- Induction Training 182Document1 pageInduction Training 182Satyam mishraNo ratings yet

- Minimum Wages Act Form 3Document2 pagesMinimum Wages Act Form 3Satyam mishraNo ratings yet

- Right To PropertyDocument24 pagesRight To PropertySungusia HaroldNo ratings yet

- Kdas Right To PropertyDocument2 pagesKdas Right To PropertySatyam mishraNo ratings yet

- Directors' BriefingDocument4 pagesDirectors' BriefingSatyam mishraNo ratings yet

- Performance Appraisal HandbookDocument67 pagesPerformance Appraisal HandbookRohan Rajkumar ChavanNo ratings yet

- PDFContent 4 PDFDocument4 pagesPDFContent 4 PDFphone2hireNo ratings yet

- RMC No. 69-2023 v2Document1 pageRMC No. 69-2023 v2Jomar CorunoNo ratings yet

- TaxaoneDocument20 pagesTaxaonedianne ballonNo ratings yet

- Satirtha 12ADocument2 pagesSatirtha 12ADebasish Monimugdha BhuyanNo ratings yet

- Chapter 10 - Allowable Deductions: IndividualDocument17 pagesChapter 10 - Allowable Deductions: IndividualKyle BacaniNo ratings yet

- 80TTB - Provides Deduction Benefit On Interest Income For Senior CitizensDocument1 page80TTB - Provides Deduction Benefit On Interest Income For Senior CitizensArjun VermaNo ratings yet

- Las - Week 3.fabm II.Document21 pagesLas - Week 3.fabm II.Jason Tagapan GullaNo ratings yet

- Code Section Summary Background Notes 26 U.S.C. 862 RegulationsDocument1 pageCode Section Summary Background Notes 26 U.S.C. 862 RegulationsEDC AdminNo ratings yet

- Franking Account WorkpaperDocument6 pagesFranking Account WorkpaperCarol YaoNo ratings yet

- Taxation For Self-Employed Ver1.0Document23 pagesTaxation For Self-Employed Ver1.0Xeena HavenNo ratings yet

- 1604-F Jan 2018 Final 2Document2 pages1604-F Jan 2018 Final 2Nguyen LinhNo ratings yet

- Bir GinaDocument1 pageBir GinaApril ManjaresNo ratings yet

- Residential Status ppt1Document17 pagesResidential Status ppt1Prasanna ReddyNo ratings yet

- HI5020: Corporate Accounting Lecture 6bDocument23 pagesHI5020: Corporate Accounting Lecture 6bFeku RamNo ratings yet

- Day 8 TaxationDocument2 pagesDay 8 TaxationKhan Shadab -27No ratings yet

- ReviewerDocument10 pagesReviewerskmasambongcouncilNo ratings yet

- 1519732537814Document1 page1519732537814vinod kumarNo ratings yet

- Gra Nhil ReturnDocument2 pagesGra Nhil ReturnpapapetroNo ratings yet

- IAS 12 Income Taxes (2021)Document18 pagesIAS 12 Income Taxes (2021)Tawanda Tatenda HerbertNo ratings yet

- WWCC 2022 SMR For BIRDocument1 pageWWCC 2022 SMR For BIRMisheru AlmarioNo ratings yet

- ACCO 20133 - UNIT IX - UpdatedDocument29 pagesACCO 20133 - UNIT IX - UpdatedHarvey AguilarNo ratings yet

- Residential Status Scope of Total IncomeDocument4 pagesResidential Status Scope of Total IncomedeepakadhanaNo ratings yet