Professional Documents

Culture Documents

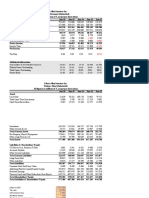

Liquidity Particulars 2011 2010

Uploaded by

Sanjay NayakOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Liquidity Particulars 2011 2010

Uploaded by

Sanjay NayakCopyright:

Available Formats

Liquidity

Particulars

2011

2010

IHP = Inventory/(DCoGS/360)

DCP = Debtors/(sales/360)

OC = IHP + DCP

SPP = Creditors/(DCoGS/360)

CCC = OC + SPP

53.5092385

5.547165064

59.05640356

72.74204528

131.7984488

49.98833749

3.64247513

53.63081262

64.69846828

118.3292809

Debt Equity ratio = Total Debt /

Total Equity

0.762095283

Interest Coverage = EBIT / Total

Interest Expenses

273.9419986

1044.112145

Solvency

Particulars

2011

2010

Net Sales

DCoGS

74908209.0000

49384717.0000

62547425.0000

41478190.0000

GP

GP Margin

25523492.0000

34.0730

21069235.0000

33.6852

less

Other Expenses

EBITDA

EBITDA Margin

9995855.0000

15527637.0000

20.7289

8572717.0000

12496518.0000

19.9793

less

Depreciation

EBIT

EBIT Margin

1533310.0000

13994327.0000

18.6820

1277533.0000

11218985.0000

17.9368

add

less

less

less

other income

Interest

impairment loss/gain on FA

provision for contingencies

508905.0000

51085.0000

103867.0000

469037.0000

426541.0000

10745.0000

0.0000

183679.0000

PBT

13879243.0000

11451102.0000

taxes

4263773.0000

3264454.0000

PAT

PAT Margin

9615470.0000

12.8363

8186648.0000

13.0887

Asset Turnover = NS/Total Assets

3.2735

7.0382

Total Assets Turnover = PAT /

Total Assets * 100

42.0198

92.1208

ROE = PAT / Total Equity * 100

75.4775

95.7039

RoCE = EBIT (1-T)/Capital

Employed * 100

79.6911

95.2974

EPS = PAT / Total No of shares

o/s*100

99.7293

84.9099

less

less

PE Multiple = Market Price / EPS

41.8403

44.6968

Dividend Payout Ration =

Dividend per share / EPS

0.0486

0.0571

Retention Ratio = 1 - Dividend

payout ratio

0.9514

0.9429

Dividend Yield = Dividend per

share / market price

1.1647

1.3362

Current Ratio = Current Asset /

Current Liabilities

0.6023

0.6265

Closing price taken from mo

2011 adjusted by 27000 rs

Closing price taken from moneycontrol for both the year as at 31/12/2010 & 31/12/2011

Balance Sheet Analysis:

1

The Shares holders has fund has invreased due to increase in profit this year.

The company has borrowed secured & unsecrued loans this year.

the deffered tax liability has increased over the last year.

The company has invested in fixed assets.

The company has disinvested their investment over the last year.

There is an increase in Current Assets.

There is an increased in Current Liabilities.

Cash Flow Analysis:

1

The Operating Profit from the Cash Flow is 85.57% of PBT for the year 2011

85.57013

The Investing Activities from Cash Flow is -108.85% of PBT for the year 2011.

-108.856

The Financing Activities from Cash Flow is 23.39% of PBT for the year 2011.

23.28584

You might also like

- Study of Supply Chain Management at Britannia Industries.Document95 pagesStudy of Supply Chain Management at Britannia Industries.Satender Kumar75% (8)

- Supply Chain Management: 9 Planning Supply and Demand in A Supply Chain: Managing Predictable VariabilityDocument28 pagesSupply Chain Management: 9 Planning Supply and Demand in A Supply Chain: Managing Predictable VariabilitySanjay NayakNo ratings yet

- Balance Sheet: Share Capital and ReservesDocument7 pagesBalance Sheet: Share Capital and ReservesTanzeel HassanNo ratings yet

- Profit & Loss: Year Ended 31 March 2012 2011 2010 2009Document2 pagesProfit & Loss: Year Ended 31 March 2012 2011 2010 2009Shaik Abdulla FaizalNo ratings yet

- Apl RatiosDocument1 pageApl Ratiosaeman_rizvi1111No ratings yet

- Pidilite Caselet DataDocument3 pagesPidilite Caselet DataTejaswi KancherlaNo ratings yet

- Balance Sheet As On 31 December 2014-2016: Amount in Millions 2016 2015 2014 V 2016 2015Document4 pagesBalance Sheet As On 31 December 2014-2016: Amount in Millions 2016 2015 2014 V 2016 2015sanameharNo ratings yet

- DR - Reddy Lab Ltd. AssignmentDocument18 pagesDR - Reddy Lab Ltd. AssignmentMahesh VermaNo ratings yet

- Financial Statements of DH ChemicalsDocument5 pagesFinancial Statements of DH ChemicalsZeeshan AdeelNo ratings yet

- Ashok LeylandDocument1,832 pagesAshok Leylandjadhavshankar100% (1)

- Leverage G10Document8 pagesLeverage G10AYUSHI SINGHNo ratings yet

- Drreddy - Ratio AnalysisDocument8 pagesDrreddy - Ratio AnalysisNavneet SharmaNo ratings yet

- 8100 (Birla Corporation)Document61 pages8100 (Birla Corporation)Viz PrezNo ratings yet

- BALANCE SHEET For ABC LTD As at March 31,: All Amount in Rs MillionsDocument4 pagesBALANCE SHEET For ABC LTD As at March 31,: All Amount in Rs MillionsAanchal MahajanNo ratings yet

- Spread Sheet of AbbotDocument2 pagesSpread Sheet of AbbotAhmad RazaNo ratings yet

- Statement of Profit & Loss of TTK Prestige For The Year Ending Mar 31Document4 pagesStatement of Profit & Loss of TTK Prestige For The Year Ending Mar 31Neelu AggrawalNo ratings yet

- Assets Non Current AssetsDocument15 pagesAssets Non Current AssetsBushraKhanNo ratings yet

- DhirajDey IMT CeresDocument5 pagesDhirajDey IMT CeresDhirajNo ratings yet

- Lecture 2 Answer 2 1564205851105Document8 pagesLecture 2 Answer 2 1564205851105Trinesh BhargavaNo ratings yet

- Financial Analysis of Islami Bank BangladeshDocument5 pagesFinancial Analysis of Islami Bank BangladeshMahmudul Hasan RabbyNo ratings yet

- Ratio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of PakistanDocument17 pagesRatio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of Pakistanshurahbeel75% (4)

- BALANCE SHEET For ABC LTD As at March 31,: All Amount in Rs MillionsDocument2 pagesBALANCE SHEET For ABC LTD As at March 31,: All Amount in Rs MillionsNeelu AggrawalNo ratings yet

- Financial AnalysisDocument2 pagesFinancial AnalysisOmar abdulla AlkhanNo ratings yet

- Hinopak MotorsDocument8 pagesHinopak MotorsShamsuddin SoomroNo ratings yet

- Balance Sheet of Instrumentation LimitedDocument8 pagesBalance Sheet of Instrumentation Limited94629No ratings yet

- Kuoni Gb12 Financialreport en 2012Document149 pagesKuoni Gb12 Financialreport en 2012Ioana ElenaNo ratings yet

- Ratio Analysis of WALMART INCDocument5 pagesRatio Analysis of WALMART INCBrian Ng'enoNo ratings yet

- Loganathan Exp 5Document2 pagesLoganathan Exp 5loganathanloganathancNo ratings yet

- Comparative Income Statement For The Year 17-18 & 18-19 Profit & Loss - Reliance Industries LTDDocument23 pagesComparative Income Statement For The Year 17-18 & 18-19 Profit & Loss - Reliance Industries LTDManan Suchak100% (1)

- 2009 Notes Amount (In Millions) : Current Tax Deffered TaxDocument29 pages2009 Notes Amount (In Millions) : Current Tax Deffered TaxKushal TodiNo ratings yet

- Chenab Limited Income Statement: Rupees in ThousandDocument14 pagesChenab Limited Income Statement: Rupees in ThousandAsad AliNo ratings yet

- Financial Statements ForecastingDocument16 pagesFinancial Statements ForecastingDeep AnjarlekarNo ratings yet

- FM Group 10Document5 pagesFM Group 10Anju tpNo ratings yet

- Interloop Limited Income Statement: Rupees in ThousandDocument13 pagesInterloop Limited Income Statement: Rupees in ThousandAsad AliNo ratings yet

- Idea Model TemplateDocument21 pagesIdea Model TemplateShilpi ShroffNo ratings yet

- Attock CementDocument18 pagesAttock CementDeepak MatlaniNo ratings yet

- ITC Presentation2.1Document10 pagesITC Presentation2.1Rohit singhNo ratings yet

- Buy DecisionDocument11 pagesBuy Decisionismat arteeNo ratings yet

- Data Sheet TTK PRESTIGEDocument4 pagesData Sheet TTK PRESTIGEpriyanshu guptaNo ratings yet

- Common SizeDocument1 pageCommon SizeMahesh GorasiaNo ratings yet

- Eidul Hussain 12Document103 pagesEidul Hussain 12Rizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Balance Sheet AnalysisDocument8 pagesBalance Sheet Analysisramyashraddha18No ratings yet

- Statement of Profit and Loss For The Year End 7.746%Document9 pagesStatement of Profit and Loss For The Year End 7.746%Akanksha MalhotraNo ratings yet

- Project Report For Spare PartsDocument5 pagesProject Report For Spare Partsrajesh patelNo ratings yet

- Group 7:: Abhishek Goyal Dhanashree Baxy Ipshita Ghosh Puja Priya Shivam Pandey Vidhi KothariDocument26 pagesGroup 7:: Abhishek Goyal Dhanashree Baxy Ipshita Ghosh Puja Priya Shivam Pandey Vidhi KothariABHISHEK GOYALNo ratings yet

- Robert Bosch GMBH - Statement of Financial PositionDocument2 pagesRobert Bosch GMBH - Statement of Financial PositionRamesh GowdaNo ratings yet

- Assets: Balance SheetDocument4 pagesAssets: Balance SheetAsadvirkNo ratings yet

- Income Statement: Particulars Revenue Gross ProfitDocument6 pagesIncome Statement: Particulars Revenue Gross ProfitRohanMohapatraNo ratings yet

- IT Return IT1 WithAnnexure 8432374Document9 pagesIT Return IT1 WithAnnexure 8432374just_urs207No ratings yet

- Bangladesh Lamps Limited ValuationDocument15 pagesBangladesh Lamps Limited ValuationShamsul Alam SajibNo ratings yet

- Descriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsDocument15 pagesDescriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsVALLIAPPAN.PNo ratings yet

- InvestmentsDocument15 pagesInvestmentsDevesh KumarNo ratings yet

- Vodafone Class 5Document6 pagesVodafone Class 5akashkr619No ratings yet

- Amazon SCM Finance DataDocument2 pagesAmazon SCM Finance DataSagar KansalNo ratings yet

- Ace AnalyserDocument2 pagesAce Analyservahora123No ratings yet

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNo ratings yet

- Fin3320 Excelproject sp16 TravuobrileDocument9 pagesFin3320 Excelproject sp16 Travuobrileapi-363907405No ratings yet

- Ch01 ProblemsDocument1 pageCh01 ProblemsSeema KiranNo ratings yet

- BTVN Chap 03Document14 pagesBTVN Chap 03Nguyen Phuong Anh (K16HL)No ratings yet

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDocument14 pagesASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)No ratings yet

- Horizential AnalysisDocument4 pagesHorizential AnalysisM.TalhaNo ratings yet

- Temporary Shelters Revenues World Summary: Market Values & Financials by CountryFrom EverandTemporary Shelters Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Food LogisticsDocument4 pagesFood LogisticsSanjay NayakNo ratings yet

- VFD Block Diagrams and SelectionsDocument11 pagesVFD Block Diagrams and SelectionsSanjay NayakNo ratings yet

- Ab Initio Training - Part 1Document105 pagesAb Initio Training - Part 1Sanjay NayakNo ratings yet

- Advance Reservation Through Internet (WWW - Irctc.co - In)Document3 pagesAdvance Reservation Through Internet (WWW - Irctc.co - In)Sanjay NayakNo ratings yet

- Food LogisticsDocument4 pagesFood LogisticsSanjay NayakNo ratings yet

- Unit 4 Automated Storage/Retrieval Systems: StructureDocument11 pagesUnit 4 Automated Storage/Retrieval Systems: StructureRuby SmithNo ratings yet

- MarketingDocument29 pagesMarketingSanjay NayakNo ratings yet

- AMULDocument31 pagesAMULBharatt VarmaNo ratings yet

- Whitepaper Dairy eDocument8 pagesWhitepaper Dairy eSanjay NayakNo ratings yet

- Chopra3 PPT ch02#Document46 pagesChopra3 PPT ch02#Sanjay NayakNo ratings yet

- ATL Ventilators Comparison PDFDocument2 pagesATL Ventilators Comparison PDFSanjay NayakNo ratings yet

- IMCDocument33 pagesIMCSanjay NayakNo ratings yet

- Asianpaints - Phase1 Case Study PDFDocument2 pagesAsianpaints - Phase1 Case Study PDFSanjay NayakNo ratings yet

- Case 6 - Retailing in IndiaDocument22 pagesCase 6 - Retailing in IndiaSanjay NayakNo ratings yet

- Sector Analysis - Food and BeveragesDocument26 pagesSector Analysis - Food and BeveragesSanjay NayakNo ratings yet

- AMULDocument31 pagesAMULBharatt VarmaNo ratings yet

- AV800 Ventilator-W PDFDocument0 pagesAV800 Ventilator-W PDFSanjay Nayak0% (1)

- Member States' Expert Group: Good Practices and PoliciesDocument14 pagesMember States' Expert Group: Good Practices and PoliciesSanjay NayakNo ratings yet

- Samsung CaseDocument19 pagesSamsung CaseSanjay NayakNo ratings yet

- Technical PDFDocument1 pageTechnical PDFSanjay NayakNo ratings yet

- Chapter 25 - Discriminant AnalysisDocument20 pagesChapter 25 - Discriminant AnalysisUmar Farooq AttariNo ratings yet

- Station Scope of Supply - Block Sub AssemblyDocument3 pagesStation Scope of Supply - Block Sub AssemblySanjay NayakNo ratings yet

- Seventy-Second Annual Report 2007-2008Document94 pagesSeventy-Second Annual Report 2007-2008ssvvinothNo ratings yet

- 07 Chapter-IDocument45 pages07 Chapter-IJanie SoniNo ratings yet