Professional Documents

Culture Documents

For Payment From July 2005 Onwards

Uploaded by

vijay123*75%(4)75% found this document useful (4 votes)

2K views1 pageFor payment from July 2005 onwards Single Copy ( to be sent to the ZAO ) Tax Deducted / COLLECTED AT SOURCE FROM (0020) COMPANY DUCTEES (0021) NON-COMPANY DEDUCTEES Assessment Year - Tax Deduction Account No. (T.A.N.) Full Name Complete Address with City and State Tel. No. Pin ( Tick One ) TDS / TCS Payable by Taxpayer

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFor payment from July 2005 onwards Single Copy ( to be sent to the ZAO ) Tax Deducted / COLLECTED AT SOURCE FROM (0020) COMPANY DUCTEES (0021) NON-COMPANY DEDUCTEES Assessment Year - Tax Deduction Account No. (T.A.N.) Full Name Complete Address with City and State Tel. No. Pin ( Tick One ) TDS / TCS Payable by Taxpayer

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

75%(4)75% found this document useful (4 votes)

2K views1 pageFor Payment From July 2005 Onwards

Uploaded by

vijay123*For payment from July 2005 onwards Single Copy ( to be sent to the ZAO ) Tax Deducted / COLLECTED AT SOURCE FROM (0020) COMPANY DUCTEES (0021) NON-COMPANY DEDUCTEES Assessment Year - Tax Deduction Account No. (T.A.N.) Full Name Complete Address with City and State Tel. No. Pin ( Tick One ) TDS / TCS Payable by Taxpayer

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

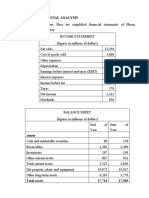

For payment from July 2005 onwards

Single Copy ( to be sent to the ZAO )

CHALLAN NO. Tax Applicable ( Tick One ) Assessment Year

TAX DEDUCTED /

ITNS COLLECTED AT

(0020) COMPANY DEDUCTEES

281 SOURCE FROM (0021) NON-COMPANY DEDUCTEES -

Tax Deduction Account No. (T.A.N.)

Full Name

Complete Address with City & State

Tel. No. Pin

Type of payment ( Tick One ) TDS / TCS Payable by Taxpayer (200)

Code TDS / TCS Regular Assessment ( Raised by I. T. Deptt. ) (400)

DETAILS OF PAYMENTS Amount ( in Rs. Only )

Income Tax FOR USE IN RECEIVING BANK

Surcharge

Education Cess Debit to A/c / Cheque credited on

Interest

Penalty

Others DD MM YY

Total SPACE FOR BANK SEAL

Total ( in words )

CRORES LACS THOUSANDS HUNDREDS TENS UNITS

Paid in cash/Debit to A/c/Cheque No Dated

Drawn on

( Name of the Bank and Branch )

Rs.

Date : Signature of person making payment

Taxpayers Counterfoil ( To be filled up by tax payer )

SPACE FOR BANK SEAL

T. A. N.

Received from

( Name )

Paid in cash/Debit to A/c/Cheque No For Rs.

Rs. ( in words )

Drawn on

( Name of the Bank and Branch )

Tax Deducted from Deductee

( Strike out whichever is not applicable )

on account of Tax Deducted / Collected at source from (Fill up code)

For the Assessment Year - Rs.

Printed From Website http://www.meraconsultant.com

You might also like

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- Tax Payment Challan 280Document2 pagesTax Payment Challan 280analystbankNo ratings yet

- Certificate of Collection or Deduction of Tax-2018-19Document2 pagesCertificate of Collection or Deduction of Tax-2018-19Sarfraz Ali100% (1)

- Acknowledgement Slip Income Tax ReturnDocument4 pagesAcknowledgement Slip Income Tax ReturnBasit RiazNo ratings yet

- Declaration 3740587674245Document4 pagesDeclaration 3740587674245Adeel TahirNo ratings yet

- Declaration 3740587110895Document4 pagesDeclaration 3740587110895sakenderNo ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9No ratings yet

- Exemption Certificate Us 159 (1) 153Document2 pagesExemption Certificate Us 159 (1) 153ijazaslam.huaweiNo ratings yet

- Acknowledgement Slip for Return of IncomeDocument4 pagesAcknowledgement Slip for Return of IncomeferozaNo ratings yet

- Atzpr8899q Q2 2023-24Document2 pagesAtzpr8899q Q2 2023-24Akansha Jain100% (1)

- Challan TR Form - 5 (A) : PAN No. (If Applicable)Document1 pageChallan TR Form - 5 (A) : PAN No. (If Applicable)26SarnokbeTeronNo ratings yet

- Form 16 TDS CertificateDocument3 pagesForm 16 TDS CertificateBijay TiwariNo ratings yet

- Order Granted Reduced Withholding RateDocument2 pagesOrder Granted Reduced Withholding RateMuhammad HamzaNo ratings yet

- CBDT e Payment Request FormDocument2 pagesCBDT e Payment Request Formsaurabh100% (1)

- Pag-IBIG Fund: Employer ID Number Payment Instruction DateDocument1 pagePag-IBIG Fund: Employer ID Number Payment Instruction DateMARCOS MADDELANo ratings yet

- Process and Guidelines For ID Card SubmissionDocument2 pagesProcess and Guidelines For ID Card SubmissionSunil Yadav0% (1)

- Pay Bill GazettedDocument3 pagesPay Bill Gazettedibrahimshahghotki_20No ratings yet

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- Axis TDS Challan Form PDFDocument1 pageAxis TDS Challan Form PDFSiva ReddyNo ratings yet

- Acg 61 PDFDocument2 pagesAcg 61 PDFPatiala Bsnl67% (3)

- Cost Estimate: Datum TechnologiesDocument1 pageCost Estimate: Datum Technologiesraj rajNo ratings yet

- A Small Briefing On CSI PayrollDocument6 pagesA Small Briefing On CSI PayrollAjay PandeyNo ratings yet

- APC Bf41f0ce 2829538036Document1 pageAPC Bf41f0ce 2829538036ratnesh vaviaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Bank Staff Operator Supervisor Linking Form - BankEmployeeDocument2 pagesBank Staff Operator Supervisor Linking Form - BankEmployeeSolanki Bharat BharatNo ratings yet

- GST Sample VoucherDocument1 pageGST Sample VoucherVenu GopalNo ratings yet

- Tax Form-22.Document27 pagesTax Form-22.Masroor RasoolNo ratings yet

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- EcsmandateformDocument1 pageEcsmandateformmohan@skillnetinc.comNo ratings yet

- Etps LandbankDocument1 pageEtps LandbankMARY ROSE BERNADASNo ratings yet

- Exercises For Chapter 23 EFA2Document16 pagesExercises For Chapter 23 EFA2Thu LoanNo ratings yet

- Australian Payslip Generator TemplateDocument1 pageAustralian Payslip Generator TemplateFarzinNo ratings yet

- Taxpayer's Counterfoil ReceiptDocument1 pageTaxpayer's Counterfoil ReceiptDarshan BhatiaNo ratings yet

- Orea Form 400Document4 pagesOrea Form 400Shailesh PatelNo ratings yet

- Receipt Summary CS SUBHANKARDocument1 pageReceipt Summary CS SUBHANKARsubhankar jain100% (1)

- Wa0000.Document23 pagesWa0000.srm finservNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument13 pagesITR-2 Indian Income Tax Return: Part A-GENHarish100% (1)

- BIR Form No. 0605Document2 pagesBIR Form No. 0605Ronald varrie BautistaNo ratings yet

- A H E P A 1 3 7 1 R: Taxpayer's CounterfoilDocument1 pageA H E P A 1 3 7 1 R: Taxpayer's CounterfoilasokaNo ratings yet

- Retention Account Statement KO5775 PDFDocument4 pagesRetention Account Statement KO5775 PDFAravinda ShettyNo ratings yet

- GST Challan ReceiptDocument1 pageGST Challan ReceiptamirNo ratings yet

- TDS TCS Tax ChallanDocument1 pageTDS TCS Tax Challanjagdish412301No ratings yet

- TDS ChallanDocument1 pageTDS ChallanJainsanjaykumarNo ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJayNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticNo ratings yet

- ImportantDocument1 pageImportantWilliam SureshNo ratings yet

- Challan No. ITNS 280Document2 pagesChallan No. ITNS 280RAHUL AGARWALNo ratings yet

- Income Tax - Bank Remittance CHALLANDocument1 pageIncome Tax - Bank Remittance CHALLANvivek anandanNo ratings yet

- Challan 280Document1 pageChallan 280Jayesh BajpaiNo ratings yet

- Itns-281 TDS ChallanDocument1 pageItns-281 TDS Challanvirendra36999100% (2)

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- Itns 285Document2 pagesItns 285Anurag SharmaNo ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- TCS TenduDocument1 pageTCS TenduSwetha KarthickNo ratings yet

- Self Assessment Tax Challan NiDocument1 pageSelf Assessment Tax Challan NiNitin KarwaNo ratings yet

- Challan No./ ITNS 282: Tax Applicable (Tick One)Document2 pagesChallan No./ ITNS 282: Tax Applicable (Tick One)satishkumar.mandora.smNo ratings yet

- Zentds KDK SoftwareDocument1 pageZentds KDK Softwarear8ku9sh0aNo ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- Chapter 1-Cash and Cash EquivalentsDocument82 pagesChapter 1-Cash and Cash Equivalentsrhaika agapito50% (6)

- Sanima Bank Customer SegmentationDocument16 pagesSanima Bank Customer SegmentationPoudel SathiNo ratings yet

- TPA9Document58 pagesTPA9Dr. Dharmender Patial50% (2)

- CCS Conduct RulesDocument9 pagesCCS Conduct RulesBIJAY KRISHNA DASNo ratings yet

- Investment Declaration Form11-12Document2 pagesInvestment Declaration Form11-12girijasankar11No ratings yet

- Sales - Quote Service LoopDocument2 pagesSales - Quote Service LoopIng Rebeca C Sayago FerrerNo ratings yet

- Consultation FamilylawDocument21 pagesConsultation FamilylawpraharshithaNo ratings yet

- Personal Loans, Purchasing Decisions, and Education FinancingDocument44 pagesPersonal Loans, Purchasing Decisions, and Education FinancingtrishNo ratings yet

- Betma Cluster RevisedDocument5 pagesBetma Cluster RevisedSanjay KaithwasNo ratings yet

- CFP Certification Education Program SyllabusDocument24 pagesCFP Certification Education Program SyllabusSanchu DhingraNo ratings yet

- Request Repo FormDocument30 pagesRequest Repo Formana bagolorNo ratings yet

- Certificate of MembershipDocument2 pagesCertificate of MembershipJaime BerryNo ratings yet

- General Legal Relationship Between Bank and Customer: Proprietary FunctionDocument2 pagesGeneral Legal Relationship Between Bank and Customer: Proprietary FunctiondoraemoanNo ratings yet

- CSC Practice QS PDFDocument304 pagesCSC Practice QS PDFDavid Young0% (1)

- Statement of Cash Flows ExplainedDocument61 pagesStatement of Cash Flows ExplainedMuhammad RezaNo ratings yet

- Chef Jack Day Xclusive Hospitality Liverpool Leicester in LiquidationDocument1 pageChef Jack Day Xclusive Hospitality Liverpool Leicester in LiquidationDeceefin TorwatNo ratings yet

- Mba ProjectDocument77 pagesMba Projectrahul pandeyNo ratings yet

- A Test For Non NumeratesDocument3 pagesA Test For Non NumeratesMA. CECILIA CATEDRILLANo ratings yet

- Viettel Strategy WordDocument2 pagesViettel Strategy Wordacbeo50% (2)

- Bataan Branch: Republic of The PhilippinesDocument8 pagesBataan Branch: Republic of The PhilippinesKim EllaNo ratings yet

- Pioneer Self Storage Fund Oct 15 PDSDocument60 pagesPioneer Self Storage Fund Oct 15 PDSAnonymous 6tuR1hzNo ratings yet

- Big Mac IndexDocument43 pagesBig Mac IndexVinayak HalapetiNo ratings yet

- Chameleons SlidesDocument44 pagesChameleons SlidesArmaghanAhmedNo ratings yet

- Project ReportDocument52 pagesProject ReportVishal NalamwadNo ratings yet

- Challenges Faced in RE FinanceDocument2 pagesChallenges Faced in RE FinanceSmriti MehtaNo ratings yet

- Reconcile Bank AccountsDocument6 pagesReconcile Bank AccountsJcMCariñoNo ratings yet

- Profile On The Production of Corrugated Iron SheetDocument26 pagesProfile On The Production of Corrugated Iron SheetTSEDEKE40% (5)

- CTA Dismissal of P&G Refund Claim ReversedDocument148 pagesCTA Dismissal of P&G Refund Claim ReversedMa. Consorcia GoleaNo ratings yet

- AVAF FASTBUY Digital A4 ENG - FinalDocument2 pagesAVAF FASTBUY Digital A4 ENG - FinaljaninekirchNo ratings yet

- Simple Interest GameDocument4 pagesSimple Interest GameCarmina CunananNo ratings yet