Professional Documents

Culture Documents

Philippines income tax matrix

Uploaded by

Moises CalastravoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Philippines income tax matrix

Uploaded by

Moises CalastravoCopyright:

Available Formats

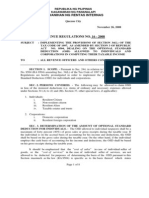

INCOME TAX MATRIX

Resident Citizen I. On TAXABLE INCOME II. From sources within the Philippines on PASSIVE INCOME of A. Interest under the expanded foreign currency deposit system B. Royalty from books, literary works and musical compositions C. Interest on any currency bank deposit, yield or monetary benefits from deposit substitute, trust fund and similar arrangement Royalty other than (B) Prize exceeding P 10,000 Other winnings (except Philippine Charity Sweeptakes and lotto winnings) D. Dividend from a domestic corporation, or from a joint stock company, insurance or mutual fund company, and regional operating headquarters of multinational company, or share in the distributative net income after tax of a partnership (except a general professional partnership), join stock or joint venture, or consortium taxable as corporation E. Interest on long-term deposit or investment in banks (with a maturity of 5 years or more) Predeterminated long-term deposit on the entire income based on the remaining maturity: 4 year to less than 5 years 3 years to less than 4 years Lesss than 3 years F. Gross income from cinematographic films and similar works III. On CAPITAL GAIN A. On sale of domestic shares of stock not traded in stock exchange B. On sale of real property situated in the Philippines Schedular Non-resident Citizen Schedular Resident Alien Schedular Non-resident Alien ETB Schedular NETB FT 25%

7.5% 10%

Exempt 10%

7.5% 10%

Exempt 10%

FT 25% FT 25%

20%

20%

20%

20%

FT 25%

10%

10%

10%

20%

FT 25%

Exempt

Exempt

Exempt

Exempt

FT 25%

5% 12% 20%

5% 12% 20%

5% 12% 20%

5% 12% 20%

FT 25% FT 25% FT 25% FT 25%

25%

FT 25%

5-10% 6%

5-10% 6%

5-10% 6%

5-10% 6%

5-10% 6%

You might also like

- CIR Assessment Prescription PeriodDocument43 pagesCIR Assessment Prescription Periodmelaniem_1No ratings yet

- Taxation Case Analysis No. 3: Key TakeawaysDocument5 pagesTaxation Case Analysis No. 3: Key TakeawaysPJ OrtizNo ratings yet

- Philippine Tax Terms DefinedDocument2 pagesPhilippine Tax Terms DefinedJeypee Motley GarciaNo ratings yet

- Estate & Donor Tax Rates Slashed Under TRAIN LawDocument61 pagesEstate & Donor Tax Rates Slashed Under TRAIN LawRamon AngelesNo ratings yet

- VAT PhilippinesDocument21 pagesVAT PhilippinesTonifranz SarenoNo ratings yet

- Atty Ligon Tx2Document92 pagesAtty Ligon Tx2karlNo ratings yet

- Punsalan Vs Municipal Board of ManilaDocument3 pagesPunsalan Vs Municipal Board of ManilaGayFleur Cabatit RamosNo ratings yet

- A. Jurisdiction of The Court of Tax Appeals: 1. Civil CasesDocument7 pagesA. Jurisdiction of The Court of Tax Appeals: 1. Civil CasesRovi Anne IgoyNo ratings yet

- 136 CIR vs. Vda de PrietoDocument2 pages136 CIR vs. Vda de PrietoMiw Cortes100% (1)

- Azerbaijan Excise Tax Calculation and RatesDocument15 pagesAzerbaijan Excise Tax Calculation and RatesQedew ErNo ratings yet

- Donors and VatDocument179 pagesDonors and VatGlino ClaudioNo ratings yet

- Cir Vs HendersonDocument3 pagesCir Vs Hendersoneunicesaavedra11No ratings yet

- 2010 Tax Matrix - Individual AliensDocument2 pages2010 Tax Matrix - Individual Alienscmv mendozaNo ratings yet

- 143.CIR Vs Stanley (Phils.)Document8 pages143.CIR Vs Stanley (Phils.)Clyde KitongNo ratings yet

- Supreme Court Rules on Taxation of Airlines Under FranchiseDocument18 pagesSupreme Court Rules on Taxation of Airlines Under Franchisemceline19No ratings yet

- Bagatsing Vs San Juan (Simbillo)Document3 pagesBagatsing Vs San Juan (Simbillo)Joshua Rizlan SimbilloNo ratings yet

- Atlas Mining Vs CirDocument2 pagesAtlas Mining Vs CirmenforeverNo ratings yet

- Senior Citizen and PWD Benefits ActDocument8 pagesSenior Citizen and PWD Benefits ActAngelica Nicole TamayoNo ratings yet

- Income Tax Tables for Individuals and CorporationsDocument9 pagesIncome Tax Tables for Individuals and Corporationshaze_toledo5077No ratings yet

- CIR v. Fisher ADocument30 pagesCIR v. Fisher ACE SherNo ratings yet

- TAXATION QUESTIONS & ANSWERSDocument49 pagesTAXATION QUESTIONS & ANSWERSMarc ToresNo ratings yet

- CIR Vs Baier-NickelDocument4 pagesCIR Vs Baier-NickelJohnde MartinezNo ratings yet

- Estate Tax GuideDocument12 pagesEstate Tax GuideEspregante RoselleNo ratings yet

- AFISCO Insurance Corp. v. CA DigestDocument3 pagesAFISCO Insurance Corp. v. CA DigestAbigayle Recio100% (1)

- Excise TaxesDocument5 pagesExcise TaxesJoAnne Yaptinchay Claudio100% (2)

- 37-Kuenzle & Streiff, Inc. v. CIR G.R. Nos. L-12010 and L-12113 October 20, 1959mDocument4 pages37-Kuenzle & Streiff, Inc. v. CIR G.R. Nos. L-12010 and L-12113 October 20, 1959mJopan SJNo ratings yet

- CIR Vs Toshiba Information EquipmentDocument1 pageCIR Vs Toshiba Information EquipmentKayee KatNo ratings yet

- Corporation Law ReviewerDocument3 pagesCorporation Law ReviewerchinchayNo ratings yet

- 10 Coca-Cola-Philippines-vs-CIRDocument1 page10 Coca-Cola-Philippines-vs-CIRhigoremso giensdksNo ratings yet

- 127 Scra 9 (GR 119761) Commisioner vs. CADocument23 pages127 Scra 9 (GR 119761) Commisioner vs. CARuel FernandezNo ratings yet

- Kepco Philippines Corporation Vs. CIR VAT Refund CaseDocument4 pagesKepco Philippines Corporation Vs. CIR VAT Refund CaseWhere Did Macky GallegoNo ratings yet

- CTA Ruling on Toshiba's Claim for VAT RefundDocument6 pagesCTA Ruling on Toshiba's Claim for VAT RefundEmrico CabahugNo ratings yet

- Tax CDocument18 pagesTax Calmira garciaNo ratings yet

- Notes in TaxDocument50 pagesNotes in TaxGeorge Ryan ZalanNo ratings yet

- Tax RemediesDocument5 pagesTax RemediesTruman TemperanteNo ratings yet

- Consumption Tax RulesDocument8 pagesConsumption Tax RulesDenvyl MangsatNo ratings yet

- Balmaceda Vs CorominasDocument9 pagesBalmaceda Vs Corominaskoey100% (1)

- Juan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeDocument2 pagesJuan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeLucifer MorningNo ratings yet

- Fisher V Trinidad DigestDocument1 pageFisher V Trinidad DigestDario G. TorresNo ratings yet

- Tax II Reviewer (Midterms)Document43 pagesTax II Reviewer (Midterms)Charmaine MejiaNo ratings yet

- Henderson Vs CirDocument2 pagesHenderson Vs CirMARRYROSE LASHERASNo ratings yet

- Nirc 1997Document348 pagesNirc 1997drdacctgNo ratings yet

- Cases On TaxationDocument13 pagesCases On TaxationPeanutButter 'n JellyNo ratings yet

- British Overseas Airways Corp. G.R. No. L-65773-74: Supreme CourtDocument12 pagesBritish Overseas Airways Corp. G.R. No. L-65773-74: Supreme CourtJopan SJNo ratings yet

- Case Digest: Lung Cenlungasdlkfjdsflter of The Philippines vs. Quezon City and Constantino RosasDocument1 pageCase Digest: Lung Cenlungasdlkfjdsflter of The Philippines vs. Quezon City and Constantino RosasAJMordenoNo ratings yet

- Tax 2 Reviewer Atty. Bolivar NotesDocument66 pagesTax 2 Reviewer Atty. Bolivar NotesMaree BajamundeNo ratings yet

- Karrer V USDocument3 pagesKarrer V USsushicat0925No ratings yet

- Collector vs. HaygoodDocument5 pagesCollector vs. HaygoodAJ AslaronaNo ratings yet

- Taxpayer's checklist for TRAIN law changesDocument6 pagesTaxpayer's checklist for TRAIN law changesChrislynNo ratings yet

- Donor S Tax QuizDocument5 pagesDonor S Tax QuizDerick John Palapag100% (1)

- Tan vs. Del Rosario Et Al G.R. No. 109289Document4 pagesTan vs. Del Rosario Et Al G.R. No. 109289ZeusKimNo ratings yet

- CIR v. P&G Philippine tax credit deniedDocument2 pagesCIR v. P&G Philippine tax credit deniedNaomi QuimpoNo ratings yet

- American Airlines Tax CaseDocument6 pagesAmerican Airlines Tax CaseDarrel John Sombilon100% (1)

- Up Tax Reviewer 2014 PDFDocument257 pagesUp Tax Reviewer 2014 PDFJoseph Rinoza PlazoNo ratings yet

- A. Final Withholding Tax 1. Passive IncomeDocument7 pagesA. Final Withholding Tax 1. Passive IncomePrincess Corine BurgosNo ratings yet

- Passive Income Tax Base Tax RateDocument2 pagesPassive Income Tax Base Tax RateBianca DeslateNo ratings yet

- Classification of Individual Taxpayers:: Income Tax RatesDocument21 pagesClassification of Individual Taxpayers:: Income Tax RatesAngelica E. RefuerzoNo ratings yet

- TRAIN Tax Rates On Passive Income in The PhilippinesDocument1 pageTRAIN Tax Rates On Passive Income in The Philippinesgwynethvm03No ratings yet

- Income Tax Guide on Passive Income & Capital GainsDocument12 pagesIncome Tax Guide on Passive Income & Capital GainsAshly MateoNo ratings yet

- Passive IncomeDocument2 pagesPassive Incomeallain_matiasNo ratings yet

- Account Details Form ADF As of 09.2017Document1 pageAccount Details Form ADF As of 09.2017Moises CalastravoNo ratings yet

- Fsa Do Connect ExcelDocument5 pagesFsa Do Connect ExcelNilton CarvalhoNo ratings yet

- Excel Fundamentals ManualDocument60 pagesExcel Fundamentals ManualAMIT AMBRENo ratings yet

- Excel for Beginners: Learn Basic FunctionsDocument16 pagesExcel for Beginners: Learn Basic FunctionsJudith Besenio VillarNo ratings yet

- Insurance Commission Examination FormsDocument1 pageInsurance Commission Examination FormsMatt Erikson Cao MalagarNo ratings yet

- Modul Microsoft Office Powerpoint 2007Document14 pagesModul Microsoft Office Powerpoint 2007Zainul ArifinNo ratings yet

- 200KM Club Cycling Event ResultsDocument8 pages200KM Club Cycling Event ResultsMoises CalastravoNo ratings yet

- Annual Income Tax Return: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument2 pagesAnnual Income Tax Return: Republic of The Philippines Department of Finance Bureau of Internal RevenueDCNo ratings yet

- AXA Solutions: Kit PerformanceDocument25 pagesAXA Solutions: Kit PerformanceAira kaye Bernardino0% (1)

- Payout Guide-Philippines-swiftDocument1 pagePayout Guide-Philippines-swiftMoises CalastravoNo ratings yet

- Excel Tips Tricks e-BookV1.1 PDFDocument20 pagesExcel Tips Tricks e-BookV1.1 PDFSulabhNo ratings yet

- Excel Manual TuturialDocument44 pagesExcel Manual TuturialJose Salvador Ollet BositoNo ratings yet

- Excel Tips Tricks e-BookV1.1 PDFDocument20 pagesExcel Tips Tricks e-BookV1.1 PDFSulabhNo ratings yet

- Excel Manual TuturialDocument44 pagesExcel Manual TuturialJose Salvador Ollet BositoNo ratings yet

- Reply Under Oath To The Letter-Advice of CMICDocument2 pagesReply Under Oath To The Letter-Advice of CMICMoises CalastravoNo ratings yet

- Modul Microsoft Office Powerpoint 2007Document14 pagesModul Microsoft Office Powerpoint 2007Zainul ArifinNo ratings yet

- 70.BM - Tax Treatment of Director's Fees.12.18.08Document3 pages70.BM - Tax Treatment of Director's Fees.12.18.08Bust GarvidaNo ratings yet

- Excel for Beginners: Learn Basic FunctionsDocument16 pagesExcel for Beginners: Learn Basic FunctionsJudith Besenio VillarNo ratings yet

- BIRForm 1905 e TIS1Document2 pagesBIRForm 1905 e TIS1Anonymous NAlWIFI56% (16)

- PhilHealth Circular No 2017-0024 PDFDocument2 pagesPhilHealth Circular No 2017-0024 PDFGil PinoNo ratings yet

- Rights of StudentsDocument2 pagesRights of StudentsMoises CalastravoNo ratings yet

- PhilHealth Circular No 2017-0024 PDFDocument2 pagesPhilHealth Circular No 2017-0024 PDFGil PinoNo ratings yet

- Manila Bulletin Publishing Corporation-ManualDocument13 pagesManila Bulletin Publishing Corporation-ManualMoises CalastravoNo ratings yet

- Impossible DreamDocument1 pageImpossible DreamteacherashleyNo ratings yet

- We Both KnowDocument1 pageWe Both KnowMoises CalastravoNo ratings yet

- Nirc PDFDocument160 pagesNirc PDFCharlie Magne G. Santiaguel100% (3)

- FlowchartDocument3 pagesFlowchartMoises CalastravoNo ratings yet

- CMPSC11 Fundamentals of Programming AlgorithmDocument4 pagesCMPSC11 Fundamentals of Programming AlgorithmMoises CalastravoNo ratings yet

- RR 16-2008Document8 pagesRR 16-2008Peggy SalazarNo ratings yet