Professional Documents

Culture Documents

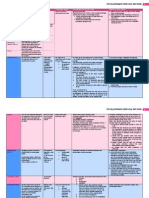

Credit Digests (First)

Uploaded by

PBWGOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Digests (First)

Uploaded by

PBWGCopyright:

Available Formats

Herrera vs Petro Phil Corp 146 Scra 385 FACTS: On December 5, 1969, Herrera and ESSO Standard, (later

substituted by Petrophil Corp.,) entered into a lease agreement, whereby the former leased to the latter a portion of his property for a period of 20yrs. subject to the condition that monthly rentals should be paid and there should be an advance payment of rentals for the first eight years of the contract, to which ESSO paid on December 31, 1969. However, ESSO deducted the amount of 101, 010.73 as interest or discount for the eight years advance rental.

On August 20, 1970, ESSO informed Herrera that there had been a mistake in the computation of the interest and paid an additional sum of 2,182.70; thus, it was reduced to 98, 828.03. As such, Herrera sued ESSO for the sum of 98, 828.03, with interest, claiming that this had been illegally deducted to him in violation of the Usury Law. ESSO argued that amount deducted was not usurious interest but rather a discount given to it for paying the rentals in advance. Judgment on the pleadings was rendered in favor of ESSO. Thus, the matter was elevated to the SC for only questions of law was involve. ISSUE: W/N the contract between the parties is one of loan or lease. RULING:

Contract between the parties is one of lease and not of loan. It is clearly denominated a "LEASE AGREEMENT." Nowhere in the contract is there any showing that the parties intended a loan rather than a lease. The provision for the payment of rentals in advance cannot be construed as a repayment of a loan because there was no grant or forbearance of money as to constitute an indebtedness on the part of the lessor. On the contrary, the defendant-appellee was discharging its obligation in advance by paying the eight years rentals, and it was for this advance payment that it was getting a rebate or discount. --There is no usury in this case because no money was given by the defendant-appellee to the plaintiffappellant, nor did it allow him to use its money already in his possession. There was neither loan nor forbearance but a mere discount which the plaintiff-appellant allowed the defendant-appellee to deduct from the total payments because they were being made in advance for eight years. The discount was in effect a reduction of the rentals which the lessor had the right to determine, and any reduction thereof, by any amount, would not contravene the Usury Law.

The difference between a discount and a loan or forbearance is that the former does not have to be repaid. The loan or forbearance is subject to repayment and is therefore governed by the laws on usury. To constitute usury, "there must be loan or forbearance; the loan must be of money or something circulating as money; it must be repayable absolutely and in all events; and something must be exacted for the use of the money in excess of and in addition to interest allowed by law." It has been held that the elements of usury are (1) a loan, express or implied; (2) an understanding between the parties that the money lent shall or may be returned; that for such loan a greater rate or interest that is allowed by law shall be paid, or agreed to be paid, as the case may be; and (4) a corrupt intent to take more than the legal rate for the use of money loaned. Unless these four things concur in every transaction, it is safe to affirm that no case of usury can be declared. Bonevie vs CA 125 SCRA 122 Facts: Spouses Lozano mortgaged their property to secure the payment of a loan amounting to 75K with private respondent Philippine Bank of Communication (PBCom). The deed of mortgage was executed on 12-6-66, but the loan proceeeds were received only on 12-12-66. Two days after the execution of the deed of mortgage, the spouses sold the property to the petitioner Bonnevie for and in consideration of 100k25K of which payable to the spouses and 75K as payment to PBCom. Afterwhich, Bonnevie defaulted payments to PBCom prompting the latter to auction the property after Bonnivie failed to settle despite subsequent demands, in order to recover the amount loaned. The latter now assails the validity of the mortgage between Lozano and Pbcom arguing that on the day the deed was executed there was yet no principal obligation to secure as the loan of P75,000.00 was not received by the Lozano spouses, so that in the absence of a principal obligation, there is want of consideration in the accessory contract, which consequently impairs its validity and fatally affects its very existence. Issue: Was there a perfected contract of loan?

Held: Yes. From the recitals of the mortgage deed itself, it is clearly seen that the mortgage deed was executed for and on condition of the loan granted to the Lozano spouses. The fact that the latter did not collect from the respondent Bank the consideration of the mortgage on the date it was executed is immaterial. A contract of loan being a consensual contract, the herein contract of loan was perfected at the same time the contract of mortgage was executed. The promissory note executed on December 12, 1966 is only an evidence of indebtedness and does not indicate lack of consideration of the mortgage at the time of its execution. Republic vs Bagtas 6 SCRA 262 FACTS:

Jose Bagtas borrowed from the Bureau of Animal Industry three bulls for a period of one year for breeding purposes subject to a government charge of breeding fee of 10% of the book value of the books. Upon the expiration of the contract, Bagtas asked for a renewal for another one year, however, the Secretary of Agriculture and Natural Resources approved only the renewal for one bull and other two bulls be returned. Bagtas then wrote a letter to the Director of Animal Industry that he would pay the value of the three bulls with a deduction of yearly depreciation. The Director advised him that the value cannot be depreciated and asked Bagtas to either return the bulls or pay their book value. Bagtas neither paid nor returned the bulls. The Republic then commenced an action against Bagtas ordering him to return the bulls or pay their book value. After hearing, the trial Court ruled in favor of the Republic, as such, the Republic moved ex parte for a writ of execution which the court granted. Felicidad Bagtas, the surviving spouse and administrator of Bagtas estate, returned the two bulls and filed a motion to quash the writ of execution since one bull cannot be returned for it was killed by gunshot during a Huk raid. The Court denied her motion hence, this appeal certified by the Court of Appeals because only questions of law are raised.

ISSUE: WON the contract was commodatum;thus, Bagtas be held liable for its loss due to force majeure. RULING:

A contract of commodatum is essentially gratuitous. Supreme Court held that Bagtas was liable for the loss of the bull even though it was caused by a fortuitous event. If the contract was one of lease, then the 10% breeding charge is compensation (rent) for the use of the bull and Bagtas, as lessee, is subject to the responsibilities of a possessor. He is also in bad faith because he continued to possess the bull even though the term of the contract has already expired. If the contract was one of commodatum, he is still liable because: (1) he kept the bull longer than the period stipulated; and (2) the thing loaned has been delivered with appraisal of its value (10%). No stipulation that in case of loss of the bull due to fortuitous event the late husband of the appellant would be exempt from liability. The original period of the loan was from 8 May 1948 to 7 May 1949. The loan of one bull was renewed for another period of one year to end on 8 May 1950. But the appellant kept and used the bull until November 1953 when during a Huk raid it was killed by stray bullets. Furthermore, when lent and delivered to the deceased husband of the appellant the bulls had each an appraised book value, to with: the Sindhi, at P1,176.46, the Bhagnari at P1,320.56 and the Sahiniwal at P744.46. It was not stipulated that in case of loss of the bull due to fortuitous event the late husband of the appellant would be exempt from liability Mina vs Pascual 25 Phil 540

Francisco is the owner of land and he allowed his brother, Andres, to erect a warehouse in that lot. Both Francisco and Andres died and their children became their respective heirs: Mina for Francisco and Pascual for Andres. Pascual sold his share of the warehouse and lot. Mina opposed because the lot is hers because her predecessor (Francisco) never parted with its ownership when he let Andres construct a warehouse, hence, it was a contract of commodatum. What is the nature of the contract between Francisco and Andres? The Supreme Court held that it was not a commodatum. It is an essential feature of commodatum that the use of the thing belonging to another shall be for a certain period. The parties never fixed a definite period during which Andres could use the lot and afterwards return it. NOTA BENE: It would seem that the Supreme Court failed to consider the possibility of a contract of precardium between Francisco and Andres. Precardium is a kind of commodatum wherein the bailor may demand the object at will if the contract does not stipulate a period or use to which the thing is devoted.

Catholic Vicar Apostolic of the Mt. Procince vs CA 165 SCRA 511 Doctrine: The bailees' failure to return the subject matter of commodatum to the bailor does not mean adverse possession on the part of the borrower. The bailee held in trust the property subject matter of commodatum.

Facts: Catholic Vicar Apostolic of the Mountain Province (VICAR for brevity) filed an application for registration of title over Lots 1, 2, 3, and 4, said Lots being the sites of the Catholic Church building, convents, high school building, school gymnasium, school dormitories, social hall, stonewalls, etc. The Heirs of Juan Valdez and the Heirs of Egmidio Octaviano filed their Answer/Opposition on Lots Nos. 2 and 3, respectively, asserting ownership and title thereto since their predecessors' house was borrowed by petitioner Vicar after the church and the convent were destroyed.. After trial on the merits, the land registration court promulgated its Decision confirming the registrable title of VICAR to Lots 1, 2, 3, and 4. The Heirs of Juan Valdez appealed the decision of the land registration court to the then Court of Appeals, The Court of Appeals reversed the decision. Thereupon, the VICAR filed with the Supreme Court a petition for review on certiorari of the decision of the Court of Appeals dismissing his application for registration of Lots 2 and 3.

Issue: Whether or not the failure to return the subject matter of commodatum constitutes an adverse

possession

on

the

part

of

the

owner

Held: No. The bailees' failure to return the subject matter of commodatum to the bailor did not mean adverse possession on the part of the borrower. The bailee held in trust the property subject matter of commodatum. Petitioner repudiated the trust by declaring the properties in its name for taxation purposes. Pajuyo vs CA 430 SCRA 492 Facts: Pajuyo entrusted a house to Guevara for the latter's use provided he should return the same upon demand and with the condition that Guevara should be responsible of the maintenance of the property. Upon demand Guevara refused to return the property to Pajuyo. The petitioner then filed an ejectment case against Guevara with the MTC who ruled in favor of the petitioner. On appeal with the CA, the appellate court reversed the judgment of the lower court on the ground that both parties are illegal settlers on the property thus have no legal right so that the Court should leave the present situation with respect to possession of the property as it is, and ruling further that the contractual relationship of Pajuyo and Guevara was that of a commodatum. Issue: Is the contractual relationship of Pajuyo and Guevara that of a commodatum? Held: No. The Court of Appeals theory that the Kasunduan is one of commodatum is devoid of merit. In a contract of commodatum, one of the parties delivers to another something not consumable so that the latter may use the same for a certain time and return it. An essential feature of commodatum is that it is gratuitous. Another feature of commodatum is that the use of the thing belonging to another is for a certain period. Thus, the bailor cannot demand the return of the thing loaned until after expiration of the period stipulated, or after accomplishment of the use for which the commodatum is constituted. If the bailor should have urgent need of the thing, he may demand its return for temporary use. If the use of the thing is merely tolerated by the bailor, he can demand the return of the thing at will, in which case the contractual relation is called a precarium. Under the Civil Code, precarium is a kind of commodatum. The Kasunduan reveals that the accommodation accorded by Pajuyo to Guevarra was not essentially gratuitous. While the Kasunduan did not require Guevarra to pay rent, it obligated him to maintain the property in good condition. The imposition of this obligation makes the Kasunduan a contract different from a commodatum. The effects of the Kasunduan are also different from that of a commodatum. Case law on ejectment has treated relationship based on tolerance as one that is akin to a landlord-tenant relationship where the withdrawal of permission would result in the termination of the lease. The tenants withholding of the property would then be unlawful.

City Bank vs Sabeano 504 SCRA 378 Facts: This is a case involving Citibank, N.A., a banking corporation duly registered under US Laws and is licensed to do commercial banking and trust functions in the Philippines and Investor's Finance Corporation (aka FNCB Finance), and affiliate company of Citibank, mainly handling money market placements(MMPs are short term debt instruments that give the owner an unconditional right to receive a stated, fixed sum of money on a specified date). Modesta R. Sabeniano was a client of both petitioners Citibank and FNCB Finance.Unfortunately, the business relations among the parties subsequently went awry. Subsequently, Sabeniano filed a complaint with the RTC against petitioners as she claims to have substantial deposits and money market placements with the petitioners and other investment companies, the proceeds of which were supposedly deposited automatically and directly to her account with Citibank. Sabenianoalleged that Citibank et al refused to return her deposits and the proceeds of her money market placements despite her repeated demands, thus, the civil case for "Accounting, Sum of Money and Damages. In their reply, Citibank et al admitted that Sabenianohad deposits and money market placements with them, including dollar accounts in other Citibank branches. However, they also alleged that respondent later obtained several loans from Citibank, executed through Promissory Notes and secured by a pledge on her dollar accounts, and a deed of assignment against her MMPS with FNCB Finance. When Sabeniano defaulted, Citibank exercised its right to off-set or compensate respondent's outstanding loans with her deposits and money market placements, pursuant to securities she executed. Citibank supposedly informed Sabeniano of the foregoing compensation through letters, thus, Citibank et al were surprised when six years later,Sabeniano and her counsel made repeated requests for the withdrawal of respondent's deposits and MMPs with Citibank, including her dollar accounts with Citibank-Geneva and her money market placements with petitioner FNCB Finance. Thus, petitioners prayed for the dismissal of the Complaint and for the award of actual, moral, and exemplary damages, and attorney's fees. The case was eventually decided after 10 years with the Judge declaring the offsetting done as illegal and the return of the amount with legal interest, while Sabeniano was ordered to pay her loans to Citibank. The ruling was then appealed. The CA modified the decision but only to the extent of Sabenianos loans which it ruled that Citibank failed to establish the indebtedness and is also without legal and factual basis. The case was thus appealed to the SC. Issue: Whether or not there was a valid offsetting/compensation of loan vis a visthe a.)Deposits and b.) MMPs. Held: General Requirement of Compensation: Art. 1278. Compensation shall take place when two persons, in their own right, are creditors and debtors of each other. Art. 1279. In order that compensation may be proper, it is necessary; (1) That each one of the obligors be bound principally, and that he be at the same time a principal creditor of the other; (2) That both debts consist in a sum of money, or if the things due are consumable, they be of the same kind, and also of the same quality if the latter has been stated; (3) That the two debts be due; (4) That they be liquidated and demandable; (5) That over neither of them there be any retention or controversy, commenced by third persons and communicated in due time to the debtor.

1. Yes. As already found by this Court, petitioner Citibank was the creditor of respondent for her outstanding loans. At the same time, respondent was the creditor of petitioner Citibank, as far as her deposit account was concerned, since bank deposits, whether fixed, savings, or current, should be considered as simple loan or mutuum by the depositor to the banking institution.122 Both debts consist in sums of money. By June 1979, all of respondent's PNs in the second set had matured and became demandable, while respondent's savings account was demandable anytime. Neither was there any retention or controversy over the PNs and the deposit account commenced by a third person and communicated in due time to the debtor concerned. Compensation takes place by operation of law. 2. Yes, but technically speaking Citibank did not effect a legal compensation or off-set under Article 1278 of the Civil Code, but rather, it partly extinguished respondent's obligations through the application of the security given by the respondent for her loans. Respondent's money market placements were with petitioner FNCB Finance, and after several rollovers, they were ultimately covered by PNs No. 20138 and 20139, which, by 3 September 1979, the date the check for the proceeds of the said PNs were issued, amounted to P1,022,916.66, inclusive of the principal amounts and interests. As to these money market placements, respondent was the creditor and petitioner FNCB Finance the debtor (thereby implying that money market placement is a simple loan or mutuum); while, as to the outstanding loans, petitioner Citibank was the creditor and respondent the debtor. Consequently, legal compensation, under Article 1278 of the Civil Code, would not apply since the first requirement for a valid compensation, that each one of the obligors be bound principally, and that he be at the same time a principal creditor of the other, was not met. What petitioner Citibank actually did was to exercise its rights to the proceeds of respondent's money market placements with petitioner FNCB Finance by virtue of the Deeds of Assignment executed by respondent in its favor. Petitioner Citibank was only acting upon the authority granted to it under the foregoing Deeds when it finally used the proceeds of PNs No. 20138 and 20139, paid by petitioner FNCB Finance, to partly pay for respondent's outstanding loans. Strictly speaking, it did not effect a legal compensation or off-set under Article 1278 of the Civil Code, but rather, it partly extinguished respondent's obligations through the application of the security given by the respondent for her loans. Although the pertinent documents were entitled Deeds of Assignment, they were, in reality, more of a pledge by respondent to petitioner Citibank of her credit due from petitioner FNCB Finance by virtue of her money market placements with the latter. According to Article 2118 of the Civil Code ART. 2118. If a credit has been pledged becomes due before it is redeemed, the pledgee may collect and receive the amount due. He shall apply the same to the payment of his claim, and deliver the surplus, should there be any, to the pledgor. --Republic vs Grijaldo 15 SCRA 681 Grijaldo obtained five loans from the Bank of Taiwanin the total sum of P1,281.97 with interest at therats of 6% per annum compounded quarterly. Thesewere evidenced by five promissory notes, due one year after they were incurred. As a security for the payment of the loans, a chattelmortgage was executed on the standing crops of hisland.

The assets in the Bank of Taiwan were vested in theUS Govt which were subsequently transferred to theRepublic of the Philippines, pursuant to Philippine Property Act of 1946 . RP is now demanding the payment of the account.Justice of Peace dismisses the case on the ground of prescription. CA rendered a decision ordering the appellant to pay the appellee. The appellant likewise maintains that because the loans were secured by a chattel mortgage on the standing crops on a land owned by him and these crops were lost or destroyed through enemy action his obligation to pay the loans was thereby extinguished. ISSUE: Is a loan secured by chattel mortgage extinguished when the security is destroyed? No. The obligation of the appellant under the five promissory notes was not to deliver a determinate thing namely, the crops to be harvested from his land, or the value of the crops that would be harvested from his land. Rather, his obligation was to pay a generic thing the amount of money representing the total sum of the five loans, with interest. The transaction between the appellant and the Bank of Taiwan, Ltd. was a series of five contracts of simple loan of sums of money. "By a contract of (simple) loan, one of the parties delivers to another ... money or other consumable thing upon the condition that the same amount of the same kind and quality shall be paid." (Article 1933, Civil Code) The obligation of the appellant under the five promissory notes evidencing the loans in questions is to pay the value thereof; that is, to deliver a sum of money a clear case of an obligation to deliver, a generic thing Tan vs Valdejueza 66SCRA 61 Plaintiff was the highest bidder in the public auction sale of a parcel of land which is the subject of the first cause of action. Defendants Arador and RediculoValdehueva executed two documents of deed of pacto de retro sale with right to repurchase in favor of the plaintiff of two portions of a parcel of land described in the second cause of action. This was not registered in the Register of Deeds. After the execution of the DOS in the second cause of action, the defendants remained in the possession of the land, taxes were paid by them. There was a civil case instituted by Tan against Valdehuezas to enjoin them from entering the parcel of land and gathering nuts but this was dismissed for failure to seek immediate trial. TC declares Tan the absolute owner of the property in the first cause of action and ordered defendants to pay plaintiff the amount of P1,200 with legal interest of 6%. With regard to the land in the second cause of action, Valdehuezas were ordered to pay the amount of P300 with legal interest of 6% Valdehuezas appealed, saying that the TC erred in making a finding on the second cause of action that the transactions were a simple loan instead of an equitable mortgage. ISSUE: Should the Valdehuezas pay the interest? RULING: No interest shall be due unless it has been expressly stipulated in writing.

--Radiowealth vs Del Rosario 335 SCRA 288 On March 2, 1991, Spouses Vicente and Maria Sumilang del Rosario (herein respondents), jointly and severally executed, signed and delivered in favor of Radiowealth Finance Company (herein petitioner), a Promissory Note for P138,948 payable in installments for 12 consecutive months. In the promissory note the date of the start of the monthly installments and when in each month such installment becomes due, were left blank. A late payment penalty charge of 2.5% per month shall be added to each unpaid installment from due date thereof until fully paid. An acceleration clause was likewise stipulated in the promissory note. Thereafter, spouses Del Rosario defaulted on the monthly installments. Despite repeated demands, they failed to pay their obligation under the promissory note. A complaint was filed for the collection of sum of money. It was likewise prayed for in the complaint that a 14% interest per annum should be charged from May 6, 1993 until fully paid. Issue: Whether the interest prayed for by the petitioner is proper? Ruling: It was held that the 14% interest per annum prayed for by the petitioner in the complaint to be paid by the respondents has no legal basis. Payment of interest was not expressly stipulated in the promissory note. What stipulated in the Note is a late payment penalty of 2.5% monthly to be added to each unpaid installment until fully paid. Thus, the interest should be deemed included in such penalty. --Republic vs Unimex 518 SCRA 19 Unimex shipped computer parts and accessories with its shipping agent to Handyware Phils Inc. When the Bureau of Customs discovered that the cargo did not tally with the description of the manifest, it was seized. Because of Handywares failing to appear in the seizure proceedings, the cargo was forfeited in favour of the government. Unimex was allowed to intervene but the Collector of Customs later ruled that the order of forfeiture was final and executor. On its appeal, the CTA reversed the forfeiture decree and ordered the release of the subject shipment to respondent subject to the payment of customs duties. (it filed separate claims for damages against Don Tim Shipping Corporation and Evergreen Marine Corporation6 but both cases were dismissed.) Respondent filed in the CTA a petition for the revival decision, praying for the immediate release by BOC of its shipment or, in the alternative, payment of the shipments value plus damages. The BOC Commissioner failed to file his answer and later informed the court that the subject shipment could no longer be found at its warehouses. CTA ordered the BOC Commissioner to pay respondent the commercial value of the goods based on the prevailing exchange rate at the time of their importation since its decision can no longer be executed.

In his MR, the BOC Commissioner argued that the CTA altered its June 15, 1992 decision by converting it from an action for specific performance into a money judgment. This was denied. In the CA, it ruled that: Considering that the BOC was grossly negligent in handling the subject shipment, this Court finds Unimex entitled to legal interests. Accordingly, the actual damages thus awarded shall be subject to 6% interest per annum. Be that as it may, such interest shall accrue only from the date of the CTA Decision on 19 September 2002 since it is from that the quantification of Unimexs damages have been reasonably ascertained

Finally, Unimex is likewise entitled to 12% interest per annum in lieu of 6% per annum from the time this Decision becomes final and executory until fully paid, in as much as the interim period is equivalent to a forbearance of credit. Petitioner likewise argues that the CA erred in imposing the 6% p.a. legal interest. According to petitioner, the obligation to pay legal interest only arises by virtue of a contract or on account of damages due to delay or failure to pay the principal on which the interest is exacted. It added that since the June 15, 1992 CTA decision did not involve a monetary award but merely the release of the goods to respondent, there was no basis for the computation and/or imposition of the 6% p.a. legal interest Issue: Is PETITIONER obligated to pay legal interest? Ruling: no, it is not. Interest may be paid either as compensation for the use of money (monetary interest) referred to in Article 1956 of the New Civil Code or as damages (compensatory interest) under Article 2209 above cited. As clearly provided in [Article 2209], interest is demandable if: a) there is monetary obligation and b) debtor incurs delay. This case does not involve a monetary obligation to be covered by Article 2209. There is no dispute that this case was originally filed questioning the seizure of the shipment by the Bureau of Customs. Our decision subject of this action for revival [of judgment] did not refer to any monetary obligation by [petitioner] towards the [respondent]. In fact, if there was any monetary obligation mentioned, it referred to the obligation of [respondent] to pay the correct taxes, duties, fees and other charges before the release of the goods can be had. NO NEED TO WRITE, BUT READ TO UNDERSTAND: In one case, the Supreme Court held: "In a comprehensive sense, the term "debt" embraces not merely money due by contract, but whatever one is bound to render to another, either for contract or the requirement of the law, such as tax where the law imposes personal liability therefor."

Therefore, the government was never a debtor to the petitioner in order that [Article] 2209 could apply. Nor was it in default for there was no monetary obligation to pay in the first place. There is default when after demand is made either judicially or extrajudicially. In other words, for interest to be demandable under Article 2209, there should be a monetary obligation and the debtor was in default In the instant case, [petitioner] was never under monetary obligation to [respondent], no demand can be made either judicially or extrajudicially. Parallel thereto, there could be no default --Garcia vs Theo 518 SCRA 433 FACTS Respondent Thio received from petitioner Garcia two crossed checks which amount to US$100,000 and US$500,000, respectively, payable to the order of Marilou Santiago. According to petitioner, respondent failed to pay the principal amounts of the loans when they fell due and so she filed a complaint for sum of money and damages with the RTC. Respondent denied that she contracted the two loans and countered that it was Marilou Satiago to whom petitioner lent the money. She claimed she was merely asked y petitioner to give the checks to Santiago. She issued the checks for P76,000 and P20,000 not as payment of interest but to accommodate petitioners request that respondent use her own checks instead of Santiagos. RTC ruled in favor of petitioner. CA reversed RTC and ruled that there was no contract of loan between the parties. ISSUE (1) Whether or not there was a contract of loan between petitioner and respondent.

Decision: Petition granted.A loan is a real contract, not consensual, and as such is perfected only upon the delivery of theobject of the contract. This is evident in Art. 1934 of the Civil Code which provides:An accepted promise to deliver something by way of commodatum or simpleloan is binding upon the parties, but the commodatum or simple loan itself shall not beperfected until the delivery of the object of the contract.Upon delivery of the object of the contract of loan (in this case the money received by thedebtor when the checks were encashed) the debtor acquires ownership of such money or loan proceedsand is bound to pay the creditor an equal amount.Although respondent did not physically receive the proceeds of the checks, these instrumentswere placed in her control and possession under an arrangement whereby she actually re-lent theamounts to Santiago

You might also like

- Credit Case DigestDocument10 pagesCredit Case DigestMhayBinuyaJuanzon100% (4)

- Credit Transaction CasesDocument12 pagesCredit Transaction CasesLutchel Albis TanjayNo ratings yet

- Credit Transactions - Case DigestsDocument104 pagesCredit Transactions - Case DigestsGemma F. TiamaNo ratings yet

- Credit Case DigestDocument20 pagesCredit Case DigestMhayBinuyaJuanzon100% (1)

- Producers Bank Vs CA - DigestDocument2 pagesProducers Bank Vs CA - DigestRengie Galo100% (2)

- Quintos vs. Beck DigestDocument3 pagesQuintos vs. Beck DigestAnonymous Mickey MouseNo ratings yet

- Creditdigeststeam DepositDocument8 pagesCreditdigeststeam DepositCheenee Nuestro SantiagoNo ratings yet

- Republic vs CA Upholds Possessory Title Over Land Occupied Since 1894Document16 pagesRepublic vs CA Upholds Possessory Title Over Land Occupied Since 1894Dan Alden ContrerasNo ratings yet

- Catholic Vicar v. CA DigestDocument2 pagesCatholic Vicar v. CA DigestPaul PhoenixNo ratings yet

- Credt Trans Digest 10 02Document29 pagesCredt Trans Digest 10 02erikha_araneta100% (2)

- Republic Vs BagtasDocument2 pagesRepublic Vs Bagtasantongrace22100% (1)

- Credit Transactions Digested Cases ConsolidatedDocument190 pagesCredit Transactions Digested Cases ConsolidatedWilbert ChongNo ratings yet

- 29 - Sentinel Insurance Co., Inc. vs. Court of Appeals, 182 SCRA 517, 23 February 1990Document2 pages29 - Sentinel Insurance Co., Inc. vs. Court of Appeals, 182 SCRA 517, 23 February 1990ESS PORT OF LEGAZPI CPD-ESSNo ratings yet

- Nego Conso DigestsDocument50 pagesNego Conso DigestsJCapsky100% (1)

- Saura Import and Export Co. Inc. v. DBPDocument2 pagesSaura Import and Export Co. Inc. v. DBPMarvin De Leon100% (1)

- Credit Case DigestsDocument75 pagesCredit Case DigestsBryanNavarroNo ratings yet

- Mina vs Pascual Land Dispute Case BreakdownDocument1 pageMina vs Pascual Land Dispute Case BreakdownKitem Kadatuan Jr.100% (1)

- Credit Transactions DigestDocument98 pagesCredit Transactions DigestMaestro Lazaro100% (1)

- CA Agro-Industrial Dev. Corp. v. Court of AppealsDocument1 pageCA Agro-Industrial Dev. Corp. v. Court of AppealsRon DecinNo ratings yet

- Garcia vs. ThioDocument1 pageGarcia vs. ThioOM MolinsNo ratings yet

- CA AGRO Vs CADocument3 pagesCA AGRO Vs CAJereca Ubando Juba100% (1)

- BPI Investment Corporation Vs CA and ALS Management & Development CorporationDocument2 pagesBPI Investment Corporation Vs CA and ALS Management & Development CorporationKristine Joy Tumbaga100% (1)

- Catholic Vicar Apostolic of The Mt. Province v. CADocument1 pageCatholic Vicar Apostolic of The Mt. Province v. CALouNo ratings yet

- People vs. Puig & Porras Qualified Theft CaseDocument1 pagePeople vs. Puig & Porras Qualified Theft CaseJenine Quiambao0% (1)

- PNB liability for employee's actsDocument2 pagesPNB liability for employee's actsCari Mangalindan Macaalay100% (1)

- Catholic Vicar Apostolic V CA 165 Scra 515Document4 pagesCatholic Vicar Apostolic V CA 165 Scra 515Aleks OpsNo ratings yet

- Case #10 Benjamin-Abubakar-V-Auditor-generalDocument1 pageCase #10 Benjamin-Abubakar-V-Auditor-generalpistekayawaNo ratings yet

- 023 Triple-V Food Services, Inc. v. Filipino Merchants Insurance Company, Inc.Document2 pages023 Triple-V Food Services, Inc. v. Filipino Merchants Insurance Company, Inc.Cassandra Hester100% (1)

- Sps. Sy vs. Westmont BankDocument2 pagesSps. Sy vs. Westmont BankASGarcia24No ratings yet

- SC upholds warehouseman's lien for unpaid storage feesDocument3 pagesSC upholds warehouseman's lien for unpaid storage feesBinkee VillaramaNo ratings yet

- Pajuyo Vs CADocument1 pagePajuyo Vs CAwesleybooks100% (1)

- 1 Credit Feb1Document15 pages1 Credit Feb1Yodh Jamin OngNo ratings yet

- Bank Cannot Freeze Accounts Based on Mere Suspicion of Involvement in ScamDocument2 pagesBank Cannot Freeze Accounts Based on Mere Suspicion of Involvement in ScamKaren De VillaNo ratings yet

- Land Title Registration Denied Despite Naval ReservationDocument1 pageLand Title Registration Denied Despite Naval ReservationTrem Gallente50% (2)

- Spouses Eduardo and Lydia Silos Vs Philippine National Bank G.R. No. 181045, July 2, 2014Document2 pagesSpouses Eduardo and Lydia Silos Vs Philippine National Bank G.R. No. 181045, July 2, 2014nikkimaxinevaldezNo ratings yet

- Sps. Juico vs. China Banking CorporationDocument1 pageSps. Juico vs. China Banking CorporationVian O.No ratings yet

- Deposit Cases Digests (BPI Vs IAC To Consolidated Terminals vs. Artex Development)Document11 pagesDeposit Cases Digests (BPI Vs IAC To Consolidated Terminals vs. Artex Development)Ron QuintoNo ratings yet

- 3 Republic Vs Grijaldo (Short)Document2 pages3 Republic Vs Grijaldo (Short)Hector Mayel MacapagalNo ratings yet

- Abubakar v. Auditor GeneralDocument1 pageAbubakar v. Auditor GeneralAvs SalugsuganNo ratings yet

- Yang V CA GR No. 138074Document1 pageYang V CA GR No. 138074Rhuejane Gay MaquilingNo ratings yet

- Credit Transaction - Case DigestDocument32 pagesCredit Transaction - Case Digestjuan dela cruzNo ratings yet

- Dela Victoria Vs Burgos PDFDocument2 pagesDela Victoria Vs Burgos PDFChristian Angelo OñateNo ratings yet

- Consolidated NinsdigestsDocument46 pagesConsolidated NinsdigestsTon Ton CananeaNo ratings yet

- PNB's Unauthorized Application of DepositDocument1 pagePNB's Unauthorized Application of DepositFrancis PunoNo ratings yet

- Republic vs. Jose Bagtas Ruling on Liability for Lost BullDocument2 pagesRepublic vs. Jose Bagtas Ruling on Liability for Lost BullDarlyn Bangsoy0% (1)

- 44 Triple V - Food Services Vs Filipino Mechants Insurance CorpDocument1 page44 Triple V - Food Services Vs Filipino Mechants Insurance CorpJerelleen RodriguezNo ratings yet

- 2-Eduque v. Ocampo 86 Phil 216 (1950)Document2 pages2-Eduque v. Ocampo 86 Phil 216 (1950)Ronald Alasa-as AtigNo ratings yet

- BPI Investment Corp V. CA (2002): Loan Contract Perfected Upon Release of FundsDocument12 pagesBPI Investment Corp V. CA (2002): Loan Contract Perfected Upon Release of FundsryuseiNo ratings yet

- BPI Vs CA Credit DigestDocument6 pagesBPI Vs CA Credit Digestmaria luzNo ratings yet

- Credit Digests - GuarantyDocument21 pagesCredit Digests - Guarantyduanepo100% (1)

- Chan Vs MacedaDocument1 pageChan Vs MacedaGillian Caye Geniza BrionesNo ratings yet

- Kaufman 42 Phil 182Document6 pagesKaufman 42 Phil 182Mp CasNo ratings yet

- Credit Trans Case DigestDocument74 pagesCredit Trans Case Digestnikkibeverly73100% (1)

- Tan Tiong Tick Vs American Apothecaries Co., Et AlDocument5 pagesTan Tiong Tick Vs American Apothecaries Co., Et AlJoni Aquino100% (1)

- Nil Digested CasesDocument69 pagesNil Digested CasesPamela Denise100% (1)

- Rono vs. Gomez (Digest)Document1 pageRono vs. Gomez (Digest)Agli DaklingNo ratings yet

- 60 PNB v. Sayo (Capistrano)Document4 pages60 PNB v. Sayo (Capistrano)itsmesteph100% (2)

- 02 - Boracay Vs Province of AklanDocument4 pages02 - Boracay Vs Province of AklanPJANo ratings yet

- PNB Liability for Checks Deposited Without IndorsementDocument2 pagesPNB Liability for Checks Deposited Without IndorsementRubyNo ratings yet

- Commodatum 1. Herrera vs. Petrophil Corporation, 146 SCRA 385 (1986)Document50 pagesCommodatum 1. Herrera vs. Petrophil Corporation, 146 SCRA 385 (1986)Jeorge Ryan MangubatNo ratings yet

- WhyDocument3 pagesWhyPBWGNo ratings yet

- Book Chapter: Philippine Intelligence Community: A Case For TransparencyDocument24 pagesBook Chapter: Philippine Intelligence Community: A Case For TransparencyPBWGNo ratings yet

- Revised Rules On Administrative Cases in The Civil Service RA 9165 & Its IRR and Plea Bargaining GuidelinesDocument1 pageRevised Rules On Administrative Cases in The Civil Service RA 9165 & Its IRR and Plea Bargaining GuidelinesPBWGNo ratings yet

- Income Taxation in GeneralDocument9 pagesIncome Taxation in GeneralPBWGNo ratings yet

- 2016 AdZ Law InstructionsDocument1 page2016 AdZ Law InstructionsPBWGNo ratings yet

- Masters National Security Law LoonDocument8 pagesMasters National Security Law LoonPBWGNo ratings yet

- Ateneo de Zamboanga University: School of Management and AccountancyDocument10 pagesAteneo de Zamboanga University: School of Management and AccountancyPBWGNo ratings yet

- Property & Succession Reviewer Obligations & Contracts ReviewerDocument2 pagesProperty & Succession Reviewer Obligations & Contracts ReviewerPBWGNo ratings yet

- Katarungang PambarangayDocument16 pagesKatarungang PambarangayPBWGNo ratings yet

- First, in The Designation of Location of Risk, Only The Two Swimming PoolsDocument10 pagesFirst, in The Designation of Location of Risk, Only The Two Swimming PoolsPBWGNo ratings yet

- Insurance CasesDocument1 pageInsurance CasesPBWGNo ratings yet

- MathDocument1 pageMathPBWGNo ratings yet

- CLR PIL SyllabusDocument9 pagesCLR PIL SyllabusPBWGNo ratings yet

- NIL Review CasesDocument1 pageNIL Review CasesPBWGNo ratings yet

- Ateneo de Zamboanga University Xavier University College of Law - ZamboangaDocument1 pageAteneo de Zamboanga University Xavier University College of Law - ZamboangaPBWGNo ratings yet

- League of Cities v. Comelec ruling on cityhood lawsDocument2 pagesLeague of Cities v. Comelec ruling on cityhood lawsJilliane Oria100% (2)

- 2016 AdZ Law InstructionsDocument1 page2016 AdZ Law InstructionsPBWGNo ratings yet

- Bar ExaminationsDocument68 pagesBar ExaminationsPBWGNo ratings yet

- UNCLOSDocument13 pagesUNCLOSPBWGNo ratings yet

- Phy Bar2011Document24 pagesPhy Bar2011PBWGNo ratings yet

- Consti AssssDocument117 pagesConsti AssssPBWGNo ratings yet

- Education, Family & Culture Rights in the PhilippinesDocument40 pagesEducation, Family & Culture Rights in the PhilippinesPBWGNo ratings yet

- Article XII Til The End.Document7 pagesArticle XII Til The End.PBWGNo ratings yet

- UNCLOS Summary TableDocument3 pagesUNCLOS Summary Tablecmv mendoza100% (3)

- MF Rep. V CADocument2 pagesMF Rep. V CAPBWGNo ratings yet

- CL1 Syllabus 2015Document48 pagesCL1 Syllabus 2015Ateneo SiyaNo ratings yet

- CL1 Syllabus 2015Document48 pagesCL1 Syllabus 2015Ateneo SiyaNo ratings yet

- Political Law 2014 Bar SyllabusDocument13 pagesPolitical Law 2014 Bar SyllabusMarge RoseteNo ratings yet

- Case AssDocument34 pagesCase AssPBWG0% (1)

- UNCLOSDocument13 pagesUNCLOSPBWGNo ratings yet

- Banco de Oro V RepublicDocument20 pagesBanco de Oro V RepublicKJ ArgallonNo ratings yet

- Oman's Labour Law BasicsDocument23 pagesOman's Labour Law BasicsAshok SureshNo ratings yet

- Public Bid 061416 NCRDocument19 pagesPublic Bid 061416 NCRBrian MigueNo ratings yet

- History of Banking IndustryDocument7 pagesHistory of Banking IndustryKimberly PasaloNo ratings yet

- BF ASN InvestmentDocument1 pageBF ASN InvestmentkeuliseutinNo ratings yet

- Shriram Group PresentationDocument36 pagesShriram Group Presentationchoudharyankush731No ratings yet

- Simple Interest Asynchronous1 Answer KeyDocument4 pagesSimple Interest Asynchronous1 Answer KeyAriane GaleraNo ratings yet

- Pestel Analysis Banking SectorDocument16 pagesPestel Analysis Banking SectorprashantNo ratings yet

- Debt Recovery Tribunal Evolution and ChallengesDocument21 pagesDebt Recovery Tribunal Evolution and ChallengesakhilaNo ratings yet

- II. Income Under The House Properties :: Basis of Charge Section 22Document4 pagesII. Income Under The House Properties :: Basis of Charge Section 22Akash Singh RajputNo ratings yet

- Plaint & Written StatementDocument7 pagesPlaint & Written StatementAdv Abhinav Gupta63% (16)

- BUDGETING SUCKS Garrett Gunderson Dale ClarkeDocument136 pagesBUDGETING SUCKS Garrett Gunderson Dale ClarkeRich Diaz100% (1)

- Republic v. SorianoDocument5 pagesRepublic v. SorianoErika Mariz CunananNo ratings yet

- B1 B2 Visa Interview Questions and Answers - Complete InfoDocument3 pagesB1 B2 Visa Interview Questions and Answers - Complete InfogiesengalaarmelNo ratings yet

- Name: Saira D. Villar. Date: Dec. 2021 Section: BSTM3101 Instructor: Mr. Edmund Lahuylahuy P-M-I CHART 07 Activity 1Document3 pagesName: Saira D. Villar. Date: Dec. 2021 Section: BSTM3101 Instructor: Mr. Edmund Lahuylahuy P-M-I CHART 07 Activity 1Saira VillarNo ratings yet

- StudentDocument33 pagesStudentKevin Che100% (2)

- Step 1: Check Your Qualifications: Bdo BankDocument4 pagesStep 1: Check Your Qualifications: Bdo BankCristy JavinarNo ratings yet

- Interest LessonDocument12 pagesInterest LessonKatz EscañoNo ratings yet

- 3 - Financial InstitutionsDocument7 pages3 - Financial InstitutionsArmeen KhanNo ratings yet

- Local Finance Circuar No.1 - 93Document6 pagesLocal Finance Circuar No.1 - 93Anonymous zDh9ksnNo ratings yet

- Mortgage market types and programsDocument3 pagesMortgage market types and programsRizma RizwanNo ratings yet

- Civil Law Review Ii: Case DigestDocument57 pagesCivil Law Review Ii: Case DigestRyanNo ratings yet

- (CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)Document12 pages(CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)jamNo ratings yet

- CH 14Document13 pagesCH 14Ranjan PradhanNo ratings yet

- 14 Co Makers StatementDocument1 page14 Co Makers StatementMelodias Vaughn100% (1)

- LecDocument12 pagesLecLorenaTuazonNo ratings yet

- Monetary Policy of RBIDocument22 pagesMonetary Policy of RBIBindu MadhaviNo ratings yet

- FINANCE MANAGEMENT FIN420 CHP 9Document38 pagesFINANCE MANAGEMENT FIN420 CHP 9Yanty IbrahimNo ratings yet

- Finacle 10 CommandDocument36 pagesFinacle 10 CommandPANKAJ MAHESHWARI100% (3)

- Short Term Sources of FinanceDocument3 pagesShort Term Sources of FinanceRachit AgarwalNo ratings yet