Professional Documents

Culture Documents

S.B. No. 2046: Go Negosyo Bill

Uploaded by

TeamBamAquinoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S.B. No. 2046: Go Negosyo Bill

Uploaded by

TeamBamAquinoCopyright:

Available Formats

SIXTEENTH CONGRESS OF THE REPUBLIC OF THE PHILIPPINES First Regular Session

) ) )

SENATE S. No. __________ ______________________________________________________________________________ Introduced by: Senator Paolo Benigno Bam A. Aquino IV ______________________________________________________________________________ AN ACT PROMOTING THE REDUCTION OF POVERTY THROUGH THE DEVELOPMENT OF MICRO, SMALL AND MEDIUM ENTERPRISES

Be it enacted by the Senate and House of Representatives of the Philippines in Congress assembled: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 SECTION 1. Short Title. This Act shall be known as the "Go Negosyo Act of 2013." SECTION 2. Declaration of Policy. - It is hereby declared the policy of the state to foster national development and alleviate poverty by encouraging the establishment of micro, small and medium enterprises (MSMEs) that generate local job creation and production in the country. The State shall do this by rationalizing existing bureaucratic regulations, providing greater incentives and benefits to MSMEs, and strengthening the Micro, Small and Medium Enterprise Development (MSMED) Council. SECTION 3. Micro, Small and Medium Enterprises (MSMEs). - MSMEs shall refer to any business activity or enterprise engaged in the production, processing or manufacturing of products or commodities, trading and services, whether single proprietorship, cooperative, partnership or corporation whose total assets must have value falling under the following categories: MICRO SMALL MEDIUM not more than Php 3,000,001 Php 15,000,001 Php 3,000,000 Php 15,000,000 Php 100,000,000

The above classification of MSMEs shall be subject to review and adjustments by the Micro, Small and Medium Enterprises Development (MSMED) Council created under Section 6 of

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

Republic Act 6977, as amended, or upon the recommendation of sectoral organizations concerned, taking into account inflation and other economic indicators. The term "services" shall exclude those rendered by anyone, who is duly licensed by the government after having passed a government licensure examination, in connection with the exercise of one's profession. The term "assets" refers to all kinds of properties, real or personal, owned by the MSME, including those arising from loans, and used for the conduct of its business as defined by the MSMED Council: Provided, That for the purpose of exemption from taxes and fees under this Act, this term shall mean all kinds of properties, real or personal, owned and/or used by the MSME for the conduct of its business as defined by the MSMED Council. Notwithstanding the plans and programs set for MSMEs, the Council shall ensure that a set of policies, plans and programs shall be formulated and implemented according to the specific and distinct needs of each category (micro, small and medium) encouraging each level of enterprise to graduate to a higher category. SECTION 4. Eligibility. Any person, natural or juridical, or cooperative, or association, having the qualifications as defined in Section 3 of this Act may apply for registration as MSME. SECTION 5. Registration and Fees. (a) Micro Enterprises. 1. Micro enterprises shall be exempted from registration fees and administrative costs charged by The Office of the Treasurer of each city or municipality for the first two (2) years of its operation. Submission of a properly filled-out registration form assessed by The Office of the Treasurer of each city and municipality shall deem a microenterprise duly registered for the first two years of its operation. 2. On the third year, the Office of the Treasurer of each city or municipality shall register the microenterprise and issue a Certificate of Authority (CoA) to enable the micro enterprise to avail of the benefits under this Act. Any such application shall be processed within fifteen (15) working days. Should the process, after application, take more than 15 days, the micro enterprise shall be deemed registered and can proceed 2

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

with its operation unless revoked by the Local Government Unit (LGU). The CoA to be issued by the LGU shall be effective for a period of two (2) years, renewable every two (2) years. 3. The Municipal or City Mayor shall designate a Micro Enterprise Registration Officer who shall be under the Office of the Treasurer. LGUs shall establish a One-Stop-Business Registration Center to handle the efficient registration and processing of permits/licenses of the concerned enterprises. Likewise, LGUs shall make a periodic evaluation of the micro enterprise's financial status for monitoring and reporting purposes. 4. To defray the administrative costs of registering and monitoring micro enterprises, the LGUs may charge micro enterprises with a registration fee not exceeding One Thousand Pesos (P1,000.00), only after the first two years of operation of the micro enterprise. (b) Small and Medium Enterprises (SME) 1. Small and medium enterprises (SMES) shall be exempted from registration fees charged by the Department of Trade and Industry (DTI) during the first two (2) years of its operation. Submission of a properly filled-out registration form assessed by DTI shall deem SMEs duly registered for the first two years of its operation. 2. On its third year, DTI, through its field offices, shall register the small and medium enterprises (SMEs) and issue a Certificate of Authority (CoA) to enable the SME to avail of the benefits under this Act. Any such application shall be processed within fifteen (15) working days. Should the process, after application, take more than 15 days, the SME shall be deemed registered and can proceed with operations unless revoked by DTI. The Certificate of Authority issued by DTI on the third year upon registration shall be effective for a period of two (2) years, renewable every two (2) years. 3. The DTI shall designate a SME Registration Officer who shall be under the DTI field office concerned. The DTI field offices shall establish a One-Stop-Business Registration Center to handle the efficient registration and processing of permits/licenses of concerned 3

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

enterprises. Likewise, the DTI shall make a periodic evaluation of the SME's financial status for monitoring and reporting purposes. 4. To defray the administrative costs of registering and monitoring small and medium enterprises, the DTI field office may charge a fee not exceeding Five Thousand Pesos (P5,000.00). SECTION 6. Incentives and Benefits. (a) Micro Enterprises.: The following incentives and benefits shall be made available to registered micro enterprises: 1. Exemption from Income Tax. - All micro enterprises shall be exempt from the payment of income tax with respect to income received from the operations of the enterprise; and 2. Exemption from the Coverage of the Minimum Wage Law. - All micro enterprises shall be exempt from the coverage of the Minimum Wage Law: Provided, That all employees covered under this Act shall be entitled to the same benefits given to any regular employee such as, among others, social security and healthcare benefits. (b) Small and Medium Enterprises. - Registered small and medium enterprises which shall hire additional employees subsequent to its registration under this Act, shall be allowed a deduction from its gross income in the amount of Forty Thousand Pesos (P40,000.00) for each new employee hired: Provided, That the maximum allowable deduction from gross income shall not exceed One Hundred Twenty Thousand Pesos (P120,000.00): Provided, further, That the employment must be continuous for a period of at least one (1) year: Provided, finally, That the incentive shall no longer be applicable upon the termination of the employee. This incentive can only be availed for a period of five (5) years from the effectivity of this Act. (c) Micro, Small and Medium Enterprises. - In addition to the above incentives, MSMEs shall be entitled to the following: 4

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

1. Exemption from Value-Added Tax (VAT) Registration and Percentage Tax. - Registered MSMEs whose annual gross selling price or gross value in money received from the sale, barter, or exchange of goods, as well as the annual gross receipts derived from the sale or exchange of services do not exceed Three Million Pesos (P3,000,000.00) shall not be required to be a VAT- registered entity and shall likewise be exempt from the payment of percentage tax under the National Internal Revenue Code, as amended. Should the enterprise exceed the Three Million Pesos (P3,000,000.00) value, it shall no longer be covered by this exemption on the following year; and 2. Local Taxes and Fees for Micro Enterprises LGUs shall not charge micro enterprises any local tax and are encouraged to reduce the amount of applicable fees and charges. 3. Local Taxes and Fees for Small and Medium Enterprises - LGUs are encouraged either to reduce the amount of applicable local taxes, fees and charges imposed or to exempt the small and medium enterprises from the payment of local taxes, fees and charges. SECTION 7. Composition of the Micro, Small and Medium Enterprise Development Council (MSMED). The Council shall be headed by the Secretary of Trade and Industry as Chairman, and may elect from among themselves a Vice-chairman to preside over the Council meetings in the absence of the Chairman. To ensure greater representation by the sectors involved, the members of the Council shall be the following: (a) Secretary of Agriculture; (b) Secretary of the Interior and Local Government; (c) Secretary of Science and Technology; (d) Secretary of Tourism; (e) Chairman of Small Business Corporation; (f) Three (3) representatives from the micro enterprise sector to represent Luzon, Visayas and Mindanao; to focus on the specific needs of micro enterprises.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

(g) Three (3) representatives from the small and medium enterprise (SME) sector to represent Luzon, Visayas and Mindanao; to focus on the specific needs of small and medium enterprises. (h) One representative from the youth sector to focus on the promotion of youth entrepreneurship; (i) One representative from the Microfinance Council; (j) One representative from the labor sector, to be nominated by accredited labor groups; and (k) A representative from the private banking sector: to serve alternately among the Chamber of Thrift Banks; the Rural Bankers Association of the Philippines (RBAP); Bankers Association of the Philippines (BAP); and the Micro Finance Council of the Philippines (MFCP). SECTION 8. Functions of MSMED Council. - In addition to the existing functions of the council as stated in RA 9501 or the Magna Carta for Micro, Small and Medium Enterprise, the following functions shall be added: (a) Development Planning. - MSMED Council shall prepare separate six-year development plans for micro enterprises and for small and medium enterprises (SMEs) to reflect a clear strategy for each sector for approval by the President. (b) Promoting Value Chain Linkages MSMED Council shall provide information and matchmaking services for MSMEs and larger firms to bridge backward and forward value chain linkages. It shall also coordinate flow of information through national websites, business directories and business contact fairs and events. (c) Technical Assistance. The MSMED Council shall develop programs to provide awareness raising, capacity building and training for MSMEs to start and grow their businesses. Assistance may be rendered to MSMEs regarding financial management, 6

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

marketing strategies, enhancement of business plans and other necessary information to help the enterprise overcome business difficulties. SECTION 9. Information Dissemination. - The Philippine Information Agency (PIA), in coordination with DTI, BSP, Department of Labor and Employment (DOLE), and DILG shall ensure the proper and adequate information dissemination of the contents and benefits of this Act to the general public especially to its intended beneficiaries specifically in the barangay level. SECTION 10. Annual Report. - The DTI, BSP, DOLE and DILG, shall submit an annual report to Congress on the status of the implementation of this Act. SECTION 11. Implementing Rules and Regulations.- The Secretary of the Department of Trade and Industry, in consultation with the Secretaries of the Department of Interior and Local Government (DILG), Department of Finance (DOF), Department of Labor and Employment (DOLE) and the Bangko Sentral ng Pilipinas (BSP) Governor shall formulate the necessary rules and regulations to implement the provisions of this Act within ninety (90) days after its approval. The rules and regulations issued pursuant to this Act shall take effect fifteen (15) days after its publication in a newspaper of general circulation. SECTION 12. Penalties.(a) Any person who shall willfully violate any provision of this Act or who shall in any manner commit any act to defeat any provision of this Act shall, upon conviction, be punished by a fine of not less than Twenty-Five Thousand Pesos (P25,000.00) but not more than Fifty Thousand Pesos (P50,000.00) and suffer imprisonment of not less than six (6) months but not more than two (2) years. (b) In case of non-compliance with the provisions of Section 7 of this Act, the BSP shall impose administrative sanctions and other penalties on the concerned lending institutions, including a fine of not less than Five Hundred Thousand Pesos (P500,000.00). Penalties on noncompliance shall be directed to the development of the MSME sector. Ninety percent (90%) of the penalties

1 2 3 4 5 6 7 8 9 10 11

collected should go to the MSMED Council Fund, while the remaining ten percent (10%) should be given to the BSP to cover for administrative expenses. SECTION 13. Separability Clause. - If any provision of this Act shall be heldunconstitutional, the remainder of the Act not otherwise affected shall remain in full force and effect. SECTION 14. Repealing Clause. - Provisions of Republic Act No. 6977, as amended by Republic Act No. 8289 and Republic Act No. 9501, Republic Act No. 9178, and all other existing laws, presidential decrees, executive orders, proclamations or administrative regulations that are inconsistent with the provisions of this Act are hereby amended, modified, superseded, or repealed accordingly. SECTION 15. Effectivity. - This Act shall take effect fifteen (15) days after its publication in the Official Gazette or in at least two (2) newspapers of general circulation.

You might also like

- Sen. Bam Aquino's Sponsorship Speech On Fair CompetitionDocument5 pagesSen. Bam Aquino's Sponsorship Speech On Fair CompetitionTeamBamAquinoNo ratings yet

- RA 10642 Lemon Law LawDocument6 pagesRA 10642 Lemon Law LawTeamBamAquinoNo ratings yet

- RA 10644: Go Negosyo LawDocument5 pagesRA 10644: Go Negosyo LawTeamBamAquinoNo ratings yet

- S.B. 2117: Filipino Sign Language Act in Broadcast Media of 2014Document3 pagesS.B. 2117: Filipino Sign Language Act in Broadcast Media of 2014TeamBamAquinoNo ratings yet

- S.B. 1032: Youth Entrepreneurship BillDocument6 pagesS.B. 1032: Youth Entrepreneurship BillTeamBamAquinoNo ratings yet

- Sen. Bam Aquino's Sponsorship Speeches On Social Enterprise, Youth Entrepreneurship and Lemon Law On Moor Vehicles BillsDocument6 pagesSen. Bam Aquino's Sponsorship Speeches On Social Enterprise, Youth Entrepreneurship and Lemon Law On Moor Vehicles BillsTeamBamAquinoNo ratings yet

- Boston Consulting Group: The Internet EconomyDocument78 pagesBoston Consulting Group: The Internet EconomyTeamBamAquinoNo ratings yet

- S.B. No. 2046: Go Negosyo Bill (UPDATED VERSION)Document7 pagesS.B. No. 2046: Go Negosyo Bill (UPDATED VERSION)TeamBamAquinoNo ratings yet

- Sen. Bam Aquino's Speech at The Pinoy Music Summit 2014Document5 pagesSen. Bam Aquino's Speech at The Pinoy Music Summit 2014TeamBamAquinoNo ratings yet

- S.B. 2122: Anti Discrimination BillDocument12 pagesS.B. 2122: Anti Discrimination BillTeamBamAquinoNo ratings yet

- P.S. Resolution 101: RESOLUTION TO PROVIDE FOR A SENATE COMMIT|EE ON TRADE, COMMERCE, AND ENTREPRENEURSHIP AND DEFINING ITS IURSIDICTION, AMENDING FORTHE PURPOSE sEcT,oN 13 (9) RULE X OF THE SENATE RULESDocument2 pagesP.S. Resolution 101: RESOLUTION TO PROVIDE FOR A SENATE COMMIT|EE ON TRADE, COMMERCE, AND ENTREPRENEURSHIP AND DEFINING ITS IURSIDICTION, AMENDING FORTHE PURPOSE sEcT,oN 13 (9) RULE X OF THE SENATE RULESTeamBamAquinoNo ratings yet

- P.S. Resolution 105: RESOLUTION DIRECTING THE APPROPRIATE SENATE COMMITTEES TO CONDUCT AN INQUIRY, IN AID OF LEGISLATION,INTO THE QUESTIONABLE CONDUCT OF OFFICIALS OF THE BUREAU OF IMMIGRATION ON THE PROFILING OF FILIPINO PASSENGERS WHICH RESULTS IN DISCRIMATION AND IMPAIRMENT OF RIGHT TO TRAVELDocument2 pagesP.S. Resolution 105: RESOLUTION DIRECTING THE APPROPRIATE SENATE COMMITTEES TO CONDUCT AN INQUIRY, IN AID OF LEGISLATION,INTO THE QUESTIONABLE CONDUCT OF OFFICIALS OF THE BUREAU OF IMMIGRATION ON THE PROFILING OF FILIPINO PASSENGERS WHICH RESULTS IN DISCRIMATION AND IMPAIRMENT OF RIGHT TO TRAVELTeamBamAquinoNo ratings yet

- Senator Bam Aquino's Sponsorship Speech of Senate Bill No 2046, Go Negosyo BillDocument5 pagesSenator Bam Aquino's Sponsorship Speech of Senate Bill No 2046, Go Negosyo BillTeamBamAquinoNo ratings yet

- S.B. No. 1091: AN ACT ESTABLISHING A MAGNA CARTA FOR PHILIPPINE INTERNET FREEDOM, CYBERCRIME PREVENTION AND LAW ENFORCEMENT, CYBERDEFENSE AND NATIONAL CYBERSECURITYDocument76 pagesS.B. No. 1091: AN ACT ESTABLISHING A MAGNA CARTA FOR PHILIPPINE INTERNET FREEDOM, CYBERCRIME PREVENTION AND LAW ENFORCEMENT, CYBERDEFENSE AND NATIONAL CYBERSECURITYTeamBamAquinoNo ratings yet

- Social Value ActDocument3 pagesSocial Value ActFoundation for a Sustainable SocietyNo ratings yet

- Resolution No. 100 - Ease of Doing BusinessDocument2 pagesResolution No. 100 - Ease of Doing BusinessTeamBamAquinoNo ratings yet

- S.B. No. 1030: Micro Enterprlse Lnstitutions Development ("MicroDev") ActDocument5 pagesS.B. No. 1030: Micro Enterprlse Lnstitutions Development ("MicroDev") ActTeamBamAquinoNo ratings yet

- S.B. 1031: Pagkaing Pinoy para Sa Batang PinoyDocument4 pagesS.B. 1031: Pagkaing Pinoy para Sa Batang PinoyTeamBamAquinoNo ratings yet

- S.B. 1090: SK Reform Bill by Sen. Bam AquinoDocument14 pagesS.B. 1090: SK Reform Bill by Sen. Bam AquinoTeamBamAquinoNo ratings yet

- S.B. 1027: Philippine Fair Competition ActDocument23 pagesS.B. 1027: Philippine Fair Competition ActTeamBamAquinoNo ratings yet

- SB 1026 - Social Enterprise BillDocument31 pagesSB 1026 - Social Enterprise BillTeamBamAquinoNo ratings yet

- S.B. 1356: People's Fund Bill by Sen. Bam AquinoDocument3 pagesS.B. 1356: People's Fund Bill by Sen. Bam AquinoTeamBamAquinoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ISJ016Document108 pagesISJ0162imediaNo ratings yet

- 2021.11.13 - BTG PACTUAL Research - Nutresa - An Unexpected Tender Offer For Nutresa Was Submitted To The RegulatorDocument6 pages2021.11.13 - BTG PACTUAL Research - Nutresa - An Unexpected Tender Offer For Nutresa Was Submitted To The RegulatorSemanaNo ratings yet

- Trident LTD Moving Up The Value ChainDocument24 pagesTrident LTD Moving Up The Value Chain772092No ratings yet

- Assignment 2 Front Sheet: Qualification BTEC Level 5 HND Diploma in BusinessDocument7 pagesAssignment 2 Front Sheet: Qualification BTEC Level 5 HND Diploma in BusinessTuong Tran Gia LyNo ratings yet

- Statement of Purpose - MS in EconomicsDocument2 pagesStatement of Purpose - MS in EconomicsVishal KuthialaNo ratings yet

- Strategic Management 1Document112 pagesStrategic Management 1Aashish Mehra0% (1)

- Financial Reporting and Analysis QuestionsDocument16 pagesFinancial Reporting and Analysis QuestionsPareshNo ratings yet

- Celebrity Fashion Annual Report 2010Document56 pagesCelebrity Fashion Annual Report 2010Abhishek RajNo ratings yet

- EPF Nomination FormDocument3 pagesEPF Nomination Formjhaji24No ratings yet

- Prescribed Books 2016Document3 pagesPrescribed Books 2016phillip muzhambiNo ratings yet

- Revenue Regulations on Cooperative Tax ExemptionsDocument5 pagesRevenue Regulations on Cooperative Tax ExemptionsmatinikkiNo ratings yet

- Homebase Co-Investment Product GuideDocument27 pagesHomebase Co-Investment Product GuideHappyLand Vietnamese CommunityNo ratings yet

- Acco Nov 2009 Eng MemoDocument19 pagesAcco Nov 2009 Eng Memosadya98No ratings yet

- Accounting for Materials ChapterDocument58 pagesAccounting for Materials ChapterIbrahim Sameer100% (1)

- Crabbe The Owner of The Ocean Hotel Is Concerned AboutDocument2 pagesCrabbe The Owner of The Ocean Hotel Is Concerned AboutAmit PandeyNo ratings yet

- PB1.3 CH1 Using NumbersDocument22 pagesPB1.3 CH1 Using NumbersGadgetGlitchKillNo ratings yet

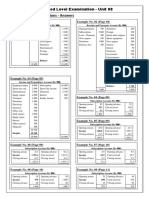

- Not-for-Profit Organizations - Answers: Advanced Level Examination - Unit 08Document12 pagesNot-for-Profit Organizations - Answers: Advanced Level Examination - Unit 08Dimuthu JayasuriyaNo ratings yet

- Benefits and ServicesDocument26 pagesBenefits and ServicesSushmit ShettyNo ratings yet

- Cost of Debt Cost of Preferred Stock Cost of Retained Earnings Cost of New Common StockDocument18 pagesCost of Debt Cost of Preferred Stock Cost of Retained Earnings Cost of New Common StockFadhila HanifNo ratings yet

- Sales Report: Sweet Bliss CompanyDocument6 pagesSales Report: Sweet Bliss CompanyDonna Julian ReyesNo ratings yet

- BA8IC ADJUSTMENTS FOR PARTNERSHIPDocument22 pagesBA8IC ADJUSTMENTS FOR PARTNERSHIPOm JogiNo ratings yet

- Christopher Seifert's Portfolio ProjectDocument4 pagesChristopher Seifert's Portfolio ProjectChris SeifertNo ratings yet

- Caf 1 Ia ST PDFDocument270 pagesCaf 1 Ia ST PDFFizzazubair rana50% (2)

- 0 DTE MEIC - January 16, 2023 by Tammy ChamblessDocument19 pages0 DTE MEIC - January 16, 2023 by Tammy Chamblessben44No ratings yet

- United States Court of Appeals, Third CircuitDocument12 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- 9 Box MatrixDocument3 pages9 Box MatrixSaurav JaiswalNo ratings yet

- Apsee 327Document2 pagesApsee 327manikanta2235789No ratings yet

- Inventory Accounting Methods: Specific Identification MethodDocument9 pagesInventory Accounting Methods: Specific Identification MethodVidhya ChuriNo ratings yet

- Cost of Capital Calculations for Preference Shares, Bonds, Common Stock & WACCDocument5 pagesCost of Capital Calculations for Preference Shares, Bonds, Common Stock & WACCshikha_asr2273No ratings yet

- February 6, 2013Document12 pagesFebruary 6, 2013The Delphos HeraldNo ratings yet