Professional Documents

Culture Documents

Appendix 1 TOF Group Ass - CRP - Taurai090909

Uploaded by

SigalloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Appendix 1 TOF Group Ass - CRP - Taurai090909

Uploaded by

SigalloCopyright:

Available Formats

Appendix 1

Summary

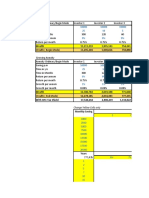

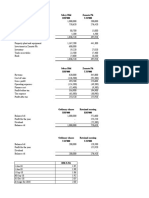

Base Case LIBOR Forecast IRR Average

Worse Case Best Case

Principal $100,000,000 $100,000,000 $100,000,000 $100,000,000 Scenario Base Case LIBOR

LIBORForecast

+ 2.5% LIBOR - 2.5% Cost

Interest rate/cap rate LIBOR forecast 11.31% 10.00% 11.00% Swap 11.80% 11.80% 11.80% 11.80%

Floor rate - - - 8.38% Cap 12.62% 14.09% 10.93% 12.55%

Spread 2.00% 2.00% 2.00% 2.00% Collar 12.19% 13.62% 10.79% 12.20%

Premium - - $1,370,000 -

IRR - Quarterly 2.91% 2.83% 3.02% 2.92%

IRR - Annual 12.18% 11.80% 12.62% 12.19%

Cap all in Collar all

Year Quarter LIBOR Forecast LIBOR Loan CF Fixed rate Swap CF Cap cost Cap CF Collar in cost Collar CF Columbia River Pulp Inc

100,000,000 100,000,000 98,630,000 100,000,000 Financial forecast 1995 1994 1993 1992 1991 1990 1989

Aug-88 Q1 0.0825 (2,562,500) 0.1131 (2,827,500) 0.0825 0.1025 (2,562,500) 0.0838 0.1038 (2,593,750) EBIT 88,975 96,275 77,160 50,934 54,387 74,234 80,308

Q2 0.0875 (2,687,500) 0.1131 (2,827,500) 0.0875 0.1075 (2,687,500) 0.0875 0.1075 (2,687,500) Interest expense 11,181 14,097 20,489 23,465 26,465 29,997 33,149

Q3 0.0925 (2,812,500) 0.1131 (2,827,500) 0.0925 0.1125 (2,812,500) 0.0925 0.1125 (2,812,500) Coverage 7.96 6.83 3.77 2.17 2.06 2.47 2.42

Q4 0.0975 (2,937,500) 0.1131 (2,827,500) 0.0975 0.1175 (2,937,500) 0.0975 0.1175 (2,937,500)

Aug-89 Q1 0.1025 (3,062,500) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1025 0.1225 (3,062,500) Current asset 94,556 93,969 75,641 61,105 54,041 47,888 39,322

Q2 0.1075 (3,187,500) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1075 0.1275 (3,187,500) Current liabilities 8,608 8,276 47,957 23,688 23,266 22,853 23,593

Q3 0.1050 (3,125,000) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1050 0.1250 (3,125,000) Liquidity 10.98 11.35 1.58 2.58 2.32 2.10 1.67

Q4 0.1025 (3,062,500) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1025 0.1225 (3,062,500)

Aug-90 Q1 0.1000 (3,000,000) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1000 0.1200 (3,000,000) Sales 257,413 258,265 323,949 200,793 196,663 208,508 209,168

Q2 0.0975 (2,937,500) 0.1131 (2,827,500) 0.0975 0.1175 (2,937,500) 0.0975 0.1175 (2,937,500) Total assets 175,364 190,907 188,299 189,108 192,049 195,246 195,410

Q3 0.0950 (2,875,000) 0.1131 (2,827,500) 0.0950 0.1150 (2,875,000) 0.0950 0.1150 (2,875,000) ROA 146.79% 135.28% 172.04% 106.18% 102.40% 106.79% 107.04%

Q4 0.0925 (102,812,500) 0.1131 (102,827,500) 0.0925 0.1125 (102,812,500) 0.0925 0.1125 (102,812,500)

IRR 2.915% 2.828% 3.016% 2.918% Net Income 54,006 56,116 38,709 19,149 19,156 29,530 31,191

Shareholders equity 57,301 57,301 57,301 57,301 57,301 57,301 57,301

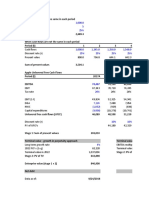

Worse Case LIBOR + 2.5% ROE 94.25% 97.93% 67.55% 33.42% 33.43% 51.53% 54.43%

Principal $100,000,000 $100,000,000 $100,000,000 $100,000,000

Interest rate/cap rate LIBOR forecast 11.31% 10.00% 11.00%

Floor rate - - - 8.38%

Spread 2.00% 2.00% 2.00% 2.00%

Premium - - $3,425,000 -

IRR - Quarterly 3.04% 2.83% 3.35% 3.24%

IRR - Annual 12.72% 11.80% 14.09% 13.62%

Cap all in Collar all

Year Quarter LIBOR Forecast LIBOR Loan CF Fixed rate Swap CF Cap cost Cap CF Collar in cost Collar CF

100,000,000 100,000,000 96,575,000 100,000,000

Aug-88 Q1 0.1075 (2,687,500) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1075 0.1275 (3,187,500)

Q2 0.1125 (2,812,500) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1100 0.1300 (3,250,000)

Q3 0.1175 (2,937,500) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1100 0.1300 (3,250,000)

Q4 0.1225 (3,062,500) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1100 0.1300 (3,250,000)

Aug-89 Q1 0.1275 (3,187,500) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1100 0.1300 (3,250,000)

Q2 0.1325 (3,312,500) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1100 0.1300 (3,250,000)

Q3 0.1300 (3,250,000) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1100 0.1300 (3,250,000)

Q4 0.1275 (3,187,500) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1100 0.1300 (3,250,000)

Aug-90 Q1 0.1250 (3,125,000) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1100 0.1300 (3,250,000)

Q2 0.1225 (3,062,500) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1100 0.1300 (3,250,000)

Q3 0.1200 (3,000,000) 0.1131 (2,827,500) 0.1000 0.1200 (3,000,000) 0.1100 0.1300 (3,250,000)

Q4 0.1175 (102,937,500) 0.1131 (102,827,500) 0.1000 0.1200 (103,000,000) 0.1100 0.1300 (103,250,000)

IRR 3.039% 2.828% 3.351% 3.244%

Best Case LIBOR - 2.5%

Principal $100,000,000 $100,000,000 $100,000,000 $100,000,000

Interest rate/cap rate LIBOR forecast 11.31% 10.00% 11.00%

Floor rate - - - 8.38%

Spread 2.00% 2.00% 2.00% 2.00%

Premium - - $3,425,000 -

IRR - Quarterly 1.79% 2.83% 2.63% 2.59%

IRR - Annual 7.37% 11.80% 10.93% 10.79%

Cap all in Collar all

Year Quarter LIBOR Forecast LIBOR Loan CF Fixed rate Swap CF Cap cost Cap CF Collar in cost Collar CF

100,000,000 100,000,000 96,575,000 100,000,000

Aug-88 Q1 0.0575 (1,437,500) 0.1131 (2,827,500) 0.0575 0.0775 (1,937,500) 0.0838 0.1038 (2,593,750)

Q2 0.0625 (1,562,500) 0.1131 (2,827,500) 0.0625 0.0825 (2,062,500) 0.0838 0.1038 (2,593,750)

Q3 0.0675 (1,687,500) 0.1131 (2,827,500) 0.0675 0.0875 (2,187,500) 0.0838 0.1038 (2,593,750)

Q4 0.0725 (1,812,500) 0.1131 (2,827,500) 0.0725 0.0925 (2,312,500) 0.0838 0.1038 (2,593,750)

Aug-89 Q1 0.0775 (1,937,500) 0.1131 (2,827,500) 0.0775 0.0975 (2,437,500) 0.0838 0.1038 (2,593,750)

Q2 0.0825 (2,062,500) 0.1131 (2,827,500) 0.0825 0.1025 (2,562,500) 0.0838 0.1038 (2,593,750)

Q3 0.0800 (2,000,000) 0.1131 (2,827,500) 0.0800 0.1000 (2,500,000) 0.0838 0.1038 (2,593,750)

Q4 0.0775 (1,937,500) 0.1131 (2,827,500) 0.0775 0.0975 (2,437,500) 0.0838 0.1038 (2,593,750)

Aug-90 Q1 0.0750 (1,875,000) 0.1131 (2,827,500) 0.0750 0.0950 (2,375,000) 0.0838 0.1038 (2,593,750)

Q2 0.0725 (1,812,500) 0.1131 (2,827,500) 0.0725 0.0925 (2,312,500) 0.0838 0.1038 (2,593,750)

Q3 0.0700 (1,750,000) 0.1131 (2,827,500) 0.0700 0.0900 (2,250,000) 0.0838 0.1038 (2,593,750)

Q4 0.0675 (101,687,500) 0.1131 (102,827,500) 0.0675 0.0875 (102,187,500) 0.0838 0.1038 (102,593,750)

IRR 1.793% 2.828% 2.627% 2.594%

You might also like

- AFM WorkingDocument7 pagesAFM Workingsairad1999No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- Financial Models - 2022Document9 pagesFinancial Models - 2022Hamza AsifNo ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- Sensitivity Analysis On Percentage of Sales 9 11 04Document12 pagesSensitivity Analysis On Percentage of Sales 9 11 04Wan Mohamad Noor Hj IsmailNo ratings yet

- Accounting Finance Sem. I Choice Base 81403 Financial Management I Q.P.CODE 24578Document3 pagesAccounting Finance Sem. I Choice Base 81403 Financial Management I Q.P.CODE 24578Gaurav ShettigarNo ratings yet

- Book1 (AutoRecovered)Document5 pagesBook1 (AutoRecovered)Tayba AwanNo ratings yet

- FM09 CH 10 Im PandeyDocument19 pagesFM09 CH 10 Im PandeyJack mazeNo ratings yet

- DCFTemplateDocument5 pagesDCFTemplateRob Keith100% (1)

- Calpine SolutionDocument5 pagesCalpine SolutionDarshan GosaliaNo ratings yet

- Group 5 - Diamond Chemicals AssignmentDocument11 pagesGroup 5 - Diamond Chemicals AssignmentRijul AgrawalNo ratings yet

- CH 9Document6 pagesCH 9K RollsNo ratings yet

- Diamond Energy ResourcesDocument3 pagesDiamond Energy ResourcesMuhammad FikryNo ratings yet

- OMSEC Morning Note 15 09 2022Document6 pagesOMSEC Morning Note 15 09 2022Ropafadzo KwarambaNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- Diamond Chemicals Team 6's DCF Analysis of Merseyside ProjectDocument1 pageDiamond Chemicals Team 6's DCF Analysis of Merseyside Projectkwarden13No ratings yet

- IS, SOFP, SCE My WorkDocument6 pagesIS, SOFP, SCE My WorkoluwapelumiotunNo ratings yet

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- Asset Class 1995 Till DateDocument12 pagesAsset Class 1995 Till DateKirron BinduNo ratings yet

- Listed Companies Highlights: Financial FocusDocument1 pageListed Companies Highlights: Financial FocusT'Tee MiniOns'TmvsNo ratings yet

- Class 9 SolutionsDocument14 pagesClass 9 SolutionsvroommNo ratings yet

- 'Diamond Chemicals PLC (A) ' Exhibit 2Document1 page'Diamond Chemicals PLC (A) ' Exhibit 2hayagreevan vNo ratings yet

- MIT2 96F12 Assn05Document3 pagesMIT2 96F12 Assn05bazezew alebelNo ratings yet

- Valuation Model - Comps, Precedents, DCF, Football Field - BlankDocument10 pagesValuation Model - Comps, Precedents, DCF, Football Field - BlankNmaNo ratings yet

- February 2020 - Final Debt Securities ValuationsDocument6 pagesFebruary 2020 - Final Debt Securities ValuationsMAYANK AGGARWALNo ratings yet

- 2019 Westpac Group Full Year TablesDocument25 pages2019 Westpac Group Full Year TablesAbs PangaderNo ratings yet

- Fm-Nov-Dec 2012Document14 pagesFm-Nov-Dec 2012banglauserNo ratings yet

- Declining BalanceDocument15 pagesDeclining BalanceGigih Adi PambudiNo ratings yet

- OMSEC Morning Note 16 09 2022Document6 pagesOMSEC Morning Note 16 09 2022Ropafadzo KwarambaNo ratings yet

- Analisa KepekaanDocument72 pagesAnalisa KepekaanHilda SusantiNo ratings yet

- 4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFDocument3 pages4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFAkshit SoniNo ratings yet

- Exhibit 1 Comparative Information On The Seven Largest Polypropylene Plants in EuropeDocument7 pagesExhibit 1 Comparative Information On The Seven Largest Polypropylene Plants in EuropetimbulmanaluNo ratings yet

- Cumulative Cash Flow Discounted Cash Flow Cum Discounted Cash FlowDocument173 pagesCumulative Cash Flow Discounted Cash Flow Cum Discounted Cash FlowAditi OholNo ratings yet

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Appendix: Revenue and EBITDA ForecastDocument8 pagesAppendix: Revenue and EBITDA ForecastSouliman MuhammadNo ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- Total Income - Annual: Sales Sales YoyDocument16 pagesTotal Income - Annual: Sales Sales YoyKshatrapati SinghNo ratings yet

- ACF - Capital StructureDocument8 pagesACF - Capital StructureAmit JainNo ratings yet

- DCF Guide Example2020Document6 pagesDCF Guide Example2020jam manNo ratings yet

- Berk Demerzo PGPM CF 2023 Chapter 7 SolutionsDocument25 pagesBerk Demerzo PGPM CF 2023 Chapter 7 SolutionsJayanth DeshmukhNo ratings yet

- B) Price of Bond When YTM Is 6% 1459.90 Price of BondDocument13 pagesB) Price of Bond When YTM Is 6% 1459.90 Price of BondMasab AsifNo ratings yet

- Final Exam For Corporate Finance Module - Term 16.2.A Part 1: Short-Answer QuestionsDocument3 pagesFinal Exam For Corporate Finance Module - Term 16.2.A Part 1: Short-Answer QuestionsHuân NguyễnNo ratings yet

- Valuation Final ExamDocument4 pagesValuation Final ExamJeane Mae Boo100% (1)

- Five Years' Financial Summary: REPORT 2015Document2 pagesFive Years' Financial Summary: REPORT 2015Rizwan ZisanNo ratings yet

- Exhibit 1 Comparative Information On The Seven Largest Polypropylene Plants in EuropeDocument10 pagesExhibit 1 Comparative Information On The Seven Largest Polypropylene Plants in EuropeFadlan AfandiNo ratings yet

- OMSEC Morning Note 01 09 2022Document6 pagesOMSEC Morning Note 01 09 2022Ropafadzo KwarambaNo ratings yet

- Financial Modeling From ACCA GroupDocument37 pagesFinancial Modeling From ACCA GroupNeehsadNo ratings yet

- Smart Task 2Document17 pagesSmart Task 2Mridul royNo ratings yet

- Project Cost (Capex) % of Project CostDocument11 pagesProject Cost (Capex) % of Project Costavinash singhNo ratings yet

- Case Problem StatementDocument11 pagesCase Problem StatementSourabh Chiprikar100% (1)

- Operating Profit - 200 2500 2500 2500 2500Document4 pagesOperating Profit - 200 2500 2500 2500 2500Archana J RetinueNo ratings yet

- Exhibit 2 Runcorn Chemicals DCF Analysis of Merseyside ProjectDocument1 pageExhibit 2 Runcorn Chemicals DCF Analysis of Merseyside ProjectBatool HamzaNo ratings yet

- Examples Bank BalancesheetDocument3 pagesExamples Bank BalancesheetdebojyotiNo ratings yet

- P191B044 - S11 BenchmarkingDocument21 pagesP191B044 - S11 BenchmarkingKshitij MaheshwaryNo ratings yet

- Payback PeriodDocument11 pagesPayback PeriodAliNo ratings yet

- Group Project 2 Sabry Zamato SolutionDocument5 pagesGroup Project 2 Sabry Zamato SolutionSyafahani SafieNo ratings yet

- Alpine Expeditions Operates A Mountain Climbing School in Colorado SomeDocument2 pagesAlpine Expeditions Operates A Mountain Climbing School in Colorado Sometrilocksp SinghNo ratings yet

- The Budget ProcessDocument16 pagesThe Budget ProcessBesha SoriganoNo ratings yet

- Employee Provident Fund - FAQDocument5 pagesEmployee Provident Fund - FAQArgha SarkarNo ratings yet

- CFA Level 2 Fixed Income 2017Document52 pagesCFA Level 2 Fixed Income 2017EdmundSiauNo ratings yet

- Manual Steps SAPNote 1699985Document3 pagesManual Steps SAPNote 1699985chandrasekha3975No ratings yet

- MAIN PPT Business Ethics, Corporate Governance & CSRDocument24 pagesMAIN PPT Business Ethics, Corporate Governance & CSRrajithaNo ratings yet

- 3 Users of Financial StatementsDocument2 pages3 Users of Financial Statementsapi-299265916100% (1)

- Essentials To ICT Market Structure1Document4 pagesEssentials To ICT Market Structure1huda EcharkaouiNo ratings yet

- Doupnik ch11Document33 pagesDoupnik ch11Catalina Oriani0% (1)

- Royal Cargo. ContradictDocument4 pagesRoyal Cargo. ContradictRiffy OisinoidNo ratings yet

- Introduction To Agricultural AccountingDocument54 pagesIntroduction To Agricultural AccountingManal ElkhoshkhanyNo ratings yet

- Fund Acc - Ringkasan Chapter 1Document3 pagesFund Acc - Ringkasan Chapter 1Andini OleyNo ratings yet

- IR MCQS by JWT AghazetaleemDocument192 pagesIR MCQS by JWT AghazetaleemAliza NasirNo ratings yet

- IAS 1 Presentation of Financial StatementsDocument12 pagesIAS 1 Presentation of Financial StatementsIFRS is easyNo ratings yet

- Business AccountingDocument1,108 pagesBusiness AccountingAhmad Haikal100% (1)

- Illovo Sugar (Malawi) PLC - Final Results - 31 Aug 2022Document1 pageIllovo Sugar (Malawi) PLC - Final Results - 31 Aug 2022Mallak AlhabsiNo ratings yet

- Investment Analysis and Portfolio Management: Prof - Rajiv@cms - Ac.inDocument41 pagesInvestment Analysis and Portfolio Management: Prof - Rajiv@cms - Ac.inAshish kumar NairNo ratings yet

- 0102 34 Si Eog 1Document79 pages0102 34 Si Eog 1Sanjiv KubalNo ratings yet

- Different Forms of Business Organizations: By: Ma. Beatrix D. Sampang Bsa - 4Document17 pagesDifferent Forms of Business Organizations: By: Ma. Beatrix D. Sampang Bsa - 4anon_855990044No ratings yet

- Improving Access To Finance in Kazakhstan's Agribusiness SectorDocument91 pagesImproving Access To Finance in Kazakhstan's Agribusiness SectorOECD Global RelationsNo ratings yet

- LTIP E Bill Oct 20 For WebDocument3 pagesLTIP E Bill Oct 20 For WebRabbul RahmanNo ratings yet

- Taxation Law I Cases Digests - 3Document15 pagesTaxation Law I Cases Digests - 3jus edizaNo ratings yet

- Keeping Transformations On TargetDocument11 pagesKeeping Transformations On TargetDimitrisNo ratings yet

- Bond Markets in The MENA RegionDocument59 pagesBond Markets in The MENA RegionstephaniNo ratings yet

- Introduction To Investment BankingDocument45 pagesIntroduction To Investment BankingHuế ThùyNo ratings yet

- Capital Budgeting Techniques IRRDocument12 pagesCapital Budgeting Techniques IRRraza572hammadNo ratings yet

- AlgorithmDocument2 pagesAlgorithmPato MartinezNo ratings yet

- Singapore Property Weekly Issue 137Document14 pagesSingapore Property Weekly Issue 137Propwise.sgNo ratings yet

- CFA Exam Locations (And Can I Change My Test Center - )Document10 pagesCFA Exam Locations (And Can I Change My Test Center - )Sudipto PaulNo ratings yet

- Grant Thornton On Credit Rating AgenciesDocument105 pagesGrant Thornton On Credit Rating AgenciesMoneycontrol News60% (5)