Professional Documents

Culture Documents

Why Stocks Go Up and Down

Uploaded by

mchallisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Why Stocks Go Up and Down

Uploaded by

mchallisCopyright:

Available Formats

Quiz Answers

http://www.pikeinvestments.com/answers.html#anchor301257

QUIZ Answers

Home Table of Contents More Information About the Author Testimonials Order

1.

FALSE Paying a dividend to common stockholders is something the board of directors may choose to do with company earnings. It does not reduce earnings.

Return to Quiz

2.

TRUE Earnings per share really means earnings per common share. Preferred dividends are deducted from earnings to get earnings available for common shareholders. This latter figure is divided by the number of common shares outstanding to get earnings per share. This is covered in Chapter 12.

Return to Quiz

3.

FALSE Retained earnings is one component of Ownership Equity. It cannot be greater than Ownership Equity. See Chapter 2, where you will also learn about Paid in Capital, Additional Paid in Capital, and Common at Par Value.

1 of 8

4/30/2013 2:17 PM

Quiz Answers

http://www.pikeinvestments.com/answers.html#anchor301257

Return to Quiz

4.

TRUE A primary offering just means the company is selling new shares. A primary offering may be the company's initial public offering, or it may be the company's second public offering, or third public offering, etc. See Chapter 5 to learn the difference between a primary offering, a secondary offering, and an initial public offering. Also see question 5 below.

Return to Quiz

5.

FALSE

The word "secondary" is a source of confusion. A secondary offering, correctly speaking, is an offering of already outstanding shares, not new share. Therefore it would have no effect on the company, and would not be dilutive. Such secondaries usually reflect insider shares, or venture capital shares which have not yet been registered with the SEC, and are now being registered and being resold to the public. Unfortunately, the word "secondary" in recent years has also come to be used to mean any primary offering of new shares other than the initial public offering. With this improper use of "secondary" the correct answer to the question is True (because this is really a primary offering). This is initially confusing, but is explained in Chapter 5. Return to Quiz

6.

FALSE

2 of 8

4/30/2013 2:17 PM

Quiz Answers

http://www.pikeinvestments.com/answers.html#anchor301257

An IPO can also be a secondary offering. That is, the shares being registered and sold to the public are unregistered shares which are currently owned by company founders, venture capitalists, and the like. An initial public offering simply means that some of the company's shares are being offered to the public for the first time. It makes no difference whether these shares are primary (new shares being created by the company), or secondary (already outstanding shares) which had not yet been registered.

Return to Quiz

7.

FALSE Not necessarily. The price/earnings ratio is usually related to the company's growth rate. A company whose earnings per share are growing at 20% per year is likely to have a much higher price/earnings ratio than a company which is only growing at only 5% per year. The slower growing company might be a lot riskier.

Return to Quiz

8.

TRUE Companies which have high depreciation and low earnings, for example, may be better valued using a multiple of cash flow. See Chapter 19, but please read Chapters 14 and 16 first.

3 of 8

4/30/2013 2:17 PM

Quiz Answers

http://www.pikeinvestments.com/answers.html#anchor301257

Return to Quiz

9.

FALSE They fall by half. This was an easy one.

Return to Quiz

10.

MAYBE A stock split by itself does not change the value of anybody's stock holdings. See Chapter 6. But sometimes there is a psychological effect which results in the stock rising slightly at about the time of the split, or when the split is first announced.

Return to Quiz

11.

TRUE As long as the company has the cash, it can pay what it wants

4 of 8

4/30/2013 2:17 PM

Quiz Answers

http://www.pikeinvestments.com/answers.html#anchor301257

(usually). Can you think of two exceptions?

Return to Quiz

12.

TRUE Capitalizing R & D costs means taking less expense that year, leaving higher profit. See Chapter 15. Important if you follow companies which have a lot of R & D expense, such as software companies.

Return to Quiz

13.

FALSE Accelerated depreciation is usually greater than straight-line depreciation. Therefore, changing to accelerated depreciation increases expenses, which lowers earnings. See Chapter 14.

Return to Quiz

14.

TRUE

4/30/2013 2:17 PM

5 of 8

Quiz Answers

http://www.pikeinvestments.com/answers.html#anchor301257

The increased depreciation expense will result in lower pretax profit, hence lower taxes, which will result in increased cash flow. See Chapter 14. The difference between cash flow and earnings is a very important concept.

Return to Quiz

15.

FALSE Amortization is an expense. Increasing expenses lowers pretax profit. Questions 12-15 are easy once these terms and concepts are explained clearly. And you need to understand it if you want to discuss investments at a professional level.

Return to Quiz

16.

FALSE Bonds are safer because they are secured by specific assets as well as the company's contractual commitment to pay interest and principal. Debentures are only backed by the latter. I can think of an exception. Can you?

Return to Quiz

6 of 8

4/30/2013 2:17 PM

Quiz Answers

http://www.pikeinvestments.com/answers.html#anchor301257

17.

FALSE Preferred stockholders are paid off ahead of common stockholders, but after all bondholders.

Return to Quiz

18.

TRUE But when long term debt is much greater than equity, the company typically has a low interest coverage ratio, which implies risk. See Chapter 4.

Return to Quiz

19.

TRUE The current yield is just the coupon (annual interest payment) divided by the current price of the bond. The yield-to-maturity also considers the coupon, but in addition, the yield-to-maturity adds the capital gain the bondholder will have if the bond is bought below par and held to maturity. If you want to understand the difference between coupon yield, current yield, and yield-to-maturity, read Chapter 9.

7 of 8

4/30/2013 2:17 PM

Quiz Answers

http://www.pikeinvestments.com/answers.html#anchor301257

Return to Quiz

20.

FALSE Return on capital is a profitability ratio. An increasing return on capital implies improving profitability. The company is most likely becoming less risky. See Chapter 4.

Return to Quiz

THESE QUESTIONS WERE NOT REALLY HARD. READ THE BOOK. YOU WILL LEARN ALL THIS, PLUS A LOT MORE.

8 of 8

4/30/2013 2:17 PM

You might also like

- The Trend Trader Nick Radge On Demand PDFDocument8 pagesThe Trend Trader Nick Radge On Demand PDFDedi Tri LaksonoNo ratings yet

- Evidence Based Technical Analysis PDFDocument2 pagesEvidence Based Technical Analysis PDFJoshua50% (2)

- Learning From Michael BurryDocument20 pagesLearning From Michael Burrymchallis100% (7)

- IT JeganDocument80 pagesIT JeganSinghRavi100% (1)

- Collateral Management GuideDocument20 pagesCollateral Management Guidereggie1010100% (3)

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Screener Setup - GersteinDocument86 pagesScreener Setup - Gersteinsreekesh unnikrishnanNo ratings yet

- TRD !!!appreciating The Risk of Ruin - Nauzer Basara (S&C Mag)Document6 pagesTRD !!!appreciating The Risk of Ruin - Nauzer Basara (S&C Mag)cesarx2No ratings yet

- Top Down Approach and AnalysisDocument11 pagesTop Down Approach and Analysismustafa-ahmed100% (2)

- Walter SchlossDocument2 pagesWalter Schlossmchallis0% (2)

- P3 Trades From Formation, Entry and Exit:: GMCR Green Mountain Coffee RoastersDocument7 pagesP3 Trades From Formation, Entry and Exit:: GMCR Green Mountain Coffee Roasterscwines03No ratings yet

- Term Sheet WhiteDocument3 pagesTerm Sheet WhiteholtfoxNo ratings yet

- Does Sector Rotation WorkDocument9 pagesDoes Sector Rotation WorkfendyNo ratings yet

- Donchian Trading GuidelinesDocument9 pagesDonchian Trading GuidelinesIzzadAfif1990No ratings yet

- Bulkowsky PsicologiaDocument41 pagesBulkowsky Psicologiaamjr1001No ratings yet

- ABnormal Returns With Momentum Contrarian Strategies Using ETFsDocument12 pagesABnormal Returns With Momentum Contrarian Strategies Using ETFsjohan-sNo ratings yet

- Edition 1Document2 pagesEdition 1Angelia ThomasNo ratings yet

- Appel, Masonson, Lydon - Using Relative Strength Analysis To Determine Where To InvestDocument15 pagesAppel, Masonson, Lydon - Using Relative Strength Analysis To Determine Where To InvestRemmy Taas100% (2)

- Reese - Invest Using The Strategies of Wall Street LegendsDocument32 pagesReese - Invest Using The Strategies of Wall Street LegendsMohammad JoharNo ratings yet

- Businessinsider - Relative Strength. How Does Momentum Investing WorkDocument4 pagesBusinessinsider - Relative Strength. How Does Momentum Investing WorkRemmy TaasNo ratings yet

- Diversified Pitchbook 2015Document14 pagesDiversified Pitchbook 2015Tempest SpinNo ratings yet

- Stop Loss For Covered CallDocument7 pagesStop Loss For Covered CallMaria Ariadna Rivera PriscoNo ratings yet

- Profitable Options Strategies: by J.W. JonesDocument43 pagesProfitable Options Strategies: by J.W. Joneswilliam380No ratings yet

- Day Trading PEG Red To Green SetupsDocument5 pagesDay Trading PEG Red To Green Setupsarenaman0528No ratings yet

- The Options Playbook Rookie Strats IDocument36 pagesThe Options Playbook Rookie Strats Ilecee01No ratings yet

- Stay Rich with a Balanced Portfolio: The Price You Pay for Peace of MindFrom EverandStay Rich with a Balanced Portfolio: The Price You Pay for Peace of MindRating: 3 out of 5 stars3/5 (1)

- Forecasting The Future With Momentum Divergence & Mastering MomentumDocument3 pagesForecasting The Future With Momentum Divergence & Mastering MomentumanyzenNo ratings yet

- Oil Shocks To Stock ReturnDocument46 pagesOil Shocks To Stock ReturnJose Mayer SinagaNo ratings yet

- SFO 200811 - Dan Harvey ReprintDocument5 pagesSFO 200811 - Dan Harvey Reprintslait73No ratings yet

- Pairs TradingDocument47 pagesPairs TradingMilind KhargeNo ratings yet

- Sector Rotation StrategyDocument3 pagesSector Rotation Strategyjlb99999100% (1)

- D Ifta Journal 09Document64 pagesD Ifta Journal 09seyed ali nateghiNo ratings yet

- The Stiffness IndicatorDocument10 pagesThe Stiffness IndicatorMiguel Sanchez GuerreroNo ratings yet

- Monroe Trout - BioDocument2 pagesMonroe Trout - BioCKachi713No ratings yet

- Alan Farley-Targeting Profitable Entry & Exit Points PDFDocument29 pagesAlan Farley-Targeting Profitable Entry & Exit Points PDFAaron DrakeNo ratings yet

- The Option Strategy Desk ReferenceDocument171 pagesThe Option Strategy Desk ReferenceMomentum PressNo ratings yet

- Navigation Search Option Vertical Spreads Bull Put Spread Bear Call SpreadDocument7 pagesNavigation Search Option Vertical Spreads Bull Put Spread Bear Call Spreadksk461No ratings yet

- The Handbook of Pairs Trading: Strategies Using Equities, Options, and FuturesFrom EverandThe Handbook of Pairs Trading: Strategies Using Equities, Options, and FuturesNo ratings yet

- Accurate Trader Report PDFDocument7 pagesAccurate Trader Report PDFmateusbrandaobrNo ratings yet

- Ssi Webinar Tom Dorsey PresentationDocument16 pagesSsi Webinar Tom Dorsey PresentationIqbal CaesariawanNo ratings yet

- MartinPringOnPricePatterns Chapter18Document15 pagesMartinPringOnPricePatterns Chapter18rsdprasad100% (1)

- Green Line Breakout (GLB) Explained GMI Remains GreenDocument9 pagesGreen Line Breakout (GLB) Explained GMI Remains GreenChris BoumaNo ratings yet

- TD SequentialDocument8 pagesTD SequentialOxford Capital Strategies LtdNo ratings yet

- The Australian Share Market - A History of DeclinesDocument12 pagesThe Australian Share Market - A History of DeclinesNick RadgeNo ratings yet

- The Profitability of Technical Trading Rules in US Futures Markets: A Data Snooping Free TestDocument36 pagesThe Profitability of Technical Trading Rules in US Futures Markets: A Data Snooping Free TestCodinasound CaNo ratings yet

- The Solitary Trader: Tim RaymentDocument3 pagesThe Solitary Trader: Tim RaymentAdemir Peixoto de AzevedoNo ratings yet

- Warren BuffetDocument11 pagesWarren BuffetmabhikNo ratings yet

- 5LittleKnownCharts MarketGaugeDocument10 pages5LittleKnownCharts MarketGaugeRajendra SinghNo ratings yet

- The Complete Options Trader: A Strategic Reference for Derivatives ProfitsFrom EverandThe Complete Options Trader: A Strategic Reference for Derivatives ProfitsNo ratings yet

- Position Sizing - Jon BoormanDocument4 pagesPosition Sizing - Jon Boormananalyst_anil1450% (2)

- Keene on the Market: Trade to Win Using Unusual Options Activity, Volatility, and EarningsFrom EverandKeene on the Market: Trade to Win Using Unusual Options Activity, Volatility, and EarningsNo ratings yet

- Adaptive Markets - Andrew LoDocument22 pagesAdaptive Markets - Andrew LoQuickie Sanders100% (4)

- Dave Landry On Swing Trading 1 PDFDocument85 pagesDave Landry On Swing Trading 1 PDFRazak Mn86% (7)

- Technical Analysis PDFDocument15 pagesTechnical Analysis PDFdineshonline0% (1)

- Chapter 44 - Relative Strength As A Criterion For Investment SelectionDocument4 pagesChapter 44 - Relative Strength As A Criterion For Investment SelectionAdarsh Jaiswal100% (1)

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- Sector Business Cycle AnalysisDocument9 pagesSector Business Cycle AnalysisGabriela Medrano100% (1)

- Testing Point FigureDocument4 pagesTesting Point Figureshares_leoneNo ratings yet

- Goldman Sachs Naked Short SellingDocument38 pagesGoldman Sachs Naked Short Sellingrichardck61No ratings yet

- How To Use IGCS in Your Trading PDFDocument11 pagesHow To Use IGCS in Your Trading PDFNil DorcaNo ratings yet

- How To Recognize Great Performing Stocks: Your Guide To Spot The Double Bottom Chart PatternDocument16 pagesHow To Recognize Great Performing Stocks: Your Guide To Spot The Double Bottom Chart PatternKoteswara Rao CherukuriNo ratings yet

- Institutional Buying Indicator PDFDocument4 pagesInstitutional Buying Indicator PDFBalajii RangarajuNo ratings yet

- 15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia FeaturesDocument2 pages15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia Featureskuruvillaj2217No ratings yet

- Security in Three Ds - Detect, Decide and DenyDocument6 pagesSecurity in Three Ds - Detect, Decide and DenymchallisNo ratings yet

- Excel Statistics ManualDocument31 pagesExcel Statistics ManualmchallisNo ratings yet

- Walter Schloss - Barrons 1985Document7 pagesWalter Schloss - Barrons 1985Boost944100% (5)

- The 8 Rules of Dividend InvestingDocument9 pagesThe 8 Rules of Dividend Investingmchallis100% (1)

- Munger Investing Principles ChecklistDocument2 pagesMunger Investing Principles Checklistsj_mcginnisNo ratings yet

- Bosses Use Anonymous Networks To Learn What Workers Really Think - WSJDocument4 pagesBosses Use Anonymous Networks To Learn What Workers Really Think - WSJmchallisNo ratings yet

- David Foster Wallace On Argumentative Writing and NonfictionDocument3 pagesDavid Foster Wallace On Argumentative Writing and Nonfictionmchallis0% (1)

- PEP 20 - The Zen of PythonDocument1 pagePEP 20 - The Zen of PythonmchallisNo ratings yet

- Use The Benjamin Graham Investing Checklist To Invest Like HimDocument4 pagesUse The Benjamin Graham Investing Checklist To Invest Like Himmchallis100% (1)

- To Fall in Love With AnyoneDocument7 pagesTo Fall in Love With AnyonemchallisNo ratings yet

- Investment MD Book ListDocument8 pagesInvestment MD Book Listmchallis100% (1)

- Converting VirtualBox VM To A Xen Hypervisor Virtual Machine - ServerStackDocument4 pagesConverting VirtualBox VM To A Xen Hypervisor Virtual Machine - ServerStackmchallisNo ratings yet

- ConsumerReports On AntiVirus SoftwareDocument2 pagesConsumerReports On AntiVirus SoftwaremchallisNo ratings yet

- FOGUserGuide - FOGProject WikiDocument15 pagesFOGUserGuide - FOGProject Wikimchallis100% (1)

- DooppDocument55 pagesDooppanon_948484969No ratings yet

- Windows 8 1 Power User GuideDocument20 pagesWindows 8 1 Power User GuidemchallisNo ratings yet

- Celesfr - Install FOG in CentOS 5Document6 pagesCelesfr - Install FOG in CentOS 5mchallisNo ratings yet

- How To Network Boot (PXE) An Automated Installation of Citrix XenDocument4 pagesHow To Network Boot (PXE) An Automated Installation of Citrix XenmchallisNo ratings yet

- Windows 7 Product GuideDocument140 pagesWindows 7 Product GuideFirli RasyiidNo ratings yet

- FOGUserGuide - FOGProject WikiDocument15 pagesFOGUserGuide - FOGProject Wikimchallis100% (1)

- Betting On The Blind Side - Vanity FairDocument4 pagesBetting On The Blind Side - Vanity FairmchallisNo ratings yet

- (Fog) FOG & XenserverDocument4 pages(Fog) FOG & XenservermchallisNo ratings yet

- Mondorescue Howto PDFDocument53 pagesMondorescue Howto PDFTitus Kernel MaestriaNo ratings yet

- The Origins of Michael Burry, Online - NYTimesDocument2 pagesThe Origins of Michael Burry, Online - NYTimesmchallisNo ratings yet

- Vanderbilt Chancellor Talk April 5 2011 BurryDocument10 pagesVanderbilt Chancellor Talk April 5 2011 Burrymchallis100% (1)

- Boring PortfolioDocument2 pagesBoring PortfoliomchallisNo ratings yet

- Big Book of Alcoholics Anonymous and The Urantia BookDocument20 pagesBig Book of Alcoholics Anonymous and The Urantia Bookmchallis0% (1)

- Simulation Tutorial QuestionsDocument2 pagesSimulation Tutorial QuestionsClaudia ChoiNo ratings yet

- Keown Chapter 8Document33 pagesKeown Chapter 8be_aeonNo ratings yet

- Chapter 13 MC PracticalDocument16 pagesChapter 13 MC PracticalAyesha BajwaNo ratings yet

- Corporate LawDocument14 pagesCorporate LawAnika SharmaNo ratings yet

- Capital MarketsDocument29 pagesCapital MarketsShivangiNo ratings yet

- NCMR Brochure Intl Edition - Pdf.coredownloadDocument47 pagesNCMR Brochure Intl Edition - Pdf.coredownload王晓斌No ratings yet

- Sol. Man. - Chapter 15 EpsDocument12 pagesSol. Man. - Chapter 15 Epsfinn mertensNo ratings yet

- Practice Question Shareholder Equity 19052021 024102pmDocument1 pagePractice Question Shareholder Equity 19052021 024102pmHasaan FarooqNo ratings yet

- Components of Indian Stock MarketDocument13 pagesComponents of Indian Stock MarketHarmender Singh SalujaNo ratings yet

- THE Complete Beginner'S Guide: Simple StockmarketDocument37 pagesTHE Complete Beginner'S Guide: Simple StockmarketDharshiniNo ratings yet

- Global Exchange Merger ManiaDocument12 pagesGlobal Exchange Merger ManiatfeditorNo ratings yet

- FINN3222 - Final Exam Review SolutionsDocument5 pagesFINN3222 - Final Exam Review Solutionsangelbear2577No ratings yet

- Chapter 5 Understanding Capital MarketDocument4 pagesChapter 5 Understanding Capital MarketSanmay MudbidrikarNo ratings yet

- Acquisition & Interest Date Interest Earned 12% Rate Interest Income 14% Rate Discount Amortization Book ValueDocument5 pagesAcquisition & Interest Date Interest Earned 12% Rate Interest Income 14% Rate Discount Amortization Book ValueGray JavierNo ratings yet

- Mezzanine Finance 12Document8 pagesMezzanine Finance 12bryant_bedwellNo ratings yet

- Atmxnet Limited: 71, Rawstorne ST, London, EC1V 7NQ, UNITED KINGDOMDocument1 pageAtmxnet Limited: 71, Rawstorne ST, London, EC1V 7NQ, UNITED KINGDOMH MNo ratings yet

- Chanos WSJ Article 1985Document12 pagesChanos WSJ Article 1985Franklin ForwardNo ratings yet

- Erpm 1Document33 pagesErpm 1Nivethitha NarayanasamyNo ratings yet

- Past Year Question Chapter 6Document6 pagesPast Year Question Chapter 6nur izzatiNo ratings yet

- Trade The Pool - EbookDocument21 pagesTrade The Pool - EbookFelipe VeritaNo ratings yet

- Option Profit AcceleratorDocument129 pagesOption Profit AcceleratorlordNo ratings yet

- AQR Tail Risk Hedging Contrasting Put and Trend Strategies PDFDocument16 pagesAQR Tail Risk Hedging Contrasting Put and Trend Strategies PDFJOEL JOHNSON 1723222No ratings yet

- Lesson Two-3Document10 pagesLesson Two-3Ruth NyawiraNo ratings yet

- RSM230 Chapter NotesDocument15 pagesRSM230 Chapter NotesJoey LinNo ratings yet

- Chapter 4 Corporate StockDocument5 pagesChapter 4 Corporate StockJhanice MartinezNo ratings yet

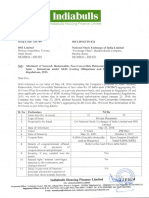

- Allotment of NCD's (Company Update)Document2 pagesAllotment of NCD's (Company Update)Shyam SunderNo ratings yet