Professional Documents

Culture Documents

Brief Exercises CHAPTER 7

Uploaded by

Trang LeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Brief Exercises CHAPTER 7

Uploaded by

Trang LeCopyright:

Available Formats

12/10/13

Cash and Receivables

Print this page

BRIEF EXERCISES

BE7-1. 1 Kraft Enterprises owns the following assets at December 31, 2014. Cash in banksavings account 68,000 Checking account balance 17,000 Cash on hand 9,300 Postdated checks 750 Cash refund due from IRS 31,400 Certificates of deposit (180-day) 90,000 What amount should be reported as cash? BE7-2. 4 Restin Co. uses the gross method to record sales made on credit. On June 1, 2014, it made sales of $50,000 with terms 3/15, n/45. On June 12, 2014, Restin received full payment for the June 1 sale. Prepare the required journal entries for Restin Co. BE7-3. 4 Use the information from BE7-2, assuming Restin Co. uses the net method to account for cash discounts. Prepare the required journal entries for Restin Co. BE7-4. 5 Wilton, Inc. had net sales in 2014 of $1,400,000. At December 31, 2014, before adjusting entries, the balances in selected accounts were: Accounts Receivable $250,000 debit, and Allowance for Doubtful Accounts $2,400 credit. If Wilton estimates that 2% of its net sales will prove to be uncollectible, prepare the December 31, 2014, journal entry to record bad debt expense. BE7-5. 5 Use the information presented in BE7-4 for Wilton, Inc. (a) Instead of estimating the uncollectibles at 2% of net sales, assume that 10% of accounts receivable will prove to be uncollectible. Prepare the entry to record bad debt expense. (b) Instead of estimating uncollectibles at 2% of net sales, assume Wilton prepares an aging schedule that estimates total uncollectible accounts at $24,600. Prepare the entry to record bad debt expense. BE7-6. 6 Milner Family Importers sold goods to Tung Decorators for $30,000 on November 1, 2014, accepting Tung's $30,000, 6-month, 6% note. Prepare Milner's November 1 entry, December 31 annual adjusting entry, and May 1 entry for the collection of the note and interest. BE7-7. 6 Dold Acrobats lent $16,529 to Donaldson, Inc., accepting Donaldson's 2-year, $20,000, zero-interestbearing note. The implied interest rate is 10%. Prepare Dold's journal entries for the initial transaction, recognition of interest each year, and the collection of $20,000 at maturity. BE7-8. 8 On October 1, 2014, Chung, Inc. assigns $1,000,000 of its accounts receivable to Seneca National Bank as

edugen.wileyplus.com/edugen/courses/crs7181/kieso9781118147290/c07/a2llc285NzgxMTE4MTQ3MjkwYzA3LWV4c2VjLTAwMDMueGZvcm0.enc?course=cr 1/3

12/10/13

Cash and Receivables

collateral for a $750,000 note. The bank assesses a finance charge of 2% of the receivables assigned and interest on the note of 9%. Prepare the October 1 journal entries for both Chung and Seneca. BE7-9. 8 Wood Incorporated factored $150,000 of accounts receivable with Engram Factors Inc. on a withoutrecourse basis. Engram assesses a 2% finance charge of the amount of accounts receivable and retains an amount equal to 6% of accounts receivable for possible adjustments. Prepare the journal entry for Wood Incorporated and Engram Factors to record the factoring of the accounts receivable to Engram. BE7-10. 8 Use the information in BE7-9 for Wood. Assume that the receivables are sold with recourse. Prepare the journal entry for Wood to record the sale, assuming that the recourse liability has a fair value of $7,500. BE7-11. 8 Arness Woodcrafters sells $250,000 of receivables to Commercial Factors, Inc. on a with recourse basis. Commercial assesses a finance charge of 5% and retains an amount equal to 4% of accounts receivable. Arness estimates the fair value of the recourse liability to be $8,000. Prepare the journal entry for Arness to record the sale. BE7-12. 8 Use the information presented in BE7-11 for Arness Woodcrafters but assume that the recourse liability has a fair value of $4,000, instead of $8,000. Prepare the journal entry and discuss the effects of this change in the value of the recourse liability on Arness's financial statements. BE7-13. 9 Recent financial statements of General Mills, Inc. report net sales of $12,442,000,000. Accounts receivable are $912,000,000 at the beginning of the year and $953,000,000 at the end of the year. Compute General Mills' accounts receivable turnover. Compute General Mills' average collection period for accounts receivable in days. *BE7-14. 10 Finman Company designated Jill Holland as petty cash custodian and established a petty cash fund of $200. The fund is reimbursed when the cash in the fund is at $15. Petty cash receipts indicate funds were disbursed for office supplies $94 and miscellaneous expense $87. Prepare journal entries for the establishment of the fund and the reimbursement. *BE7-15. 10 Horton Corporation is preparing a bank reconciliation and has identified the following potential reconciling items. For each item, indicate if it is (1) added to balance per bank statement, (2) deducted from balance per bank statement, (3) added to balance per books, or (4) deducted from balance per books. (a) Deposit in transit $5,500. (b) Bank service charges $25. (c) Interest credited to Horton's account $31. (d) Outstanding checks $7,422. (e) NSF check returned $377. *BE7-16. 10

2/3

edugen.wileyplus.com/edugen/courses/crs7181/kieso9781118147290/c07/a2llc285NzgxMTE4MTQ3MjkwYzA3LWV4c2VjLTAwMDMueGZvcm0.enc?course=cr

12/10/13

Cash and Receivables

Use the information presented in *BE7-15 for Horton Corporation. Prepare any entries necessary to make Horton's accounting records correct and complete. *BE7-17. 11 Assume that Toni Braxton Company has recently fallen into financial difficulties. By reviewing all available evidence on December 31, 2014, one of Toni Braxton's creditors, the National American Bank, determined that Toni Braxton would pay back only 65% of the principal at maturity. As a result, the bank decided that the loan was impaired. If the loss is estimated to be $225,000, what entry(ies) should National American Bank make to record this loss?

Copyright 2012 John Wiley & Sons, Inc. All rights reserved.

edugen.wileyplus.com/edugen/courses/crs7181/kieso9781118147290/c07/a2llc285NzgxMTE4MTQ3MjkwYzA3LWV4c2VjLTAwMDMueGZvcm0.enc?course=cr

3/3

You might also like

- Intermediate Accounting IFRS Edition Chapter 07 Cash and ReceivablesDocument109 pagesIntermediate Accounting IFRS Edition Chapter 07 Cash and ReceivablesAnnisayuniarz100% (4)

- Ananda Febrian P.S - 041911333118 - Tugas Akm 8Document5 pagesAnanda Febrian P.S - 041911333118 - Tugas Akm 8sari ayuNo ratings yet

- Accounting Textbook Solutions - 39Document19 pagesAccounting Textbook Solutions - 39acc-expert0% (1)

- Essence Company Blends and Sells Designer FragrancesDocument2 pagesEssence Company Blends and Sells Designer FragrancesElliot Richard100% (1)

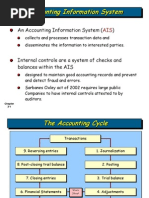

- Wiley - Chapter 3: The Accounting Information SystemDocument36 pagesWiley - Chapter 3: The Accounting Information SystemIvan BliminseNo ratings yet

- 1.kieso 2020-1118-1183Document66 pages1.kieso 2020-1118-1183dindaNo ratings yet

- Problems Chapter 7Document9 pagesProblems Chapter 7Trang Le0% (1)

- 3 Cash - Assignment PDFDocument6 pages3 Cash - Assignment PDFCatherine RiveraNo ratings yet

- Current Liabilities and Contingencies: Intermediate Accounting 12th Edition Kieso, Weygandt, and WarfieldDocument75 pagesCurrent Liabilities and Contingencies: Intermediate Accounting 12th Edition Kieso, Weygandt, and WarfieldKris Gersel Micah LirazanNo ratings yet

- Diskusi Mid Test - Meeting 7Document26 pagesDiskusi Mid Test - Meeting 7Jimmy LimNo ratings yet

- PT ANEKA KARYA Revenue Recognition Construction ContractDocument7 pagesPT ANEKA KARYA Revenue Recognition Construction Contract30 Novita Kusuma WardhaniNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- 6.PR Spoilage Good Proses CostingDocument2 pages6.PR Spoilage Good Proses CostingSembilan 19No ratings yet

- Solution Manual For Advanced Accounting 11th Edition by Beams 3 PDF FreeDocument14 pagesSolution Manual For Advanced Accounting 11th Edition by Beams 3 PDF Freeluxion bot100% (1)

- Chapter 16Document6 pagesChapter 16YasirNo ratings yet

- 1 Intermediate Accounting IFRS 3rd Edition-554-569Document16 pages1 Intermediate Accounting IFRS 3rd Edition-554-569Khofifah SalmahNo ratings yet

- Chapter 3Document13 pagesChapter 3ashibhallauNo ratings yet

- Intermediate Accounting - Kieso - Chapter 9Document65 pagesIntermediate Accounting - Kieso - Chapter 9Steffy Amory100% (1)

- Audit 12 - Rizq Aly AfifDocument2 pagesAudit 12 - Rizq Aly AfifRizq Aly AfifNo ratings yet

- Week13 SolutionsDocument14 pagesWeek13 SolutionsRian RorresNo ratings yet

- Chapter 8 PDFDocument62 pagesChapter 8 PDFgetasewNo ratings yet

- CH16Document80 pagesCH16mahinNo ratings yet

- BookDocument111 pagesBookRey Salvador Batan, Jr.No ratings yet

- Firda Arfianti - LC53 - Consolidated Workpaper, Wholly Owned SubsidiaryDocument3 pagesFirda Arfianti - LC53 - Consolidated Workpaper, Wholly Owned SubsidiaryFirdaNo ratings yet

- ACY4001 Individual Assignment 2 SolutionsDocument7 pagesACY4001 Individual Assignment 2 SolutionsMorris LoNo ratings yet

- KIeso Chapter 18 Part 1Document8 pagesKIeso Chapter 18 Part 1Pelangi DiamondNo ratings yet

- 6-GL and FR CycleDocument6 pages6-GL and FR Cyclehangbg2k3No ratings yet

- Chapter 4 - Completing The Accounting CycleDocument142 pagesChapter 4 - Completing The Accounting Cycleyoantan100% (1)

- Income Statement CH 4Document6 pagesIncome Statement CH 4Omar Hosny100% (1)

- ACC-423 Learning Team B Week 2 Textbook ProblemsDocument10 pagesACC-423 Learning Team B Week 2 Textbook ProblemsdanielsvcNo ratings yet

- ACCT550 Homework Week 1Document6 pagesACCT550 Homework Week 1Natasha DeclanNo ratings yet

- Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsDocument53 pagesMultinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsMostafa Monsur AhmedNo ratings yet

- Kieso IFRS4 TB ch17Document68 pagesKieso IFRS4 TB ch17Scarlet WitchNo ratings yet

- Wahyudi-Syaputra Assignment-2 Akl-IiDocument4 pagesWahyudi-Syaputra Assignment-2 Akl-IiWahyudi SyaputraNo ratings yet

- Cost-plus target return pricing and activity-based costing analysisDocument7 pagesCost-plus target return pricing and activity-based costing analysisAryan LeeNo ratings yet

- Achievement Test 3.chapters 5&6Document9 pagesAchievement Test 3.chapters 5&6Quỳnh Vũ100% (1)

- Pertemuan 8 Chapter 17Document29 pagesPertemuan 8 Chapter 17Jordan Siahaan100% (1)

- Exercise - Dilutive Securities - AdillaikhsaniDocument4 pagesExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsan100% (1)

- CH 08Document10 pagesCH 08Antonios FahedNo ratings yet

- FinalDocument5 pagesFinalanika fierroNo ratings yet

- ch9 CorrectedDocument6 pagesch9 CorrectedWadood AhmedNo ratings yet

- Soal Ch. 15Document6 pagesSoal Ch. 15Kyle KuroNo ratings yet

- Analisis Biaya Semester Gasal 2016 - 2017 Tugas Individual 2Document3 pagesAnalisis Biaya Semester Gasal 2016 - 2017 Tugas Individual 2Maulana HasanNo ratings yet

- Chapter 4 Branch AccountingDocument31 pagesChapter 4 Branch AccountingAkkamaNo ratings yet

- Chapter 21 Latihan SoalDocument10 pagesChapter 21 Latihan SoalJulyaniNo ratings yet

- Homework Chapter 7Document12 pagesHomework Chapter 7Trung Kiên NguyễnNo ratings yet

- Kisi2 UAS AKM TerjawabDocument8 pagesKisi2 UAS AKM TerjawabBakhtiar AlakadarnyaNo ratings yet

- Latihans segmented reporting and absorption vs variable costingDocument3 pagesLatihans segmented reporting and absorption vs variable costingPrisilia AudilaNo ratings yet

- Intermediate Accounting - Kieso - Chapter 1Document46 pagesIntermediate Accounting - Kieso - Chapter 1Steffy AmoryNo ratings yet

- Chapter 3 ExaminationDocument4 pagesChapter 3 ExaminationSurameto HariyadiNo ratings yet

- Newman Hardware Store Completed The Following Merchandising Tran PDFDocument1 pageNewman Hardware Store Completed The Following Merchandising Tran PDFAnbu jaromiaNo ratings yet

- Working 3Document6 pagesWorking 3Hà Lê DuyNo ratings yet

- The Statement of Financial Position of Stancia Sa at DecemberDocument1 pageThe Statement of Financial Position of Stancia Sa at DecemberCharlotte100% (1)

- Tugas Akuntansi Keuangan LanjutanDocument8 pagesTugas Akuntansi Keuangan LanjutanMin DaeguNo ratings yet

- FINANCIAL ACCOUNTING IFRS EDITION SLIDES ch02Document51 pagesFINANCIAL ACCOUNTING IFRS EDITION SLIDES ch02salmanyz6100% (2)

- Assignment 5-2020Document2 pagesAssignment 5-2020Muhammad Hamza0% (4)

- Exercise Chap 7Document16 pagesExercise Chap 7JF FNo ratings yet

- Chapter 7 SolutionsDocument6 pagesChapter 7 SolutionsJay100% (1)

- CH 07Document8 pagesCH 07Holly MotleyNo ratings yet

- Problems Set CDocument5 pagesProblems Set CDiem Khoa PhanNo ratings yet

- Exam 1 Study Guide Chapter Questions TypesDocument3 pagesExam 1 Study Guide Chapter Questions TypesTrang LeNo ratings yet

- NCAA Database Design with Deletion ConstraintsDocument5 pagesNCAA Database Design with Deletion ConstraintsTrang Le75% (4)

- 1130 Emily Sprainis A3 O2Document3 pages1130 Emily Sprainis A3 O2Trang LeNo ratings yet

- ESCH WebRequest Fall 2015Document2 pagesESCH WebRequest Fall 2015Trang LeNo ratings yet

- 1130 Emily Sprainis A3 O2Document3 pages1130 Emily Sprainis A3 O2Trang LeNo ratings yet

- 3304 Chapter 3 Text SolutionsDocument32 pages3304 Chapter 3 Text SolutionsTrang LeNo ratings yet

- MIS 4374 Lecture 01Document51 pagesMIS 4374 Lecture 01Trang LeNo ratings yet

- MBA CSU Admission ProcessDocument2 pagesMBA CSU Admission ProcessTrang LeNo ratings yet

- Adjusting Entries HandoutDocument3 pagesAdjusting Entries HandoutTrang LeNo ratings yet

- Appendix 7B Impairments of ReceivablesDocument3 pagesAppendix 7B Impairments of ReceivablesTrang LeNo ratings yet

- Assignment 6, Option 2 (Chapter 6: Behavioral Modeling)Document1 pageAssignment 6, Option 2 (Chapter 6: Behavioral Modeling)Trang LeNo ratings yet

- Problems Chapter 7Document9 pagesProblems Chapter 7Trang Le0% (1)

- Exam 2Document3 pagesExam 2Trang LeNo ratings yet

- Notes ReceivableDocument7 pagesNotes ReceivableTrang Le100% (3)

- Accounts ReceivableDocument9 pagesAccounts ReceivableTrang LeNo ratings yet

- Solutions To Chapter 2 Why Corporations NeedDocument5 pagesSolutions To Chapter 2 Why Corporations NeedfarhanahmednagdaNo ratings yet

- Appendix 7B Impairments of ReceivablesDocument3 pagesAppendix 7B Impairments of ReceivablesTrang LeNo ratings yet

- GMAT Idiom ListDocument8 pagesGMAT Idiom ListTrang LeNo ratings yet

- Summary of Stat 581/582: Text: A Probability Path by Sidney Resnick Taught by Dr. Peter OlofssonDocument26 pagesSummary of Stat 581/582: Text: A Probability Path by Sidney Resnick Taught by Dr. Peter OlofssonTrang LeNo ratings yet

- Estimating Confidence IntervalsDocument2 pagesEstimating Confidence IntervalsTrang LeNo ratings yet

- De 1Document4 pagesDe 1Trang LeNo ratings yet

- Citi BankDocument21 pagesCiti BankVysakh PkNo ratings yet

- The National Economic and Development Authority: Pambansang Pangasiwaan Sa Kabuhayan at PagpapaunladDocument8 pagesThe National Economic and Development Authority: Pambansang Pangasiwaan Sa Kabuhayan at PagpapaunladEricajane GumilaoNo ratings yet

- RFP RTGSDocument14 pagesRFP RTGSShakil Chowdhury0% (1)

- Shriram Transport Finance Company LTD: Customer Details Guarantor DetailsDocument3 pagesShriram Transport Finance Company LTD: Customer Details Guarantor DetailsThirumalasetty SudhakarNo ratings yet

- Model Bank Digital Channels: Online Banking: Pre-Sales Demo User GuideDocument18 pagesModel Bank Digital Channels: Online Banking: Pre-Sales Demo User GuideigomezNo ratings yet

- Original Proposal of Georgia Bank and Trust To Columbia County For Banking ServicesDocument20 pagesOriginal Proposal of Georgia Bank and Trust To Columbia County For Banking ServicesAllie M GrayNo ratings yet

- Gmail - PHA Well Wishers Sent You An Amazon Pay Gift Cardd!Document2 pagesGmail - PHA Well Wishers Sent You An Amazon Pay Gift Cardd!dhanrajNo ratings yet

- Agent Banking Tariff Poster FinalDocument1 pageAgent Banking Tariff Poster FinalNicholas AmanyaNo ratings yet

- Bank Reconciliation BookkeepingDocument5 pagesBank Reconciliation BookkeepingJoyce Ericka P. BalonNo ratings yet

- Basel ReportDocument8 pagesBasel ReportskenkanNo ratings yet

- Komitmen Fee 3% Serang BantenDocument2 pagesKomitmen Fee 3% Serang BantenHardi HendratmoNo ratings yet

- On Line Audit 2Document2 pagesOn Line Audit 2Nicolas ErnestoNo ratings yet

- Multiple Bank Account MandateDocument2 pagesMultiple Bank Account Mandateanaga1982No ratings yet

- Top 100 Bank of the Philippine Islands StockholdersDocument3 pagesTop 100 Bank of the Philippine Islands StockholdersAimThon Sadang GonzalesNo ratings yet

- Jaiib - 1 Mcqs Nov 2017 MDocument108 pagesJaiib - 1 Mcqs Nov 2017 MPs PadhuNo ratings yet

- TVM - QuestionsDocument2 pagesTVM - QuestionsUdittiNo ratings yet

- DocumentDocument1 pageDocumentAdminAli100% (1)

- Bangued Loan Agreement RatificationDocument2 pagesBangued Loan Agreement RatificationAmelia BersamiraNo ratings yet

- Notice - Opening New Joint Bank Ac by JVD Scholarship Holders - RegDocument1 pageNotice - Opening New Joint Bank Ac by JVD Scholarship Holders - RegSuneel KumarNo ratings yet

- Tata - Transaction Slip-NO CODEDocument1 pageTata - Transaction Slip-NO CODEsudeshna palitNo ratings yet

- Proof of CashDocument2 pagesProof of CashAiden Pats80% (5)

- Why Co-op Banks FailDocument22 pagesWhy Co-op Banks FailRohit YadavNo ratings yet

- MBA Thesis On Challenges of Commercial Microfinance in EthiopiaDocument97 pagesMBA Thesis On Challenges of Commercial Microfinance in Ethiopiahailu letaNo ratings yet

- Debentures and ChargesDocument2 pagesDebentures and ChargesAnshuman ChakrabortyNo ratings yet

- HDFC Bank - Wikipedia, The Free Encyclopedia - Part2Document1 pageHDFC Bank - Wikipedia, The Free Encyclopedia - Part2Rahul LuharNo ratings yet

- Operating Guidelines For DonorsDocument13 pagesOperating Guidelines For DonorsKasim Shaikh100% (1)

- Unocoin Start-Up Case Study - Bitcoin Platform in IndiaDocument3 pagesUnocoin Start-Up Case Study - Bitcoin Platform in IndiaMadhav LuthraNo ratings yet

- Credit AgreementDocument102 pagesCredit AgreementKnowledge Guru100% (1)

- Chapter 7 Loans ReceivableDocument12 pagesChapter 7 Loans ReceivableJohn Fraleigh Dagohoy Carillo100% (1)

- Language For Using Money When TravellingDocument4 pagesLanguage For Using Money When TravellingKrisNo ratings yet