Professional Documents

Culture Documents

Specialty Toys Problem PDF

Uploaded by

Santanu DasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Specialty Toys Problem PDF

Uploaded by

Santanu DasCopyright:

Available Formats

Introduction to Statistics and

Econometrics

Case Problem

SPECIALTY TOYS

Specialty Toys

Specialty faces the decision of how many

Weather Teddy units to order for the coming

holiday season. Members of the management

team suggested order quantities of

15000, 18000, 24000 or 28000 units. The wide

range of order quantities suggested indicate

considerable disagreement concerning the

market potential. The product management

team asks you for an analysis of the stock-out

probabilities for various order quantities,

an estimate of the profit potential, and to help

make an order quantity recommendation.

Specialty expects to sell Weather Teddy for

$24 based on a cost of $16 per unit. If

inventory remains after the holiday

season, Specialty will sell all surplus inventory

for $5 per unit.

After reviewing the sales history of similar

products, Specialtys senior sales forecaster

predicted an expected demand of 20,000

units with a 0.95 probability that demand

would be between 10,000 units and 30,000

units.

Questions

Approximate the demand distribution using

Normal distribution and sketch the distribution.

Compute the probability of a stock-out for the

order quantities suggested by members of the

management team.

Compute the projected profit for the order

quantities suggested by the management team

under three scenarios: worst case in which sales

is 10,000 units, most likely case in which sales is

20,000 units and best case in which sales is

30,000 units.

Questions

One of Specialtys managers felt that the profit potential

was so great that the order quantity should have a 70%

chance of meeting demand and only a 30% chance of any

stock-outs. What quantity would be ordered under this

policy, and what is the projected profit under the three

sales scenarios?

Provide your own recommendation for an order

quantity and note the associated profit projections.

Normal Distribution

20,000

.025

10,000 30,000

.025 .95

At 30,000,

30000 20000

1.96

5102

Mean and Standard deviation are

20000, 5102

x

x

z

=

= = =

=

= =

Stock out situation

The management team suggested order

quantities of 15000, 18000, 24000 or 28000

units.

If order quantity is 15000,

15000 20000

0.98

5102

[ 15000] [ 0.98]

0.3365 0.5 0.8865

x

z

P X P Z

= = =

> = >

= + =

Stock out situation

For order quantity being 18000, the

probability of stock out is 0.6517.

At 24,000, the probability of stock out is

0.2177.

At 28,000, the probability of stock out is

0.0582.

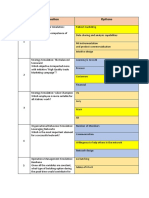

Profit Projection

For order quantity being 15,000, profit

projection is

Sales

Unit Sales Total Cost at $24 at $5 Profit

10,000 240,000 240,000 25,000 25,000

20,000 240,000 360,000 0 120,000

30,000 240,000 360,000 0 120,000

At 18,000,

Sales

Unit Sales Total Cost at $24 at $5 Profit

10,000 288,000 240,000 40,000 -8,000

20,000 288,000 432,000 0 144,000

30,000 288,000 432,000 0 144,000

At 24,000,

Sales

Unit Sales Total Cost at $24 at $5 Profit

10,000 384,000 240,000 70,000 -74,000

20,000 384,000 480,000 20,000 116,000

30,000 384,000 576,000 0 192,000

At 28,000,

Sales

Unit Sales Total Cost at $24 at $5 Profit

10,000 448,000 240,000 90,000 -118,000

20,000 448,000 480,000 40,000 72,000

30,000 448,000 672,000 0 224,000

Profit potential being high

Order quantity should have a 70% chance of meeting demand

and only a 30% chance of any stock-outs.

For Q=22,653, the projected profits under

the three scenarios are

20000

0.52 22,653

5102

Q

z Q

= = =

Sales

Unit Sales Total Cost at $24 at $5 Profit

10,000 362,488 240,000 63,265 -59,183

20,000 362,488 480,000 13,265 130,817

30,000 362,488 543,672 0 181,224

Assignment Problem 3

Are male college students more easily bored than

their female counterparts? This question was

examined in the article Boredom in Young Adults

Gender and Cultural Comparisons (Journal of

Cross-Cultural Psychology, 1991). The authors

administered a scale called the Boredom

Proneness Scale to 97 male and 148 female U.S.

college students. Does the accompanying data

support the research hypothesis that the mean

Boredom Proneness Rating is higher for men than

for women? Test the appropriate hypothesis using

a 0.05 significance level.

Gender Sample

Size

Sample

Mean

Sample

Standard

deviation

Male

Female

97

148

10.40

9.26

4.83

4.68

Solution

0 1 2

1 1 2

1 2

1 2

1 2

1 2

2 2

1 2

1 2

0.05

:

:

97 148

10.40 9.26

4.83 4.68

1.14

1.83

0.3885

1.645

H

H

n n

X X

s s

X X

Z

s s

n n

Z

=

>

= =

= =

= =

= = =

+

=

As , we reject the null hypothesis at

5% level of significance.

Hence it can be concluded that the mean

Boredom Proneness Rating is higher for

men than for women at 5% level of

significance.

Z Z

>

Assignment Problem 2

A manufacturer has just marketed a new appliance

with a one year warranty. The product development

plan anticipates that the cost of meeting the warranty

terms will be Rs 5000 per appliance, on the

average, with a standard deviation of Rs 4000. As the

warranty period expires for the first appliances

sold, the manufacturer will note the actual costs of

warranty servicing (X). Two testing approaches have

been suggested for deciding whether or not the

average warranty costs are exceeding the Rs 5000

target. (1) Wait for warranty data on the first 100

appliances sold and conclude that the average cost

will exceed the target if > Rs 5800. (2) Wait for

warranty data on the first 400 appliances sold and

conclude that the average cost will exceed the target

if > Rs 5400.

A timely conclusion about actual warranty

costs is desirable because the manufacturer

wishes to reduce the warranty terms if

these are proving too generous to be

profitable. On the other hand, an

unnecessary reduction of warranty terms

would adversely affect future sales of the

industrial appliance. Assume that the

warranty data on the initial sales will

constitute random sample observations.

Questions

Define the parameter and the alternatives H

0

and H

1

which

are of interest in this situation.

Sketch the power curves for the two test approaches on the

same graph, assuming that the anticipated standard deviation

of warranty costs is accurate. How do the risks of the two

approaches compare if the mean warranty cost is on target?

If it is Rs1000 higher than the target?

The test approach with n=400 was eventually chosen and the

sample results were sample mean =Rs 5340 and s= Rs 3840.

Using the specified decision rule for this approach, what

conclusion should be drawn about average warranty costs?

Estimate the alpha risk of your test when =Rs 5000. Estimate

the beta risk of your test when the mean warranty cost is

Rs1000 higher than the target.

Hypotheses

Type I error

P[Rejecting H

0

| H

0

is true]

0

1

: 5000

: 5000

H

H

=

>

Type I error

Rule 1

Reject if . Here .

Rule 2

Reject if . Here .

0

H 5800 X >

100 n =

5800| 5000 0.0228 P X ( = > = =

0

H

5400 X >

400 n =

5400| 5000 0.0228 P X ( = > = =

Power of a test

The power of a statistical hypothesis test

is the probability of rejecting the null

hypothesis when the null hypothesis is

false.

Power = (1 - )

Table showing Power

Rule 1 Rule 2

5100 0.0401 0.0668

5400 0.1587 0.5

5700 0.4013 0.9332

6000 0.6915 0.9999

6300 0.9878 1

Power Curve

0

0.2

0.4

0.6

0.8

1

1.2

5000 5100 5400 5700 6000 6300

Rule 1

Rule 2

As , Rule 2 will not reject the null

hypothesis. Therefore, we conclude that

the warranty cost does not exceed Rs

5000.

400 Rs 5340 Rs 3840 n X s = = =

5340 X =

Risks

If is known,

If is unknown,

Beta risk when the mean warranty cost is

Rs 1000 higher than the target.

If is known, is negligible.

If is unknown, is negligible.

0.0228 =

0.0188 =

Assignment Problem 1

An aluminum company is experimenting with a new

design for electrolytic cells in smelter pot rooms. A

major design objective is to maximize a cells

expected service life. Thirty cells of the new design

were started and operated under similar

conditions, and failed at the following ages (in days):

Two items of concern to management are: (1) the

mean service life of this design, and (2) the

comparative performance of this design with the

standard industry design, which is known to have a

mean service life of 1,300 days. Management does not

want to conclude that the new design is superior to

the standard one unless the evidence is fairly strong.

Assuming the distribution of service life of the cell is normal; calculate an

appropriate 95% confidence interval for the mean service life of cells of

the new design. Justify your choice of one or two-sided confidence interval.

Should management conclude that the new design is superior to the

standard one with respect to mean service life? Comment.

It has been suggested that the logarithms of service life are more normally

distributed than the original observations. Take logarithms (to base 10) of

the service-life data and calculate the same type of confidence interval as

in (a) for the mean log-service-life of cells of the new design. Cells of the

standard design are known to have mean log-service-life of 3.095 (to base

10). Can management claim with confidence that the mean log-service-life

is greater for cells of the new design than for cells of the standard design?

Graph histograms of the original data and the log-data. Does the

distribution of log-service-lives appear to be more normal than the

distribution of service-lives, as suggested? Comment

A management objective is to obtain a large total service life for the cells.

Is the mean service life or the mean log-service-life the more relevant

measure here? Explain.

Confidence interval

The confidence interval is

This does not support that the new design is

superior to the standard one.

1

( ) ,

n

s

X t

n

| |

|

\ .

( )

1255.361,

0.05

1379.133 399.0149 (29) 1.699 X s t = = =

Logarithms of service times

The confidence interval is

This does not support that the new

design is superior to the standard one.

0.05

3.120485 0.134747 (29) 1.699

Y

Y s t = = =

( )

3.078,

0

1

2

3

4

5

6

7

8

9

10

500 800 1100 1400 1700 2000 2300 More

F

r

e

q

u

e

n

c

y

Bin

Histogram

0

1

2

3

4

5

6

7

8

9

10

2.79 2.89 2.99 3.09 3.19 3.29 3.39 More

F

r

e

q

u

e

n

c

y

Bin

Histogram

You might also like

- 04 Case Ch06Document5 pages04 Case Ch06themercyangelNo ratings yet

- Business Schools of AsiaDocument12 pagesBusiness Schools of AsiaRahul JainNo ratings yet

- Specialty Toys Case ProblemDocument5 pagesSpecialty Toys Case ProblemHope Trinity EnriquezNo ratings yet

- Specialty Toys Case Study Recommends 18,784 Unit OrderDocument10 pagesSpecialty Toys Case Study Recommends 18,784 Unit OrderHàMềmNo ratings yet

- Avalanche Corporation - EXAM - With Production ProcessDocument18 pagesAvalanche Corporation - EXAM - With Production ProcessawsNo ratings yet

- CASE 3 - Buisness Schools of Asia - PacificDocument8 pagesCASE 3 - Buisness Schools of Asia - PacificRaj Rajeshwari KayanNo ratings yet

- Optimize tomato product mix for maximum profitDocument2 pagesOptimize tomato product mix for maximum profitVinod Kumar G100% (1)

- Specialty Toys Case StudyDocument2 pagesSpecialty Toys Case StudyKuldeep Kumar33% (3)

- Specialty Toys - Weather TeddyDocument15 pagesSpecialty Toys - Weather TeddyAnuj Sharma100% (3)

- Homework 4Document3 pagesHomework 4amisha25625850% (1)

- Managerial Report of B Schools of The South AsiaDocument9 pagesManagerial Report of B Schools of The South AsiaAshutoshNo ratings yet

- SBE11E Case Chapter 08Document4 pagesSBE11E Case Chapter 08CountNo ratings yet

- Starbucks: Case StudyDocument6 pagesStarbucks: Case StudyanjaliNo ratings yet

- NLP 2019-20Document36 pagesNLP 2019-20Akshay TyagiNo ratings yet

- Decision Sheet Shanghai GDP ApostasyDocument2 pagesDecision Sheet Shanghai GDP ApostasyMEDABOINA SATHVIKANo ratings yet

- Catawba Industrial Company SlidesDocument15 pagesCatawba Industrial Company SlidesCR7pNo ratings yet

- BigBazaar and Kishore BiyaniDocument30 pagesBigBazaar and Kishore BiyaniChitra Vaswani100% (1)

- Problem SetDocument6 pagesProblem SetKunal KumarNo ratings yet

- Stars Mark: BournvitaDocument5 pagesStars Mark: Bournvitanihal msNo ratings yet

- Management Sheet 1 (Decision Making Assignment)Document6 pagesManagement Sheet 1 (Decision Making Assignment)Dalia EhabNo ratings yet

- Shell Attempts To Returrn To Premiere Status JIA MERCADODocument7 pagesShell Attempts To Returrn To Premiere Status JIA MERCADOJohn Carlo SantiagoNo ratings yet

- Globalization of Indian Automobile IndustryDocument25 pagesGlobalization of Indian Automobile IndustryAjay Singla100% (2)

- Linear Programming CasesDocument5 pagesLinear Programming CasesRohanMohapatraNo ratings yet

- Balancesheet As On 31st May 2012 Liabilities Rs Assets RsDocument3 pagesBalancesheet As On 31st May 2012 Liabilities Rs Assets Rsrahul.iamNo ratings yet

- Model QuestionsDocument2 pagesModel Questionspuneeth rajuNo ratings yet

- Cambridge Software Corporation: Case AnalysisDocument11 pagesCambridge Software Corporation: Case AnalysisMilind GuptaNo ratings yet

- A Case Study On International Expansion: When Amazon Went To ChinaDocument3 pagesA Case Study On International Expansion: When Amazon Went To ChinaitsarNo ratings yet

- Case study - Business Schools of Asia PacificDocument11 pagesCase study - Business Schools of Asia PacificSanjana Singh100% (1)

- Case Consumer Research IncDocument1 pageCase Consumer Research IncsanNo ratings yet

- 101 Session FourDocument45 pages101 Session FourVinit PatelNo ratings yet

- A SPECIALTY TOYS CASE Managerial ReportDocument7 pagesA SPECIALTY TOYS CASE Managerial ReportSimran DhungelNo ratings yet

- Case Problem 1 - Product MixDocument7 pagesCase Problem 1 - Product Mixgorgory_30% (1)

- Catawba Industrial CompanyDocument2 pagesCatawba Industrial CompanyNikhil Singh0% (2)

- Problem Set 6 - Mixed SetDocument3 pagesProblem Set 6 - Mixed SetRitabhari Banik RoyNo ratings yet

- Management AccountingDocument1 pageManagement AccountingMohtasim Bin HabibNo ratings yet

- QMDocument87 pagesQMjyotisagar talukdarNo ratings yet

- Garden Place Balance Sheet and Financial StatementsDocument2 pagesGarden Place Balance Sheet and Financial StatementsPratyush BaruaNo ratings yet

- 1 Sampling DistDocument35 pages1 Sampling DistYogeshNo ratings yet

- Electrical Equipment Industry 2020Document2 pagesElectrical Equipment Industry 2020Ipsita Bhattacharjee100% (1)

- T8 RevivalDocument6 pagesT8 RevivalSumit AggarwalNo ratings yet

- Three Squirrels and A Pile of NutsDocument6 pagesThree Squirrels and A Pile of NutsAnurag GoelNo ratings yet

- Haidilao IPODocument14 pagesHaidilao IPOcyber owenNo ratings yet

- Calendar Demand ProblemDocument43 pagesCalendar Demand Problemrahul.iamNo ratings yet

- 33899Document6 pages33899shoaibNo ratings yet

- Metabical Case SolutionDocument8 pagesMetabical Case SolutionShelton Nazareth0% (1)

- Classic Pen Case CMADocument2 pagesClassic Pen Case CMARheaPradhanNo ratings yet

- A1 10BM60005Document13 pagesA1 10BM60005amit_dce100% (2)

- (191018) Aerospace Co. - BainDocument12 pages(191018) Aerospace Co. - BainRossieDameLasriaNo ratings yet

- ZipCar SolutionDocument15 pagesZipCar SolutionAshwinKumarNo ratings yet

- Catawba Industrial Company Assignment Questions and Memo InstructionsDocument2 pagesCatawba Industrial Company Assignment Questions and Memo InstructionsSaravana Krishnan0% (2)

- Assigment 6 - Managerial Finance Capital BudgetingDocument5 pagesAssigment 6 - Managerial Finance Capital BudgetingNasir ShaheenNo ratings yet

- Porter's Five Forces Industry AnalysisDocument10 pagesPorter's Five Forces Industry AnalysiskulsoomalamNo ratings yet

- CLS Exr - LP IntroDocument4 pagesCLS Exr - LP IntroArun Viswanath100% (1)

- The Future of Workforce at _VOISDocument7 pagesThe Future of Workforce at _VOISAnu SahithiNo ratings yet

- A Specialty Toys Case Managerial ReportDocument8 pagesA Specialty Toys Case Managerial ReportNixon Arturo Rodriguez JaimesNo ratings yet

- Applying Decision Analysis to Litigation, Product Development, and Market ResearchDocument24 pagesApplying Decision Analysis to Litigation, Product Development, and Market ResearchAmandeep DahiyaNo ratings yet

- Relationship Marketing ToyotaDocument9 pagesRelationship Marketing ToyotaNadiah Muhamad Basri100% (1)

- It’s Not What You Sell—It’s How You Sell It: Outshine Your Competition & Create Loyal CustomersFrom EverandIt’s Not What You Sell—It’s How You Sell It: Outshine Your Competition & Create Loyal CustomersNo ratings yet

- Problems On Confidence IntervalDocument6 pagesProblems On Confidence Intervalrangoli maheshwariNo ratings yet

- S19 6295 Final ExamDocument4 pagesS19 6295 Final Examzeynullah giderNo ratings yet

- PWC Ceo Survey Report 2018Document32 pagesPWC Ceo Survey Report 2018BernewsAdmin100% (2)

- Code Rules PDFDocument32 pagesCode Rules PDFSantanu DasNo ratings yet

- BCG Online Case Example PDFDocument8 pagesBCG Online Case Example PDFSantanu DasNo ratings yet

- Train Number Train Name From Station Destination Station Runs From Source OnDocument2 pagesTrain Number Train Name From Station Destination Station Runs From Source OnSantanu DasNo ratings yet

- Capital Liquidity LCRDocument61 pagesCapital Liquidity LCRSantanu DasNo ratings yet

- Deloitte - Gfsi 1103 Basel III Pov Bank Capital Landscape 2012 03Document53 pagesDeloitte - Gfsi 1103 Basel III Pov Bank Capital Landscape 2012 03Santanu DasNo ratings yet

- Butler Lumber 292741Document3 pagesButler Lumber 292741Santanu DasNo ratings yet

- Roles and ResponsibilitiesDocument13 pagesRoles and Responsibilitiespummy_bhaiNo ratings yet

- Germany Since WWIIDocument17 pagesGermany Since WWIISantanu DasNo ratings yet

- ICTMS 2013 eAbstractBookDocument68 pagesICTMS 2013 eAbstractBookSantanu DasNo ratings yet

- Module 2 - Chapter8Document37 pagesModule 2 - Chapter8Santanu DasNo ratings yet

- ICTMS 2013 - Program ScheduleDocument3 pagesICTMS 2013 - Program ScheduleSantanu DasNo ratings yet

- 12020241074-Ass 2Document25 pages12020241074-Ass 2Santanu DasNo ratings yet

- Cover Headline: Second Line Lorem IpsumDocument25 pagesCover Headline: Second Line Lorem IpsumSantanu DasNo ratings yet

- Siib c1Document38 pagesSiib c1Santanu Das100% (1)

- Amul Ice Cream: Cost Sheet AnalysisDocument9 pagesAmul Ice Cream: Cost Sheet AnalysisSantanu Das50% (2)

- Britania ValuationDocument28 pagesBritania ValuationSantanu DasNo ratings yet

- TreesampDocument19 pagesTreesampSantanu DasNo ratings yet

- Cost & Management Accounting: Total 70Document1 pageCost & Management Accounting: Total 70Santanu DasNo ratings yet

- Extra Component - Amul Ice CreamDocument7 pagesExtra Component - Amul Ice CreamSantanu DasNo ratings yet

- Stats Stats Stats Stats Stats Stats Stats Stats StatsDocument3 pagesStats Stats Stats Stats Stats Stats Stats Stats StatsSantanu DasNo ratings yet

- TVM TablesDocument2 pagesTVM Tablesanmol_sidNo ratings yet

- Impact of FDI - Group2Document28 pagesImpact of FDI - Group2Santanu DasNo ratings yet

- Amul Ice-Cream Cost Sheet AnalysisDocument5 pagesAmul Ice-Cream Cost Sheet AnalysisSantanu DasNo ratings yet

- Excels For 8th EdDocument235 pagesExcels For 8th Edsanta171No ratings yet

- LIBOR Manipulation Scam ExplainedDocument16 pagesLIBOR Manipulation Scam ExplainedSantanu Das100% (1)

- Business Associations IndiaDocument37 pagesBusiness Associations IndiaSantanu DasNo ratings yet

- Capital Expenditure DecisionsDocument38 pagesCapital Expenditure Decisionsparag3482No ratings yet

- Chapter 9 - Application International TradeDocument50 pagesChapter 9 - Application International Tradecarysma25100% (1)

- Nordson EFD Ultimus I II Operating ManualDocument32 pagesNordson EFD Ultimus I II Operating ManualFernando KrauchukNo ratings yet

- Comparison of Unix and Dos: AssignmentDocument10 pagesComparison of Unix and Dos: AssignmentMohsin ShakoorNo ratings yet

- Textbook List for Sri Kanchi Mahaswami Vidya Mandir 2020-21Document13 pagesTextbook List for Sri Kanchi Mahaswami Vidya Mandir 2020-21drsubramanianNo ratings yet

- ATT III - 13. Prevent, Control and Fight Fires On BoardDocument9 pagesATT III - 13. Prevent, Control and Fight Fires On BoardPak WeNo ratings yet

- 1 Crisp Projects: Erode Salem Madurai Trichy Kochi Bengaluru CoimbatoreDocument20 pages1 Crisp Projects: Erode Salem Madurai Trichy Kochi Bengaluru CoimbatoreKathir VelNo ratings yet

- Risk in Clean RoomDocument9 pagesRisk in Clean RoomABEERNo ratings yet

- UniSim Heat Exchangers User Guide PDFDocument22 pagesUniSim Heat Exchangers User Guide PDFzhangyiliNo ratings yet

- PCH (R-407C) SeriesDocument53 pagesPCH (R-407C) SeriesAyman MufarehNo ratings yet

- Product Code Threaded Rod Size (R) Lenght (L) MM Pitch (MM) Minimum Proof Load (N) Microns ( ) Bundle QuantityDocument1 pageProduct Code Threaded Rod Size (R) Lenght (L) MM Pitch (MM) Minimum Proof Load (N) Microns ( ) Bundle QuantityKABIR CHOPRANo ratings yet

- GITAM Guidelines For MBA Project Work - 2018Document6 pagesGITAM Guidelines For MBA Project Work - 2018Telika RamuNo ratings yet

- The 4th International Conference of the International Forum on Urbanism (IFoU) 2009 Amsterdam/Delft - FiberCity as a Paradigm Shift of Urban DesignDocument4 pagesThe 4th International Conference of the International Forum on Urbanism (IFoU) 2009 Amsterdam/Delft - FiberCity as a Paradigm Shift of Urban DesignChris de VriesNo ratings yet

- Specification of PCB800099 Controller Board V1.0Document10 pagesSpecification of PCB800099 Controller Board V1.0benabdullahNo ratings yet

- Ticket SunilDocument2 pagesTicket SunilDURGA PRASAD TRIPATHYNo ratings yet

- Assignment (40%) : A) Formulate The Problem As LPM B) Solve The LPM Using Simplex AlgorithmDocument5 pagesAssignment (40%) : A) Formulate The Problem As LPM B) Solve The LPM Using Simplex Algorithmet100% (1)

- Paper 2Document17 pagesPaper 2Khushil100% (1)

- Chapter 3Document12 pagesChapter 3Raymond LeoNo ratings yet

- Maintenance Procedure For Switchyard Equipment Volume-II (EHDocument39 pagesMaintenance Procedure For Switchyard Equipment Volume-II (EHbisas_rishiNo ratings yet

- Hydro Cyclone: Centripetal Force Fluid ResistanceDocument10 pagesHydro Cyclone: Centripetal Force Fluid ResistanceMaxwell ToffahNo ratings yet

- KV Sainik Vihar Class 6 Science Holidays HomeworkDocument7 pagesKV Sainik Vihar Class 6 Science Holidays HomeworkABYAN ShaikNo ratings yet

- ADC MethodDocument16 pagesADC MethodPhilip K MathewNo ratings yet

- Cascadable Broadband Gaas Mmic Amplifier DC To 10Ghz: FeaturesDocument9 pagesCascadable Broadband Gaas Mmic Amplifier DC To 10Ghz: Featuresfarlocco23No ratings yet

- Handout 4: Course Notes Were Prepared by Dr. R.M.A.P. Rajatheva and Revised by Dr. Poompat SaengudomlertDocument7 pagesHandout 4: Course Notes Were Prepared by Dr. R.M.A.P. Rajatheva and Revised by Dr. Poompat SaengudomlertBryan YaranonNo ratings yet

- Register for a WordPress account in 5 easy stepsDocument5 pagesRegister for a WordPress account in 5 easy stepsPutriNo ratings yet

- Educ 61 Module 5 ActivityDocument4 pagesEduc 61 Module 5 ActivityMitchille GetizoNo ratings yet

- Instructions: Hmems80 2020 Semester 1 Assignment 01 (Unique Number: 873964) Due Date: 9 March 2020Document8 pagesInstructions: Hmems80 2020 Semester 1 Assignment 01 (Unique Number: 873964) Due Date: 9 March 2020Matshele SerageNo ratings yet

- Balino, Shedina D. Beed 2-CDocument5 pagesBalino, Shedina D. Beed 2-CSHEDINA BALINONo ratings yet

- PGSuperDocument71 pagesPGSuperVietanh PhungNo ratings yet

- POOJA TRADING CO. Price List for FRP Manhole CoversDocument1 pagePOOJA TRADING CO. Price List for FRP Manhole Coversmitesh20281No ratings yet

- Army Aviation Digest - Feb 1967Document68 pagesArmy Aviation Digest - Feb 1967Aviation/Space History LibraryNo ratings yet

- Resultados de La Web: GDDS - Traducción Al Español - Ejemplos Inglés - Reverso ..Document3 pagesResultados de La Web: GDDS - Traducción Al Español - Ejemplos Inglés - Reverso ..Jo PaterninaNo ratings yet