Professional Documents

Culture Documents

Industrial Grinders N V

Uploaded by

api-250891173Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Industrial Grinders N V

Uploaded by

api-250891173Copyright:

Available Formats

Industrial Grinders

Marshawn Pettes

With a large quantity of steel rings on hand, what would happen if the demand for steel rings was completely destroyed by new plastic rings over taking the market?

5/07/2013

Industrial Grinders N.V. Case Analysis

Problem Statement

Industrial Grinders N.V. (IG) has a large quantity of steel rings on hand and the substantial inventory of special steel for their manufacture with a total book value of the inventories exceeding $93,000. Lawrence Bridgeman, the general manager of the German plant of IG, is concern that the demand for steel rings will be completely destroyed when the plastic rings overtake the market in which could cause a direct hit to the bottom line. Bridgeman has to figure out what to do with the excessive inventory and determine the best action to take that will make a profit and cut deficits.

Identify the Criteria

Low Cost Sale Price High Sales Per Week

Weight the Criteria

Criteria Low Cost Sale Price High Sales Per Week Weight 0.5 0.2 0.3

Generate Alternatives

Produce more steel with the extra material and try to sell as much as possible. Throw away all of the steel rings and materials. Produce and sell only plastic rings. Sell finished steel rings and sell the plastic ring only in markets where competitors sell it.

Rate each Alternative on each Criterion (1-10, 10 being the Best)

Alternative Produce More Steel Drop Steel, Just Plastic Plastic in Selective Markets Low Cost 1 8 8 Sale Price 5 5 5 High Sales Per Week 7 3 6

Marshawn Pettes Industrial Grinders N.V. 05/07/13

Industrial Grinders N.V. Case Analysis

Produce More Steel In terms of using the material to produce more steel rings, I would have to ask, Would you spend $64,628.25 so save $26,400.00? then I would follow with a second and third question What if there is a chance that you could make a profit of $33,783.88 in about two years, if you sale all of the steel, but there is no grantee and the chances are slim to none? Would you change your answer? Figure 3 illustrates the risk of ut ilizing the material on hand to produce more steel. Although IG has $26,400.00 worth of material to produce an additional 34,500 rings, it would cost approximately $68,628.25 in additional cost for direct labor and overhead to actually produce the rings (See Figure 1). This will cause the company to have more rings totaling to approximately 59,742, a greater book value at about $(157,628.25), and ultimately a greater risk to loss even more money. The projected timeframe to sale all 59,742 rings is a little under 2 years with the assumption that IG continues to sell at the same rate of 690 rings per week. When the plastic rings spread throughout the market, it would most likely destroy the demand for steel rings. This would make it very difficult to sell 59,742 rings when no one wants them.

Drop Steel, Just Plastic In mid-September the companys projected amount of steel rings on hand are approximately 15,100. This means that the company is projecting to sell about 10,142 from May to September, in which the profit from those sales should bring the book value down from $(93,000.00) to $(60,506.27). If IG was to throw all of the steel rings and material away at this point, they would have to cover a deficit of about $(60,506.27) with just profit from plastic rings. Due to the fact that plastic rings has a lifespan four times as long as steel rings, selling plastic rings at the same rate of steel rings would be extremely difficult. I would assume that the plastic rings would most likely sale at a rate around 173 per week, which is four times less than the steel rings. The rings are only replaced when they go bad and if the life of the rings expands then it would take longer to get a resale. If this assumption turns out to be true, then it would take approximately 2 years and 3 months to cover the deficit of the steel rings with just the profits from the plastic rings (See Figure 3).

Plastic Only in Selective Markets

Marshawn Pettes Industrial Grinders N.V. 05/07/13

Industrial Grinders N.V. Case Analysis

Customer would begin to question why the plastic rings are only available to certain segment or location. They may also question why they are paying the same amount for steel rings when the plastic rings are portrayed to be better with a greater longevity. This could be taking as unfair to some of the customers in which could eventually harm the sales of IG machines.

Compute the optimal decision

Alternative Produce More Steel Drop Steel, Just Plastic Plastic in Selective 4 Markets Low Cost 0.5 4 Sale Price 1 1 1 High Sales Per Week Totals 2.1 3.6 0.9 5.9 1.8 6.8

According to the information above, the optimal decision in this case is to continue selling steel rings in the normal markets and only sell the plastic rings in the markets that the competitors are already selling them in. This option is best among the three alternatives in terms of making profit and cutting deficits. Producing more steel or just selling plastic rings both scored less against the criteria. Producing more steel rings may sale more per week for a limited of time but the cost of producing steel rings is very high compared to plastic rings. On the other hand, the cost of producing plastic rings in very low but the sales per week is projected to decrease due to the longevity of the product. This results in steel rings and plastic rings being similar to one another in terms of creating revenue in the long run (See Figure 5).

Marshawn Pettes Industrial Grinders N.V. 05/07/13

Industrial Grinders N.V. Case Analysis

Recommendation It is too risky to utilize the $26,400.00 worth of material to produce more steel rings and the special steel could not be sold even for scrap. Bridgeman should throw out the $26,400.00 worth of special steel and focus more so on selling all of the finish rings. The projected time it would take to sell the remaining 15,100 rings, in September, is five months (See Figure 2). If all of the steel rings sale, the net book value will go down from $(60,506.27) to about $(12,125.87) in February. A small investment of $4,320.55 can cover the $(12,125.87) debt left over from the steel rings. Bridgeman should take $4,320.55 from labor to purchase the tools and equipment to make plastic rings and cover the cost of 3,785 plastic rings. If IG sales approximately 3,785 plastic rings, they would break even of the total debt left over from the steel rings. The projected timeframe of selling 3,785 plastic rings is also five months (See Figure 4). Therefore, Bridgeman should offer both steel and plastic rings with the assumption and hope that some customers would fall into the status quo trap and continue buying steel rings. The plastic rings are currently only affecting about 10% of IGs markets. This gives IG the room needed to sell off their finish steel in which could result in them solving their inventory problem. If IG provides the customers with the opportunity to choose between plastic or steel themselves, the whole idea about the customers finding out and harming sales would be irrelevant because they made the choice themselves. Those that fall into the status quo trap will buy the steel until they try the plastic for the first time. This is a good thing because it would bring the inventory for steel down and allow the customers to become more comfortable with the plastic rings, because the steel rings is projected to discontinue.

Marshawn Pettes Industrial Grinders N.V. 05/07/13

Industrial Grinders N.V. Case Analysis

$320.40 Price Per 100 Units 690 Steel Rings Sold per week Life 2 months 173 Plastic Rings Sold per week Life 8 months

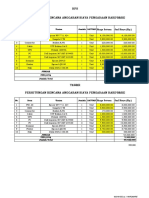

Figure 1:

STEEL

MAY

On hand Book Value Cost of Finish Goods Unit Per $ Finished Rings $93,000.00 $66,600.00 0.38 25,242

Produce More Steel Cost of Material Rings Produce Cost to Produce 100 Additional Cost to Produce Total Cost to Produce 34500 Total Finish Rings Total Cost Weeks To Sell Months Sunk Cost Poss. Profit

$26,400.00 34,500 $263.85 $64,628.25 $91,028.25 59,742 $157,628.25 87 22 $191,412.13 $33,783.88

Marshawn Pettes Industrial Grinders N.V. 05/07/13

Industrial Grinders N.V. Case Analysis

Figure 2: Mid-September

Finished Rings Weeks to Sell Months Rings Sold Profit from Rings Sold Book Value Sunk Cost Poss. Lost 15,100 22 5 10,142 $32,493.73 $60,506.27 $48,380.40 $(12,125.87)

Produce More Steel Book Value Total Rings Weeks to Sell Months Sunk Cost Poss. Profit Break Even Units Weeks Months Profit after 5 months Total Lost after 5 months

$125,134.52 49,600 72 18 $158,918.40 $33,783.88 39,056 57 14 $45,112.32 $(80,022.20)

Figure 3: Just Plastic

Book Value Break Even Unit Weeks Months Cost $60,506.27 18,885 109 27 $12,577.15

Marshawn Pettes Industrial Grinders N.V. 05/07/13

Industrial Grinders N.V. Case Analysis

Figure 4: Just Plastic After Steel on hand is Sold

Book Value Break Even Unit Weeks Months Cost Additional cost Total cost $12,125.87 3,785 22 5 $2,520.55 $1,800.00 $4,320.55

Figure 5: Steel Vs. Plastic From September to December

Steel Sell (mid Sept-Dec) Sales Cost Tools and Equipment Net Income in Dec $6,243.12 11,040 $35,372.16 $29,129.04 Plastic 2,768 $8,868.67 $1,843.49 $1,800.00 $5,225.18

Steel Vs. Plastic Rings for 1 Year

Steel Sales Cost Net Income $114,959.52 $94,669.38 $20,290.14 Plastic $28,823.18 $5,991.34 $22,831.85 $21,031.85 $2,541.71 Plastic After tools $ $741.71 equip

Marshawn Pettes Industrial Grinders N.V. 05/07/13

Net Difference

Industrial Grinders N.V. Case Analysis

Calculations

Book Value 93000 Rings Produce X 34500 X Cost of Material = $ 26,400.00 Total Cost of Rings /100= 263.85/100 = Cost of Finish Goods = $ 66,600.00 Total Cost to Produce 34500 units $ 91,028.25 Cost of Material = Additional Cost 26400 = 64,628.25

Total Cost to Produce 34500 Units 91028.25 Rings Produce / 34500 /

Total Cost to Produce = Unit Per $ 91028.25 =

0.38

Cost of Finish Goods X Unit Per $ = 66,600 X Finish Rings + 25242 + Book Value + 93000 + Sunk Cost: Poss. Profit: Weeks to Sale: Months to Sale: Break Even: Sales: Cost: Poss. New Rings

Total Finish Rings 0.38 = 25,242 = Total Finish Rings 34500 = 59742

Additional Cost = Total Cost 64628.25 = 157628.25 Total of Profit that could have been made from the Units Total Profit less the Cost of the Units Total Units divided by the Rings Sold per Week Total Weeks to sale divided by 4 Book Value divided by Price per Unit Number of Units times Price per Unit Number of Units times Cost per Unit

Marshawn Pettes Industrial Grinders N.V. 05/07/13

You might also like

- Should Industrial Grinders Produce Plastic RingsDocument6 pagesShould Industrial Grinders Produce Plastic RingsCarrie Stevens100% (1)

- Huron Automotive Company ExcelllDocument6 pagesHuron Automotive Company Excelllmaximus0903No ratings yet

- Joint Cost SignatronDocument8 pagesJoint Cost SignatronGloryNo ratings yet

- Micoderm Profitability AnalysisDocument21 pagesMicoderm Profitability AnalysisGlory100% (1)

- Kanthal CaseDocument5 pagesKanthal CaseMonica Rosa LinaNo ratings yet

- American Lawbook Corporation (A)Document9 pagesAmerican Lawbook Corporation (A)Adwitiya Datta20% (5)

- Destin Brass Case Study SolutionDocument5 pagesDestin Brass Case Study SolutionAmruta Turmé100% (2)

- Kanthal Case Study SolutionsINTRODUCTIONKanthal Is Comp Termpaper Essay Studies Test 1071194975Document5 pagesKanthal Case Study SolutionsINTRODUCTIONKanthal Is Comp Termpaper Essay Studies Test 1071194975rahuldesai1189No ratings yet

- Learning Points - CmaDocument2 pagesLearning Points - CmaGloryNo ratings yet

- Symalit FEP 1000 Product Data SheetDocument1 pageSymalit FEP 1000 Product Data SheetandreshuelvaNo ratings yet

- Kool King Division (A)Document10 pagesKool King Division (A)Rajesh Kumar AchaNo ratings yet

- Ace Automotive PresentationDocument9 pagesAce Automotive PresentationGloryNo ratings yet

- Destin Brass FinalDocument10 pagesDestin Brass FinalKim Garver100% (2)

- Huron AutomotiveDocument8 pagesHuron Automotiveanubhav1109No ratings yet

- Caso Soren ChemicalsDocument8 pagesCaso Soren ChemicalsNatalia LeonNo ratings yet

- Compagnie Du FroidDocument18 pagesCompagnie Du FroidSuryakant Kaushik0% (3)

- Costing analysis of carburator batch shows higher costs under proposed methodsDocument13 pagesCosting analysis of carburator batch shows higher costs under proposed methodsshreyansh1200% (1)

- Curled Metal Inc.-Case Discussion Curled Metal Inc. - Case DiscussionDocument13 pagesCurled Metal Inc.-Case Discussion Curled Metal Inc. - Case DiscussionSiddhant AhujaNo ratings yet

- Destin Brass Products Co Case WorksheetDocument2 pagesDestin Brass Products Co Case WorksheetManishNo ratings yet

- Cost & Management Accounting For MBA 13, Binder 2014Document213 pagesCost & Management Accounting For MBA 13, Binder 2014SK Lashari100% (1)

- Always Use 2 Decimal Places (When % As Percent - Not As Fractions) and Provide Detail of The Calculations MadeDocument2 pagesAlways Use 2 Decimal Places (When % As Percent - Not As Fractions) and Provide Detail of The Calculations MadeKirtiKishanNo ratings yet

- Financial Analysis and Inventory Management of Laboratory Equipment CompanyDocument29 pagesFinancial Analysis and Inventory Management of Laboratory Equipment CompanyShirsendu Bikash DasNo ratings yet

- PolarSports Solution PDFDocument8 pagesPolarSports Solution PDFaotorres99No ratings yet

- LIFO vs FIFO Impact on Merrimack TractorsDocument3 pagesLIFO vs FIFO Impact on Merrimack TractorsstudvabzNo ratings yet

- Sherman Motor CompanyDocument5 pagesSherman Motor CompanyshritiNo ratings yet

- Kanthal Activity-Based CostingDocument13 pagesKanthal Activity-Based CostingRaymon AquinoNo ratings yet

- Ma Case WriteupDocument4 pagesMa Case WriteupMayank Vyas100% (1)

- Curled Metal Inc: Submitted To Prof Gururaj Kidiyoor Group I1Document9 pagesCurled Metal Inc: Submitted To Prof Gururaj Kidiyoor Group I1paminderNo ratings yet

- Stuart Daw questions costing approach transaction basisDocument2 pagesStuart Daw questions costing approach transaction basisMike ChhabraNo ratings yet

- Forner Carpet CompanyDocument7 pagesForner Carpet CompanySimranjeet KaurNo ratings yet

- AB Thorsten Case StudyDocument6 pagesAB Thorsten Case StudyRahul PambharNo ratings yet

- Case Study - Destin Brass Products CoDocument6 pagesCase Study - Destin Brass Products CoMISRET 2018 IEI JSCNo ratings yet

- Mueller Lehmkuhl Case Write UpDocument2 pagesMueller Lehmkuhl Case Write UpPauline AndrieNo ratings yet

- Hilton Case1Document2 pagesHilton Case1Ana Fernanda Gonzales CaveroNo ratings yet

- Reliance GRP 11Document8 pagesReliance GRP 11tanmaysrivNo ratings yet

- Ace AutomotiveDocument4 pagesAce AutomotiveGlory0% (1)

- SDM - Case-Soren Chemicals - IB Anand (PGPJ02027)Document6 pagesSDM - Case-Soren Chemicals - IB Anand (PGPJ02027)AnandNo ratings yet

- UHS case study answers optimizedDocument6 pagesUHS case study answers optimizedldthielen60% (5)

- Vershire Company Aluminum Can Division Case StudyDocument7 pagesVershire Company Aluminum Can Division Case StudyAradhysta Svarnabhumi0% (1)

- 520 Greenlawn Commercial Questions f12 PDFDocument1 page520 Greenlawn Commercial Questions f12 PDFAshish Kothari0% (2)

- Midwest Office Products - ABC Method & Customer Cost AnalysisDocument2 pagesMidwest Office Products - ABC Method & Customer Cost AnalysisAbhishek MalhotraNo ratings yet

- Hanson Case Turnaround FactorsDocument6 pagesHanson Case Turnaround FactorsAnosh DoodhmalNo ratings yet

- Destin BrassDocument5 pagesDestin Brassdamanfromiran100% (1)

- University Health ServicesDocument8 pagesUniversity Health ServicesXavier Mascarenhas100% (2)

- OM Scott Case AnalysisDocument20 pagesOM Scott Case AnalysissushilkhannaNo ratings yet

- Cartwright Lumber Company Paper EXAMPLEDocument5 pagesCartwright Lumber Company Paper EXAMPLEJose SermenoNo ratings yet

- Lille Tissage WorksheetDocument19 pagesLille Tissage WorksheetJaouadiNo ratings yet

- ML Case Solution - (Individual) PGXPM VI (Term III) N.v.deepakDocument4 pagesML Case Solution - (Individual) PGXPM VI (Term III) N.v.deepakDeepak Rnv86% (7)

- Store 24Document13 pagesStore 24Deepak Singh NegiNo ratings yet

- Patagonia CaseDocument1 pagePatagonia CaseArmyandre Rossel SanchezNo ratings yet

- Forner Carpet Case StudyDocument7 pagesForner Carpet Case StudySugandha GuptaNo ratings yet

- Case QuestionsDocument6 pagesCase QuestionslddNo ratings yet

- GE Health Care Case: Executive SummaryDocument4 pagesGE Health Care Case: Executive SummarykpraneethkNo ratings yet

- Cost Accounting - Case-Daniel DobbinsDocument1 pageCost Accounting - Case-Daniel DobbinsRatin Mathur100% (4)

- NFL's Scoofles: Scooped With Marketing Research Problem?Document1 pageNFL's Scoofles: Scooped With Marketing Research Problem?ETCASES0% (1)

- Salesperson Ellis Barrow HammondDocument7 pagesSalesperson Ellis Barrow HammondRohan Chatterjee100% (1)

- Mueller-Lehmkuhl Case Analysis ThreatDocument3 pagesMueller-Lehmkuhl Case Analysis ThreatDebdyuti Datta GuptaNo ratings yet

- HLL Distribution ChannelDocument2 pagesHLL Distribution ChannelKunj ShahNo ratings yet

- Industrial Grinders N VDocument9 pagesIndustrial Grinders N VJuan Manuel RamirezNo ratings yet

- Reichard Maschinen Plastic Ring TransitionDocument23 pagesReichard Maschinen Plastic Ring TransitionAliefiah AZNo ratings yet

- Superior Manufacturing Company MpettesDocument8 pagesSuperior Manufacturing Company Mpettesapi-250891173100% (5)

- Google IncDocument11 pagesGoogle Incapi-250891173No ratings yet

- Calaveras VineyardsDocument12 pagesCalaveras Vineyardsapi-250891173100% (4)

- Acid Rain - The Southern Company FinalDocument26 pagesAcid Rain - The Southern Company Finalapi-250891173100% (5)

- Msufcu Marketing PlanDocument22 pagesMsufcu Marketing Planapi-250891173No ratings yet

- Msufcu Strategy Schematic 1 1Document1 pageMsufcu Strategy Schematic 1 1api-250891173No ratings yet

- ScriptsDocument6 pagesScriptsDx CatNo ratings yet

- Asia Competitiveness ForumDocument2 pagesAsia Competitiveness ForumRahul MittalNo ratings yet

- Perilaku Ramah Lingkungan Peserta Didik Sma Di Kota BandungDocument11 pagesPerilaku Ramah Lingkungan Peserta Didik Sma Di Kota Bandungnurulhafizhah01No ratings yet

- Revision Summary - Rainbow's End by Jane Harrison PDFDocument47 pagesRevision Summary - Rainbow's End by Jane Harrison PDFchris100% (3)

- Alluring 60 Dome MosqueDocument6 pagesAlluring 60 Dome Mosqueself sayidNo ratings yet

- How To Make Wall Moulding Design For Rooms Accent Wall Video TutorialsDocument15 pagesHow To Make Wall Moulding Design For Rooms Accent Wall Video Tutorialsdonaldwhale1151No ratings yet

- Mariam Kairuz property dispute caseDocument7 pagesMariam Kairuz property dispute caseReginald Matt Aquino SantiagoNo ratings yet

- Solar Powered Rickshaw PDFDocument65 pagesSolar Powered Rickshaw PDFPrãvëèñ Hêgådë100% (1)

- Garner Fructis ShampooDocument3 pagesGarner Fructis Shampooyogesh0794No ratings yet

- HPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANDocument2 pagesHPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANYanto AstriNo ratings yet

- BSD ReviewerDocument17 pagesBSD ReviewerMagelle AgbalogNo ratings yet

- Amadora V CA Case DigestDocument3 pagesAmadora V CA Case DigestLatjing SolimanNo ratings yet

- 7 Q Ans Pip and The ConvictDocument3 pages7 Q Ans Pip and The ConvictRUTUJA KALE50% (2)

- 4TH Quarter English 10 Assessment TestDocument6 pages4TH Quarter English 10 Assessment TestafbnjkcdNo ratings yet

- Writing Assessment and Evaluation Checklist - PeerDocument1 pageWriting Assessment and Evaluation Checklist - PeerMarlyn Joy YaconNo ratings yet

- Final Project Report On Potential of Vending MachinesDocument24 pagesFinal Project Report On Potential of Vending Machinessatnam_monu80% (5)

- Diaz, Rony V. - at War's End An ElegyDocument6 pagesDiaz, Rony V. - at War's End An ElegyIan Rosales CasocotNo ratings yet

- MEAB Enewsletter 14 IssueDocument5 pagesMEAB Enewsletter 14 Issuekristine8018No ratings yet

- iPhone Repair FormDocument1 pageiPhone Repair Formkabainc0% (1)

- Bpo Segment by Vitthal BhawarDocument59 pagesBpo Segment by Vitthal Bhawarvbhawar1141100% (1)

- Costco Case StudyDocument3 pagesCostco Case StudyMaong LakiNo ratings yet

- I Saw Water Flowing - VaticanDocument3 pagesI Saw Water Flowing - VaticanChu Gia KhôiNo ratings yet

- MT 1 Combined Top 200Document3 pagesMT 1 Combined Top 200ShohanNo ratings yet

- What Are Open-Ended Questions?Document3 pagesWhat Are Open-Ended Questions?Cheonsa CassieNo ratings yet

- Relatório ESG Air GalpDocument469 pagesRelatório ESG Air GalpIngrid Camilo dos SantosNo ratings yet

- Training of Local Government Personnel PHDocument5 pagesTraining of Local Government Personnel PHThea ConsNo ratings yet

- Global Pre-Qualification - Registration of Vendors For Supply of Various Raw Materials - ProductsDocument2 pagesGlobal Pre-Qualification - Registration of Vendors For Supply of Various Raw Materials - Productsjavaidkhan83No ratings yet

- 22 Reasons To Go Mgtow Troofova ReethinDocument291 pages22 Reasons To Go Mgtow Troofova Reethinalbert86% (7)

- The Role of Store LocationDocument6 pagesThe Role of Store LocationJessa La Rosa MarquezNo ratings yet

- Organizational CultureDocument76 pagesOrganizational Culturenaty fishNo ratings yet