Professional Documents

Culture Documents

Risk Management Solution Manual Chapter 10

Uploaded by

DanielLamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Management Solution Manual Chapter 10

Uploaded by

DanielLamCopyright:

Available Formats

Chapter 10

Analysis of Insurance Contracts

.1 Teaching Note

This chapter is divided into several parts. First, the basic parts of an insurance contract are discussed in some detail. The difference between a named-perils policy and an all-risks (open-perils) policy should be made clear to the student. Second, the definition of an insured should be stressed. It is worthwhile and relevant to show students that they can be insured under another auto insurance policy if they are driving another persons car with permission. Third, endorsements and riders can be briefly discussed. Next, some class time should be spent on the different types of deductibles. It is important to point out that many insureds have collision insurance deductibles that are too low relative to the substantial increase in automobile prices over time. In addition, some time should be spent on coinsurance in property insurance and coinsurance (percentage participation clause) in health insurance. Coinsurance is a fundamental principle of insurance and is worthy of some class time.

.2

I.

Outline

Basic Parts of an Insurance Contract A. Declarations Page 1. Naturestatements made by the applicant for insurance 2. Purposeto provide information for underwriting, rating, and identifying who and what is insured and for how much B. Definitions C. Insuring Agreement 1. Named perils coverage 2. All-risks (open-perils) coverage D. Exclusions 1. Excluded perils 2. Excluded losses 3. Excluded property 4. Reasons for exclusions a. Some perils are considered uninsurable b. Extraordinary hazards are present c. Coverage is provided by other contracts d. Moral hazard is present to a high degree e. Coverage is not needed by the typical insured

2011 Pearson Education, Inc. Publishing as Prentice Hall

60RejdaPrinciples of Risk Management and Insurance, Eleventh Edition

E. Conditions 1. Give notice of loss 2. Preserve and protect property from further loss or damage 3. Submit proof of loss F. Miscellaneous Provisions 1. Cancellation clause 2. Appraisal 3. Assignment 4. Other insurance

II.

Definition of the Insured A. Named insured B. First named insured C. Other insureds D. Additional insureds

III. Endorsements and Riders A. Purposeto add, delete, or modify provisions in the original contract B. Riders may increase or decrease benefits or amounts of insurance C. Riders may add coverage for new perils or losses IV. Deductibles A. Purposes of Deductibles 1. Eliminate small claims 2. Reduce premiums 3. Reduce moral and morale hazard B. Types of Deductibles 1. Property insurance a. Straight deductible b. Aggregate deductible 2. Health insurance a. Calendar-year deductible b. Corridor deductible c. Elimination period V. Coinsurance A. Nature of Coinsurance B. Purpose of Coinsuranceto achieve equity in rating C. Coinsurance in Health Insurance (Percentage Participation Clause)

2011 Pearson Education, Inc. Publishing as Prentice Hall

Chapter 10Analysis of Insurance Contracts61

VI. Other Insurance Provisions A. Types 1. Pro rata liability clause 2. Contribution by equal shares 3. Primary and excess coverage 4. Coordination-of-benefits provision B. Purpose is to prevent profiting from insurance and to support the principle of indemnity

.3

a.

Answers to Case Application

Donna is covered under her policy since she is driving a nonowned car with the permission of the owner. She is also covered under Mikes policy. However, Mikes policy is primary, and Donnas policy is excess. Accordingly, Donnas policy does not pay until Mikes policy limits are exhausted. Mikes policy will pay $100,000. Donnas policy pays nothing. Mikes policy pays $250,000. Donnas policy pays $50,000. $100,000

b. c.

.4

Answers to Review Questions

1. There are six basic parts to an insurance contract: (a) Declarations (b) Definitions (c) Insuring agreement (d) Exclusions (e) Conditions (f) Miscellaneous provisions 2. (a) All policies contain one or more exclusions. There are three major types of exclusions: (1) Excluded perils (2) Excluded losses (3) Excluded property (b) Exclusions are necessary for several reasons. The peril may be uninsurable by private insurers, extraordinary hazards may be present, coverage may be provided by other contracts, moral hazard may be present to a high degree, and coverage may not be needed by the typical insureds. 3. (a) Conditions are provisions inserted in the policy that qualify or place limitations on the insurers promise to perform. (b) The legal significance is that if the policy conditions are not met by the insured, the insurer can refuse to pay the claim.

2011 Pearson Education, Inc. Publishing as Prentice Hall

62RejdaPrinciples of Risk Management and Insurance, Eleventh Edition

4. (a) The named insured is the person or persons named in the declarations section of the policy. (b) The policy may cover additional insureds even though they are not specifically named in the policy. For example, in addition to the named insured, the homeowners policy also covers resident relatives of the named insured or spouse and any person under age 21 who is in the care of any insured. 5. (a) An endorsement or rider is a written provision that adds to, deletes, or modifies the provisions in the original contract. (b) An endorsement normally has precedence over any conflicting terms in the contract to which the endorsement is attached. 6. (a) With a straight deductible, the insured must pay a certain number of dollars before the insurer is required to make a loss payment. Such a deductible applies typically to each loss. (b) A calendar-year deductible is typically present in major medical policies. Eligible medical expenses are accumulated during the calendar year, and once they exceed the deductible amount, the insurer pays the promised benefits. Once the deductible is satisfied during the calendar year, no additional deductibles are imposed on the insured. (c) Commercial insurance contracts may contain an aggregate deductible. An aggregate deductible means that all losses that occur during a specified time period, usually a policy year, are accumulated to satisfy the deductible amount. Once the deductible is met, the insurer pays losses in excess of the deductible. 7. (a) See page 200 in the text for an illustration of the coinsurance clause. (b) The fundamental purpose of coinsurance is to achieve equity in rating. Most property losses are partial and not total. If everyone insures only for the partial loss rather than the total loss, the premium rate for each $100 of insurance must be higher. This would be inequitable to the insured who wishes to insure his or her property to its full value. Thus if the insured meets the coinsurance requirement he or she will receive a rate discount, and the person who is underinsured will be penalized through application of the coinsurance formula. 8. In health insurance, a typical coinsurance provision requires the insured to pay 20, 25, or 30 percent of covered medical expenses in excess of the deductible. The purposes are to reduce premiums and prevent overutilization of policy benefits. 9. (a) Other-insurance provisions are typically present in many insurance contracts. These provisions apply when more than one policy covers the same loss. The purpose of these provisions is to prevent profiting from insurance and violation of the principle of indemnity. Some important other-insurance provisions include the pro rata liability clause, contribution by equal shares, and primary and excess insurance. (b) For an example of the pro rata liability clause, see page 202 in the text. 10. The primary insurer pays first, and the excess insurer pays only after the policy limits under the primary policy are exhausted. No more than 100 percent of the loss is paid. Thus, profiting from insurance by duplicate payment of benefits is avoided.

2011 Pearson Education, Inc. Publishing as Prentice Hall

Chapter 10Analysis of Insurance Contracts63

.5

1.

Answers to Application Questions

(a) The homeowners policy excludes certain types of property such as aircraft because the protection is not needed by the typical insured. To cover aircraft under the homeowners policy as personal property would be grossly unfair to other insureds who would then be required to pay substantially higher premiums for coverage they do not need. (b) Other reasons for exclusions include the following: (1) the peril may be considered uninsurable by commercial insurers; (2) extraordinary hazards are present; (3) coverage is provided by other contracts, (4) moral hazard is present; and (5) the loss may he difficult to determine and measure. (a) (1) Loss A $1500 Loss B $2500 Loss C $9000 (2) Loss A $0 Loss B $0 Loss C $1000. The three losses total $16,000. Since the annual aggregate deductible is $15,000, the amount paid after the occurrence of loss C is $1000. (b) The coordination-of-benefit provisions in most group plans are based on complex rules developed by the National Association of Insurance Commissioners (NAIC). The following summarizes the major provisions based on the NAIC rules: Coverage as an employee is usually primary to coverage as a dependent. For example, Karen and Chris Swift both work, and each is insured as a dependent under the others group medical insurance plan. If Karen incurs covered medical expenses, her plan pays first. She then submits any unreimbursed expenses (such as the deductible and coinsurance payments) to Chris insurer for payment. No more than 100 percent of the eligible medical expenses are paid under both plans. With respect to dependent children, if the parents are married or are not separated, the plan or the parent whose birthday occurs first during the year is primary; the plan of the parent with the later birthday is secondary. For example, if Karens birthday is in January and Chris birthday is in July, Karens plan would pay first if her son is hospitalized. Chris plan would be secondary. (a) $25,000 $200,000 $50,000 = $25,000 80% $500,000 (b) $10,000 (c) The fundamental purpose of coinsurance is to attain equity in rating. Most property insurance losses are partial and not total. If everyone in the insured group insures only for the partial loss rather than for the total loss, the premium rate for each $100 of insurance would be higher. To promote rate equity, the insured who meets the coinsurance requirement is given a rate discount, while insureds who do not meet the coinsurance requirement at the time of loss are penalized according to the coinsurance formula.

2.

3.

2011 Pearson Education, Inc. Publishing as Prentice Hall

64RejdaPrinciples of Risk Management and Insurance, Eleventh Edition

4.

(a) Company A has one-fifth of the total amount of insurance. Thus, based on the pro rata liability clause, it will pay one-fifth of the $100,000 loss or $20,000. Company B and Company C will each pay $40,000. (b) The purpose is to reduce profiting from insurance and violation of the principle of indemnity. (a) Based on contribution by equal shares, each company shares equally in the loss until the share of each insurer equals the lowest limit of liability under any policy, or until the full amount of the loss is paid. Company A and Company B will each contribute $125,000 toward the loss. At that point, the limit of liability under Company Bs policy is exhausted. Therefore Company A will pay the remaining $50,000. Thus Company A pays a total of $175,000 and Company B pays $125,000. (b) $25,000 Ashley must first satisfy the $500 deductible. The insurer pays 80 percent of the remaining $9500 of medical expenses, or $7600. Ashley pays 20 percent of the remaining $9500, or $1900. Including the deductible, Ashley must pay a total of $2400. The 80 percent coinsurance clause requires the insured to carry at least $400,000 of property insurance to avoid a coinsurance penalty (80% $500,000). The clubhouse, however, is insured for only $300,000, or three-fourths of the required amount. Thus only three-fourths of the loss will be paid, or $30,000. This can be illustrated by the coinsurance formula: Amount of insurance carried loss = amount paid Amount of insurance required $300,000 40,000 = $30,000 80% $500,000

5.

6.

7.

2011 Pearson Education, Inc. Publishing as Prentice Hall

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Opposition To Motion To DismissDocument24 pagesOpposition To Motion To DismissAnonymous 7nOdcANo ratings yet

- Family Worship PDF - by Kerry PtacekDocument85 pagesFamily Worship PDF - by Kerry PtacekLeo100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Joint Ventures NOT Taxable As CorporationsDocument2 pagesJoint Ventures NOT Taxable As CorporationsanneNo ratings yet

- Risk Management Solution Manual Chapter 09Document7 pagesRisk Management Solution Manual Chapter 09DanielLam100% (10)

- Risk Management Solution Manual Chapter 02Document6 pagesRisk Management Solution Manual Chapter 02DanielLam86% (7)

- Risk Management Solution Manual Chapter 01Document7 pagesRisk Management Solution Manual Chapter 01DanielLam100% (5)

- Risk Management Solution Manual Chapter 19Document9 pagesRisk Management Solution Manual Chapter 19DanielLam100% (2)

- A Choral FanfareDocument5 pagesA Choral FanfareAdão RodriguesNo ratings yet

- Special Proceedings RULE 74 - Utulo vs. PasionDocument2 pagesSpecial Proceedings RULE 74 - Utulo vs. PasionChingkay Valente - Jimenez100% (1)

- Risk Management Solution Manual Chapter 03Document8 pagesRisk Management Solution Manual Chapter 03DanielLam71% (7)

- Chapter 3 Introduction To Risk Management NewDocument7 pagesChapter 3 Introduction To Risk Management NewDanielLam83% (6)

- Knecht Vs UCCDocument2 pagesKnecht Vs UCCXing Keet LuNo ratings yet

- Risk Management Solution Manual Chapter 04Document5 pagesRisk Management Solution Manual Chapter 04DanielLam75% (4)

- BSBDIV501 Assessment 1Document7 pagesBSBDIV501 Assessment 1Junio Braga100% (3)

- 01sample - Petition For Compulsory Recognition - rrp10182020Document3 pages01sample - Petition For Compulsory Recognition - rrp10182020Madam JudgerNo ratings yet

- Swot Analysis MatrixDocument1 pageSwot Analysis MatrixAhmed Abdel-FattahNo ratings yet

- Al Awasim Min Al Qawasim (AbuBakr Bin Al Arabi)Document199 pagesAl Awasim Min Al Qawasim (AbuBakr Bin Al Arabi)Islamic Reserch Center (IRC)No ratings yet

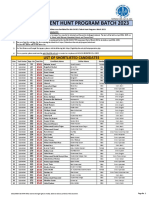

- Iba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesDocument30 pagesIba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesSomil KumarNo ratings yet

- Homework For Non Current Assets Held For SaleDocument2 pagesHomework For Non Current Assets Held For Salesebosiso mokuliNo ratings yet

- 1st Indorsement RYAN SIMBULAN DAYRITDocument8 pages1st Indorsement RYAN SIMBULAN DAYRITAnna Camille TadeoNo ratings yet

- PEER PRESSURE - The Other "Made" Do ItDocument2 pagesPEER PRESSURE - The Other "Made" Do ItMyrrh PasquinNo ratings yet

- Macroeconomics 10th Edition Colander Test BankDocument45 pagesMacroeconomics 10th Edition Colander Test Bankmichaellopezxsnbiejrgt100% (36)

- Stanley Chesley v. Kentucky Bar Association, KBA Reponse Brief To Board of Governors, 5/10/11Document81 pagesStanley Chesley v. Kentucky Bar Association, KBA Reponse Brief To Board of Governors, 5/10/11stanwichNo ratings yet

- GMS Arrivals Checklist Non Tank 24 Feb 2022Document68 pagesGMS Arrivals Checklist Non Tank 24 Feb 2022Oleg Frul100% (1)

- Customer Master - CIN Details Screen ChangesDocument4 pagesCustomer Master - CIN Details Screen Changespranav kumarNo ratings yet

- Rawls TheoryDocument4 pagesRawls TheoryAcademic ServicesNo ratings yet

- 2.7 Industrial and Employee RelationDocument65 pages2.7 Industrial and Employee RelationadhityakinnoNo ratings yet

- Ess Check ListDocument2 pagesEss Check ListBabu Viswanath MNo ratings yet

- TachometerDocument7 pagesTachometerEngr MahaNo ratings yet

- Sworn Statement - TemarioDocument1 pageSworn Statement - Temariozyphora grace trillanesNo ratings yet

- APSA2011 ProgramDocument191 pagesAPSA2011 Programsillwood2012No ratings yet

- Cirrus 5.0 Installation Instructions EnglishDocument62 pagesCirrus 5.0 Installation Instructions EnglishAleksei PodkopaevNo ratings yet

- CHAPTER 7:, 8, & 9 Group 3Document25 pagesCHAPTER 7:, 8, & 9 Group 3MaffyFelicianoNo ratings yet

- In This Chapter : Me, ShankarDocument20 pagesIn This Chapter : Me, ShankarPied AvocetNo ratings yet

- Celebration of International Day For Street ChildrenDocument3 pagesCelebration of International Day For Street ChildrenGhanaWeb EditorialNo ratings yet

- Motion For Preliminary InjunctionDocument4 pagesMotion For Preliminary InjunctionElliott SchuchardtNo ratings yet

- The Marriage of King Arthur and Queen GuinevereDocument12 pagesThe Marriage of King Arthur and Queen GuinevereYamila Sosa RodriguezNo ratings yet