Professional Documents

Culture Documents

Lifehappens

Uploaded by

api-117701159Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lifehappens

Uploaded by

api-117701159Copyright:

Available Formats

Life Happens: A Work, Class, & Access to Resources Exercise! Created by: Tracy E.

Ore Associate Professor, Saint Cloud State University, Department of Sociology & Anthropology The Objectives: 1. For families to provide their members with the basic necessities of: Food Clothing Shelter Taxes

2. For families to provide their children with the best possible education. 3. To maintain the physical and mental well being of each family member by providing: Health care Entertainment Vacations The Equipment: Family Descriptions Cost of Living Sheets Life Happens Cards Preparation: Have class members count off from 1-7. After counting off, class members should then divide into seven groups according to their respective numbers. Each group is then given a Family Profile that indicates the make-up of the family (e.g., how many adults, children, etc.), the household income, the amount of assets, as well as any special circumstances. During the Exercise: Each family must meet the needs of each member and develop and maintain the budget of the household. Families should calculate a monthly budget. The instructor periodically distributes Life Happens cards that indicate an event or circumstance that will impact the family. Members of that particular family will have to make attempts to accommodate the events and circumstances of these cards. The instructor acts as the government/state/and any other institution that has the responsibility of insuring the welfare and safety of children. Due to the lack of response or the irresponsibility of particular families, it may be necessary to take children into protective custody. Ending the Exercise: The game ends after each family has had adequate time to manage their budgets, deal with their particular life circumstances (as determined by their profile and Life Happens cards), etc. Each family should give an oral report describing their family (how many members, what kind of housing they live in, what their jobs are, etc.) and what an average week day and an average weekend looks like

More information about this exercise, as well as copies of Life Happens cards can be found at: http://web.stcloudstate.edu/teore/life

for their family. They should then explain what happened to them by way of life events, how they dealt with those events, and what the impact was on their family. The class will then discuss how well they think each family dealt with their particular situations. FAMILY DESCRIPTIONS A Note About the Families: Income levels of the families below are based on data from the 2000 census as well as a recent occupational salary survey. The income levels of the families essentially represent median incomes in the different income quintiles and are typical for the occupations described. It is important to note that none of the families meet official definitions of poor or marginally poor. As a result, they do not qualify for any social services. Family Profile #1 After Tax Annual Income: $16,080.00 Assets: $0.00 Family Members: 1 Adult Female 1 Adult Male 1 female child age 6 1 male child age 7

Description: Your family lives in an apartment in a small town outside a large metropolitan area. Both adults work full-time for minimum wage ($5.15/hour). Your employers provide no health benefits or vacation time. There is no mass transit available. The youngest child has a learning disability and requires additional tutoring outside of the public school she attends. Family Profile #2 After Tax Annual Income: $25,000.00 Assets: $0.00 Family Members: 2 Adult Females 1 male child age 6 months 1 male teenager age 18

Description: Your family lives in an apartment in a large metropolitan area. One adult works as a teacher in the public schools. She and one child are covered under her employers insurance program. The other adult recently lost her job as an employee at a major telephone company. There is a metropolitan bus service available. The teenager is applying to go to college. Family Profile #3 After Tax Annual Income: $40,000.00 Assets: $5,000.00 (Non-liquid) Family Members: 1 Adult Female 1 Adult Male 3 Teenagers age 13-17

Description: Your family lives in a (not-yet-paid-for) house in a small town outside a large metropolitan area. One adult works full-time at a refrigerator plant. The other adult works part-time at a catalog warehouse. There is a metropolitan bus service available. The youngest child is autistic and requires an adult be home with him.

Family Profile #4 After Tax Annual Income: $65,000.00 Assets: $10,000.00 (Non-liquid) Family Members: 1 Adult Female 1 Adult Male 1 female child age 4 1 male child age 8

Description: Your family lives in a (not-yet-paid-for) house in a large metropolitan area. Both adults work full-time in a small business that you own. Your health insurance is provided through your business. Family Profile #5 After Tax Annual Income: $14,500.00 Assets: $0.00 Family Members: 1 Adult Female 1 child age 3

Description: Your family lives in an apartment in a suburb of a large metropolitan area. The adult works full-time as a nurses aid in a near-by hospital. There is a metropolitan bus service available. The friend that watches your child while you work is moving away soon. You will need to make alternative arrangements. Family Profile #6 After Tax Annual Income: $140,000.00 Assets: $20,000.00 (Non-liquid) Family Members: 2 Adult Males 1 teenage male age 16

Description: Your family lives in a (not-yet-paid-for) house in a large metropolitan area. You own two cars, one of which is paid for. Both adults work as lawyers: one as a public defender, the other in a private firm. Each employer provides health benefits. Your son is hoping to graduate early from high school and is considering traveling before attending college. Family Profile #7 After Tax Annual Income: $250,000.00 Assets: $100,000.00 Family Members: 1 Adult Female 1 Adult Male 2 female children age 3 and 12 2 male children age 17 and 18

Description: Your family lives in a house in a large metropolitan area. One adult serves as the president of a Bank. Health benefits are provided for your entire family through the employer. You own two cars, both of which are paid for. The other adult does not work outside the home. The oldest teenager is applying to college. The 12 year-old-girl has a learning disability and requires additional tutoring outside of the public school she attends.

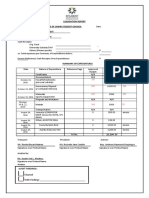

COST OF LIVING* Mandatory Monthly Costs FOOD Food on sale (lower quality, mostly prepared foods): Food not on sale (higher quality, fresh vegetables, etc.): CLOTHING Buying new and cleaning old SHELTER Renting a 2 bedroom apartment: Renting a 3 bedroom apartment: Buying a 3 Bedroom home: UTILITIES Gas Electric Water Phone TRANSPORTATION New Car Payment: Lexus Honda Civic Ford Focus Used Car $850 $350 $225 $170 (monthly costs for car for repair and service costs.) Note : if you have a used car you must also purchase at least one monthly bus pass. $50/month/car $500 deductible No coverage for uninsured drivers $85/month/car $250 deductible Uninsured driver coverage $130/car/month (minimum) $24/month $50 $50 $50 $40 (minimum) $550 (electric not included) $650 (electric not included) $20,000 down, $800/month $1,200 annual property taxes $20.00 per person (minimum) $100 per person $175 per person

Insurance: Package 1

Package 2

Gas: Bus:

Note: These figures are based on rental costs in Minnesota. You will need to adjust these figures so that they accurately reflect the cost-of-living in your area. Go to the Economic Policy Institute (http://www.epinet.org/content.cfm/datazone_fambud_budget) to calculate costs in your area.

EDUCATION Through High School: Public: Private: Religious High School Prep School Free $3,000/year $7,000/year for day student $16,000/year for boarding student $2,800/year $7,400/year $29,000/year $40.00/college $150/family $500 one-time emergency room deductible $20/office visit 50% off prescriptions $275/family No emergency room deductible $10/office visit $10 co-pay on prescriptions $30/person for miscellaneous medical costs $250/month $750/month $81.25/person $25.00/person $50.00/month (minimum payment)

College: Community State Ivy League College Application Fees HEALTH INSURANCE Package 1

Package 2

No Health Coverage CHILD CARE Basic care (no activities or educational programs): Extended care (activities and educational programs): Costs for everything from toothpaste to home repairs. STATE SALES TAXES CREDIT CARD BILLS

MISCELLANEOUS PERSONAL AND HOUSEHOLD EXPENSES

Optional Expenses Cable Broadband Internet DVD/Video Rental Going out to the movies Donations (religious organizations, charities) Personal (haircuts, cosmetics) Gym membership Pet food/Pet Care $50/month $30.00/month $3.00/DVD/video $15.00/person You determine amount. You determine amount. $40/month $40/month

Other Costs You May Incur Due to Life Happens Events Live-in nurse: Physician (office visit only) X-rays and other tests Hospital stay Pre-natal visits Braces Car Repairs Plumber Hotel Motel Dining out (fancy) Dining out (fast food) $300/week $75 $300 per x-ray/test $300/day $100.00 (if uninsured) $1,500 $150 $100/hour (3hour minimum) $75/night $35/night $25/person $5/person

You might also like

- America's Child-Care Crisis: Rethinking an Essential BusinessFrom EverandAmerica's Child-Care Crisis: Rethinking an Essential BusinessNo ratings yet

- North Suburban Cook Standard 09Document5 pagesNorth Suburban Cook Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- South Suburban Cook Standard 09Document5 pagesSouth Suburban Cook Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Fact Sheet: Rep. Dave Camp (R-MI-4)Document2 pagesFact Sheet: Rep. Dave Camp (R-MI-4)progressmichiganNo ratings yet

- Municipal Briefing NotesDocument7 pagesMunicipal Briefing NotesACORN_CanadaNo ratings yet

- Northside Chicago Standard 09Document5 pagesNorthside Chicago Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Stephenson Standard 09Document4 pagesStephenson Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Henderson County, IllinoisDocument4 pagesSelf-Sufficiency in Henderson County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Hancock County, IllinoisDocument4 pagesSelf-Sufficiency in Hancock County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Clinton County, IllinoisDocument4 pagesSelf-Sufficiency in Clinton County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Richland County, IllinoisDocument4 pagesSelf-Sufficiency in Richland County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Clark Standard 09Document4 pagesClark Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Lee Standard 09Document4 pagesLee Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Lawrence County, IllinoisDocument4 pagesSelf-Sufficiency in Lawrence County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Randolph County, IllinoisDocument4 pagesSelf-Sufficiency in Randolph County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- East St. Louis Standard 09Document4 pagesEast St. Louis Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Massac County, IllinoisDocument4 pagesSelf-Sufficiency in Massac County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Jackson County, IllinoisDocument4 pagesSelf-Sufficiency in Jackson County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Rock Island Standard 09Document4 pagesRock Island Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Coles Standard 09Document4 pagesColes Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Alexander County, IllinoisDocument4 pagesSelf-Sufficiency in Alexander County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Franklin County, IllinoisDocument4 pagesSelf-Sufficiency in Franklin County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Christian County, IllinoisDocument4 pagesSelf-Sufficiency in Christian County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Bureau Standard 09Document4 pagesBureau Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Jasper Standard 09Document4 pagesJasper Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Pulaski County, IllinoisDocument4 pagesSelf-Sufficiency in Pulaski County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Menard Standard 09Document4 pagesMenard Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Johnson County, IllinoisDocument4 pagesSelf-Sufficiency in Johnson County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Edgar Standard 09Document4 pagesEdgar Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Livingston Standard 09Document4 pagesLivingston Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- St. Clair Standard 09Document4 pagesSt. Clair Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- DeKalb Standard 09Document4 pagesDeKalb Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Kane Standard 09Document4 pagesKane Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Kendall County, IllinoisDocument4 pagesSelf-Sufficiency in Kendall County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Macoupin County, IllinoisDocument4 pagesSelf-Sufficiency in Macoupin County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Lake Standard 09Document4 pagesLake Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Perry Standard 09Document4 pagesPerry Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Jo Daviess Standard 09Document4 pagesJo Daviess Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Champaign County, IllinoisDocument4 pagesSelf-Sufficiency in Champaign County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Crawford County, IllinoisDocument4 pagesSelf-Sufficiency in Crawford County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Mercer Standard 09Document4 pagesMercer Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Effingham County, IllinoisDocument4 pagesSelf-Sufficiency in Effingham County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Brown Standard 09Document4 pagesBrown Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Bond Standard 09Document4 pagesBond Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Pope Standard 09Document4 pagesPope Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Henry Standard 09Document4 pagesHenry Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Clay Standard 09Document4 pagesClay Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Dewitt County, IllinoisDocument4 pagesSelf-Sufficiency in Dewitt County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Mason Standard 09Document4 pagesMason Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Boone Standard 09Document4 pagesBoone Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Iroquois County, IllinoisDocument4 pagesSelf-Sufficiency in Iroquois County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Knox Standard 09Document4 pagesKnox Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Greene Standard 09Document4 pagesGreene Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- McLean Standard 09Document4 pagesMcLean Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Woodford County, IllinoisDocument4 pagesSelf-Sufficiency in Woodford County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Mcdonough County, IllinoisDocument4 pagesSelf-Sufficiency in Mcdonough County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Piatt County, IllinoisDocument4 pagesSelf-Sufficiency in Piatt County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Marion Standard 09Document4 pagesMarion Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Self-Sufficiency in Hamilton County, IllinoisDocument4 pagesSelf-Sufficiency in Hamilton County, IllinoisSocial IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Pike Standard 09Document4 pagesPike Standard 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Universal Physical Features HandoutDocument1 pageUniversal Physical Features Handoutapi-117701159No ratings yet

- Abcs of Australia Oceania Group InstructionsDocument2 pagesAbcs of Australia Oceania Group Instructionsapi-117701159No ratings yet

- The Hidden Story of Partition and Its Legacies ProjectDocument6 pagesThe Hidden Story of Partition and Its Legacies Projectapi-117701159No ratings yet

- East Asia Project Student HandoutDocument5 pagesEast Asia Project Student Handoutapi-117701159No ratings yet

- India and Its Neighbors Activity ProjectDocument5 pagesIndia and Its Neighbors Activity Projectapi-117701159No ratings yet

- 2014 World Population Data Sheet - Eng PDFDocument20 pages2014 World Population Data Sheet - Eng PDFT.c. AndreeaNo ratings yet

- Mapping Lab Power PointDocument7 pagesMapping Lab Power Pointapi-117701159No ratings yet

- Changing Demographics HandoutDocument3 pagesChanging Demographics Handoutapi-117701159No ratings yet

- European UnionDocument17 pagesEuropean Unionapi-117701159No ratings yet

- Desertification Causes and Effects Sahel QR CodesDocument1 pageDesertification Causes and Effects Sahel QR Codesapi-117701159No ratings yet

- 2014 World Population Data Sheet - Eng PDFDocument20 pages2014 World Population Data Sheet - Eng PDFT.c. AndreeaNo ratings yet

- Chap 17Document36 pagesChap 17api-117701159No ratings yet

- North Atlantic Drift QR LessonDocument2 pagesNorth Atlantic Drift QR Lessonapi-117701159No ratings yet

- SahelDocument39 pagesSahelapi-117701159No ratings yet

- Conflict and Terror in Pakistan CC Doc HandoutDocument6 pagesConflict and Terror in Pakistan CC Doc Handoutapi-117701159No ratings yet

- BBC Religion SheetDocument1 pageBBC Religion Sheetapi-117701159No ratings yet

- LL Picture ExplanationDocument2 pagesLL Picture Explanationapi-117701159No ratings yet

- Geographic Foundations of East Asia Student HandoutDocument1 pageGeographic Foundations of East Asia Student Handoutapi-117701159No ratings yet

- East Asia MapDocument1 pageEast Asia Mapapi-117701159No ratings yet

- Compare Hinduism and Buddhism DiagramDocument1 pageCompare Hinduism and Buddhism Diagramapi-117701159No ratings yet

- Chap 16Document40 pagesChap 16api-117701159No ratings yet

- Chap 15Document32 pagesChap 15api-117701159No ratings yet

- Geographic Foundations of East Asia Student InformationDocument3 pagesGeographic Foundations of East Asia Student Informationapi-117701159No ratings yet

- World Religion ChartDocument2 pagesWorld Religion Chartapi-117701159No ratings yet

- Chap 14Document32 pagesChap 14api-117701159100% (1)

- Chap 13Document40 pagesChap 13api-117701159No ratings yet

- Chap 12Document36 pagesChap 12api-117701159No ratings yet

- Chap 10Document36 pagesChap 10api-117701159No ratings yet

- Chap 11Document42 pagesChap 11api-117701159100% (1)

- Vietnam - S WTO CommitmentsDocument853 pagesVietnam - S WTO CommitmentsTruong Thu NganNo ratings yet

- Nov Dec MCQ Practice Work Sheet No 3 With Answers 1Document25 pagesNov Dec MCQ Practice Work Sheet No 3 With Answers 1Lai Kee KongNo ratings yet

- Lecture 7Document44 pagesLecture 7Tiffany TsangNo ratings yet

- University Students Hit by InflationDocument2 pagesUniversity Students Hit by InflationTantizmNo ratings yet

- Managerial Accounting 12Th Edition Warren Test Bank Full Chapter PDFDocument67 pagesManagerial Accounting 12Th Edition Warren Test Bank Full Chapter PDFykydxnjk4100% (14)

- Local Budget Circular No 131Document28 pagesLocal Budget Circular No 131alzhammer manupacNo ratings yet

- Guidelines For Applicants IPA CBBEM FinalDocument13 pagesGuidelines For Applicants IPA CBBEM FinalMilan Poka MijajlovicNo ratings yet

- Effects of Tax Avoidance To The Economic Development in Taraba StateDocument75 pagesEffects of Tax Avoidance To The Economic Development in Taraba StateJoshua Bature SamboNo ratings yet

- PPE PPT - Ch10Document81 pagesPPE PPT - Ch10ssreya80No ratings yet

- Cost AccountingDocument18 pagesCost AccountingNigel UruilalNo ratings yet

- Goleta City Council Budget WorkshopDocument144 pagesGoleta City Council Budget WorkshopBrooke TaylorNo ratings yet

- QuestionnaireDocument22 pagesQuestionnairevasanthNo ratings yet

- Idoc - Pub - Icse X Maths Project On Home BudgetDocument21 pagesIdoc - Pub - Icse X Maths Project On Home BudgetLinga Alex75% (4)

- Acca Paper 1.2Document25 pagesAcca Paper 1.2anon-280248No ratings yet

- Project Management in Practice Fifth Edition The World of Project ManagementDocument90 pagesProject Management in Practice Fifth Edition The World of Project ManagementShyair GanglaniNo ratings yet

- Income Taxation BsaDocument11 pagesIncome Taxation BsaCrizel SerranoNo ratings yet

- Impact of Public Debt On The Economic Growth of PakistanDocument24 pagesImpact of Public Debt On The Economic Growth of PakistanSadiya AzharNo ratings yet

- Excel Portfolio Management DashboardDocument5 pagesExcel Portfolio Management Dashboardvalerie.carbonneauNo ratings yet

- Banking VIVA QuestionsDocument15 pagesBanking VIVA Questionsnobo_dhakaNo ratings yet

- Budgeting Styles Among The 11 AbmDocument16 pagesBudgeting Styles Among The 11 AbmTimothy Robert Estella100% (1)

- Marginal Costing TutorialDocument5 pagesMarginal Costing TutorialRajyaLakshmiNo ratings yet

- Chapter 4 ManagerialDocument30 pagesChapter 4 ManagerialZuhaib SagarNo ratings yet

- Cash Cost in MiningDocument7 pagesCash Cost in Miningbatman_No ratings yet

- Hansen AISE IM Ch08Document54 pagesHansen AISE IM Ch08AimanNo ratings yet

- Cash Management 11012018Document41 pagesCash Management 11012018narunsankarNo ratings yet

- Richard Koo - Balance Sheet RecessionsDocument44 pagesRichard Koo - Balance Sheet Recessionsamjones85100% (1)

- ACCT 346 Midterm ExamDocument7 pagesACCT 346 Midterm ExamDeVryHelpNo ratings yet

- 7 - Final Sportsfest Liquidation ReportDocument1 page7 - Final Sportsfest Liquidation ReportAustin Viel Lagman MedinaNo ratings yet

- Guidelines Conducting Stakeholder AnalysisDocument42 pagesGuidelines Conducting Stakeholder AnalysisDavid Sigalingging100% (1)

- International Capital BudgetingDocument28 pagesInternational Capital BudgetingMatt ToothacreNo ratings yet