Professional Documents

Culture Documents

Weygand 8e ch2 Solution

Uploaded by

Seany SukmawatiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weygand 8e ch2 Solution

Uploaded by

Seany SukmawatiCopyright:

Available Formats

Tugas 2 SIAK Seany Sukmawati (1106154034)

E2-15 The statement of cash flows classifies each transaction as an operating activity, an investing

activity, or a financing activity. Operating activities are the types of activities the company performs

to generate profits. Investing activities include the purchase of longlived assets such as equipment or

the purchase of investment securities. Financing activities are borrowing money, issuing shares, and

paying dividends.

Presented below are the following transactions

1. Issued stock for $20,000 cash.

2. Issued note payable for $10,000 cash.

3. Purchased equipment for $11,000 cash.

4. Received $15,000 cash for services provided.

5. Paid $1,000 cash for rent.

6. Paid $600 cash dividend to stockholders.

7. Paid $6,500 cash for salaries.

I nstructions

Classify each of these transactions as operating, investing, or financing activities.

Cash Flow Statement

Operating Actifities

Cash received from services provided 15,000

Cash paid for rent (1,000)

Cash paid for salaries (6,500)

Cash Flows From Operating Actifities 7,500

Investing Actifities

Purchase of equipment (11,000)

Cash Flows From Investing Actifities (11,000)

Financing Actifities

Issue of shares 20,000

Issue of note payable 10,000

Payment of dividends (600)

Cash Flows From Financing Actifities 29,400

Total Cash Flow $ 25,900

P2-5A The Classic Theater opened on April 1. All facilities were completed on March 31. At this

time, the ledger showed No. 101 Cash $6,000, No. 140 Land $10,000, No. 145 Buildings (concession

stand, projection room, ticket booth, and screen) $8,000, No. 157 Equipment $6,000, No. 201

Accounts Payable $2,000, No. 275 Mortgage Payable $8,000, and No. 311 Share Capital--Ordinary

$20,000. During April, the following events and transactions occurred.

Apr. 2 Paid film rental of $800 on first movie.

3 Ordered two additional films at $1,000 each.

9 Received $1,800 cash from admissions.

10 Made $2,000 payment on mortgage and $1,000 for accounts payable due.

11 Classic Theater contracted with D. Zarle Company to operate the concession stand.

Zarle is to pay 18% of gross concession receipts (payable monthly) for the rental of the

concession stand.

Tugas 2 SIAK Seany Sukmawati (1106154034)

12 Paid advertising expenses $300.

20 Received one of the films ordered on April 3 and was billed $1,000. The film will be

shown in April.

25 Received $5,200 cash from admissions.

29 Paid salaries $1,600.

30 Received statement from D. Zarle showing gross concession receipts of $1,000 and the

balance due to The Classic Theater of $180 ($1,000 x 18%) for April. Zarle paid one-

half of the balance due and will remit the remainder on May 5.

30 Prepaid $900 rental on special film to be run in May.

In addition to the accounts identified above, the chart of accounts shows No. 112 Accounts

Receivable, No. 136 Prepaid Rent, No. 400 Service Revenue, No. 429 Rent Revenue, No. 610

Advertising Expense, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense.

I nstructions

(a) Enter the beginning balances in the ledger as of April 1. Insert a check mark () in the reference

column of the ledger for the beginning balance.

(b) Journalize the April transactions.

(c) Post the April journal entries to the ledger. Assume that all entries are posted from page 1 of the

journal.

(d) Prepare a trial balance on April 30, 2014.

(a) Beginning Ledger

Cash No. 101

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 6,000

Land No. 140

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 10,000

Buildings No. 145

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 8,000

Equipment

No. 157

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 6,000

Accounts Payable

No. 201

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 2,000

Mortgage Payable

No. 275

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 8,000

Share CapitalOrdinary

No. 311

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 20,000

Tugas 2 SIAK Seany Sukmawati (1106154034)

(b) Journal

Date Account Title Ref Debit Credit

Apr. 2 Film Rental Expense 800

Cash 800

(Payment for film rental)

Apr. 3 No Entry 0

No Entry 0

(Ordered additional films)

Apr. 9 Cash 1,800

Admission Revenue 1,800

(Received cash for services provided)

Apr. 10 Mortgage Payable 2,000

Accounts Payable 1,000

Cash 3,000

(Made payments on mortgage and accounts

payable)

Apr. 11 No Entry 0

No Entry 0

(Contract to operate concession stand)

Apr. 12 Advertising Expense 300

Cash 300

(Paid advertising expenses)

Apr. 20 Film Rental Expense 1,000

Accounts Payable 1,000

(Rented film on account)

Apr. 25 Cash 5,200

Admission Revenue 5,200

(Received cash for services provided)

Apr. 29 Salaries Expense 1,600

Cash 1,600

(Paid salaries expense)

Apr. 30 Accounts Receivable 90

Cash 90

Concession Revenue 180

(Received cash & balance on account for

concession revenue)

Apr. 30 Prepaid Rentals 900

Cash 900

(Paid cash for future film rentals.)

(c) Ledger

Cash No. 101

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 6,000

2 J1 0 800 5,200

9 J1 1,800 0 7,000

10 J1 0 3,000 4,000

12 J1 0 300 3,700

25 J1 5,200 0 8,900

29 J1 0 1,600 7,300

30 J1 90 0 7,390

30 J1 0 900 6,490

Tugas 2 SIAK Seany Sukmawati (1106154034)

Accounts Receivable No. 112

Date Explanation Ref. Debit Credit Balance

Apr. 30 J1 90 0 90

Prepaid Rent

No. 136

Date Explanation Ref. Debit Credit Balance

Apr. 30 J1 900 0 900

Land

No. 140

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 10,000

Buildings

No. 145

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 8,000

Equipment

No. 157

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 6,000

Accounts Payable

No. 201

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 2,000

10 J1 1,000 0 1,000

20 J1 0 1,000 2,000

Mortgage Payable

No. 275

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 8,000

10 J1 2,000 0 6,000

Share CapitalOrdinary

No. 311

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 20,000

Service Revenue

No. 400

Date Explanation Ref. Debit Credit Balance

Apr. 9 J1 0 1,800 1,800

25 J1 0 5,200 7,000

Rent Revenue

No. 429

Date Explanation Ref. Debit Credit Balance

Apr. 30 J1 0 180 180

Advertising Expense

No. 610

Date Explanation Ref. Debit Credit Balance

Apr. 12 J1 300 0 300

Salaries and Wages Expense

No. 726

Date Explanation Ref. Debit Credit Balance

Apr. 29 J1 1,600 0 1,600

Rent Expense

No. 729

Date Explanation Ref. Debit Credit Balance

Apr. 2 J1 800 0 800

20 J1 1,000 0 1,800

Tugas 2 SIAK Seany Sukmawati (1106154034)

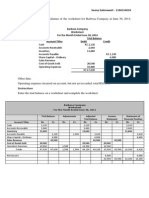

(d) Trial Balance

CLASSIC THEATER

Trial Balance

April 30, 2014

Debit Credit

Cash $ 6,490 $ 0

Accounts Receivable 90 0

Prepaid Rent 900 0

Land 10,000 0

Buildings 8,000 0

Equipment 6,000 0

Accounts Payable 0 2,000

Mortgage Payable 0 6,000

Share Capital--Ordinary 0 20,000

Service Revenue 0 7,000

Rent Revenue 0 180

Advertising Expense 300 0

Salaries and Wages Expense 1,600 0

Rent Expense 1,800 0

$ 35,180

$ 35,180

You might also like

- The Lake TheaterDocument4 pagesThe Lake Theaterwaywardguy_6950% (2)

- E2-1 Larry Burns Has Prepared The Following List of Statements About AccountsDocument3 pagesE2-1 Larry Burns Has Prepared The Following List of Statements About AccountsegaNo ratings yet

- Exercise Chapter 3: Adjusting The AccountsDocument9 pagesExercise Chapter 3: Adjusting The AccountsSeany Sukmawati100% (3)

- Be16 P16 2aDocument7 pagesBe16 P16 2aLisa Hammerle ClarkNo ratings yet

- Tugas Accounting 2 PRINTDocument6 pagesTugas Accounting 2 PRINTAnnaley WilstaniaNo ratings yet

- Baiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklDocument13 pagesBaiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklMelati SepsaNo ratings yet

- P4Document3 pagesP4Trisyall TriyonoputraNo ratings yet

- CH 04Document111 pagesCH 04arif nugrahaNo ratings yet

- Tugas P2-1A Dan P2-2A Peng - AkuntansiDocument5 pagesTugas P2-1A Dan P2-2A Peng - AkuntansiAlche MistNo ratings yet

- ACC 557 Week 2 Chapter 2 (E2-6, E2-9, E2-11, P2-2A) 100% ScoredDocument18 pagesACC 557 Week 2 Chapter 2 (E2-6, E2-9, E2-11, P2-2A) 100% ScoredJoseph W. Rodgers100% (1)

- Student data and journal entriesDocument6 pagesStudent data and journal entriesElriska Tiffani75% (4)

- Dini Kusuma Wardani F0221073 Accounting Cycle For Service Company (Part III)Document29 pagesDini Kusuma Wardani F0221073 Accounting Cycle For Service Company (Part III)Dini Kusuma100% (1)

- Assignment 2Document4 pagesAssignment 2Sultan LimitNo ratings yet

- Tugas Akuntan 3Document14 pagesTugas Akuntan 3Michael Edision UrikpyNo ratings yet

- Jawaban BE15 - AKMDocument3 pagesJawaban BE15 - AKMMazz BadruezNo ratings yet

- HW 7Document2 pagesHW 7Mishalm96No ratings yet

- Ganang Surya Hananta Swara 1901572691 Tugas Personal Ke-4 Minggu 8Document22 pagesGanang Surya Hananta Swara 1901572691 Tugas Personal Ke-4 Minggu 8Vira JilmiNo ratings yet

- Accounting Problem 5 5ADocument8 pagesAccounting Problem 5 5AParbon Acharjee100% (1)

- CH 03Document68 pagesCH 03Chang Chan Chong100% (1)

- Tugas MK Dasar Akuntansi Pertemuan Ke-15Document2 pagesTugas MK Dasar Akuntansi Pertemuan Ke-15Mochamad Ardan FauziNo ratings yet

- Quis 5Document3 pagesQuis 5Right LineNo ratings yet

- ACC 557 Week 2 Chapter 3 (E3-6, E3-7, E3-11, P3-2A) 100% ScoredDocument26 pagesACC 557 Week 2 Chapter 3 (E3-6, E3-7, E3-11, P3-2A) 100% ScoredJoseph W. RodgersNo ratings yet

- E2-7 Answer KeyDocument1 pageE2-7 Answer Keyusenix1100% (1)

- 4brief Ex 4Document5 pages4brief Ex 4Ervina CorneliaNo ratings yet

- P1-2B 6081901141Document3 pagesP1-2B 6081901141Mentari Anggari67% (3)

- SELF TEST ACCOUNTING QUIZDocument18 pagesSELF TEST ACCOUNTING QUIZAwun Sukma100% (1)

- Akm E7-9 P7-3 P7-6 P7-13Document5 pagesAkm E7-9 P7-3 P7-6 P7-13tira sundayNo ratings yet

- Bowman Co September transactions journalDocument8 pagesBowman Co September transactions journalwibuNo ratings yet

- Chapter 4 Homework (April 22)Document6 pagesChapter 4 Homework (April 22)Sugim Winata EinsteinNo ratings yet

- Hercules Poirot WorksheetDocument6 pagesHercules Poirot WorksheetvaldaNo ratings yet

- Bimbel PADocument31 pagesBimbel PAHalle TeferiNo ratings yet

- E3 5Document3 pagesE3 5Lisa Hammerle Clark60% (5)

- P3 2aDocument10 pagesP3 2adzaky2303No ratings yet

- Accounting 1Document11 pagesAccounting 1Audie yanthiNo ratings yet

- Soal Latihan Minggu 4Document9 pagesSoal Latihan Minggu 4Alifia AprizilaNo ratings yet

- Pertemuan 12 - Investasi Obligasi PDFDocument21 pagesPertemuan 12 - Investasi Obligasi PDFayu utamiNo ratings yet

- Comprehensive Problems Solution Answer Key Mid TermDocument5 pagesComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneNo ratings yet

- Week 3 Accounting HelpDocument4 pagesWeek 3 Accounting HelpGiuseppe Mccoy100% (1)

- P7-11 (Income Effects of Receivables Transactions) Sandburg Company Requires Additional Cash For ItsDocument3 pagesP7-11 (Income Effects of Receivables Transactions) Sandburg Company Requires Additional Cash For ItsDella Putri Reba UtamyNo ratings yet

- Exercise - Dilutive Securities - AdillaikhsaniDocument4 pagesExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsanNo ratings yet

- Soal Lat UAS P. Akuntansi I (PT. HARIS)Document4 pagesSoal Lat UAS P. Akuntansi I (PT. HARIS)Nurul Alifah Putri100% (1)

- Adjusting Entries for ResortDocument11 pagesAdjusting Entries for ResortSher KurniaNo ratings yet

- Adjusting Allowance for Doubtful AccountsDocument2 pagesAdjusting Allowance for Doubtful AccountsWisanggeni RatuNo ratings yet

- P1-1a 6081901141Document2 pagesP1-1a 6081901141Mentari AnggariNo ratings yet

- Bank Reconciliation and Adjusting Entries for Aglife GeneticsDocument9 pagesBank Reconciliation and Adjusting Entries for Aglife GeneticsDetha Prasetio KumaraNo ratings yet

- P5-1A Dan P5-2ADocument6 pagesP5-1A Dan P5-2ASherly Meliana Geraldine100% (1)

- Tugas 4 Dasar AkuntansiDocument20 pagesTugas 4 Dasar AkuntansiAji Surya Wijaya75% (4)

- Chapter 4 ExerciseDocument5 pagesChapter 4 ExerciseSeany SukmawatiNo ratings yet

- Chapter 3: Working With Financial StatementsDocument10 pagesChapter 3: Working With Financial StatementsNafeun AlamNo ratings yet

- CH 04Document4 pagesCH 04vivien33% (3)

- Tara's Maids Cleaning Service Financial RecordsDocument21 pagesTara's Maids Cleaning Service Financial RecordsMuhammad Faris100% (1)

- Question P8-1A: Cafu SADocument29 pagesQuestion P8-1A: Cafu SAMashari Saputra100% (1)

- Pertemuan 11 - EkuitasDocument34 pagesPertemuan 11 - EkuitasCristian Kumara PutraNo ratings yet

- Byte Repair Service, Inc Neraca Saldo December 31, 2013: JurnalDocument5 pagesByte Repair Service, Inc Neraca Saldo December 31, 2013: Jurnaljilboobs100% (2)

- Chapter 7 Problem 7.3 Nathali, Jeffrey, TasyaDocument6 pagesChapter 7 Problem 7.3 Nathali, Jeffrey, Tasyavtech netNo ratings yet

- Jawaban PEM Chapter 23 No 4,5,7Document3 pagesJawaban PEM Chapter 23 No 4,5,7Baldiaz Ryana SunaryoNo ratings yet

- Accounting Exer 1Document3 pagesAccounting Exer 1Md Delowar Hossain Mithu80% (5)

- Forntier Park General Journel Date Titles & Explanation Ref Debit CreditDocument15 pagesForntier Park General Journel Date Titles & Explanation Ref Debit CreditHasan TarekNo ratings yet

- BASIC ACCOUNTING PRINCIPLESDocument28 pagesBASIC ACCOUNTING PRINCIPLEStanvir ahmedNo ratings yet

- ch01 PDFDocument2 pagesch01 PDFDanish BaigNo ratings yet

- Compensation management at TCSDocument17 pagesCompensation management at TCSPunitValaNo ratings yet

- Bond Risk - Duration and ConvexityDocument26 pagesBond Risk - Duration and ConvexityamcucNo ratings yet

- 25 Surprising Facts About Warren BuffettDocument14 pages25 Surprising Facts About Warren BuffettRushabh KapadiaNo ratings yet

- GDP TransactionsDocument8 pagesGDP TransactionsMohamed FoulyNo ratings yet

- Hongkong DisneyDocument22 pagesHongkong DisneyLiam LêNo ratings yet

- Sfac 1Document28 pagesSfac 1Meyta FatmarsaniNo ratings yet

- Differences between IFRS, US GAAP and Indian GAAPDocument4 pagesDifferences between IFRS, US GAAP and Indian GAAPshinesanjuNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesDocument7 pages9706 Accounting: MARK SCHEME For The October/November 2013 SeriesCambridge Mathematics by Bisharat AliNo ratings yet

- Yangon Technological University Department of Civil EngineeringDocument28 pagesYangon Technological University Department of Civil Engineeringthan zawNo ratings yet

- Government Top Officers - OfficialsDocument234 pagesGovernment Top Officers - OfficialsUdit Yadav - Adler TeamNo ratings yet

- RM ProjectDocument5 pagesRM ProjectswatiNo ratings yet

- Top 10 Strategies For Profit On Binary OptionsDocument26 pagesTop 10 Strategies For Profit On Binary OptionsBinary Options Profit78% (9)

- Banks ServicesDocument28 pagesBanks ServicesAyushNo ratings yet

- PPP Corporate KYC FormatDocument13 pagesPPP Corporate KYC FormatBappa Maitra100% (1)

- Housing Department Material Submission FormDocument49 pagesHousing Department Material Submission FormansonchongNo ratings yet

- Multinational Business Finance Solution Manual 12th Edition by Etiman Stone Hill Moffitt Prepared by Wasim Orakzai IM Sciences KUST ISBN 0 321 1789Document229 pagesMultinational Business Finance Solution Manual 12th Edition by Etiman Stone Hill Moffitt Prepared by Wasim Orakzai IM Sciences KUST ISBN 0 321 1789Alli Tobba83% (12)

- Sales TrainingDocument19 pagesSales TrainingAashish PardeshiNo ratings yet

- Negative Rates and Bank ProfitabilityDocument17 pagesNegative Rates and Bank ProfitabilityADBI EventsNo ratings yet

- Acctg 029 - Mod 3 Conso Fs Subs DateDocument8 pagesAcctg 029 - Mod 3 Conso Fs Subs DateAlliah Nicole RamosNo ratings yet

- Course Outline Business FinanceDocument6 pagesCourse Outline Business FinanceKalonduMakauNo ratings yet

- ABM 1 Reviewer ModuleDocument9 pagesABM 1 Reviewer Modulejoseph christopher vicenteNo ratings yet

- Bill Williams New Trading DimensionsDocument24 pagesBill Williams New Trading DimensionsAmine Elghazi50% (2)

- Department of Architecture Urban Planning 1 Assignment 2: by Bethelhem Getnet To Yirsaw ZegeyeDocument8 pagesDepartment of Architecture Urban Planning 1 Assignment 2: by Bethelhem Getnet To Yirsaw Zegeyefitsum tesfayeNo ratings yet

- Nesta: What We DoDocument24 pagesNesta: What We DoNestaNo ratings yet

- Annual General Meeting PresentationDocument23 pagesAnnual General Meeting Presentationtanvi virmaniNo ratings yet

- ChapDocument74 pagesChapTote FrotyNo ratings yet

- GST - Final Presentation On Mutual Funds Sector - FINALDocument44 pagesGST - Final Presentation On Mutual Funds Sector - FINALSulochana ChoudhuryNo ratings yet

- Tutorial 5 A212 Foreign OperationsDocument9 pagesTutorial 5 A212 Foreign OperationsFatinNo ratings yet

- Ey Cost of Capital India Survey 2017Document16 pagesEy Cost of Capital India Survey 2017Rahul KmrNo ratings yet

- Urban Planning and Real Estate DevelopmentDocument5 pagesUrban Planning and Real Estate Developmentanon_145354896No ratings yet