Professional Documents

Culture Documents

Business Credit Secrets Revealed

Uploaded by

Akil Bey91%(44)91% found this document useful (44 votes)

11K views13 pagesThe document provides information on establishing business credit, including the steps to take and different business entity structures to choose from. It discusses getting a DUNS number from Dun & Bradstreet, choosing an entity like an LLC, corporation, or partnership, and the importance of following certain guidelines for Dun & Bradstreet profiles to avoid being flagged. Different business structures like offshore corporations, Nevada corporations, and in-state corporations are compared regarding taxes, liability, and business credit considerations.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides information on establishing business credit, including the steps to take and different business entity structures to choose from. It discusses getting a DUNS number from Dun & Bradstreet, choosing an entity like an LLC, corporation, or partnership, and the importance of following certain guidelines for Dun & Bradstreet profiles to avoid being flagged. Different business structures like offshore corporations, Nevada corporations, and in-state corporations are compared regarding taxes, liability, and business credit considerations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

91%(44)91% found this document useful (44 votes)

11K views13 pagesBusiness Credit Secrets Revealed

Uploaded by

Akil BeyThe document provides information on establishing business credit, including the steps to take and different business entity structures to choose from. It discusses getting a DUNS number from Dun & Bradstreet, choosing an entity like an LLC, corporation, or partnership, and the importance of following certain guidelines for Dun & Bradstreet profiles to avoid being flagged. Different business structures like offshore corporations, Nevada corporations, and in-state corporations are compared regarding taxes, liability, and business credit considerations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 13

Business Credit Secrets Revealed

Table Of Contents - The Steps of Business

Credit

1) Know the Donts Before You StartOr Else!

2) Choose your Business Entity

3) Get a Duns Number

4) Get a Paydex (and 2 other Scores)

5) Apply for Unsecured Business Credit

Step #1 - Know the Donts Before you

Start

You must know the Donts and the Dos in Business Credit before you start. Here are the Dos:

How Do You Get Premium Business Credit?-A One-Two Combination:

Dun and Bradstreet

Paydex Score

Filing your Profile with Dun and Bradstreet

With 70 percent of the market share for business credit reporting, Dun & Bradstreet is the titan of business

credit profiles. The most important thing you can do is start your Dun & Bradstreet profile and get your

Duns number to start applying for credit.

Be forewarned: There are certain Donts you need to know before you start a Duns profile for your

business. With Business Credit what you dont know can hurt you! Many businesses get a Dun and

Bradstreet business credit ratingbefore they've taken other necessary steps, and unwittingly damn

themselves to a poor or red flag status, effectively dooming them for good business credit before they

start.

What exactly do need to know to establish a positive Dun & Bradstreet profile for maximum business

credit? What are the donts? Basically, you must follow these rules and set up properly before you

call Dun & Bradstreet to set up a profile. Here are the things you must have to open the way to top

business credit ratings:

You must have a tax ID number (getting a tax ID number is discussed in the next section Getting

a Tax ID Number)

You must have a phone number listed in the business directory of your local phone company and

more importantly, it must be locatable by the operator.

To get top business credit rating, you must have 10 employees or more.

You must say have been in business for 2-3 years or more, although being incorporated recently is

ok.

Optionally, to get the highest business credit rating you want to have more than 1 branch location

that is listed with the local phone operator.

You must have live operators or employees answering the phone at your business at all times.

You must file your articles of incorporation, officers list, and other corporate paperwork such as

financial statements with your incorporating state.

You must file financial statements with Dun & Bradstreet as well, saying that you make 3 hundred

thousand or more year.

You must be current on all your state corporate filing fees, as well as your state and federal taxes.

If the Dun & Bradstreet field officer in your location stops by, you must have a real brick and

mortar location for your business and look like youre legitimately doing business there. Is not

acceptable to have a P.O. Box address.

You must have a business license with your local city, state, or county if it is required in your

locale, and

Optionally, is a good idea to have a web site that shows in the search results of the major search

engines.

Step #2 - Choose Your Business Entity

You may have heard that creating a corporation or LLC will limit your liability and show a certain amount

of stability to business creditors. Here are some options for choosing your business entity:

Sole Proprietorship -

The simplest form of business in which a sole owner and his business are not legally distinct entities; the

owner is personally liable for business debts.

General Partnership -

A partnership in which there are no limited partners, and each partner has managerial power and untitled

liability for partnership debts.

Limited Partnership -

The limited partnership has limited and general partners. The general partners manage the business and are

individually liable for the debts of the partnership. The limited partners are limited in the amount they can

lose, by the amount of money they invested in the partnership.

S-Corporation -

A corporation that is eligible, and does elect to be taxed under the Subchapter S of the Internal Revenue

Code. Basically, shareholders pay tax on the corporation's income by reporting their pro rate shares of pass-

through items on their own individual income tax returns.

C Corporation -

A corporation that is an organization authorized by state law, to act as a legal entity distinct from its

owners. A corporation has it's own name, and has it's own powers to achieve legal purposes, and therefore,

is a separate legal entity.

Limited Liability Company (LLC) -

The LLC is a hybrid between a corporation and a limited partnership. LLC's provide protection from

personal liability, just as corporations do, and yet LLC's receive the tax treatment of limited partnerhsips, or

a C corporation, whichever the members of the LLC desire

Some Notes on Choosing an Entity

a) The Offshore Corporation there are lawyers that specialize in just this type of entity, claiming that

you can achieve maximum freedom from state tax and maximum protection from lawsuits by filing

offshore. There might be some extra expenses in setting up this way, and remember that your creditors will

often times be local, so theres a disadvantage in having your corporation set up in another country. Make

sure you find a lawyer that specializes in these and is passionate about them, since they are a specialty unto

themselves. Also dont be scared off by lawyers that are bigots and just favor one entity that like to make

money with, like the LLC. Offshore definitely has its uses, especially if you are a business of some scale

that can afford the fees for upkeep.

b) The Nevada Corporation Class C or Class S Nevada is unique in that it does not have state tax, and

also it enjoys special protection from liability because it does not require officers to appear on the officers

list, they can choose nominees, virtually staying anonymous. Also, Nevada has a law that defines

ownership as possession, so in other words you could pass your stock like a football to a relative to avoid

being identified as an officer or owner in the Corporation. With the foreign Corporation act that passed in

the late 90s, the states want you to register as a foreign corporation if youre not actually doing business

in Nevada. You can choose Class C so that you print stock (the stock you can pass like a football if you are

in trouble) or Class S corporation. The class S corporations is for small businesses, like a one woman/man

shop. However, the class S doesnt have the double taxation, taxing the corporation and the stockholders

both. I personally favor the Class C Nevada Corporation, I think Class C looks better for business credit.

You need a lot of employees to get the highest business credit scores, and the Class S gives the appearance

of a smaller business. I will explain more about business credit scores later.

c) The In State Corporation. This is where you incorporate in the state you are in. You have to pay state

tax, but youre usually minimizing your profits on your tax statements anyway. For Business Credit, it is

more important to not be red flagged by Dun and Bradstreet as a sham business as in having a fake

storefront or P.O. Box in Nevada, so it is much better to have a corporation in your home state for business

credit. Banks you will be applying to for credit lines and credit cards will much prefer this ultimately,

rather than saying you have a Nevada corporation with a home branch in Nevada.

d) The LLC. This is the most popular entity these days because it is cheap to set up usually only four

hundred dollars or so. And also the LLC prevents creditors from coming after your personal assets so the

liability is limited to your business assets.

e) Sole Proprietorship. Anyone can do business in their own name as long as they pay their taxes and get

a business license in their local city or county, so for instance if you are Sally Aimes, you can do business

as Sally Aimes. The question is why would you want to do business under a sole proprietorship? Then

surely you would be applying for credit and using your own Social Security number and therefore your

business loans would be basically personal loans. I would like you to get an ideal entity for business credit,

such as a Corporation where you could buy multi-million dollar real estate projects or other businesses in

the future with business credit, so this means you would probably want to choose an entity that reflects

these large ambitionssome kind of corporation.

The Advantages and Disadvantages of

Various Entities

Advantages of an LLC Relative to a "C" Corporation

Tax Consequences to Owners. The primary advantage of the LLC over the "C" Corporation is in the tax

consequences to owners. As a pass-through entity, the LLC's income and losses flow through and are taxed

to or deducted by the members, normally retaining the character they had in the LLC. Thus, there is a

single level of tax, and losses are fully deductible by members (but are subject to passive activity rules and

the deduction may not be in excess of their bases in their membership interests). The income of a C

corporation is taxable, both by the federal government and your state, at the corporate tax rate. Thus the

corporation and its shareholders may be subject to "double taxation", when dividends are paid to

shareholders because the corporation pays tax on its income and the shareholders pay tax on dividends

received from the corporation, and the corporation is not allowed to deduct dividends as an expense.

Structure of the Owners Participation. The owners of the LLC have greater latitude and flexibility in

providing for the return of an owner's investment. There is also more liberty in structuring the owners

participation in the enterprise.

Disadvantages of an LLC Relative to "C" Corporation.

Retention of Earnings. A venture that intends to retain substantial earnings may find the corporate

structure beneficial. It is likely that the marginal corporate tax rate on the retained earnings (only 15% up to

50K) will be lower than the marginal rates applicable to individuals. One needs to carefully study the

venture's projections and calculate the estimated after-tax financial performance of the venture before

making a decision.

Fringe Benefits. An LLC taxed as a partnership cannot provide many of the fringe benefits that a "C"

Corporation can. Members are not "employees" for purposes of the fringe benefit rules. See, e.g., IRC

5105(9) relating to accident and health care plans and IRC #79 relating to group term life insurance. If the

LLC provides members with fringe benefits, the cost must be included in the member's gross income. In

some states, "C"s can maintain more favorable asset-protected retirement plans.

Advantages of LLC Relative to "S" Corporation

Restrictions on Ownership. An "S" Corporation offers the advantage of limited liability for owners, and

some of the advantages of being taxed as a partnership. It does not pay tax on its earnings, and its profits

and losses are passed through and taxed directly to its shareholders. However, there are a number of

restrictions on the ownership of and the operation of an "S" corporation that do not apply to an LLC. The

"S" corporation can have only one class of stock. Its stockholders can be only natural persons, and those

persons must be U.S. citizens or resident aliens. An "S" corporation may have no more than 75

shareholders.

Special Allocations. Further, an "S" Corporation may not specially allocate tax attributes to its

shareholders. Those attributes pass through pro rata. This fact restricts the type of debt the corporation may

issue, hampers efforts to gradually shift control of family-owned businesses, and in general makes passive

investments difficult to structure.

Deductibility of Losses. An "S" corporation differs in the ability to obtain tax basis from its share of the

entity's liability, which determines the extent of losses that may be deducted by the owners, and their ability

to receive operating distributions tax free. An "S" corporation shareholder does not share in the entity

liabilities and its basis is limited to the cash invested. Both an LLC member and a limited partner increase

their basis by the allocable share of entity liabilities. Moreover, distributions of appreciated property trigger

a gain to the "S" corporation that passes through to the shareholders. Also, there is a second entity level tax

on built-in gain, if the "S" corporation was formerly a "C".

Disadvantages of LLC Relative to "S" Corporation

The LLC offers the limited liability of the "S" corporation and pass-through taxation with none of the "S"

corporation restrictions on ownership and operations. Therefore, we really cannot see a great deal of

general disadvantage. However, there may be some disadvantages in a special case.

In addition to any disadvantages of LLCs compared to other entities, one should keep in mind the following

general drawbacks to the use of LLCs: The legal ramifications of forming and operating an LLC, e.g., tax

classification is more uncertain because of the lack of guidance from established case law and regulations.

This may be more theoretical than real. Other states may not recognize all of the rights and privileges

afforded to an LLC in your home state. If the LLC has one or more members who are non-residents of the

LLC state, it must file a list of members and consents with its annual state tax return. As to any non-

resident member who fails to consent to your state tax jurisdiction, the LLC must pay the tax attributable to

the non-consenting member's distributive share of LLC income. The members of an LLC may have implied

authority to act on behalf of the LLC and bind the LLC, e.g. signing of deed of trust (mortgage).

As a general rule, the LLC will probably serve well in those circumstances where the limited partnership

and "S" corporation were formerly used. The LLC may even be used in those circumstances where the "C"

corporation was used. However, the "C" corporation does have its advantages, particularly with respect to

the availability of nontaxable fringe benefits and asset protected retirement plans. Therefore, we

recommend you continue to use the "C" corporation in those circumstances where a "C" corporation was

formerly used. Use an LLC in those situations were a limited partnership (including an FLP, unless a

specific estate and gift tax result is desired) or "S" corporation was formerly used.

Getting a Tax ID Number

To get your Tax ID Number, also called an EIN or Employer Identification Number, you can apply online

with the IRS at:

https://sa1.www4.irs.gov/sa_vign/newFormSS4.do

You can have (and need) a Tax ID Number for business credit, even if you dont have employees.

You have to tie the Tax ID number with the Social Security number, so that IRS can identify an individual

that belongs to that corporation. It can be any officer in your corporation (not only the chief owner or

stockholder), but you do have to give a SS#, and if you are a one woman or one man show it probably has

to be yours.

Does this affect your privacy? Not really. The IRS does not divulge this information. Business owners are

concerned not only with building their business credit, but asset protection and secrecy usually as a

secondary concern. For instance, in Nevada you can hide as the owner of a corporation because you can

get officers of the Corporation other than yourself and even choose nominees, professionals for hire that

will put their names on your officers list from the state so that your identity would be hidden if anyone tried

to sue you.

Another asset protection strategy is to have two corporations where one is the holding company for a

corporation that owns another corporation. You do all your business activity in the subordinate

corporation, and if one day someone sues you you have your parent corporation or holding company

place a lien or UCC-1 form on your corporation being sued. That way the financial assets of your

corporation are already spoken for because they are attached by your other corporation. Some corporate

officers like this method of asset protection and privacy.

However, the goal of privacy is the opposite of the goal of business credit. This is because when you are

starting to build business credit you want the opposite of privacy. You want Dun & Bradstreet to come and

visit your call you and check your address and phone, you want your bank to be able to reach you and

verify that your business lives where you say it does, and you want to both of them to be able to verify with

your incorporating state that you exist as a Corporation, (or in the case of a sole proprietorship) that you

exist as a business license to the city).

However, think of it this way: if you want business credit and are applying for for the first time, think of a

way that you can be public. Is very important to get a phone listing with 411 for your business. If you

have an 800 number, get this listed with the operator. Get the phone listing the most legitimate style

possible. If youre very small business and always answer your own phone, you might spring about 25

dollars a month for 24-hour answering service that answers live, rather than a cheesy answering machine.

If youre just starting a new corporation or LLC, and you need a tax ID number to start your business credit

file, then go ahead and use your Social Security number. The reason is that although you may want

nominees to hide who you are once asset protection is the goal, when you are first building business credit

you want to be public.

Your name needs to be on the officers list of the corporation. Does this mean that others can find you?

Actually, if collectors or litigants mean to get a hold of you and cause you ill will then they will not be able

to do it because the IRS does not release this information, namely whose Social Security number is

associated with your corporation. Also, any officer can put their Social Security number on the

Corporation and does not need to be the one that owns stock in the Corporation.

If youre just starting out, and there are no other officers of the Corporation (in other words your one-man

show or one-women show), and if you dont plan on getting sued in the near future then go-ahead and

associate your Social Security with the tax id number. You can do it on the Internet at this link:

Can you put your 1 year old niece on the Officers List of your corporation? No, the officers of your

corporation have to be 18 years or older.

Remember that the LLC holds the advantage that if someone wants to sue you personally and you have a

corporate account, the prosecution cant touch it. to belongs to the Corporation which is a completely

different entity. If you have someone that is trying to sue you as an LLC or corporation, you can use your

asset protection corporation to placed a lien on your corporation and therefore render it to useless to attach.

Its already been attached.

Step #3 Get a Dun and Bradstreet

Business Profile and a DUNS Number

If youre going to play with the big boys and big girls, and you want to get the largest low interest rate

commercial loans for your business, then you are going to have to have a good rating with Dun and

Bradstreet. Dun and Bradstreet and Experian Business are the two main companies that track business

credit. There are others, but theyre not as large or important. Experian is also not at all as large as Dun

and Bradstreet. Dun and Bradstreet is 70 % of the market share for business credit reporting and Experian

is just about all the rest.

Dun and Bradstreet is the important institution in tracking businesses, and youre DUNS report will make

you or break you in business credit. You want to get a Duns Number and Business Profile by contacting

Dun and Bradstreet on the phone or by email, but you want to be very very careful (!) to make sure you are

ready to talk to Dun & Bradstreet. We will tell you below what to do to get ready. The reason is that when

they ask you what kind of business you are, how many employees, etc., you want to think over very

carefully what you want your business image to be, because once you give them information, it is very

difficult to remove it.

So, for instance, if you tell them that you are a home-based business and you only have one employee, you

are basically takingthe risk of ruining your chances for having the highest type of business credit score, the

one reserved for companies with 50 employees are more. Also, what you tell Dun and Bradstreet is put on

the report and is permanent, so when you go to a bank to apply for a working capital loan or credit line,

they may not like what is on there, for instance that youre "only" a home-based business with just one

employee.

Here is an example of what you want to tell Dun & Bradstreet in order to be eligible for the highest credit

score (Paydex score of 75 or over. Will be explained in the next section get a Paydex score):

Been in business 5 years.

Gross more than a million in sales a year.

50 employees. (Some people go with 5 employees, but no less than 25 is necessary for a top credit

score, i.e. 75 Paydex score)

Business based in the same state as the officer (you)

Address and phone that is listed under your business name, phone that answers with your business

name.

A location that looks like an office, just in case a Dun & Bradstreet field officer shows up.

More than one branch office, a headquarters office that you can be visited in, and a satellite office

in another city. (Companies with more than one branch appear larger and more stable to Dun and

Bradstreet).

Warning: If youre not ready to tell Dun & Bradstreet these things then do not call them yet!

Dun & Bradstreet will call to verify not only that your phone answers with your business name, but that

you are listed, and they will even go so far as to call the Secretary of State to see if you are really

incorporated and if you have paid your corporate dues with the State. If youre located in a different state

than your Nevada corporation like I am, they will call your state to ask if youre registered as a foreign

corporation in that state!

Dun & Bradstreet will go through great lengths to protect their reputation by making sure youre honest in

your business pursuits and that you really do exist. As far as your financial statements, they rely on what

you tell them for the most part, and you can say that you have 5 or 50 employees.

Step #4 Get A High PAYDEX Score

Part 1 of 3 Know your Business Credit Scores

There are three business credit reporting agencies in the United States that lenders and financial institutions

rely on for information to grant credit, those being D&B, Experian, and ClientChecker.

Dun and Bradstreet or D&B

Over 70 million businesses are registered with D&B

The credit profile created by D&B uses information provided by the business owners and vendors of the

business

Grants a PAYDEX score to businesses based on payment experiences of the business

Issues a DUNS Rating based on the financial statements of the business

Has a High Risk status for company's that will destroy a company's ability to obtain credit

Experian Business

Over 14 million businesses are registered with Experian

The credit profile created by Experian uses information provided by vendors only

Grants an Intelliscore based on payment experiences

Is one of the three largest personal credit bureaus

ClientChecker

The only credit reporting agency dedicated to small businesses

The credit profile created by ClientChecker uses information provided by vendors only

Grants a PayQuo Score based on payment experiences

Here are the three Business Credit Scores

The business credit scores with D&B and Experian are what the lenders and financial institutions look for

to determine credit.

PAYDEX Score

Score ranges from 0 to 100

A score of 75+ is good

Based on payment experiences reported by vendors

Need 5 trade references who report to D&B

Intelliscore

Score ranges from 0 to 100

A score of 75+ is good

Based on payment experiences reported by vendors

Need 2 trade references who report to Experian

DUNS Rating

Various rating schedules

Based on employee size and financial statements

Also takes into account payment history

PayQuo Score

Score ranges from 20 to 90

A score of 80+ is good

Based on payment experiences reported by vendors

Need 3 trade references who report to ClientChecker

Part 2 of 3 Raise your Business Credit Scores

Your Duns Number and Business Profile by itself doesnt mean anything much to a real serious creditor

like American Express card or a bank that gives SBA loansyou really need whats called a PAYDEX

score. A score of 75 or better is ideal, and is equivalent somewhat to the consumer credit score of 75.

To get a high PAYDEX score, you must:

Find 5 vendors to give you business credit (we list 20 below)

Pay 15 days before your invoice says your payment is due

After 6 months, apply for a credit card or credit with the larger vendors like American Express or

Wells Fargo (more listed below) that normally wont touch you without a PAYDEX score. Pay

this card before the due date.

Ask a commercial lender (it might be your present bank) for a working capital loan, or equipment

lease, even it is secured by equipment, inventory or some business assets. Pay this loan before the

due date.

Challenges to establishing business credit for a Paydex score are the following:

Just like consumer credit history, people will report the bad but not the good. A telephone bill that

went to collection will easily look like a bad debt on your Dun & Bradstreet report, and will be

very difficult to remove.

Unlike Consumer Credit, there is no Fair Credit Reporting Act that protects businesses. Therefore

youre only recourse if something is inaccurate is to beg, plead and cajole Dun & Bradstreet to

take it off, and show proof of payment and / or a deletion letter from your creditor.

Finding a vendor that reports to Dun and Bradstreet is challenging because you have to know who

they are! We will fix that.

Use a Secured Visa Business Credit Card that Reports to D&B

and Experian

We have a vendor that will do this for you: it is a Prepaid Secured Visa account. To get this card, it is

merely $100, and no one is turned away! You have to be referred by us, so all you have to do is click here

to request an application to your email address of choice. Get your Business Credit Card today!

mailto:BusinessCreditVisa@thebestever.net Allow 24 or 48 hours for a reply. You will get a link to our

online application for a Secured Visa Business Credit Card. How much identification do you need to apply

for the prepaid business credit card?

The only identification you need is the Tax ID and the date of birth. Because of the Patriot Act they now

require your date of birth on these types of applications. However that is very little information to provide

to start getting positive business credit reported to your credit report!

After you develop a good credit history with this vendor (pay 15 days early on your invoice), then:

Step #4 Get A High PAYDEX Score

Part 3 of 3 - Apply for Secured Loans or Equipment Leases

How about that nice Porsche? Actually, of late the IRS frowns on the lease of overly fancy automobiles,

but you can lease an automobile, tractor or some other piece of equipment once you have 3 trade

references, and get your vendor to report your on time payments to Dun and Bradstreet.

How to Qualify for Auto or Equipment Leasing

Most businesses have been through the ringer with leasing companies because they are promised the world

by other leasing companies only later to be told they couldnt be approved, many times without an

explanation as well.

It is usually much easier to obtain funding from a leasing company than a bank. Most leasing companies do

not rely upon the same information as banks when a credit decision is made. Leases involving stronger

credits and equipment with low depreciation rates will always be easier to approve.

Lessors will generally look at 4 things when analyzing a companys credit:

1) Three Trade References - These are suppliers and vendors of yours that have given your company 15

or 30 days to pay them and have always been paid on time or even 15 days early. If a trade reference comes

back with net 30 terms and an average pay history of 35 days, then that trade reference is useless and we

must get another one.

2) Average Bank Account Balance. This is important because it tells us if the company can afford an

additional monthly payment as well as the usual stressors put on their cash flow. Upon request, your bank

will fax us a sheet that gives us the average balance of your account in the last 6 months. It will also tell us

if there have been any NSF checks written from that account. Unfortunately, however, some banks have

ceased to co-operate with outside creditors. Many times it may be necessary for the lessee to fax us the last

6 months bank statements, so we can calculate our own average balance.

3) Personal Credit of the Officer or Majority Owner of the Company. It may not be necessary to use

this information in certain circumstances but in most cases we must view it. The logic behind pulling the

credit is that if the officer or owner of the company pays their bills on time than they will pay their

companys bills on time. Even if there wont be any guarantees on the lease, sometimes it helps to view the

credit in order to strength the leases overall credit rating.

4) Dun & Bradstreet Report on your Company. The report will tell us if there are any outstanding liens

or judgments in the companys name. In some cases it will give us financial information on the company

which may or may not be useful. Most importantly it will give us a Paydex score. The Paydex score is an

overall credit score of your company which reflects the timeliness of your pay history to vendors, suppliers,

and creditors alike. A good Paydex score is usually 65 and above. Any company with a Paydex score

below 65 may be required to show additional proof of a good credit history. We understand that much of

the Dun & Bradstreet information can be inaccurate, however, the truth of the matter is that if there is

negative information listed on the report, then credit managers will weigh that in their credit decision.

These are the 4 major items any leasing company will judge for a credit decision. If you have at least 2

good trade references to give us, a good bank rating, and good credit, there is no question that we will be

able to help your company out.

Step #5 Apply for Unsecured Business

Credit such as Unsecured Business Loans,

SBA, Working Capital Loans, Factoring

Here are the steps to getting unsecured Business Credit

1) Get a vendor that will do the following:

1) give you Business Credit with little or no credit history

2) not require a personal guarantee

3) report to Dun and Bradstreet

3) Apply for vendors that are relatively easy to get:

Staples! They will check your Experian Report first and if you have one for business they will give you a

card without requiring a personal guarantee!

Check out these other vendors, especially Viking Office Supply, Gas Cards and Neimann Marcus. They

have a history of lending to new businesses.

Neimann Marcus

Nordstroms

J.C. Penney

Comp U.S.A.

Texaco

Shell

Home Depot

Target

Staples

Radio Shack

Mobil

Office Depot

Office Max

Viking Office Supply

3) After you have paid these companies 15 days before your invoice is due for a few months try the

following:

Equipment Leasing

(Make sure they report to D&B, Experian)

Wells Fargo Business Visa

Relatively easy to get right now! They dont require a personal guarantee if you have some of the

aforementioned companies on your report!

Pay 15 days early on these invoices for 6 months!

4) Apply to Vendors that are harder to get:

American Express Blue (Small Business, they tend to want a personal guarantee, but lend prestige

to your file)

Credit Lines or Factoring Accounts with your local Credit Union or Business Bank.

Good luck on your business credit venture! Send us your success testimonials at

stories.customer@thebestever.net. Write us to sign up for free updates to these books as well. Check out

our other e-books at http://www.thebestever.net :

Improve your Credit Score in 24 Hours!

How I improved my credit score 40 points in 24 hours and saved $8,000!

Credit Dispute Letters

16 powerful letters in legal language to improve your credit score today.

You might also like

- Boss Up Your Business Credit; A Business Credit Building and Credit Positioning GuideFrom EverandBoss Up Your Business Credit; A Business Credit Building and Credit Positioning GuideRating: 4 out of 5 stars4/5 (8)

- The Premier Guide to Business Credit: The Inside Secrets to Build Business Credit & Take Business to Next Level!From EverandThe Premier Guide to Business Credit: The Inside Secrets to Build Business Credit & Take Business to Next Level!No ratings yet

- Build Business Credit 1Document10 pagesBuild Business Credit 1Matthew McCluster95% (21)

- 50 BusinessCreditInfoDocument8 pages50 BusinessCreditInfoROYAL100% (5)

- How To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditFrom EverandHow To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditNo ratings yet

- Avoid Being Scammed By A Credit Repair CompanyFrom EverandAvoid Being Scammed By A Credit Repair CompanyRating: 3 out of 5 stars3/5 (1)

- Business Credit Made EasyDocument68 pagesBusiness Credit Made Easylabeledagenius100% (25)

- Build Business Credit Fast ManualDocument79 pagesBuild Business Credit Fast ManualScooterKat100% (8)

- Dustin Mathews Business Credit ManifestoDocument31 pagesDustin Mathews Business Credit Manifestojim_fleck100% (22)

- Business Credit Building Checklist 2020Document6 pagesBusiness Credit Building Checklist 2020Patrick Py100% (11)

- How To Setup Your Initial Business Credit Profiles With Dun & Bradstreet, Experian, and Equifax CommercialDocument43 pagesHow To Setup Your Initial Business Credit Profiles With Dun & Bradstreet, Experian, and Equifax CommercialCarol100% (6)

- The 6 Secrets To Build Business CreditDocument8 pagesThe 6 Secrets To Build Business CreditJake Song67% (3)

- Business Credit GuruDocument550 pagesBusiness Credit GuruMann Burnette93% (14)

- $ The Billionaire's Business Blueprint $Document336 pages$ The Billionaire's Business Blueprint $Reginald Ringgold97% (58)

- Business Credit EbookDocument14 pagesBusiness Credit EbookNeal R Vreeland92% (13)

- Six Figure Business Credit PDFDocument111 pagesSix Figure Business Credit PDFhui ziva100% (1)

- How To Build Credit For Your EIN That Is Not Linked To Your SSN 2019Document11 pagesHow To Build Credit For Your EIN That Is Not Linked To Your SSN 2019walter80% (5)

- Business CreditDocument13 pagesBusiness CreditMenjetuNo ratings yet

- EbookDocument9 pagesEbookChuck McConville100% (2)

- Business Credit Jump StartDocument97 pagesBusiness Credit Jump Startssuttonii100% (4)

- Shelf Corp Secrets-1Document38 pagesShelf Corp Secrets-1savedsoul226644893% (57)

- The Ultimate Credit Loophole by WIZCREDITGURUDocument97 pagesThe Ultimate Credit Loophole by WIZCREDITGURUrodney96% (57)

- BUSINESS CREDIT DONE CorrectionDocument13 pagesBUSINESS CREDIT DONE CorrectionTola50% (6)

- Super Business CreditDocument8 pagesSuper Business Creditsuperbusinesscredit13% (15)

- How To Get Business Credit Approvals?Document6 pagesHow To Get Business Credit Approvals?smallbusinessloan100% (5)

- The Official: Business Credit BuildingDocument7 pagesThe Official: Business Credit BuildingK BNo ratings yet

- Business Credit Top 10 To DosDocument16 pagesBusiness Credit Top 10 To Dosasarius1No ratings yet

- Step by Step Guide: To A 700 Credit ScoreDocument12 pagesStep by Step Guide: To A 700 Credit Scorecdproduction89% (27)

- "Corporate Flipper ": How To Make AT LEAST $50,000 A Year Creating and Selling Shelf CorporationsDocument18 pages"Corporate Flipper ": How To Make AT LEAST $50,000 A Year Creating and Selling Shelf CorporationsSunilbharat Meduri90% (10)

- CreditRepairSuperGURU Business Funding Consulting, LLC To JUSTIN DAVISDocument49 pagesCreditRepairSuperGURU Business Funding Consulting, LLC To JUSTIN DAVISrodney57% (14)

- Secrets To Business Credit - Monica MainDocument75 pagesSecrets To Business Credit - Monica MainJawan Starling100% (7)

- Build Business Credit Fast Guide To A Solid Business Credit FoundationDocument4 pagesBuild Business Credit Fast Guide To A Solid Business Credit FoundationOlivia Grace100% (19)

- 12 Credit Lines & Cards: You Can Get FORDocument9 pages12 Credit Lines & Cards: You Can Get FORJay Lewis100% (2)

- Business Credit GuideDocument10 pagesBusiness Credit GuideKeenen New Manley100% (3)

- How To Get EIN Business Credit PDFDocument9 pagesHow To Get EIN Business Credit PDFEL-Essene Y'Isroyal-Y'IsraELNo ratings yet

- Three Levels of Biz CreditDocument5 pagesThree Levels of Biz CreditNicolás MoraNo ratings yet

- Bank Notes SecretsDocument99 pagesBank Notes Secretssavedsoul2266448100% (12)

- Credit Secretits Bible by WIZCREDITGURU 2012-2014Document7 pagesCredit Secretits Bible by WIZCREDITGURU 2012-2014rodney14% (7)

- Your Guide To Perfect CreditDocument168 pagesYour Guide To Perfect Creditwhistjenn100% (5)

- 37 Days To Clean Credit EbookDocument80 pages37 Days To Clean Credit EbookVenita Jefferson17% (6)

- Secret Lenders List 6.2019Document7 pagesSecret Lenders List 6.2019Luis Alfredo Cañizalez C94% (18)

- Add Tradelines To Credit Report - UCC Filings PDFDocument18 pagesAdd Tradelines To Credit Report - UCC Filings PDFmatt96% (83)

- 2017 Business Credit EbookDocument15 pages2017 Business Credit EbookfdskaNo ratings yet

- 7 Days To Better Credit 105kDocument15 pages7 Days To Better Credit 105kDaniel_Murray_338791% (98)

- Lofty Credit Primary TradelinesDocument1 pageLofty Credit Primary Tradelinesmyfaithwalk1343100% (2)

- CreditsecretsandloopholesDocument139 pagesCreditsecretsandloopholesAnthony Roberts50% (2)

- Trade LinesDocument55 pagesTrade LinesKadir Wisdom86% (7)

- Erasing Bad Credit Manual 0402Document91 pagesErasing Bad Credit Manual 0402nevayield80% (5)

- Building Business CreditDocument90 pagesBuilding Business Credithalcino100% (1)

- Credit With Starter Vendor ListDocument3 pagesCredit With Starter Vendor Listzion100% (3)

- Credit Secrets: THE CREDIT SECRETS MINI-BOOKDocument43 pagesCredit Secrets: THE CREDIT SECRETS MINI-BOOKZana Lo100% (5)

- 10K PrimariesDocument25 pages10K PrimariesCarol67% (3)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditFrom EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditRating: 5 out of 5 stars5/5 (1)

- Using Successful and Proven Strategies of Credit and Finance, Grants, and Taxation Principles to Obtain Multiple Lines of Credit to Build Your Home-Based Business OpportunityFrom EverandUsing Successful and Proven Strategies of Credit and Finance, Grants, and Taxation Principles to Obtain Multiple Lines of Credit to Build Your Home-Based Business OpportunityRating: 1 out of 5 stars1/5 (1)

- 16 List of Affirmative Defenses and CounterclaimsDocument11 pages16 List of Affirmative Defenses and CounterclaimsAkil Bey100% (2)

- Federal Laws Identity TheftDocument12 pagesFederal Laws Identity TheftAkil Bey100% (1)

- 4a Demand To Cease and Desist Collection ActivitiesDocument2 pages4a Demand To Cease and Desist Collection ActivitiesAkil Bey100% (1)

- Affidavit of Cancellation Discharge NoteDocument2 pagesAffidavit of Cancellation Discharge NoteAkil Bey100% (15)

- Stop Paying Affidavit (Template)Document3 pagesStop Paying Affidavit (Template)Akil Bey93% (28)

- 000 Rebuttal of NOD Letter2Document2 pages000 Rebuttal of NOD Letter2Susie Jewlery-LadyNo ratings yet

- 15 FdcpaDocument3 pages15 Fdcpadhondee130% (1)

- Affidavit of Mortgage DebtDocument5 pagesAffidavit of Mortgage DebtAkil Bey100% (6)

- Attorney Acting As Debt Collector Lawsuit PDFDocument54 pagesAttorney Acting As Debt Collector Lawsuit PDFAkil BeyNo ratings yet

- Astrological AllegoryDocument18 pagesAstrological AllegoryAkil Bey100% (2)

- AffirmationsDocument2 pagesAffirmationsAkil Bey100% (6)

- Fighting Corruption FT RodCDocument2 pagesFighting Corruption FT RodCAkil BeyNo ratings yet

- Writs of Mandamus & Prohibition PDFDocument5 pagesWrits of Mandamus & Prohibition PDFAkil BeyNo ratings yet

- Dun and Bradstreet Company Info 06-20-08Document6 pagesDun and Bradstreet Company Info 06-20-08Akil Bey100% (4)

- Agencies Incorporated in DelawareDocument1 pageAgencies Incorporated in DelawareAkil BeyNo ratings yet

- Warranty Deed ConveyanceDocument1 pageWarranty Deed ConveyanceAkil Bey100% (1)

- Affidavit by Declaration To Discharge DebtDocument4 pagesAffidavit by Declaration To Discharge DebtAkil Bey100% (5)

- 1916 Black A Treatise On Recission of Contracts and Cancellation of Written Inst Vol 01Document4 pages1916 Black A Treatise On Recission of Contracts and Cancellation of Written Inst Vol 01Akil Bey100% (2)

- 1916 Black A Treatise On Recission of Contracts and Cancellation of Written Inst Vol 01 PDFDocument876 pages1916 Black A Treatise On Recission of Contracts and Cancellation of Written Inst Vol 01 PDFAkil BeyNo ratings yet

- Wells Fargo DiscoveryDocument16 pagesWells Fargo DiscoveryAkil Bey100% (1)

- Debt Collection Industry Transparency Act (Draft Bill)Document12 pagesDebt Collection Industry Transparency Act (Draft Bill)D.D.No ratings yet

- Using Your ExemptionDocument21 pagesUsing Your ExemptionNoble Sulaiman Bey96% (23)

- Moorish History in JamaicaDocument13 pagesMoorish History in JamaicaAkil BeyNo ratings yet

- Memorandum On Setoff Via Coupon VoucherDocument3 pagesMemorandum On Setoff Via Coupon VoucherAkil Bey100% (6)

- 1916 Black A Treatise On Recission of Contracts and Cancellation of Written Inst Vol 01Document4 pages1916 Black A Treatise On Recission of Contracts and Cancellation of Written Inst Vol 01Akil Bey100% (2)

- Claim in Recoupment Rescission Case LawDocument16 pagesClaim in Recoupment Rescission Case LawAkil Bey100% (3)

- Theresa Houthuysen: Courtroom ChambersDocument1 pageTheresa Houthuysen: Courtroom ChambersAkil BeyNo ratings yet

- Bachrach Motor Co vs. Espiritu 52 Phil 346Document4 pagesBachrach Motor Co vs. Espiritu 52 Phil 346Celine GarciaNo ratings yet

- Credit Risk Management HDFC Project Report Mba FinanceDocument102 pagesCredit Risk Management HDFC Project Report Mba FinanceNishant Kuradia0% (1)

- DR - Srinivas Madishetti Professor, School of Business Mzumbe UniversityDocument67 pagesDR - Srinivas Madishetti Professor, School of Business Mzumbe UniversityNicole TaylorNo ratings yet

- Regulatory Framework For Business TransactionsDocument36 pagesRegulatory Framework For Business TransactionsKriztleKateMontealtoGelogo100% (7)

- Corpus Christi Town Club Order Authorizing Auction SaleDocument1 pageCorpus Christi Town Club Order Authorizing Auction SalecallertimesNo ratings yet

- E-AP-2 - Short-Term Loans and AdvancesDocument7 pagesE-AP-2 - Short-Term Loans and AdvancesAung Zaw HtweNo ratings yet

- Pivot Table ExerciseDocument11 pagesPivot Table ExerciseHasan Babu KothaNo ratings yet

- Cibil Score and Diff Between LLP & LTD CoDocument2 pagesCibil Score and Diff Between LLP & LTD Cog h raoNo ratings yet

- THD Vs Lowes Balance Sheet &financial AnalysisDocument13 pagesTHD Vs Lowes Balance Sheet &financial AnalysisR K Patham100% (2)

- Companies Act 1994Document34 pagesCompanies Act 1994msuddin7688% (26)

- MERS Electronic Tracking Agreement With Warehouse LenderDocument16 pagesMERS Electronic Tracking Agreement With Warehouse LenderTB100% (1)

- Exercise 1-1 To 1-5Document5 pagesExercise 1-1 To 1-5Jennette ToNo ratings yet

- RHB Press Release RHB WILL NOT COMPOUND INTEREST DURING MORATORIUM PDFDocument2 pagesRHB Press Release RHB WILL NOT COMPOUND INTEREST DURING MORATORIUM PDFNad AidanNo ratings yet

- Indiabulls Commercial Credit LimitedDocument41 pagesIndiabulls Commercial Credit LimitedGunjanNo ratings yet

- Preview AgreementDocument6 pagesPreview AgreementdivyaNo ratings yet

- Pas 1Document5 pagesPas 1Simon Marquis LUMBERANo ratings yet

- Income Tax Case Digest 1. Madrigal v. Rafferty 38 Phil 14 G.R. No. 12287 (1918) Malcolm, JDocument17 pagesIncome Tax Case Digest 1. Madrigal v. Rafferty 38 Phil 14 G.R. No. 12287 (1918) Malcolm, JKarl Marxcuz Reyes100% (1)

- Personal Budget SpreadsheetDocument7 pagesPersonal Budget Spreadsheetamiller1987No ratings yet

- Natural Obligations (Arts. 1423-1430)Document3 pagesNatural Obligations (Arts. 1423-1430)Christine Labao100% (1)

- 7.lease Vs FinanceDocument6 pages7.lease Vs FinanceShiva AroraNo ratings yet

- III. Notes On Law On Pledge Real Estate Mortgage Chattel Mortgage Antichresis Agency1Document9 pagesIII. Notes On Law On Pledge Real Estate Mortgage Chattel Mortgage Antichresis Agency1Aldrin Frank ValdezNo ratings yet

- DIONISIO MOJICA vs. CA, and RURAL BANK OF YAWIT, INC.Document2 pagesDIONISIO MOJICA vs. CA, and RURAL BANK OF YAWIT, INC.Jan Mar Gigi GallegoNo ratings yet

- RibaDocument34 pagesRibajhony_bravooNo ratings yet

- d9150 Application For Subsidy Certificate v0316Document10 pagesd9150 Application For Subsidy Certificate v0316MAX-NETNo ratings yet

- Right of Lien by BankersDocument13 pagesRight of Lien by Bankersgeegostral chhabraNo ratings yet

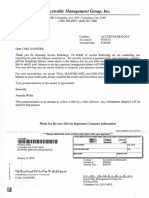

- RMG Inc. ClaimDocument2 pagesRMG Inc. ClaimCarl AKA Imhotep Heru ElNo ratings yet

- PW Barefoot InvestorDocument9 pagesPW Barefoot Investornaveenmi2No ratings yet

- Loan Agreement and Promissory NoteDocument5 pagesLoan Agreement and Promissory Notereginald_sigua100% (1)

- Chattel MortgageDocument2 pagesChattel MortgageSugar ReeNo ratings yet

- 1 4 Final Note, Credit Transactions - 2BDocument4 pages1 4 Final Note, Credit Transactions - 2BRia Evita RevitaNo ratings yet