Professional Documents

Culture Documents

Prepare The Consolidated Statement of Financial Position For Picant As at 31 March 2010

Uploaded by

Saad HassanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prepare The Consolidated Statement of Financial Position For Picant As at 31 March 2010

Uploaded by

Saad HassanCopyright:

Available Formats

1

On 1 April 2009 Picant acquired 75% of Sanders equity shares in a share exchange of three shares in

Picant for every two shares in Sander. The market prices of Picants and Sanders shares at the date of

acquisition were $320 and $450 respectively.

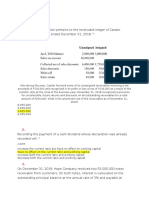

The summarised statements of financial position of the two companies at 31 March 2010 are:

- At the date of acquisition the fair values of Sanders property, plant and equipment was

equal to its carrying amount with the exception of Sanders factory which had a fair value of

$2 million above its carrying amount. Sander has not adjusted the carrying amount of the

factory as a result of the fair value exercise. This requires additional annual depreciation of

$100,000 in the consolidated financial statements in the post-acquisition period.

Also at the date of acquisition, Sander had an intangible asset of $500,000 for software in its

statement of financial position. Picants directors believed the software to have no

recoverable value at the date of acquisition and Sander wrote it off shortly after its

acquisition.

- At 31 March 2010 Picants current account with Sander was $34 million (debit). This did

not agree with the equivalent balance in Sanders books due to some goods-in-transit

invoiced at $18 million that were sent by Picant on 28 March 2010, but had not been

received by Sander until after the year end. Picant sold all these goods at cost plus 50%.

- Picants policy is to value the non-controlling interest at fair value at the date of acquisition.

For this purpose Sanders share price at that date can be deemed to be representative of the

fair value of the shares held by the non-controlling interest.

Prepare the consolidated statement of financial position for Picant as at 31 March 2010.

You might also like

- 1 Corporate ReportingDocument6 pages1 Corporate Reportingswarna dasNo ratings yet

- Prac 1 Final PreboardDocument10 pagesPrac 1 Final Preboardbobo kaNo ratings yet

- 15 June IntDocument10 pages15 June Intshah md musleminNo ratings yet

- Quali ExamDocument15 pagesQuali ExamDexell Mar MotasNo ratings yet

- Intermediate Accounting 2Document88 pagesIntermediate Accounting 2Mj ArbisonNo ratings yet

- 2018 ACCO 4103 2nd Summer ExamDocument5 pages2018 ACCO 4103 2nd Summer ExamSherri BonquinNo ratings yet

- BusCom Long Quiz Possible QuestionsDocument5 pagesBusCom Long Quiz Possible QuestionsCathleen Drew TuazonNo ratings yet

- Brant On Banking Began Operations On January 1 2015 BrantDocument1 pageBrant On Banking Began Operations On January 1 2015 BrantTaimur TechnologistNo ratings yet

- Acc 113 2nd Periodical Examination PDF FreeDocument17 pagesAcc 113 2nd Periodical Examination PDF FreeStefanie FerminNo ratings yet

- Earnings Impact of Accounting ChangesDocument6 pagesEarnings Impact of Accounting ChangesMJ YaconNo ratings yet

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- BUS309 - Assignment 1Document2 pagesBUS309 - Assignment 1ashikNo ratings yet

- Activity 3-4 SB CompensationDocument3 pagesActivity 3-4 SB CompensationNhel Alvaro0% (1)

- Pindi Yulinar Rosita - 008201905023 - Exercise Chapter 2Document43 pagesPindi Yulinar Rosita - 008201905023 - Exercise Chapter 2Pindi Yulinar100% (5)

- Chapter 4Document37 pagesChapter 4mikeNo ratings yet

- R3 - ARC - AP and ATDocument10 pagesR3 - ARC - AP and ATOliver SalamidaNo ratings yet

- UntitledDocument9 pagesUntitledPriya NairNo ratings yet

- ACCA F7 CONSOLIDATED BSDocument9 pagesACCA F7 CONSOLIDATED BSKathleen HenryNo ratings yet

- Exercises P Class5-2022Document6 pagesExercises P Class5-2022Angel MéndezNo ratings yet

- Financial Accounting II RequirementDocument27 pagesFinancial Accounting II RequirementAnonymousNo ratings yet

- IF2 - Project 1 PDFDocument6 pagesIF2 - Project 1 PDFBillNo ratings yet

- Solution AP Test Bank 1Document6 pagesSolution AP Test Bank 1Brian BascoNo ratings yet

- AdditionalDocument18 pagesAdditionaldarlene floresNo ratings yet

- UK Aid Direct guide to managing and disposing of assetsDocument7 pagesUK Aid Direct guide to managing and disposing of assetsmohamed AdenNo ratings yet

- Prof 3 (Final) : If The Partnership Agreement Provides For The Division of Losses Only. Profits Should Be DividedDocument22 pagesProf 3 (Final) : If The Partnership Agreement Provides For The Division of Losses Only. Profits Should Be DividedTifanny MallariNo ratings yet

- 1.1 Evolution of Accounting 1.2 Accounting Concepts and PrinciplesDocument5 pages1.1 Evolution of Accounting 1.2 Accounting Concepts and PrinciplesNawaz AhamedNo ratings yet

- MODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALDocument3 pagesMODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALmimi960% (2)

- Fin2bsat Quiz1 InvProperty Fund PpeDocument5 pagesFin2bsat Quiz1 InvProperty Fund PpeMarvin San JuanNo ratings yet

- Financial ManagementDocument7 pagesFinancial ManagementSh Mati ElahiNo ratings yet

- Description: Tags: GA200204Att1Document2 pagesDescription: Tags: GA200204Att1anon-89354No ratings yet

- IA Chapters 4 9 ProblemsDocument6 pagesIA Chapters 4 9 ProblemsNica PasionaNo ratings yet

- MB0045Document3 pagesMB0045Wael AlsawafiriNo ratings yet

- One Product Corp Opc Incorporated at The Beginning of LastDocument2 pagesOne Product Corp Opc Incorporated at The Beginning of LastLet's Talk With HassanNo ratings yet

- Seatwork #3 Solutions and Income CalculationsDocument3 pagesSeatwork #3 Solutions and Income CalculationsLemuel ReñaNo ratings yet

- Acc 308 - Week4-4-2 Homework - Chapter 13Document6 pagesAcc 308 - Week4-4-2 Homework - Chapter 13Lilian L100% (1)

- Past Exam QuestionDocument95 pagesPast Exam Questionabsankey770No ratings yet

- FAR ReviewDocument9 pagesFAR ReviewJude Vincent VittoNo ratings yet

- p1 Managerial Finance August 2017Document24 pagesp1 Managerial Finance August 2017ghulam murtazaNo ratings yet

- HW On Receivable Financing ADocument3 pagesHW On Receivable Financing ARedNo ratings yet

- IA 3 MidtermDocument9 pagesIA 3 MidtermMelanie Samsona100% (1)

- Accounting Test 1Document8 pagesAccounting Test 1Nanya BisnestNo ratings yet

- Minny Group consolidated SFPDocument7 pagesMinny Group consolidated SFPMhamudul HasanNo ratings yet

- Final Exam Audapp2 2020Document5 pagesFinal Exam Audapp2 2020HisokaNo ratings yet

- Total P 1,200,000: Refer PDF Problem 1Document2 pagesTotal P 1,200,000: Refer PDF Problem 1Joanna Rose DeciarNo ratings yet

- Chapter 1 SFPDocument4 pagesChapter 1 SFPmhl scrnnnNo ratings yet

- Module 4 - Notes ReceivableDocument22 pagesModule 4 - Notes ReceivableJennalyn S. GanalonNo ratings yet

- (Effective 1/1/2006) (Effective 1/1/2006) : Taxpayer Relations SectionDocument2 pages(Effective 1/1/2006) (Effective 1/1/2006) : Taxpayer Relations SectionMarie Jose De SilvaNo ratings yet

- Saint Columban College Business Education 2nd Semester Financial StatementsDocument3 pagesSaint Columban College Business Education 2nd Semester Financial StatementsJoe Honey Cañas Carbajosa100% (1)

- Consolidateion QuestionDocument2 pagesConsolidateion QuestionSUSANA KRAIKUENo ratings yet

- Audit Liabilities to Evaluate Financial ReportingDocument2 pagesAudit Liabilities to Evaluate Financial ReportingJessicaNo ratings yet

- CFASDocument2 pagesCFASNamelyka GarciaNo ratings yet

- IA3 Mod 4 REDocument12 pagesIA3 Mod 4 REjulia4razoNo ratings yet

- Investments That Do Not Normally Change in Value Are Disclosed On The Balance Sheet As Cash and Cash EquivalentsDocument3 pagesInvestments That Do Not Normally Change in Value Are Disclosed On The Balance Sheet As Cash and Cash EquivalentsHussainNo ratings yet

- New Fund Offer Documents ExplainedDocument9 pagesNew Fund Offer Documents Explainedamoldesh29No ratings yet

- AP-01 Audit of SHEDocument5 pagesAP-01 Audit of SHEOneil Capati FranciscoNo ratings yet

- ACTG312 Quiz 09Document2 pagesACTG312 Quiz 09Sherri BonquinNo ratings yet

- Accounting PretestDocument4 pagesAccounting PretestseymourwardNo ratings yet

- Consolidated Financial StatementsDocument33 pagesConsolidated Financial StatementsTamirat Eshetu Wolde100% (1)

- Sonia Company Accounting Obligations AuditDocument4 pagesSonia Company Accounting Obligations AuditBianca ReyesNo ratings yet

- RAW PARROT Business PlanDocument1 pageRAW PARROT Business PlanSaad HassanNo ratings yet

- Assignment 1 - TQMDocument1 pageAssignment 1 - TQMSaad HassanNo ratings yet

- J IqbalDocument2 pagesJ IqbalSaad HassanNo ratings yet

- The Professionals' Academy of Commerce Gujranwala Campus Class Test Module-B Ief (B3) May 07, 2012Document1 pageThe Professionals' Academy of Commerce Gujranwala Campus Class Test Module-B Ief (B3) May 07, 2012Saad HassanNo ratings yet

- June 2014 AccaDocument1 pageJune 2014 Accanm2007kNo ratings yet

- ACCA F3 Financial Accounting INT Solcved Past Papers 0107Document40 pagesACCA F3 Financial Accounting INT Solcved Past Papers 0107QAMAR REHMAN100% (4)

- Important TopicsDocument2 pagesImportant TopicsSaad HassanNo ratings yet

- ACCOUNTING COMPETENCY EXAM SAMPLEDocument12 pagesACCOUNTING COMPETENCY EXAM SAMPLEAmber AJNo ratings yet

- H8 AMA April2013 3rd Week QDocument10 pagesH8 AMA April2013 3rd Week QSaad HassanNo ratings yet

- P7int 2007 Dec QDocument8 pagesP7int 2007 Dec QLibrariaTuturor LibrarieNo ratings yet

- CISA 2013 BrochureDocument4 pagesCISA 2013 BrochureSaad HassanNo ratings yet

- List of All CompaniesDocument88 pagesList of All CompaniesSaad HassanNo ratings yet

- Papers Analysis 2008Document6 pagesPapers Analysis 2008Saad HassanNo ratings yet

- Application Form DownloadDocument10 pagesApplication Form DownloadSaad HassanNo ratings yet

- B4Document6 pagesB4Saad HassanNo ratings yet

- Papers Analysis 2008Document6 pagesPapers Analysis 2008Saad HassanNo ratings yet

- Revision Test 1 (Sale CH 1-3)Document1 pageRevision Test 1 (Sale CH 1-3)Saad HassanNo ratings yet

- h3 Test, Chap 3Document4 pagesh3 Test, Chap 3Saad HassanNo ratings yet

- Examiner's Report: F9 Financial Management December 2011Document5 pagesExaminer's Report: F9 Financial Management December 2011Saad HassanNo ratings yet

- AnswersDocument10 pagesAnswersagbe123No ratings yet

- I Com Acc AnalysisDocument6 pagesI Com Acc AnalysisSaad Hassan0% (1)

- Double Entries & Trial BalanceDocument75 pagesDouble Entries & Trial BalanceSaad HassanNo ratings yet

- Summary Varous SectionsDocument5 pagesSummary Varous SectionsTalha SiddNo ratings yet

- Observations of Examiners On Performance of Candidates in Writtedfasdfan Part of CSS Examination 2006Document10 pagesObservations of Examiners On Performance of Candidates in Writtedfasdfan Part of CSS Examination 2006Shahimulk KhattakNo ratings yet

- BBA Plant Assets Fundamentals Financial Accounting Depreciation MethodsDocument3 pagesBBA Plant Assets Fundamentals Financial Accounting Depreciation MethodsSaad HassanNo ratings yet

- Acca Manuals Pbe Form June13Document1 pageAcca Manuals Pbe Form June13Saad HassanNo ratings yet

- CSS 2005 Exam Performance ObservationsDocument6 pagesCSS 2005 Exam Performance ObservationsSaad HassanNo ratings yet

- Advanced Performance Management (P5)Document14 pagesAdvanced Performance Management (P5)Saad HassanNo ratings yet

- Taxable Income Calculation for ABC Partnership FirmDocument1 pageTaxable Income Calculation for ABC Partnership FirmSaad HassanNo ratings yet

- Eurobusiness Second Edition Second EditiDocument55 pagesEurobusiness Second Edition Second EditiНастя ПавленкоNo ratings yet

- KijamiiDocument16 pagesKijamiiRawan AshrafNo ratings yet

- DMA Capital Africa Finance Series - Sovereign Wealth Funds Global Insight For African StatesDocument10 pagesDMA Capital Africa Finance Series - Sovereign Wealth Funds Global Insight For African StatesDMA Capital GroupNo ratings yet

- Amazon 7pDocument6 pagesAmazon 7pnyan hein aungNo ratings yet

- The Impacts of Globalization Present and Future PerspectivesDocument5 pagesThe Impacts of Globalization Present and Future PerspectivesEndiong EkponneNo ratings yet

- Concur Expense: Taxation: Setup Guide For Standard EditionDocument47 pagesConcur Expense: Taxation: Setup Guide For Standard Editionoverleap5208No ratings yet

- Market Failure Case StudyDocument2 pagesMarket Failure Case Studyshahriar sayeedNo ratings yet

- Word Family ECONOMY - VežbeDocument16 pagesWord Family ECONOMY - VežbeNevena ZdravkovicNo ratings yet

- Pert 4 ExcelDocument8 pagesPert 4 ExcelSagita RajagukgukNo ratings yet

- India Strategy - Booster shots for key sectors in 2022Document210 pagesIndia Strategy - Booster shots for key sectors in 2022Madhuchanda DeyNo ratings yet

- How Affiliate Marketing Impacts E-CommerceDocument13 pagesHow Affiliate Marketing Impacts E-CommercePrecieux MuntyNo ratings yet

- Jun 2004 - Qns Mod BDocument13 pagesJun 2004 - Qns Mod BHubbak Khan100% (1)

- Journal EntriesDocument139 pagesJournal EntriesTapan kumarNo ratings yet

- Acct Statement - XX7301 - 03052023Document1 pageAcct Statement - XX7301 - 03052023Pranay BhosaleNo ratings yet

- Nepal COSDocument45 pagesNepal COSLeo KhkNo ratings yet

- CG Question 567Document1 pageCG Question 567Maryam MalikNo ratings yet

- Insead AmpDocument23 pagesInsead AmpJasbir S RyaitNo ratings yet

- CSR Practices of Indian Public Sector BanksDocument6 pagesCSR Practices of Indian Public Sector BankssharadiitianNo ratings yet

- India's Leading Infrastructure Companies 2017Document192 pagesIndia's Leading Infrastructure Companies 2017Navin JollyNo ratings yet

- 12BIỂU MẪU INVOICE-PACKING LIST- bookboomingDocument7 pages12BIỂU MẪU INVOICE-PACKING LIST- bookboomingNguyễn Thanh ThôiNo ratings yet

- Marketing Plan For Ready-Made Canned Foo PDFDocument10 pagesMarketing Plan For Ready-Made Canned Foo PDFHussain0% (1)

- NAQDOWN PowerpointDocument55 pagesNAQDOWN PowerpointsarahbeeNo ratings yet

- Mid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121Document10 pagesMid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121rabab balochNo ratings yet

- RESA FAR PreWeek (B43)Document10 pagesRESA FAR PreWeek (B43)MellaniNo ratings yet

- Accounting Standard As 1 PresentationDocument11 pagesAccounting Standard As 1 Presentationcooldude690No ratings yet

- Shanghai Mitsubishi Elevator Produces One Millionth UnitDocument3 pagesShanghai Mitsubishi Elevator Produces One Millionth Unitرياض ريزوNo ratings yet

- Retail MCQ ModuleDocument19 pagesRetail MCQ ModuleBattina AbhisekNo ratings yet

- ALL IN MKT1480 Marketing Plan Worksheet 1 - Team ContractDocument29 pagesALL IN MKT1480 Marketing Plan Worksheet 1 - Team ContractBushra RahmaniNo ratings yet

- 2021 Playbook For Credit Risk ManagementDocument41 pages2021 Playbook For Credit Risk ManagementAbNo ratings yet

- Financial Accessibility of Women Entrepreneurs: (W S R T W P W E)Document5 pagesFinancial Accessibility of Women Entrepreneurs: (W S R T W P W E)Vivi OktaviaNo ratings yet