Professional Documents

Culture Documents

FIN 534 Homework Chapter 11

Uploaded by

Jenna KiragisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIN 534 Homework Chapter 11

Uploaded by

Jenna KiragisCopyright:

Available Formats

Jenna Kiragis

5/18/2014

FIN 534 Homework Chapter 11

Directions: Answer the following five questions on a separate document. Explain how you

reached the answer or show your work if a mathematical calculation is needed, or both. Submit

your assignment using the assignment link in the course shell. Each question is worth five points

apiece for a total of 25 points for this homework assignment.

1. Which of the following statements is CORRECT?

a. An example of an externality is a situation where a bank opens a new office, and

that new office causes deposits in the bank's other offices to decline.

b. The NPV method automatically deals correctly with externalities, even if the

externalities are not specifically identified, but the IRR method does not. This is

another reason to favor the NPV.

c. Both the NPV and IRR methods deal correctly with externalities, even if the

externalities are not specifically identified. However, the payback method does

not.

d. Identifying an externality can never lead to an increase in the calculated NPV.

e. An externality is a situation where a project would have an adverse effect on

some other part of the firm's overall operations. If the project would have a

favorable effect on other operations, then this is not an externality.

Explanation:

In Section 11.1f Externalities of our book, we learn that externalities are effects of a

project on other parts of the firm or on the environment (Brigham & Ehrhardt, 2014).

Answer A explains a Negative Within-Firm Externalities where a firm open up and the

traffic flow drops at the other firm.

2. Which of the following statement s is CORRECT?

a. If a firm is found guilty of cannibalization in a court of law, then it is judged to

have taken unfair advantage of its customers. Thus, cannibalization is dealt with

by society through the antitrust laws.

b. If cannibalization exists, then the cash flows associated with the project must

be increased to offset these effects. Otherwise, the calculated NPV will be biased

downward.

c. If cannibalization is determined to exist, then this means that the calculated NPV

if cannibalization is considered will be higher than the NPV if this effect is not

recognized.

d. Cannibalization, as described in the text, is a type of externality that is not

against the law, and any harm it causes is done to the firm itself.

e. If a firm is found guilty of cannibalization in a court of law, then it is judged to

have taken unfair advantage of its competitors. Thus, cannibalization is dealt with

by society through the antitrust laws.

Explanation:

In Section 11.1f Externalities of our book, we learn that cannibalization is a form of

Negative Within-Firm Externalities. The new business eats into the companys existing

business (Brigham & Ehrhardt, 2014). The book explains Apples iPod model. By

producing a newer model, the previous model is cannibalized. Therefore my answer D

explains that cannibalization is not against the law and the only harm done is to itself.

3. Which of the following statements is CORRECT?

a. Under current laws and regulations, corporations must use straight-line

depreciation for all assets whose lives are 5 years or longer.

b. Corporations must use the same depreciation method (e.g., straight line or

accelerated) for stockholder reporting and tax purposes.

c. Since depreciation is not a cash expense, it has no effect on cash flows and thus

no effect on capital budgeting decisions.

d. Under accelerated depreciation, higher depreciation charges occur in the early

years, and this reduces the early cash flows and thus lowers a project's projected

NPV.

e. Using accelerated depreciation rather than straight line would normally have no

effect on a project's total projected cash flows but it would affect the timing of the

cash flows and thus the NPV.

Explanation:

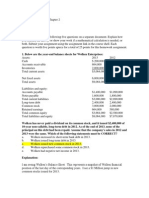

I choose answer E, because of section 11-2e Evaluating Project Cash Flows

(Accelerated Depreciation versus Straight-Line Depreciation). In this section, we learn

more about accelerated depreciation and its effects of other resources. The book gives an

example of accelerated depreciation versus straight-line depreciation and how it can

affect NPV (Brigham & Ehrhardt, 2014).

4. Which of the following statements is CORRECT?

a. Under current laws and regulations, corporations must use straight-line

depreciation for all assets whose lives are 5 years or longer.

b. Corporations must use the same depreciation method for both stockholder

reporting and tax purposes.

c. Using accelerated depreciation rather than straight line normally has the effect

of speeding up cash flows and thus increasing a project's forecasted NPV.

d. Using accelerated depreciation rather than straight line normally has no effect on

a project's total projected cash flows nor would it affect the timing of those cash

flows or the resulting NPV of the project.

e. Since depreciation is a cash expense, the faster an asset is depreciated, the

lower the projected NPV from investing in the asset.

Explanation:

I choose answer C, because of section 11-2e Evaluating Project Cash Flows

(Accelerated Depreciation versus Straight-Line Depreciation). The book gives an

example of accelerated depreciation versus straight-line depreciation and how it can

affect NPV (Brigham & Ehrhardt, 2014).

5. Which of the following statements is CORRECT?

a. Under current laws and regulations, corporations must use straight-line

depreciation for all assets whose lives are 3 years or longer.

b. If firms use accelerated depreciation, they will write off assets slower than they

would under straight-line depreciation, and as a result projects' forecasted NPVs

are normally lower than they would be if straight-line depreciation were required

for tax purposes.

c. If they use accelerated depreciation, firms can write off assets faster than they

could under straight-line depreciation, and as a result projects' forecasted NPVs

are normally lower than they would be if straight-line depreciation were required

for tax purposes.

d. If they use accelerated depreciation, firms can write off assets faster than they

could under straight-line depreciation, and as a result projects' forecasted NPVs

are normally higher than they would be if straight-line depreciation were required

for tax purposes.

e. Since depreciation is not a cash expense, and since cash flows and not

accounting income are the relevant input, depreciation plays no role in capital

budgeting.

Explanation:

From everything read about accelerated depreciation, I had to choose answer D because it

fit inline with the book. Section 11-2e Evaluating Project Cash Flows (Accelerated

Depreciation versus Straight-Line Depreciation) gives a nice detailed scenario about

using accelerated depreciation and how it affects taxes.

Brigham, E., & Ehrhardt, M. (2014). Financial management. (14th ed.). Mason, Ohio: Cengage Learning.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PMP FormulasDocument5 pagesPMP Formulasbhaveshkumar78100% (8)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Evaluation Mining Project (Topal, 2008)Document15 pagesEvaluation Mining Project (Topal, 2008)LFNo ratings yet

- Cebu BRT Feasibility StudyDocument35 pagesCebu BRT Feasibility StudyCebuDailyNews100% (3)

- Sheep Fatening ProposalDocument25 pagesSheep Fatening ProposalSemir100% (2)

- Petroleum EconomicsDocument37 pagesPetroleum Economicsaa100% (1)

- Detergent Powder Manufacturing Unit Rs. 28.83 Million Jun-2021Document23 pagesDetergent Powder Manufacturing Unit Rs. 28.83 Million Jun-2021Syed Fawad AhmadNo ratings yet

- MCQ of Capital Budgeting Part 2Document4 pagesMCQ of Capital Budgeting Part 2sameerNo ratings yet

- L4M2 Udemy Rev Question 3Document18 pagesL4M2 Udemy Rev Question 3Mohamed Elsir100% (2)

- FIN 534 Homework Chapter 9Document3 pagesFIN 534 Homework Chapter 9Jenna KiragisNo ratings yet

- FIN 534 Homework Chapter 6Document3 pagesFIN 534 Homework Chapter 6Jenna KiragisNo ratings yet

- FIN 534 Homework Chapter 5Document3 pagesFIN 534 Homework Chapter 5Jenna KiragisNo ratings yet

- FIN 534 Homework CHP 8Document3 pagesFIN 534 Homework CHP 8Jenna KiragisNo ratings yet

- FIN 534 Homework Chap.2Document3 pagesFIN 534 Homework Chap.2Jenna KiragisNo ratings yet

- FIN 534 Chapter 4 HomeworkDocument3 pagesFIN 534 Chapter 4 HomeworkJenna KiragisNo ratings yet

- Rencana Bisnis Art Box Creative and Coworking SpaceDocument2 pagesRencana Bisnis Art Box Creative and Coworking SpacesupadiNo ratings yet

- IT2403 - Software Project ManagementDocument140 pagesIT2403 - Software Project ManagementPreethi NilaNo ratings yet

- Case Study Golf Shirts-1536445838776Document44 pagesCase Study Golf Shirts-1536445838776Kimberley WrightNo ratings yet

- PMP Formulas 01234Document12 pagesPMP Formulas 01234Waqas AhmedNo ratings yet

- Investment Process: Case: Target CorporationDocument55 pagesInvestment Process: Case: Target Corporationjk kumarNo ratings yet

- Coworking Space Rs. 55.67 Million Dec-2022Document37 pagesCoworking Space Rs. 55.67 Million Dec-2022Mansoor AhmadNo ratings yet

- Capital BudgetingDocument21 pagesCapital BudgetingGabriella RaphaelNo ratings yet

- Review Test Submission - Lecture 8 - Online Assignment - ..Document6 pagesReview Test Submission - Lecture 8 - Online Assignment - ..RishabhNo ratings yet

- 15 11 22 PracticeDocument5 pages15 11 22 PracticeАнна Миколаївна МасовецьNo ratings yet

- MBAA 518 Online Syllabus 0515Document6 pagesMBAA 518 Online Syllabus 0515HeatherNo ratings yet

- Homework P 125 2asDocument4 pagesHomework P 125 2aserpx7jky100% (1)

- Project Economics & Financial MangmentDocument38 pagesProject Economics & Financial MangmentshardultagalpallewarNo ratings yet

- ProntoDocument8 pagesProntoFidela HerdyantiNo ratings yet

- Exam Name: CFA Level I Total Questions: 22 Assignment Name: JUN18L1QME/C02 (9dbafcb4) Pass Mark Rate: 65% Assignment Duration: 33 MinutesDocument9 pagesExam Name: CFA Level I Total Questions: 22 Assignment Name: JUN18L1QME/C02 (9dbafcb4) Pass Mark Rate: 65% Assignment Duration: 33 MinutesjuanNo ratings yet

- PS2S71 Managing Projects and Operations: Aims:-Management ObjectivesDocument37 pagesPS2S71 Managing Projects and Operations: Aims:-Management ObjectivesFadekemi AdelabuNo ratings yet

- ComprehensiveDocument9 pagesComprehensiveChristopher RogersNo ratings yet

- Profile On The Production of Fiberglass Reinforced PlasticsDocument28 pagesProfile On The Production of Fiberglass Reinforced Plasticsmitesh20281No ratings yet

- Envases Desechables BiodegradablesDocument220 pagesEnvases Desechables BiodegradablesCARLOS GOMEZNo ratings yet

- Main Project Capital Budgeting MbaDocument110 pagesMain Project Capital Budgeting MbaRaviKiran AvulaNo ratings yet

- Lesson 4 Agile Estimating Planning Monitoring and ControllingDocument51 pagesLesson 4 Agile Estimating Planning Monitoring and Controllingbharath S SNo ratings yet

- Net Present Value: Examples From Notes: Capital Budgeting IDocument25 pagesNet Present Value: Examples From Notes: Capital Budgeting Ikrish lopezNo ratings yet

- Assignment SolutionDocument14 pagesAssignment SolutionEfeme SammuelNo ratings yet