Professional Documents

Culture Documents

Cpa 2014 Reg Aicpa Questions

Uploaded by

ChunweiXianCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cpa 2014 Reg Aicpa Questions

Uploaded by

ChunweiXianCopyright:

Available Formats

2014 AICPA DISCLOSED QUESTIONS -- REGULATION

The following pages contain all of the new multiple-choice questions released by the AICPA in

2014. Our editors have added correct and incorrect answer explanations and renumbered and

organized the questions to conform to our study units.

These questions are presented in this PDF in our Review book format, with the answers and answer

explanations to the right of each question. Gleim recommends that candidates answer these questions

in our CPA Test Prep instead of via this PDF in order to emulate a more realistic test-taking experience.

Material from Uniform CPA Examination, Selected Questions and Unofficial Answers,

Copyright 1974-2014 by the American Institute of Certified Public Accountants, Inc., is reprinted

and/or adapted with permission. Visit the AICPAs website at www.aicpa.org for more information.

1

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Study Unit 1, Subunit 2

Shore, a paid tax return preparer, was given three

partnership Schedule K-1 forms by client Fuller. Fuller

is a limited partner in each of the partnerships. The

K-1s disclosed small pass-through losses allocated to

Fuller. Fuller had passive income in excess of these

losses from other partnerships. According to the

AICPA Statements on Standards for Tax Services,

assuming that no at-risk limitations apply, what is

Shores professional responsibility regarding the

reporting of these partnership losses on Fullers

federal income tax return?

A. To verify the clients basis by examining

clients records from the initial investment to

the present.

B. To accept the information without further

inquiry unless Shore has reason to believe that

the information is incorrect.

C. To verify the initial investment in each

partnership entity unless Shore has reason to

believe that the information is incorrect.

D. To request the complete partnership returns of

the partnership entities unless Shore has

reason to believe that the information is

incorrect.

Answer (B) is correct.

REQUIRED: The tax preparers professional responsibility

under the SSTS for the reporting of partnership losses.

DISCUSSION: In good faith, a member may rely, without

verification, on information provided by the taxpayer or third

parties. Reasonable inquiries should be made if information

appears to be incorrect, incomplete, or inconsistent on its face or

on the basis of other facts known, and prior returns should be

consulted whenever feasible (TS 300).

Answer (A) is incorrect. Verification is unnecessary, but the

member should make reasonable inquiries if the information

appears to be incorrect, incomplete, or inconsistent. Answer (C)

is incorrect. The member should make reasonable inquiries if the

information appears to be incorrect, incomplete, or inconsistent.

Answer (D) is incorrect. Prior returns should be consulted

whenever feasible.

Study Unit 1, Subunit 4

Which of the following bodies has the authority to

suspend or revoke a CPAs license for acts

discreditable to the profession?

A. The state society of certified public

accountants.

B. The state board of accountancy.

C. The Public Company Accounting Oversight

Board.

D. The American Institute of Certified Public

Accountants.

Answer (B) is correct.

REQUIRED: The body with the authority to suspend or

revoke a CPAs license for acts discreditable.

DISCUSSION: State boards can suspend or revoke

licensure through administrative processes, such as board

hearings.

Answer (A) is incorrect. State CPA societies are voluntary,

private entities that can admonish, suspend, or expel their own

members, but they cannot suspend or revoke a CPA license.

Answer (C) is incorrect. The PCAOB has no injunctive power, but

it may initiate administrative proceedings. It may not suspend or

revoke a CPA license. Answer (D) is incorrect. The AICPA

Professional Ethics Division investigates ethics violations.

However, it generally imposes sanctions only in less serious

cases. The Joint Trial Board handles more serious infractions.

Expulsion from the AICPA does not bar the individual from

practice of public accounting. Thus, violation of a rule established

by a board of accountancy is more serious than expulsion from

the AICPA.

2

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Study Unit 2, Subunit 1

Under Regulation D, Rule 505, of the Securities

Act of 1933, which of the following statements is

correct regarding a $3,000,000 stock offering sold

only to accredited investors?

A. The issuer may sell the stock to only 35

accredited investors.

B. The issuer may make the offering through a

general advertising.

C. The issuer must supply all accredited investors

with financial information.

D. The issuer must notify the SEC within 15 days

after the first sale of the offering.

Answer (D) is correct.

REQUIRED: The true statement about a stock offering sold

only to accredited investors under Rule 505.

DISCUSSION: Various procedural rules generally must be

followed to qualify for an exemption under Regulation D, some of

which do not apply to certain exemptions. However, a

requirement to notify the SEC by filing Form D within 15 days of

the first offering applies to all 3 exemptions (Rule 504, Rule 505,

and Rule 506).

Answer (A) is incorrect. Under Rule 505, the issue may be

purchased by an unlimited number of accredited investors.

Answer (B) is incorrect. Under Rule 505, no general solicitation

or advertising is permitted. Answer (C) is incorrect. The issuer

must supply all nonaccredited (not accredited) investors with

material information about the issuer, its business, and the

securities being offered prior to the sale.

Study Unit 2, Subunit 3

Pick, CPA, was engaged by Edge Corp. to audit

Edges financial statements. Pick, in performing the

audit and rendering an unmodified opinion,

intentionally ignored several material omissions in the

financial statements. Edge included Picks auditors

report in its annual filing with the SEC and in its

annual stockholders report. Drane purchased shares

of Edge stock based on Dranes review of the past

performance of the stock and current-year financial

statements. When the omissions in the financial

statements became known, the value of Edge stock

declined and Drane suffered a loss. Under the

provisions of Rule 10b-5 of the Securities Exchange

Act of 1934, what will be the result of a suit by Drane

against Pick?

A. Drane will win because Pick acted with intent.

B. Drane will win because Pick was negligent.

C. Drane will lose because only Edge is liable.

D. Drane will lose because the stock purchased

was not part of a new issue.

Answer (A) is correct.

REQUIRED: The result of a suit under Rule 10b-5 by an

investor against an auditor who intentionally ignored material

omissions in the financial statements of the investee.

DISCUSSION: Rule 10b-5 states that it is illegal for any

person, directly or indirectly, to use interstate commerce or a

national securities exchange to defraud anyone in connection

with the purchase or sale of any security, whether or not required

to be registered. It is most often applied to insider trading and

corporate misstatements. A person may violate Rule 10b-5

without actively participating in the purchase or sale of the

security. All that is required is that the partys activity be

connected with the purchase or sale. Liability is only to actual

purchasers or sellers. They need not be in privity with the

defendant. The SEC or a private party may sue. A plaintiff must

prove each of the following: (1) an oral or written misstatement or

omission of a material fact or other fraud; (2) its connection with

any purchase or sale of securities; (3) the defendants intent to

deceive, manipulate, or defraud (scienter); (4) reliance on the

misstatement (but a private plaintiff ordinarily need not prove

reliance in omission cases); and (5) loss caused by the reliance.

Accordingly, the auditor is liable for fraud because (s)he

intentionally ignored material omissions in the financial

statements that constituted written misstatements of material

facts related to a purchase of securities that resulted in loss.

Answer (B) is incorrect. The defendant-auditor intentionally

ignored material omissions in the financial statements. Thus, the

auditors actions are fraudulent, not negligent. Answer (C) is

incorrect. The defendant-auditor is liable for intentional

concealment of material misstatement of the financial

statements. The auditor is therefore liable for fraud. Answer (D) is

incorrect. Rule 10b-5 applies to the purchase or sale of any

security, whether or not required to be registered.

3

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Study Unit 2, Subunit 4

Under the common law, which of the following

defenses, if used by a CPA, would best avoid liability

in an action for negligence brought by a client?

A. The client was contributorily negligent.

B. The client was comparatively negligent.

C. The accuracy of the CPAs report was not

guaranteed.

D. The CPAs negligence was not the proximate

cause of the clients losses.

Answer (D) is correct.

REQUIRED: The best defense by a CPA against a clients

negligence claim.

DISCUSSION: A plaintiff-client must prove all of the following

elements of negligence: (1) the accountant owed the client a

duty, (2) the accountant breached this duty, (3) the accountants

breach actually and proximately caused the clients injury, and

(4) the client suffered damages. Proximate cause is a chain of

causation that is not interrupted by a new, independent cause.

Moreover, the injury would not have occurred without the

proximate cause. However, actual causation is insufficient. The

injury also must have been reasonably foreseeable. Thus, the

concept of proximate cause limits liability to foreseeable

damages. Accordingly, lack of proof of proximate cause

precludes any recovery of damages.

Answer (A) is incorrect. Contributory negligence is not

recognized as a defense in a substantial majority of states. Most

states have adopted a comparative negligence approach that

allows a contributorily negligent plaintiff to recover a percentage

of the damages. Answer (B) is incorrect. The client is liable for

his or her percentage of the damages in a state that applies the

comparative negligence rule. Answer (C) is incorrect. A CPAs

report offers reasonable assurance, not a guarantee.

Which of the following pairs of elements must a

client prove to hold an accountant liable for common

law negligence?

A. Freedom from contributory negligence and

privity.

B. Breach of the accountants duty of care and

loss.

C. Willful misrepresentation and breach of the

accountants duty of care.

D. Scienter and a violation of GAAP.

Answer (B) is correct.

REQUIRED: The elements to be proved to hold an

accountant liable for negligence.

DISCUSSION: To hold an accountant liable for negligence,

the plaintiff-client must prove all of the following elements of

negligence: (1) the accountant owed the client a duty of

reasonable care and diligence, (2) the accountant breached this

duty, (3) the accountants breach actually and proximately

caused the clients injury, and (4) the client suffered damages

(loss).

Answer (A) is incorrect. Comparative, not contributory,

negligence is recognized in most states. It is a defense to liability,

not an element of the tort of negligence. Moreover, in most

states, privity of contract no longer is required for a plaintiff to

hold an accountant liable for negligence. The majority rule is that

an accountant is liable to foreseen users and users within a class

of foreseen users. Answer (C) is incorrect. Willful

misrepresentation is an element of fraud, not negligence.

Answer (D) is incorrect. Scienter is actual or implied knowledge

of fraud. It is an element of fraud, not common law negligence.

Compliance with GAAP is a defense to negligence.

American Corp. retained Baker, CPA, to conduct

an audit of its financial statements to obtain a bank

line of credit. American signed an engagement letter

drafted by Baker that included a disclaimer provision.

As a result of Bakers failure to detect a material

misstatement in Americans financial statements, the

audit report contained an unmodified opinion. Based

on Americans audited financial statements, National

extended credit to American. American filed a petition

in bankruptcy shortly thereafter. National sued Baker

for damages based on common law fraud. What

would be Bakers best defense?

A. Baker acted with due diligence in conducting

the audit.

B. Baker included a disclaimer provision in the

engagement letter with American.

C. National was not in privity with Baker.

D. Baker lacked the intent to deceive.

Answer (D) is correct.

REQUIRED: The auditors best defense to a claim of fraud

made by a third-party user of the audited financial statements

who relied on them to extend credit to the client.

DISCUSSION: A finding of fraud requires proof that the

misrepresentation was made with knowledge of, or reckless

disregard for, its falsity. Thus, proving that the accountant lacked

the intent to deceive is the best defense to a claim of fraud.

Answer (A) is incorrect. Because failure to exercise due care

is not an element of fraud, proof that the accountant acted with

due diligence is not the best defense. Answer (B) is incorrect.

Liability for fraud cannot be disclaimed. Answer (C) is incorrect.

Liability for fraud is to all reasonably foreseeable users.

A foreseeable user is any person the accountant should have

foreseen would be injured by justifiable reliance on the

misrepresentation. Privity is not required. National is a

foreseeable user because Baker should have reasonably

foreseen that Americans financial statements would be used to

obtain credit from a bank.

4

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Study Unit 3, Subunit 5

Baker, an unmarried individual, sold a personal

residence, which has an adjusted basis of $70,000,

for $165,000. Baker owned and lived in the residence

for 7 years. Selling expenses were $10,000. Four

weeks prior to the sale, Baker paid a handyman

$1,000 to paint and fix-up the residence. What is the

amount of Bakers recognized gain?

A. $0

B. $84,000

C. $85,000

D. $95,000

Answer (A) is correct.

REQUIRED: The amount of gain recognized on sale of a

principal residence.

DISCUSSION: While the correct amount of realized gain is

$85,000, IRC Sec. 121 excludes the gain on the sale of a

principal residence, up to $250,000 per taxpayer, subject to

certain rules and limitations. As none of the facts would lead us

to reduce this exclusion, no gain is recognized on the disposition

of the home.

Answer (B) is incorrect. The costs incurred to paint and

repair the home are not capital improvements and would not

increase the basis of the home. Answer (C) is incorrect. While

$85,000 is the correct amount of realized gain ($165,000 amount

realized, less $10,000 selling expenses, less $70,000 adjusted

basis), the amount of recognized gain differs due to the exclusion

amount on the sale of a principal residence. Answer (D) is

incorrect. Selling expenses are treated as a reduction in the

amount realized to the seller of property and would decrease the

gain realized on the disposition of the home.

Study Unit 4, Subunit 1

Nan, a cash basis taxpayer, borrowed money from

a bank and signed a 10-year interest-bearing note on

business property on January 1 of the current year.

The cash flow from Nans business enabled Nan to

prepay the first three years of interest attributable to

the note on December 31 of the current year. How

should Nan treat the prepayment of interest for tax

purposes?

A. Deduct the entire amount as a current

expense.

B. Deduct the current years interest and amortize

the balance over the next two years.

C. Capitalize the interest and amortize the

balance over the 10-year loan period.

D. Capitalize the interest as part of the basis of

the business property.

Answer (B) is correct.

REQUIRED: Nans appropriate treatment for the prepayment

of interest on business property.

DISCUSSION: Despite being a cash-basis taxpayer, the

interest expense must be apportioned to the periods to which it is

attributable. As the first three years portion is paid in Year 1, the

Year 1 portion is currently deductible. The remainder must be

deducted in the year to which it is attributable (Year 2 in Year 2,

and Year 3 in Year 3), regardless of when paid.

Answer (A) is incorrect. The interest expense must be

allocated to the period which it benefited and may not be entirely

deducted presently. Answer (C) is incorrect. As the prepayment

of interest does not benefit the periods after the end of Year 3, it

is not reasonable to allocate the interest to periods beyond

Year 3. Answer (D) is incorrect. The appropriate treatment for the

prepayment of interest on business property is to capitalize and

amortize the interest in the period to which it applies.

Study Unit 5, Subunit 1

Which of the following statements is correct

regarding the deductibility of donations made to

qualifying charities by a cash-basis individual

taxpayer?

A. A contemporaneous written acknowledgment

is required for donations of $100.

B. A charitable contribution deduction is not

allowed for the value of services rendered to a

charity.

C. A qualified appraisal for real property

donations is not required to be attached to the

tax return unless the property value exceeds

$10,000.

D. The charitable contribution deduction for

long-term appreciated stock is limited to 50%

of adjusted gross income.

Answer (B) is correct.

REQUIRED: The correct statement regarding charitable

contributions.

DISCUSSION: The costs of services rendered to a charity

(such as legal advice, accounting assistance, or volunteering

time) as a donation are not deductible as a charitable

contribution. However, any expenses incurred in the rendering of

those services (such as travel costs, mileage, supplies, etc.) are

deductible.

Answer (A) is incorrect. Donations of $250 or more continue

to require substantiation by a written receipt from the

organization (the bank record alone is not sufficient). Answer (C)

is incorrect. A qualified appraisal for real property donations is

required to be attached to the tax return for property valued over

$5,000. Answer (D) is incorrect. Donations of appreciated capital

gain property are limited to 30% of AGI, assuming they are made

to 50% limit organizations. Otherwise, the donation may be

limited to 20%.

5

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Pat, a single taxpayer, has adjusted gross

income of $40,000 in the current year. During the

year, a hurricane causes $4,100 damage to Pats

personal use car on which Pat has no insurance. Pat

purchased the car for $20,000. Immediately before

the hurricane, the cars fair market value was $11,000

and immediately after the hurricane its fair market

value was $6,900. What amount should Pat deduct as

a casualty loss for the current year after all threshold

limitations are applied?

A. $4,100

B. $4,000

C. $100

D. $0

Answer (D) is correct.

REQUIRED: The current-year deduction amount for the

casualty loss.

DISCUSSION: Only casualty losses in excess of 10% of AGI

may be deducted after applying the $100 floor. Generally,

casualty losses are deductible to the extent of the lesser of the

decline in FMV or adjusted basis (less insurance

reimbursements) due to the event. In this case, both the amount

of the damage and the decline in FMV are $4,100. After applying

the $100 floor, the remaining casualty loss is $4,000. Subject to

the 10% AGI limitation, the loss is reduced by $4,000 ($40,000

10%) to $0.

Answer (A) is incorrect. The amount of $4,100 is the decline

in fair market value as well as the amount of the casualty loss

before application of the $100 floor. Answer (B) is incorrect. The

amount of $4,000 is the decline in fair market value as well as the

amount of the casualty loss after the application of the $100 floor,

but before the application of the 10% of AGI limitation.

Answer (C) is incorrect. The amount of $100 is the casualty loss

floor that must be subtracted from each casualty loss before

applying any other limitations.

Study Unit 5, Subunit 2

Which of the following is not a deduction to arrive

at adjusted gross income?

A. Alimony payments.

B. Trade or business expenses.

C. Capital losses in excess of capital gains.

D. Unreimbursed employee business expenses.

Answer (D) is correct.

REQUIRED: The below-the-line (from AGI) deduction.

DISCUSSION: Unreimbursed employee expenses are a

deduction from AGI, as an itemized deduction (below-the-line).

Answer (A) is incorrect. Alimony is an above-the-line

deduction (for AGI). Answer (B) is incorrect. Trade or business

expenses are deducted on Schedule C, which is listed

above-the-line (a deduction for AGI). Answer (C) is incorrect.

Capital losses in excess of capital gains are deducted on

Schedule D, which is listed above-the-line (a deduction for AGI).

Study Unit 5, Subunit 4

When computing alternative minimum tax, the

individual taxpayer may take a deduction for which of

the following items?

A. State income taxes.

B. Personal and dependency exemptions.

C. Miscellaneous itemized deductions in excess

of 2% of adjusted gross income floor.

D. Casualty losses.

Answer (D) is correct.

REQUIRED: The allowable deduction for an individual

against alternative minimum taxable income.

DISCUSSION: Casualty losses are allowed as deductions

against alternative minimum taxable income (AMTI), subject to

limitations.

Answer (A) is incorrect. State income taxes are not permitted

as a deduction against alternative minimum taxable income

(AMTI). Answer (B) is incorrect. Personal and dependency

exemptions must be added back in the computation of alternative

minimum taxable income (AMTI). Answer (C) is incorrect.

Miscellaneous itemized deductions subject to the 2% floor are

not permitted as deductions against alternative minimum taxable

income (AMTI), subject to limitations.

6

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

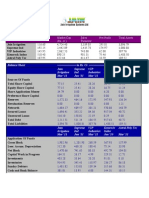

Study Unit 5, Subunit 5

Dietz is a passive investor in three activities

which have been profitable in previous years. The

profit and losses for the current year are as follows:

Gain (Loss)

Activity X $(30,000)

Activity Y (50,000)

Activity Z 20,000

Total $(60,000)

What amount of suspended loss should Dietz allocate

to Activity X?

A. $18,000

B. $20,000

C. $22,500

D. $30,000

Answer (C) is correct.

REQUIRED: The allocable amount of suspended passive

losses to Activity X.

DISCUSSION: The passive activity income is allocated pro

rata between the two activities with passive losses. As Activity X

accounts for 37.5% ($30,000 $80,000 total loss) of the passive

losses, it is allocated $7,500 ($20,000 37.5%) of the passive

activity income. This results in a net $22,500 ($30,000 $7,500)

passive activity loss allocable to Activity X.

Answer (A) is incorrect. The passive activity income must be

used to offset some of the passive activity loss from Activity X.

Answer (B) is incorrect. The amount of $20,000 is the passive

activity income, not the amount of the loss allocable to Activity X.

Answer (D) is incorrect. A portion of the passive activity income

must be used to offset the passive losses from Activity X.

The Jacksons, who file a joint return, actively

participate in a solely-owned rental real estate activity

that produces a $30,000 loss during the current year.

Their adjusted gross income was $120,000 before

considering the rental activity. How much of the rental

loss, if any, are the Jacksons entitled to deduct?

A. $0

B. $15,000

C. $25,000

D. $30,000

Answer (B) is correct.

REQUIRED: The amount of deductible rental loss on rental

real estate.

DISCUSSION: Generally, an active participant in rental real

estate may deduct up to $25,000 per year in rental real estate

losses. For taxpayers whose MAGI exceeds $100,000, the

amount of the active real estate loss deduction is reduced for

50% of the excess of MAGI over $100,000. For the Jacksons,

this means the currently deductible portion of real estate losses is

$15,000 {$25,000 [($120,000 MAGI $100,000 base amount)

50% limitation]}.

Answer (A) is incorrect. A portion of the rental real estate

loss is deductible. Answer (C) is incorrect. This is the correct

general amount for active real estate loss deduction. However,

the Jacksons are subject to high-income limitations. Answer (D)

is incorrect. The full amount of the loss is not deductible.

Study Unit 6, Subunit 1

Which of the following types of costs are required

to be capitalized under the Uniform Capitalization

Rules of Code Sec. 263A?

A. Marketing.

B. Distribution.

C. Warehousing.

D. Office maintenance.

Answer (C) is correct.

REQUIRED: Expense required to be capitalized for UNICAP.

DISCUSSION: UNICAP rules require the capitalization of all

expenses necessary to bring the asset to its intended use.

Storage of an asset prior to its intended use would qualify as a

cost incurred to bring it to its full use and should be capitalized

under UNICAP.

Answer (A) is incorrect. UNICAP rules require the

capitalization of all expenses necessary to bring the asset to its

intended use. Marketing expenses would be an expense incurred

in the sale of goods or services, not in the implementation of the

asset. Answer (B) is incorrect. UNICAP rules require the

capitalization of all expenses necessary to bring the asset to its

intended use. Distribution costs would be attributable to the sale

of goods and services, not to the acquisition and implementation

of an asset. Answer (D) is incorrect. UNICAP rules require the

capitalization of all expenses necessary to bring the asset to its

intended use. Office maintenance is an indirect expense

allocable to all of the operations of the business equally, not a

particular asset.

7

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Study Unit 6, Subunit 3

An individual reports the following capital

transactions in the current year:

Short-term capital gain $ 1,000

Short-term capital loss 11,000

Long-term capital gain 10,000

Long-term capital loss 6,000

What amount is deducted in arriving at adjusted gross

income?

A. $10,000

B. $6,000

C. $3,000

D. $0

Answer (C) is correct.

REQUIRED: The amount of net capital loss from multiple

transactions.

DISCUSSION: The net short-term capital loss for the year is

$6,000. This is partially deductible in the current year, as

individuals are permitted to use up to $3,000 of capital losses to

offset ordinary income each year.

Answer (A) is incorrect. The short-term losses for the year

must first be used to offset long-term capital gain. Answer (B) is

incorrect. This is the correct amount of net short-term capital

loss. However, the full amount is not deductible against ordinary

income during the year. Answer (D) is incorrect. While

corporations are not permitted to offset ordinary income with

capital losses, individuals are permitted to deduct a portion of

their short-term capital loss carryforward against ordinary income

each year.

Study Unit 6, Subunit 4

On March 1 of the previous year, a parent sold

stock with a cost of $8,000 to their child for $6,000, its

fair market value. On September 30 of the current

year, the child sold the same stock for $7,000 to

Hancock, who is unrelated to the parent and child.

What is the proper treatment for these transactions?

A. Parent has a $2,000 recognized loss and child

has $1,000 recognized gain.

B. Parent has $2,000 recognized loss and child

has $0 recognized gain.

C. Parent has $0 recognized loss and child has

$1,000 recognized gain.

D. Parent has $0 recognized loss and child has

$0 recognized gain.

Answer (D) is correct.

REQUIRED: The proper treatment for related party stock

sales.

DISCUSSION: With a related party stock sale, the original

related seller is not permitted to recognize any realized loss on

the disposition. However, if the recipient of that stock

subsequently disposes of it at a gain, they are permitted to

reduce any gain realized by the amount of the disallowed loss. In

this case, $2,000 ($6,000 amount realized, less $8,000 adjusted

basis) of loss is realized to the parent on the initial disposition.

The child takes a $6,000 fair market value basis. Upon

subsequent disposition, the child realizes a $1,000 gain on the

sale of the shares ($7,000 amount realized, less $6,000 adjusted

basis). However, this is reduced to $0 by the disallowed loss to

the parent. The remaining $1,000 loss ($2,000 disallowed loss,

less $1,000 used to offset the childs gain) is permanently lost.

Answer (A) is incorrect. The recognition of losses on related

party stock sales is not permitted, and the childs gain should not

be fully recognized. Answer (B) is incorrect. The recognition of

losses on related party stock sales is not permitted. Answer (C) is

incorrect. The parents disallowed loss is allowed to offset the

childs subsequently realized gain.

Study Unit 6, Subunit 6

Prime Corporations building was destroyed by a

tornado. The fair market value of the building at the

time of the tornado was $400,000, and its adjusted

basis was $350,000. The insurance proceeds totaled

$500,000 as follows:

$400,000 for the building.

$100,000 for lost profits during rebuilding.

Prime does not defer any gain under the involuntary

conversion provisions of Code Sec. 1033. What

amount of the insurance proceeds is taxable to

Prime?

A. $0

B. $50,000

C. $100,000

D. $150,000

Answer (D) is correct.

REQUIRED: The amount of insurance proceeds taxable due

to an involuntary conversion.

DISCUSSION: The lost profits during rebuilding would be

taxable whether received from customers or insurance proceeds,

as they represent business income (or a replacement thereof).

As Prime does not elect involuntary conversion treatment, the

conversion of the building to cash is treated as a sale of the

property. The amount realized on the disposition (the insurance

proceeds) is $400,000, less the $350,000 adjusted basis on the

property. Accordingly, the taxable income from insurance

proceeds is equal to $150,000 ($100,000 lost profits + $50,000

gain on building).

Answer (A) is incorrect. A portion of the insurance proceeds

is taxable to Prime. Answer (B) is incorrect. This is the correct

amount of insurance proceeds recognized on the building as

taxable income. However, the lost profits during rebuilding must

also be considered. Answer (C) is incorrect. The lost profits

during rebuilding would be taxable whether received from

customers or insurance proceeds. However, a portion of the

buildings proceeds is also taxable.

8

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Study Unit 6, Subunit 7

A sole proprietor of a farm implement store sold a

truck for $15,000 that had been used to make service

calls. Three years ago, the truck cost $30,000, and

$21,360 depreciation was taken. What is the

appropriate classification of the $6,360 gain for tax

purposes?

A. Ordinary gain.

B. Section 1231 (Property Used in the Trade or

Business and Involuntary Conversions) gain.

C. Long-term capital gain.

D. Short-term capital gain.

Answer (A) is correct.

REQUIRED: The appropriate characterization of an amount

received on disposition of business property.

DISCUSSION: As the property is depreciable, personal,

trade or business property, it is subject to the Section 1245

recapture rules. These rules provide that any gain realized, to the

extent of the lesser of gain realized or depreciation taken, is

characterized as ordinary income. In this case, depreciation

exceeds the realized gain, so the entire portion should be

characterized as ordinary income.

Answer (B) is incorrect. While it is correct that the property is

Section 1231 property (if not subject to other characterization

rules), the recapture provisions must be applied to determine if

any take priority. Answer (C) is incorrect. Capital assets explicitly

exclude trade or business property. Answer (D) is incorrect. The

definition of a capital asset expressly excludes trade or business

property.

Study Unit 7, Subunit 1

Which of the following corporations would be

taxed as a personal service corporation?

A. A real estate brokerage.

B. A catering service.

C. An architecture and engineering firm.

D. A groundskeeping firm.

Answer (C) is correct.

REQUIRED: The activity that would qualify a corporation as

a personal service corporation.

DISCUSSION: Personal service corporations are

corporations that derive substantially all (roughly 95%) of their

gross receipts from personal service activities (health, law,

engineering, accounting, actuarial science, consulting, or

performing arts). Accordingly, an architecture and engineering

firm would be classified as a personal service corporation.

Answer (A) is incorrect. A real estate brokerage is not

considered a personal service activity when determining personal

service corporation status. Answer (B) is incorrect. A catering

service is not considered a personal service activity for the PSC

rules. Answer (D) is incorrect. Groundskeeping is not one of the

activities that would subject a corporation to personal service

corporation rules.

Study Unit 7, Subunit 4

What is the maximum amount of capital losses in

excess of capital gains that a C corporation may

deduct in a year?

A. $0

B. $3,000

C. $5,000

D. $10,000

Answer (A) is correct.

REQUIRED: The maximum recognizable amount of

C corporation capital losses.

DISCUSSION: Unlike individuals, a corporation is not

permitted to offset ordinary income with net short-term capital

losses. Instead, they are suspended and carried forward.

Answer (B) is incorrect. Unlike individuals, a deduction for

net capital losses is not allowed to offset ordinary income.

Answer (C) is incorrect. A corporation may not deduct net capital

losses against ordinary income. Answer (D) is incorrect. A

corporation is not permitted a deduction for capital losses in

excess of capital gains against ordinary income.

9

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

A corporate taxpayers capital gains and losses

are as follows:

Short-term capital gain $ 7,000

Short-term capital loss (43,000)

Long-term capital gain 9,000

Long-term capital loss (21,000)

What amount of capital loss deduction is the taxpayer

entitled to use to offset against ordinary income?

A. $0

B. $3,000

C. $12,000

D. $48,000

Answer (A) is correct.

REQUIRED: The amount of capital loss deduction for a

corporate taxpayer.

DISCUSSION: Corporate taxpayers are not permitted to

deduct net capital loss against ordinary income.

Answer (B) is incorrect. Unlike an individual, a corporate

taxpayer is not permitted a deduction of capital loss against

ordinary income. Answer (C) is incorrect. A corporate taxpayer is

not permitted to deduct capital loss against ordinary income.

Answer (D) is incorrect. Capital loss may not be used to offset

ordinary income for corporate taxpayers.

Study Unit 9, Subunit 1

Porter, the sole shareholder of Preston Corp.,

transferred property to the corporation as a

contribution to capital. Two years later, Corley

transferred property to the corporation in exchange for

a 10% interest in corporate stock. The property

transferred was valued as follows:

Porters

transfer

Corleys

transfer

Basis $ 50,000 $250,000

Fair market value 200,000 500,000

What amount represents the corporations basis in the

property received?

A. $700,000

B. $550,000

C. $450,000

D. $300,000

Answer (B) is correct.

REQUIRED: The basis to the corporation in property

received upon contribution.

DISCUSSION: Under Sec. 351, a shareholder or

shareholders who control more than 80% of a corporation may

contribute property to a corporation without recognition of gain or

loss by either party. The corporation takes a carryover basis in

the property, and the taxpayer takes a substituted (equal to the

basis given up) basis in the shares of the corporation received.

However, the contribution by a shareholder who does not qualify

under Sec. 351 would trigger recognition of gain to the

shareholder, and the corporation would take a FMV basis in the

property. In this question, the first contribution would result in a

carryover (AB) basis to the corporation of $50,000, and the

second would be at a FMV of $500,000. Accordingly, the total is

$550,000 of basis held by the corporation after contributions.

Answer (A) is incorrect. The amount of the basis to the

corporation is not simply the fair market value. Answer (C) is

incorrect. The basis amount on the contribution of property upon

formation (or as the sole shareholder) is not fair market value.

Answer (D) is incorrect. The basis to the corporation is not simply

the amount of the adjusted basis in the hands of the

shareholders.

Study Unit 9, Subunit 3

At the beginning of the year, Data, a

C corporation, had a $45,000 deficit in accumulated

earnings and profits. For the current year, Data

reported earnings and profits of $15,000. Data

distributed $18,000 to its shareholders during the

current year. What amount of the distribution is

treated as a taxable dividend?

A. $0

B. $3,000

C. $15,000

D. $18,000

Answer (C) is correct.

REQUIRED: The amount of the taxable dividend from Data

Corporation.

DISCUSSION: A distribution is taxable as a dividend to the

extent of earnings and profits. In this case, the C corporation has

$15,000 of current E&P to use in characterizing a distribution as

a dividend. The remaining $3,000 is treated as a return of basis

to the extent that the shareholder has stock basis remaining. Any

excess over the shareholders stock basis is treated as capital

gain. Note that the treatment indicated here ignores the deficit in

accumulated E&P. Depending on whether accumulated E&P is

positive or negative and current E&P is positive or negative,

different ordering rules apply in determining the amount of a

taxable dividend and the remaining distributions character.

Answer (A) is incorrect. A portion of the distribution is taxable

as a dividend. Answer (B) is incorrect. Earnings and profits is

used to determine the amount of a distribution taxable as a

dividend, not the amount excluded from dividend treatment.

Answer (D) is incorrect. The whole distribution is not taxable as a

dividend, after E&P calculations.

10

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Study Unit 10, Subunit 2

Beech Corp., an accrual-basis, calendar-year

S corporation, has been an S corporation since its

inception. At the beginning of the current year, Gold

owned 50% of the 100 issued shares of Beech stock,

and had a $3,000 tax basis in the Beech stock. During

the current year, Beech had $200,000 in net business

income and $4,000 in Oak County municipal bond

interest income. Beech made no distributions to its

shareholders. What was Golds tax basis in Beech

stock at year end?

A. $102,000

B. $103,000

C. $104,000

D. $105,000

Answer (D) is correct.

REQUIRED: Golds tax basis in Beech stock.

DISCUSSION: The shareholders stock basis would be

$105,000 [$3,000 beginning basis + $100,000 income allocation

($200,000 50% ownership interest) + $2,000 municipal interest

($4,000 50% ownership interest)]. The stock basis is increased

for the portion of the municipal interest in order for that income to

never be subject to taxation. If the basis was not increased, when

the interest was later sold, gain would be realized on the portion

of the business attributable to that income.

Answer (A) is incorrect. The shareholders stock basis must

be increased for their portion (50%) of the municipal bond

interest. Answer (B) is incorrect. The shareholders stock basis

must be adjusted for the municipal interest. Answer (C) is

incorrect. The shareholders stock basis must be adjusted for

their portion (50%) of the municipal bond interest.

Study Unit 10, Subunit 3

Which of the following increases the accumulated

adjustments account of an S corporation?

A. Capital contributions by the shareholders.

B. Distribution to shareholders.

C. Interest and dividends.

D. Charitable contributions.

Answer (C) is correct.

REQUIRED: The amounts that increase the accumulated

adjustments account of an S corporation.

DISCUSSION: Interest and dividends received by an S

corporation increase the accumulated adjustments account

(AAA) of the S corporation.

Answer (A) is incorrect. The capital contribution to an S

corporation by a shareholder would not increase the accumulated

adjustments account (AAA) of an S corporation. Answer (B) is

incorrect. Distributions to a shareholder would not increase the

accumulated adjustments account (AAA) of an S corporation.

Answer (D) is incorrect. Charitable contributions made do not

increase the accumulated adjustments account (AAA) of an S

corporation.

Study Unit 11, Subunit 1

Anderson and Decker are equal members in

Andek, an LLC, which has not elected to be treated

as a corporation. Anderson contributes $7,000 cash,

and Decker contributes a machine with an adjusted

basis of $5,000 and fair market value of $10,000,

subject to a liability of $3,000. What is Deckers basis

in Andek?

A. $2,000

B. $3,500

C. $5,000

D. $10,000

Answer (B) is correct.

REQUIRED: Deckers basis in a partnership from capital

contributions.

DISCUSSION: As Decker contributed property to a

non-electing LLC, it is treated as a general partnership for federal

tax purposes. The beginning basis in a partners partnership

interest is the basis of property contributed, less any liabilities to

which the property is subject, plus the partners share of

partnership liabilities. In this case, Deckers basis is $3,500

[$5,000 contributed property basis $3,000 associated liability +

$1,500 liability assumed (50% partnership interest $3,000

partnership liability contributed)].

Answer (A) is incorrect. Deckers basis is increased for his

proportionate share of partnership liabilities, including those he

contributes. Answer (C) is incorrect. The liability associated with

the property will also affect the basis Decker takes in his Andek

LLC interest. Answer (D) is incorrect. The basis, not FMV, of

property contributed is the starting number for the basis

calculation. The liability must also be considered.

11

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Study Unit 11, Subunit 5

Johnson, an individual, has a 50% interest in

DEF Partnership. Johnsons adjusted basis at the

beginning of the year was $14,000. The partnerships

ordinary income for the current year was $6,000.

Johnson received a non-liquidating distribution of

$8,000 cash and property with an adjusted basis of

$12,000 and a fair market value of $15,000. What is

the basis of the distributed property, other than cash,

to Johnson?

A. $6,000

B. $9,000

C. $12,000

D. $15,000

Answer (B) is correct.

REQUIRED: Johnsons basis in distributed property from

DEF partnership.

DISCUSSION: The basis of the property distributed in a

non-liquidating distribution is the lesser of remaining basis in the

partner's partnership interest (after cash is distributed) and the

adjusted basis of the property. In this case, the basis in the

partnership interest is $9,000 [$14,000 beginning + $3,000

ordinary income allocation ($6,000 ordinary income 50%

partnership interest) $8,000 cash distributed]. In the event that

the cash exceeded the adjusted basis of the partnership interest,

gain may have been recognized and the partner's basis in the

property would increase to $0.

Answer (A) is incorrect. This is the amount of the ordinary

income of the partnership for the year and does not directly

impact the basis in the property distributed. Answer (C) is

incorrect. The basis of the property is the lesser of remaining

basis in the partners partnership interest (after cash is

distributed) and the adjusted basis of the property. The remaining

partnership basis is not $12,000. Answer (D) is incorrect. The

basis of the property is not FMV when distributed.

Able, an individual, is a partner in CD Partnership

with an adjusted basis of $30,000 for Ables

partnership interest. Able received a non-liquidating

distribution of $25,000 cash and property with an

adjusted basis of $7,000 and a fair market value of

$10,000. What amount of gain should Able

recognize?

A. $0

B. $2,000

C. $5,000

D. $12,000

Answer (A) is correct.

REQUIRED: The gain recognized by Able on the

non-liquidating distribution of property.

DISCUSSION: Gain would be recognized if the FMV of cash

exceeded Ables basis in the partnership interest. However, this

is not the case. Instead, the cash is distributed at FMV and the

basis in the partnership interest is reduced by the amount of the

cash. Then, any remaining basis in the partnership interest is

allocated to the property distributed, up to the lesser of the

adjusted basis of the property in the hands of the partnership or

the amount of partnership interest basis to be allocated. In this

case, $5,000 of partnership interest basis is allocated to the

property distributed.

Answer (B) is incorrect. Gain is not recognized when

property is distributed in excess of partnership basis. The basis in

the hands of the recipient is simply computed with respect to the

remaining basis in the partnership interest. Answer (C) is

incorrect. Gain is not computed as the excess of partnership

basis over cash distributed. Answer (D) is incorrect. The amount

of $12,000 is not the correct amount of gain recognized on the

distribution of the property.

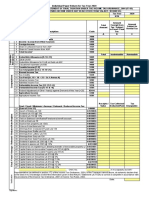

Study Unit 11, Subunit 6

Belson and Forman decided to terminate North

partnership. On the date of termination, Norths

balance sheet was as follows:

Adjusted

Basis

Cash $2,000

Equipment (fair market value $4,000) 6,000

Capital Belson 4,000

Capital Forman 4,000

Formans outside basis is $2,000. The partnership

assets were distributed equally between the partners.

What is Formans tax basis in the property received?

A. $1,000

B. $4,000

C. $6,000

D. $10,000

Answer (A) is correct.

REQUIRED: Formans tax basis in the property received on

the termination of the partnership.

DISCUSSION: After the cash is distributed, Forman has

$1,000 ($2,000 beginning basis $1,000 cash received) in basis

remaining. This is allocated to the property distributed, up to the

adjusted basis of the property in the hands of the partnership.

Answer (B) is incorrect. The basis of the property is not set to

the FMV of the property in the hands of the partnership.

Answer (C) is incorrect. The basis of the property is limited to the

lesser of basis in the partnership interest or the adjusted basis in

the hands of the partnership. Answer (D) is incorrect. The basis

in the property is not the sum of the fair market value and the

adjusted basis in the hands of the partnership.

12

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Study Unit 13, Subunit 1

Which of the following correctly lists the order,

from earliest to latest, that U.S. legislative bodies

consider new tax legislation?

A. House of Representatives, U.S. Senate, Joint

Conference Committee.

B. Joint Conference Committee, House of

Representatives, Senate Finance Committee.

C. U.S. Senate, Joint Conference Committee,

House of Representatives.

D. House of Representatives, Joint Conference

Committee, U.S. Senate.

Answer (A) is correct.

REQUIRED: The correct order, from earliest to latest, that

U.S. legislative bodies consider new tax legislation.

DISCUSSION: Tax bills are reviewed in the House Ways

and Means Committee before being considered by the full

House. The House version is referred to the Senate Finance

Committee before being considered by the full Senate. If the

Senate approves the House version as is, the bill is next

presented to the President. However, the Senate often revises

the House version, which requires a review by a joint

House-Senate committee. The joint committee version must be

approved first by the House and then by the Senate, before

reaching the President.

Answer (B) is incorrect. Bills for raising revenue do not

originate in the Joint Conference Committee. Answer (C) is

incorrect. Bills for raising revenue do not originate in the U.S.

Senate. Answer (D) is incorrect. Tax bills do not go before the

Joint Conference Committee before they go before the U.S.

Senate.

Study Unit 13, Subunit 2

A taxpayer has had one issue under audit by the

Internal Revenue Service for several years. Unless

the taxpayer agrees otherwise, the IRS has at most

how many years to assess taxes after the taxpayers

return was filed?

A. Three.

B. Four.

C. Five.

D. Seven.

Answer (A) is correct.

REQUIRED: The statute of limitations for assessment of tax

liability by the IRS.

DISCUSSION: The statute of limitations for assessment of

tax liability (except in the case of fraud or other special

exceptions) is generally 3 years from the date the return is filed.

Note that an early return is treated as filed on the due date.

Answer (B) is incorrect. Under normal circumstances, the

IRS does not have 4 years to assess liability. Answer (C) is

incorrect. Five years is not the correct statute of limitations to

assess tax liability. Answer (D) is incorrect. Under normal

circumstances, the IRS has fewer than 7 years to assess liability.

Study Unit 16, Subunit 4

After which of the following situations would it

usually not be necessary to notify third parties of the

termination of an agencys existence?

A. The achieving of the agencys purpose.

B. The destruction of the subject matter of the

agency.

C. A termination by mutual agreement.

D. A termination by the principal.

Answer (B) is correct.

REQUIRED: The situation in which notice to third parties of

termination of an agencys existence is not necessary.

DISCUSSION: Destruction of the subject matter of the

agency makes fulfilling the purpose of the agency impossible.

Thus, it terminates the agency by operation of law. Because most

terminations by operation of law terminate apparent authority,

notice to third parties of termination of the agencys existence is

usually not necessary.

Answer (A) is incorrect. Achieving the agencys purpose

results in termination by an act of the parties. Because the

apparent authority of the agent continues to exist until the third

party receives notice of the termination, notice to third parties of

the agencys existence may be necessary. Answer (C) is

incorrect. Termination by mutual agreement is by an act of the

parties. Because the apparent authority of the agent continues to

exist until the third party receives notice of the termination, notice

to third parties of the agencys termination may be necessary.

Answer (D) is incorrect. Termination by the principal would result

in termination by an act of the parties. Because the apparent

authority of the agent continues to exist until the third party

receives notice of the termination, notice to third parties of the

agencys termination may be necessary.

13

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Study Unit 18, Subunit 8

Taso Corp. sells laptop computers to the public.

Taso sold and delivered a laptop to Cara on credit.

Cara gave Taso a purchase money security interest in

the laptop by executing and delivering to Taso a

promissory note for the purchase price and a security

agreement covering the laptop. Cara purchased the

laptop for personal use. Taso did not file a financing

statement. Under the Secured Transactions Article of

the UCC, is Tasos security interest perfected?

A. No, because the laptop is a consumer good.

B. No, because Taso failed to file a financing

statement.

C. Yes, because it was perfected at the time of

attachment.

D. Yes, because Taso retained possession of the

collateral.

Answer (C) is correct.

REQUIRED: The reason, if any, that a purchase money

security interest in goods sold to a consumer is perfected.

DISCUSSION: A PMSI in consumer goods ordinarily is

automatically perfected without filing or possession. Thus, it

becomes effective at the time of attachment.

Answer (A) is incorrect. Because the laptop is a consumer

good, the PMSI is perfected upon attachment. Answer (B) is

incorrect. Filing is not necessary for the perfection of a PMSI in

consumer goods. Answer (D) is incorrect. Possession is not

necessary for the perfection of a PMSI in consumer goods.

Under the Secured Transactions Article of the

UCC, a financing statement generally must contain

A. The signature of a witness to the execution of

the financing statement.

B. The dollar amount of the consideration

provided by the secured party.

C. The date the underlying debt will be paid.

D. The name of the debtor.

Answer (D) is correct.

REQUIRED: The content of a financing statement.

DISCUSSION: The financing statement must contain (1) the

name of the debtor, (2) the name of the secured party (or

representative), and (3) an indication of the covered collateral

(UCC 9-502).

Answer (A) is incorrect. The financing statement is not

required to be witnessed. Answer (B) is incorrect. The financing

statement is not required to state the consideration provided by

the secured party. Answer (C) is incorrect. The financing

statement is not required to contain the date the underlying debt

will be paid.

Study Unit 18, Subunit 10

Under the Secured Transactions Article of the

UCC, if a secured creditor rightfully repossesses and

sells a debtors collateral, which of the following

obligations is the first to be paid from the proceeds of

the sale?

A. The debt owed any creditor with a subordinate

security interest in the collateral.

B. The balance of the debt owed the primary

secured creditor.

C. The reasonable expenses incurred by the sale.

D. The refund of the debtors payments made

prior to the date of the sale.

Answer (C) is correct.

REQUIRED: The first obligation to be paid from the proceeds

of the sale of rightfully repossessed collateral.

DISCUSSION: After repossession, the secured party may

dispose of the collateral by public or private proceedings. The

proceeds of collection or enforcement are applied in the following

order: (1) payment of reasonable expenses of collection or

enforcement, (2) satisfaction of the debt owed to the secured

party under whose security interest the collection or enforcement

is made, (3) satisfaction of the debts owed to subordinate

secured parties, and (4) payment of any surplus to the debtor.

Answer (A) is incorrect. Creditors with subordinate interests

have claims inferior to (1) the reasonable expenses incurred by

the sale and (2) the interest of the secured creditor. Answer (B) is

incorrect. The balance of the debt owed the primary secured

creditor is paid only after the reasonable expenses incurred by

the sale. Answer (D) is incorrect. The debtor receives only

payment of any surplus proceeds after the sale.

14

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Study Unit 19, Subunit 5

Hall forged Crandalls signature on a promissory

note dated April 1, Year 3. The note was for $5,000

and was payable to bearer on demand. Hall offered to

sell the note to Corn for $4,000. Corn knew that

Crandall had been out of the country since Year 1. In

addition, Corn knew that Crandalls name and

signature were misspelled, and that Hall had a

questionable reputation. Despite this, Corn purchased

the note for $4,000. Under the Negotiable Instruments

Article of the UCC, what are Corns rights under the

note?

A. Corn is a holder in due course and may

enforce the note against Hall and Crandall.

B. Corn is a holder in due course under the

shelter rule and may enforce the note only

against Hall.

C. Corn is a holder and may enforce the note

against Hall.

D. Corn is a holder and may enforce the note

against Crandall.

Answer (C) is correct.

REQUIRED: The rights of a purchaser of a bearer

promissory note with a forged payors signature.

DISCUSSION: Corn is a holder as a person in possession of

a bearer negotiable instrument. The note presumably was

negotiated by Hall to Corn by transfer of possession without an

endorsement. However, Corn is not a holder in due course

because Corn had notice of an unauthorized signature and other

circumstances that established a defense to the instrument

(e.g., misspellings and purchase at a deep discount).

Accordingly, Corn only has the rights of a holder, but Hall has

contractual liability to Corn as a signer of the promissory note.

An unauthorized signature operates as the signature of the

unauthorized signer in favor of a person who pays in good faith

or takes for value. Moreover, the transferor of an instrument for

consideration but without an endorsement is liable for breach of

transfer warranties to the immediate transferee. The transferor

warrants that (1) the warrantor (Hall) is entitled to enforce the

instrument, (2) all signatures are authentic and authorized,

(3) the instrument has not been altered, (4) no defense or claim

of any party is good against the warrantor, and (5) the warrantor

has no knowledge of insolvency proceedings against the maker

of the note.

Answer (A) is incorrect. Corn was aware of Halls forgery and

cannot be a holder in due course. Also, because the signature

was a forgery, Crandall is not liable. Answer (B) is incorrect. Corn

did not obtain the note from a holder in due course and is

therefore not a holder in due course under the shelter rule.

Answer (D) is incorrect. Crandall is not liable because the

signature was forged.

Under the Negotiable Instruments Article of the

UCC, which of the following defenses by the maker of

a negotiable instrument can be successfully asserted

against a holder in due course?

A. Fraud in the execution.

B. Fraud in the inducement.

C. Breach of the underlying contract.

D. Lack of consideration by the original payee.

Answer (A) is correct.

REQUIRED: The defense effective against a holder in due

course.

DISCUSSION: Fraud in the execution is a real defense. It is

committed against the signer of the instrument when (s)he is

induced to sign without knowledge and a reasonable opportunity

to learn its character and essential terms. Real defenses are

effective against a holder in due course.

Answer (B) is incorrect. Fraud in the inducement is a

personal defense. It occurs when, although the defrauded party

is aware of entering into a contract and its terms, the underlying

consideration is misrepresented. Personal defenses are not

effective against a holder in due course. Answer (C) is incorrect.

Traditional contract defenses, such as breach of contract, are

personal defenses. Personal defenses are not effective against a

holder in due course. Answer (D) is incorrect. Traditional contract

defenses, such as lack of consideration, are personal defenses.

Personal defenses are not effective against a holder in due

course.

15

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Study Unit 19, Subunit 7

Roland applied to Berkley Bank for a $100,000

loan. As a condition to granting the loan, Berkley

requested a document of title evidencing Rolands

ownership of several paintings Roland had in storage.

Under the Documents of Title Article of the UCC,

which of the following documents is not a document

of title evidencing Rolands current ownership of the

paintings?

A. A warehouse receipt.

B. A bill of lading.

C. An appraisal.

D. An electronic document of title.

Answer (C) is correct.

REQUIRED: The item not a document of title evidencing

current ownership.

DISCUSSION: A document of title has three functions: (1) it

is a receipt for goods, (2) it is a contract for the storage or

transport of goods between a bailor (one who entrusts personal

property to another) and a bailee (one who receives such

property to hold in trust), and (3) it is evidence of title to the

goods. An appraisal is an indication of value, not proof of

ownership.

Answer (A) is incorrect. A warehouse receipt is a document

of title issued by a warehouser to the person who deposits goods

for storage. Thus, a warehouse receipt evidences ownership.

Answer (B) is incorrect. A bill of lading is a document of title

issued by a person engaged in the business of carrying goods.

Thus, a bill of lading evidences ownership. Answer (D) is

incorrect. A document of title may be in electronic or tangible

form. An electronic document of title is evidenced by a record of

information shared in an electronic medium, not inscribed on a

tangible medium.

16

Copyright 2014 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SCDL-Project FinanceDocument113 pagesSCDL-Project FinanceManish Garg0% (1)

- Rocket Internet Prospectus 2014Document379 pagesRocket Internet Prospectus 2014w24nyNo ratings yet

- Profitability Atlas - ExideDocument16 pagesProfitability Atlas - ExidekrkamranpNo ratings yet

- Securities and Regulation Code - MIDTERMDocument9 pagesSecurities and Regulation Code - MIDTERMJanelle TabuzoNo ratings yet

- Annual Report 38th AGMDocument268 pagesAnnual Report 38th AGMhNo ratings yet

- Original VouchingDocument91 pagesOriginal VouchingaamritaaNo ratings yet

- Nptel Course Financial Management Assignment Ii: Liabilities Rs. (Million) Asset Rs. (Million)Document3 pagesNptel Course Financial Management Assignment Ii: Liabilities Rs. (Million) Asset Rs. (Million)yogeshgharpureNo ratings yet

- Income Tax Chapter 4Document7 pagesIncome Tax Chapter 4Anton LauretaNo ratings yet

- Assignment On: Financial Statement Analysis and Valuation Course Code: (F-401)Document7 pagesAssignment On: Financial Statement Analysis and Valuation Course Code: (F-401)Md Ohidur RahmanNo ratings yet

- SEx 5Document44 pagesSEx 5Amir Madani100% (3)

- BIR Form 2551MDocument6 pagesBIR Form 2551MDeiv PaddyNo ratings yet

- ACCA SBR Mar-20 FightingDocument34 pagesACCA SBR Mar-20 FightingThu Lê HoàiNo ratings yet

- Rohan SoftwareDocument5 pagesRohan Softwarechinum1No ratings yet

- Business Tax Environment: by Aliza Abid BhuttaDocument15 pagesBusiness Tax Environment: by Aliza Abid BhuttaAhmed zeeshanNo ratings yet

- Company - Jain Irrigation System LTDDocument31 pagesCompany - Jain Irrigation System LTDNoor_DawoodaniNo ratings yet

- Chapter 3 How Securities Are Traded: Multiple Choice QuestionsDocument28 pagesChapter 3 How Securities Are Traded: Multiple Choice QuestionsSarah100% (1)

- Exercise On Csofp - Associates Happy Enjoy Fun - Mixed PDFDocument3 pagesExercise On Csofp - Associates Happy Enjoy Fun - Mixed PDFNoor ShukirrahNo ratings yet

- Micro Shots 2010Document158 pagesMicro Shots 2010arif7000No ratings yet

- Business Law Provisions of the Revised Corporation CodeDocument20 pagesBusiness Law Provisions of the Revised Corporation CodeVanessa AtienzaNo ratings yet

- Individual Paper Return For Tax Year 2020: SignatureDocument26 pagesIndividual Paper Return For Tax Year 2020: SignaturejamalNo ratings yet

- Comparative Ratio Analysis of Britannia and CadburyDocument21 pagesComparative Ratio Analysis of Britannia and CadburyPriyank Galaw57% (7)

- Accounts and AuditDocument31 pagesAccounts and AuditexclusiverammyNo ratings yet

- 7 Secrets of Eternal WealthDocument52 pages7 Secrets of Eternal WealthdhruvNo ratings yet

- Corporation Law: Revised Corporation Code of THE PHILIPPINES (R.A. No. 11232)Document91 pagesCorporation Law: Revised Corporation Code of THE PHILIPPINES (R.A. No. 11232)Grace HiaviaNo ratings yet

- Word Problems PDFDocument3 pagesWord Problems PDFYzzabel Denise L. Tolentino100% (1)

- $RN8C7G2Document3 pages$RN8C7G2akxerox47No ratings yet

- Basf DF 2006Document172 pagesBasf DF 2006JORGE100% (1)

- DPPL Annual Report 2016-17Document63 pagesDPPL Annual Report 2016-17xyzNo ratings yet

- Beml Project Print OUTDocument144 pagesBeml Project Print OUTanon_196360629No ratings yet

- Ar2015 GroupDocument256 pagesAr2015 GroupSabina MunteanuNo ratings yet