Professional Documents

Culture Documents

Advanced Accounting 1

Uploaded by

SheenaGaliciaNewOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Accounting 1

Uploaded by

SheenaGaliciaNewCopyright:

Available Formats

Advanced

Accounting

1

Partnership

FORMATION

Review: Partnership

What is partnership?

Partnership is an unincorporated association of two or

more individuals to carry on, as co-owners, a

business, with the intention of dividing the profits

among themselves.

Ibig sabihin:

Ito ay isang Negosyo na

pinapatakbo ng dalawa o

higit pang indibidwal. Maari

silang mag contribute ng

Pera(Capital), Industriya(Skills),

o Mga Kagamitan na hindi

Pera (Non-Cash Asset).

Nasa Basic accounting lang

po iyan.

Take note:

For example, Partner B contributes a

building.. Once na narecord sa book of

partnership ung contribution ni B, wala

na syang karapatan sa Building na iyon..

Dahil automatic pagaari na ito ng

PARTNERSHIP. Dahil yan sa SEPARATE

LEGAL PERSONALITY ng Partnership.

Major Considerations in the accounting

for the equity of partnership

1. Formation Creation of the partnership

2. Operation Division of profit or loss (P/L)

3. Dissolution Admission/withdrawal of

partner

4. Liquidation- winding-up of affairs

Formation

Valuation of contributions of partnership

All assets contributed to (liabilities assumed

by) the partnership shall be measured at

Fair Value FV.

Kapag nag form ng Partnership ang dalawang Sole

Proprietorship business dito tayo magkakaroon ng

accounting problem. First we should adjust the books of sole

proprietors (SP) into their Fair Market Value or (FV). After

adjusting, we should close the nominal accounts of the SP..

(Ung parang closing entries lang sa basic accounting). Now

after closing the nominal accounts, we transfer the

permanent accounts like Cash, Inventories, PPE and liabilities

carried at their Fair Market Value to the books of the

Partnership.. Gets? And ang total ng mga yan ay ang Net,

Contriubtion ng partner..

Profit and loss is based on the agreement of the partners.

However, If the problem is silent about the P/L ratio, Equity ratio is the most

proper way to distribute the P/L

Type of contribution Fair Value

Cash and Cash Equivalents Face amount of cash or cash equivalent

contributed.

Inventory Net Realizable Value (Estimated selling price

less cost to sell), If and only if it is lower than

the COST.

Fixed asset Order of Priority:

a) Price in a binding sale agreement

b) Quoted price in an active market

c) Estimate based on best information

available

Financial Instruments

(Financial assets and

financial liabilities)

Order of Priority:

a) Quoted price in an active market

b) Fair Value based on observable data

c) Estimate based on best information

available

Example

A and B formed a partnership. The following are their contributions:

A B

Cash 100000 10000

Accounts Recievable 75000

Inventory 80000

Land 50000

Building 130000

Total 255000 190000

Note Payable 70000

A, capital 185000

B, Capital 190000

Total 255000 190000

Additional Information:

Included in accounts receivable is an account amounting to 30,000

which is deemed uncollectible.

The inventory has an estimated selling price of 120,000 and 15,000

cost to sell.

Unpaid mortgage in Land of 10,000 is not assumed by the

partnership.

Unpaid mortgage in Building of 5,000 is assumed by the partnership.

The building is over-depreciated by 10,000.

The Note Payable is stated at face amount. A proper valuation

requires recognition of a 15,000 discount on note payable.

A and B shares P/L 50% and 50% respectively.

Requirement:

1. Compute for the adjusted balances

on partners' capital accounts.

2. Journal Entry.

ADJUSTED BALANCES A B

Partners

hip

Cash 100000 10000 110000

Accounts Receivable (75-30) 45000 45000

Inventory (No adjustment) 80000 80000

Land (No adjustment) 50000 50000

Building (130+10) 140000 140000

Total 225000 200000 425000

Note patable (70-15) 55000 55000

Mortgage Payable-bldg (Assumed by

the partnership) 5000 5000

A, capital 170000 170000

B, Capital 195000 195000

Total 225000 200000 425000

Cash 110,000

A/R 45,000

Inventory 80,000

Land 50,000

Building 140,000

Discount on Note 15,000

N/P 70,000

Mortgage 5,000

A, Cap 170,000

B, Cap 195,000

Bonus method

Bonus on initial investment: An accounting exists when the capital account of a partner is

credited for an amount greater than the fair value of his contribution.

Hirap iexplain pero eto ang example:

Union and Christian agreed to form a partnership. Union shall contribute 100,000 cash while Christian shall

contribute 140,000 cash. However due to the expertise of Union , the partners agreed that they should

initially have equal interest in the partnership capital.

Actual Contribution Percentage Bonus Total

Union 100000 50% 20000 120000

Christian 140000 50% -20000 120000

Total 240000

Dapat ang capital ni Union is 50% of the total contributions. At para

mangyari iyon, mababawasan ang capital ni Christian nang sa

gayon ay ma kumpleto ang 50% ni Union. Bakin nga ba gugustuhin

ni Christian na magbigay ng capital kay Union?? Simple, kasi si

Union ang may EXPERTISE. Meaning si Union ang magbibigay buhay

sa kanilang partnership.. Hope gets mo?

Other ways to make the initial

investments equalize.

1. Cash Settlement between partners

Cash settlement outside the partnership is one way of buying

the equity of the other partner.

For example U invested 100k while C invested 70k.

U C Partnership

Initial Investment 100000 70000 170000

Now, to equalize their capitals instead of making additional

investment to the partnership, C can ask U to buy 15k of his equity

so that the initial investment would 170k, 85 for U and 85 for C.

Cash 170000

U,cap 100000

C,cap 70000

U C Partnership

Initial Investment 85000 85000 170000

Cash 170000

U,cap 85000

C,cap 85000

Partner U received 15000 pesos from C. This transaction is not recognized anymore by the

partnerships book because it is made under the table. And we can see that the Total

cash contributed remains at 170,000. Lets compare the values if C decided to make

additional investment to the partnership.. The capital of U is 100k, meaning C should meet

this amount.. C would have invested an additional (100k-70k) 30k pesos. Times two than of

paying U for an additional 15k. GETS?

Mejo baluktot na english pasensya naman daw.

2. Additional investment (Withdrawal of investment)

Additional investment or withdrawal of investment

can be one alternative to equalize the partners capital.

For example Initial investment is 100k . P/L sharing is 45%

and 55% for E and D respectively.

D contributed 60k while 40k for E.

Other ways to make the initial

investments equalize.

initial contribution Additional(withdraw) Required Cap

E 40000 5000 45000

D 60000 (5000) 55000

Practice question

PP, RR, and SS are new CPAs and are to form a partnership. PP is

to contribute cash of 50,000 and a computer originally costing

60,000 but has a second hand value of 25,000. RR is to contribute

cash of 80,000. SS, whose family is selling computers, is to

contribute cash of 25,000 and a brand new computer with a

regular selling price of 60,000 but which cost is 50,000.

Required: what would be the capital balances upon formation

are? PP,RR,SS. Using the 3 independent situations.

1. Partners agree to share profits equally.

2. Partners agreed to have equal interest on the initial

investment.

3. Partners agreed to share profits 20%, 20%, 60% for PP, RR, SS

respectively. All partners are willing to make additional

investment if ever.

Test your brain. Dont scan any notes you have with you right now! AJA!

Nga mahahalagang

pakakatandaan sa Formation.

Sa partnership kahit nd pareho ang Contributed Capitals ninyo ai pwede paring Equal

ang P/L sharing. Depende kasi yan sa Agreement.

It is very important to make either written, orally or implied agreement between partners

before the inception of the partnership. This may minimize if not eliminate the confusion

and disputes that may arise between or among partners.. Written agreement is

recommended.

Madali lang ang FORMATION.! Antabayanan ang susunud na kabanata!

GOD BLESS YOU!

Reference: Advance Accounting 1

Author1 Zeus Vernon B. Millan 2014

Author2 P. Guerrero and J. Peralta

You might also like

- AT Quizzer 1 - Overview of Auditing (2TAY1718)Document12 pagesAT Quizzer 1 - Overview of Auditing (2TAY1718)JimmyChaoNo ratings yet

- AFAR - Business CombinationDocument11 pagesAFAR - Business CombinationJohn Mahatma Agripa100% (8)

- Corporate LiquidationDocument9 pagesCorporate Liquidationacctg2012100% (2)

- Cash and Cash EquivalentDocument12 pagesCash and Cash EquivalentSheenaGaliciaNew100% (1)

- Long-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Document5 pagesLong-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Divine Cuasay100% (1)

- AFAR 2018 FOREX and Translation of FSDocument5 pagesAFAR 2018 FOREX and Translation of FSMikko RamiraNo ratings yet

- Bank ReconciliationDocument19 pagesBank ReconciliationSheenaGaliciaNew100% (4)

- Model Consortium Agreement For APPROVALDocument34 pagesModel Consortium Agreement For APPROVALSoiab KhanNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- TCDocument29 pagesTCDanny NationalNo ratings yet

- Audit of Revenue-Receipt CycleDocument9 pagesAudit of Revenue-Receipt CycleMa Tiffany Gura RobleNo ratings yet

- Accounting For Foreign Currency TransactionsDocument3 pagesAccounting For Foreign Currency TransactionsMaureen Derial PantaNo ratings yet

- A Theoretical Study of The Constitutional Amendment Process of BangladeshDocument58 pagesA Theoretical Study of The Constitutional Amendment Process of BangladeshMohammad Safirul HasanNo ratings yet

- Acctg. For Business Combinations - 2019 - TocDocument16 pagesAcctg. For Business Combinations - 2019 - Tocbassmastah38% (8)

- Intermediate Accounting 1 PDFDocument5 pagesIntermediate Accounting 1 PDFTrang Nguyen100% (2)

- Yamamoto Vs NishinoDocument3 pagesYamamoto Vs NishinoTricia SandovalNo ratings yet

- Consolidated FS (PFRS 10)Document9 pagesConsolidated FS (PFRS 10)Izzy BNo ratings yet

- Home Office and Branched Agencies by Little Boy AsperoDocument43 pagesHome Office and Branched Agencies by Little Boy AsperoShielarien Donguila100% (1)

- Advanced Financial Accounting & Reporting Part 2Document18 pagesAdvanced Financial Accounting & Reporting Part 2Ezio PaulinoNo ratings yet

- Accounting For PartnershipDocument46 pagesAccounting For PartnershipRejean Dela Cruz100% (1)

- Document - 2019-12-20T133208.945 PDFDocument2 pagesDocument - 2019-12-20T133208.945 PDFMina JoonNo ratings yet

- Accounting For Business CombinationsDocument19 pagesAccounting For Business Combinationsvinanovia50% (2)

- Business Combination and Consolidation PDFDocument21 pagesBusiness Combination and Consolidation PDFP.Fabie100% (2)

- People v. Aruta, G. R. 120915, April 3, 1998Document2 pagesPeople v. Aruta, G. R. 120915, April 3, 1998LeyardNo ratings yet

- Applied AuditingDocument2 pagesApplied Auditingctcasiple50% (2)

- Devamsha's Big 4 Competency Bible: Final InterviewDocument33 pagesDevamsha's Big 4 Competency Bible: Final InterviewsadasdNo ratings yet

- Afar 2 Module CH 1Document13 pagesAfar 2 Module CH 1Razmen Ramirez PintoNo ratings yet

- Foreign Currency TransactionDocument60 pagesForeign Currency TransactionJoemar Santos TorresNo ratings yet

- 07 - Foreign Currency TransactionsDocument5 pages07 - Foreign Currency TransactionsMelody Gumba50% (2)

- Advanced Accounting - Volume 1Document3 pagesAdvanced Accounting - Volume 1Hazel Pulido Garin22% (27)

- Chapter 18 Policies Estimates and ErrorsDocument28 pagesChapter 18 Policies Estimates and ErrorsHammad Ahmad100% (1)

- Excelsior Community College Advanced Financial Accounting Unit II - Branch AccountingDocument7 pagesExcelsior Community College Advanced Financial Accounting Unit II - Branch AccountingSheniel StephensNo ratings yet

- Administrative Office ManagementDocument44 pagesAdministrative Office ManagementLea VenturozoNo ratings yet

- AC13.1.1 Module 1 - Provisions, Contingencies, and Other LiabilitiesDocument15 pagesAC13.1.1 Module 1 - Provisions, Contingencies, and Other LiabilitiesRenelle HabacNo ratings yet

- Graded Quesions Complete Book0Document344 pagesGraded Quesions Complete Book0Irimia Mihai Adrian100% (1)

- AFAR - Part 2Document13 pagesAFAR - Part 2Myrna Laquitan100% (1)

- Joint Arrangements by Antonio DayagDocument1 pageJoint Arrangements by Antonio DayagbrookeNo ratings yet

- Advanced Accounting Dayag Solution Manual 2014 PDFDocument4 pagesAdvanced Accounting Dayag Solution Manual 2014 PDFMary Ann melendeZNo ratings yet

- 1 PFRS 3 Business CombinationDocument30 pages1 PFRS 3 Business CombinationCharles MateoNo ratings yet

- ACSTRAN - Realization and LiquidationDocument4 pagesACSTRAN - Realization and LiquidationDheine MaderazoNo ratings yet

- Cbactg01 Complete ModuleDocument170 pagesCbactg01 Complete ModuleJ LagardeNo ratings yet

- Partnership FormationDocument3 pagesPartnership Formationmiss independent100% (1)

- Naqdown FinalsDocument6 pagesNaqdown FinalsMJ YaconNo ratings yet

- Notes To Consolidation Immediately After BusComDocument4 pagesNotes To Consolidation Immediately After BusComMelisa DomingoNo ratings yet

- Cost Accounting Practice Set (L. Payongayong)Document60 pagesCost Accounting Practice Set (L. Payongayong)rocketkaye100% (2)

- Audit of Investments 1Document2 pagesAudit of Investments 1Raz MahariNo ratings yet

- AuditDocument4 pagesAuditRoxanneNo ratings yet

- Ra 9178Document11 pagesRa 9178Rahul HumpalNo ratings yet

- Afar ToaDocument22 pagesAfar ToaVanessa Anne Acuña DavisNo ratings yet

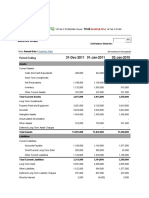

- The Operating Results in Summarized Form For A Retail ComputerDocument1 pageThe Operating Results in Summarized Form For A Retail ComputerAmit PandeyNo ratings yet

- BSA 3202 Topic 2 - Joint ArrangementsDocument14 pagesBSA 3202 Topic 2 - Joint ArrangementsjenieNo ratings yet

- Afar 19Document20 pagesAfar 19Ivhy Cruz EstrellaNo ratings yet

- Corporation QuizDocument13 pagesCorporation Quizjano_art21No ratings yet

- MAS Lauderbach 1 PDFDocument210 pagesMAS Lauderbach 1 PDFIllion IllionNo ratings yet

- Final Preboard May 08Document21 pagesFinal Preboard May 08Ray Allen PabiteroNo ratings yet

- ACCT201 Accounting For Special TransactionsDocument7 pagesACCT201 Accounting For Special TransactionsMiles SantosNo ratings yet

- This Study Resource Was: Lecture NotesDocument9 pagesThis Study Resource Was: Lecture NotesKristine Lirose BordeosNo ratings yet

- MODADV3 Handouts 1 of 2Document23 pagesMODADV3 Handouts 1 of 2Dennis ChuaNo ratings yet

- Sample Problems MCQDocument3 pagesSample Problems MCQMary Yvonne AresNo ratings yet

- Module 04 - Financial InstrumentsDocument19 pagesModule 04 - Financial Instrumentsapostol ignacioNo ratings yet

- Accounting For Branches and Combined FSDocument112 pagesAccounting For Branches and Combined FSyuaningtyasnvNo ratings yet

- Ge Elec 6 Flexible Obtl A4Document9 pagesGe Elec 6 Flexible Obtl A4Alexandra De LimaNo ratings yet

- Auditing The Finance and Accounting FunctionsDocument19 pagesAuditing The Finance and Accounting FunctionsMark Angelo BustosNo ratings yet

- IFRS 2 Share Based Payment Final Revision ChecklistDocument17 pagesIFRS 2 Share Based Payment Final Revision ChecklistEmezi Francis ObisikeNo ratings yet

- Chapter 09 - Partnerships - Formation, Operatios, and Changes in Ownership InterestsDocument53 pagesChapter 09 - Partnerships - Formation, Operatios, and Changes in Ownership Interestsgracerich20No ratings yet

- Chapter 9: Partnerships - Formation and Operation I. DefinedDocument7 pagesChapter 9: Partnerships - Formation and Operation I. DefinedJason CabreraNo ratings yet

- Partnership Formation & OperationDocument4 pagesPartnership Formation & Operationdiane pandoyosNo ratings yet

- Quiz 1Document5 pagesQuiz 1cpacpacpa100% (2)

- Contracts Reviewer For CPA AspirantsDocument13 pagesContracts Reviewer For CPA Aspirantsojodelaplata1486No ratings yet

- Chap 001Document61 pagesChap 001SheenaGaliciaNew100% (1)

- Costing AccountingDocument81 pagesCosting AccountingSheenaGaliciaNewNo ratings yet

- Overview IASDocument12 pagesOverview IASButt ArhamNo ratings yet

- Jay Scott Lawsuit 2Document25 pagesJay Scott Lawsuit 2NewsTeam20No ratings yet

- Obli Fin SumDocument22 pagesObli Fin SumLaureen LejardeNo ratings yet

- 8eeed194-a327-4f92-90a1-8ccc8dee52f0Document6 pages8eeed194-a327-4f92-90a1-8ccc8dee52f0Don RedbrookNo ratings yet

- TM ApplicationDocument2 pagesTM Applicationlalitkaushik0317No ratings yet

- Deepali Project ReportDocument34 pagesDeepali Project ReportAshish MOHARENo ratings yet

- Rizzo v. Goode, 423 U.S. 362 (1976)Document19 pagesRizzo v. Goode, 423 U.S. 362 (1976)Scribd Government DocsNo ratings yet

- DBP VS CaDocument55 pagesDBP VS CasamanthaNo ratings yet

- Chain Pulley Spare - Parts - Manual - Hoisting - SparDocument4 pagesChain Pulley Spare - Parts - Manual - Hoisting - Sparprashant mishraNo ratings yet

- Overview of Data Tiering Options in SAP HANA and Sap Hana CloudDocument38 pagesOverview of Data Tiering Options in SAP HANA and Sap Hana Cloudarban bNo ratings yet

- List of Books WrittenEdited by DR - Asghar Ali EngineerDocument2 pagesList of Books WrittenEdited by DR - Asghar Ali EngineerFarman AliNo ratings yet

- Affinity (Medieval) : OriginsDocument4 pagesAffinity (Medieval) : OriginsNatia SaginashviliNo ratings yet

- Rigsby Jessica Resume FinalDocument1 pageRigsby Jessica Resume Finalapi-506330375No ratings yet

- Kellogg Company Balance SheetDocument5 pagesKellogg Company Balance SheetGoutham BindigaNo ratings yet

- Poe-Llamanzares v. COMELECDocument1 pagePoe-Llamanzares v. COMELECRammel SantosNo ratings yet

- False Imprisonment and IIED Ch. 1Document2 pagesFalse Imprisonment and IIED Ch. 1Litvin EstheticsNo ratings yet

- Governance, Business Ethics and Sustainability: Part - ADocument4 pagesGovernance, Business Ethics and Sustainability: Part - Asheena2saNo ratings yet

- Cooperative BankDocument70 pagesCooperative BankMonil MittalNo ratings yet

- Chapter 02 Courts and Alternative Dispute ResolutionDocument13 pagesChapter 02 Courts and Alternative Dispute ResolutionРустам ДандонитиллоNo ratings yet

- Accounting STDDocument168 pagesAccounting STDChandra ShekharNo ratings yet

- Certified Patent Valuation Analyst - TrainingDocument8 pagesCertified Patent Valuation Analyst - TrainingDavid WanetickNo ratings yet

- Shah Amin GroupDocument11 pagesShah Amin GroupNEZAMNo ratings yet

- Redress SchemeDocument164 pagesRedress SchemePhebeNo ratings yet

- Motion To Vacate Summary Eviction OrderDocument3 pagesMotion To Vacate Summary Eviction OrderAlly MakambaNo ratings yet