Professional Documents

Culture Documents

Portfolio Size and Growth Loan Portfolio Portfolio Growth Outreach No. of Branches No. of Borrowers

Uploaded by

Satyashil RangareOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Portfolio Size and Growth Loan Portfolio Portfolio Growth Outreach No. of Branches No. of Borrowers

Uploaded by

Satyashil RangareCopyright:

Available Formats

1.5 2.5 3.7 4.4 4.

5

68%

49%

19%

2%

0%

10%

20%

30%

40%

50%

60%

70%

80%

0

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Mar-10 Mar-11 Mar-12 Mar-13 Sep-13

I

n

P

e

r

c

e

n

t

I

n

R

s

.

'

0

0

0

C

r

o

r

e

Portfolio Size and Growth

Loan Portfolio Portfolio Growth

0

1

2

3

4

5

6

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

2

Mar-10 Mar-11 Mar-12 Mar-13 Sep-13

I

n

m

i

l

l

i

o

n

I

n

t

h

o

u

s

a

n

d

Outreach

No. of Branches No. of Borrowers

The portfolio outstanding and borrower base have grown at a CAGR of 44 and 24% respectively

during the 3 years.

The geographic diversity is set to improve through expansion in operations to other states.

Bandhan has a presence in 22 states,

growing at the rate of 25-30%

West Bengal, Assam and Bihar account

for two-thirds of its branches and three-

fourth of its loans are in these 3 states

60% (of Bandhans customers) do not

have bank accounts and the 40% with

accounts do not use them regularly

Mostly in Under-Banked parts of India

Of the 245 districts, Bandhan operates in,

173 are under banked

Of Its 2016 branches, 1444 are in under-

banked eastern and north-eastern India

0

100

200

300

400

500

600

700

800

900

N

o

.

o

f

B

r

a

n

c

h

e

s

22 States

Bandhan has a presence in 22 states, but West Bengal, Assam and Bihar alone account for 67% of

the total branches

Bandhans main areas of operations: East India and North East India

Lagging in other parts of India on Financial Inclusion

Arunachal

Manipur

Mizoram

Nagaland

Meghalaya

Sikkim

Assam West Bengal

Tripura

Rest of India

Bihar

0

5000

10000

15000

20000

25000

30000

35000

40000

45000

-2 0 2 4 6 8 10 12 14

P

o

p

u

l

a

t

i

o

n

p

e

r

b

r

a

n

c

h

No. of Branch per 1000 sq km

0

10

20

30

40

50

60

70

80

28.4

33.2

41.9

47.6

28.2

57.9

40.3

65.1

31.7

79

31.7

Credit Deposit Ratio

You might also like

- BTL Presentations, Below The Line BTL PPT - RC&M India Experiential Marketing FirmDocument22 pagesBTL Presentations, Below The Line BTL PPT - RC&M India Experiential Marketing Firmrcmindia_videoNo ratings yet

- Understanding Rural Finance in IndiaDocument22 pagesUnderstanding Rural Finance in Indiajatin_met1No ratings yet

- Earning Updates (Company Update)Document93 pagesEarning Updates (Company Update)Shyam SunderNo ratings yet

- Chaitanya India Fin Credit Private LimitedDocument22 pagesChaitanya India Fin Credit Private LimitedAditi SharmaNo ratings yet

- Financial InclusionDocument42 pagesFinancial InclusionNeeta PaiNo ratings yet

- Regional Rural BanksDocument13 pagesRegional Rural Banksshivakumar N100% (1)

- IDirect Banking SectorReport Mar2014Document16 pagesIDirect Banking SectorReport Mar2014Tirthajit SinhaNo ratings yet

- Chapter - 5 Regional Rural BanksDocument11 pagesChapter - 5 Regional Rural Banksbaby0310No ratings yet

- Fusion ScreenshotDocument13 pagesFusion ScreenshotMadhusudan ParwalNo ratings yet

- SBI Sponsored RRBs Financial Inclusion StudyDocument6 pagesSBI Sponsored RRBs Financial Inclusion StudyAafrinNo ratings yet

- CSP Survey 16 AugDocument24 pagesCSP Survey 16 Augshrin548366No ratings yet

- PMMY Performance in North East IndiaDocument12 pagesPMMY Performance in North East IndiaRajmani SinghNo ratings yet

- Project Report (ITM) : Prof. Kalyan AgrawalDocument11 pagesProject Report (ITM) : Prof. Kalyan AgrawalKajal singhNo ratings yet

- Regional Rural BanksDocument11 pagesRegional Rural BanksIndermohan Singh80% (5)

- Project Report On Regional Rural Banks (RRBS)Document14 pagesProject Report On Regional Rural Banks (RRBS)Dhairya JainNo ratings yet

- HDFC Bank Report: Growth Prospects in Indian Banking SectorDocument14 pagesHDFC Bank Report: Growth Prospects in Indian Banking SectorRajveer Obhan100% (2)

- BOB PerformanceDocument33 pagesBOB Performancep2488100% (1)

- RRB Project ReportDocument13 pagesRRB Project ReportHetvi TankNo ratings yet

- Objectives of Regional Rural Banks 1Document8 pagesObjectives of Regional Rural Banks 1Sandeep Sandy100% (1)

- QS - Indian Bank - Initiating CoverageDocument11 pagesQS - Indian Bank - Initiating CoverageratithaneNo ratings yet

- Growth of Regional Rural BankDocument14 pagesGrowth of Regional Rural BankPreethi RaviNo ratings yet

- Canara FinalDocument23 pagesCanara FinalNija PillaiNo ratings yet

- Statistics For Planning 2009: Co-Operation and BankingDocument24 pagesStatistics For Planning 2009: Co-Operation and BankinggramamukhyaNo ratings yet

- B2B Channel Opportunity in Indian Trading BusinessDocument24 pagesB2B Channel Opportunity in Indian Trading BusinessdharshrulzNo ratings yet

- Earnings Update Q4FY15 (Company Update)Document45 pagesEarnings Update Q4FY15 (Company Update)Shyam SunderNo ratings yet

- Kamrul Hassan Report Submission On RAKUB BCOM FINALDocument6 pagesKamrul Hassan Report Submission On RAKUB BCOM FINALKamrulHassanNo ratings yet

- Micro Finance Situation in North IndiaDocument4 pagesMicro Finance Situation in North IndiaGagan_Deep_8630No ratings yet

- Progress in Banking Sector Due To Monetory PolicyDocument40 pagesProgress in Banking Sector Due To Monetory PolicyAmit RangleNo ratings yet

- 15 Chapter 8Document66 pages15 Chapter 8Prabhu MoorthyNo ratings yet

- Banking Sector Liberalization in IndiaDocument4 pagesBanking Sector Liberalization in IndiabbasyNo ratings yet

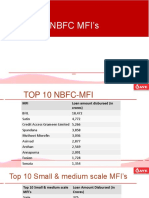

- Top 10 NBFC MFIs and their loan disbursement amountsDocument10 pagesTop 10 NBFC MFIs and their loan disbursement amountsNeeraj KumarNo ratings yet

- Analysis N DiscussionDocument16 pagesAnalysis N DiscussionjaikiNo ratings yet

- HDFC Bank - We Understand Your World - Stock Analysis & ValuationDocument93 pagesHDFC Bank - We Understand Your World - Stock Analysis & ValuationDeep SukhwaniNo ratings yet

- Project Report (ITM) : Chandragupt Institute of Management PatnaDocument7 pagesProject Report (ITM) : Chandragupt Institute of Management PatnaKajal singhNo ratings yet

- Presentation (Company Update)Document21 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- Yes BankDocument7 pagesYes BankAjay SutharNo ratings yet

- HDFC Bank April 2023 Concall ScriptDocument18 pagesHDFC Bank April 2023 Concall ScriptnightNo ratings yet

- Bajaj Finance Limited Q2 FY15 Presentation: 14 October 2014Document33 pagesBajaj Finance Limited Q2 FY15 Presentation: 14 October 2014adi99123No ratings yet

- SBI FY 2016 Results and Performance HighlightsDocument5 pagesSBI FY 2016 Results and Performance HighlightsHusainKaderNo ratings yet

- A Study On Non Performing Assets of Canara BankDocument4 pagesA Study On Non Performing Assets of Canara BankIOSRjournal100% (1)

- Role of Regional Rural BanksDocument17 pagesRole of Regional Rural Banksvigneshkarthik23No ratings yet

- 15 Chapter 8Document14 pages15 Chapter 8sirajkkNo ratings yet

- Rural Banking in India: A Study of Regional Rural BanksDocument10 pagesRural Banking in India: A Study of Regional Rural BanksNaresh KhutikarNo ratings yet

- HR Issues and Challenges in Indian Banking SectorDocument17 pagesHR Issues and Challenges in Indian Banking SectorsownikaNo ratings yet

- 18 Chapter 8Document33 pages18 Chapter 8Pratik LawanaNo ratings yet

- Specialized BanksDocument29 pagesSpecialized BankskhusbuNo ratings yet

- APGVB's Eight District CoverageDocument63 pagesAPGVB's Eight District CoverageSwamy GaddikopulaNo ratings yet

- Investor Presentation (Company Update)Document22 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- RBL Bank IPO ReviewDocument13 pagesRBL Bank IPO ReviewJilesh PabariNo ratings yet

- Union Bank of India Initiating CoverageDocument11 pagesUnion Bank of India Initiating CoverageratithaneNo ratings yet

- Idfc First Bank q4 Fy23 ResultsDocument3 pagesIdfc First Bank q4 Fy23 ResultsAshNo ratings yet

- 4.micro Finance & Social InclusionDocument27 pages4.micro Finance & Social InclusionSaurabh SinghNo ratings yet

- Earnings Presentation For June 30, 2016 (Company Update)Document13 pagesEarnings Presentation For June 30, 2016 (Company Update)Shyam SunderNo ratings yet

- IBPS RRB CWE III Quick Reference Guide 2014Document58 pagesIBPS RRB CWE III Quick Reference Guide 2014ilakkikarthiNo ratings yet

- Role of RBI in Funding Agricultural DevelopmentDocument13 pagesRole of RBI in Funding Agricultural DevelopmentAmrit Kajava100% (2)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- White Paper Telecom Industry Tunes Customer ExperienceDocument23 pagesWhite Paper Telecom Industry Tunes Customer ExperienceSatyashil RangareNo ratings yet

- Big Data Customized ReportDocument24 pagesBig Data Customized Reportsurnj1No ratings yet

- Take Order and Confirm - 0 MinDocument2 pagesTake Order and Confirm - 0 MinSatyashil RangareNo ratings yet

- Krisitins Cookie SolutionDocument1 pageKrisitins Cookie SolutionSrivastav GauravNo ratings yet

- Liquor License PDFDocument3 pagesLiquor License PDFSatyashil RangareNo ratings yet

- BK Swain DocumentDocument11 pagesBK Swain DocumentSatyashil RangareNo ratings yet

- Krisitins Cookie SolutionDocument1 pageKrisitins Cookie SolutionSrivastav GauravNo ratings yet

- BK Swain DocumentDocument11 pagesBK Swain DocumentSatyashil RangareNo ratings yet