Professional Documents

Culture Documents

Financial Analysis of Annual Report For Dabur

Uploaded by

Vidit GargOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Analysis of Annual Report For Dabur

Uploaded by

Vidit GargCopyright:

Available Formats

Financial Analysis of Annual Report for

Dabur

Submitted By:-

Sahil Gupta 221122

Shruti Pal 221122

Srishti Narang 221149

Varun Tripathi 221163

Vidit Garg 221164

Vipul Sachdeva 221170

Himalaya Tarani 221173

DABUR INDIA

COMPANY PROFILE

Dabur India Limited is the fourth largest FMCG Company in India with Revenues of over US$1 Billion (Rs 5,283 Crore) and Market Capitalization

of US$4 Billion (Rs 20,000 Crore). Building on a legacy of quality and experience of over 127 years, Dabur is today Indias most trusted name

and the worlds largest Ayurvedic and Natural Health Care Company. Dabur today operates in key consumer products categories like Hair Care,

Oral Care, Health Care, Skin Care, Home Care and Foods. The company has a wide distribution network, covering over 3.4 million retail outlets

with a high penetration in both urban and rural markets. Daburs products also have a huge presence in the overseas markets and are today

available in over 60 countries across the globe. Its brands are highly popular in the Middle East, Africa, SAARC countries and the US. Daburs

overseas revenues account for over 30% of the total turnover.Dabur India is also a world leader in Ayurveda with a portfolio of over 250

Herbal/Ayurvedic products. Daburs FMCG portfolio today includes five flagship brands with distinct brand identities.

Dabur India Limited has marked its presence with significant achievements and today commands a market leadership status. Our story of success

is based on dedication to nature, corporate and process hygiene, dynamic leadership and commitment to our partners and stakeholders. The

results of our policies and initiatives speak for themselves

Leading consumer goods company in India with a turnover of Rs. 2834.11 Crore (FY09)

3 major strategic business units (SBU) - Consumer Care Division (CCD), Consumer Health Division (CHD) and International Business Division (IBD)

3 Subsidiary Group companies - Dabur International, Fem Care Pharmaand newu.

17 ultra-modern manufacturing units spread around the globe

Products marketed in over 60 countries

Wide and deep market penetration with 50 C&F agents, more than 5000 distributors and over 2.8 million retail outlets all over India

Short Description of Three Major Strategic Business Units (SBUs)

a) Consumer Care Division (CCD):-

Consumer Care Business, which incorporates the entire FMCG business of Dabur comprising Health care and Home & Personal care verticals

accounts for 56% of the Companys consolidated revenues International Business Division (IBD), which includes Daburs organic overseas

business as well as the acquired entities, Hobi Group and Namaste Laboratories LLC, accounts for 30.3% of Dabursconsolidated revenues.

The Consumer Care Business is the largest segment, contributing to 56% of consolidated sales and grew by 11.4% during fiscal 2011-12.

The segment is divided into the key verticals of Health care and Home and Personal care.

Master Brands:

Dabur - Ayurvedic healthcare products

Vatika - Premium hair care

Hajmola - Tasty digestives

Ral - Fruit juices & beverages

Fem - Fairness bleaches & skin care products

9 Billion-Rupee brands: DaburAmla, DaburChyawanprash, Vatika, Ral, Dabur Red Toothpaste, DaburLalDantManjan, Babool, Hajmola and Dabur Honey

Strategic positioning of Honey as food product, leading to market leadership (over 75%) in branded honey market

DaburChyawanprash the largest selling Ayurvedic medicine with over 65% market share.

Vatika Shampoo has been the fastest selling shampoo brand in India for three years in a row

Hajmola tablets in command with 60% market share of digestive tablets category. About 2.5 croreHajmola tablets are consumed in India every day

Leader in herbal digestives with 90% market share

Foods Division, consisting of fruit-based beverages and

culinary pastes business, contributes 10.1% of total

sales.

Daburs Foods Business emerged as the star performer

of 2011-12 as the category crossed Rs. 500 crores in

sales. This marks a 10-fold jump in its sales in nine

years, a big achievement given the fact that this

business is driven purely by packaged fruit juices -- a

category that was almost nonexistent a decade ago and

was pioneered by Dabur. The Foods business at present

includes fruit juices and nectars under the brands Ral

and RalActiv and culinary pastes under the brand

Hommade.

Foods Division:-

Daburs International Business continued on a strong growth trajectory with sales growing by 78.3% to Rs. 1,616 crores. The International Business

now contributes 30.3% to consolidated sales. Fiscal 2011-12 was the first full year of the two overseas acquisitions Hobi Group and Namaste

Laboratories, LLC under the Dabur fold.

During the year, these acquisitions were ssimilated and integrated with the existing organic overseas business. If we were to look at the growth in

sales of the organic business excluding acquisitions, nthe business grew by 27.1% to Rs. 929.9 crores. Our key geographies by total overseas

revenues now are: Middle East, Africa, Asia and U.S.

International Business Division

(IBD):-

Financial Statement Analysis

Solvency Ratios

The long-term solvency of a business is affected

by the extent of debt used to finance the assets of

the company. The presence of heavy debt in a

companys capital structure is thought to reduce

the companys solvency because debt is more

risky than equity. Important indicators of a firms

solvency are discussed below:-

1.) Debt-Equity Ratio

2.) Debt Assets Ratio

3.) Interest Coverage Ratio

Debt-Equity Ratio

Debt-Equity Ratio

Year 2010 2011 2012 2013

Total Debt 14,137 10,997 25,201 27,781

Shareholder

Fund

73,820 74,938 1,10,116 1,30,327

Debt-Equity

Ratio

0.19 0.14 0.22 0.21

It measures the relationship of the capital provided by creditors to the amount provided by shareholders. Debt includes interest-bearing liabilities,

both short-term & long-term, but excludes operating liabilities. A lower Debt-Equity Ratio is better for the company.

Debt-Equity Ratio = Total Debt / Total Shareholder Funds

(All Figures in Rs. Lacs)

These ratios are very low which indicates that in the coming future, the company can easily increase the amount of leverage in its capital structure. Over the

years, the company has been increasing its shareholders funds. The debt has also increased except for one year when the company repaid some part of its

debt. Over the years the ratio has been increasing showing indicating that the company has started relying more on external borrowings.

(both long-term &short-term). However, the proportion of the Debt still is very low in comparison to the Equity of the company. This also indicates that its

fixed charges i.e. interest on debt is low indicating good financial position of the company.

Debt-Assets Ratio

Debt-Assets Ratio

Year 2010 2011 2012 2013

Total Debt 14,137 10,997 25,201 27,781

Total Assets 1,55,062 1,74,346 2,40,791 2,84,071

Debt-Assets

Ratio

0.09 0.06 0.10 0.09

(All Figures in Rs. Lacs)

A lower Debt-Asset Ratio indicated that most of the assets of the company are financed through its Equity Funds. Also, the ratio has decreased

from the years 10-11 & 12-13 which signify an increasing dependence of the company on equity funds for the purpose of financing its assets &

less dependence on its Debt. This is a good sign for the company, as it reduces the chances of default of payment.

Interest Coverage Ratio

Interest Coverage Ratio

Year 2010 2011 2012 2013

EBITA 46,974 57,020 67,709 66,701

Interest

Payments

1,338 560 1,293 1,410

Interest

Coverage Ratio

35.1 101.82 52.36 47.30

This is the measure of protection available to the creditors for payment of interest charges by the company. It shows whether the company has

sufficient income to cover its interest requirements by a wide margin.It is calculated by dividing the profit before interest, tax and depreciation

by the interest expense.

Interest Coverage Ratio = Earnings before Interest, Tax & Depreciation / Interest Payments to Borrowers

(All Figures in Rs. Lacs)

A high Interest Coverage Ratio implies that there is adequate safety for payment of interest even if there was a drop in the companys earnings.

Although the ratio initially increased & then decreased, it is still maintained at a healthy level.The ratio increased in the year 2011 because of the fact

that the company decreased its debt from Rs.14,137 in the year 2010 to Rs. 10,997 in 2011 and, therefore, its expenses on interest on debt fell. Further, the

ratio increased in the years 2012 and 2013 because of increase in debt and the subsequent increase in interest charges.

Liquidity Ratios

Liquidity is the ability of a business to meet its short-term

obligations when they fall due. An enterprise should have

enough liquid and other current assets which can be

converted into cash so that it can pay its suppliers & lenders

on time. For evaluating Daburs liquidity, we examine the

following ratios

1.) Current Ratio

2.) Quick Ratio

3.) Net Working Capital

Current Ratio

Current Ratio

Year 2010 2011 2012 2013

Current Assets 74,505 91,795 1,39,732 1,63,062

Current Liabilities 66,410 87,216 92,384 1,07,742

Current Ratio 1.12 1.05 1.34 1.32

It is a widely used indicator of a companys ability to pay its debts in the short-term, and shows the amount of current assets a

company has per rupee of current liabilities. Here, current assets include loans &advances and current liabilities include provisions. It is an

important indicator of a companys current and prospective liquidity position.

Current Ratio = Current Assets / Current Liabilities

(All Figures in Rs. Lacs)

A low Current Ratio implies a strained liquidity position for the company. However, FMCG companies usually do not have a high current ratio

because of fast conversion of inventory into cash. Therefore the Current Ratio of Dabur is less than normal. Another reason for the low ratio is

that the company follows a conservative policy and has high provisions (almost 50% of the liabilities) which increases the liabilities and decreases

this ratio. Still a gradual increase in the ratio indicates favourable conditions for the company. Ideal current ratio is 2:1, and we have seen an

increasing trend in their current ratio.

Quick Ratio

Quick Ratio

Year 2010 2011 2012 2013

Quick Assets 48,333 61,951 93,673 1,10,205

Current Liabilities 66,410 87,216 92,384 1,07,742

Quick Ratio 0.72 0.71 1.01 1.02

The quick ratio measures a company's ability to meet its short-term obligations with its most liquid assets. The higher the quick ratio, the better

is the position of the company.

Quick Ratio = (Current Assets Inventory) / Current Liabilities

(All Figures in Rs. Lacs)

Inventory in case of Dabur forms a significant part of current Assets, hence quick ratio is low. However, the ratio has improved over the past two

years, indicating that the ability of the firm to meet its short-term obligations using its quick assets has improved. Ideal quick ratio is 1:1 and Dabur

lately has achieved it.

Net Working Capital

Net Working Capital

Year 2010 2011 2012 2013

Current Assets 74,505 91,795 1,39,732 1,63,062

Current Liabilities 66,410 87,216 92,384 1,07,742

Net Working

Capital

8,095 4,579 47,348 55,320

It represents operating liquidity available to a business.

Net working capital is calculated as: Current Assets - Current Liabilities.

(All Figures in Rs. Lacs)

The NWC shot up from a modest 4,579 in 11 to a healthy 47,348 in 12. This was mainly because the current assets of the company grew due to

an increase in investments, inventory and cash balances whereas the current liabilities remained stable.

Inventory Turnover Ratio

Year 2010 2011 2012 2013

Cost of Goods

Sold

1,22,243 1,37,393 1,27,405 1,48,370

Average

Inventory

24,586 28,008 37,952 46,061

Inventory

Turnover Ratio

4.97 4.90 3.35 3.22

This ratio shows the number of times a companys inventory is turned into sales. Investment in inventory represents idle cash. The lesser the

inventory, the greater the cash available for meeting operating needs. Besides, lean, fast-moving inventory runs a lower risk of obsolescence and

reduces interest, insurance & storage charges.

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

(All Figures in Rs. Lacs)

Inventory Turnover Ratio is usually high for an FMCG company. However, in the case of Dabur the company has accumulated huge amounts of inventory

over the years. This has led to a gradual decrease in the Inventory Turnover Ratio of the company. Such high levels of inventory strain the companys liquidity

& availability of cash within a short time frame. This typically suggests the opportunity cost of Dabur, the amount of inventory that is idle typically means the

cash they are just wasting.

Debtor Turnover Ratio

Year 2010 2011 2012 2013

Net Avg. Credit

Sales

2,42,368 2,65,206 3,08,053 3,51,997

Average Debtors 11,236 12,142 16,647 21,332

Debtor Turnover

Ratio

21.57 21.84 18.50 16.50

A companys ability to collect from its customers in a prompt manner enhances its liquidity. The Debtor Turnover Ratio measures the efficacy

of the firms credit policy and collection mechanism and shows the number of times each year the debtors turn into cash. High DTR indicates that

debtors are being converted rapidly into cash and the quality of the companys portfolio of debtors is good.

Debtor Turnover Ratio = Net Average Credit Sales / Average Debtors

(All Figures in Rs. Lacs)

Although the DTR of the company has decreased over the previous years, it still was able to maintain a healthy Debtor Turnover Ratio of 16.50 in the

year 2013. This indicates a favourable debtor portfolio of the company. But Dabur should stop this declining trend as Debtor Turnover Ratio directly affects

the liquidity of your company and low DTR would mean your debtors are not that credible and would thus increase the chances of bad debts.

Creditor Turnover Ratio

Year 2010 2011 2012 2013

Net Avg. Credit

Purchases

1,22,243 1,29,818 1,32,399 1,37,888

Average

Creditors

28,143 31,522 42,194 53,998

Creditor

Turnover Ratio

4.34 4.11 3.13 2.55

It compares creditors with the total credit purchases & signifies the credit period enjoyed by the firm in paying creditors. Accounts payable include

both sundry creditors and bills payable.The Credit Turnover Ratio represents the number of days used by the firm to repay its creditors. A high

creditor turnover ratio signifies that the creditors are being paid promptly. This situation enhances the credit worthiness of the company. However

a very favourable ratio to this effect also shows that the business is not taking the full advantage of credit facilities allowed by the creditors.

Creditor Turnover Ratio = Net Average Credit Purchases / Average Creditors

(All Figures in Rs. Lacs)

Over the years the amount of Creditors has increased whereas the Net Purchases have remained stable. This has been a major factor contributing

to the decrease in the creditor turnover ratio. Although CTR is decreasing it is still maintained at a level which is favourable for the creditors of

the company.

Collection Period vs. Credit Period

The collection period is less as compared to the credit period enjoyed by the company which is in favour of the company. This means that the company

has managed its debtors well and the suppliers are having a high degree of faith in it, it also enjoys a good reputation with the creditors.

This right here is a very solid advantage for a company, as it has reduced the chances of possible bad debts by maintaining a low collection period , which

makes the debtors comply to quick returning of money.

On the other hand the credit period is high which signifies that the Dabur has more time to pay to its creditors.

Profitability Ratios

Profitability ratios measure the degree of operating success of the

company. The only reason why investors are interested in a company is

that they think they will earn a reasonable return in the form of capital

gain and dividends on their investment. Therefore, they are keen to learn

about the ability of the company to earn revenues in excess of its

expenses. Failure to earn an adequate rate of profit over a period will

also drain the companys cash and impair its liquidity.

The Profitability ratios are :

1.) Gross Profit Margin

2.) Net Profit Margin

3.) Return on Capital Employed

Gross Profit Margin

Year 2010 2011 2012 2013

Gross Profit 1,13,049 1,43,034 2,00,656 2,27,563

Net Sales 2,42,368 2,88,045 3,28,061 3,75,933

Gross Profit

Margin

46.64 49.65 61.16 60.53

It is used to assess a firm's financial health by revealing the proportion of money left over from revenues after accounting for the cost of

goods sold. Gross profit margin serves as the source for paying additional expenses and future savings.

It is also known as "gross margin".

Gross Profit Margin = Gross ProfitNet Sales X 100

(All Figures in Rs. Lacs)

Over the years the GPM has increased for Dabur. Although, for the year 2013 the margin decreased, it is still maintained at an attractive level.

Increasing gross profit margin can mean two things for the company. First, the company has a favourable pricing power. When a firm raise price

due to overwhelming demand, gross profit margin will increase. Secondly, increasing gross profit margin may mean that a firm is

getting more efficient in production. When price per unit stays the same while the cost of variable unit drops, gross profit margin will increase.

Net Profit Margin

Year 2010 2011 2012 2013

Net Profit 37,356 43,333 47,141 46,324

Net Sales 2,42,368 2,88,045 3,28,061 3,75,933

Net Profit

Margin

15.41 15.04 14.36 12.32

A ratio of profitability calculated as net income divided by revenues, or net profits divided by sales. It measures how much out of every

dollar of sales a company actually keeps in earnings.

A higher profit margin indicates a more profitable company that has better control over its costs compared to its competitors.

Net Profit Margin = Net ProfitNet Sales X 100

(All Figures in Rs. Lacs)

The Net Profit Margin has decreased over the years. This decreasing trend is because of an increase in the operating costs by Dabur. The firm

will have to reallocate its resources & ensure efficient working so as to improve its Net Profit Margin.

Return on Capital Employed

Year 2010 2011 2012 2013

PAT + Interest 38,694 43,893 48,434 47,734

Capital Employed 1,55,062 1,74,346 2,40,791 2,84,071

ROCE 24.95 25.17 20.11 16.80

It is a ratio that indicates the efficiency and profitability of a company's capital investments, By comparing net income to the sum of a company's

debt and equity capital, investors can get a clear picture of how the use of leverage impacts a company's profitability. Financial analysts consider

the ROCE measurement to be a more comprehensive profitability indicator because it gauges management's ability to generate earnings from a

company's total pool of capital.

Return on Capital Employed = PAT + InterestCapital Employed X 100

(All Figures in Rs. Lacs)

As indicated earlier the operating costs of the firm have been on a rise for the past few years. This has led to a decrease in its Net Profit of the

company. Therefore, a proportionate increase in the Capital Employed has yielded a less proportionate increase in the Net Profit of the company.

This has been a major reason for a decreasing ROCE.

TREND ANALYSIS

Sales

EBITDA

Profit after Tax (PAT)

Earnings Per Share And Dividend Per Share

Net sales

0

1,000

2,000

3,000

4,000

5,000

6,000

FY10 FY11 FY12 FY13

Net Sales

Net Sales

Net sales have shown an increasing trend over the four years. Sales have increased

by 88% from FY10 to FY13.

EBITDA

The EBITDA in absolute amount has increased over the four years from 517 crores to

948 crores representing a increase of 83% over four years.

The EBITDA Margin, however has declined for FY13 to 18% from 20% in FY12. So,

even though EBITDA has increased by 14% over the previous year, the sales have

increased by 30% over the previous year due to which the EBITDA Margin has

declined. EBITDA Margin remained stable from FY11 to FY12 at 20%.

Profit after Tax (PAT)

PAT has increased significantly over the years for Dabur. PAT has increased by 65%

over the four year period.

Earnings Per Share And Dividend

Per Share

The above chart indicates that both EPS and DPS have not been stable for Dabur

over the four year period. Also it is evident that there exists a relation between EPS

and DPS, that is when the company has a higher EPS then its DPS is also higher and

vice versa

You might also like

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- British American Tobacco Bangladesh - History Product StrategyDocument17 pagesBritish American Tobacco Bangladesh - History Product StrategyRifazAhmedRumanNo ratings yet

- Ias 33 EpsDocument55 pagesIas 33 EpszulfiNo ratings yet

- Financial Statements: Analysis of Attock Refinery LimitedDocument1 pageFinancial Statements: Analysis of Attock Refinery LimitedHasnain KharNo ratings yet

- Term Paper-Bangas (FSAV)Document14 pagesTerm Paper-Bangas (FSAV)Ashikur Rahman ShikuNo ratings yet

- Goldstar Example of Ratio AnalysisDocument13 pagesGoldstar Example of Ratio AnalysisRoshan SomaruNo ratings yet

- Case Study FinalDocument11 pagesCase Study FinalistiakNo ratings yet

- Ebit Eps AnalysisDocument11 pagesEbit Eps Analysismanish9890No ratings yet

- ACI LimitedDocument6 pagesACI Limitedtanvir616No ratings yet

- Management Accounting Group-8: Anuraag S.Shahapur-14021 SINDHU S.-14154 Pooja Chiniwalar-14099Document15 pagesManagement Accounting Group-8: Anuraag S.Shahapur-14021 SINDHU S.-14154 Pooja Chiniwalar-14099prithvi17No ratings yet

- Literature ReviewDocument19 pagesLiterature ReviewRonak BhandariNo ratings yet

- Valuation ProblemsDocument5 pagesValuation ProblemsAparna KalaskarNo ratings yet

- CASEDocument1 pageCASESanskar VyasNo ratings yet

- Fin Sony Corporation Financial AnalysisDocument13 pagesFin Sony Corporation Financial Analysisapi-356604698100% (1)

- FSA Atlas Honda AnalysisDocument20 pagesFSA Atlas Honda AnalysisTaimoorNo ratings yet

- Myntra - Media StrategyDocument13 pagesMyntra - Media StrategyPiyush KumarNo ratings yet

- Wal MartDocument12 pagesWal Martkillersrinu100% (2)

- Financial Ratio AnalysisDocument26 pagesFinancial Ratio AnalysisMujtaba HassanNo ratings yet

- Chap 1Document32 pagesChap 1Joy Lu100% (1)

- Group 1 Nguyễn Thị Thanh Thanh Nguyễn Thị Anh Thư Nguyễn Thị Yến Nhi Nguyễn Quang Lâm Hoàng Công Minh Lê Chăm Anh Lê Anh ThưDocument3 pagesGroup 1 Nguyễn Thị Thanh Thanh Nguyễn Thị Anh Thư Nguyễn Thị Yến Nhi Nguyễn Quang Lâm Hoàng Công Minh Lê Chăm Anh Lê Anh ThưThanh ThanhNo ratings yet

- A Study Applying DCF Technique For Valuing Indian IPO's Case Studies of CCDDocument11 pagesA Study Applying DCF Technique For Valuing Indian IPO's Case Studies of CCDarcherselevators100% (1)

- Engro Fertilizer - Financial AnalysisDocument16 pagesEngro Fertilizer - Financial AnalysisHasan AshrafNo ratings yet

- Consumer Behaviour in Post-Covid EraDocument1 pageConsumer Behaviour in Post-Covid EraAkash DhimanNo ratings yet

- Quiz 1Document3 pagesQuiz 1Yong RenNo ratings yet

- Financial Analysis For PepsicoDocument5 pagesFinancial Analysis For PepsicoZaina Alkendi100% (1)

- AssignmentDocument14 pagesAssignmentBeri Z Hunter100% (1)

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Importance of Economics To ManagersDocument8 pagesImportance of Economics To Managersdhiraj_sonawane_1No ratings yet

- Capital StructureDocument41 pagesCapital Structure/jncjdncjdnNo ratings yet

- Case DELL Overtake HP Final - EdDocument20 pagesCase DELL Overtake HP Final - Edas1klh0No ratings yet

- Artifact v. MGMT 565 - Team Paris Waldo CountyDocument12 pagesArtifact v. MGMT 565 - Team Paris Waldo CountyRizkyHaryogiNo ratings yet

- Modi Rubber Limited CaseDocument17 pagesModi Rubber Limited Casericha042460250% (1)

- Agora Supply ChainDocument14 pagesAgora Supply ChainkmeaNo ratings yet

- UK PESTLE ANALYSIS Part 1Document25 pagesUK PESTLE ANALYSIS Part 1S Waris Hussain100% (20)

- SDPK Financial Position Project FinalDocument33 pagesSDPK Financial Position Project FinalAmr Mekkawy100% (1)

- Internship Report On Financial Performance Analysis of Exim Bank LTDDocument40 pagesInternship Report On Financial Performance Analysis of Exim Bank LTDNure AlamNo ratings yet

- Ratio Analysis Assignment 2020Document1 pageRatio Analysis Assignment 2020Nguyễn Thu TrangNo ratings yet

- Asian Currencies Sink in 1997Document3 pagesAsian Currencies Sink in 1997majidpathan208No ratings yet

- CASE STUDY-Financial Statement AnalysisDocument10 pagesCASE STUDY-Financial Statement Analysisssimi137No ratings yet

- Lecture 10 - Financial Statement AnalysisDocument35 pagesLecture 10 - Financial Statement AnalysisTabassum Sufia MazidNo ratings yet

- Linear Optimization-7-7-17Document35 pagesLinear Optimization-7-7-17preetmehtaNo ratings yet

- Financial Ratio AnalysisDocument3 pagesFinancial Ratio Analysisijaz bokhariNo ratings yet

- Case-Study On Aviation IndustryDocument14 pagesCase-Study On Aviation IndustrySurabhi ParasharNo ratings yet

- PG Valuation Analysis Project FinalDocument20 pagesPG Valuation Analysis Project FinalKaushal Raj GoelNo ratings yet

- Fin Strategy CaseDocument17 pagesFin Strategy CaseAiswarya NairNo ratings yet

- Cvs Health Financial AnalysisDocument12 pagesCvs Health Financial Analysisapi-643481686No ratings yet

- Credit Assignment 1Document5 pagesCredit Assignment 1Marock Rajwinder0% (1)

- Solutions To Chapter 12Document8 pagesSolutions To Chapter 12Luzz LandichoNo ratings yet

- An Iso 9001: 2000 Certified International B-SchoolDocument4 pagesAn Iso 9001: 2000 Certified International B-SchoolKunal BadhwarNo ratings yet

- Diversification of Horlicks BrandDocument12 pagesDiversification of Horlicks Branddeepak_hariNo ratings yet

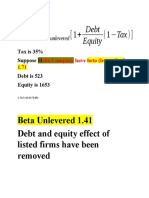

- Beta Levered and UnleveredDocument3 pagesBeta Levered and UnleveredNouman MujahidNo ratings yet

- Chemalite Group - Cash Flow Statement - PBTDocument8 pagesChemalite Group - Cash Flow Statement - PBTAmit Shukla100% (1)

- Future Bangladesh: A Comprehensive Analysis GEN226 (Section-9)Document7 pagesFuture Bangladesh: A Comprehensive Analysis GEN226 (Section-9)Farhana Hoque MaheeNo ratings yet

- Cash Flow Statement-2015Document43 pagesCash Flow Statement-2015Sudipta Chatterjee100% (1)

- Receivables ManagementDocument4 pagesReceivables ManagementVaibhav MoondraNo ratings yet

- Principle of ManagementDocument23 pagesPrinciple of ManagementSachinswariNo ratings yet

- Case 3 - Starbucks - Assignment QuestionsDocument3 pagesCase 3 - Starbucks - Assignment QuestionsShaarang BeganiNo ratings yet

- Tutorial 4 AnwersDocument6 pagesTutorial 4 AnwersSyuhaidah Binti Aziz ZudinNo ratings yet

- Financial Statement Analysis of DaburDocument40 pagesFinancial Statement Analysis of DaburNimishaNandan70% (37)

- Group 11 - DaburDocument36 pagesGroup 11 - DaburSayan MondalNo ratings yet

- IMCproject Group 7Document25 pagesIMCproject Group 7Vidit GargNo ratings yet

- Imc End Term Project Part 1Document21 pagesImc End Term Project Part 1Vidit GargNo ratings yet

- Green BeltDocument24 pagesGreen BeltVidit GargNo ratings yet

- Market SegmentationDocument4 pagesMarket SegmentationVidit GargNo ratings yet

- Project GuidelinesDocument2 pagesProject GuidelinesVidit GargNo ratings yet

- Key Takeaways:: 1. When Anger and Power Collide It Yields Greater Value in A NegotiationDocument2 pagesKey Takeaways:: 1. When Anger and Power Collide It Yields Greater Value in A NegotiationVidit GargNo ratings yet

- Group 11 Negotiating With The ChineseDocument9 pagesGroup 11 Negotiating With The ChineseVidit Garg100% (1)

- SituationDocument1 pageSituationVidit GargNo ratings yet

- Nego Q2Document2 pagesNego Q2Vidit GargNo ratings yet

- The Growing Competitionn Over Maritime RightsDocument4 pagesThe Growing Competitionn Over Maritime RightsVidit GargNo ratings yet

- Hindustan Lever LTDDocument4 pagesHindustan Lever LTDVidit GargNo ratings yet

- Nego Q2Document2 pagesNego Q2Vidit GargNo ratings yet

- Application of 6-Sigma For Service Improvement-AT International Management Institute CanteenDocument31 pagesApplication of 6-Sigma For Service Improvement-AT International Management Institute CanteenModak Priy Singh100% (2)

- Woman On Board Adds To DiversityDocument13 pagesWoman On Board Adds To DiversityVidit GargNo ratings yet

- Bap - PNGDocument21 pagesBap - PNGVidit GargNo ratings yet

- SM Project FinalDocument24 pagesSM Project FinalVidit GargNo ratings yet

- Question 3) Evaluate The Process of Conversion of Strategy To The Big Idea Through Word Association and Suggest Possibilities of AlternativesDocument4 pagesQuestion 3) Evaluate The Process of Conversion of Strategy To The Big Idea Through Word Association and Suggest Possibilities of AlternativesVidit GargNo ratings yet

- Marketing Question 1Document3 pagesMarketing Question 1Vidit GargNo ratings yet

- Continental India Limited - IntroductionDocument8 pagesContinental India Limited - IntroductionVidit GargNo ratings yet

- Six Sigma 10 Improve Phase-2Document50 pagesSix Sigma 10 Improve Phase-2Vidit GargNo ratings yet

- Six Sigma 9 Analyze-2Document46 pagesSix Sigma 9 Analyze-2Vidit GargNo ratings yet

- Casestudy Kaya 130831073641 Phpapp01Document22 pagesCasestudy Kaya 130831073641 Phpapp01Vidit GargNo ratings yet

- FCB GridDocument4 pagesFCB GridVidit GargNo ratings yet

- S 5 The Communication ProcessDocument35 pagesS 5 The Communication ProcessVidit GargNo ratings yet

- 6 Sigma Projects PresentationDocument31 pages6 Sigma Projects PresentationVidit GargNo ratings yet

- 6 Sigma Projects PresentationDocument31 pages6 Sigma Projects PresentationVidit GargNo ratings yet

- Ss Case StudyDocument19 pagesSs Case StudyVidit GargNo ratings yet

- Delhi Metro Rail Corporation LTDDocument3 pagesDelhi Metro Rail Corporation LTDVidit GargNo ratings yet

- Green Building ProjectDocument15 pagesGreen Building ProjectVidit GargNo ratings yet

- Lenovo SBM 3Document6 pagesLenovo SBM 3Vidit GargNo ratings yet

- A Study of Mergers and Acquisitions in India & Their Impact On Financial PerformanceDocument10 pagesA Study of Mergers and Acquisitions in India & Their Impact On Financial PerformanceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Ampalaya Ice CreamDocument12 pagesAmpalaya Ice CreamEdhel Bryan Corsiga SuicoNo ratings yet

- Cafe Monte Bianco Case AnalysisDocument2 pagesCafe Monte Bianco Case AnalysisScribdTranslationsNo ratings yet

- Corporate Finance Cheat SheetDocument1 pageCorporate Finance Cheat SheetbaronfgfNo ratings yet

- Chapter 4 - Fundamentals of AccountingDocument75 pagesChapter 4 - Fundamentals of AccountingThuy Tien DinhNo ratings yet

- EFM Classic Business Free TrialDocument310 pagesEFM Classic Business Free TrialDarkchild HeavensNo ratings yet

- Viva Term Finance & BankingDocument26 pagesViva Term Finance & BankingMinhaz Hossain Onik100% (2)

- Quick Tax Guide 2023-2024Document26 pagesQuick Tax Guide 2023-2024RobertKimtaiNo ratings yet

- Joint Arrangement Discussion ProblemsDocument2 pagesJoint Arrangement Discussion ProblemsDiana Rose BassigNo ratings yet

- ALFADocument3 pagesALFAWahyudi IskandarNo ratings yet

- Farm Record BookDocument39 pagesFarm Record Bookravindra bhalsingNo ratings yet

- Commission by Samuel Mabugu: PresentationDocument20 pagesCommission by Samuel Mabugu: PresentationBuddha 2.ONo ratings yet

- Aspect Furniture Trends Corporation: Operation PlanDocument17 pagesAspect Furniture Trends Corporation: Operation PlanShen VillNo ratings yet

- La Sallian Educational Innovators Foundation Inc, Vs CIR GR No. 202792 February 27, 2019Document4 pagesLa Sallian Educational Innovators Foundation Inc, Vs CIR GR No. 202792 February 27, 2019Junaid DadayanNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/22 October/November 2017Document12 pagesCambridge Assessment International Education: Accounting 0452/22 October/November 2017pyaaraasingh716No ratings yet

- Chapter: Common Size, Comparative and Trend AnalysisDocument6 pagesChapter: Common Size, Comparative and Trend Analysiseldridatech pvt ltdNo ratings yet

- Ans Ch25 Igcse Bus ST TCDDocument4 pagesAns Ch25 Igcse Bus ST TCDyawahabNo ratings yet

- Chapter Two Financial Analysis and Planning Part One-Financial Analysis 2.1Document17 pagesChapter Two Financial Analysis and Planning Part One-Financial Analysis 2.1TIZITAW MASRESHA100% (2)

- Acctg 102 - Prelim Exams - 3048Document3 pagesAcctg 102 - Prelim Exams - 3048AYAME MALINAO BSA19No ratings yet

- An Analysis of Interest Rate Spread in Nepalese Commercial BankDocument12 pagesAn Analysis of Interest Rate Spread in Nepalese Commercial BankUday Sharma33% (9)

- Assignment QuestionsDocument12 pagesAssignment QuestionsyogendradilwalaNo ratings yet

- Installmen Sales ProblemsDocument10 pagesInstallmen Sales ProblemsKristine GoyalaNo ratings yet

- Pepsi Annual ReportDocument118 pagesPepsi Annual Reportcurtnie bernardoNo ratings yet

- Revenue Recognition - Ind As 18Document9 pagesRevenue Recognition - Ind As 18User PuppyNo ratings yet

- Zero View and Settings in HFMDocument7 pagesZero View and Settings in HFMkonda83No ratings yet

- Group 8 PilgrimDocument13 pagesGroup 8 PilgrimNitesh SoniNo ratings yet

- Project KavyaDocument98 pagesProject KavyaAnkit GuptaNo ratings yet

- Stock Investing Mastermind - Zebra Learn-85Document2 pagesStock Investing Mastermind - Zebra Learn-85RGNitinDevaNo ratings yet

- The Detection of Earnings Manipulation Messod D. BeneishDocument27 pagesThe Detection of Earnings Manipulation Messod D. BeneishOld School Value100% (13)

- Comparative Analysis of Working Capital Management of Agro Tech Foods LTDDocument4 pagesComparative Analysis of Working Capital Management of Agro Tech Foods LTDVignan MadanuNo ratings yet