Professional Documents

Culture Documents

2014 AMAA Winter Conference Member Directory

Uploaded by

Mike NallCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2014 AMAA Winter Conference Member Directory

Uploaded by

Mike NallCopyright:

Available Formats

2014 WINTER CONFERENCE

ATTENDEE DIRECTORY

DYNAMIC

DEALMAKING:

NEW RULES, NEW STRATEGIES, NEW OPPORTUNITIES

ALLIANCE OF MERGER & ACQUISITION ADVISORS

JANUARY 21-23, 2014

FAIRMONT SCOTTSDALE PRINCESS RESORT

SCOTTSDALE, ARIZONA

Produced in Partnership With:

The Alliance of Merger & Acquisition Advisors (The Alliance) is the premiere

international organization serving the educational and transactional support

needs of middle market M&A professionals worldwide. The Alliance was

formed in 1998 to connect CPAs, atorneys and other experienced corporate

nancial investors and advisors. Our more than 900 professionals are among

the most highly recognized leaders in the industrydrawing upon proven

capital resources combined with a think-tank of transactional expertise

to beter serve the many business investment needs of middle market

companies worldwide.

AM&AA members represent corporate and institutional sellers and buyers

of businesses ranging broadly from $5 to $500 million in transaction value.

These essential corporate nancial advisory and transaction services include

investment banking, accounting, nance, valuation, tax, law and due diligence.

Become a Member Today!

Receive $200 off your first year of membership

(Available for a limited time to

2014 Winter Conference atendees only!)

See us at the registration desk or

email us at info@amaaonline.org

ALLIANCE OF MERGER & ACQUISITION ADVISORS

(877) 844-2535

info@amaaonline.org | www.amaaonline.org

Conference Agenda 1

Conference Planning Commitee 8

AM&AA Founders Circle 9

AM&AA Advisory Board 10

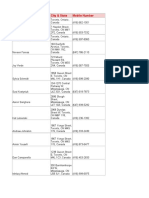

Conference Atendees 15

Exhibit Road Map/Conference Sponsors 57

Media Partners 73

AM&AA Sta 74

TABLE OF CONTENTS

This years

AM&AA

Winter Conference

oers a mobile app

to help set up

one-on-one meetings.

DOWNLOAD

THE MOBILE APP

You must log in to use the

networking function

Forgot your login information?

Stop by the registration desk

and well remind you

You can also use the app to:

Create your own schedule

Send messages to other atendees

Find sponsors

View presentations

Take notes

Sponsored by:

Badges

All atendees and registered spouses/companions must wear their name badges to

all functions for admitance. For your convenience, name badges are color-coded to

facilitate networking:

AM&AA Exhibit Table

Make sure to visit the AM&AA exhibit table in the far lef corner of the exhibit hall to nd

information on all the great things the organization has to oer!

Info. on free member resources i.e. private equity info., DealMarket

M&A certifcation course information

Membership applications

M&A handbook

Discounted member benefts i.e. One Source

Information from our strategic alliances

Save the Dates for our conferences

Green Badges

Investors

Lenders

Private Equity

Corporate Development

- CFO

- CEO

- Corporate Executive

White Badges

Investment Bankers/Broker

Dealers

M&A Intermediaries

Yellow Badges

CPAs

Atorneys

Business Valuators

Business Consultants

Financial Advisors

Technology, Professional Service

and Support Providers

CONFERENCE INFORMATION

Time Event

6:00 p.m. -

7:30 p.m.

Early Arrival Reception Sonoran Room & Patio

Atendees arriving on Monday are invited to network with M&A colleagues travel-

ing from abroad and the local business community at this casual reception.

MONDAY, JANUARY 20, 2014

Time Event

8:00 a.m. Registration Opens East Foyer A

9:00 a.m. -

9:15 a.m.

Opening Remarks Princess Ballroom Salons D-E

9:15 a.m. -

11:45 a.m.

Workshop: Whats In Your Toolbox? Princess Ballroom Salons D-E

Panelists:

Bob Machiz, President, Money Sof Inc.

Michael Vermillion, Senior Director, NAVEX Global

During this deep dive session atendees will walk away with the tools necessary

for running their M&A shop. Fee structures, rm growth, industry trends and best

practices will all be discussed.

10:40 a.m.-

11:00 a.m.

Coffee Break Princess Ballroom Salons D-E

11:00 a.m.-

12:00 p.m.

Workshop: Firm Management Best Practices for Growth and

Stories from the Trenches Princess Ballroom Salons D-E

Panelists:

Chris Blees, Partner, Biggskoord PC

Fred Jager, President, Hunter Wise Financial Group LLC

Kerry Morris, Partner, Shoreline Partners LLC

Sid Shaver, Managing Director, Statesman Corporate Finance

Dennis Roberts, Chairman & Senior Managing Director, The McLean Group

Hear from experienced dealmakers how they have built their businesses, the

challenges they have faced, and the key to their success.

12:30 p.m. -

4:30 p.m.

Golf Tournament

TPC Scotsdale

Join your colleagues for AM&AAs Annual Golf Tournament. Located at one of PGAs

fan-favorite courses in Scotsdale. Space is limited, so please register early to secure

your place. The cost of participation is $279 and all players must be registered for the

AM&AA Winter Conference.

* A shutle will provide transportation for all players from the hotel to the course

1

TUESDAY, JANUARY 21, 2014

AGENDA

Time Event

1:30 p.m. -

3:00 p.m.

Deep Dive: An Inside Look at Recent Deals

Princess Ballroom Salons D-E

Tom Goldblat, Founder, Ravinia Capital LLC

Kirk Griswold, Partner, Argosy Capital

Christopher Roden, Managing Director, C3 Capital Partners LLC

Presenters will go through the ins and outs of the deal, explain how they grew the

company and how they were able to sell it for a great return. Its the information that

rarely gets reported, but is commonly the reason a deal is successful. Learn what these

rms did behind the scenes to drive growth and returns.

3:00 p.m. -

3:15 p.m.

Coffee Break Princess Ballroom Salons A-E

3:15 p.m. -

4:00 p.m.

Cross Border M&A Roundtable: An International Update on Deal-

making Abroad Princess Ballroom Salons D-E

Moderator: Lisa Wright, Head of M&A Products, Bureau Van Dijk

Panelists:

Sri Geedipalli, Director, Simanor LLC

Phil Gilbert, Managing Director, P&M Corporate Finance

Euan Rellie, Senior Managing Director, Business Development Asia

Jennifer Watson, Principal, Masuda Funai

The world is no longer divided by water. M&A is truly a global business today. This panel

will talk about the opportunities and challenges that face dealmakers as they look to

grow their businesses globally.

4:00 p.m. -

5:00 p.m.

Regulation Update: The Impact of Crowdfunding and the JOBS Act

on Deal Activity Princess Ballroom Salons D-E

Moderator: James Simpson, Finance 500 Inc.

Panelists:

Laura Crosby-Brown, Director of Compliance, Regulatory Compliance

Michael Dinan, Founder, President & CEO, Dinan & Company

Loren Heger, Vice President and General Counsel, FNEX

Chris Tyrrell, CEO, OerBoard

Want to remain a top player in the market? Understanding new regulations, including

the impact the JOBS Act and crowdfunding will have on the market, is a must.

6:00 p.m. -

7:30 p.m.

Welcome Reception

Princess Ballroom Salons A-E

2

AGENDA

TUESDAY, JANUARY 21, 2014

3

Time Event

7:00 a.m.

8:00 a.m.

Breakfast & Registration Opens East Foyer A

8:00 a.m. -

9:00 a.m.

YesPrivate Company Data Does Exist! Princess Ballroom Salons F-G

Lisa Wright, Head of M&A Products, Bureau Van Dijk

An overview on what to expect from where: learn how to get the hard to nd

information on private companies located outside the U.S. and Canada. This session

will look at what to expect from dierent countries, examples of the depth of

information and data available and the relationship between private company ling

requirements and M&A deal information.

9:00 a.m. -

9:15 a.m.

Opening Remarks Princess Ballroom Salons F-G

9:15 a.m. -

9:45 a.m.

Keynote Presentation Princess Ballroom Salons F-G

Doug Ducey, Arizona State Treasurer and Former Partner & CEO, Cold Stone

Creamery

9:45 a.m. -

10:00 a.m.

Coffee Break Princess Ballroom Salons A-E

10:00 a.m. -

11:00 a.m.

State of the Market: An Update on the M&A and Private Equity

Markets Princess Ballroom Salons F-G

Moderator: Graeme Frazier, Founder, Private Capital Research LLC and GF Data

Resources LLC

Panelists:

Jeri Harman, Founder and Partner, Avante Mezzanine Partners

Mark Jones, Partner, River Associates Investments LLC

Tim Oleszczuk, Managing Director, Grace Mathews

Stephen Perry, Co-President, Linsalata Capital

Where are we today? AM&AA is famous for giving atendees an in-depth

breakdown of the status of the M&A market and what key changes professionals

need to be on the lookout for. This panel promises not to disappoint.

11:00 a.m. -

12:00 p.m.

Moving Downmarket: Why Bigger PE Firms Are Looking at Smaller

Deals Princess Ballroom Salons F-G

Moderator: Anthony Citrolo, Managing Partner, New York Brokerage Business

Panelists:

Jeremy Holland, Principal, Origination, The Riverside Company

Jay Jester, Managing Director, Director of Business Development, Audax Group

Tim Mages, Principal, Salem Halifax Capital Partners

Fritz Richards, Co-Founder, Prestwick Partners

Bigger used to mean beter. Not so much anymore. As the dealmaking environment

continues to become more competitive, larger private equity shops are moving

downmarket in hopes of fnding untapped deals. Learn what dealmakers need to

know about the larger players and what they need to do stay competitive.

WEDNESDAY, JANUARY 22, 2014

AGENDA

Time Track A Princess Ballroom - Salon F Track B Princess Ballroom - Salon G

1:30 p.m. -

2:30 p.m.

Doing Deals With

Independent Sponsors: Who

Are These Guys, Anyway?

Moderator:

Alex Livingston, Founder,

Redwood Management Partners

Panelists:

Stephen Altman, Partner, Cornerstone

Capital Partners

Richard Baum, Managing Partner,

Consumer Growth Partners

Bruce Lipian, Managing Director, Stone

Creek Capital

Dan Lipson, Partner, Rotunda Capital

As fundraising has become increasingly

more dicult to complete, some rms

have decided to forego the fund and

compete for deals on a one-o basis.

Learn what role the fundless sponsor is

playing in the dealmaking food chain and

how working with them can be benecial.

What Limited Partners Look for

in a PE Fund Manager

Moderator:

Benjamin Sykora, Vice President,

Bow River Capital Partners

Panelists:

Kelly DePonte, Managing Director,

Probitas

Partners

Nathan Harnetiaux, Portfolio Manager,

Kemper Corporation

Brian Kinsman Managing Partner,

Bunker Hill Capital

Jonathan Wilson, Principal, Siguler Gu

As limited partners shine the light even

brighter on private equity rms, learn

what exactly LPs are looking for from fund

managers and rms today. How important is

track record and succession planning? What

level of involvement do LPs expect to have

afer the fund is closed? This a cannot-miss

panel where LPs will tell all.

Time Event

12:00 p.m.-

1:30 p.m.

Lunch Keynote Princess Ballroom Salons A-E

Steven LaTourete, President, McDonald Hopkins Government Strategies

Middle-Market Thought Leader of the Year Awards

This award was instituted by the AM&AA to honor individuals who have made

signicant contributions to the middle market M&A profession through the

publication of works that promote research and higher standards of excellence.

It recognizes those in the M&A community that create and advocate ideas that

add value to the industry, thereby adding value to the AM&AAs education and

credentialing programs, such as the Certied Merger & Acquisitions Advisor

(CM&AA) credential.

4

2:30 p.m. -

2:45 p.m.

Coffee Break Princess Ballroom Salons A-E

Award Partners

WEDNESDAY, JANUARY 22, 2014

2013

2014

AGENDA

Time Track A Princess Ballroom - Salon F Track B Princess Ballroom - Salon G

2:45 p.m. -

3:45 p.m.

Capital Markets Update

Insight Into New Structures

Coming Into the Market and

What Role Mezz Will Play

Moderator:

Tom Kesoglou, Partner,

McCarter & English LLP

Panelists:

Christopher Dunlop, Managing Director,

Houlihan Lokey

Mat Greeson, Managing Director,

Greene Holcomb Fisher

Justin Kaplan, Partner, Balance Point

Capital Partners

Peter Rothschild, Principal, Tamarix

Capital

The lending markets have certainly had

their ups and downs since the nancial

crisis. During this panel fnd out the latest

information about the debt markets,

including the role mezzanine lending is

playing and how that is evolving.

Snapshot: Whats Going on

With the Corporate Dealmaking

Landscape Today and What Has

Changed

Moderator: Celine Armstrong, Vice President

and Product & Content, S&P Capital IQ

Panelists:

David Cohn, Managing Director, Diamond

Capital Advisors LLC

Barret Hicken, Director, Potens Capital

Advisors

Brian Steens, Director, Business Development

& Global Supply Chain, Industrial Parts Depot

Richard Truelick, Former VP of Corporate

Development, Beatrice Foods Co.

Learn from experienced corporate buyers which

deals are interesting to them in the market

today and how dealmaking environment has

changed over the years in addition to what they

expect to see in the future.

3:45 p.m. -

4:00 p.m.

Coffee Break

4:00 p.m. -

5:00 p.m.

ESOP Deals: How to employ

the ESOP Strategy in M&A

Moderator: Carol Hance, Managing

Director, LongueVue Capital

Panelists:

Elizabeth Di Cola, Vice President, ESOP

Finance Group, Fifh Third Bank

Aziz El-Tahch, Managing Director, Stout

Risius Ross

Ira Starr, Managing Partner, Long Point

Capital

Learn how ESOPs are a fexible

acquisition structure that can benet

sellers through increased afer tax

liquidity, continued participation in

business growth, and expanded estate

planning options. This structure can also

benet the sponsor through accelerated

enterprise value growth.

Preparing Your Company for An

Investment or Sale

Moderator: Jaime Raczka, Director of

Marketing, AXIAL

Panelists:

Tracy Albert, Managing Partner, Deloite

Corporate Finance

Warren Henson, President and Senior

Managing Director, Green, Manning & Bunch

Ltd.

Jonathan Howe Managing Director, Wedbush

Securities

Je Kadlic, Co-Founder and Managing

Partner, Evolution Capital Partners

How can a broker prepare their client for the

right partner or exit? Brokers need to make

sure they clearly understand their clients

goals and expectations and make sure they are

aligned with the potential buyer or investor

and come to a well-balanced agreement. Find

out how its done during this discussion.

5

WEDNESDAY, JANUARY 22, 2014

AGENDA

Princess Ballroom Salons A-E

6

Time Event

5:00 p.m.-

6:30 p.m.

Networking Reception Princess Ballroom Salons A-E

Join us for an evening of fun to network with corporate executives, private equity

groups, and other M&A professionals.

WEDNESDAY, JANUARY 22, 2014

THURSDAY, JANUARY 23, 2014

Time Event

7:00 a.m. -

8:00 a.m.

Networking Breakfast & Registration Opens East Foyer A

8:00 a.m. -

9:00 a.m.

Washington Update Campaign for Clarity

Princess Ballroom Salons F-G

Mike Ertel, Managing Director, Broker Legacy M&A Advisors

Scot Gluck, Of Counsel, Venable LLP

Bob Gurrola, President, SUMMA Financial Group LLC

Shane Hansen, Partner, Warner, Norcross & Judd

These panelists will discuss the recent events in Washington aecting business

brokers and M&A advisors, including HR 2274, and eorts to get an identical bill

introduced in the Senate, and recent activity within the SEC.

9:00 a.m. -

10:00 a.m.

Only in the Lower MarketTrends

Impacting Lower Middle Market Firms

Including the Minority Recap

Princess Ballroom Salons F-G

Moderator: David McLean, Partner, Paton Boggs

Panelists:

Mathew Carroll, Partner, Westview Capital

Partners

John Farr, Managing Director, Columbia West

Capital

David Felts, Managing Director, Brookwood

Associates

Connor Searcy, Managing Director, Trive Capital

Everyone knows that the lower middle market

doesnt quite operate like the rest of the market. The

nuances specic to the lower middle market are a

unique space to complete transactions in. Find out

what dealmakers are doing to complete deals today

and what role the minority recap is playing.

10:00 a.m. -

10:15 a.m.

Coffee Break Princess Ballroom Salons A-E

8:30 a.m. - 12:00 p.m.

PE Expo

Princess Ballroom Salons A-E

The PE Expo features

pre-qualied investors

presenting their criteria

to interested investment

bankers/intermediaries and

other M&A professionals.

See what they are looking for

that might t your deal.

AGENDA

7

THURSDAY, JANUARY 23, 2014

8:30 a.m. - 12:00 p.m.

PE Expo

Princess Ballroom Salons A-E

The PE Expo features

pre-qualied investors

presenting their criteria

to interested investment

bankers/intermediaries and

other M&A professionals.

See what they are looking for

that might t your deal.

11:45 a.m. -

1:00 p.m.

Lunch

Princess Ballroom Salons A-E

1:00 p.m. -

3:00 p.m.

Deal Bash Princess Ballroom Salons A-E

Connections with investment bankers & intermediaries

(investment bankers & intermediaries present and share their deals and opportunities)

Dont miss out on:

2 hours of networking, tabled by screened middle-market intermediaries/

investment bankers, all bearing deals & transaction opportunities.

No appointments necessary

4:00 p.m.

5:00 p.m.

CollaborationThe New Normal

Princess Ballroom Salons F-G

Dr. Judith Glaser, Chairman, Creating WE Institute

Join the MidMarket Alliance for this post-conference keynote presentation by Dr.

Judith Glaser, Chairman of The Creating WE Institute. Her work encapsulates the

driving force behind the MidMarket Alliance: the power of collaboration.

Time Event

10:15 a.m. -

11:15 a.m.

Where Are the Sellers? What Motivates

Sellers to Become Engaged in a Sale?

Princess Ballroom Salons F-G

Moderator: James Hill, Chairman of Private

Equity Practice, Benesch, Friedlander, Coplan &

Arono

Panelists:

Devin Mathews, Managing Partner, Chicago

Growth Partners

Christopher Petrossian, Managing Director,

Lincoln International

Michael S. Pfeer, Managing Director, Post

Capital Partners LLC

Michael Wilkins, Managing Director, Harris

Williams & Co.

Deal fow has been tough to fnd in the lower middle

market. Why? This panel will provide insight into

what sellers want before they look for a sale and

when the deal pipeline is likely to be full again.

11:45 a.m. -

12:25 p.m.

Lunch Keynote : Ending Too Small to

Succeed Princess Ballroom Salons A-E

David Schweikert , Arizona, 6th District, United

States House of Representatives

AGENDA

Mike Adhikari

Illinois Corporate Investments

David Cohn

Diamond Capital Advisors

Jef Dinerstein

Haynes & Boone LLP

David Dollinger

UHY LLP

Evan Eichorn

One Source

Graeme Frazier

Private Capital Research

Andrew Gustin

Hammond Kennedy & Whitney

Barbara Hernandez

Evolution Capital Partners

Don Hillier

Harvest CFO Consulting, LLC

Justin Kaplan

Balance Point Capital Partners

Tom Kesoglou

McCarter & English

*Conference Chair

Brian Kohn

Copley Capital

Michael Landers

UHY LLP

Kyle Madden

KLH Capital

Curtis Odom

Prescient Strategists, LLC

Ed Pratesi

Brentmore Valutaion Advisors

Kathy Richardson-Mauro

ROCG

Brent Rippe

Rippe & Kingston, LLC

Je Sackman

Rubin Brown, LLP

Steven Silverman

Doeren Mayhew

Mike Snider MSB

Global Business Alliance

Brent Solomon

CohnReznick

Brian Steens

Storm Industries

Jim Valderrama

Grant Thornton

Holly Washington

S&P Capital IQ

Scot Woodward

UHY LLP

AGENDA

THANK YOU TO OUR

CONFERENCE PLANNING COMMITTEE

8

If you would like to be a part of the Conference Planning Commitee,

join us Thursday, Jan. 23rd in the exhibit hall from 8:30 a.m. 10:00 a.m.

or email Amie Schneider at aschnedier@amaaonline.org

Kevin Carlie

2004

Jim Carulas

2004

Richard Siemsen

2004

Karin Gale

2004

Sid Shaver

2007

Lloyd Bell

2009

Mike Adhikari

2009

Nancy Horton

2011

Christian Blees

2011

J. Michael Ertel

2011

Graeme Frazier

2012

David Cohn

2013

Kenneth Marks

2013

Ron Rudich

2013

9

AM&AA FOUNDERS CIRCLE

Mike Adhikari, CM&AA

Illinois Corporate Investments, Inc.

Lake Zurich, IL 60047

847-438-1657

madhikari@at.net

Lloyd Bell, CM&AA

Meaden & Moore

Cleveland, OH 44114

216-241-3272

lbell@meadenmoore.com

Chris Blees, CM&AA

BiggsKoord P.C.

Colorado Springs, CO 80906

719-579-9090

blees@biggskoord.com

K. Perry Campbell, CM&AA

ACT Consultants, Inc.

Vancouver, WA 98662

360-696-9450

pcampbell@actconsultants.com

Kevin Carlie, CM&AA

Stone, Carlie & Company

St. Louis, MO 63105

314-721-5800

kcarlie@stonecarlie.com

= Atending the Winter Conference

AM&AA ADVISORY BOARD

10

11

Anthony Citrolo, CM&AA

Strategic Merger & Acquisition Advisors

New York, NY 10001

631-390-9650

anthony@strategicmaadvisor.com

David Cohn, CM&AA

Diamond Capital Partners

Los Angeles, CA 90067

310-432-8592

dcohn@diamondcapadvisors.com

Champ Davis, CM&AA

Davis Capital

Chicago, IL 60606

312-623-4500

cdavis@daviscapital.com

J. Michael Ertel, CM&AA

Legacy M&A Advisors, LLC

St. Petersburg, FL 33715

813-864-6610

mertel@lmaalle.com

Graeme Frazier

Private Capital Research, LLC

Conshohocken, PA 19428

610-825-1153

bgfrazier@pcrllc.com

AM&AA ADVISORY BOARD

12

Robert Gurrola, CM&AA

Summa Financial Group, LLC

San Jose, CA 95110

408-454-2600

rgurrola@summallc.com

Ray Hanson, CM&AA

Pragma Ventures

West Linn, OR 97068

503-635-1173

rghanson@pragmaventures.com

Kenneth Marks, CM&AA

High Rock Partners, Inc.

Raleigh, NC 27615

919-256-8152

khmarks@highrockpartners.com

Ronald Rudich, CM&AA

Gor ne, Schiller & Gardyn, PA

Owings Mills, MD 21117

410-517-6838

rrudich@gsg-cpa.com

AM&AA ADVISORY BOARD

Sid Shaver, CM&AA

Statesman Corporate Finance

Houston, TX 77027

713-590-4697

sshaver@statesmanbiz.com

Steven Silverman, CM&AA

Doeren Mayhew

Houston, TX 77057

713-789-7077 x236

silverman@doeren.com

Michael Snider, CM&AA

MSB Global Business Alliance

Atlanta, GA 30307

404-378-7707

mrs@msbllc.net

Brian Wendler, CM&AA

National Business Valuation Services

Dallas, TX 75287

972-235-6287

bwendler@nationalbvs.com

AM&AA ADVISORY BOARD

13

Kuldeepak Acharya

Anchin Capital Advisors LLC

New York, NY

kuldeepak.acharya@anchin.com

212-536-6803

Investment Banker/Broker Dealer

Drew Adams

StoneCreek Capital

Irvine, CA

drew@stonecreekcapital.com

949-752-4580

Private Equity Investor

Stephen Adamson

Avante Mezzanine Partners

Los Angeles, CA

sadamson@avantemezzanine.com

310-667-9242

Private Equity Investor

Mike Adhikari, CM&AA

Illinois Corporate Investments, Inc.

Lake Zurich, IL 60047

847-438-1657

madhikari@att.net

Javier Aguirre

Farragut Capital Partners

Chevy Chase, MD

jaguirre@farragutcapitalpartners.com

301-913-5296

Private Equity Investor

= Member of AM&AA

Joseph P. Alam

MID-STATES CAPITAL, LLC

Grosse Pointe Farms, MI

jpa@midstatescapital.com

313-215-1700

Business Broker

Jonathan Alt

Cornerstone Capital Holdings

Blue Bell, PA

jalt@cstonecapital.com

215-628-4486

Private Equity Investor

Stephen Altman

Cornerstone Capital Partners

New York, NY

saltman@

cornerstonecapitalpartners.com

212-986-5470

Robert Anderson

Snell & Wilmer L.L.P.

Las Vegas, NV

rcanderson@swlaw.com

702-784-5386

Attorney

Michael Arguelles

Stonehenge Partners, Inc.

Columbus, OH

marguelles@stonehengepartners.com

614-246-2490

Private Equity Investor

CONFERENCE ATTENDEES

15

Registered atendees as of December 20, 2013.

Download the conference mobile app to view the complete atendee list.

CONFERENCE ATTENDEES

16

Celine Armstrong

S&P Capital IQ

New York, NY

Carmstrong@spcapitaliq.com

212-438-1090

Info Services/Technology Specialists

David Asmus

Hinshaw & Culbertson LLP

Phoenix, AZ

dasmus@hinshawlaw.com

602-631-4400

Attorney

Muideen Alabi Ayoola

United Bank for Africa PLC

Ibadan, Nigeria

KAZY1424@yahoo.com

Accountant/CPA

Brooke Balcom

Fifth Third Bank

Cincinnati, OH

Brooke.Balcom@53.com

513-534-3853

Lender

Ben Barnes

RubinBrown LLP

Clayton, MO

ben.barnes@rubinbrown.com

314-678-3531

Accountant/CPA

= Member of AM&AA

Paula Barrett

Reinsel Kuntz Lesher LLP

Wyomissing, PA

pbarrett@rklcpa.com

610-898-8110

Accountant/CPA

Kimberley Batherson

CGA Nova Scotia

Halifax, Nova Scotia, Canada

kbatherson@halifaxgrain.com

902-425-4923

Accountant/CPA

Richard Baum

Consumer Growth Partners

White Plains, NY

rbaum@consumergrowth.com

914-220-8337

Private Equity Investor

Alexander Bean

Plexus Capital

Raleigh, NC

alex@plexuscap.com

919-256-6342

Private Equity Investor

Mike Becker

Plexus Capital

Raleigh, NC

mbecker@plexuscap.com

919-256-6342

Private Equity Investor

Christian Berger

Patton Boggs

Dallas, TX

cberger@pattonboggs.com

214-758-1544

Attorney

Howard Berkower

McCarter & English, LLP

New York, NY

hberkower@mccarter.com

212-609-6821

Attorney

Zoltan Berty

Caltius Mezzanine

Los Angeles, CA

zberty@caltius.com

310-996-0127

Private Equity Investor

Steven Besbeck, CM&AA

Diamond Capital Advisors

Calabasas, CA

sbesbeck@charter.net

310-432-8569

Investment Banker/Broker Dealer

Christian Blees, CM&AA

BiggsKofford Capital

Colorado Springs, CO

blees@biggskofford.com

719-579-9090

M and A Intermediary

= Member of AM&AA

Timothy Block

Harvey & Company

Newport Beach, CA

jjenkins@harveyllc.com

949-757-0400

M and A Intermediary

Debra Bower-Pinto

CGA Nova Scotia

Halifax, Nova Scotia, Canada

dpinto@consultpinto.com

902-425-4923

Accountant/CPA

Wilma Braat, CM&AA

MNP Corporate Finance

Calgary, Alberta, Canada

wilma.braat@mnp.ca

403-537-7632

M and A Intermediary

Austin Buckett, CM&AA

BiggsKofford, P.C.

Colorado Springs, CO

abuckett@biggskofford.com

719-579-9090

Investment Banker/Broker Dealer

Hector Bultynck

Peninsula Capital Partners

Detroit, MI

Bultynck@peninsulafunds.com

313-237-5105

Private Equity Investor

CONFERENCE ATTENDEES

17

Andrew Burgess

Marquette Business Credit, Inc.

Dallas, TX

andrew.burgess@marquette.com

214-389-5926

Lender

Andrew Bushell

Cornerstone Capital Holdings

Los Angeles, CA

abushell@cstonecapital.com

310-499-5670

Private Equity Investor

Keith Butcher

Butcher Joseph Hayes LLC

St Louis, MO

keith.butcher@butcherjoseph.com

314-558-5116

Investment Banker/Broker Dealer

Chad Byers, CM&AA

Brandywine Mergers & Acquisitions

Malvern, PA

cbyers@bma1.com

484-324-2597

M and A Intermediary

Anthony Calamunci

Roetzel & Andress

Toledo, OH

ACalamunci@Ralaw.com

419-254-5247

Attorney

= Member of AM&AA

K. Perry Campbell CM&AA

ACT Consultants, Inc.

Vancouver, WA 98662

360-696-9450

pcampbell@actconsultants.com

Kevin Carlie, CM&AA

Stone Carlie

St. Louis, MO

kcarlie@stonecarlie.com

314-889-1110

Accountant/CPA

Matthew Carroll

WestView Capital Partners

Boston, MA

mtc@wvcapital.com

617-261-2054

Private Equity Investor

Cesar Castaneda

Gallagher

Dallas, TX

cesar_castaneda@ajg.com

972-663-6188

Consultant

Chris Cathcart

The HalifaxGroup

Washington, DC

ccathcart@thehalifaxgroup.com

202-530-8319

Private Equity Investor

CONFERENCE ATTENDEES

18

Lewis Chan

Presidential Financial Corporation

Alpharetta, GA

lchan@presidentialnancial.com

770-723-7401

Lender

Teresa Cherry, CM&AA

The Family Wealth Collective

Chicago, IL

tcherry@familywealthcollective.com

312-540-9840

Financial Advisor

Anthony Citrolo, CM&AA

Strategic M&A Advisors/NYBB

Woodbury, NY

anthony@nybbinc.com

631-390-9650

M and A Intermediary

Jessica Clemence

Jordan Zalaznick Advisers

Chicago, IL

jclemence@jzadvisersinc.com

312-573-6437

Private Equity Investor

Ty Clutterbuck

Peninsula Capital Partners

Detroit, MI

clutterbuck@peninsulafunds.com

313-237-5110

Private Equity Investor

= Member of AM&AA

David Cohn, CM&AA

Diamond Capital Advisors LLC

Los Angeles, CA

dcohn@diamondcapadvisors.com

310-650-4304

Investment Banker/Broker Dealer

Stana Colovic

CGA Nova Scotia

Halifax, Nova Scotia, Canada

stana@cga-ns.org

902-425-4923

Corporate Executive

Scott Colvert

Trinity Hunt Partners

Dallas, TX

lmorris@trinityhunt.com

214-777-6603

Private Equity Investor

James Colyer

True North Companies

Scottsdale, AZ

jcolyer@tnch.com

617-314-7504

Private Equity Investor

Tom Compton

Fifth Third Bank - Structured Finance

Cincinnati, OH

tom.compton@53.com

513-534-6502

Lender

CONFERENCE ATTENDEES

19

Donald Connor

CGA Nova Scotia

Halifax, Nova Scotia, Canada

dconnor@cga-ns.org

902-425-4923

Accountant/CPA

Stephen Connor

Hamilton Robinson Capital Partners

Stamford, CT

sbc@hrco.com

203-602-0011

Private Equity Investor

Matthew Cook

Kidd & Company

Old Greenwich, CT

mcook@kiddcompany.com

203-661-0070

Private Equity Investor

Michael Corrigan

Corporate Value Metrics, LLC

Westborough, MA

mcorrigan@corporatevalue.net

508-870-5805

Management Consultant

Ranga Covindassamy

Business Development Asia

New York, NY

rcovindassamy@bdallc.com

212-265-5300

Investment Banker/Broker Dealer

= Member of AM&AA

Brooks Crankshaw

Highland Ridge Capital LLC

Chicago, IL

brooks@highlandridgecapital.com

312-775-2030

Investment Banker/Broker Dealer

Laura Crosby-Brown

Regulatory Compliance

Londonderry, NH

lcbrosbybrown@

regualtorycompliance.com

603-216-8918

Consultant

Amy Cross

StillPoint Capital

Tampa, FL

across@stillpointcap.com

813-891-9100

Investment Banker/Broker Dealer

John Curzon, CM&AA

CCK Capital Strategies, PLC

Tulsa, OK

john@cckcpa.com

918-491-4036

Accountant/CPA

Beth DaSilva

Fleetridge Pacic

San Diego, CA

bethd@eetridge.com

619-523-0303

M and A Intermediary

CONFERENCE ATTENDEES

20

Christine Davis

S&P Capital IQ

New York, NY

christine.davis@spcapitaliq.com

212-438-5579

Info Services/Technology Specialists

Nina De Guzman, CM&AA

VSP Global

Rancho Cordova, CA

ninade@vsp.com

916-851-7556

Analyst

Jerry Dentinger

BDO USA, LLP

Chicago, IL

jdentinger@bdo.com

312-239-9191

Consultant-Value/Growth

Kelly DePonte

Probitas Partners

San Francisco, CA

kkd@probitaspartners.com

415-704-2463

Private Equity Investor

Aarti Desai

S&P Capital IQ

Chicago, IL

adesai@spcapitaliq.com

312-233-7145

Info Services/Technology Specialists

= Member of AM&AA

Max DeZara

Akoya Capital

Chicago, IL

mdezara@akoyacapital.com

312-546-8322

Private Equity Investor

Richard Diamond

Strait Lane Capital Partners, LLC

Dallas, TX

richard.diamond@straitlanecapital.com

214-295-9574

Private Equity Investor

Debra Dickson

Deerpath Capital Management

Houston, TX

ddickson@deerpathcapital.com

713-936-5623

Lender

Elizabeth Di Cola

Fifth Third Bank, ESOP Finance Group

Chicago, IL

Elizabeth.DiCola@53.com

312-704-7132

Lender

Ralph Dieckmann

Integre Partners

Chicago, IL

dieckmann@integrepartners.com

312-488-4850

Business Broker

CONFERENCE ATTENDEES

22

Michael Dinan

Dinan & Company, LLC

Phoenix, AZ

mdinan@dinancompany.com

602-248-8700

Investment Banker/Broker Dealer

Jeff Dinerstein

Haynes and Boone, LLP

Houston, TX

jeff.dinerstein@haynesboone.com

713-547-2065

Attorney

Sandra Ditore

Family Ofce Exchange

Chicago, IL

sditore@familyofce.com

312-327-1233

Consultant

Timothy Dixon, CM&AA

Apex Consulting

Cayuga, IN

tim@apexconsulting.com

217-703-4974

Consultant-Value/Growth

Anthony Dolan

Prairie Capital Advisors, Inc.

Oakbrook Terrace, IL

adolan@prairiecap.com

630-413-5587

Investment Banker/Broker Dealer

= Member of AM&AA

Kevin Doyle

Intralinks

New York NY

kdoyle@intralinks.com

212-346-7601

Consultant

Dave Dozor

Dozor Enterprises, Inc.

Tucson, AZ

dave@dozor-enterprises.com

520-333-9231

Corporate Executive

Doug Ducey

Arizona State Treasurer

Phoenix, AZ

dougd@aztreasury.gov

602-542-7891

Christopher Dunlop

Houlihan Lokey

Los Angeles, CA

310-788-5307

cdunlop@hl.com

Investment Broker

Willis Eayrs, CM&AA

Stuttgart, Germany

weeayrs@hotmail.com

1.1491763829e+014

Consultant-Value/Growth

CONFERENCE ATTENDEES

23

Jennifer Ehlen

Thompson Street Capital Partners

St Louis, MO

jehlen@tscp.com

314-446-3316

Private Equity Investor

Evan Eichorn

OneSource Information Services

Concord, MA

evan.eichorn@onesource.com

978-318-4300

Info Services/Technology Specialists

Aziz El-Tahch

Stout Risius Ross

New York, NY

aeltahch@srr.com

212-400-7299

Daniel Elliott

SCA Advisors

Houston, TX

delliott@sunbelttexas.com

281-798-2910

M and A Intermediary

J. Michael Ertel, CM&AA

Legacy M&A Advisors, LLC

St Petersburg, FL

mertel@lmaallc.com

888-864-6610

M and A Intermediary

= Member of AM&AA

John Farr

Columbia West Capital

Scottsdale, AZ

jfarr@columbiawestcap.com

480-664-1381

Investment Banker

Thomas Farrell

Generational Equity, LLC

Dallas, TX

tfarrell@genequityco.com

972-232-1100

Investment Banker

Jason Faucett

Transition Capital Partners

Dallas, TX

jason@tcplp.com

214-978-3812

Private Equity Investor

Peter Feinberg

Hoge Fenton Jones & Appel

San Jose, CA

pdf@hogefenton.com

408-287-9501

Attorney

David Felts

Brookwood Associates

Atlanta, GA

Df@brookwoodassociates.com

404-419-1580

Investment Banker/Broker Dealer

CONFERENCE ATTENDEES

24

Derek Ferguson

Victory Park Capital

Chicago, IL

dferguson@vpcadvisors.com

312-705-4852

Private Equity Investor

Michael Ferreira

Maxim Integrated

San Jose, CA

mike.ferreira@maximintegrated.com

408-601-5433

M and A Intermediary

Gary Ferrell, CM&AA

Diamond Capital Advisors

Los Angeles, CA

gferrell@earthlink.net

3104-432-8579

Investment Banker/Broker Dealer

Jon Finger

Patton Boggs

Dallas, TX

jnger@pattonboggs.com

214-758-6697

Attorney

Bob Forbes

Forbes Mergers & Acquisitions

Greenwood Village, CO

bob@forbesma.com

303-770-6017

M and A Intermediary

= Member of AM&AA

Steven Forleiter

Webster Business Credit, Corp.

Marlboro, NJ

sforleiter@websterbcc.com

732-585-0535

Lender

Graeme Frazier

Private Capital Research LLC / GF Data

Conshohocken, PA

bgfrazier@pcrllc.com

610-825-1153

Private Equity Investor

Patricia Freitas Fuoco

Pacheco Neto Sanden Teisseire

Advogados

So Paulo, Brazil

pfreitas@pnst.com.br

5.511389744e+011

Attorney

Walker French

Statesman Corporate Finance

Houston, TX

wfrench@statesmanbiz.com

713-595-1352

Investment Banker/Broker Dealer

Seth Friedman

RLJ Credit Opportunity Fund, L.P.

Bethesda, MD

sfriedman@rljcredit.com

240-744-7853

Private Equity Investor

CONFERENCE ATTENDEES

25

Juliana G. Meyer Gottardi

Pacheco Neto Sanden Teisseire

Advogados

So Paulo, Brazil

jmeyer@pnst.com.br

5.511389744e+011

Attorney

Clint Gage

Roetzel & Andress

Ft Lauderdale, FL

cgage@ralaw.com

954-759-2760

Attorney

Dennis Gano

Exit Planning Institute

Algonquin, IL

gano@exit-planning-institute.org

847-458-2124

Consultant-Value/Growth

Sri Geedipalli, CM&AA

Simanor

New York, NY

sgeedipalli@simanor.com

646-340-2040

M and A Intermediary

Daniel Geisler

Mergermarket

New York, NY

daniel.geisler@mergermarket.com

646-378-3140

Corporate Executive

= Member of AM&AA

Philip Gilbert

P&M Corporate Finance, LLC

Southeld, MI

phil.gilbert@pmcf.com

248-223-3326

Investment Banker/Broker Dealer

Scott Gluck

Venable LLP

Washington, DC

sgluck@venable.com

202-344-4426

Adam Goddard

Morgan Stanley

North Potomac, MD

adam.goddard@ms.com

301-961-1826

Chris Godwin

Gen Cap America

Nashville, TN

cgodwin@gencapamerica.com

615-256-0231

Private Equity Investor

Tom Goldblatt

Ravinia Capital LLC

Chicago, IL

tgoldblatt@raviniacapitalllc.com

773-336-2833

CONFERENCE ATTENDEES

26

Benjamin Gould

Masuda, Funai, Eifert & Mitchell, Ltd.

Chicago, IL

BGould@masudafunai.com

312-245-7498

Attorney

Andrew Greenberg

GF Data Resources LLC

W. Conshohocken, PA

atg@gfdataresources.com

610-260-6239

Investment Banker/Broker Dealer

Michael Greer

McGladrey LLP

Phoenix, AZ

michael.greer@mcgladrey.com

602-636-6000

Accountant/CPA

Matt Greeson

Greene Holcomb Fisher

Scottsdale, AZ

mgreeson@ghf.net

480-348-1525

Investment Banker/Broker Dealer

Kirk Griswold

Argosy Capital

Wayne, PA

kirk@argosycapital.com

610-971-9685

Private Equity Investor

= Member of AM&AA

Andri Gunnarsson

DealMarket AG

Zurich, Switzerland

andri@dealmarket.com

+41 43 888 75 30

Info Services/Technology Specialists

Robert Gurrola, CM&AA

Summa Financial Group, LLC.

San Jose, CA

rgurrola@summallc.com

408-454-2600

M and A Intermediary

Jaime Guzman-Fournier

JGF Financial, Inc.

San Diego, CA

jgf@jgfnancial.com

858-750-3509

Private Equity Investor

Travis Haley

Main Street Capital Corporation

Houston, TX

thaley@mainstcapital.com

713-350-6000

Private Equity Investor

Nancy Halwig

UPS Capital Global Supply Chain

Finance

Atlanta, GA

nhalwig@ups.com

404-828-7912

Lender

CONFERENCE ATTENDEES

28

Carol Hance

LongueVue Capital, LLC

Metairie, LA

chance@lvcpartners.com

646-660-3994

Private Equity Investo

Shane Hansen

Warner Norcross & Judd

Grand Rapids, MI

ltuttlemeasure@wnj.com

616-752-2492

Attorney

Jeri Harman

Avante Mezzanine Partners

Los Angeles, CA

jharman@avantemezzanine.com

310-667-9244

Private Equity Investor

Nathan Harnetiaux

Kemper Corporation

Chicago, IL

nharnetiaux@kemper.com

312-661-4600

Private Equity Investor

David Harvey

Harvey & Company LLC

Newport Beach, CA

dharvey@harveyllc.com

949-757-0400

M and A Intermediary

= Member of AM&AA

Chris Haskett

Graco Inc.

Minneapolis, MN

chaskett@graco.com

612-623-6026

Corporate Executive

Patrick Healy

C3 Capital

Kansas City, MO

phealy@c3cap.com

816-756-2225

Private Equity Investor

Calvin Hedman, CM&AA

Hedman M&A

Valencia, CA

calvin.hedman@hedmanpartners.com

661-287-6333

Investment Banker/Broker Dealer

Loren Heger

FNEX

Indianapolis, IN

lheger@fnex.com

317-468-9899

Investment Banker/Broker Dealer

Warren Henson

Green Manning & Bunch

Denver, CO

whenson@gmbltd.com

303-592-4800

Investment Banker/Broker Dealer

CONFERENCE ATTENDEES

29

Barbara Hernandez

Evolution Capital Partners

Cleveland, OH

bhernandez@evolutioncp.com

216-593-0402

Private Equity Investor

Ken Heuer

Kidd & Company

Old Greenwich, CT

kheuer@kiddcompany.com

203-661-0070

Private Equity Investor

Barrett Hicken, CM&AA

Potens Capital Advisors

Salt Lake City, UT

bhicken@potenscapital.com

801-988-5908

M and A Intermediary

Jim Hill

Benesch

Cleveland, OH

jhill@Beneschlaw.com

216-363-4444

Attorney

Rob Hill

IronRock Capital Partners

St Louis, MO

rhill@ironrockcap.com

314-200-2626

Private Equity Investor

= Member of AM&AA

Don Hillier

Harvest CFO

Cleveland, OH

dhillier@harvestcfo.com

724-316-4752

Corporate Executive

Peter Hlavin

TriVista

Aliso Viejo, CA

peter.hlavin@trivista.com

949-218-4830

Consultant-Value/Growth

Milwood Hobbs, Jr.

Oaktree Capital Management, L.P.

New York, NY

mhobbs@oaktreecapital.com

212-284-7893

Capital Markets Lender

Aleece Hobson

Hollinden | Professional Services

Marketing

Houston, TX

aleece@hollinden.com

713-520-5532

Marketing Specialist

Reagan Hogerty

Jordan/Zalaznick Advisers, Inc.

Chicago, IL

rhogerty@jordanind.com

312-573-6434

Private Equity Investor

CONFERENCE ATTENDEES

30

Jeremy Holland

The Riverside Company

Santa Monica, CA

jholland@riversidecompany.com

310-499-5080

Private Equity Investor

Christine Hollinden, CPSM

Hollinden | Professional Services

Marketing

Houston, TX

christine@hollinden.com

713-520-5532

Professional Services Marketer

Matthew Hook

Centereld Capital Partners

Indianapolis, IN

matt@centereldcapital.com

317-237-2324

Private Equity Investor

Rich Horgan

Regulatory Compliance

Londonderry, NH

sv@regulatorycompliance.com

603-216-8919

Consultant-Value/Growth

Jarrett Horne

Citrix ShareFile

Raleigh, NC

janna.hamm@citrix.com

919-745-6160

Info Services/Technology Specialists

= Member of AM&AA

Jonathan Howe

Wedbush Securities

Los Angeles, CA

jon.howe@wedbush.com

213-688-4367

Investment Banker/Broker Dealer

Matthew Hricko

Stout Risius Ross, Inc.

New York, NY

mhricko@srr.com

646-807-4224

Business Valuator

Jason Hubbard

KLH Capital

Tampa, FL

jason@klhcapital.com

813-222-0160

Private Equity Investor

David Hugenberg

BNY Mellon

Houston, TX

David.Hugenberg@bnymellon.com

281-796-2428

Other

Lisa Hulme

Prevail Capital, LLC

Naples, FL

prevailcapital@gmail.com

239-234-1169

Investment Banker/Broker Dealer

CONFERENCE ATTENDEES

32

Carroll Hurst

Keiter

Richmond, VA

churst@keitercpa.com

804-273-6204

Accountant/CPA

Jack Isaacs

RLJ Equity Partners

Los Angeles, CA

jisaacs@rljequity.com

323-422-4686

Private Equity Investor

John Iwanski

Riveron Consulting

Chicago, IL

john.iwanski@riveronconsulting.com

312-262-3661

Accountant/CPA

Zaida Jackson

StillPoint Capital

Tampa, FL

zjackson@stillpointcap.com

813-891-9100

Investment Banker/Broker Dealer

Fred Jager, CM&AA

Hunter Wise Financial Group

Irvine, CA

fjager@hunterwise.com

949-732-4100

Investment Banker/Broker Dealer

= Member of AM&AA

Fayyaz Ahmed Jarral

CKA&Associates International

Islamabad, Pakistan

fayyazjarral@gmail.com

9.2333517999e+011

Accountant/CPA

Robert Jensen

McGladrey & Pullen, LLP

Chicago, IL

bob.jensen@mcgladrey.com

312-634-4300

Accountant/CPA

John Jester

Audax Group

Boston, MA

jcjester@audaxgroup.com

617-859-1509

Private Equity Investor

Robert Jirovec

Acuity Capital Network

Las Vegas, NV

rjirovec@acuitycapitalnetwork.com

702-220-3170

Investment Banker/Broker Dealer

Jim Johnson

Marquette Business Credit, Inc.

Dallas, TX

jim.johnson@marquette.com

214-389-5906

Lender

CONFERENCE ATTENDEES

33

Andy Jones

PEI Services

Austin, TX

ajones@peiservices.com

512-777-1010

Info Services/Technology Specialists

Mark Jones

River Associates Investments, LLC

Chattanooga, TN

mjones@riverassociatesllc.com

423-755-0888

Private Equity Investor

Jeff Kadlic

Evolution Capital Partners

Cleveland, OH

jkadlic@evolutioncp.com

216-593-0402

Private Equity Investor

Justin Kaplan

Balance Point Capital Partners

Westport, CT

jkaplan@balancepointcapital.com

203-652-8264

Private Equity Investor

Adam Keck

Gibraltar Business Capital, LLC

Scottsdale, AZ

akeck@gibraltarbc.com

480-440-2496

Lender

= Member of AM&AA

Michael Keck, CM&AA

Five Talents Financial Group

Somerset, KY

mkeck@vetalentsnancialgroup.com

859-333-7932

M and A Intermediary

Steve Keck, CM&AA

Five Talents Financial Group

Somerset, KY

jencomaskeck@gmail.com

859-333-7932

M and A Intermediary

Aldy Keene

Loyalty Research Center

Indianapolis, IN

akeene@loyaltyresearch.com

317-465-1990

Consultant-Value/Growth

Michael Kelley

Merion Investment Partners

Radnor, PA

mkelley@merionpartners.com

610-230-0939

Private Equity Investor

Thomas Kesoglou

McCarter & English, LLP

New York, NY

tkesoglou@mccarter.com

212-609-6821

Attorney

CONFERENCE ATTENDEES

34

Don Keysser, CM&AA

Hannover Ltd.

Bloomington, MN

don@hannoverconsulting.com

612-710-0995

M and A Intermediary

Todd Kinney

BDO USA, LLP

New York, NY

tkinney@bdo.com

212-885-7485

Consultant-Value/Growth

Brian Kinsman

Bunker Hill Capital

San Diego, CA

brian.kinsman@bunkerhillcapital.com

858-793-4560

Private Equity Investor

Joseph Knowles

Dragonswood Advisors, Inc.

Pittsburgh, PA

joseph.knowles@att.net

412-258-2073

Other

Michael Kornman

NCK Capital

Dallas, TX

michael@nckcapital.com

469-995-9692

Private Equity Investor

= Member of AM&AA

Eric Korsten

Branford Castle, Inc.

New York, NY

ekorsten@branfordcastle.com

212-317-2219

Private Equity Investor

Wade Kozich

GBQ Partners LLC

Columbus, OH

wkozich@gbq.com

614-221-1120

Accountant/CPA

Ted Kramer

Hammond, Kennedy, Whitney & Co., Inc.

Indianapolis, IN

tk@hkwinc.com

317-705-8735

Private Equity Investor

Brent Kulman

BB&T Capital Partners

Winston-Salem, NC

bkulman@bbandt.com

336-733-0354

Private Equity Investor

Heather La Freniere

Gibraltar Business Capital, LLC

Northbrook, IL

heatherl@gibraltarbc.com

224-374-1517

Lender

CONFERENCE ATTENDEES

35

Michael Landers

UHY, LLP

Houston, TX

mlanders@uhy-us.com

713-407-3223

Accountant/CPA

Ross Landreth, CM&AA

Medical Valuations, Inc.

Phoenix, AZ

ross@medicalvaluations.com

480-529-3057

Business Valuator

Steven LaTourette

McDonald Hopkins

Washington, DC

slatourette@mhgsdc.com

202-559-2620

Corporate Executive

Benjamin Lau

Acctone Business Consulting Limited

Sheung Wan, Hong Kong

ben@acctone.com

852-60100061

Accountant/CPA

Josh Lawler

Zuber Lawler & Del Duca LLP

Los Angeles, CA

jlawler@zuberlaw.com

213-596-5620

Attorney

= Member of AM&AA

Fanfu Li

Actuant Corporation

Menomonee Falls, WI

fanfu.li@actuant.com

2622931917

Corporate Executive

Bruce Lipian

StoneCreek Capital

Irvine, CA

bruce@stonecreekcapital.com

949-752-4580

Private Equity Investor

Dan Lipson

Rotunda Capital Partners

Bethesda, MD

dl@rotundacapital.com

240-482-0609

Private Equity Investor

Alex Livingston

Redwood Management Partners

San Francisco, CA

alex@redwoodmp.com

415-952-7593

Investment Management

William Loftis, CM&AA

Blue River Financial Group, Inc.

Grand Blanc, MI

wloftis@blueriverfg.com

810- 694-9520

Investment Banker/Broker Dealer

CONFERENCE ATTENDEES

37

Joseph Logan

Pinnacle Group International

Carefree, AZ

jlogan@pinnaclegroup.com

480-994-6170

Other

Mark Looft

Cole Taylor Business Capital

Irvine, CA

mlooft@coletaylor.com

949-606-5227

Lender

Torben Luth

JZ International

London, United Kingdom

Torben@jzieurope.com

+44 207 491 3633

Private Equity Investor

Joe Maas, CM&AA

Synergetic Finance

Seattle, WA

joe@synergeticnance.com

206-386-5455

Financial Advisor

Robert Machiz

MoneySoft Inc.

Phoenix, AZ

machiz@moneysoft.com

602-266-7710

= Member of AM&AA

Ben Mackay

Evolve Capital

Dallas, TX

ben@evolvecapital.com

214-220-4801

Private Equity Investor

Kyle Madden

KLH Capital

Tampa, FL

kyle@klhcapital.com

813-222-0160

Private Equity Investor

Heather Madland

Huron Capital Partners

Detroit, MI

hmadland@huroncapital.com

313-962-5800

Private Equity Investor

Anthony J. Madonia

Anthony J. Madonia & Associates, Ltd.

Chicago, IL

tony@madonia.com

312-578-9300

Attorney

David Magdol

Main Street Capital Corporation

Houston, TX

dmagdol@mainstcapital.com

713-350-6000

Private Equity Investor

CONFERENCE ATTENDEES

38

Tim Mages

Salem Halifax Capital Partners, LP

Atlanta, GA

tmages@salemcapital.com

770-790-5053

Private Equity Investor

Ann Mahon

Intralinks

New York, NY

amahon@intralinks.com

212-346-7601

Info Services/Technology Specialists

Dan Mahoney

CMF Associates, LLC

Philadelphia, PA

dmahoney@cmfassociates.com

215-531-7493

M and A Intermediary

Cary Mailandt

Montgomery Coscia Greilich LLP

Plano, TX

cary.mailandt@mcggroup.com

972-748-0262

Consultant-Value/Growth

Justine Mannering

Business Development Asia

New York, NY

jmannering@bdallc.com

212-265-5300

Investment Banker/Broker Dealer

= Member of AM&AA

Kenneth Marks, CM&AA

High Rock Partners, Inc.

Raleigh, NC

khmarks@att.net

919-256-8152

M and A Intermediary

Peter Martin, CM&AA

Kennedy and Coe

Loveland, CO

pmartin@kcoe.com

970-685-3419

M and A Intermediary

Nancy Martinez

Dinan & Company, LLC

Phoenix, AZ

nmartinez@dinancompany.com

602-248-8700

Investment Banker/Broker Dealer

Charles Maskell

Chesapeake Corporate Advisors

Baltimore, MD

cmaskell@ccabalt.com

410-537-5988

Business Valuator

Devin Mathews

Chicago Growth Partners

Chicago, IL

dmathews@cgp.com

312-698-6312

Private Equity Investor

CONFERENCE ATTENDEES

39

Nelson (JR) Matthews

Tregaron Capital Co.

Palo Alto, CA

matthews@tregaroncapital.com

650-403-2085

Private Equity Investor

Eric Mattson

Excellere Partners

Denver, CO

emattson@excellerepartners.com

303-765-2371

Private Equity Investor

Joel Mayersohn

Roetzel & Andress

Ft Lauderdale, FL

jmayersohn@ralaw.com

954-759-2763

Attorney

Bob McDonald, CM&AA

Briggs & Veselka Co.

Houston, TX

bmcdonald@bvccpa.com

713-667-9147

Accountant/CPA

David McGuire

Trinity Industries, Inc.

Dallas, TX

david.mcguire@trin.net

214-589-8086

Corporate Executive

= Member of AM&AA

Rich McMenamin

CliftonLarsonAllen LLP

Oak Brook, IL

richard.mcmenamin@claconnect.com

630-954-8107

Accountant/CPA

Scott McRill

SS&G, Inc.

Solon, OH

smcrill@ssandg.com

440-248-8787

M and A Intermediary

Jeffrey Miller

Valuation Research Corporation

New York, NY

jmiller@valuationresearch.com

212-983-3370

Business Valuator

Cory Mims

ICV Partners

New York, NY

cmims@icvpartners.com

212-455-9609

Private Equity Investor

Jonathan Moore

Flackman, Goodman & Potter, P.A.

Ridgewood, NJ

jcm@fgpcpa.com

201-639-5746

Accountant/CPA

CONFERENCE ATTENDEES

40

Joseph Morris

Private Capital Research LLC

Conshohocken, PA

jmorris@pcrllc.com

610-825-1193

Private Equity Investor

Kerry Morris, CM&AA

Shoreline Partners, LLC

San Diego, CA

kmorris@shoreline.com

858-587-9800

Investment Banker/Broker Dealer

Kathy Nalywajko

Legg Mason Investment Counsel

New York, NY

Klnalywajko@lmicglobal.com

212-554-7160

Financial Advisor

Jordan Nickerson

DealMarket AG

Zurich, Switzerland

jordan@dealmarket.com

+41 43 888 75 30

Info Services/Technology Specialists

Dennis Niven, CM&AA

B2B CFO

Scottsdale, AZ

dniven@b2bcfo.com

480-766-3198

Consultant-Value/Growth

= Member of AM&AA

Paul Novak

Iron Rock Capital Partners

St. Louis, MO

paul.novak@capitalforbusiness.com

314-746-7427

Private Equity Investor

Richard M. Oblath

Shell Downstream Inc.

London, United Kingdom

richard.oblath@shell.com

+44 207 934 5407

Corporate Executive

Walter OHaire

Valuation Research Corporation

San Francisco, CA

wohaire@valuationresearch.com

415-513-4777

Business Valuator

Tim Oleszczuk

Grace Matthews, Inc.

Milwaukee, WI

timo@gracematthews.com

414-278-1120

Investment Banker/Broker Dealer

Robert L. Palmer

Community Bankers Association of Ohio

Columbus, OH

rlpalmer@cbao.com

614-846-2349

Consultant-Value/Growth

CONFERENCE ATTENDEES

41

Brett Parr

Capital For Business

St. Louis, MO

brett.parr@capitalforbusiness.com

314-746-7427

Private Equity Investor

Andrew Peix

Serent Capital

San Francisco, CA

andrew.peix@serentcapital.com

415-343-1028

Private Equity Investor

Andrew Pendleton, CM&AA

Montgomery Coscia Greilich LLP

Plano, TX

andrew.pendleton@mcggroup.com

972-748-0283

Consultant-Value/Growth

Stephen B. Perry

Linsalata Capital Partners

Mayeld Heights, OH

sperry@linsalatacapital.com

440-684-1400

Private Equity Investor

Barry Peterson

Northcreek Mezzanine

Cincinnati, OH

bpeterson@northcreekmezzanine.com

513-985-6601

Private Equity Investor

= Member of AM&AA

Christopher Petrossian

Lincoln International

Los Angeles, CA

cpetrossian@lincolninternational.com

213-283-3703

Investment Banker/Broker Dealer

Ren Pettinelli

IronRock Capital Partners

St Louis, MO

rpettinelli@ironrockcap.com

314-200-2626

Private Equity Investor

Michael Pfeffer

Post Capital Partners

New York, NY

mpfeffer@postcp.com

212-888-5700

Private Equity Investor

Dan Phelan

Merrill DataSite

Los Angeles, CA

dan.phelan@merrillcorp.com

213 253 2139

Info Services/Technology Specialists

Paul Pillat, CM&AA

Cornerstone Business Services Inc.

Green Bay, WI

ppillat@cornerstone-business.com

920-436-9890

M and A Intermediary

CONFERENCE ATTENDEES

42

Richard Prestegaard

High Road Capital Partners

New York, NY

rprestegaard@highroadcap.com

212-554-3270

Private Equity Investor

Carr Preston

Akoya Capital Partners, LLC

Chicago, IL

cpreston@akoyacapital.com

312-546-8312

Private Equity Investor

Daniel Prisciotta

Equity Stragies Group

Paramus, NJ

Dan.Prisciotta@lfg.com

201-556-4502

Financial Advisor

Fredric Prohov, CM&AA

Prohov & Assoicates, Ltd.

Chicago, IL

rprohov@paalaw.com

312-807-3965

Attorney

Donnie Quist, CM&AA

Hood Engineering & Technical

Calgary, Alberta, Canada

dquist@hoodgroup.ca

780-975-0787

Corporate Executive

= Member of AM&AA

Brendan Rampi

S&P Capital IQ

Chicago, IL

brampi@spcapitaliq.com

212-438-5579

Info Services/Technology Specialists

Kay Ranade

Loyalty Research Center

Indianapolis, IN

KRanade@LoyaltyResearch.com

317-465-1990

Consultant/Value Growth

Colin Raws

Boathouse Capital

Wayne, PA

colin.raws@boathousecapital.com

610-688-6314

Private Equity Investor

Christopher Reap

True North Companies

Scottsdale, AZ

creap@tnch.com

617-314-7504

Private Equity Investor

Euan Rellie

Business Development Asia

New York, NY

erellie@bdallc.com

212-265-5300

Investment Banker/Broker Dealer

CONFERENCE ATTENDEES

43

Nicholas Renter

Merrill DataSite

Dallas, TX

nicholas.renter@merrillcorp.com

214-754-2100

Info Services/Technology Specialists

Christopher Reuscher

Roetzel & Andress

Akron, OH

creuscher@ralaw.com

330-762-7994

Attorney

Max Reviakin

Sutton Place Strategies

New York, NY

mreviakin@suttonplacestrategies.com

917-407-6407

Info Services/Technology Specialists

Chuck Richards

CoreValue Software

Norwich, VT

crichards@corevaluesoftware.com

800-640-1848

Info Services/Technology Specialists

Fritz Richards

Prestwick Partners, LLC

Minneapolis, MN

fritz@prestwickpartners.net

612-339-6115

Investment Banker/Broker Dealer

= Member of AM&AA

Billy Richardson

TBSI Consulting

Waco, TX

brichardson@tbsiconsulting.com

254-757-1709

Consultant-Value/Growth

Joseph Rippe, CM&AA

Rippe & Kingston Capital Advisors

Cincinnati, OH

jrippe@rippe.com

513-977-4528

Business Valuator

Douglas Robbins, CM&AA

Robbinex Inc.

Hamilton, Ontario, Canada

dmr@robbinex.com

905-523-7510

Business Broker

Michael Roberts

Roberts McGivney Zagotta LLC

Chicago, IL

mroberts@rmczlaw.com

312-251-2295

Attorney

Christopher Roden

C3 Capital, LLC

Scottsdale, AZ

croden@c3cap.com

203-913-1621

Private Equity Investor

CONFERENCE ATTENDEES

44

RALAW.COM

ROETZEL & ANDRESS,

A LEGAL PROFESSIONAL ASSOCIATION

CHICAGO WASHINGTON, D.C. CLEVELAND TOLEDO AKRON COLUMBUS CINCINNATI

ORLANDO FORT MYERS NAPLES FORT LAUDERDALE TALLAHASSEE NEW YORK

STRATEGY MATTERS

What are your business goals? How do you plan to accomplish them?

Your strategy for business growth matters, and the experienced corporate

lawyers at Roetzel will collaborate with you to develop and execute a

customized plan designed to unlock value at your enterprise. At Roetzel,

we advise our clients through the entirety of the lifecycle, from early stage,

entrepreneurial companies to high-growth private companies and publicly

traded entities. Whether the growth you seek is domestic or international,

organic or driven by acquisitions, our attorneys are here to propose

innovative solutions and assist you every step of the way.

Our team of talented lawyers guides clients to identify the right deal

opportunities, meticulously execute on complex transactions and

effectively plan for post-transaction integration. We also provide

comprehensive counsel on sophisticated issues in securities, tax,

corporate governance, compliance, anti-trust, executive

compensation, labor and employment.

Strategy matters.

For more information, visit us at

ralaw.com/mergers_acquisitions.

R&A_12-301_GFI-46.indd 1 12/19/13 2:25 PM

Tony Roe

The Independence Group

Folsom, CA

troe@independencegroup.com

916-458-7356

M and A Intermediary

Michael Rosenbaum

Quadrant Five

Chicago, IL

michael@quadrantvefocus.com

312-582-4470

Consultant-Value/Growth

Peter Rothschild

Tamarix Capital Corp.

New York, NY

prothschild@tamarixcapital.com

212-419-2858

Private Equity Investor

Ronald Rudich, CM&AA

Gorne Schiller & Gardyn, P.A.

Owings Mills, MD

rrudich@gsg-cpa.com

410-517-6838

Business Valuator

Jeff Sackman

RubinBrown LLP

Clayton, MO

jeff.sackman@rubinbrown.com

314-290-3406

Accountant/CPA

= Member of AM&AA

Allison Salo

S&P Capital IQ

Chicago, IL

asalo@spcapitaliq.com

212-438-5579

Info Services/Technology Specialists

Bud Sandberg, CM&AA

Wals & Associates, Ltd.

Minneapolis, MN

wals@pro-ns.net

952-525-2260

Consultant-Value/Growth

George Sandmann

CoreValue Software

Norwich, VT

gsandmann@corevaluesoftware.com

800-640-1848

Info Services/Technology Specialists

Steve Sangalis

Progress Equity Partners

Englewood, CO

steve@progressequity.com

303-297-1701

Private Equity Investor

Eddie Santillan

Redwood Management Partners

San Francisco, CA

eddie@redwoodmp.com

415-952-7593

Private Equity Investor

CONFERENCE ATTENDEES

46

CONFERENCE ATTENDEES

Adam Schecter

Geneva Glen Capital

Chicago, IL

aschecter@genevaglencapital.com

312-525-8502

Private Equity Investor

Janet Scherr

The Independence Group

Folsom, CA

jscherr@independencegroup.com

916-458-7356

M and A Intermediary

Erich Schmid, CM&AA

Business Intermediary Services, Ltd.

Fairview, NC

ekschmid@prodigy.net

828-333-9729

M and A Intermediary

Ian Schnider

Fortress Investment Group

Los Angeles, CA

ischnider@fortress.com

310-228-3014

Lender

David Schweikert

Arizona, 6th District

U.S. House of Representatives

Scottsdale, AZ

480-946-2411

= Member of AM&AA

Conner Searcy

Trive Capital

Dallas, TX

connersearcy@trivecapital.com

214-499-9722

Private Equity Investor

Ted Sengpiel

Merrill DataSite

St Louis, MO

ted.sengpiel@merrillcorp.com

314-315-2909

Info Services/Technology Specialists

Sameer P. Sethi

Sethi Petroleum

Plano, TX

ahmad@sethi-fg.com

972-509-9100

Corporate Executive

Michael Sharkey

Cole Taylor Business Capital

Rosemont, IL

msharkey@coletaylor.com

262-827-4670

Other

Sid Shaver, CM&AA

Sid Shaver

Statesman Corporate Finance LLC

Houston, TX

sshaver@statesmanbiz.com

713-590-4697

Investment Banker/Broker Dealer

47

CONFERENCE ATTENDEES

Terence Shepherd, CM&AA

ROCG

Framingham, MA

terry@sgllp.com

617-412-4640

Consultant-Value/Growth

Linda Shepro

FDX Capital

Chicago, IL

lshepro@fdxcapital.com

312-327-1221

Investment Banker/Broker Dealer

Jonathan Siebers, CM&AA

Smith Haughey Rice & Roegge

Grand Rapids, MI

jsiebers@shrr.com

616-458-5298

Attorney

Scott Siegel

PineBridge

New York, NY

scott.siegel@pinebridge.com

646-857-8661

Private Equity Investor

Lawrence Simon

Clearview Capital, LLC

Los Angeles, CA

lsimon@clearviewcap.com

310-806-9555

Private Equity Investor

= Member of AM&AA

Santiago Simon del Burgo, CM&AA

ESADE Business School

Barcelona, Spain

santiago.simon@esade.edu

34 932806162

M and A Intermediary

James Simpson, CM&AA

Finance 500, Inc.

Irvine, CA

jsimpson@cfg.nance500.com

949-502-6814

Investment Banker/Broker Dealer

Eric Sloane

Southeld Mezzanine Capital

Los Angeles, CA

esloane@southeldmezz.com

310-473-7900

Lender

Pryor Smartt

Lead Capital Partners

Nashville, TN

psmartt@leadcp.com

615-499-6164

Private Equity Investor

Michael Smiggen

BMO Harris Bank

Phoenix, AZ

mike.smiggen@bmo.com

602-650-3816

Lender

48

CONFERENCE ATTENDEES

Megan Sneed

Burch & Company, Inc.

Kansas City, MO

jenburch@burchco.com

816-842-4660

Broker Dealer

Christopher Snider

Exit Planning Institute

Algonquin, IL

csnider@exit-planning-institute.org

847-458-2124

M and A Intermediary

Michael Snider, CM&AA

MSB Global Business Alliance

Atlanta, GA

mrs@msbllc.net

404-378-7707

Robert Socol

Stout Risius Ross, Inc.

Chicago, IL

rsocol@srr.com

312-752-3335

Business Valuator

Brent Solomon, CM&AA

Brent Solomon

CohnReznick LLP

Bethesda, MD

brent.solomon@cohnreznick.com

301-280-3658

Business Valuation

= Member of AM&AA

Astrid Soto

Audax Group

Boston, MA

asoto@audaxgroup.com

617-859-1625

Private Equity Investor

Bruce Sprenger

Cole Taylor Business Capital

Brookeld, WI

bsprenger@coletaylor.com

262-827-4670

Private Equity Investor

Ira Starr

Long Point Capital

New York, NY

istarr@longpointcapital.com

212-593-1800

Private Equity Investor

Kristen Steagall

Axial

New York, NY

kristen.steagall@axial.net

917-639-5328

M and A Intermediary

Brian Steffens, CM&AA

Storm Industries, Inc.

Torrance, CA

bsteffens@ipdparts.com

310-602-5312

Business Development

49

Ideas Relationships Results

The Rainmaker Companies is

the leading provider of alliance,

consulting and training services

in the accounting industry.

We help you face todays

unique challenges with proven

solutions that help accounting

firms grow.

For more information, please visit

www.therainmakercompanies.com

or call us on 615-373-9880

CONFERENCE ATTENDEES

Scott Stepanik

CapTarget

San Diego, CA

s.stepanik@captarget.com

888-952-1777

Private Equity Investor

Nicholas Stone

Cyprium Investment Partners

Chicago, IL

nstone@cyprium.com

312-283-8801

Private Equity Investor

Harvey Strode, CM&AA

Hunter Wise Financial Group;

UCBB Capital & Financial Solutions

Diamond Bar, CA

h.strode@gmail.com

909-268-7530

Investment Banker/Broker Dealer

Jacob Sturdy

IronRock Capital Partners

St Louis, MO

jsturdy@ironrockcap.com

314-200-2626

Private Equity Investor

Joseph Svitek

Ash Brokerage

Fort Wayne, IN

joe.svitek@ashbrokerage.com

260-434-9745

Accountant/CPA

= Member of AM&AA

Benjamin Sykora

Bow River Capital Partners

Denver, CO

sykora@bowrivercapital.com

303-861-8466

Private Equity Investor

Justin Teich

Brandywine Mergers & Acquisitions

Malvern, PA

jteich@bma1.com

484-534-8600

M and A Intermediary

Kelci Thomasco

IronRock Capital Partners

St Louis, MO

kthomasco@ironrockcap.com

314-200-2626

Private Equity Investor

Andrew Thompson

Wafra Partners

New York, NY

a.thompson@wafra.com

212-759-3700

Private Equity Investor

John Thornton

Tregaron Capital Co.

Palo Alto, CA

thornton@tregaroncapital.com

650-403-2082

Private Equity Investor

51

CONFERENCE ATTENDEES

Lorelei Tolson

Oxford Financial Group

Indianapolis, IN

ltolson@ofgltd.com

317-805-5134

Financial Advisor

Richard Truelick

Beatrice Foods Co.

Truelick Associates

Phoenix, AZ

602-225-2000

Justin Unertl

Excellere Partners

Denver, CO

junertl@excellerepartners.com

303-765-2416

Private Equity Investor

Donald VanderZwaag, CM&AA

Rua Associates

Grand Rapids, MI

don@ruaassociates.com

616-610-9705

M and A Intermediary

Raul Varela

Merrill DataSite

Los Angeles, CA

Raul.Varela@merrillcorp.com

720-264-1423

Info Services/Technology Specialists

= Member of AM&AA

David Vavrichek

Deerpath Capital Management, LP

New York, NY

dvavrichek@deerpathcapital.com

646-786-1023

Lender

Michael Vermillion

NAVEX Global

New York, NY

mvermillion@navexglobal.com

908-781-1825

Kurt Viehl

Mergermarket

New York, NY

kurt.viehl@mergermarket.com

646-378-3140

Corporate Executive

Anthony Walker, CM&AA

TE Connectivity

Fort Mill, SC

stocks12@gmail.com

860-208-8949

Corporate Executive

Richard Ward

Stifel Nicolaus

Irvine, CA

wardr@stifel.com

949-271-5110

Financial Advisor

52

53

CONFERENCE ATTENDEES

Holly Washington

S&P Capital IQ

New York, NY

hwashington@spcapitaliq.com

212-438-2286

Info Services/Technology Specialists

Jennifer Watson

Masuda, Funai, Eifert & Mitchell, Ltd.

Chicago, IL

jwatson@masudafunai.com

312-245-7500

Attorney

Bob Wegbreit

GF Data Resources

West Conshohocken, PA

bw@gfdataresources.com

610-260-6263

Consultant-Value/Growth

Jessica Whitman

Houston, TX

Main Street Capital Corporation

jwhitman@mainstcapital.com

713-350-6000

Private Equity Investor

Michael Wilkins

Harris Williams & Co.

San Francisco, CA

mwilkins@harriswilliams.com

415-288-4260

M and A Intermediary

Larry Willis

The Independence Group

Folsom, CA

lwillis@independencegroup.com

916-458-7356

M and A Intermediary

= Member of AM&AA

Jonathan Wilson

Siguler Guff

Boston, MA

jwilson@sigulerguff.com

617-648-2100

Jay Winkler

Entrada Group

Chicago, IL

jwinkler@entradagroup.com

210-828-8300

Private Equity Investor

Tim Witt

Prairie Capital Advisors, Inc.

Oakbrook Terrace, IL

tim.witt@prairiecap.com

630-413-5593

Investment Banker/Broker Dealer

Scott Woodward, CM&AA

Whitley Penn, LLP

Dallas, TX

scott.woodward@whitleypenn.com

214-393-9412

Accountant/CPA

Lisa Wright, CM&AA