Professional Documents

Culture Documents

Oracle Financial Syllabus Online Training

Uploaded by

Saurav Dutta0 ratings0% found this document useful (0 votes)

23 views12 pagesOracle Financials

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOracle Financials

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views12 pagesOracle Financial Syllabus Online Training

Uploaded by

Saurav DuttaOracle Financials

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 12

Oracle Cash Management Overview

Describing the bank account model

Describing the key concepts of reconciling bank accounts

Explaining the key concepts of cash pools, cash positioning, and cash forecasting

Setting Up Oracle Cash Management

Describing how to set up Oracle General Ledger

Describing how to set up related applications

Describing how to set up Oracle Cash Management

Creating Bank Accounts

Defining banks

Defining bank branches

Creating bank accounts

Defining bank transactions codes

Defining bank account signing authorities

Bank Transfers

Describing how to set up bank transfers

Creating a bank transfer

Settling a bank transfer

Creating a bank account transfer template

Creating bank statement cashflows

Managing Bank Statements

Entering and importing bank statements

Describing the Bank Statement Open Interface

Reviewing and correcting bank statement errors

Entering bank statements manually

Reconciling Bank Statements

Reconciling bank statements manually and automatically

Recording exceptions and reversals

Reconciling corrections and adjustments to bank errors

Clearing and unclearing transactions

Transferring bank reconciliation transactions to your general ledger

Explaining archiving and purging

Cash Forecasting

Defining a cash forecast template

Generating a cash forecast

Modifying a cash forecast

Exporting a cash forecast to your spreadsheet application

Identifying implementation considerations

Using cash forecasting reports

Oracle E-Business Tax Overview

E-Business Tax key concepts

Tax Determination Management

Integration within Oracle E-Business Suite

Part 1: Oracle E-Business Tax Basic Tax Configuration

E-Business Tax configuration flow

Regime to Rate flow

Tax Regimes

Taxes

Tax Statuses

Tax Rates

Tax Jurisdictions

Part 2: Oracle E-Business Tax Basic Tax Configuration

Additional setup options

Tax Zones

Tax Accounts

Tax Reporting types

Managing Party Tax Profiles

Party Tax Profiles

Self-Assessment taxes

Offset taxes

Tax Exemptions

Tax Registrations

Part 1: Setting Up Tax Rules

Rule Engine

Rule Types

Tax Rule defaults

Guided Tax Rule Entry

Make tax available on transactions

Oracle Tax Simulator

Part 2: Setting Up Tax Rules

Determining factors: party, product, place, and process

Tax Determining Factor Set

Regime Determination Set

Tax Formulas

Tax Condition Sets

Managing Taxes on Transactions

Services

Payables transactions

Receivables transactions

Intercompany transactions

Managing tax lines

Managing tax exemptions

Overview of Oracle Asset Management

E-Business Suite Integration

Implementation Considerations for Oracle Financials

Oracle Assets Setup Steps

Implementing Oracle Assets

Adding Assets Manually

Mass Asset Additions

Acquire and Build CIP Assets

Reconciling Data in Oracle Assets

Asset Controls Setup

Oracle Assets Setup Steps

Setup Steps Flow

Setting Up Key Flexfields

Location Key Flexfield

Creating Key Flexfield Combinations

Specifying System Controls

Setting Up Asset Calendars

Maintaining an Audit Trail

Asset Books

Asset Books Regions

Calendar Region

Accounting Rules Region

Organizations and Security by Book

Security by Book Setup Steps

Troubleshooting Security by Book

Implementation Considerations for Security by Book

Asset Categories

Asset Categories Positioning

Asset Categories Regions

Asset Categories Setup

Manual Asset Additions

Asset Life Cycle

Adding Assets Manually

Detailed Asset Additions

Asset Cost Terminology

Accumulated Depreciation Considerations

Manual Asset Additions Journal Entries

Mass Asset Additions

Mass Asset Additions Process

Using the Mass Additions Interface Table

Tracking Expensed Items in Oracle Assets

Changing Asset Information

Accounting for Cost Adjustments

Purge Mass Additions

Creating Assets Using Web ADI

CIP Asset Additions

Adding and Capitalizing a CIP Asset

Acquire and Build CIP Assets

Automatically Adding CIP Assets to Tax Books

Modifying the Cost of CIP Assets

Recording a CIP Asset Addition

Capitalizing a CIP Asset

Reversing a Capitalized Asset

CIP Assets and Oracle Projects

Asset Adjustments and Maintenance

Single Asset Reclassification

Mass Reclassification

Inheriting Depreciation Rules

Choosing to Expense or Amortize Depreciation Adjustments

Amortizing Adjustments Using a Retroactive Start Date

Asset Revaluation

Performing Physical Inventory

Physical Inventory Reconciliation

Depreciation

Elements of Depreciation

Depreciation Setup Areas

Basic Depreciation Calculation

Depreciation Methods

Entering Production Information

Prorate Conventions

Run Depreciation Process

Depreciation Forecasts

Asset Retirements

Tracking Asset Retirements

Overview of Retiring an Asset

Restrictions on Retirements and Reinstatements

Reinstating Retired Assets

Retirement Processing Flow

Recording Retirements

Retirement Reports

Calculating Gains and Losses

Asset Accounting

Setting Up Asset Accounting

Oracle Subledger Accounting

Assets Journal Entries Flow

Reconciling Data in Oracle Assets

Generating Reports to Reconcile to the General Ledger

Reconciling Asset Cost Accounts

Reconciling Mass Additions

Asset Inquiry and Reporting

Viewing Asset Information Online

Types of Asset Inquiries

Asset Inquiry Options

Tax Accounting

Creating a Tax Book

Prerequisites for Setting Up Tax Book Asset Categories

Entering Information in Tax Books

Updating a Tax Book Manually

Tax Book Upload Interface

Deferred Depreciation

Adjusting Accumulated Depreciation

General Tax Reports

Oracle General Ledger Process

Understanding the General Ledger Functions and Features

Analyzing the General Ledger Accounting Cycle

Reviewing General Ledger Integration Points

Generating Standard Reports and Listings

Ledger

Describing the Elements Required to Define Ledgers

Identifying Attributes, Options and Settings to Define the Accounting Flexfield

Defining an Accounting Calendar

Using Accounting Setup Manager

Creating Accounting Setups

Creating Accounting Setup Structures

Completing Accounting Options

Analyzing Reporting Currencies

Basic Journal Entries

Describing how Journal Entries are Positioned in the Accounting Cycle

Identifying Attributes, Options and Settings to Define the Accounting Flexfield

Defining an Accounting Calendar

Creating Manual Journal Entries

Posting Journal Entries

Performing Accounting Inquiries

Performing Drilldowns to Oracle Sub-ledger applications

Creating Reversing Entries

Summary Accounts

Understanding how Summary Accounts are used in General Ledger

Defining Rollup Groups for Creating Summary Accounts

Assigning Parent Values to Rollup Groups

Entering Summary Account Templates

Discussing Implementation Considerations

Advanced Journal Entries

Understanding Advanced Journal Entries Functions

Understanding the Business Benefits of Advanced Journal Entries

Understanding Recurring Journals

Understanding Mass Allocation Journals

Understanding Auto-Allocations

Understanding Journal Scheduling

Understanding Journal Approval

Advanced Security

Describing Data Access Security for Legal Entities and Ledgers

Understanding Management Reporting and Security

Financial Budgeting

Understanding Anatomy of a Budget

Completing the Budget Accounting Cycle

Discussing Budget Entry Methods

Uploading Budget Amounts

Transferring Budget Amounts

Freezing and Unfreezing Budget Amounts

Multi-Currency

Defining Foreign Currencies

Entering Foreign Currency Journals

Revaluing Foreign Currency Balances

Translating Balances Into Foreign Currency

Consolidations

Identifying Consolidations Across the General Ledger Business Process

Understanding Key Implementation Issues Across Consolidations

Understanding the Global Consolidation System

Defining the Elements of the Consolidation Workbench

Period Close

Understanding the Accounting Cycle

Understanding Steps in the Close Process

Performing Journal Import of Sub-ledger Balances

Generating Revaluation

Understanding the Closing Period

Consolidating Account Balances

Financial Reporting

Identifying Financial Reporting Across the General Ledger Business Process

Understanding Basic Report Building Concepts

Understanding the Financial Statement Generator

Generating Financial Reports using the Standard Request Submission Form

Procure to Pay Overview

Describing the Procure to Pay Process Flow

Describing how the Procure to Pay Process Fits Across the eBusiness Suite Applications

Payables Overview

Overview of Payables Processes

Understanding Supplier Entry

Understanding Invoice Entry

Understanding Payments

Analyzing Payables Integration Points

Using Payables Open Interfaces to Import Data

Suppliers

Understanding the Procure to Pay Lifecycle

Defining Supplier and Supplier Sites

Identifying the Key Reports

Understanding Setup Options

Analyzing Implementation Considerations

Invoices

Importing and Entering Invoices and Invoice Distributions

Matching Invoices to Purchase Orders

Validating Invoices

Applying and Releasing Holds

Understanding the Invoice Approval Workflow

Generating Key Reports

Analyzing Setup Options

Analyzing Implementation Considerations

Payments

Describing the Payments Process

Setting Up Banks and Bank Accounts

Entering Single Payments

Processing Multiple Payments

Understanding how to Review Payments

Understanding how to Adjust Payments

Analyze Setting up and Creating Bills Payable

Creating, Applying, and Releasing Holds on Prepayments

Expense Reports

Describing the Expense Reports Process

Understanding how to Enter Expense Report Templates

Entering Expense Reports

Understanding how to Apply Advances

Identifying the Key Expense Reports

Period Close

Describing the Period Closing Process in Payables

Describing the Period Closing Process in Purchasing

Reconciling Payables Transactions for the Period

Identifying Key Programs and Reports

Understanding Setup Options

Understanding Implementation Considerations

Transaction Taxes in Payables

Describing how Transaction Taxes are Calculated

Inserting Manual Tax Lines

Updating Transaction Tax Lines

Viewing Tax Summary and Details

Identifying Key Reports

Understanding Setup Options

Order to Cash Lifecycle Overview

Describing the overall Order to Cash Process from Order Entry through Bank Reconciliation

Discussing the key areas in the Order to Cash Life Cycle

Describing the integration between the applications

Overview of Oracle Receivables Process

Explaining where the Receivables processing is positioned within the Order to Cash Life Cycle

Describing the overall Receivables Process

Discussing the key areas in the Receivables Process

Manage Parties and Customer Accounts

Defining the Features to Enter and Maintain Party and Customer Account Information

Defining the Features to Enter and Maintain Party and Customer Account Information

Creating Profile Classes and Assigning them to Customer Accounts

Creating and Maintaining Party and Customer Account Information

Enabling Customer Account Relationships

Merging Parties and Customer Accounts

Viewing Party and Customer Account Information

Process Invoices

Describing How Processing Invoices Fits into the Receivables Process

Entering and Completing Invoices

Correcting Invoices

Printing Transactions and Statements

Using Event-Based Management

Demonstrating Promised Commitment Accounts

Implement Customer Invoicing

Entering Setup Information related to Invoicing

Understanding Key Implementation Considerations in Customer Invoicing

Receipts

Describing the Receipt Process

Applying Receipts Using Different Methods

Creating Charge-backs, Adjustments, and Claims

Using Balancing Segments

Applying Non-Manual Receipts

Implement Receipts

Entering Setup Information for Receipts

Discussing the Implementation Considerations

Tax Processing

Understanding the Tax Accounting Process

Understanding Oracle E-Business Tax Setups for Receivables

Managing Tax Accounts and Tax Adjustments

Period Closing

Understanding Sub-ledger Accounting Related to Period Closing

Defining Various Actions Required to Close a Period in the Order to Cash E-Business Flow

Describing Available Reports Assisting in the Closing Process

Explaining How to Run the Revenue Recognition Program and the General Ledger Interface Program

Appendix A: Bank Reconciliation

Reconciliation Overview

Reconciliation Integration

Reconciliation: Oracle Receivables

AutoReconciliation Overview

Clearing and Reconciling Transactions in Oracle Receivables

Cash Application Work Queue

Order to Cash Lifecycle Overview

Describing the overall Order to Cash Process from Order Entry through Bank Reconciliation

Discussing the key areas in the Order to Cash Life Cycle

Describing the integration between the applications

Overview of Oracle Receivables Process

Explaining where the Receivables processing is positioned within the Order to Cash Life Cycle

Describing the overall Receivables Process

Discussing the key areas in the Receivables Process

Manage Parties and Customer Accounts

Defining the Features to Enter and Maintain Party and Customer Account Information

Defining the Features to Enter and Maintain Party and Customer Account Information

Creating Profile Classes and Assigning them to Customer Accounts

Creating and Maintaining Party and Customer Account Information

Enabling Customer Account Relationships

Merging Parties and Customer Accounts

Viewing Party and Customer Account Information

Process Invoices

Describing How Processing Invoices Fits into the Receivables Process

Entering and Completing Invoices

Correcting Invoices

Printing Transactions and Statements

Using Event-Based Management

Demonstrating Promised Commitment Accounts

Implement Customer Invoicing

Entering Setup Information related to Invoicing

Understanding Key Implementation Considerations in Customer Invoicing

Receipts

Describing the Receipt Process

Applying Receipts Using Different Methods

Creating Charge-backs, Adjustments, and Claims

Using Balancing Segments

Applying Non-Manual Receipts

Implement Receipts

Entering Setup Information for Receipts

Discussing the Implementation Considerations

Tax Processing

Understanding the Tax Accounting Process

Understanding Oracle E-Business Tax Setups for Receivables

Managing Tax Accounts and Tax Adjustments

Period Closing

Understanding Sub-ledger Accounting Related to Period Closing

Defining Various Actions Required to Close a Period in the Order to Cash E-Business Flow

Describing Available Reports Assisting in the Closing Process

Explaining How to Run the Revenue Recognition Program and the General Ledger Interface Program

Appendix A: Bank Reconciliation

Reconciliation Overview

Reconciliation Integration

Reconciliation: Oracle Receivables

AutoReconciliation Overview

Clearing and Reconciling Transactions in Oracle Receivables

Cash Application Work Queue

Overview of Subledger Accounting

What Is Subledger Accounting?

Introduction to Subledger Accounting

What Is a Subledger?

Create Accounting and Transfer Journal Entries to General Ledger

Create Accounting Program Overview

Draft Accounting and Online Accounting

Straight-Through Accounting

Transfer Journal Entries to GL Program Overview

Transfer Journal Entries to General Ledger Program

Inquiries

Accounting Events Inquiry Process

Viewing Subledger Journal Entry Lines

Subledger Journal Entry Lines Inquiry Process

Drilldown from GL

Reports

Subledger Accounting Reports Overview

Custom Parameters

Journal Entries Report

Creating Manual Subledger Journal Entries

Subledger Journal Entries Overview

Creating Subledger Journal Entries

Reviewing and Completing Subledger Journal Entries

Duplicating Subledger Journal Entries

You might also like

- Accenture Technology Vision 2012Document52 pagesAccenture Technology Vision 2012ferdinanerenioNo ratings yet

- Business Intelligence (BI) Using IBM CognosDocument40 pagesBusiness Intelligence (BI) Using IBM CognosVerus JohnNo ratings yet

- Accenture Bringing Science To SellingDocument12 pagesAccenture Bringing Science To SellingVadym VavryshNo ratings yet

- Factorial Analysis of Variance: Julia HartmanDocument65 pagesFactorial Analysis of Variance: Julia HartmanSaurav DuttaNo ratings yet

- Cognos 8.4 UpgradeDocument27 pagesCognos 8.4 UpgradeSaurav DuttaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- History Project: (For Ist Semester)Document27 pagesHistory Project: (For Ist Semester)Jp YadavNo ratings yet

- Ought To, Should, Must and Have ToDocument2 pagesOught To, Should, Must and Have Topinay athena100% (1)

- HSS S6a LatestDocument182 pagesHSS S6a Latestkk lNo ratings yet

- United Nations Industrial Development Organization (Unido)Document11 pagesUnited Nations Industrial Development Organization (Unido)Ayesha RaoNo ratings yet

- Flow Concepts: Source: Managing Business Process Flows by Anupindi, Et AlDocument7 pagesFlow Concepts: Source: Managing Business Process Flows by Anupindi, Et AlKausik KskNo ratings yet

- O&M Manager Seeks New Career OpportunityDocument7 pagesO&M Manager Seeks New Career Opportunitybruno devinckNo ratings yet

- All About Form 15CA Form 15CBDocument6 pagesAll About Form 15CA Form 15CBKirti SanghaviNo ratings yet

- Display of Order of IC Constitution and Penal Consequences of Sexual HarassmentDocument1 pageDisplay of Order of IC Constitution and Penal Consequences of Sexual HarassmentDhananjayan GopinathanNo ratings yet

- Bangla Book "Gibat" P2Document34 pagesBangla Book "Gibat" P2Banda Calcecian100% (3)

- Achieving Excellence Guide 3 - Project Procurement LifecycleDocument27 pagesAchieving Excellence Guide 3 - Project Procurement LifecycleMoath AlhajiriNo ratings yet

- RA 8293 Key Provisions on Compulsory Licensing and Patent RightsDocument30 pagesRA 8293 Key Provisions on Compulsory Licensing and Patent RightsPrincessNo ratings yet

- EXIDEIND Stock AnalysisDocument9 pagesEXIDEIND Stock AnalysisAadith RamanNo ratings yet

- Forecasting - Penilaian BisnisDocument63 pagesForecasting - Penilaian BisnisyuliyastutiannaNo ratings yet

- Excerpt of "The Song Machine" by John Seabrook.Document9 pagesExcerpt of "The Song Machine" by John Seabrook.OnPointRadioNo ratings yet

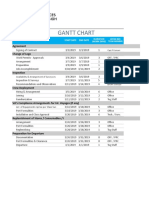

- Gantt Chart TemplateDocument3 pagesGantt Chart TemplateAamir SirohiNo ratings yet

- XTRO Royal FantasyDocument80 pagesXTRO Royal Fantasydsherratt74100% (2)

- University of ST Andrews 2009 ArticleDocument156 pagesUniversity of ST Andrews 2009 ArticleAlexandra SelejanNo ratings yet

- 2021 Pslce Selection - ShedDocument254 pages2021 Pslce Selection - ShedMolley KachingweNo ratings yet

- Marketing PlanDocument18 pagesMarketing PlanPatricia Mae ObiasNo ratings yet

- 2020 BMW Group SVR 2019 EnglischDocument142 pages2020 BMW Group SVR 2019 EnglischMuse ManiaNo ratings yet

- Full Download Understanding Business Ethics 3rd Edition Stanwick Test BankDocument35 pagesFull Download Understanding Business Ethics 3rd Edition Stanwick Test Bankleuterslagina100% (22)

- Annexure ADocument7 pagesAnnexure ABibhu PrasadNo ratings yet

- Elements of Consideration: Consideration: Usually Defined As The Value Given in Return ForDocument8 pagesElements of Consideration: Consideration: Usually Defined As The Value Given in Return ForAngelicaNo ratings yet

- NDRRMF GuidebookDocument126 pagesNDRRMF GuidebookS B100% (1)

- Bob Marley - SunumDocument5 pagesBob Marley - SunumNaz SakinciNo ratings yet

- Impact of Information Technology On The Supply Chain Function of E-BusinessesDocument33 pagesImpact of Information Technology On The Supply Chain Function of E-BusinessesAbs HimelNo ratings yet

- James Tucker - Teaching Resume 1Document3 pagesJames Tucker - Teaching Resume 1api-723079887No ratings yet

- Passwordless The Future of AuthenticationDocument16 pagesPasswordless The Future of AuthenticationTour GuruNo ratings yet

- Horngren Ima16 Tif 07 GEDocument59 pagesHorngren Ima16 Tif 07 GEasem shaban100% (3)

- Gramatyka Test 14Document1 pageGramatyka Test 14lolmem100% (1)