Professional Documents

Culture Documents

Finance Full Moves Sop

Uploaded by

haroldpsbCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance Full Moves Sop

Uploaded by

haroldpsbCopyright:

Available Formats

Finance Standard Operating Procedures

TABLE OF CONTENTS

ADMINISTRATION

AD01-: DUE DATES............................................................................................ 9

AD02-SOP: CONTROLLER'S PERIODIC CHECKLIST FOR FULL SERVICE

HOTELS.............................................................................................................. 10

AD03-SOP: BACKGROUND INVESTIGATION OF EMPLOYEES..................... 14

AD04-SOP: INTERNAL AUDIT.......................................................................... 15

AD05-SOP: LOCAL SOP's............................................................................... 16

AD06-SOP: KEY CONTROLS............................................................................18

ACCOUNTS PAYABLE

AP01-SOP: INVOICE AND CHECK PREPARATION....................................... 25

AP02-SOP: CHECK SIGNING PROCEDURES................................................. 28

AP03-SOP: CAPITAL EXPENDITURES.............................................................. 29

AP04-SOP: EXPENSE REPORTS........................................................................ 32

AP05-SOP: TRAVEL AGENT COMMISSIONS................................................. 33

AP06: GROUP TRAVEL AGENT COMMISSIONS............................................ 34

AP07-SOP: PURCHASE ORDERS..................................................................... 35

AP08-SOP: VENDOR CREDIT LETTER.............................................................. 37

ACCOUNTS RECEIVABLE

AR01-SOP: CREDIT POLICY............................................................................ 38

AR02-SOP: GUEST & CITY LEDGER................................................................. 44

AR03-SOP-: RETURNED CHECKS.................................................................... 47

AR04-SOP: ALLOWANCE FOR DOUBTFUL ACCOUNTS................................ 48

AR05-SOP: CITY LEDGER AGING STANDARDS............................................ 50

AR06-SOP: GUEST LEDGER ADJUSTMENTS.................................................... 51

AR07-SOP: ADVANCE DEPOSITS................................................................... 52

AR08-SOP: ACCOUNTING FOR CHARGE BACKS........................................ 53

CASH CONTROLS

CA01-SOP: HOUSE FUNDS & AUDITS............................................................. 54

CA02-SOP: PETTY CASH................................................................................. 61

CA03-SOP: CHECKING ACCOUNTS............................................................. 63

CA04-SOP: BANK RECONCILIATIONS.......................................................... 65

CA05-SOP: DROP SAFE PROCEDURES.......................................................... 66

CA06-SOP: CONSOLIDATED DEPOSITS......................................................... 69

CA07-SOP: CASH OVER / SHORT.................................................................. 75

CA08-SOP: ARMORED CAR SERVICE........................................................... 76

CA09-SOP: CREDIT CARD PROCESSING...................................................... 77

CA10-SOP: EMPLOYEE ADVANCES.............................................................. 78

CA11-SOP: TRAVEL ADVANCES.................................................................... 81

DATA PROCESSING

DP01-SOP: SOFTWARE LICENSE..................................................................... 82

DP01-SOP: BACKUP OF SYSTEMS.................................................................. 83

FINANCIAL CONTROLS

FC01-SOP: FINANCIAL CONTROLS - LTD...................................................... 84

FC02-SOP: CHECK BOOK ACCOUNTING.................................................... 94

FC03-SOP: FINANCIAL STATEMENT PACKAGE............................................ 95

FC04-SOP: CONTROLLER'S CHECKLIST......................................................... 96

FC05-SOP: BALANCE SHEET RECONCILIATION......................................... 103

FC06-SOP: FULL YEAR FORECASTING......................................................... 108

FC07-SOP: PREPAIDS & ACCRUALS............................................................ 110

FC08-SOP: FLOW THROUGH PROFIT............................................................ 112

FC09-SOP: GENERAL LEDGER INPUT........................................................... 113

FC10-SOP: NIGHT AUDIT INCOME VERIFICATION..................................... 114

FC11-SOP: SPECIAL EVENT ANALYSIS......................................................... 115

FC12-SOP: CASH FLOW................................................................................ 116

FC13-SOP: LEASES & CONTRACTS.............................................................. 117

FC14-SOP: CORPORATE OFFICE EXPENSES............................................... 123

FC15-SOP: CASH PAYMENTS OVER $10,000.............................................. 124

FC16-SOP: LEGAL CLAIMS........................................................................... 125

FC17-SOP: SALES TAX RETURNS................................................................... 126

FC18-SOP: REQUIRED DISCLAIMERS........................................................... 127

FOOD & BEVERAGE CONTROLS

FB01-SOP: F & B PRIMARY CONTROLS........................................................ 128

FB02-SOP: F & B COST CREDITS................................................................... 131

FB03-SOP: CHECK CONTROLS..................................................................... 134

PAY ROLL

PR01-SOP: SCHEDULING.............................................................................. 138

PR02-SOP: TIP DECLARATION...................................................................... 140

PR03-SOP: DEDUCTIONS NOT TAKEN.......................................................... 142

PR04-SOP: TIME CLOCK REPORTS............................................................... 143

PR05-SOP: APS TIME CLOCK REPORTS........................................................ 145

RC01-SOP: RECORDS RETENTION................................................................ 148

RC01-SOP: RELEASE OF RECORDS TO GUESTS........................................... 158

RC03-SOP: RELEASE OF RECORDS TO GOVERNMENT OFFICIALS........... 159

DUE DATES

VISION: To define dates and times that reports are due to the

Tecton corporate office.

TEAM PLAYERS: FINANCE

MOVE #: AD01

EFFECTIVE DATE: 12/01/05

DATE REVISED: 5/05/10

Page 9 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

It is the responsibility of the General Manager to insure that all reports are

delivered in a timely fashion.

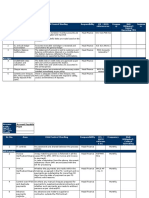

SCHEDULE

REPORT DUE DATE TIME METHOD

Financial Package (see below)

10

th

of

Month

5 pm Upload to Extranet

Controllers Checklist

Cash Flow

10

th

of

Month

5 pm Upload to Extranet

Weekly Snapshot

Every

Thursday

Noon E-Mail to Corporate

Forecast

25

th

of

Month

5 pm Upload to Extranet

Forecast Snapshot

25

th

of

Month

5 pm E-mail to Corporate

Notes:

1. If due date falls on a weekend or a holyday, the reports are due the next business day.

2. For year-end reporting purposes, the financials will be due on the 15

th

of J anuary, unless it falls on a

weekend, in which case it is due on the next business day.

Financial Package Components:

General Managers Critique

Financial Statement

Balance Sheet

AR and AP Recap

Capital Projects

Sales Report

Star Report

Leases, Contracts and License Schedule

Guest Satisfaction Report (UNIFOCUS)

Full Year Forecast

CONTROLLERS PERIODIC CHECKLIST

FOR FULL SERVICE HOTELS

VISION: The Controller is to establish a review of key procedures to

safeguard the financial operation of the hotel and to assist in the

compliance with the Key Financial Controls.

TEAM PLAYERS: FINANCE

MOVE #: AD02

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 10 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

It is the responsibility of the Controller to ensure that reviews are in concurrence

with the frequency indicated.

PROCEDURE

The Controller and/or Assistant Controller are to review the following procedures

as indicated:

1. Daily

a. Review all guest ledger adjustments, paid outs and gift shop discounts,

housekeeping discrepancy reports and night audit log.

b. Review management house charges; route to Executive Committee

for approvals.

c. Review daily revenue report.

d. Review credit limit report after reviewed by Accounts Receivable and

approved by the Front Office Manager.

e. Review security reports.

f. Review credit approval for groups.

g. Review PMS daily report guest ledger, city ledger, and advance

deposit control figures to ensure they balance to PMS detail. Verify

PMS ledger balances with M3 daily report.

h. Review daily bank balance for current cash position.

i. Review city ledger payment log and verify with account receivables

posting.

j. Sign off and verify all account receivable adjustments and credit card

adjustments.

k. Review daily over/short report and ensure departmental follow up and

adherence to policy.

CONTROLLERS PERIODIC CHECKLIST

FOR FULL SERVICE HOTELS

VISION: The Controller is to establish a review of key procedures to

safeguard the financial operation of the hotel and to assist in the

compliance with the Key Financial Controls.

TEAM PLAYERS: FINANCE

MOVE #: AD02

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 11 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

2. Weekly

a. Review all over 60 day accounts, returned checks and charge backs

for collection efforts.

b. Review labor reports at Executive Committee meeting. Review

deviations with Department Heads, i.e., where productivity goals are

not being achieved. Distribute overtime reports to respective E.C.

members.

c. Review Checkbook Accounting Report with department head.

d. Review petty cash reimbursement.

e. Attend and participate in weekly sales strategy meeting.

f. Review invoices and other backup for accuracy when checks are

signed.

3. Monthly

a. Review all outstanding wage advances.

b. Reconcile all balance sheet and bank accounts prior to the close of

the following month. Ensure any outstanding items in A/R clearing

accounts and miscellaneous receivables clear by next closing.

c. Reconcile individual capital expenditure summaries to the general

ledger and ensure compliance to Tectons Capital Expenditure Policy.

d. Ensure that credit meetings are held with the proper personnel.

e. Review the tax exempt report and ensure that all Sales, Local and

Occupancy Taxes are paid timely and accurately.

f. Ensure all cashier banks are counted on a surprise basis at least once a

month and retain evidence of the count. Review all contracts for

accuracy.

g. Audit General Cashiers safe at least twice per month on a surprise

basis and retain evidence of the count.

CONTROLLERS PERIODIC CHECKLIST

FOR FULL SERVICE HOTELS

VISION: The Controller is to establish a review of key procedures to

safeguard the financial operation of the hotel and to assist in the

compliance with the Key Financial Controls.

TEAM PLAYERS: FINANCE

MOVE #: AD02

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 12 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

h. Review food and beverage purchases with the Chef and Director of

Food and Beverage to ensure that all invoices are accounted for

before closing the period.

i. Prepare monthly financial statement package and send to Corporate.

j. Participate in (Accounting Representative) and review all inventories.

Research major cost variances.

k. Prepare and submit full year forecast.

l. Ensure that all franchise fees, management fees and royalties are paid

in accordance with the management and franchise contracts.

4. Other Periodic Requirements

a. Follow up on response to internal audit program. Inspect for

compliance with appropriate action to be taken.

b. Coach and counsel department associates and managers as needed.

Update goals and development plans via rap sessions and annual

reviews.

c. Complete Controllers audit once a year. Audit other areas as

needed.

d. Conduct a complete payroll payoff twice a year.

e. Periodically require bids on supply purchases.

f. Review adherence to Record Retention Policy at least annually to

ensure compliance with state and federal guidelines.

g. Review and update the contracts and leases on file on a regular basis.

h. Review Sales, Front Desk and Catering Bonus Worksheet and Annual

Executive Committee Bonus Worksheet.

i. Ensure all real estate taxes and mortgage payments are paid in

accordance with the management contract.

j. Ensure all Tecton and Owners payments are paid promptly.

CONTROLLERS PERIODIC CHECKLIST

FOR FULL SERVICE HOTELS

VISION: The Controller is to establish a review of key procedures to

safeguard the financial operation of the hotel and to assist in the

compliance with the Key Financial Controls.

TEAM PLAYERS: FINANCE

MOVE #: AD02

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 13 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

k. Update Accounting S.O.P. Manual as directed from Tecton. Educate

hotel management and enact policies.

l. Ensure the medical employee/employer calculations and deductions

are correct.

m. Once a year, the Controller and the Assistant Controller will work (at a

minimum) one night audit shift each, separate of one another, to

ensure night audit controls are at an optimum.

BACKGROUND INVESTIGATION OF

EMPLOYEES

VISION: All employees are to have background checks performed

prior to a final offer of employment.

TEAM PLAYERS: FINANCE

MOVE #: AD03

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 14 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

It is the responsibility of the property Human Resources Department to see that a

complete and thorough investigation is made of all employees. When a

promotion or transfer into a cash handling or high guest access position is made,

additional background checks should be performed. High guest access

positions are housekeepers, engineers, bell persons, storeroom clerks and

receiving clerks.

PROCEDURES

ALL EMPLOYEES:

Reference check with at least three prior employers, if applicable, with

determining reasons why they left each of their jobs. Verify dates of

employment, pay, and rehire status. Obtain as much information from the direct

supervisor or department head.

If the applicant is still employed, his or her present employer should not be

contacted unless advance approval is obtained from the applicant. In the

event of employment, materials directly related to the interview process should

be retained as a permanent part of the employees record.

CASH HANDLING EMPLOYEES, SECURITY OFFICERS & HIGH ACCESS POSITIONS:

An outside reference/background verification company may be used for these

searches. The employee must give written authorization to proceed with this

investigation. The investigation should include:

Credit Check

Arrest record check in each city or state for the past 5 years

Verification of college degree, if applicable

If the reports surface inconsistencies or discrepancies, they should be verified.

Once verified, appropriate action should be taken by the Director of Human

Resources and the General Manager after consulting Corporate Human

Resources.

INTERNAL AUDIT

VISION: Every property is to be audited by a Tecton representative

at least once each year.

TEAM PLAYERS: FINANCE

MOVE #: AD04

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 15 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

PROCEDURE

1. The property will be notified at least one week in advance of a scheduled

internal audit.

2. The Tecton representative will perform the audit with the Controller and/or

General Manager. Accounting staff and department heads may also be

interviewed during this process.

3. Within two weeks the property will receive the graded audit.

4. Within two weeks a response is to be prepared with action plans and due

dates as to when the property will be in compliance.

5. Internal Audit checklist available on Tecton Extranet.

LOCAL SOPs

VISION: This is to outline the formal procedure for preparation,

approval and maintenance of LSOPs.

TEAM PLAYERS: FINANCE

MOVE #: AD05

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 16 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

It is the responsibility of the Controller to monitor compliance and maintain

current files on all Accounting LSOPs that affect their area.

PROCEDURE

1. When a Tecton Accounting Standard Operating Procedure cannot be

implemented because of limited number of staff or lack of technology, an

LSOP must be developed to accomplish the intended control.

2. An LSOP may be developed to deal with specific issues not already covered

by a Tecton SOP.

3. At no time may an LSOP contradict or supersede any Tecton SOPs. They

must have a policy statement, responsibility and procedure and be

approved by Regional Controllers or VP of Finance before implementation.

4. All LSOPs must be written in the same format as Tecton SOPs. They must

have a policy statement, responsibility and procedure and be approved by

Regional Controllers or VP of Finance Corporate before implementation.

5. The Request for Exception from Policy form must accompany the LSOP

submitted.

LOCAL SOPs

VISION: This is to outline the formal procedure for preparation,

approval and maintenance of LSOPs.

TEAM PLAYERS: FINANCE

MOVE #: AD05

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 17 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

TECTON HOSPITALITY

REQUEST FOR EXCEPTION FROM POLICY

HOTEL NAME: DATE:

POLICY FROM WHICH EXCEPTION IS BEING REQUESTED:

REASON FOR REQUEST:

WHAT IS THE BENEFIT THE PROPERTY WILL GAIN MAKING THIS CHANGE?

WHAT ARE THE POTENTIAL RISKS INVOLVED IF THIS CHANGE IS IMPLEMENTED?

SUBMITTED BY:

APPROVALS:

REGIONAL CONTROLLER VP OF FINANCE

DATE OF FINAL APPROVAL

PLEASE ATTACH THE LOCAL STANDARD OPERATING PROCEDURE WHICH WILL REPLACE THE

POLICY BEING ALTERED

KEY CONTROLS

VISION: Compliance with tight key controls ensures guest and

associate safety, prevents pilferage and maintains compliance

with primary financial controls.

TEAM PLAYERS: FINANCE

MOVE #: FN-SOP-AD-06

DATE ISSUED: 9/27/02

DATE REVISED: 4/12/10

Page 18 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

Key Security / Lock Boxes

- All keys (hard and electronic) are to be kept in secure lock boxes

- Keys for lock boxes are to be held by the Department Head, Supervisor on Duty or

Manager on Duty, and maintained in a safe when not in use (i.e. overnight).

- Key Log Books must be kept at every lockbox

Key Log Books

- Key Log Books/Binders must be kept at every Lock Box. See sample page attached.

- Logs should identify which key (hard or electronic) is being issued/returned, to who, time,

and Supervisor issuing the key. Associate and Supervisor both need to sign keys in and

out. A supervisor or manager MUST be present when keys are issued and returned, and

all key issues and returns must be signed/witnessed on the Log by the

supervisor/manager

- A new log page should be started for each day.

- Logs/Log pages should be filed, and kept for 7 years.

- Under no circumstances should keys be carried off property

- If an individual has left property without returning keys, that individual must immediately

return the key to the property and a report filed with the appropriate department head for

further action.

Key Inventories

- Inventories are to be conducted at the end of each shift, minimum daily.

- Supervisor must ensure all keys are accounted for, either physically present in the Lock

Box, or signed out appropriately in the Log Book.

- Supervisor must sign the Log Book on completion of the shift/daily inventory certifying that

all keys are accounted for.

Key Log Audits

- Regular random audits must be conducted by the Department Head, Controller, and

General Manager, minimum monthly. The manager conducting the audit must certify in the

log that the audit was conducted and all keys appropriately accounted for.

- Key Log audit verification will be part of the Operations Audit.

KEY CONTROLS

VISION: Compliance with tight key controls ensures guest and

associate safety, prevents pilferage and maintains compliance

with primary financial controls.

TEAM PLAYERS: FINANCE

MOVE #: FN-SOP-AD-06

DATE ISSUED: 9/27/02

DATE REVISED: 4/12/10

Page 19 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

Master Key Schedule

- A schedule of Master Keys whether hard or electronic (including sub-master, section, floor,

etc) must be kept in the hotel safe

- The schedule must list each key ID, areas it accesses, and the department it was issued

to

- Department Heads must sign Key Requisition (sample attached) to obtain or have a

master key created

- Master Keys issued to specific individuals (i.e. GM, FOM, Exec HK, Chief Engineer) must

be specifically noted and signed for by the individual on the Master Key Schedule.

- Only the General Manager may determine who can issue or create master keys

- Any new master keys issued or created must be updated on the Master Key Schedule

- Department Heads are responsible for master keys issued to their departments, and the

subsequent security of master keys. Department Heads are responsible for ensuring the

key control policy and SOP is enforced within their departments

- The General Manager is responsible for ensuring Department Heads are compliant with

the Key Control policy and SOP at all times, and can be verified in the Operations Audit

Associate Key Control Agreement

- A copy of the Associate Key Control Agreement is attached

- All Associates requiring access to hard or electronic keys to carry out their duties are

required to complete the Key Control Agreement. The Agreement must be read,

understood, and signed by the Associate and their Manager and placed on the Associate

File. As a general rule, all Associates should sign a Key Control Agreement as part of their

new-hire paperwork.

- Keys must not be issued to Associates who have not signed a Key Control Agreement

Terminated Associates

- All keys must be retrieved from any Associate upon termination (whether voluntary or

involuntary) before they leave the property

- Master keys issued specifically to an individual must be returned to the safe and updated

on the Master Key Schedule as returned. The General Manager should determine whether

that key (typically electronic) should be destroyed or can be re-issued.

KEY CONTROLS

VISION: Compliance with tight key controls ensures guest and

associate safety, prevents pilferage and maintains compliance

with primary financial controls.

TEAM PLAYERS: FINANCE

MOVE #: FN-SOP-AD-06

DATE ISSUED: 9/27/02

DATE REVISED: 4/12/10

Page 20 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

Missing and Deprogrammed Keys

- Missing keys must be reported to the Manager on Duty or General Manager immediately

- If a key is determined missing or an associate has lost a key for more than 4 hours,

Engineering will be notified immediately to reprogram all hotel locks or the appropriate

hard key lock changed out. A report will be filed with the appropriate department head.

- A missing/lost key report must be completed when a key is lost. Missing/Lost Key reports

should be kept in the Key Log book.

- Deprogrammed keys should be returned to the Department Head who will complete a Key

Requisition to request a new key to be issued or created. The Master Key Schedule must

be updated accordingly.

- Master Keys lost or deprogrammed should be recorded on the Master Key Schedule

Issuing Guest Room Keys to Guests

- No more than 2 keys should be issued to a guest unless there are additional persons in

the room requiring keys

- Names of all occupants in the room (receiving keys) should be noted in the PMS

- Blank guest keys should be kept in a secure location

- A policy and procedure should be put in place for returning guest keys left in rooms, etc.,

to the front desk for security and re-use

Additional Keys for Guests

- Guests must produce photo ID and be registered guests in order to receive additional or

replacement keys

- Care should be taken to ensure the correct departure date is coded onto additional guest

keys

Locking Out a Guest

- The General Manager, Manager on Duty, or Director of Security may lock out a guest for

non-payment, failed credit, or failing to check out, or other serious circumstances requiring

the Manager to speak with the guest before allowing them to return to their guestroom.

E-Keys (Emergency Keys)

- A set of Emergency Keys (E-Keys) should be kept in the hotel safe or safety deposit box;

a secure location accessible by authorized managers in the event of an emergency or key

system failure.

KEY CONTROLS

VISION: Compliance with tight key controls ensures guest and

associate safety, prevents pilferage and maintains compliance

with primary financial controls.

TEAM PLAYERS: FINANCE

MOVE #: FN-SOP-AD-06

DATE ISSUED: 9/27/02

DATE REVISED: 4/12/10

Page 21 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

- A log must be kept with the E-Keys itemizing the keys included in the E-Key pack, and

their access. This log is different from the Master Key Schedule and any other key log, and

must be kept with the E-Key pack.

- E-Keys may only be issued in the case of an emergency or key system failure

- When E-Keys are issued, the log should be updated to show the date, time, reason and

authorized manager issuing them

- Once the emergency has passed, or the Key System is once again functional, all E-Keys

are to be returned to the E-Key pack and secured.

- The Manager must update the E-Key log with date/time certifying that all E-Keys are

returned and the E-Key pack is complete and ready for future use as necessary.

Page 22 of 155

ASSOCIATE KEY/LOCK CONTROL AGREEMENT

By signing this form you are accepting full responsibility in the action of receiving, returning, and/or

issuing keys and locks, and the security of them while in your possession.

1) With the singular exception of office keys, by AUTHORIZED office staff, ABSOLUTELY NO

HOTEL KEYS SHALL BE REMOVED FROM THE HOTEL PROPERTY. If the nature of

your duties is such as to cause you to leave the property, or if you leave the property for a

break, TURN YOUR KEYS IN TO YOUR DEPARTMENT HEAD. If your Department Head

is unavailable, your keys may be turned in to the Front Desk or Hotel Manager on Duty.

Should you discover that you have inadvertently left the property with such keys in your

possession, immediately contact the Hotel Manager on Duty and advise him/her of the keys

in your possession in the most expeditious manner possible. DO NOT WAIT UNTIL YOUR

NEXT SHIFT, OR UNTIL AFTER LUNCH, OR THE NEXT DAY. It should be assumed that

any such keys removed from the property have been stolen unless this procedure is

followed. This directive specifically includes individual guest suite keys.

2) Unless specifically instructed in writing by authorized senior management, no associates

may duplicate, cause to be duplicated, or in any manner make any drawing, tracings or

impressions, or record any key codes that would allow duplication, by themselves or other

persons, of any hotel key.

3) With the exception of appropriate suite keys being issued to hotel guests registered to that

suite, NO HOTEL KEYS WILL BE ISSUED OR IN ANY MANNER GIVEN TO ANY NON-

HOTEL ASSOCIATE.

4) Having accepted issue of hotel keys, key rings, key sets, the accepting associate has full

responsibility for the use, safekeeping, and turn-in of said keys to the issuer or authorized

turn-in point. This responsibility cannot be delegated or assigned to another person. You

must not allow someone else to do this for you. .

a) Keys, once accepted, should be kept on the person of the receiver. Keys may not be

left unattended unless secured in a locked drawer, safe or safe box. Keys must

never be left on a desk top, work station, cart, in a jacket or uniform pocket hung in

an unsecured area, or in any similar situation that would have them out of the control

of the receiver.

b) If the seal on a sealed key ring/set is broken or otherwise ineffective, it is the

immediate responsibility of the receiver to bring this ring/set to the attention of senior

Page 23 of 155

management. Failure to make this required notification to management shall be

considered gross negligence and shall result in disciplinary action.

c) Loss or theft of any key ring/set must be immediately reported to the departmental

manager. Departmental management is required to make immediate notification to

the hotel General Manager, or, in the event of inability to contact the General

Manager, the Hotel Manager on duty. Failure to make such immediate notification

shall constitute grounds for termination for cause.

These Hotel Policies/Rules of Operation are admittedly strict and deliberately inflexible.

They are designed to protect you and our guests from unauthorized persons having access

to our property or persons. They are intended to make our hotel as secure as we practically

can, and are accordingly considered ongoing conditions of employment of staff and

management alike. Your whole-hearted cooperation and compliance are required at all

times.

5) ISSUED KEYS BECOME YOUR RESPONSIBILITY!

a) No keys are to leave the property at any time.

b) No keys are to be duplicated.

c) No Master Keys may be issued to non-hotel associates.

d) Keys are not to be left unattended.

e) Lost or broken keys must be reported immediately to senior management.

Keys that are not numbered and are personal keys may not be issued to anyone but the

individual to whom the personal key belongs.

Keys must be signed back in and returned before leaving the hotel. Failure to comply with

the preceding or any negligence thereto will result in disciplinary action, up to and including

termination.

I understand and agree that under no circumstances am I allowed to enter any locked area

of the hotel, including guest rooms, without prior Department Head, Supervisor, or

Manager on Duty approval, and even then I will only enter to complete my duties or for the

good cause of the hotel.

I understand that abusing these rules will also result in disciplinary action up to and

including termination.

I have read and understand the Key Control SOP, and acknowledge this form will be

placed in my Employee File.

Associate print name____________________________________________

Associate signature________________________ Date______________

Managers Signature________________________ Date_______________

Page 24 of 155

KEY REQUISITION FORM

Department:_____________________________________________

Requested by:___________________________________________(Printed name)

Authorized by:___________________________________________(Name and signature)

Date:__________________________________________________

Key to allow access to the following areas (cross out blanks):

_________________________ ___________________________

_________________________ ___________________________

_________________________ ___________________________

By signing this form, you are assuming full responsibility in the action of receiving,

returning, and/or issuing a specific key or lock, and understand that you are bound by the

Key Control SOP and Associate Key Control Agreement.

Associate print name_________________________________________

Associate signature__________________________________________

Date_________________

Managers Signature__________________________________________

Date_________________

INVOICE AND CHECK PREPARATION

VISION: To create a standardized system for all invoice approvals

and check preparations. To record invoices accurately in the

proper accounts and financial periods.

TEAM PLAYERS: FINANCE

MOVE #: AP01

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 25 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

PROCEDURE:

1. All non-food and beverage invoices are sent to accounting initially, not to a

department head. Duplicate copies of invoices should be destroyed.

2. All packing slips, Bills of Lading or delivery tickets should be forwarded to

accounting.

3. Invoices should be stamped upon receipt with a voucher stamp which

contains the following information:

Expense Account No (may be several lines)

Received By

General Manager Approval

4. Invoices are matched with Purchase Orders, packing slips, etc. and routed

for approval. Invoices must be returned immediately to the accounting

office. Under no circumstances may an invoice be held by a manager.

5. All invoices must have Purchase Orders attached with the following

exceptions:

Utility Bills

Monthly Leases

Monthly Franchise or Corporate Fees

Food and Beverage Invoices

Tax Payments

Executive Office Expenses

Professional Services

Contractual Services with a Set Amount

INVOICE AND CHECK PREPARATION

VISION: To create a standardized system for all invoice approvals

and check preparations. To record invoices accurately in the

proper accounts and financial periods.

TEAM PLAYERS: FINANCE

MOVE #: AP01

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 26 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

6. Food and beverage invoices should be signed and dated at the time of

delivery by an authorized receiver and entered on the daily Purchase Log.

These logs will be balanced to the general ledger at month end.

7. Never pay from a statement. Never pay a previous balance or balance

forward on an invoice.

8. Check requests should only be used for items that do not have an invoice

such as advances, CODs or mail orders. A detailed description should be

included on the check request with any other information attached. COD or

mail order items must have some sort of back-up attached:

Faxed estimate from Vendor

Copy of flyer or ad for item

9. Coupon payments, applications or other bills that must be returned with

payment should be photocopied and the photocopy processed as the

invoice.

10. Petty Cash reimbursements should be recapped at least at month end, but

weekly if needed. Individual Petty Cash slips should never exceed $150.00,

unless COD or emergencies. All back-up should be properly signed and

approved with receipts attached. The reimbursement form should have the

following information:

Date of Transaction

Payee

Reason

Account Number

Amount

11. Expense Reports should be turned in for reimbursement no later than the

week following the week of travel or the transaction takes place. Forms must

be filled in completely with all receipts attached and be approved by the

INVOICE AND CHECK PREPARATION

VISION: To create a standardized system for all invoice approvals

and check preparations. To record invoices accurately in the

proper accounts and financial periods.

TEAM PLAYERS: FINANCE

MOVE #: AP01

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 27 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

department head and General Manager. General Manager Expense

Reports must be approved by Tecton VP of Operations.

12. Use tax should be added to any invoice from out of state. It should not be

paid to the vendor but rather accrued to use tax and increase the expense

amount. There should be a current State Sales Tax Rules & Regulations book

in the accounting office.

13. Cash discounts should be taken whenever possible and credited to the

proper expense account.

14. Checks should have a separate voucher to attach to the invoices and file in

alphabetical vendor files. This should be the third section of a laser check or

a copy of a carbonized check.

CHECK SIGNING PROCEDURE

VISION: To create a check signature control to protect the integrity

of all cash disbursements.

TEAM PLAYERS: FINANCE

MOVE #: AP02

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 28 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

Check signing is a very important exercise and the signatory will be held

accountable. It will be the responsibility of the signing parties to verify the

accuracy of each check. Review the Accounts Payable Policy and apply each

point as relates to each check. Verify that all back-up is attached to the check

and that the amounts on the back-up are the same as the amounts on the

check.

PROCEDURE

At a full service property, all checks must have two signatures, General Manager

and one other property designate as determined by the VP of Operations and

Corporate Controller. This will be specific to each property. At a limited service

property or an independent property, checks shall be signed by the Regional

Controller, and on a weekly basis the General Manager will approve the check

register.

Bank resolutions will include the authorized property signatures and two Tecton

officers. Copies of the bank resolutions must be retained on property with an

additional copy to the Tecton corporate office. The checks are to be

maintained in the accounting office in a locked cabinet and issued numerically

CAPITAL EXPENDITURES

VISION: To establish guidelines for the purchase and approval

process of capital items.

TEAM PLAYERS: FINANCE

MOVE #: AP03

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 29 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

PROCEDURE

During the budgeting process each year a capital budget will be prepared.

This will include capital equipment purchases for the upcoming year and a

three (3) year major capital plan.

A capital purchase is defined as a purchase of an asset that has a life of at least

two (2) years and a value of at least $1000.00.

Equipment repairs may also be capitalized if the amount exceeds $5,000.00 and

extends the life of the asset by three (3) years or more.

Building repairs and improvements must exceed $2,000.00 and extend the useful

life by three (3) years, not just maintain the asset. This would include paving

parking lots, repairing sidewalks, pool, etc.

The Capital Requisition must be prepared and approved prior to the

expenditure. Three bids, if possible, must be obtained and attached to the

Capital Requisition. Once the Capital Requisition is approved, the property may

proceed with the expenditure, provided proper funding is available. If replaced

equipment is sold, the Capital Requisition should document the sale and the

funds received should be treated based on the propertys individual

management agreement.

If the major project exceeds the budgeted amount, a written explanation must

accompany the Capital Requisition.

Any unbudgeted purchases must have written explanations included with the

Capital Requisition.

CAPITAL EXPENDITURES

VISION: To establish guidelines for the purchase and approval

process of capital items.

TEAM PLAYERS: FINANCE

MOVE #: AP03

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 30 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

REQ#

TECTON

CAPITAL REQUISITION

DATE:

PROPERTY NAME:

Description of Capital Asset to be Purchased

Reason for Expenditure

Disposition of Replaced Equipment

Total Cost of Capital Asset

Item Cost

Shipping

Sales Tax

Installation

Total Cost

Proceeds from Disposition

Net Cost

Approvals

Department Head

Controller

General Manager

Executive VP of Operations

CAPITAL EXPENDITURES

VISION: To establish guidelines for the purchase and approval

process of capital items.

TEAM PLAYERS: FINANCE

MOVE #: AP03

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 31 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

The original of this form must be maintained in a Capital file with the three bids

and a copy of all related invoices. One copy of this form must be attached to

the original invoice. This copy will serve as the Purchase Order.

EXPENSE REPORTS

VISION: To ensure Expense Reports have appropriate

documentation, proper approval and expensed in a timely

manner.

TEAM PLAYERS: FINANCE

MOVE #: AP04

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 32 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

1. The approved Tecton Expense Report is to be used and completed. All

Expense Reports must be submitted the following week of the expense.

2. Original receipts should be attached for each expense.

3. Any outstanding cash advances should be deducted from the total of the

Expense Report. If there is a balance due to the hotel, it should be paid

back to the hotel at the time of the expense report submission. .

4. The individual should sign the Report and submit it for approval. .

5. The General Manager will approve the Expense Report and then submit it to

Accounts Payable for payment.

6. The Accounts Payable Clerk will cut the check in the next check run. Under

no circumstances should manual checks or Petty Cash be used to

reimburse the individual.

7. Mileage will be reimbursed according to Federal guidelines. Travel to and

from work will not be reimbursed.

8. General Manager Expense Reports are to be submitted to the President for

approval before payment.

TRAVEL AGENT COMMISSIONS

VISION: It is Tecton Hospitalitys policy to correctly and accurately

pay travel agents.

TEAM PLAYERS: FINANCE

MOVE #: AP05

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 33 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

The Rooms Department is responsible to review and pay the commissions.

PROCEDURE

1. The checks are to be maintained in the accounting office in a locked

cabinet and issued numerically. A Log should be maintained listing the date,

checks issued and signature of issuing person and Rooms Department.

2. The Rooms Department should review the Travel Agent Commission Report

DAILY to verify the accuracy of the commission. These should only be for

individual reservations, not group rooms.

3. The checks should be prepared on a weekly basis in accordance with the

Travel Agent Commission Report from the PMS System.

4. A Check Register should be prepared and given to Accounting on a weekly

basis.

5. Payments may only be made to travel agents with IATA numbers.

GROUP TRAVEL AGENT COMMISSIONS

VISION: On a selected basis, a Group Travel Agent Commission

may be paid to an individual, company or third party who provided

the hotel with paid group room business.

TEAM PLAYERS: FINANCE

MOVE #: AP06

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 34 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

The Director of Sales is responsible to obtain approval in advance from the

General Manager for the payment of a group commission.

PROCEDURE

1. The General Manager must approve the commissionable booking based on

profitability in advance. This commission is payable on consumed room rate

ONLY, not food and beverage.

2. This commission will be coded to the appropriate Rooms Department

Expense Account, not netted out of group room rate.

3. The commission will be paid from the operating account. To release the

check, the entire group function bill must be paid. The check request from

the Director of Sales should include the correct Group Room Pick-up Reports

and a copy of the Sales Contract that states the group was commissionable.

Note: Group commissions are deducted from the Group Room Revenue when

calculating any incentive or bonus award.

PURCHASE ORDERS

VISION: It is the policy of Tecton that all non-food and beverage

consumable purchases over $150.00 are purchased through the

Purchase Order System with proper approvals. Any purchase over

$1000.00 must have three (3) bids obtained and attached.

TEAM PLAYERS: FINANCE

MOVE #: AP07

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 35 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

It is the responsibility of both the General Manager and Controller to ensure this

policy is followed by all departments.

PROCEDURE

Four-part, Tecton approved Purchase Orders are to be used. The following

numbers refer to the sample PO and how to properly complete each area:

1. Area for property name and address.

2. Pre-numbered requisition.

3. Vendor name and address.

4. Detailed description of items to be purchased.

5. Signature area To be completed in the same order No order may be

placed before these signatures are obtained.

6. Detail of items to be purchased Three areas for mixed item order:

Expense code General Ledger account number

Budget Amount of budget for the month

Last Balance Running balance of budget remaining to

spend for the month for this expense line

This PO Req Total amount for this PO including tax and

freight

Available Balance Last Balance less this PO Request

7. Space to list three (3) bids if this purchase request exceeds $500.00. The bids

should be attached.

PURCHASE ORDERS

VISION: It is the policy of Tecton that all non-food and beverage

consumable purchases over $150.00 are purchased through the

Purchase Order System with proper approvals. Any purchase over

$1000.00 must have three (3) bids obtained and attached.

TEAM PLAYERS: FINANCE

MOVE #: AP07

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 36 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

8. Distribution of completed Purchase Order:

Vendor Copy To be mailed to Vendor

Department Copy Copy to be maintained by department by

vendor for future reference.

Invoice Copy To be attached to invoice by department

when invoice is received for approval If

invoice is not received by months end, but

merchandise has been received, this

becomes the basis for expense accrual.

Accounting Copy To be maintained by the accounting office in

numeric order for control purposes.

VENDOR CREDIT LETTER

VISION: This policy defines a standard form for obtaining credit from

vendors on behalf of a hotel managed by Tecton Hospitality.

TEAM PLAYERS: FINANCE

MOVE #: AP08

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 37 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

It is the responsibility of the Controller to provide vendors with a clear outline of

information regarding ownership.

PROCEDURE

The following information should be prepared on property letterhead to

establish credit with vendors:

The following information should be prepared on property letterhead to

establish credit with vendors:

OWNERS NAME Legal ownership of Hotel

MANAGING AGENT Legal Managing Co. name not Tecton

Hospitality

TRADE NAME d/b/a Name of Hotel

MAILING ADDRESS Address with Attn: Accounts Payable

TELEPHONE Hotel number or DDA for Accounts Payable

CONTACT Accounts Payable

BANK Bank used for Operating Account

OFFICER Bank Officer contact

THREE VENDOR REFERENCES

Name: _____________ Name: ________________ Name: ________________

Address: ___________ Address: ______________ Address: ______________

Telephone: _________ Telephone: ____________ Telephone: ____________

Contact: ____________ Contact: ______________ Contact: ______________

Note: If you need further information, please do not hesitate to contact the

Hotel Controller.

CREDIT POLICY

VISION: To set forth the Hotels credit policy for all areas of the

Hotel.

TEAM PLAYERS: FINANCE

MOVE #: AR01

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 38 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

The Hotels Executive Committee is charged with the overall responsibility to

enforce the credit policy through the Credit Committee, which, at a minimum,

will consist of the following people: General Manager, Controller, Credit

Manager or Accounts Receivable Supervisor, and other designates of the

General Manager.

A. GUEST IDENTIFICATION AND REGISTRATION

1. For a credit card charging guest, the credit card should be swiped for

authorization and imprinted on the back of the registration card.

2. A cash paying guest, noted as a CIA, must provide a valid drivers

license or another form of identification with picture and signature.

3. A deposit in the amount of room, tax and incidentals for the entire stay

should be collected from the guest prior to check-in.

4. Direct billing arrangements must be set up at least twenty-one (30) days

prior to check-in and approved by the Credit Manager, AR Supervisor or

Controller.

B. HIGH BALANCE REPORT

1. Should be reviewed daily by the Front Office Manager. All accounts

should be verified as to credit approval or follow up action. Front Office

procedures should be followed.

C. CHECK CASHING

1. Travelers Checks for Registered Guests Must be signed in the presence

of a cashier. Verify signature with one piece of identification; all three

signatures must agree.

2. No third-party personal or Travelers Checks.

3. No Hotel payroll checks or any employee checks.

CREDIT POLICY

VISION: To set forth the Hotels credit policy for all areas of the

Hotel.

TEAM PLAYERS: FINANCE

MOVE #: AR01

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 39 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

D. GROUP AND CATERING

1. Credit will only be granted to groups spending $1,000 minimum per

event and $10,000 per year. The Controller and Credit Manager or AR

Supervisor must jointly approve all requests for credit.

All credit applications must be checked and approved or returned Not

Approved by the Accounting Department prior to the function.

Completed credit applications should be given to Accounting at least

twenty-one (30) days prior to the function. Accounting will return the

application as Approved or Not Approved within five (5) business

days of receipt.

Credit checks are necessary when a group makes definite

arrangements at our Hotel. In these circumstances, the salesperson

should send a Credit Application to the customer. The customer should

return the completed form to the Credit Manager. Accounting must

approve or deny the credit application and forward a copy of the

information to the Sales Department for their files. The original should be

filed in an alphabetical file in the Accounting Department.

Credit applications should be requested annually from all clients. If it is

decided that granting credit may be risky based upon the credit history,

the Controller and/or Director of Hotel Sales and Director of Catering

should meet to determine if there are some alternatives, such as

deposits for full prepayment, that will allow us to book the business and

minimize our risk.

If a company has been billed and becomes delinquent in payment, it is

the responsibility of the Accounting Office to notify the Front Desk,

Reservation and Catering Departments immediately of this condition.

The billing privilege will be terminated until full payment is received. A

decision will be made as to future billing status.

CREDIT POLICY

VISION: To set forth the Hotels credit policy for all areas of the

Hotel.

TEAM PLAYERS: FINANCE

MOVE #: AR01

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 40 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

2. It is standard procedure to require deposits, advance payment,

authorized credit card, and/or same night payment for groups of

questionable or unknown credit responsibility.

Deposits are specifically required for the following functions:

High School, College, Fraternity/Sorority groups

Weddings and Bar Mitzvahs

Testimonial Dinners

Private Family groups

Dances, Garden, Bridge, Bowling and similar Clubs

Church functions

Christmas parties or related December functions

Fundraising functions Political

Speculative type functions where ability to pay depends on total

attendance or the sale of tickets, i.e., beauty contests, cosmetic

shows, talent contests, entertainers, etc.

A deposit of Fifty Percent (50%) should be requested in the initial letter of

confirmation. The deposit should be received within ten (10) days,

together with the signed Letter of Confirmation. Additional instructions

for further deposits and method of payment should be incorporated in

this same letter.

All political fundraising functions will require full payment Forty-eight (48)

hours in advance of the function. There will be no deviation from this

procedure.

Deposits are not meant to alienate our customer. They are used as a

sound business procedure to lessen indiscriminate bookings and

cancellations. A deposit can be refundable or non-refundable and

should be stated in the Letter of Confirmation. These terms should be

CREDIT POLICY

VISION: To set forth the Hotels credit policy for all areas of the

Hotel.

TEAM PLAYERS: FINANCE

MOVE #: AR01

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 41 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

included with the deposit paragraph or the payment term paragraph.

Deposits are refunded when sufficient notice is received and the space

can be re-sold. Deposits are non-refundable when the timeframe does

not permit the space to be re-sold and other business was turned down

prior to the cancellation. The Director of Catering should make the final

judgment on this, as there are times when the reason for cancellation

may be justified and we do not want to place any future business in

jeopardy.

E. CREDIT MEETINGS AGENDA

A Credit Meeting should be held once each month. Notice of meeting

should be given via a memo. The attendees should be at least General

Manager, Controller, Accounts Receivable Manager, Director of Sales,

Front Office Manager and Catering Manager. The agenda of the

Credit Meeting should cover the following areas:

1. Status report on 60-day and older accounts;

2. Review any potential problem accounts in current or 30 day

category;

3. Review returned checks;

4. Review unbillable and charge-back items;

5. Discussion and action plan to avoid reoccurrence;

6. Status of compliance with Credit Policy;

7. Update on all accounts with the Collection Agency; and

8. Assignment of new accounts with the Collection Agency.

Minutes are to be kept and circulated to all the members of the Credit

Committee. Minutes should be maintained for one (1) year.

CREDIT POLICY

VISION: To set forth the Hotels credit policy for all areas of the

Hotel.

TEAM PLAYERS: FINANCE

MOVE #: AR01

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 42 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

HOTEL NAME CREDITAPPLICATION AND AUTHORIZATION

Function Title: Function Date:

Company Name:

Company Address: Billing address:

Phone Number: Attention:

Contact: Phone Number:

Personnel authorized to sign for charges: (*) Signature:

Name:

Name:

Name:

(*) Credit References: (Prior Hotels with established credit history preferred)

1. Name: 2. Name:

Address Address

Phone No.: Phone No.:

Date of Function(s): Date of Function(s):

3. Name: 4. Name:

Address Address

Phone No.: Phone No.:

Date of Function(s): Date of Function(s):

Is your group exempt from State Tax? No Yes

Note: The undersigned agrees to make immediate payment upon receipt of a statement. In the event such payment is not made

within Twenty-five (25) days after receipt of the original statement, it is agreed that the Hotel may immediately impose a late

payment charge at the rate of 1 % per month (annual rate of 18%), or the maximum allowed by law, on the unpaid balance, and

the reasonable cost of collection, including attorneys fees.

I HEREBY AUTHORIZE THE HOTEL TO VERIFY THE ABOVE INFORMATION.

Print Name: Signature:

Title:

FOR INTERNAL USE ONLY

Booking Sales Person: Credit Approved

Aprox. Total Billing: Credit Denied

CREDIT POLICY

VISION: To set forth the Hotels credit policy for all areas of the

Hotel.

TEAM PLAYERS: FINANCE

MOVE #: AR01

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 43 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

Corporate Credit Card No.: By:

GUEST AND CITY LEDGER

VISION: The purpose of this policy is to define receivables and

collection responsibility.

TEAM PLAYERS: FINANCE

MOVE #: AR02

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 44 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

All Receivables residing in the Guest Ledger are the responsibility of the Front

Office and those in City Ledger are the responsibility of the Accounting Office.

PROCEDURE

Accounts Receivable are comprised of two basic types:

1. Guest Ledger represents the unbilled accounts of guests who are currently in

the Hotel, advance deposits, master accounts and house accounts. These

receivables will remain at the Front Desk and are the responsibility of the

Front Office Manager.

2. City Ledger represents the billed but uncollected accounts of guests who

have departed from the Hotel. These receivables are the end result of Guest

Ledger and become the responsibility of the Accounting Department, with

the Controller ultimately responsible.

A. TRANSFERS TO CITY LEDGER

All accounts for direct bill must be approved and authorized by the

Credit Supervisor before the Front Office cashiers can transfer the

completed Guest Ledger accounts to City Ledger. The approval for

credit should be done prior to arrival. The transfer to City Ledger should

be done on the day of check-out for individual and voucher accounts

and on the third day for group masters.

A thorough review of each account transferred to City Ledger is the

direct responsibility of the Front Office Manager in conjunction with the

Accounting Department Credit Supervisor. Under no circumstances

should undocumented items be transferred to City Ledger to clear the

Guest Ledger.

Once items have been transferred to City Ledger, it is the responsibility

of the Accounting Department to follow up on collections on all

accounts. Any adjustments that are to be made to these accounts are

GUEST AND CITY LEDGER

VISION: The purpose of this policy is to define receivables and

collection responsibility.

TEAM PLAYERS: FINANCE

MOVE #: AR02

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 45 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

to be properly documented and approved by the Controller or General

Manager and Manager of the department whose revenue is affected.

B. PAYMENTS

On a daily basis, all accounts receivable payments will be received by

someone other than an accounting staff member. They will be logged

and a duplicate of this Log and copies of the checks will be given to

Accounts Receivable. The checks will be dropped in the drop safe.

Payments are then posted to the subsidiary City Ledger by the Credit

Supervisor. The last page on the aging is then displayed or printed and

compared to the General Ledger City Ledger balance to ensure the

two are in balance. All discrepancies are to be identified and

corrected immediately.

If a payment is partial, the customer will be contacted immediately to

determine how the payment is to be applied. If the payment is an

overpayment or duplicate payment, a refund check will be sent

immediately.

If a payment is received and an account cannot be located, the

customer will be contacted immediately to determine the disposition of

the payment.

When clearing credit balances from the accounts receivable again,

whether arising from overpayment or non-utilization of advance deposits

(excluding forfeited deposits due to insufficient notification by the

guest), every effort must be made to locate the proper recipient. In the

unusual circumstance where this cannot be accomplished, the

remaining credit balance would be recognized as miscellaneous

income after six months. At month-end a copy of the aging should be

retained (as backup) with the General Ledger account.

C. BILLING

GUEST AND CITY LEDGER

VISION: The purpose of this policy is to define receivables and

collection responsibility.

TEAM PLAYERS: FINANCE

MOVE #: AR02

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 46 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

The billing of accounts receivable is to be maintained on a daily basis,

with no more than three (3) working days between the date the guest

account is transferred to City Ledger and the date it is placed into the

mail, except for Banquet Master Accounts which should be in the mail

no later than five (5) working days.

The initial billing on all accounts will include a statement and backup

invoices (i.e., folios, etc.) to support each current transaction reflected

on the statement. All bills over $10,000.00 should be sent via certified

mail.

D. COLLECTION

1. The first billing from the property will be within 3 days of the guests

departure from the Hotel. All group billings should contain a pre-

printed card identifying Accounts Receivable Supervisor or Credit

Manager as the person to contact to discuss billing.

10 days after the first bill is mailed, all accounts should be

telephoned to confirm that the bill has been received and to

determine the status. The results of this call should be recorded in

the guests file. If it is determined that the bill was not received or is

incorrect, a corrected billing will be sent out by overnight mail with

a follow up phone call to verify receipt and expected payment

date.

2. Every 10 days communication should be attempted to determine

status of the account and documented. The results of this call

should be recorded in the guests file.

3. When the account has aged 70 days, the Controller will then

decide:

a. Write-off the account as uncollectible;

b. Continue collection efforts from the property; or

c. Send to collection.

RETURNED CHECKS

VISION: It is the policy of Tecton Hospitality to collect all checks that

are returned from the bank.

TEAM PLAYERS: FINANCE

MOVE #: AR03

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 47 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

It is the responsibility of the Controller to train all departments in the proper

procedures for accepting checks. It is the Department Heads responsibility to

train staff in same.

PROCEDURE

All checks are to be processed through the banking system twice. After

attempting to deposit the check again, the returned check will become an

account receivable.

After every effort has been made to collect the returned check, to include, but

not limited to, all efforts as outlined in the Tecton Credit Policy, the returned

check should be written off.

ALLOWANCE FOR DOUBTFUL ACCOUNTS

VISION: Tecton Hospitality standards for aged receivables.

TEAM PLAYERS: FINANCE

MOVE #: AR04

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 48 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

It is the direct responsibility of the Controller to ensure that an adequate

Allowance for Doubtful Accounts exists and that all write-offs follow the

approval process outlined below.

PROCEDURES

ALLOWANCE FOR DOUBTFUL ACCOUNTS

A reserve will be maintained to cover the subsequent write-off of accounts

receivable. This should be equal to 3% or non-credit card accounts receivable.

A monthly entry will be made to debit the Bad Debt expense in the A&G

Department and credit the Allowance for Doubtful Accounts. This amount may

be based on an annualized amount.

WRITE-OFFS

There will be, from time to time, accounts receivable accounts which will be

deemed uncollectible. These accounts will be charged to the Allowance for

Doubtful Accounts or to the departmental bad debt expense.

A. If all hotel credit procedures and company policies have been followed

and the account is deemed uncollectible, the account should be written

off to the Allowance for Doubtful Accounts.

In the event that your write-off reduces the Reserve for Bad Debts to less

than 3% of non-credit card receivables, an adjustment needs to be made

to the Reserve accordingly.

B. If an account is transferred to City Ledger and is not billable, the Accounts

Receivable Supervisor will make every effort possible to obtain a billing

address. In a case where it becomes impossible to bill the account, it will

be written off and charged to the bad debt expense of the department

which was responsible. Examples of this would include walkouts, non-

readable credit card imprints, CIAs, etc.

ALLOWANCE FOR DOUBTFUL ACCOUNTS

VISION: Tecton Hospitality standards for aged receivables.

TEAM PLAYERS: FINANCE

MOVE #: AR04

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 49 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

Also, if a policy is violated and the account is billed but not collected, the

account will be written off and charged to the bad debt expense of the

responsible department.

C. Accounts Receivable write-offs should be documented as to reason,

including comments of appropriate department.

All write-offs and adjustments, including credit card rebates, must be

approved by the department head, Controller, and General Manager.

D. Accounts are to be written off when they are determined to be

uncollectible, but in no case are they to be retained on the books

beyond 180 days.

Unidentified credit balances in the 180 day age category are to be

written off as a credit to Allowance for Doubtful Accounts.

Except for items previously written off to a departmental bad debt

expense, all recovery of Bad Debt previously written off are to be credited

to the Allowance for Doubtful Accounts. Recovery of items written off to

a departmental expense should be credited to the expense where it was

originally charged

CITY LEDGER AGING STANDARDS

VISION: Tecton Hospitality standards for aged receivables.

TEAM PLAYERS: FINANCE

MOVE #: AR05

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 50 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

Standards for aged receivables are:

0 29 days 72%

30 59 days 20%

60+ days 8%

GUEST LEDGER ADJUSTMENTS

VISION: To ensure that adequate controls are in place over all

transactions in the Guest Ledger.

TEAM PLAYERS: FINANCE

MOVE #: AR06

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 51 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

The General Manager working with the Front Office Manager has full

responsibility for the total Guest Ledger.

PROCEDURE

1. All adjustments are to be posted the same day they are approved.

2. All adjustments made are circulated daily to the Executive Committee for

review and approval the following day.

3. The Controller or General Manager General Manager will review the daily

credit card batch reports and verify that any credit card credits are

legitimate.

4. The accounting staff may post adjustments and miscellaneous vouchers to

the Guest Ledger. At the end of their shift they will run a shift close to verify

the accuracy of the transactions.

5. All transactions to Guest Ledger will require a miscellaneous or adjustment

voucher. This form must be completed and authorized per policy with

appropriate backup attached. Front Office and Accounting are to

forward all items to the Night Audit Staff with their shift work. Night Audit will

then forward all forms and documentation to Accounting via the Income

J ournal packet. The Controller or the General Manager General

Management must review all forms and documentation daily, including the

shift closing of any Accounting Clerk.

6. All City ledger transfers will be performed by the Accounting Department.

This must be done within SOP stated time limits.

ADVANCE DEPOSITS

VISION: To standardize the method of recording advance deposits

on all properties.

TEAM PLAYERS: FINANCE

MOVE #: AR07

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 52 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

It is the responsibility of the Controller and General Manager General Manager

or Front Desk Manager to insure that the following methods are used to record

advance deposits.

PROCEDURE

All advance deposits should be logged and restrictively endorsed. The checks

are separated as either Rooms or Banquets advance deposits. They should be

listed by date of arrival. Copies of the Logs and checks should be made and

the actual checks dropped in the drop safe.

A copy of the Log should be given to Accounting, Banquets and Reservations.

1. The catering secretary should create a master for the group and advise

Reservations of the account number.

2. Reservations should transfer the reservation from their Reservation System

and post the advance deposit in the advance deposit mode They should

then run a shift close to balance to the check copies and drop the check

copies in their drop envelope.

3. The General Cashier will compare the totals posted by Reservations to the

total drop from the original processor and report any overages or shortages

with the Consolidated Deposit Over/Short Report.

4. Under no circumstances should any advance deposit receipts be held or

not posted on the same or next business day that they are received.

5. The advance deposit detail should be reconciled daily to the control total

in the Guest Ledger and balanced to the General Ledger each month.

ACCOUNTING FOR CHARGE BACKS

VISION: The purpose of this policy is to standardize the method for

processing all CHARGE BACKS and minimizing write-off.

TEAM PLAYERS: FINANCE

MOVE #: AR08

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 53 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

It is the responsibility of the Controller to ensure that the following methods are

used to process CHARGE BACKS.

PROCEDURE

1. When CHARGE BACKS OR RETRIEVAL REQUESTS are received, the

Accounting Department must respond in the prescribed time for each

credit card company and maintain a log of action taken.

2. When a credit is due the guest, advise the credit card company that a

credit was issued.

A. Prepare an adjustment voucher and post through the PMS System.

B. Code to the corresponding revenue account if an error in charging.

C. Code to the correct bad debt account if considered a write-off.

D. Adjust the appropriate statistical account as necessary.

HOUSE FUNDS AND AUDITS

VISION: To protect property assets.

TEAM PLAYERS: FINANCE

MOVE #: CA01

EFFECTIVE DATE: 12/01/05

DATE REVISED: 12/01/05

Page 54 of 155

M.O.V.E.S.

Managing Operating

Visions Ensuring Success

RESPONSIBILITY

The Controller and the appropriate Executive Committee member must sign all

completed Bank Contracts prior to issuance of banks. Bank amounts will be