Professional Documents

Culture Documents

Daily Research

Uploaded by

'Osvaldo' Rio0 ratings0% found this document useful (0 votes)

32 views6 pages20140430 Daily Research

Original Title

20140430 Daily Research

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document20140430 Daily Research

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views6 pagesDaily Research

Uploaded by

'Osvaldo' Rio20140430 Daily Research

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

Previous Day:

Pada penutupan perdagangan hari Selasa (29/4), IHSG naik

sebanyak 0,923 poin (0,02%) ke level 4819,68. Ada sebanyak

164 saham yang naik, 108 saham yang mengalami koreksi,

dan 96 saham yang stagnan. Total perdagangan hari ini seban-

yak Rp 5,221 triliun. LQ45 turun 1,64 poin (-0,20%) ke level

812,09. Sektor-sektro di zona hijau adalah sektor agrikultur

naik 1,74%, sektor perdagangan naik 0,98%, dan sektor con-

sumer goods naik 0,84%. Sektor-sektor di zona merah adalah

sektor infrastruktur turun 1,67%, sektor aneka industri turun

1,35%, dan sektor pertambangan turun 0,91%. Foreign net

sell sebesar Rp 497,94 miliar. Indeks Nikkei turun 0,98%.

Indeks Straits Times jatuh 0,15%. Indeks Hang Seng naik

1,45%. Indeks Shanghai naik 0,82%.

Todays Market:

Secara teknikal indeks hari Rabu (30/4) diperkirakan akan

bergerak mixed di level 4783-4858. Bank Indonesia mengesti-

masikan neraca perdagangan Maret 2014 surplus lebih dari

US$ 800 juta menunjukan perbaikan perdagangan bulan Ma-

ret 2014 merupakan penopang surplus perdagangan kuartal I

-2014. Hal ini dapat memberikan sentimen positif terhadap

indeks hari ini.

Top Technical Buys:

PTPP, UNTR, BBCA, BWPT

Sinarmas Investment Research/ 62 21 3925550/research@sinarmassekuritas.co.id DAILY RESEARCH

UNDERVALUED STOCKS 2014:

MYOR 34,600

ROTI 1,330

Closing

JCI

Transaction Value (Rp tn)

Transaction Volume (mn shares)

Foreign Net Buy (Sell) (Rp bn) (497.94)

Foreign Net Buy (Sell) YTD (Rp tn) 33.52

as percentage of last year's 0.44

Total Market Capitalization (Rp tn) 4,477.38

Closing

1 Day

Return %

YTD

Change

%

4,819.68 0.02 12.8

812.09 (0.20) 14.2

27.57 2.22 20.7

25.18 1.53 18.4

16,535.37 0.53 (0.2)

1,878.33 0.48 1.6

4,103.54 0.72 (1.7)

6,769.91 1.04 0.3

14,288.23 (0.98) (11.7)

22,132.53 1.45 (3.7)

3,242.71 (0.15) 2.2

1,859.34 0.19 (0.4)

FOREX Change

YTD

Change

%

USD/IDR (22.50) 5.6

EUR/IDR (92.20) 5.2

JPY/IDR (0.01) 2.9

SGD/IDR (20.43) 4.8

AUD/IDR 22.01 1.5

GBP/IDR 4.41 3.7

Price

1 Day

Return %

YTD

Change

%

CRUDE OIL

(USD)/BARREL 100.49 (0.78) 2.1

COAL (USD) / MT 76.90 0.07 (5.9)

NATURAL GAS

(USD) / mmBtu 4.84 0.08 14.3

GOLD (USD) / OUNCE 1,295.30 (0.05) 7.4

NICKEL (USD) / MT 18,199.00 0.27 30.9

TIN (USD) / MT 23,166.00 (0.13) 3.7

CPO (MYR) / MT 2,690.00 (0.99) 2.4

RUBBER (JPY)/KG 206.00 0.83 (26.4)

WHEAT/BUSHEL 7.06 (0.32) 16.6

CORN/BUSHEL 5.15 (0.10) 22.1

4,819.68

5.221

5,179

IDX Statistics

Commodities

JCI

LQ45

EIDO

IDX

9,180.43

10,699.25

19,403.39

Key Indices

STRAITS TIMES

KLSE

Rate (IDR)

11,526.30

15,923.25

112.48

HANG SENG

DOW JONES

S&P 500

NASDAQ

FTSE

NIKKEI

See important disclaimer at the end of this report

Wednesday, April 30, 2014

4,795

4,805

4,815

4,825

JCI Index

Last Price Previous day Closed at 4819.68

2

CORPORATE NEWS

PT Intiland Development Tbk (DILD) membukukan kenaikan laba bersih 51,82% di kuartal I-2014 men-

capai Rp 121,52 miliar dibandingkan periode yang sama di tahun sebelumnya Rp 80,04 miliar. Kenaikan

laba bersih ditopang lonjakan pendapatan usaha. Pendapatan usaha pada kuartal I-2014 naik sebesar 8%

menjadi Rp 452,60 miliar. (Positive) Source: Indonesia Finance Today

PT Waskita Karya Tbk (WSKT) akan investasi Rp 5 triliun untuk membangun superblock di Surabaya,

Jawa Timur. Pengerjaan konstruksi akan dilakukan secara bertahap oleh perusahaan dalam kurun waktu

lima tahun kedepan. (Positive) Source: Indonesia Finance Today

PT Jasa Marga Tbk (JSMR) membukukan kenaikan laba bersih 16,74% menjadi Rp 376,05 miliar dari pe-

riode yang sama tahun sebelumnya Rp 322,1 miliar. Kenaikan laba ini ditopang oleh kemampuan perusa-

haan menekan beban. Beban usaha perusahaan menyusut 22,48% dari Rp 1,69 triliun menjadi Rp 1,31 tril-

iun. (Positive) Source: Kontan

PT Summarecon Agung Tbk (SMRA) mengantongi pinjaman Rp 2,21 triliun dari PT Bank Central Asia

Tbk (BBCA) dan PT Bank Mandiri Tbk (BMRI). Fasilitas tersebut dijamin dengan asset tanah dan bangunan

milik perusahaan yang tersebar di Jakarta, Banten, dan Bali. (Positive) Source: Investor Daily

See important disclaimer at the end of this report

Wednesday, April 30, 2014

3

Eddy Wijaya/ Technical Analyst/62 21 3925550 TRADING VIEW

See important disclaimer at the end of this report

Wednesday, April 30, 2014

By: Rheza, Tiesha, RichardRESEARCH DEPARTMENT By: Eddy Wijaya (+6221-3925550)

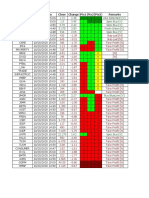

TICKER RECOMMENDATION PRICE ENTRY EXIT S2 S1 R1 R2 EXPLANATION

AGRICULTURE

AALI Buy on Weakness 29000 28600 29400 28200 28600 29400 29800 Rsi : uptrend

BWPT Trading Buy 1400 1400 1415 1380 1390 1415 1430 Macd : uptrend

LSIP Buy on Weakness 2450 2420 2480 2400 2420 2480 2510 Rsi : uptrend

BANK & FINANCE

BMRI Buy on Weakness 9800 9725 9900 9650 9725 9900 10000 Macd : downtrend

BBRI Buy on Weakness 9775 9700 9850 9650 9700 9850 9950 Stoc osc : downtrend

BBNI Trading Sell 4835 4835 4805 4795 4805 4845 4885 Falling window

BBCA Trading Buy 11000 11000 11100 10800 10900 11100 11225 Rsi : reversal

CONSUMER GOODS

INDF Buy on Weakness 7025 6950 7050 6850 6950 7050 7150 White spinning top

ICBP Buy on Weakness 10000 9900 10100 9800 9900 10100 10200 Stoc osc :uptrend

GGRM Trading Buy 55750 55750 56200 54900 55350 56200 56600 Rsi : uptrend

UNVR Buy on Weakness 29000 28900 29300 28650 28900 29300 29600 Macd : downtrend

CPIN Trading Sell 3825 3825 3805 3785 3805 3835 3855 Macd : downtrend

MAIN Buy on Weakness 2975 2960 3000 2940 2960 3000 3040 Black spinning top

BASIC & MISC INDUSTRY

ASII Trading Sell 7475 7475 7400 7300 7400 7550 7650 Black spinning top

SMGR Trading Sell 14975 14975 14800 14600 14800 15050 15200 Macd : downtrend

INTP Trading Sell 21875 21875 21700 21500 21700 22000 22250 Black spinning top

INFRASTRUCTURE

TLKM Trading Sell 2270 2270 2250 2225 2250 2290 2305 Macd : downtrend

PGAS Trading Sell 5300 5300 5250 5200 5250 5350 5400 Macd : death cross

JSMR Buy on Weakness 5850 5800 5925 5750 5800 5925 6000 Black spinning top

TBIG Buy on Weakness 6300 6200 6350 6100 6200 6350 6450 Inverted hammer

RETAIL

MAPI Buy on Weakness 6100 6050 6150 6000 6050 6150 6225 Gravestone doji

RALS Trading Sell 1235 1235 1225 1210 1225 1245 1260 Black spinning top

ACES Trading Sell 750 750 740 730 740 760 780 Macd : downtrend

MPPA Buy on Weakness 2765 2745 2770 2725 2745 2770 2790 Stoc osc : downtrend

MINING

PTBA Trading Sell 9800 9800 9700 9600 9700 9900 10000 Falling window

ADRO Buy on Weakness 1125 1115 1140 1100 1115 1140 1160 Black spinning top

ITMG Trading Sell 24875 24875 24800 24700 24800 25000 25100 Gravestone doji

ANTM Buy on Weakness 1200 1180 1220 1160 1180 1220 1240 Long legged doji

TINS Buy on Weakness 1545 1530 1560 1510 1530 1560 1590 Rsi : downtrend

UNTR Trading Buy 21900 21900 22100 21350 21600 22100 22250 Morning star

PROPERTY

ASRI Buy on Weakness 535 525 540 515 525 540 560 White spinning top

LPKR Buy on Weakness 1070 1060 1070 1050 1060 1070 1090 White spinning top

CTRA Trading Sell 1030 1030 1010 980 1010 1045 1060 Macd : downtrend

APLN Trading Sell 263 263 261 258 261 267 273 Macd : downtrend

SMRA Buy on Weakness 1090 1080 1100 1060 1080 1100 1120 White spinning top

SSIA Buy on Weakness 850 835 865 815 835 865 880 Long legged doji

BSDE Buy on Weakness 1565 1550 1580 1540 1550 1580 1600 Rsi : reversal

WIKA Buy on Weakness 2295 2285 2315 2270 2285 2315 2330 White spinning top

PTPP Buy on Weakness 1830 1820 1850 1800 1820 1850 1880 Rsi : reversal

ADHI Buy on Weakness 2975 2950 3000 2920 2950 3000 3050 Black spinning top

4

Global Equity Indices

Description YTD Change % 30-Apr-14 Forward 2014 P/E Ratio (Best Est.)

LQ45 14.2 812

Nikkei 225 (11.7) 14,390

JCI 12.8 4,820

FTSE 100 0.3 6,770

ASX 200 2.4 5,480

DJIA (0.2) 16,535

S&P500 1.6 1,878

STI 2.2 3,238

CAC 40 4.7 4,498

Shanghai Composite (4.5) 2,020

DAX 0.3 9,584

KOSPI (2.0) 1,972

Hang Seng (3.7) 22,454

Euro Stoxx 3.2 3,209

Description YTD Change % 30-Apr-14 Description YTD Change % 30-Apr-14

AALI 15.5 29,000 ICBP (2.0) 10,000

ADRO 3.2 1,125 IMAS (2.2) 4,790

AKRA 9.0 4,770 INCO 36.2 3,610

ANTM 10.1 1,200 INDF 6.4 7,025

ASII 9.9 7,475 INDY 3.4 610

ASRI 24.4 535 INTP 9.4 21,875

BBCA 14.6 11,000 ITMG (12.7) 24,875

BBNI 22.4 4,835 JSMR 23.8 5,850

BBRI 34.8 9,775 KLBF 22.0 1,525

BBTN 32.8 1,155 LPKR 17.6 1,070

BDMN 13.9 4,300 LSIP 26.9 2,450

BHIT (9.7) 307 MAIN (6.3) 2,975

BKSL 8.9 171 MAPI 10.9 6,100

BMRI 24.8 9,800 MNCN 2.5 2,690

BMTR 13.9 2,165 PGAS 18.4 5,300

BSDE 21.3 1,565 PTBA (3.9) 9,800

BUMI (35.3) 194 SMCB 24.8 2,840

BWPT 5.3 1,400 SMGR 5.8 14,975

CPIN 13.3 3,825 SSIA 51.8 850

EXCL (7.1) 4,830 TLKM 6.6 2,270

GGRM 32.7 55,750 UNTR 15.3 21,900

GIAA (7.7) 458 UNVR 11.5 29,000

HRUM (14.2) 2,360 JAKPROP INDEX

JAKBIND INDEX

Sectors JAKFIN INDEX

Description

JAKCONS INDEX

Property (2.0) JAKMIND INDEX

Basic Industry (3.6) JAKINFR INDEX

Trade (0.4) JAKAGRI INDEX

Finance 1.6 JAKMINE INDEX

Miscellaneous Industry 1.3

Consumer (0.2)

Infrastructure 2.0

Agriculture 5.5

Mining 5.8

1-mth Return %

Selected Indonesian Equities

14.9

16.2

15.1

13.9

15.4

14.8

16.0

14.3

14.3

7.9

13.5

7.6

10.4

13.9

See important disclaimer at the end of this report

Wednesday, April 30, 2014

5

Dividend

Upcoming IPO

See important disclaimer at the end of this report

Company Business Offering

Date

Share

in Rp.

Price in Rp. Listing Date

PT Dwi Aneka Jaya Kemasindo Kemasan

PT Puradelta Lestari Properti 205-255

Ticker Status DPS (Rp) Cum Date Ex Date Recording Payment

MPPA Final 186 5 Mei 2014 6 Mei 2014 8 Mei 2014 19 Mei 2014

AISA Final 75.5 8 Mei 2014 9 Mei 2014 13 Mei 2014 30 Mei 2014

SDRA Final 11 9 Mei 2014 12 Mei 2014 14 Mei 2014 2 Juni 2014

AALI Final 355 9 Mei 2014 12 Mei 2014 14 Mei 2014 2 Juni 2014

EXCL Final TBA 13 Mei 2014 14 Mei 2014 19 Mei 2014 4 Juni 2014

UNTR Final 340 14 Mei 2014 16 Mei 2014 20 Mei 2014 5 Juni 2014

MLPL Final 21.2 16 Mei 2014 19 Mei 2014 21 Mei 2014 5 Juni 2014

ASGR Final 44 16 Mei 2014 19 Mei 2014 21 Mei 2014 6 Juni 2014

ROTI Final 3.12 19 Mei 2014 20 Mei 2014 22 Mei 2014 5 Juni 2014

AUTO Final 61.5 21 Mei 2014 22 Mei 2014 26 Mei 2014 11 Juni 2014

LPPF Final 157.7 11 Juni 2014 12 Juni 2014 16 Juni 2014 30 Juni 2014

MLPT Final 1.60 5 Mei 2014 6 Mei 2014 8 Mei 2014 22 Mei 2014

MFMI Final 1.60 5 Mei 2014 6 Mei 2014 8 Mei 2014 19 Mei 2014

Ticker NS:OS Price (Rp) Cum Date Ex Date Recording Trading

IBST 2:11 3176 28 April 2014 29 April 2014 2 Mei 2014 6 Mei-13 Mei 2014

Rights Issue

Wednesday, April 30, 2014

6

Global Reference Rates FOREX Rate (USD) Change %

FED Rate 0.25 USDIDR 11,526 0.20

BI Rate 7.50 USDEUR 0.72 0.01

ECB Rate 0.25 USDJPY 103 0.10

BOJ Rate 0.10 USDSGD 1.26 0.02

BOE Rate 0.50 USDAUD 1.08 (0.17)

PBOC Rate 6.00 USDGBP 0.59 0.00

Description March February

Inflation YTD (%) 1.41 1.33 8.40

Inflation YOY (%) 7.32 7.75 0.92

Inflation MOM (%) 0.08 0.26 1.46

Foreign Reserves (USD bn) 102.60 7.65

GDP YOY Growth Rate Q42013 (%) 5.72 7.94

GDP Growth Rate 2013 (%) 5.78 8.42

GDP YOY (USD bn) 878.04

Dual Listed Price (IDR) Change %

TLKM (US) 2,189.94 (5.00)

ANTM (GR) 1,034.65 0.00

%

Lending & Deposit Rates

INDOGB 15Y YIELD (%)

JIBOR (IDR) (%)

LIBOR (GBP) (%)

SIBOR (USD) (%)

INDOGB 5Y YIELD (%)

INDOGB 10Y YIELD (%)

MACRO INDICATORS RAPBN 2014 APBN-P 2013 APBN 2013

GDP (%) 5.8-6.1 6.3 6.8

Inflation (%) 4.5-5.5 7.2 4.9

IDR/USD (IDR) 10,000-10,500 9,600 9,300

SBI3 Months (%) 5.5 5.0 5.0

Crude Oil (USD/brl) 106 108 100

Oil Production (bpd) 870,000 840,000 900,000

Total APBN (IDR tn) 1,240 1,726 1,683

DISCLAIMER

This material is issued by PT Sinarmas Sekuritas, a member of Indonesia Stock Exchanges, represent the opinion of PT Sinarmas Sekuritas,

derived its judgment from sources deemed reliable, however, PT Sinarmas Sekuritas and its affiliated cannot guarantee its accuracy and

completeness. PT Sinarmas Sekuritas or its affiliates may be involved in transactions contrary to any opinion herein or have positions in the

securities recommended herein and may seek or will seek investment banking or other business relationships with the companies in this

material. PT Sinarmas Sekuritas, its employees and its affiliates, expressly disclaim any and all liability for representation or warranties,

expressed or implied, here in or omission there from or for any loss how so ever arising from any use of this material or its contents or

otherwise arising in connection there with. Opinion expressed in this material are our present view and are subject to change without no-

tice.

Wednesday, April 30, 2014

You might also like

- Evaluating a Company's External EnvironmentDocument23 pagesEvaluating a Company's External Environment'Osvaldo' RioNo ratings yet

- Chapter 5: Bond Valuation and Interest RatesDocument52 pagesChapter 5: Bond Valuation and Interest Rates'Osvaldo' RioNo ratings yet

- Morning Call Morning Call: Markets Snaps 3-Day Losing StreakDocument4 pagesMorning Call Morning Call: Markets Snaps 3-Day Losing StreakrcpgeneralNo ratings yet

- Daily Market Update On 20 July 2023Document5 pagesDaily Market Update On 20 July 2023Simon PeterNo ratings yet

- Trader's Daily Digest - 25.04.2016Document7 pagesTrader's Daily Digest - 25.04.2016Sudheera IndrajithNo ratings yet

- Daily Market Update 3 January 2023 File-202301031742097186877 PDFDocument5 pagesDaily Market Update 3 January 2023 File-202301031742097186877 PDFChandan BaggaNo ratings yet

- Derivative Report 22 MAY 2014Document8 pagesDerivative Report 22 MAY 2014PalakMisharaNo ratings yet

- Morning Call Morning Call: Markets End Lower Infy ZoomsDocument4 pagesMorning Call Morning Call: Markets End Lower Infy ZoomsrcpgeneralNo ratings yet

- Institutional Research Technical ReportDocument4 pagesInstitutional Research Technical ReportRajasekhar Reddy AnekalluNo ratings yet

- Trading JournalDocument11 pagesTrading Journalsachin100% (1)

- Daily Trade Journal - 08.07.2013Document6 pagesDaily Trade Journal - 08.07.2013Randora LkNo ratings yet

- ZerodhaDocument89 pagesZerodhaAarti ParmarNo ratings yet

- Derivative Report 21 July 2014Document8 pagesDerivative Report 21 July 2014Stock Tips provider in IndiaNo ratings yet

- Trader's Daily Digest - 28.01.2016Document7 pagesTrader's Daily Digest - 28.01.2016Sudheera IndrajithNo ratings yet

- Daily Market Update OF 25 APRIL 2023-202304251728143358428Document4 pagesDaily Market Update OF 25 APRIL 2023-202304251728143358428Pratik ShingareNo ratings yet

- Morning Call Morning Call: Markets End Lower Ahead of RBI PolicyDocument4 pagesMorning Call Morning Call: Markets End Lower Ahead of RBI PolicyrcpgeneralNo ratings yet

- Trader's Daily Digest - 14.12.2015Document7 pagesTrader's Daily Digest - 14.12.2015Sudheera IndrajithNo ratings yet

- 1st Dec NewsletterDocument23 pages1st Dec NewsletterPrashant BhanotNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument37 pagesIndex Movement:: National Stock Exchange of India LimitedJayant SharmaNo ratings yet

- Derivative Report 18 June 2014Document8 pagesDerivative Report 18 June 2014PalakMisharaNo ratings yet

- Bulls Ready To Take Off Again: Punter's CallDocument6 pagesBulls Ready To Take Off Again: Punter's CallNeerajMattaNo ratings yet

- Daily Market WrapDocument7 pagesDaily Market WrapSudheera IndrajithNo ratings yet

- Trader's Daily Digest - 19.04.2016Document7 pagesTrader's Daily Digest - 19.04.2016Sudheera IndrajithNo ratings yet

- Derivative Report 10 July 2014Document8 pagesDerivative Report 10 July 2014Stock Tips provider in IndiaNo ratings yet

- Technical Morning - Call - 270721Document5 pagesTechnical Morning - Call - 270721Ram hedaNo ratings yet

- Derivative Report 25 June 2014Document8 pagesDerivative Report 25 June 2014PalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- Watch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Document11 pagesWatch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Damini CapitalNo ratings yet

- Special Report 13 Sep 2013 by Epic ResearchDocument7 pagesSpecial Report 13 Sep 2013 by Epic ResearchNidhi JainNo ratings yet

- Index Dipped Amidst Profit Taking : Tuesday, April 30, 2013Document7 pagesIndex Dipped Amidst Profit Taking : Tuesday, April 30, 2013Randora LkNo ratings yet

- Equity Report 6 To 10 NovDocument6 pagesEquity Report 6 To 10 NovzoidresearchNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Daily Trade Journal - 18.09.2013Document6 pagesDaily Trade Journal - 18.09.2013Randora LkNo ratings yet

- Derivative Report 02 July 2014Document8 pagesDerivative Report 02 July 2014PalakMisharaNo ratings yet

- Buy/ Script Entry Stop Target Remark Sell Price LossDocument4 pagesBuy/ Script Entry Stop Target Remark Sell Price LossJitesh PatelNo ratings yet

- Trade ListDocument8 pagesTrade ListSoma AriaNo ratings yet

- Market - Outlook - 09 - 09 - 2015 1Document14 pagesMarket - Outlook - 09 - 09 - 2015 1PrashantKumarNo ratings yet

- Derivative Report 23 MAY 2014Document8 pagesDerivative Report 23 MAY 2014PalakMisharaNo ratings yet

- Trader's Daily Digest - 09.12.2015Document7 pagesTrader's Daily Digest - 09.12.2015Sudheera IndrajithNo ratings yet

- Premarket MorningCall AnandRathi 30.11.16Document5 pagesPremarket MorningCall AnandRathi 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Special Report 12 - Sep-2013 by Epic ResearchDocument7 pagesSpecial Report 12 - Sep-2013 by Epic ResearchNidhi JainNo ratings yet

- Daily Trade Journal - 04.10.2013Document6 pagesDaily Trade Journal - 04.10.2013Randora LkNo ratings yet

- Bluechips Stepped Center Stage Amidst Rallying of IndicesDocument6 pagesBluechips Stepped Center Stage Amidst Rallying of IndicesRandora LkNo ratings yet

- Isin-Codes 2022 Equities Bonds - DerivativesDocument10 pagesIsin-Codes 2022 Equities Bonds - DerivativesJoshua NdoloNo ratings yet

- Daily Trade Journal - 04.03Document7 pagesDaily Trade Journal - 04.03ran2013No ratings yet

- Special Report by Epic Reseach 08 August 2013Document4 pagesSpecial Report by Epic Reseach 08 August 2013EpicresearchNo ratings yet

- Daily Trade Journal - 05.11.2013Document6 pagesDaily Trade Journal - 05.11.2013Randora LkNo ratings yet

- Derivative Report 16 July 2014Document8 pagesDerivative Report 16 July 2014Stock Tips provider in IndiaNo ratings yet

- Daily Trade Journal - 30.01.2014Document6 pagesDaily Trade Journal - 30.01.2014Randora LkNo ratings yet

- Trader's Daily Digest - 15.02.2016Document7 pagesTrader's Daily Digest - 15.02.2016Mahesh SamarawickramaNo ratings yet

- Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDocument12 pagesSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDeepanjaliNo ratings yet

- Derivative Report 01 July 2014Document8 pagesDerivative Report 01 July 2014PalakMisharaNo ratings yet

- Indices Ended in Opposites JKH Added 73% To The Daily TurnoverDocument6 pagesIndices Ended in Opposites JKH Added 73% To The Daily Turnoverishara-gamage-1523No ratings yet

- Derivative Report 15 July 2014Document8 pagesDerivative Report 15 July 2014Stock Tips provider in IndiaNo ratings yet

- Darvas BizCafeDocument24 pagesDarvas BizCafeFerry LinardiNo ratings yet

- Derivative Report 27 MAY 2014Document8 pagesDerivative Report 27 MAY 2014PalakMisharaNo ratings yet

- Sri Lanka Stock Market Weekly ReviewDocument2 pagesSri Lanka Stock Market Weekly ReviewDhananjaya HathurusingheNo ratings yet

- NDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-InDocument30 pagesNDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-Inpriyamvada_tNo ratings yet

- Ticker Date/Time Close Change Pix1 Pix2 Pix3 RemarksDocument5 pagesTicker Date/Time Close Change Pix1 Pix2 Pix3 Remarksfajaraljogja100% (1)

- DailycallsDocument18 pagesDailycallsumaganNo ratings yet

- Upward Climb in ASPI Amidst Crossings Adding 54% To TurnoverDocument6 pagesUpward Climb in ASPI Amidst Crossings Adding 54% To TurnoverRandora LkNo ratings yet

- Solutions Chapter 4 Parity ConditionsDocument15 pagesSolutions Chapter 4 Parity ConditionsKenny ZhouNo ratings yet

- BRM CH 19Document55 pagesBRM CH 19'Osvaldo' RioNo ratings yet

- Solutions Chapter 15 Internationsl InvestmentsDocument12 pagesSolutions Chapter 15 Internationsl Investments'Osvaldo' RioNo ratings yet

- Step 3 - Checking The Competitive Advantage PotentialDocument6 pagesStep 3 - Checking The Competitive Advantage Potential'Osvaldo' RioNo ratings yet

- Stocks ChapterDocument57 pagesStocks ChapterBagus ZijlstraNo ratings yet

- 1st Session - Chapter 4 - Time Value of MoneyDocument95 pages1st Session - Chapter 4 - Time Value of Money'Osvaldo' RioNo ratings yet

- 2nd Session - Chapter 6 - Risk, Return, and The Capital Asset Pricing ModelDocument51 pages2nd Session - Chapter 6 - Risk, Return, and The Capital Asset Pricing Model'Osvaldo' RioNo ratings yet

- 1st Session - Chapter 1 - Overview of Financial Management and The Financial EnvironmentDocument22 pages1st Session - Chapter 1 - Overview of Financial Management and The Financial Environment'Osvaldo' RioNo ratings yet

- Quantitative Demand AnalysisDocument39 pagesQuantitative Demand Analysis'Osvaldo' RioNo ratings yet

- Bankruptcy LawDocument39 pagesBankruptcy LawAlan BudiNo ratings yet

- 2st Session - Company LawDocument42 pages2st Session - Company Law'Osvaldo' RioNo ratings yet

- 1st Session - Business LawDocument18 pages1st Session - Business Law'Osvaldo' RioNo ratings yet

- Application Development by Information Systems ProfessionalsDocument21 pagesApplication Development by Information Systems Professionals'Osvaldo' RioNo ratings yet

- Operation Management - Project ManagementDocument28 pagesOperation Management - Project Management'Osvaldo' RioNo ratings yet

- Chapter 5 Profit CentersDocument20 pagesChapter 5 Profit Centers'Osvaldo' Rio75% (4)