Professional Documents

Culture Documents

Square Strategic Management

Uploaded by

tofu_vCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Square Strategic Management

Uploaded by

tofu_vCopyright:

Available Formats

1

1.0 Introduction

1.1 Origin of the Report

SQUARE Pharmaceuticals Limited is the largest pharmaceutical company in Bangladesh and

it has been continuously in the 1

st

position among all national and multinational companies

since 1985. The company plays a significant role in producing quality drugs in Bangladesh. It

also plays a vital role in developing the socioeconomic condition of our country by paying a

large amount of tax and taking participation in social activities. As a part of our study

curriculum in BBA course, we have been assigned to conduct a study on Square

Pharmaceuticals in order to find management practices followed by the company. So we have

selected Square for these characteristics.

1.2 Objectives of the Study

The Primary objective of the study is to find out the management practices followed by

SQUARE pharmaceuticals limited. The secondary objectives of this study are:

To present an overview of the Square Pharmaceuticals Ltd.

To analyze the performance through the flow of time.

To Understand the efficiency within pharmaceuticals in Bangladesh

To identify and analyse Square Pharmaceuticals Ltds strategies and

management policies.

1.3 Methodology

Primary sources: Primary sources are officers and manager of the Square Pharmaceuticals

Ltd., Local office branch and clients. Following factors were considered to collect

information:

Face to Face conversation.

Telephone conversation

Secondary sources: Secondary information will be collected from following sectors:

Annual Report of Square Pharmaceuticals Limited.

Brac EPL brokerage reports

Periodicals published by Bangladesh Bank.

Other material collected from the bank.

Various books, articles, journals, compilations and also from the web sites.

2

Presentation of information: Collected information and findings of the analysis are

presented in both table and graphical form

Methods of data analysis: I analyzed the data in both quantitative and subjective way. I used

some techniques for the purpose of analysis. These are:

The strategic position

Analysing strategic capabilities

SWOT Analysis

Porters Five Forces Analysis

Business level strategy

Corporate level strategy

Theoretical Graphical analysis

Basically, this report has been written in descriptive format and also theoretical in nature to

gain insights and understanding about the assigned topic.

1.4 Limitations of the Study

The limitation of the study is defined by the expensiveness of the facts covered by the study

and those that left out. It is observable that almost all studies have some boundaries. During

performing my work, we may face a number of limitations. These are as follows:

Privacy of I nformation: Companies do not want to share all of the information to

everyone. Sometimes they also use false or modify the financial statements to attract

the investors. For this reason the proper analysis will not be possible without having

direct contact with the top management.

Financial Limitations: Prepare a proper report is not possible in a very limited

amount of money. Because, a huge amount of data and face to face contact with the

people of the organization is needed to make the report more reliable. But, I have not

that much fund to collect information from a various range of sources.

Time Limitations: I have been given a very limited time. Within this time it is some

time difficult to prepare a proper study report. It may be not possible for me to

conduct proper interview with all the employees I have surveyed.

Data Collection: Annual report is the main source of data in this study. But, annual

report doesnt show us the real picture of the financial condition of an organization.

3

1.5 SQUARE Pharmaceuticals Limited

SQUARE Pharmaceuticals Limited (SPL) is the largest pharmaceutical company in

Bangladesh and is leading the Pharmaceuticals sector from the very beginning. It has been

continuously in the 1

st

position among all national and multinational companies since 1985. It

was established in 1958 and converted into a public limited company in 1991. The sales

turnover of SPL was more than Taka 11.46 Billion (US$ 163.71 million) with about 19.3%

market share; having a growth rate of about 13.9% (April 09- March 10).

Square Pharmaceuticals Limited is an organization with equal emphasis on Leadership,

Technology, Quality and Passion. Square Pharmaceuticals Ltd. is the leading branded generic

pharmaceutical manufacturer in Bangladesh producing quality essential and other ethical

drugs and medicines.

SQUARE today symbolizes a name - a state of mind. But its journey to the growth and

prosperity has been no bed of roses. From the inception in 1958, it has today burgeoned into

one of the top line conglomerates in Bangladesh. Square Pharmaceuticals Ltd., the flagship

company, is holding the strong leadership position in the pharmaceutical industry of

Bangladesh since 1985 and is now on its way to becoming a high performance global player.

1.6 Market Players in Pharmaceuticals Industry Bangladesh

Domestically, Bangladeshi companies

including the locally based MNCs produce

95%-97% of the drugs and the rest are

imported. Although about 250

pharmaceutical companies are registered in

Bangladesh, less than 100 are actively

producing drugs.

The domestic market is highly concentrated

and competitive. However, the local

manufacturers dominate the industry as they

enjoy approximately 87% of market share,

while multinationals hold a 13% share.

Another notable feature of this sector is the

concentration of sales among a very small

number of top companies. The top 10

players control around two-third of the market share while the top 15 companies cover 77%

of the market. In comparison, the top ten

4

Japanese firms generated approximately 45% of

the domestic industry revenue, while the top ten

UK firms generated approximately 50%, and the

top ten German firms generated approximately

60%.

Square Pharmaceuticals is the stand out market

leader with a market share of 19.3% which

posted domestic revenue of BDT 11.46 Billion

(US$ 163.71 million) in the last four quarters

(Apr 09 - Mar 10). Their nearest competitors are

Incepta Pharmaceuticals and Beximco

Pharmaceuticals with market shares of 8.5% and

7.6% respectively. Incepta and Beximco had

BDT 4.9 billion and BDT 4.4 billion in

domestic sales for the last four quarters.

Although a number of MNCs are operational in

Bangladesh market, no MNCs are in the top ten

in terms of domestic sales.

1.7 Introducing Strategy of SQUARE Pharmaceuticals Limited

1.7.1 Vision

We view business as a means to the material and social wellbeing of the investors, employees

and the society at large, leading to accretion of wealth through financial and moral gains as a

part of the process of the human civilization.

1.7.2 Mission

Our Mission is to produce and provide quality & innovative healthcare relief for people,

maintain stringently ethical standard in business operation also ensuring benefit to the

shareholders, stakeholders and the society at large.

Exhibit 1.1: Market Players in the Pharmaceuticals

Industry Bangladesh

5

1.7.3 Objective

Our objectives are to conduct transparent business operation based on market mechanism

within the legal & social framework with aims to attain the mission reflected by our vision.

1.7.4 Values

The SQUARE Pharmaceutical Limiteds strategies are based upon 5 core values, which are:

Understanding, Goodwill/reputation, and Cost-conscious, focused, cumulative effort.

1.7.5 Corporate Focus

Our vision, our mission and our objectives are to emphasise on the quality of product, process

and services leading to growth of the company imbibed with good governance practices.

1.7.6 Strategies

The SQUARE way provides a high-level statement of strategies:

To be the best in pharmaceutical industry

To remain as market leader

To establish competitive cost base

To work together with its sister concerns to accelerate cumulative effort

1.7.7 Competitive strengths

With this SPL identifies its competitive strengths as:

A trustworthy pharmaceutical firm with competitively high company goodwill, which

provides Pharmaceutical products of high standard at a lower cost.

Well branded products and rich product diversification.

Four internationally approved and aligned API units.

Modern cost effective products.

As a listed company in Dhaka Stock Exchange (DSE), SPL gathers its share-holders

trustworthiness as well.

6

1.7.8 Strategy Lenses

Specifically, the strategy lenses of SQUARE Pharmaceuticals can be described with a view to

its pricing and selection of target customers.

Since SPLs inception in 1964 till the early 1980s, the company literally thrived in order to

capture market share. Against Beximco Pharmathe firm which was actively taking the first

mover advantage over SPL, the company was unable to narrow down its option to choose

price based strategy or differentiation based strategy, while also struggling on attracting

customer response. (Strategy as design)

Lately, in 1987 the firm while the company pioneered in pharmaceutical export from

Bangladesh with a strategy ofoffering lower priced products that promises quality; it

started to achieve higher growth. (Strategy as experience)

However, in the start of 21

st

century when the SPL had to live up to its image, US FDA/UK

MCA standard new pharmaceutical factory goes into operation built under the supervision of

Bovis Lend Lease, UK; and the company was accumulating opportunities to grow with

diversification. (Strategy as idea)

***Note: The Strategic Position, Strategic Choices, and Strategy into Action have not discussed here

in this section, because those terms are extensively discussed in the latter chapters. ***

7

Chapter 2

The Strategic Position

2.1 Layers of the business environment

8

For Square Pharmaceuticals Limited, to make sense of an uncertain world, it is necessary that

the company emphasizes on understanding its business environment. However, this can be

difficult for several reasons. First, the environment encapsulates many different influences

the difficulty is making sense of this diversity. Second is the problem of complexity which

arises because many of the separate issues in the business environment are interconnected.

The layers of business environment typically provides the framework for understanding

environment of organizations with the aim of helping to identify key issues and ways of

coping with complexity and change.

2.2 The PESTEL framework

PESTEL analysis provides a framework examining the external environment of a company

(Gillespie, 2010, p.13; Morrison, 2006, p. 20). PESTEL stands for political, Economical,

Social, technological, environmental and legal factors. PESTEL analysis helps a company to

categorize the relevant issues in its environment, so that it can assess its relative importance

and develop an appropriate strategy (Sloman & Hinde, 2007). The following sections provide

an overview of the factors currently affecting the Square Pharmaceuticals in Bangladesh.

Political Factors

Experienced international businesses engage in political risk assessment, a systematic

analysis of the political risks they face in foreign countries and any changes in the political

environment that may adversely affect the companys business activities (Griffin & Pustay,

2010, p.97; Czinkota et al., 2009, p.102; Daniels et al, 2009, p.154). Politically Bangladesh is

now going through a very unstable period since the recession had struck Europe, USA, and

Exhibit 2.1: Layers of the business environment

9

Bangladeshparticularly, Dhaka Stock Exchangeleaving most companies thriving. Yet

domestic Pharmaceutical firms are getting good support from its government.

Support of Government

Bangladesh Government regards the pharmaceutical industry as one of the key sector for

attracting Foreign Direct Investment (FDI) in the country (BOI, 2010a). With strong

government support Bangladesh is developing a robust manufacturing and technically

experienced industrial base for this sector, while extensively supporting the domestic firms.

Bangladesh was placed 15

th

globally for the protection which it affords investors in the World

Banks (2009) Doing Business survey.

I ssues

General strikes by opposite political parties those caused huge loss to the business and

industries were a regular part of political life in Bangladesh. The though improved in past

years despite very few occasions (BBC, June 2010), but in the year of 2013, the fact of strikes

has been raising and resulting in a terrible business condition. Companies are still facing

some corruption and bureaucracy issues when to do business in Bangladesh. For example,

according to the World Bank report (2009), it requires 7 procedures and takes 44 days to start

a business there. Despite some bureaucratic problems in overall the current political

environment of Bangladesh is business-friendly for Square Pharmaceuticals.

Economic Factors

Although the economy of Bangladesh is achieving a considerable GDP growth, but the

recent economic condition within the country is very sophisticated. Due to many loan scams

occurred in recent years, the investment portfolio is not raising, instead it seems to be

stagnated. As for Square Pharmaceuticalsbeing the sister concern of Square Group, a

company must growth rate, inflation, unemployment, wages, income, stability, poverty and

the like of that country (Daniels et al. 2009, p. 185). These factors of Bangladesh are analysed

in following sections and also compared with China, India, Pakistan and UK to get a

comparative picture.

GDP Growth

The economy of Bangladesh has grown 5-6% per year since 1996 despite many internal

problems like political instability, poor infrastructure, corruption, and insufficient power

supplies and its growth was resilient during the 2008-09 global financial crisis and recession

10

[shown in Exhibit 3.1]. The GDP growth rate of Bangladesh was higher than in Pakistan or

UK, and very close as in India and according to the World Factbook (2009) its position was

18

th

among the 213 countries in 2009. GDP per capita of Bangladesh was US$ 1,600 that was

lower than India, China and Pakistan.

Inflation

Inflation rate is a measure of the increase in the cost of living that influence on many parts of

the economic confidence, and the stability (Daniels et al., 2009, p. 196). From 1991 the

inflation rate of Bangladesh is always under 10 percent until 2011 (Exhibit 2.2).

Country 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Bangladesh

5.2 5.3 5.6 4.4 5.3 4.9 6.4 6.6 6.3 4.9 5.7 6 6.1

Exhibit 2.1: GDP growth of Bangladesh

Table 2.1: Real GDP growth rate of Bangladesh [1999-2012]

11

Higher inflation rate raises the cost of living and historically annual inflation rates of 10 to 30

percent, erodes confidence in a countrys currency and spurs people to search for better ways

to store value (Daniels et al., 2009, p. 196). Lower inflation is a good indicator for Square

Pharmaceuticals Bangladesh marketplace.

Unemployment Rate

Daniels et al (2009) argues that unemployment depress economic growth, create social

pressures, and provoke political uncertainty. However, the unemployment rate of Bangladesh

is 5% according to World Bank researchwhich indicates that India and China seemingly

controlling their unemployment rate with 3.8% and 4.1% respectively for the year of 2012.

The proportion of unemployed workers in a country shows how well a country productively

uses its human resources. In Bangladesh unemployed workers do not get any benefits or

allowances from the government. Without unemployment benefits, people are compelled to

engage in some work, even if this is only a few hours in low-paid informal jobs (Mujeri,

2004). Lower unemployment increases buying capabilities of customers in Bangladesh.

Debt

The larger the total debt becomes, the more uncertain a countrys economy becomes (Daniels

et al., 2009, p. 198). The public debt makes up 36.12% of the total GDP of Bangladesh, while

Indias public debt consists 67.59% of GDP (2012 est.), meaning that the economy of

Bangladesh certainly stable enough than India.

The resulting pressure to revise government policies, in the face of growing internal debt, can

create economic uncertainties for investors and companies (Daniels et al., 2009). Bangladesh

is in better position than neighbour countries in terms of debt problem and that is a good sign

for its pharmaceutical industry.

Exhibit 2.2: Inflation Rate in Bangladesh [2000-2011]

12

Labor Force and Cost

For the pharmaceutical industry, the cost of labour is one of the key elements of total

production costs. Companies always search the world for the best deal with the difference

between low-cost and high-cost countries (Daniels et al., 2009, p. 201). According to the

Office of the US Trade Representative (2008) the cost of manufacturing one million tablets

was estimated to be $18,000 in the USA, $8,000 in India and $6,500-7,500 in Bangladesh.

This is accounted for Bangladeshs highly competitive labour and energy costs. The report

also highlights that the labor costs in the pharmaceutical industry are 20-30% lower in

Bangladesh than in India. Bangladesh is 8

th

according to the number of total labour force in

the world that is more than Pakistan, UK, Germany, France or Japan (World Factbook 2009).

Abundant supply of cheap labour forces would be attractive factor for Square

Pharmaceuticals to extend their investment in Bangladesh.

Socio-Cultural Factors

A company should identify key cultural differences in the country where it is doing or

intended to do business and then it must need to alter its customary practices to succeed there

(Daniels et al., 2009).

Alternative Medicines

There is a long tradition of self-medication in Bangladesh as many of its population cannot

afford to see health professionals when they fall ill. Majority of population are still using

complementary and alternative medicine (CAM) in the country (Islam & Farah 2008).

Alternative medicine refers to health practices, approaches, knowledge and beliefs

incorporating plant, animal and mineral based medicines, spiritual therapies, manual

techniques and exercises, applied singularly or in combination to treat, diagnose and prevent

illnesses or maintain well-being. Reports of Islam and Farah (2008) estimated that 70-75%

populations of the country still use traditional medicine namely herbal, homeopathy, religious

and magical methods for management of their health problems of various kinds.

Religion

According to the World Factbook (2010), 89.5% of the population in Bangladesh is Muslim.

The religious belief and practices have influence and impact on national/international

business that is seen in a cultures values and attributes toward entrepreneurship,

consumption and social organisation (Griffin & Pustay, 2010; Morrison, 2006 and Czinkota

et al., 2009). Many Muslim workers require extra time break for daily prayer. Muslims are

forbidden from the consumption of pork and alcohol. The pharmaceutical companies need to

consider these religious factors to do the business in Bangladesh.

13

Population Demographics

Bangladesh tops South Asia with its average life expectancy of 61 years though per capita

consumption of medication is one of the lowest in the region (World Factbook, 2012). The

population of Bangladesh ranks seventh in the world with about 160 million people and it is

one of the most densely populated countries in the world. Due to the total size of the

population, good life expectancy and the stable growth of economy, the country has

considerable market for pharmaceutical products.

Technological factors

Technological environment is another important dimension of a country and the foundation

of its resource base (Griffin & Pustay, 2010). Three key technological factors are discussed in

following sections.

Research and Development

Foreign direct investment has brought about the globalization of production, but this has not

led to the globalization of technological innovation in Bangladesh. Large companies have

tendency to concentrate their R&D activities in their home countries, but progressively

specialized R&D is being decentralized to overseas locations, to benefit from different areas

of excellence in different localities (Patel & Pavitt, 1991; Archibugi & Michie, 1997).

According to the World Bank report (2008), pharmacists of Bangladesh have been trained for

quality assurance and skilled engineers for reverse engineering and manufacturing but its

workforce has lack of new research and innovation skills, which is very important for

innovative drugs.

Bangladeshi pharmaceutical firms target mainly lower-end branded generics. Despite the

country possessing huge manufacturing capabilities of domestic need, the complete lack of

R&D in domestic companies could cause the market to be idle. According to the

Kostermanss (2008) report, universities and government research is currently under funded

in Bangladesh and the pharmaceutical industry here currently invests about 1% in R&D.

Energy

Bangladeshs unreliable power supply forces most Bangladeshi firms to depend on self-

generation of power (World Bank, 2008). Disruptions of power supply result in significant

productivity losses in Bangladesh. The World Bank (2008) reports that the power cost could

be lower when generators are running on highly under-priced natural gas of Bangladesh.

Large pharmaceutical companies like Square Pharmaceuticals Limited can install gas based

energy system.

14

Environmental Factor

Couple of key environmental factors discussed in following sections those significant for

Square Pharmaceuticalsoperation in Bangladesh.

Climate Change

Bangladesh is now widely recognized to be one of the countries which are most vulnerable to

climate change as a result of global warming. It is a low-lying region that risks submerging

some of its parts beneath the sea (Morrison, 2006, p. 428). Natural hazards that come from

increased rainfall, rising sea levels, and tropical cyclones are expected to increase as climate

change, each seriously affecting agriculture, water & food security, human health and shelter

(MoEF, 2008). Environmental impacts are often considered necessary side effects of

development or the price to pay in order to achieve progress (Furley, 1996; Hesselberg, 1992;

Weissman, 1993). Square Pharmaceuticals (Bangladesh) claims in its website that it takes a

leading role in its work in the areas of Health, Safety and Environment in pharmaceutical

industry.

Waste Management

The National Drug Policy 2005 of Bangladesh states that the pharmaceutical plants must

need to comply with environmental legislation like disposal of waste streams. Environment

may have hazardous impact if the wastages of manufacturing plants are not managed

properly. Square Pharmaceuticals takes care of all their toxic and non toxic waste to make

sure that all the disposable water is properly treated and disposed.

Legal Factors

Every company in every country must comply with local legal system and regulations

regarding operations (Daniels et al., 2009). The legal environment has a great impact on

doing business in any country. According to the World Bank (2012) reports Bangladesh is

ranked 122

nd

out of 183 economies whereby India is ranked 132

nd

.

National Drug Policy

The Bangladesh governments Director of Drug Administration (DDA) has an essential

monitoring and supervisory role on all activities related to import, procurement of raw

materials, production and import of finished drugs, export, sale, pricing, etc. for all kinds of

15

medicine. The National Drug Policy (2005) states that the WHOs current Good

Manufacturing Practices (GMP) should be strictly followed and that manufacturing units will

be regularly inspected by the DDA. Other key features of regulation are restrictions on

imported drugs (where these are produced by four or more local firms); a ban on the

production in Bangladesh of around 1,700 drugs which are considered non-essential or

harmful; and strict price controls, affecting some 117 principal medicines.

TRIPS

The World Trade Organizations (WTO) Trade Related Aspects of Intellectual Property

Right (TRIPS) agreement permits 49 Least Developed Countries (LDCs) including

Bangladesh to reverse-engineer, manufacture and sell patented generic pharmaceutical

products locally as well as for export to other developing and Least Developed Countries

(LDCs) until 2016 (World Bank, 2008, p. 15). Bangladesh is unique among the 49 LDCs as it

has a strong pharmaceutical base. This sector is the second largest sector in terms of national

revenue and it exported drugs to over 50 countries in the world (Azad, 2006). Square

Pharmaceuticals are enjoying the benefit of TRIPS as it has manufacturing based in

Bangladesh.

2.3 Porters Diamond Model on Square Pharmaceuticals

The Porters Diamond model, which was developed by Michael Porter, can be used to predict

a firms success in the industry regardless the country boundary. Here in this section we will

try to study Square Pharma based on Porters Diamond model.

The four factorswhat will be taken under consideration are:

1. Factor Condition

2. Demand Condition

3. Firm Strategy, Structure, and Rivalry

4. Related and Supporting Industries

Now, one by one we will look into each factor separately in the latter section.

Factor Condition

Considering basic factors for Square Pharmaceuticals, the climate, demography, geography,

and natural resources of Bangladesh are more-or-less very optimal for the company to

produce medicines and provide healthcare to the people.

We must look into the various departments of the firm in order to know the condition of the

advance factors of Square Pharmaceuticals.

16

1. Research & Development (R&D)

With strong reverse engineering capability, square focuses principally on developing high

quality generic formulations, matching the profile of innovator products.

The growing innovation is evident from Squares successful launching of advanced

formulations like multi layer tablets, sustained release formulations, dispersible

tablets, melt-in mouth tablets, and chewable vitamins, etc.

To ensure the availability of raw materials over the range of therapeutic classes

Square are developing a number of APIs.

The capability of square to product hi-tech, specialized niche products as well as drug

delivery systems have been the firms core strength to transform SPL into an

innovation driven generic drug company.

Advancing R&D programs, such as SPL in collaboration with ICDDRB (International

Center of Diarrhoeal Disease Research, Bangladesh) produced 1.8 million zinc tablets

for the center, which was under a project named SUZY (Scaling Up Zinc treatment

for Young) aimed at advancing research on zinc therapy on children with Diarrhoea

and Pneumonia.

2. Human Resource

Strategic Human Resource Development programs are the energy sources for SQUAREs

Human Resource (HR) department for running towards the peak of success. There are

currently 4197 employees working in Square. The HR department

- Ensures strong supporting role to develop & implement HR policy

guidelines for uninterrupted continuity of operations.

- Maintain an effective way to deal with labor union and still no unrest has

been recorded as dispute.

3. Raw Materials

One of the most key strength of SPL is that the company is comprehensively able to produce

its own needed raw materials. Some information about the firms capability of production is

provided below.

SPL has invested in state of the art formulation plants aligned to regulated market standards.

Four plants based on the Dhaka site can produce Pharmaceutical products to the highest GMP

specifications. These four plants are:

General Plant (approved by MHRA)

Cephalosporin plant (quality system aligned to MHRA requirements, plant being

prepared by European Union regulatory agencies and FDA inspection)

BFS plant (quality system aligned to MHRA requirements)

17

Biotech (insulin) plant

As with possessing some internationally

recognized plants, the SPL also represented

as the high quality-bulk drugs manufacturer

in Bangladesh.

4. Distribution System

One of SPLs major strength lies with its

sales and marketing teamthat has help SPL

to attain one of the best distribution channels

of this country.

5. Technology

Square Pharma has always been a leader in adopting ground-breaking technologies that

introduced both skill and scale in the business process. The company is focused on the quality

of the product so that its product can compete with the top level pharmaceuticals in the world.

SPL is pioneer in Bangladeshi pharmaceutical industry in introducing technology driven

products in local and international markets. Such specialty products include: Suppositories,

Inhalation aerosols, including Ozone-benign HFA MDIs; and Nasal sprays, etc.

Demand Condition

In Bangladesh theres a huge demand on Square pharmas products. SQUAREthe brand

itself provides reliability and trustworthiness, which might be simply why demand is pretty

high.

Square is now offering 670 types of medicines in Bangladesh with ensured qualitythat

creates proper perceived value for the money spent.

On the other hand, the present market status of SPL is continuously widening with already

supplying products overseas in United Kingdom, Gambia, Ghana, Bhutan Afghanistan,

Kenya, Nepal, Sri Lanka, Vietnam, and in many other countries. SPL is now exploring the

Middle-east market for its product to sell.

Related and Supporting Industry

Related and supporting industries such as, hospitals and health care centres, Insurance and

Public Health bodies, Retail Pharmacies and stores, and many diagnostic centres are available

Exhibit 2.4: The Distribution Channel of Square

Pharmaceuticals Limited

18

to support the square pharmaceuticals. To support the company, SQUARE group itself

established SQUARE Hospitals Ltd that went into operation in December 2006. The hospital

is consisted with 300 plus beds built at the cost of $50 million; and which is aimed to provide

global standard healthcare services at an affordable cost.

Firm Strategy, Structure, and Rivalry

In Bangladesh there are currently 245, out of which 200 have operations in the country. The

market is totally dominated by the local companies and there are only 5 multi-nationals

currently operating. The 245 companies together have 5600 brands registered in Bangladesh.

Among these companies Square Pharmaceuticals Limited is being the leaderwithholding

19.3% market share.

We have discussed the company structure widely in chapter 1 and for a better view company

strategy will be discussed in chapter 3 & 4. Now in this section we will only look at the

domestic rivalry below.

Square Pharmaceuticals with being the market leader (with 19.3% market share) earned

domestic revenue of BDT 11.46 Billion (US$ 163.71 million) (Annual Report 2011-12) last

year. SPLs nearest competitors are Incepta Pharmaceuticals Ltd and Beximco

Pharmaceuticals Ltd (BPL) with market share of 8.5% and 7.6% respectively. Incepta and

Beximco had earned total revenue of BDT 4.9 billion and BDT 4.4 billion. Although a

number of MNCs are operational, but among them Novartis is very aggressively competing

in the market.

Between two top rivalsconsidering Beximco Pharma as the arch rival of Square Pharma,

BPL only owns as much as half of the market share owned by SPL. This typically suggests

the strong positioning of Square Pharmaceuticals in Bangladesh market.

2.4 Sources of Competition the five forces framework

Inherent within the notion of strategy is the issue of competitiveness. And thus, Porters five

forces framework is designed to identify sources of competition in an industry or a sector. For

Square Pharmaceuticals Ltd, it must be used at the level of strategic business units (SBUs)

and not at the level of whole organization. This is because organisations are diverse in their

operations and markets.

19

Understanding the connections between competitive forces and key drivers in the macro-

environment is essential, as well as understanding the fact that the five forces are not

independent of each other. Pressure from one direction can trigger changes in another in a

dynamic process of shifting sources of competition.

Over the past few decades, the pharmaceutical industry has been struck by many challenges.

There have also been opportunities such as: revolutionary developments in information

technology and the emergence of market institutions. The pharmaceutical industry includes

all companies that develop drugs to consumers. The analysis of Square Pharmaceuticals in

the light of Porters five forces framework is as follows:

Threat of new entrants

Threat of new entrants in the pharmaceuticals industry is very low because of the high cost of

R&D and patent limitations required to enter the industry. Even though, the economies of

scale for production may not be very significant, other barriers to entry are high. To develop

new drugs is a very costly and timely process that requires a lot of research and development.

Along with high R&D costs, the heavy regulation of the pharmaceutical industry is another

Exhibit 2.5: Porters five forces model

20

barrier to entry. All drugs and chemicals used need to be approved and when the drugs are

not approved, the time and money used to develop them is lost by the firm. The standards are

very strict. The established firms have large budgets to spend on marketing to uphold their

brand, just another cost necessary for a new entrant.

Rivalry among Existing Firms

There is a fierce competition among the existing firms. Among the various pharmaceutical

companies when one of them produces new medicine with same component, existing firms

are forced to produce same type of medicine to exploit the opportunity; and also blocking the

first mover from capturing the whole market share of that specific product.

From a study it has been found that, during a 24 month period 268 patients entered the study.

138 patients were randomized to omeprazole treatment; 130 to ranitidine treatment.

Seventeen patients (6.3%) discontinued the clinical trial without any follow-up assessments,

including 8 (5.8%) in the omeprazole group and 9 (6.9%) in the ranitidine group. Study

dropouts number was not significantly different. As omeprazole being the product of SPL

and ranitidine of Opsonin, both used were used for gastric treatment, it was seemingly clear

that people are being indifferent on choosing medicine.

However, the rivalry between two top players: Beximco and Square, has now poled into the

Square Pharmaceuticals side. One of the key reasons is that, the public trust on Beximco has

been diminishing vigorously due to some scams committed Beximco Groups sister concerns

and the majority share-holder Salman F. Rahman. While on the other hand, SQUARE is

acquiring public trust day-after-day through their corporate social responsible activities and

operations.

Bargaining Power of Suppliers

It is essential to identify the suppliers for the pharmaceuticals industry. The suppliers could

be wide variety of the providers such as the raw materials and intermediates, the

manufacturing and production plants, the overseas head offices who supply finished products,

the local co-marketing partners who supply products or third party suppliers anywhere along

the supply chain. Also labour can be considered as a supplier to industry. All suppliers

provide different levels of threat. It is not easy for the pharmaceuticals industry to change

suppliers even when they threaten to withhold supply. Labour can also be the significant

supplier because labour holds immense power when enquiring for more compensation or

reducing quality by working fewer hours. In the pharmaceuticals industry, each supplier

holds a certain level of power to be a threat, but it is not too high. The threat from suppliers in

the pharmaceuticals industry is not considered significantly bigger than that in other

industries as long as there is no considerable threat from the raw material suppliers. Thus,

supplier power is low in the pharmaceuticals industry.

21

Bargaining Power of Buyers

Major consumers in pharmaceuticals industry include doctors, patients, hospitals, drug stores

and pharmacists. There are several significant indicators of the threat of buyers in the

pharmaceutical industry; they include the number of buyers, product differentiation, and

product significance of a buyers final cost. Buyers do not pose a big threat to

pharmaceuticals industry, because firms spend most of their research and development on

new patent drugs.

Since the industry has many buyers, and given that competition normally occurs among

consumers, (e.g. competition among hospitals and drug stores); the power of the buyers in

terms of the number of buyers in the industry is relatively small. Although big retail stores

possess some bargaining power in the industry, they do not pose a big threat in the

pharmaceuticals industry as they do to the other industries.

Threat of Substitutes

Threat of substitutes is low (with patents) and medium (after patent expiry). Overall, the

pharmaceutical industry shows an upward trend in its core markets. The industry remains

highly valued as a favorable market position with strong financial make-up and strong

earnings growth. Its future potential demand trend is positive and despite increased

competition the industry still shows a continuing upward growth momentum.

2.5 The Dynamics of Competition

The previous section lookedhow competition may arise but has not discussed the process

of competition over time. The competitive advantage of an organisation may be eroded

because the forces discussed above change and/or competitors manage to overcome adverse

forces (Johnson, Scholes et al, 2008). Square Pharmaceuticals in this case, may respond to

this erosion of its competitive position, creating what has been called a cycle of business as

shown in Exhibit 2.6 and exemplified with SPL later.

22

It has been stated earlier that the Pharmaceutical industry in Bangladesh is matured. And SPL

is the market leader in that industry. If any new entrants comes into this industry and starts

operation, then for SPL and other firms like Incepta, Beximco, Aristopharma, will follow the

strategy of Cycle of competition in order to protect its competitive advantage and rip out new

competitions.

2.6 Strategic Group Mapping Matrix

In a given industry such as Pharmaceuticals industry in Bangladesh, there are many

companies each of which has different capabilities and which compete on different surfaces.

This is the concept of strategic groups. But competition occurs in markets which are not

confined to the boundaries of an industry and there will almost certainly be important

differences in the expectations of different customer groups (Johnson, Scholes et al, 2008).

Strategic groups are organizations within an industry or sector with similar strategic

characteristics, following similar strategies or competing on similar bases (Johnson, Scholes

et al, 2008).

Beximco Square Incepta Novartis Gaco

What

products do

they offer?

Inhalers,

Medicines:

Tablets,

Medicines:

Tablets,

Capsules,

Medicines:

Tablets,

Capsules,

Inject-able

drugs,

Medicines:

Tablets,

Capsules,

and other

Exhibit 2.6: Cycles of Competition

Exhibit 2.2: Strategic Group Mapping Matrix

23

Capsules,

Syrups, etc.,

inject-able

drugs

Syrups, etc.,

Inhalers, inject-

able drugs

Syrups, etc. Tablets,

Capsules,

Syrups, etc.

local

drugs.

Which

beneficiary

or customer

group do

they work

with?

Patients of all

groups, with

an emphasized

focus on

Diabetes,

Cardiac issues,

Rheumatic

fever.

Patients of all

groups, with a

slight

differentiation

in hi-tech

drugs,

Diabetes, Skin

issues, Old

peoples

diseases.

Targeting

general

patients

affected

with

common

diseases and

health

issues.

Targeting

mass market

with

differentiation

strategy

focused on

typical health

conscious

peoples.

Focusing

highly on

rural

markets

less health

conscious

and price

sensitive

peole.

What is their

impact?

Impact on the

market is high

with product

diversification,

and

differentiated

products.

Simultaneously

capturing the

market with

unique pricing

and good

quality

products.

Introducing

similar

products as

competitors

offering,

lately

challenging

the

innovators

with

upgraded

product

quality.

Introducing

international

standard in

the local

market and

threatening its

competitors

continuously.

Sourcing

production

formulas,

offering

product at

lowest

possible

costs, and

attracting

rural

people.

What might

be their plans

for the

future?

Focusing on

un-attracted

customers and

produce

quality.

Striving to

achieve

Profitable

growth,

targeting mass

market and

focusing on

product

diversifications.

Emphasising

on product

development

rather than

product

innovation,

acquiring

more market

share and

public trust.

Attract health

conscious

people with

moderate

earning level;

create more

value through

knowledge

based

operations.

Lower

price, and

achieve

advantage

on other

competitor

in price

sensitive

market.

How might

you create

greater

impact by

reconsiderin

g your

relationship

with them?

Investing more

on R&D

projects may

provide a

competitive

edge to SPL

over Beximco.

Acquiring

patent

rights; and

using TRIPS

laws

effectively

by SPL may

earn

exclusive

immunity

from this

company.

Supplying

international

best

standardized

products may

inactive the

policies of

Novartis.

Using cost

efficiency,

and

making

rural

people

more

conscious

will drive

down

Gaco.

24

When information above is depicted in order to find the positioning of SQUARE

Pharmaceuticals Limited, we have derived the chart belowshown in Exhibit 2.3, that shows

that SPL is in a winning position against its competitors.

2.7 Market Segment

In this section of the study, we will identify SPLs market segmentsin which they are

operating. A market segment is a group of customers who have similar needs that are

different from customer needs in other parts of the market (Johnson, Scholes et al, 2008).

Based on three factorsCharacteristics of people / organisations, Purchase / use situation,

and Users needs and preferences for product characteristics, the market segments of SPL is

identified.

Customer needs varies depending on characteristics of people, purchase/use situation, and

user needs, where factors such as age, race, income, customer loyalty, price and brand

preference come into play. For SPL, the target market is the mass market. The company

focuses on customers of all ages from the age of 6 months to ever aged. On the other hand,

the company offers products at lower price but not at the lowest in the market. Square ensures

LOW

SQUARE

PHARMA

SQUARE

PHARMA

INCEPTA

GACO

BEXIMCO

NOVARTIS

WON

Exhibit 2.3: Market positioning of Square Pharmaceuticals Ltd.

25

quality at a price that can be afforded byfrom lower-middle class people to upper class

people.

The relative market share is highest for SPL, with a leading 19.3% in the pharmaceutical

industry. Organisations that have built up most experience in servicing a particular market

segment should not only have lower costs in so doing, but also have built relationships which

maybe difficult for others to break down (Johnson, Scholes et al, 2008). The statement is very

true in case of SPL and pharmaceutical industry of Bangladesh.

2.8 SWOT analysis of SQUARE Pharmaceuticals Limited

SWOT analysis (alternatively SWOT Matrix) is a structured planning method used to

evaluate the Strengths, Weaknesses, Opportunities, and Threats involved in a project or in a

business venture. A SWOT analysis can be carried out for a product, place, industry or

person. It involves specifying the objective of the business venture or project and identifying

the internal and external factors that are favorable and unfavorable to achieving that

objective. The technique is credited to Albert Humphrey, who led a convention at the

Stanford Research Institute (now SRI International) in the 1960s and 1970s using data from

Fortune 500 companies. The degree to which the internal environment of the firm matches

with the external environment is expressed by the concept of strategic fit.

Setting the objective of Square Pharmaceuticals Limited should be done after the SWOT

analysis has been performed. This would allow achievable goals or objectives to be set for the

organization.

Strengths

Huge demand in domestic market

Favorable regulatory authorities for domestic manufacturers

Increasing health expenditure due to growing health consciousness

International Standard product manufacturing units

Global experience

Increasing achievement of Public Trust.

Weaknesses

Lack of investment and knowledge-based workforce hindering R&D

Failure to Capitalise TRIPS so far

A weak advertising system

26

Cant produce all the medicine of cancer and some fatal diseases

Sometime owners relative employee act as a disturbance employee

Cant export medicines in all the countries in the world

Time consuming decision making process

Incorrect method for collecting resources and inventory management

Lack of asset management and debt

Minimum profit in comparison with others

Opportunities

Government Support

Banking and information technology

Credit line with well known foreign bank can gear up its foreign exchange business.

Entering in new arena product helps to grow customers' confidence.

Opportunity to take market share away from rivals by offering new

Innovative product or services

Opportunity to enter into the global market

Threats

Hiking price of raw materials: More and more factories, especially small ones, are

facing closure due to price hike of raw materials. As we are just entered in the market

it will be a great threat for us.

Inadequate Power supply: The industry sources also blamed lack of adequate power

Supply for making the industry more vulnerable. We have to face the same problem

here and for this many industries are shutting down now days.

Frequent Currency Devaluation

Competitors are much in pharmaceutical industries.

Competitors are offering innovative new product and services regularly. Matching

them is really hard.

27

Chapter 3

Strategic Capability

28

3.0 Strategic Capability

This part of the study analyses the adequacy and suitability of the resources and competences

of Square Pharmaceuticals Limited for it to survive and prosper. Before discussing the

strategic capability of SPL, we must look into the resources the company already possess.

Typically Square Pharmaceuticals Ltds resources can be considered under following four

broad categories:

Physical Resources: SPL has 7 major unitsthat are simultaneously used for

production and Research &Development. Those units are: Dhaka Unit, Pabna Unit,

Cephalosporin unit, AgroVet unit, Pesticide unit, API units, PET Bottle unit. Among

the units PET Bottle unit was established in 2004 with first integrated machines of its

kindwhich can produce 5000 piece of products in an hour, and can run relentlessly

24/7. Also, one of the SPLs major achievement is that it has invested in establishing

some world-class plants, such as General plant, Cephalosporin plant, and others

which are established to compete in the international market and according to the

international requirements.

Financial Resources: Being the market leader of Bangladeshi pharmaceuticals

industrywith 19.3% of market share, and also BDT 11.46 Billion (US$ 163.71

million) (est. 2012) annual revenue, the financial firepower of Square Pharmaceuticals

is quite phenomenal for the local market. The financial resources of this company can

be overlooked through looking at the financial position of SPL on a basis of

investment and investment financing.

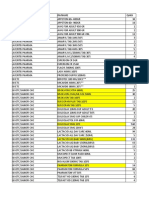

The total investment made by the Company upto 31 March, 2010, 2011 and 2012 as

detailed below:

The above investment have been financed as follows :

29

Human Resources: The human resources of

Square Pharmaceuticals are quite adequate.

With over 3500 employees the company is

exploiting in the field of Marketing,

Production, Finance, and in other business

areas. Basically the Human Resource

Management policy guidelines are strictly

followed within the company which has led the

company to achieve profitable growth.

I ntellectual Capital: For Square

Pharmaceuticals limited, the intellectual capital

is the remarkable strength. With almost 600

types of medicine offering SPL has captured

the high market share. However, the

organization also exports its products in many

different countries, which shows their high

visionary business system and high volume of

consumer database.

3.1 Strategic Capability the terminology

Term Definition Square Pharmaceuticals Ltd

Strategic

Capability

The ability to perform at the level

required to survive and prosper. It is

underpinned by the resources and

competences of the organization.

Market leader and accumulating annual

revenue of BDT 11.46 Billion (US$

163.71 million).

Threshold

Resources

The resources needed to meet

customers minimum requirements and

therefore to continue to exist.

Supporting sister concerns of SQUARE,

world-class production facilities.

Threshold

Competences

Activities and processes needed to meet

customers minimum requirements and

therefore to continue to exist.

Successful & effective HR policies,

Effective marketing plans, efficient

investment and well-managed financial

resources.

Unique

Resources

Resources that underpin competitive

advantage and are difficult for

competitors to imitate or obtain.

Exceptional visionary management,

strategic management, world-class R&D

facilities.

Core

Competences

Activities that underpin competitive

advantage and are difficult for

competitors to imitate or obtain.

A combination of strategic plans:

including short-term & long-term plans,

global competitive experience,

demanding higher competition and

innovation.

Table 3.1: Total Employee Distribution

30

3.2 Cost Efficiency Model and its effect on SPL

An important strategic capability that Square Pharmaceuticals Limited (SPL) possesses isit

ensures that the cost efficiency is achieved over time; and also ensures that the company is

paying adequate attention to its cost management in order to achieve competitive advantage

in the long-run. This will involve having both appropriate resources and competences to

manage costs. Customers can benefit from cost efficiency in terms of lower prices or more

product features at the same price (Johnson, Scholes et al., 2008). The management of the

cost base of Square Pharmaceuticals could be a basis for achieving competitive advantage.

However, it is seemingly a threshold capability of the Square Pharmaceuticals for two

reasons withholding the fact that it faces fierce competition from it arch rival Beximco

Pharma, and some other companies, such as Novartis, Incepta, and Eskeyef. The two reasons

are: first, because customer do not value product features at any price; and second,

competitive rivalry will continually require the driving down of costs. However, the first

reason is omit-able in terms of medicinal productsthat Square Pharmaceuticals basically

produces. For the second reason, it is very necessary for SPL to achieve cost efficiency.

Cost efficiency is determined by a number of cost drivers (Johnson, Scholes et al., 2008),

which are discussed below in the light of Square Pharmaceuticals.

Economies of Scale is an important source of advantage for SPL. Economies of scale

typically indicate the cost advantage that a firm achieves with increased output or production.

Since its inception in 1964, SPL has been growing substantially along with increased

production and sales. Through increased production and sales, the company is being able to

diminish it per unit fixed cost, which is leading the company production cost per unit

significantly.

While Supply Cost influences an organizations overall cost position, in this case, Square

Pharmaceuticals are well armoured. The companys one of the key strength is highlighted in

this areawhereby, Square Pharma is producing it own raw material for the final product.

However, this doesnt end the entire story. Sometimes it is better to source raw materials at

cheaper cost than producing it by own machineries. It is a concept of cost accounting where it

is suggested that while sourcing products from other suppliers the own machineries could be

rented out in order to save cost. But for Square Pharmaceuticals, it seems to be beneficial to

make and not opt to buy raw materials.

Product/Process design also influences the cost position of SPL. Efficiency gains in

production processes have been achieved by many organisations over a number of years

through improvements in capacity-fill, labour productivity, yield (from materials), or working

capital utilization. Managing capacity-fill has been somewhat an issue for Square

Pharmaceuticals, which is one of the reasons why SPL has expanded it market overseas.

However, SPL is successfully producing at its full capacity, and marketing & selling those

products in the global market.

31

In addition to the above factors, the low labour cost in Bangladesh is also facilitating SPLs

sale of products at lower cost in low earning countries, such as Kenya, Ghana, Afghanistan,

Nepal, Gambia, etc.

Finally, it is undeniable that Square Pharmaceuticals, since its inception in 1964 has been

gathering experience in cost management. In

28 years, SPL is doing business in Bangladesh,

with increasing its tally of experience in

managing cost efficiency. However, it is true

for Square that its higher cumulative

experience in Bangladesh market which may

be considered as a reason for its higher market

share than any other companies in the local

market. It is important to remember that it is the

relative market share in definable market

segments that matters. There are important

implications of the experience curve concept

that could influence SPLs competitive

position:

It is seemingly clear that growth is not optional in order to survive in the pharmaceutical

industry. Through different financial statements SPL has illustrated that growth is very

important for itself, and not taking the fact lightly. This is why SPL is achieving profitable

growth over the years.

For SPL the first mover advantage factor has been proven pivotal in becoming the market

leader with highest portion of market share (19.3%). Beximco and Square Pharmaceuticals

started their journey in 1980 and 1964 respectively. Incepta Pharmaceutical Company had

emerged in 1999, three decades later than Square Pharmaceuticals had started business; and

yet Incepta competing aggressively with Square. This is quite clear that Square

Pharmaceuticals has a first mover advantage in cost efficiency, with offering low price

products in the market.

3.3 Diagnosing Strategic Capability of SPL

If Square Pharmaceuticals Ltd is to achieve competitive advantage by delivering value to

customers, they need to identify how that value is crated or lost. This section of the study will

discuss aboutThe value chain, The value network, and Activity mappingof SPL.

The Value Chain of SPL primarily describes the activities within and around the

organization which together create a product or service. It is cost of the value activities and

the value that they deliver that determines whether or not the best value products or services

are developed (Johnson, Scholes et al., 2008).

Experience Curve

Exhibit 3.1: Experience Curve

32

The concept was used and developed by Michael Porter in relation to competitive strategy.

More-or-less the values chain is basically similar for all companies in the Pharmaceutical

industry in Bangladesh. In Exhibit 3.2, the value chain followed by SPL is shown.

The value chain for SPL is almost the same as followed by other manufacturing firms. The

primary activities include: Material handling, stock control, and machining, testing,

packaging, quality management, distribution controlling, and marketing and sales activities,

etc. Whereas, the secondary activities include: process of acquiring materials, technology

development, human resource management, etc.

In SPL, both the primary and secondary activities are delivering positive value, while the firm

may have faced some issues about their service, but that fact has been overwhelmed through

providing regular R&D newsletters to Health Care professionals on a regular basis, and also

with the support of its sister concern Square Hospital.

The Value Network is the set of inter-organizational links and relationships that are

necessary to create product or service (Johnson, Scholes et al., 2008). It is the process of

specialisation within the value network on a set of linked activities that can underpin

excellence in creating best value products (Johnson, Scholes et al., 2008). In the figure below

an assumption of Square Pharmas Value Network is depicted.

Exhibit 3.2: The Value Chain

33

Figure: The Value Network That May Suit Square Best.

34

Some key issues can be helpful in designing the value network for Square Pharmaceuticals

Limited. And the issues are as follows:

The two department of SPL are simply creating the most value; they are: production and

distribution. In chapter 2 the strength of distribution is highlighted with a map (Exhibit 2.4);

and in the beginning of this chapterunder the cost efficiency model production efficiency

gained by SPL was described.

Profit generally pools in the production sector of SPL, whereby the company has shown

many times that they are the cost management leader in the pharmaceutical industry of

Bangladesh with providing a similar quality and sometimes higher at a lower price than its

competitors. Although it may seem disturbing that how this production efficiency is pooling

greater profit, but eventually low cost production increases the sale of final medicinal

products drastically for SPL, while enabling them to increase quantity of supply in both local

and global marketplace.

The make or buy decision is highly under consideration of SPL, while the company is still

pursuing the making decision.

The Activity map of SPL can be divided into three major areas. The following diagrams

(Exhibits 3.3, 3.4, and 3.5) highlight critical steps in the systems selection, procurement, and

distribution components for Square Pharmaceuticals Limited.

Exhibit 3.3: The Selection Cycle

35

Exhibit 3.4: Pharmaceutical Procurement Cycle

Exhibit 3.3: The Distributing Cycle.

36

3.4 Benchmarking of SPL

There are number of different approaches in benchmarking. In this case of Square

Pharmaceuticals, we will use Industry/Sector Benchmarking method. Insights can be gleaned

by looking at the comparative performance of other organizations in the same industry, sector

or between similar public service providers (Johnson, Scholes et al., 2008). In the

benchmarking process below, we will use comparatively basic factors to analysis the top

three playersBeximco Pharmaceuticals, Square Pharmaceuticals, and Incepta

Pharmaceuticalsin the pharmaceutical industry of Bangladesh.

Note: Companies will be provided with scores in each criterion from 1 to 10. Where 1 is being the

lowest valued score and indicates worst level of performance and 10 is the highest valued score and

indicates best level of efficiency.

Scoring Criteria Firms

BEXIMCO SQUARE INCEPTA

Management 7.7 8.0 8.5

Product quality

(Tablets and Capsules)

8.0 8.5 9.2

Product quality (inhalers

and other Medicines)

9.5 8.9 7.3

Distribution 8.2 9 7.8

Technology

Development

7.7 7.6 8.1

Research & Development 8.4 8.9 8.1

Corporate Social

Responsibility

6.1 8.2 6.5

Customer Loyalty 8.3 9.5 9.2

Medicine

Recommendation by

Doctors

8 9.1 8.8

Public Trust 4.7 9.3 8.9

Total

76.6 87 82.4

The results above are derived from a survey on very short number of respondents being only

10. We had particularly taken the judgements from 2 corporate personnel, 3 general people,

and 5 professional doctors. With 10 criteria selected and each criterion can at most score a 10

out of 10, the generated total scores are: 76.6 (Beximco), 87 (Square), and 82.4 (Incepta).

From the evaluation above, we dont really wonder why Square Pharmaceuticals Ltd has

been a dominant force in the market.

37

3.5 The Game Theory

Game theory is concerned with the interrelationships between the competitive moves of a set

of competitors. The central idea is that the strategist has to anticipate the reaction of

competitors (Johnson, Scholes et al, 2008).

Simultaneous games

Simultaneous games discussed so far the competitors were making decisions or move at the

same time and without knowing what each other was doing. Ethical egoism is the view that

each company like Prime Bank ought to maximize its own interest. As a moral theory it has

been criticized in many ways. For example it is commonly said that we should always look

after our own interest. We have other duties too. Sometimes we need to sacrifice our personal

interest for the greater interest of the society. Absolute selfishness is generally rejected and is

considered immoral.

Criticism: Some scholars like Adam Smith in his book The Wealth of Nation, however

believe that if everyone maximizes his own interest then general interest will be maximized.

For example if each individual firm maximizes its interest then overall (all firms) interest will

be increased. But we believe that general interest will not increase. Let us consider the

following situations:

The Prisoners Dilemma

Suppose, for example, that pharmaceutical firmsSquare Pharmaceuticals Limited and

Incepta Pharmaceuticals dominate in a market and have to decide whether to try to gain

market share through spending heavily on marketing.

Bottom right hand quadrant: Low marketing expenditure by both of the firms i.e.

Square Pharmaceuticals Limited and Incepta Pharmaceuticals. They may know that

38

the return from such expenditure would not offset its cost. Therefore, the logical

course of action would be for both Prime Bank Limited and First Security Islamic

bank to keep marketing expenditure at the current low level of preserve their current

shares: in a sense to collude tacitly to keep the situation as it is for mutual benefit. If

both players select this strategy, the payoff to each firm is represented in the bottom

right hand quadrant of table.

Top right and bottom left quadrant: There is likely to be a temptation by one or the

other competitors to try to take an advantage over the other. Both Square

Pharmaceuticals Limited and Incepta Pharmaceuticals Ltd know that if they alone

spent more on marketing they would achieve substantial returns. However there is

likely to be a temptation by one or other competitor to try to steal an advantage over

the other. Each knows that if they alone spend more on marketing they would achieve

substantial return. This is represented in the top right and bottom left quadrants. In

this area of marketing Square Pharma is leading compared to Incepta Pharma.

Top left hand quadrant: Suppose Square and Beximco are in the same path to take

decision about spending on advertising. Both Square Pharmaceuticals Limited and

Incepta Pharmaceuticals decide to spend heavily on marketing to ensure that the other

competitor does not get an advantage. Danger of this heavy marketing expenditure

might lead worse return for both parties. The danger is, of course, that, knowing this,

both parties decide they must spend heavily on marketing to ensure that other

competitor does not get an advantage. The result is the top left quadrant which is a

much worse return to both firms than would have happened had they both decided to

keep marketing expenditures at the current level.

Bottom left and top right quadrant: There is likely to be temptation by one or the other

competitors to try to take an advantage over the other. Each knows that if they alone

spent more on marketing they would achieve substantial returns. Same as it is in top

right and bottom left quadrant.

The prisoners dilemma model therefore suggests that the incentives open to a pay-off which

is much worse for both.

Prisoners Dilemma illustrates some important principles:

A dominant strategy is one that outperforms all other strategies whatever rivals

choose. The dominant strategy is to spend heavily on marketing. If we consider about

two pharmaceutical firmssuch as Square Pharmaceuticals Limited and Incepta

Pharmaceuticals then we can easily decide that SPL is in the dominant position in

terms of spending more on advertising.

A dominated strategy is a competitive strategy that if pursued by a competitor, is

bound to outperform the company. If an organisation does not have a dominated

strategy, it is important to identify whether it faces a dominated strategy, that is, a

competitive strategy that, if pursued by a competitor is bound to outperform the

company. For instance just think about Square Pharmaceuticals Limited and Incepta

39

Pharmaceuticals, what about their position regarding product development? Incepta is

in the dominant position.

Equilibrium is a situation where each competitor engineering to get the best A

possible strategic solution for themselves given the response from the other.

A Simultaneous move game

BPL investment

High low

High

SPL

Investment

Low

Here SPL stands for Square Pharmaceuticals Ltd and BPL stands for Beximco

Pharmaceuticals Ltd.

SPL is known to have excellent product quality at a low price and for corporate social

responsibility but is short of enough concentration required to invest heavily in rapid

development of products. Beximco is strong financially but relatively weak in terms of its

research and design. In terms of the crucial choice of investing in research and design or not,

investing heavily would shorten the development time but would incur considerable costs.

These choices can be thought of in terms of the sort of matrix shown above.

In box D each of the competitors probably regards of investing by both as the worst outcome:

SPL because of its weak reinvestment budget and it could be a risky route to follow Beximco

because if it can raise the finance, SPL has better chances of winning given its CSR ideas.

BPL=3

SPL=4

B BPL=4

SPL=2

C BPL=2

SPL=3

D BPL=1

SPL=1

40

SPL has a dominant strategy, which is keep its investment low. If Beximco were to invest

low, SPL would get a better pay off by also investing low (box A). on the other hand, if

Square pharma were to go for a high level of investment, SPL would suffer, but not as much

by keeping investment on the low side as it would if it went for a high level of investment on

the low side as it would if it went for a high level of investment (box B is better than box D

for SPL)

SQUARE Pharma on the other hand, does not have a dominant strategy. However it knows

that SPL does and therefore probable expects that SPL will keep levels of investment down.

Beximco also knows that if it goes for a low level of investment, it loses whether or not SPL

adopts the same strategy or goes a high level of investment (boxes A and C). So does it make

any sense for Square Pharma to go for a low level of investment; it is a dominated strategy.

This is not what SPL ideally wants- but the best it can do is follow its dominant strategy of

investing low which result in the least worst pay off-the Equilibrium solution (box B).

Sequential games

The guiding principle here is to think forwards and then reason backwards. In other words,

start by trying to think through the sequences of moves that competitors might make based on

a reasonable assumption about what that competitors desires as the outcome. On that basis

then decide the most advantageous moves you can make.

If SPL decides to invest low it knows that Beximco is likely to respond high and gain the

advantage. However, if SPL moves first and then invests high it places Beximco in a difficult

position. If Beximco also invests high it ends up with a low pay off as well as Square

Pharmaceuticals Limited. In these situation provided of course that Beximcos game theorist.

Beximco would reject that strategy as a dominants strategy and choose to invest low. That is

the equilibrium situation of Sequential game.

Some important strategic lessons need to be recognised, in particular the importance of:

- Identifying dominant and dominated strategies;

- The timing in strategic moves;

- The careful weighting of risk

- Establishing credibility and commitment

Repeated games

In repeated games, competitors interact repeatedly and it has been shown that it such

circumstances the equilibrium outcome is much more likely to favour cooperation or

accommodation of both parties best interest. This is not necessarily because of explicit

collusion, but because they learn to do so through experience.

41

This is how the pharmaceutical sector of Bangladesh are running with such unstable share

market for such long period of time; still continuing. The entire firms are running with a

strong collaboration among them.

However this cooperation depends on some factors. These are

The number of competitors in the market. If there is less in number then it is easy for

cooperation among organization. In Bangladesh it has become easy for banks as there

few in number.

If smaller competitor competing with larger competitors it is quite possible that

smaller will gain disproportionately by breaking rank.

Depend on substantial difference between organizations.

If there any chance of lack of transparency on bases of competition within the market

then again cooperation is difficult.

Changing the rules of the game

Here thinking through the logic of the game, a competitor might find that they are simply not

able to compete effectively within the rules as they exist. In this game theory competitors are

flexible to change game plan to gain maximum market share i.e. If organisation A fails to

gain maximum market share by heavily investing on marketing or R&D than change the

game plan to price based strategies or either way. But SPL has got its game plan right and

need not to change the rules of the game.

42

Chapter 4

Business Level Strategy

This chapter is about the competitive strategies of Square Pharmaceuticals Limited (SPL) and

the choices that it made to gain competitive advantage. The important issues are the issues

that underpin competitive advantage. It must be remembered that competitive strategy in SPL

43

is created in the separate business units of an organisation. And thus the business level

strategy begins with identifying Strategic Business Units (SBUs).

4.1 Identifying Strategic Business Unit

A strategic business unit is a part of an organization for which there is a distinct external

market (Johnson, Scholes et al., 2008). The identification of SPLs strategic business units is

essential to the development of business-level strategies since these will vary from one SBU

to another.

Although there are major pitfalls of SBUs exist, yet SPL is overcoming them continuously.

The SPL even if got geographically diversified, and have a total of 670 products available in

the market, the company is focusing highly on its local market, while slightly focusing to

expand globally as well.

With brand categorization and highly managed customer database, Square Pharmaceuticals