Professional Documents

Culture Documents

Estimating Funds Requirements Butler Lumber Company

Uploaded by

Nabab ShirajuddoulaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

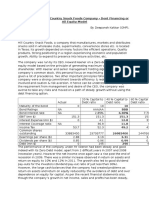

Estimating Funds Requirements Butler Lumber Company

Uploaded by

Nabab ShirajuddoulaCopyright:

Available Formats

An Analysis on estimating Funds Requirements

Presented By :

Saurabh Kumar Sinha 2009PGP049

Saurabh Patawari 2009PGP050

Siddharth Shankar Prasad 2009PGP051

Sourjyo Das 2009PGP052

Sreethala Ganapathy 2009PGP053

Shubhangi Shree 2009PGP054

Butler Lumber in Spring 1991

Originally founded but Butler and Stark

Butler buys out Stark for $105,000 by taking a $70,000 loan

payable over 10 years at 11% p.a.

Needs $247000 - approaches Suburban National Bank

Relies heavily on trade credit

Why does Butler Lumber want to shift banks?

Now, Suburban National bank wants real collateral for its

loans

He, however, wants a larger unsecured loan (Suburban bank

has cap of $250,000 on its loans)

He also wants a larger loan that would give him flexibility

He considers Northrop National Bank as an alternative

Reasons for choosing Northrop over Suburban

Higher cap on loans $465,000

This credit line would provide to him larger flexibility

Company History

Began in 1981 as a partnership by Butler ad Stark

Business incorporated in 1988 by Butler by buying out

Starks share for $105,000

Paid $35,000 ,$70,000 as bank loan at interest rate of 11%

repayable at $7000 over a period of 10 years

Business operating conditions

Located in a suburb in Pacific Northwest

Company owned land and buildings near a railroad

Credit term of 30 days offered to customers

Company had a good reputation as researched by Northnorp National

Bank

Personal assets of Butler-joint equity on a house of $72,000 mortgaged

at $38,000

Company pays suppliers after 30 days not availing the discount of 2%

offered by the suppliers for payment within 10 days

Terms of Northrop National Bank

Secured 90-day note with a limit of $465,000

Maintaining the net working capital to an agreed level

Constraints on capital expenditure and withdrawing

Interest rates on floating basis at 10.5%

Assumptions

Projected sales in 1991 at $3.6 million with scope for

improvement

About 55% of the sales during April-September period

Permanent severance of relationship with Suburban

Bank

Low Credit Limit :

-Credit limit of Suburban National bank was $ 250,000

but the cash requirement of Butler lumber company

was more

Heavy reliance on Trade Credit:

-To stay within credit limit Butler had to rely heavily on

Trade Credit. A larger loan amount would ease this

reliance

Security for loan :

-Suburban was now seeking Collateral whereas Butler

wanted unsecured loan

Limitations would be placed on withdrawal of funds

which may negatively impact his salary

Loss of autonomy for making investments in fixed

assets as approval of Bank would be required

Loan would be issued on variable interest rate which

depends on market fluctuations- a high Interest rate

will decrease net income

Rigid control on Working Capital level will have to be

maintained

Loss of flexibility in regard to additional borrowing as

restrictions imposed by National Bank

Concept :

It describes lenders contribution for each dollar of

owners contribution

It estimates stability

Standard Value is 2:1

If it is less than this, it is favourable because:

1) High safety margin for lenders

2) Less interest payments

3) Scope for more loans

4) No trading on Equity

LEVERAGE RATIOS

Debt equity ratio

It has been increasing over the years which suggests

increased dependency on external funds and high financial

risk . Moreover , it indicates rapid growth in company as

well which arises greater need of external funds

Debt Ratio

It has been increasing over the years which increased

extent of debt financing in business

Hence, majority of the companys assets are being financed

by external funds

Concept :

Indicates availability of Current Assets for each unit of

Current Liability

It estimates short term Liquidity of the Company

It also estimates margin of safety for creditors a high

ratio means less risk for creditors

A ratio of less than 1 is a cause of concern

Quick Ratio

Considers only cash as quick assets for meeting short

term liability

CURRENT RATIO

It has been decreasing over the years, which suggests that

it has more current claims than current assets.

In fact a satisfactory ratio of 2:1 was never achieved in any

of the years

It points to narrow margin of safety for creditors

The ratio indicates whether debtors are being allowed

excessive credits

A higher credit may suggest general problems with

debt collection or the financial position of major

customers

Days Receivables is increasing which indicates poor

collection policy

Ideal Days Receivables allowed was 30 but we are

getting 43 for 1990 which necessitates better credit

collection policy

If sustainable growth is higher than internal growth rate,

need for external funds will be less

Company will be able to fund its growth requirements

Internal growth rate vs Sustainable growth rate

In all the years, the sustainable growth rate is higher than

the internal growth rate of the company, which indicates

that the company will sustain for a long period of time and

indicates a positive scope.

Hence, it makes sense to go for bank loans and it is

convincing as well for the bank to grant required loan

amount

PROFITABILITY RATIO

Net profit margin

It has been low over the years, with merely 1.8% in

1988 and shows a decrease over the years accounting to

mere 1.6%

This suggests poor capacity of the company to

withstand adverse economic conditions and

comparitively low operating efficiency of the firm

1) To buy out Starks (former partner) interest he took a

loan of $ 70,000

Payment of installments ( 11 % interest + $7000 annual

payment) reduces available cash

2) To fund the growth of the company funds were

needed.

3) To decrease reliance on trade credit. Currently he is

unable to avail discounts on purchases made because

of lack of cash, with larger funds he can take advantage

of discount by making payment within 10 days

Accounts payable to sales increasing

Accounts receivable to sales increasing

Quick and current ratio is decreasing

Projected sales high compared to what actually the

company can achieve on the basis of the trend over last

few years(assuming for 1

st

quarter sales are 22.5%)

Out of $465,000, $247000 will be used to pay previous

bank loan and $7000 to pay as part of loan previously

taken to pay his initial partner

Decrease in accounts payable and paying suppliers

immediately to avail the option of 2% discount

Quantity discounts and days receivable needs to be

reduced

Operational efficiency has to be increased to better the

profit margin

Decreasing his personal withdrawings which is almost

twice of net income, this will help in increasing the

profit margin

You might also like

- Contract Law BibleDocument45 pagesContract Law Biblemewinga5621100% (10)

- Trust Agreement: Back To Table of ContentsDocument16 pagesTrust Agreement: Back To Table of ContentsJurisprudence Law100% (1)

- Beneficiary's (Bailor) Deposit Disbursement Payment Discharge of Contract CloseDocument5 pagesBeneficiary's (Bailor) Deposit Disbursement Payment Discharge of Contract Closein1or93% (14)

- Butler Lumber SuggestionsDocument2 pagesButler Lumber Suggestionsmannu.abhimanyu3098No ratings yet

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- Case 26 Rockboro Group ADocument27 pagesCase 26 Rockboro Group AKanoknad KalaphakdeeNo ratings yet

- Revolving Line of Credit AgreementDocument9 pagesRevolving Line of Credit AgreementRobert ArkinNo ratings yet

- Trust Receipts LawDocument6 pagesTrust Receipts LawPrinting PandaNo ratings yet

- Play Time Toy Company Financial AnalysisFebMarAprMayJunJulAugSepOctNovDecTotal10812614512512512514514581655192520571006900070.3782.1094.4881.4581.4581.4594.48950.031,078.401,254.331,340.34Document16 pagesPlay Time Toy Company Financial AnalysisFebMarAprMayJunJulAugSepOctNovDecTotal10812614512512512514514581655192520571006900070.3782.1094.4881.4581.4581.4594.48950.031,078.401,254.331,340.34Brian Balagot100% (3)

- Working Capital Simulation Managing Growth Key Metrics and Strategic DecisionsDocument5 pagesWorking Capital Simulation Managing Growth Key Metrics and Strategic DecisionsAvinashDeshpande1989100% (1)

- Reg D For DummiesDocument51 pagesReg D For DummiesDouglas SlainNo ratings yet

- Rockboro Machine Tools Corporation Case QuestionsDocument1 pageRockboro Machine Tools Corporation Case QuestionsMasumiNo ratings yet

- Play Time Toy Financial AnalysisDocument4 pagesPlay Time Toy Financial AnalysischungdebyNo ratings yet

- Ethics in Todays World3Document41 pagesEthics in Todays World3tkerrvanderslice100% (1)

- Butler Lumber Company Funding AnalysisDocument2 pagesButler Lumber Company Funding AnalysisDucNo ratings yet

- Butler Lumber Company: An Analysis On Estimating Funds RequirementsDocument17 pagesButler Lumber Company: An Analysis On Estimating Funds Requirementssi ranNo ratings yet

- Butler Lumber Case Study Solution: Assess Financial Situation & Loan RequestDocument8 pagesButler Lumber Case Study Solution: Assess Financial Situation & Loan RequestBagus Be WeNo ratings yet

- Butler Lumber 1Document6 pagesButler Lumber 1Bhavna Singh33% (3)

- Case AnalysisDocument11 pagesCase AnalysisSagar Bansal50% (2)

- RockboroDocument4 pagesRockboromNo ratings yet

- Butler Lumber CompanyDocument8 pagesButler Lumber CompanyAnmol ChopraNo ratings yet

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionChris Mlincsek67% (3)

- Butler Lumber Case DiscussionDocument3 pagesButler Lumber Case DiscussionJayzie Li100% (1)

- Group B&D - Case 19 - Fonderia PresentationDocument24 pagesGroup B&D - Case 19 - Fonderia PresentationVinithi Thongkampala100% (2)

- Hill Country Snack Food Co. Optimal Capital StructureDocument7 pagesHill Country Snack Food Co. Optimal Capital StructureAnish NarulaNo ratings yet

- Sure CutDocument1 pageSure Cutchch917No ratings yet

- Hill Country Snack Foods Co - UDocument4 pagesHill Country Snack Foods Co - Unipun9143No ratings yet

- Deluxe's Restructuring and Capital StructureDocument4 pagesDeluxe's Restructuring and Capital StructureshielamaeNo ratings yet

- Butler Excel Sheets (Group 2)Document11 pagesButler Excel Sheets (Group 2)Nathan ClarkinNo ratings yet

- Butler Lumber - Pro Forma - Balance and Income StatementDocument4 pagesButler Lumber - Pro Forma - Balance and Income StatementJack Benjamin83% (6)

- Hill Country CaseDocument5 pagesHill Country CaseDeepansh Kakkar100% (1)

- Case Presentation-McKenzie Corporations Capital BudgetingDocument17 pagesCase Presentation-McKenzie Corporations Capital Budgetingpragati bora67% (3)

- Butler Lumber CaseDocument4 pagesButler Lumber CaseLovin SeeNo ratings yet

- Mr. Butler's Loan Requirements for Lumber Company ExpansionDocument6 pagesMr. Butler's Loan Requirements for Lumber Company ExpansionamanNo ratings yet

- Case Analysis of Butler Lumber Company's Financial PerformanceDocument14 pagesCase Analysis of Butler Lumber Company's Financial PerformanceSangeet SaritaNo ratings yet

- Rockboro Machine Tools Corporation: Source: Author EstimatesDocument10 pagesRockboro Machine Tools Corporation: Source: Author EstimatesMasumi0% (2)

- Case 26 Assignment AnalysisDocument1 pageCase 26 Assignment AnalysisNiyanthesh Reddy50% (2)

- FM Butler Grup 2Document10 pagesFM Butler Grup 2Anna Dewi Wijayanto100% (1)

- Surecut Shears, Inc.: AssetsDocument8 pagesSurecut Shears, Inc.: Assetsshravan76No ratings yet

- (S3) Butler Lumber - EnGDocument11 pages(S3) Butler Lumber - EnGdavidinmexicoNo ratings yet

- Butler Lumber Company Financials 1988-1991Document7 pagesButler Lumber Company Financials 1988-1991Sam Rosenbaum100% (1)

- Butler Lumber Company Case Analysis: Assessing Financial Strategy and Expansion NeedsDocument2 pagesButler Lumber Company Case Analysis: Assessing Financial Strategy and Expansion NeedsJem JemNo ratings yet

- Butler Lumber Final First DraftDocument12 pagesButler Lumber Final First DraftAdit Swarup100% (2)

- New Heritage Doll Company Report: Design Your Own Doll Project Best ChoiceDocument5 pagesNew Heritage Doll Company Report: Design Your Own Doll Project Best ChoiceRahul LalwaniNo ratings yet

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDocument5 pagesCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashNo ratings yet

- Calaveras VineyardsDocument12 pagesCalaveras Vineyardsapi-250891173100% (4)

- Butler Lumber CompanyDocument4 pagesButler Lumber Companynickiminaj221421No ratings yet

- Butler Lumber Case SolutionDocument4 pagesButler Lumber Case SolutionPierre Heneine86% (7)

- This Study Resource Was: 1 Hill Country Snack Foods CoDocument9 pagesThis Study Resource Was: 1 Hill Country Snack Foods CoPavithra TamilNo ratings yet

- Gen Math - Q2 - SLM - WK5Document10 pagesGen Math - Q2 - SLM - WK5Floraville Lamoste-MerencilloNo ratings yet

- Butler Lumber Case SolutionDocument4 pagesButler Lumber Case SolutionCharleneNo ratings yet

- Butler Lumber CaseDocument14 pagesButler Lumber CaseSamarth Mewada83% (6)

- Types of PartnersDocument2 pagesTypes of PartnersEjaz ShahidNo ratings yet

- (REVIEWER) Credit Transactions - Lerma Philomatheia Tips PDFDocument7 pages(REVIEWER) Credit Transactions - Lerma Philomatheia Tips PDFAndrea RioNo ratings yet

- Management ContractDocument58 pagesManagement ContractImee S. YuNo ratings yet

- Butler Lumber Company: Following Questions Are Answered in This Case Study SolutionDocument3 pagesButler Lumber Company: Following Questions Are Answered in This Case Study SolutionTalha SiddiquiNo ratings yet

- Cartwright Lumber Company PDFDocument5 pagesCartwright Lumber Company PDFtparvais100% (5)

- Altus Group 19 Canadian Cost Guide Final 2Document22 pagesAltus Group 19 Canadian Cost Guide Final 2k100% (1)

- Case Study of Stryker CorporationDocument5 pagesCase Study of Stryker CorporationYulfaizah Mohd Yusoff40% (5)

- 454K Loan for Cartwright Lumber CoDocument5 pages454K Loan for Cartwright Lumber CoRushil Surapaneni50% (2)

- Butler CaseDocument16 pagesButler Casea_14sNo ratings yet

- Analysis Butler Lumber CompanyDocument3 pagesAnalysis Butler Lumber CompanyRoberto LlerenaNo ratings yet

- HAMPTON MACHINE TOOL Case - PresentationDocument7 pagesHAMPTON MACHINE TOOL Case - PresentationChaitanya90% (10)

- StrykerDocument10 pagesStrykerVeer SahaniNo ratings yet

- Case 3: Rockboro Machine Tools Corporation Executive SummaryDocument1 pageCase 3: Rockboro Machine Tools Corporation Executive SummaryMaricel GuarinoNo ratings yet

- Pacific Grove Spice's acquisition of High Country Seasonings and TV show sponsorshipDocument9 pagesPacific Grove Spice's acquisition of High Country Seasonings and TV show sponsorshipdiddiNo ratings yet

- Bulter Lumber CaseDocument3 pagesBulter Lumber CaseSwarna RSNo ratings yet

- Team 9A Case Analysis of Harris Seafoods Cash Flows and ValuationDocument2 pagesTeam 9A Case Analysis of Harris Seafoods Cash Flows and ValuationNadia Iqbal100% (1)

- 5.1 Receivable ManagementDocument18 pages5.1 Receivable ManagementJoshua Cabinas100% (1)

- BMA Tut 9Document7 pagesBMA Tut 9Thảo ĐỗNo ratings yet

- Wilson Lumber Case Group 5Document10 pagesWilson Lumber Case Group 5Falah HindNo ratings yet

- Bank Decision MakingDocument3 pagesBank Decision Makingjob_deloitte7440No ratings yet

- Stress TestingDocument7 pagesStress TestingNabab ShirajuddoulaNo ratings yet

- Conceptual Islamic CardDocument9 pagesConceptual Islamic CardNabab ShirajuddoulaNo ratings yet

- Anomalous Evidence Market EfficiencyDocument7 pagesAnomalous Evidence Market EfficiencyNabab ShirajuddoulaNo ratings yet

- Les Service PLCDocument8 pagesLes Service PLCNabab ShirajuddoulaNo ratings yet

- Instruction Manual For Omoa SlidesDocument2 pagesInstruction Manual For Omoa SlidesNabab ShirajuddoulaNo ratings yet

- Aurora SupplyDocument2 pagesAurora SupplyNabab Shirajuddoula100% (1)

- Access To CreditDocument16 pagesAccess To CreditNabab ShirajuddoulaNo ratings yet

- Community Learning GhanaDocument6 pagesCommunity Learning GhanaNabab ShirajuddoulaNo ratings yet

- Pan Pacific DhakaDocument39 pagesPan Pacific DhakaNabab ShirajuddoulaNo ratings yet

- Arak Cook 1997Document16 pagesArak Cook 1997Nabab ShirajuddoulaNo ratings yet

- CSP SukibDocument6 pagesCSP SukibNabab ShirajuddoulaNo ratings yet

- Dhaka Botanical Nursery - Exploratory Marketing Research ProposalDocument13 pagesDhaka Botanical Nursery - Exploratory Marketing Research ProposalNabab ShirajuddoulaNo ratings yet

- Determination of QualityDocument15 pagesDetermination of QualityNabab ShirajuddoulaNo ratings yet

- Financial Detective PfizerDocument17 pagesFinancial Detective PfizerNabab ShirajuddoulaNo ratings yet

- Company in IndiaDocument5 pagesCompany in IndiaGeetvikNo ratings yet

- LLP Agreement for Business Advisory FirmDocument22 pagesLLP Agreement for Business Advisory FirmRamanil AnkurNo ratings yet

- Kim Lin CaseDocument18 pagesKim Lin CaseJai Juet Phang100% (3)

- Research Paper For International FinanceDocument18 pagesResearch Paper For International FinancenanoiNo ratings yet

- Hayman July 07Document5 pagesHayman July 07grumpyfeckerNo ratings yet

- Tally Ledger Under Group ListDocument3 pagesTally Ledger Under Group ListRAMESHNo ratings yet

- Tamil Nadu Value Added Tax Act, 2006Document67 pagesTamil Nadu Value Added Tax Act, 2006Viswanathan SivaramanNo ratings yet

- Engineering Economy QuizDocument6 pagesEngineering Economy QuizGretchel Diane Patlunag-EscabusaNo ratings yet

- Supreme Court Rules in Favor of Land Owners in Partition CaseDocument5 pagesSupreme Court Rules in Favor of Land Owners in Partition CaseAnonymous ft7pdr6UTsNo ratings yet

- Property 6th SemDocument12 pagesProperty 6th Sem1994sameerNo ratings yet

- Timothy Paul Owens Guilty Plea Voyager BankDocument2 pagesTimothy Paul Owens Guilty Plea Voyager BankJimHammerandNo ratings yet

- Revolving Credit Facilities and Expected Credit LossesDocument20 pagesRevolving Credit Facilities and Expected Credit LossesJohn SitholeNo ratings yet

- 1 PDFsam 270120 BM PDFDocument243 pages1 PDFsam 270120 BM PDFSomenath PaulNo ratings yet

- United States v. Cox, 1st Cir. (2017)Document29 pagesUnited States v. Cox, 1st Cir. (2017)Scribd Government DocsNo ratings yet

- Ohio - Deutsche V Holden Answer and Counterclaims - Fraud On The CourtDocument12 pagesOhio - Deutsche V Holden Answer and Counterclaims - Fraud On The Courtwinstons2311No ratings yet

- Money Markets: Financial Markets and Institutions, 10e, Jeff MaduraDocument46 pagesMoney Markets: Financial Markets and Institutions, 10e, Jeff MaduraNurul FitriyahNo ratings yet

- Dbms Insurance SectorDocument21 pagesDbms Insurance SectorTech_MXNo ratings yet

- A Comparative Study of Marketing Strategies of HDFC With Icici BankDocument10 pagesA Comparative Study of Marketing Strategies of HDFC With Icici BankXtremeInfosoftAlwarNo ratings yet

- Catamount Properties 2018, LLC (Debtor)Document13 pagesCatamount Properties 2018, LLC (Debtor)8221 Hydra Ln, Las Vegas, NV 89128No ratings yet