Professional Documents

Culture Documents

Market Study Executive Summary

Uploaded by

api-237055696Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Study Executive Summary

Uploaded by

api-237055696Copyright:

Available Formats

2

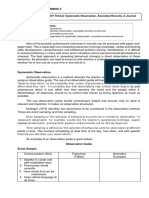

Executive Summary

This report has two purposes. The first is to summarize consumer demographic and buying habits

along Semoran Boulevard from East Colonial Drive to the International Airport, Orlando, Florida (the

corridor). The second purpose is to provide recommendations for increasing the prosperity of the area.

This document can be used by entrepreneurs, commercial realtors, bankers, consultants and organizations

with a stake in the Semoran Corridor to establish new businesses, expand product lines, and develop

strategies to improve the areas prosperity.

The 2012 population was approximately 261,576 persons and 108,000 households within a 5-mile

radius of Curry Ford and Semoran Boulevard (the center point). This population is expected to increase

5% by 2017. The population is largely Hispanic (well over 50%) within a 1-mile radius of the center

point, decreasing to 36% at the five-mile radius. There is a strong white population that increases across

the 1, 3, and 5-mile circle. Median, 2012 household income is lower than the U.S. average at $35.270

within a one-mile radius, increasing to $43,299 at the five-mile radius, but still below the US average of

$50,157. A small majority of consumers tend to live in rented dwellings within 1-mile radius, with a

small majority owning homes at the 5-mile radius point. Consumers are heavily dependent on cars for

transportation. The area is a gateway to Orlando given the airport and the 528 and 408 highways

generating daily traffic counts of approximately 57,500 per day.

Dominant business categories are restaurants, medical services and professional services

(insurance, legal). Research described in a Tapestry Market Segmentation Report indicates dominant

consumer groups are Solo Acts (single individuals), Global Roots (recent immigrants with family abroad

and often, children and youth at home), Family Portrait (families with youth and children at home),

Traditional Living (hardworking, established consumers) and Upscale Avenue (well-off professionals)

groups. Solo Acts, Global Roots and Traditional Living groups are largely consistent across the 1, 3, and

5 mile analysis area, while Family and Upscale Avenue groups emerge toward the 3 and 5-mile radii. A

retail sales gap analysis indicates there is significant leakage within a 1-mile radius (shoppers do not

purchase items they need within the corridor). However, the gap analysis indicates that at the 3 and 5-

mile radius points, there may be unsatisfied demand in certain business categories such as shoes, office

supplies, building materials, lawn and garden equipment, and special food services like caterers.

Recommendations include:

a) events and experiences for single individuals who represent a large population along the corridor.

b) leveraging the corridors cultural diversity in promotional events, artwork and branding to attract

diverse visitors from out of the corridor who want cultural experiences

c) attracting businesses for affordable products and services that cater to families such as entertainment,

clothing, shoes, and toys.

d) increasing local spending by residents and organizations with a Buy Local program.

e) cooperation and strategic planning for the health industry, the second largest business segment

f) increasing local residents median household income

g) leveraging the La Costa Wetlands as a destination location for events and festivals to increase traffic to

the area.

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ASTM E466 Uji Fatik LogamDocument5 pagesASTM E466 Uji Fatik LogamMad Is100% (1)

- Aol2 M6.1Document5 pagesAol2 M6.1John Roland CruzNo ratings yet

- 1st Year Unit 7 Writing A Letter About A CelebrationDocument2 pages1st Year Unit 7 Writing A Letter About A CelebrationmlooooolNo ratings yet

- Weathering Week 2 Lesson PlanDocument2 pagesWeathering Week 2 Lesson Planapi-561672151No ratings yet

- If Tut 4Document7 pagesIf Tut 4Ong CHNo ratings yet

- Dma ControllerDocument28 pagesDma ControllerVEL TECHNo ratings yet

- QuestionnaireDocument4 pagesQuestionnairevishal chauhanNo ratings yet

- Forensic 2 Module 1-ContentDocument12 pagesForensic 2 Module 1-ContentSheri Ann PatocNo ratings yet

- Health COX's Monthly Dashboard - 2023 NovDocument4 pagesHealth COX's Monthly Dashboard - 2023 Novcox mamNo ratings yet

- Developing A Biblical WorldviewDocument22 pagesDeveloping A Biblical WorldviewAaron AmaroNo ratings yet

- Azhari, Journal 7 2011Document11 pagesAzhari, Journal 7 2011Khoirunnisa ANo ratings yet

- A Short History of The IsmailisDocument30 pagesA Short History of The IsmailisAbbas100% (1)

- Synthesis of Bicyclo (2.2.l) Heptene Diels-Alder AdductDocument2 pagesSynthesis of Bicyclo (2.2.l) Heptene Diels-Alder AdductJacqueline FSNo ratings yet

- FIDP Business Ethics and Social Responsibility PDFDocument7 pagesFIDP Business Ethics and Social Responsibility PDFRachell Mae Bondoc 1No ratings yet

- Defining Pediatric SepsisDocument2 pagesDefining Pediatric SepsisArisa DeguchiNo ratings yet

- Section 22 Knapsack CipherDocument9 pagesSection 22 Knapsack CipherchitrgNo ratings yet

- TC1 Response To A Live Employer Brief: Module Code: BSOM084Document16 pagesTC1 Response To A Live Employer Brief: Module Code: BSOM084syeda maryemNo ratings yet

- Alaska Non-Timber Forest Products Harvest ManualDocument41 pagesAlaska Non-Timber Forest Products Harvest Manualtigriochelito100% (1)

- Trends in Computer-Based Second Language Assessment Jamieson 2005Document15 pagesTrends in Computer-Based Second Language Assessment Jamieson 2005Oana CarciuNo ratings yet

- What Is Talent AcquisitionDocument6 pagesWhat Is Talent AcquisitionMJ KuhneNo ratings yet

- Z Transform Part 1 PDFDocument16 pagesZ Transform Part 1 PDFAnanth SettyNo ratings yet

- The Court Cards: Hans Christian AndersenDocument4 pagesThe Court Cards: Hans Christian Andersenbresail4No ratings yet

- Convekta Training MethodsDocument9 pagesConvekta Training MethodsTech PadawanNo ratings yet

- Birth Characteristic in Men With FertilityDocument9 pagesBirth Characteristic in Men With FertilityAanii SNo ratings yet

- Cost Accounting and Management Essentials You Always Wanted To Know: 4th EditionDocument21 pagesCost Accounting and Management Essentials You Always Wanted To Know: 4th EditionVibrant Publishers100% (1)

- 99 Attributes of Allah Al Khaliq (The Creator) Al Bari (The Inventor) Al Musawwir (The Fashioner)Document7 pages99 Attributes of Allah Al Khaliq (The Creator) Al Bari (The Inventor) Al Musawwir (The Fashioner)Abdourahamane GarbaNo ratings yet

- Practice in KeyboardingDocument16 pagesPractice in KeyboardingRaymart GonzagaNo ratings yet

- Picaresque Novel B. A. Part 1 EnglishDocument3 pagesPicaresque Novel B. A. Part 1 EnglishIshan KashyapNo ratings yet

- The Traditional of The Great Precept Transmission Ordination Ceremony in Vietnam BuddhistDocument20 pagesThe Traditional of The Great Precept Transmission Ordination Ceremony in Vietnam BuddhistAn NhiênNo ratings yet

- Several Terms Redirect Here. For Other Uses, See,, and - This Article Is About Jinn in Islam. For Other Uses, See andDocument2 pagesSeveral Terms Redirect Here. For Other Uses, See,, and - This Article Is About Jinn in Islam. For Other Uses, See andEduard Loberez ReyesNo ratings yet