Professional Documents

Culture Documents

Stock Tracking

Uploaded by

api-265139853Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Tracking

Uploaded by

api-265139853Copyright:

Available Formats

$52.

00

$54.00

$56.00

$58.00

$60.00

$62.00

$64.00

$66.00

$68.00

9,000.00

9,500.00

10,000.00

10,500.00

11,000.00

11,500.00

12,000.00

12,500.00

13,000.00

1 2 3 4 5 6 7 8 9 10 11

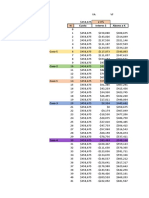

Dow Jones Industrial Average

DJIA ^DJI

Buffalo Wild Wings ^BWLD

$52.00

$54.00

$56.00

$58.00

$60.00

$62.00

$64.00

$66.00

$68.00

2,200.00

2,300.00

2,400.00

2,500.00

2,600.00

2,700.00

2,800.00

NASDAQ (IXIC)

NASDAQ ^IXIC

Buffalo Wild Wings ^BWLD

$52.00

$54.00

$56.00

$58.00

$60.00

$62.00

$64.00

$66.00

$68.00

1,050.00

1,100.00

1,150.00

1,200.00

1,250.00

1,300.00

1 2 3 4 5 6 7 8 9 10 11

Standard and Poor's 500 (GSPC)

S&P500 ^GSPC

Buffalo Wild Wings ^BWLD

$56.00

$58.00

$60.00

$62.00

$64.00

$66.00

640.00

660.00

680.00

700.00

720.00

740.00

760.00

780.00

1 2 3 4 5 6 7 8 9 10 11

Russel 2000 (RUT)

Russell 2000 ^RUT

Buffalo Wild Wings ^BWLD

Buffalo

Wild

Wings NASDAQ S&P500

Russell

2000 DJIA

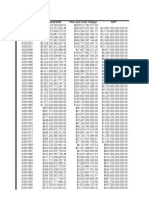

Week Symbols ^BWLD ^IXIC ^GSPC ^RUT ^DJI

Start 9-Sep 59.70 $ 2,467.99 1,154.23 673.96 ########

1 16-Sep 64.40 $ 2,622.31 1,216.01 714.31 ########

2 23-Sep 59.34 $ 2,483.23 1,136.43 652.43 ########

3 30-Sep 59.80 $ 2,415.40 1,131.42 644.16 ########

4 7-Oct 56.96 $ 2,479.35 1,155.46 656.21 ########

5 14-Oct 58.72 $ 2,667.85 1,224.58 712.46 ########

6 21-Oct 62.88 $ 2,637.46 1,238.25 712.42 ########

7 28-Oct 65.60 $ 2,737.15 1,285.09 761.00 ########

8 4-Nov 64.34 $ 2,686.15 1,253.23 746.49 ########

9 11-Nov 63.99 $ 2,678.75 1,263.85 744.64 ########

10 18-Nov 63.61 $ 2,572.50 1,215.65 719.42 ########

4 1 2 3 5 6 7 8 9 10

Price on Price on Price on Price on Price on Price on Price on Price on Price on Price on Price on

7-Oct 9-Sep 16-Sep 23-Sep 30-Sep 14-Oct 21-Oct 28-Oct 4-Nov 11-Nov 18-Nov

BWLD 56.96 $ 59.70 $ 64.40 $ 59.34 $ 59.80 $ 58.72 $ 62.88 $ 65.60 $ 64.34 $ 63.99 $ 63.61 $

Begin End

% Change 9/9/11 11/18/11 Change

7.31% ^DJI 10,992.13 11,796.16 804.03

4.23% ^IXIC 2,467.99 2,572.50 104.51

5.32% ^GSPC 1,154.23 1,215.65 61.42

6.75% ^RUT 673.96 719.42 45.46

6.55% BWLD 59.70 $ 63.61 $ 3.91 $

DJIA NASDAQ S&P500

Russell

2000 Stock Stock Stock Stock Stock

Week Symbols ^DJI ^IXIC ^GSPC ^RUT DRI EAT RT CAKE BWLD

Start 9-Sep 10,992.13 2,467.99 1,154.23 673.96 43.37 $ 20.01 $ 7.28 $ 25.60 $ 59.70 $

1 16-Sep 11,509.09 2,622.31 1,216.01 714.31 45.61 $ 21.21 $ 7.92 $ 27.44 $ 64.40 $

2 23-Sep 10,771.48 2,483.23 1,136.43 652.43 46.06 $ 21.73 $ 7.02 $ 26.49 $ 59.34 $

3 30-Sep 10,913.38 2,415.40 1,131.42 644.16 42.75 $ 20.92 $ 7.16 $ 24.65 $ 59.80 $

4 7-Oct 11,103.12 2,479.35 1,155.46 656.21 44.12 $ 20.99 $ 7.16 $ 24.99 $ 56.96 $

5 14-Oct 11,644.49 2,667.85 1,224.58 712.46 46.66 $ 22.29 $ 7.71 $ 27.01 $ 58.72 $

6 21-Oct 11,808.79 2,637.46 1,238.25 712.42 47.17 $ 22.73 $ 7.88 $ 27.33 $ 62.88 $

7 28-Oct 12,231.11 2,737.15 1,285.09 761.00 48.50 $ 23.28 $ 8.52 $ 28.36 $ 65.60 $

8 4-Nov 11,983.24 2,686.15 1,253.23 746.49 47.36 $ 22.78 $ 7.85 $ 27.36 $ 64.34 $

9 11-Nov 12,153.68 2,678.75 1,263.85 744.64 47.41 $ 22.92 $ 7.47 $ 27.59 $ 63.99 $

10 18-Nov 11,796.16 2,572.50 1,215.65 719.42 46.47 $ 23.20 $ 7.15 $ 26.75 $ 63.61 $

1 2 3 4 5 6 7 8 9 10

Price on Price on Price on Price on Price on Price on Price on Price on Price on Price on Price on

9-Sep 16-Sep 23-Sep 30-Sep 7-Oct 14-Oct 21-Oct 28-Oct 4-Nov 11-Nov 18-Nov

DRI 43.37 $ 45.61 $ 46.06 $ 42.75 $ 44.12 $ 46.66 $ 47.17 $ 48.50 $ 47.36 $ 47.41 $ 46.47 $

EAT 20.01 $ 21.21 $ 21.73 $ 20.92 $ 20.99 $ 22.29 $ 22.73 $ 23.28 $ 22.78 $ 22.92 $ 23.20 $

RT 7.28 $ 7.92 $ 7.02 $ 7.16 $ 7.16 $ 7.71 $ 7.88 $ 8.52 $ 7.85 $ 7.47 $ 7.15 $

CAKE 25.60 $ 27.44 $ 26.49 $ 24.65 $ 24.99 $ 27.01 $ 27.33 $ 28.36 $ 27.36 $ 27.59 $ 26.75 $

BWLD 59.70 $ 64.40 $ 59.34 $ 59.80 $ 56.96 $ 58.72 $ 62.88 $ 65.60 $ 64.34 $ 63.99 $ 63.61 $

Begin End

9/9/11 11/18/11 Change % Change

^DJI 10,992.13 11,796.16 804.03 7.31%

^IXIC 2,467.99 2,572.50 104.51 4.23%

^GSPC 1,154.23 1,215.65 61.42 5.32%

^RUT 673.96 719.42 45.46 6.75%

DRI 43.37 $ 46.47 $ 3.10 $ 7.15%

EAT 20.01 $ 23.20 $ 3.19 $ 15.94%

RT 7.28 $ 7.15 $ (0.13) $ -1.79%

CAKE 25.60 $ 26.75 $ 1.15 $ 4.49%

BWLD 59.70 $ 63.61 $ 3.91 $ 6.55%

9-Sep

^DJI 10,992.13

^IXIC 2,467.99

^GSPC 1,154.23

^RUT 673.96

DRI 43.37 $

EAT 20.01 $

RT 7.28 $

CAKE 25.60 $

BWLD 59.70 $

9-Sep 16-Sep Change Change % Change Change %

^DJI 10,992.13 11,509.09 516.96 4.703% 516.96 4.703%

^IXIC 2,467.99 2,622.31 154.32 6.253% 154.32 6.253%

^GSPC 1,154.23 1,216.01 61.78 5.352% 61.78 5.352%

^RUT 673.96 714.31 40.35 5.987% 40.35 5.987%

DRI 43.37 $ 45.61 $ $2.24 5.165% $2.24 5.165%

EAT 20.01 $ 21.21 $ $1.20 5.997% $1.20 5.997%

RT 7.28 $ 7.92 $ $0.64 8.791% $0.64 8.791%

CAKE 25.60 $ 27.44 $ $1.84 7.188% $1.84 7.188%

BWLD 59.70 $ 64.40 $ $4.70 7.873% $4.70 7.873%

Fri-Consumer sentiment With improved views of the current economy, a gauge of consumer

sentiment rose in September after tumbling to a nearly-three-year low in August, according to

data released Friday University of Michigan/Thomson Reuters. The preliminary sentiment

reading for September increased to 57.8 from 55.7 in August. The August reading was the

lowest level since November 2008 with Washingtons protracted debt-ceiling negotiations

RT - The cheapest restaurants in America are luring activist investors who are betting

companies from Ruby Tuesday Inc. (RT) to Cracker Barrel Old Country Store Inc. (CBRL)

can make more money selling their own real estate than food. The 10 biggest U.S.

restaurants that sell for less than the value of their property, plants and equipment trade at

70 cents on the dollar, according to data compiled by Bloomberg.

CAKE - Lower guest counts and less spending will most likely hit mid-range restaurants like

The Cheesecake Factory Incorporated (Nasdaq:CAKE) and P.F. Chang's China Bistro

(Nasdaq:PFCB)especially hard. A recent consumer survey conducted by RBC Capital

Markets says that a third of Americans will tighten their belts when it comes to dining out over

the next 90 days.

Company Specific News

Worries about the European debt markets pushed U.S. Treasury bond yields lower and

that helped drive interest rates on fixed-rate mortgages to new record lows this week,

according to a weekly survey of conforming loan rates released Thursday by Freddie Mac.

The average rate on a 30-year fixed mortgage dropped to 4.09% in the week ending

Thursday the lowest in the 40 years Freddie Mac has tracked that figure down from

4.12% a week ago and from 4.37% a year ago. On a 15-year loan, the average rate dipped

The S&P 500 scored its best week since early July on signs euro zone leaders were acting

together to limit any damage from its sovereign debt crisis.The leaders took steps this week

to show they were tackling the debt crisis, which has plagued markets for weeks, including

coordinated central bank moves to give European banks greater access to funding in dollars.

A record number of people were in poverty last year as households saw their income

decrease, according to data from the Census Bureau Tuesday, demonstrating the weakness

of the economy even after the official end of the recession. The 46.2 million people in poverty

in 2010 was the most for the 52 years that estimates have been published, and the number

of people in poverty rose for the fourth consecutive year as the poverty rate climbed to 15.1%

EAT - Brinker International, Inc.s (NYSE: EAT - News) share price has entered into oversold

territory with a stochastic value of 13.094.

DRI- On Thursday, the first lady joined Darden Restaurants Inc. executives at one of their

Olive Garden restaurants in Hyattsville, Md., near Washington to announce that the

company's chains are pledging to cut calories and sodium in their meals by 20 percent over

a decade. Fruit or vegetable side dishes and low-fat milk will become standard with kids'

meals unless a substitution is requested. Mrs. Obama said Darden's announcement is a

EAT - Fast food restaurants are vastly outperforming higher priced restaurants. Since the

beginning of September, McDonald's and Wendy's are down just 4.3% and 1.2%,

respectively. That is vastly less than the 4% drop seen by Cracker Barrel Old Country Store,

Inc. (Nasdaq:CBRL), or the 8.3% decline for Chili's operator Brinker International, Inc.

(NYSE:EAT).

Weekly Since 1/14

Wed-Retail Sales Retail sales were steady in August, as consumers spent more on

essentials at gas stations and grocery stores, but less on cars, according to government data

released Wednesday. The Commerce Department said U.S. retail and food services sales in

August reached $389.5 billion, with the flat result the lowest growth since May. Excluding the

volatile auto segment, sales rose 0.1%. Economists surveyed by MarketWatch had expected

an increase of 0.3% for the overall number, as well as for the data excluding autos.

Thurs-Consumer price index Americans paid more money for a broad range of goods and

services last month, including gas, food, clothing and shelter, and the higher costs ate into

their inflation-adjusted income. The Labor Department on Thursday said consumer prices

rose a seasonally adjusted 0.4% in August. The increase was largely responsible for a 0.6%

drop in the average hourly wages of U.S. workers, adjusted for inflation. It marked the

Economic News

Analyst Recommendations

DRI - Darden Restaurants, Inc. (NYSE:DRI) could be about to retest its 52-week low

16-Sep 23-Sep Change Change % Change Change %

^DJI 11,509.09 10,771.48 (737.61) -6.409% (220.65) -2.007%

^IXIC 2,622.31 2,483.23 (139.08) -5.304% 15.24 0.618%

^GSPC 1,216.01 1,136.43 (79.58) -6.544% (17.80) -1.542%

^RUT 714.31 652.43 (61.88) -8.663% (21.53) -3.195%

DRI 45.61 $ 46.06 $ $0.45 0.987% $2.69 6.202%

EAT 21.21 $ 21.73 $ $0.52 2.452% $1.72 8.596%

RT 7.92 $ 7.02 $ ($0.90) -11.364% ($0.26) -3.571%

CAKE 27.44 $ 26.49 $ ($0.95) -3.462% $0.89 3.477%

BWLD 64.40 $ 59.34 $ ($5.06) -7.857% ($0.36) -0.603%

Federal Open Market Committee (FOMC) Meeting - Information received since the Federal

Open Market Committee met in August indicates that economic growth remains slow. Recent

indicators point to continuing weakness in overall labor market conditions, and the

unemployment rate remains elevated.

Company Specific News

DRI - Today at the Clinton Global Initiative's (CGI) Seventh Annual Meeting, Darden

Restaurants formally announced the company's three-year commitment to rebuilding troubled

fisheries through Fishery Improvement Projects (FIPs). Initial FIP work will be in and around the

Gulf of Mexico with partners Publix Super Markets and Sustainable Fisheries Partnership

DRI - Darden Restaurants, Inc. (NYSE:DRI - News) will be webcasting their 2011 Shareholder's

Meeting to be held in Orlando on Thursday, September 22, 2011

Gold prices continued to plunge Friday, despite the market turmoil that often drives investors to

the traditional safe haven. Gold tumbled $101.90, or 5.9%, in regular trading to $1,639.80 an

ounce. It's the second straight day of steep declines for the precious metal. According to the

Chicago Mercantile Exchange, Friday marked the first $100 daily price drop since Jan. 22,

1980, when gold plunged $143.50 to $682 the day after having spiked to a record high. Keith

Springer, president of Springer Financial Advisors, said that while gold has benefited from

economic uncertainty in recent months and years, it's primarily been a hedge against inflation.

But the growing worries about a global economic slowdown have raised new fears that there

DRI-Darden Restaurants Inc.said annual revenue will increase by as much as 53 percent by

fiscal 2016. Revenue will be between $10.5 billion and $11.5 billion in 2016, Chief Executive

Officer Clarence Otis said today during a webcast of the Orlando, Florida-based companys

annual meeting. In the next five years, Darden will increase profit by as much as $3.50 a share,

he said. Darden dropped 68 cents to $44.56 at 4:01 p.m. in New York Stock Exchange

composite trading. The shares have declined 4 percent this year, compared with a 10 percent

CAKE - The Cheesecake Factory Inc. which currently operates 168 restaurants, recently

announced the opening of a new unit in San Mateo, California. This is the fifth of the companys

targeted 7 new openings for fiscal 2011. The other restaurants have already opened in Texas,

New Jersey, Florida and Connecticut

Weekly Since 1/14

Thurs Initial Jobless Claims- Fewer out-of-work Americans filed new claims for unemployment

benefits last week, but applications remain at an elevated level that reflects the slow pace of

hiring in the U.S., government data showed Thursday. New requests for compensation in the

week ended Sept. 17 fell by 9,000 to a total of 423,000, the Labor Department said. Initial

claims from two weeks ago were revised up to 432,000 from an original reading of 428,000.

Thurs Leading Economic Indicators - The nations economy should exhibit continued weak

growth through the fall and winter, the Conference Board said Thursday as it reported that its

index of leading economic indicators expanded at a tepid pace in August.

The leading economic index grew 0.3% in August, compared with a 0.1% gain expected by

economists polled by MarketWatch. The gauge for July was revised to 0.6% from a prior

estimate of 0.5%. The LEI is a weighted gauge of 10 indicators that are designed to signal

business-cycle peaks and troughs. Among the 10 indicators that make up the LEI, four made

positive contributions in August, led by the real money supply, with other positive contributions

coming from the interest rate spread, building permits, and the index of supplier deliveries. The

largest negative contribution came from stock prices. Other negative contributions came from a

gauge of consumer expectations, average weekly manufacturing hours, average weekly claims

for unemployment-insurance benefits, manufacturers new orders for consumer goods and

The Federal Reserve announced "Operation Twist" Wednesday, a widely expected stimulus

move reviving a policy from the 1960s.The policy involves selling $400 billion in short-term

Treasuries in exchange for the same amount of longer-term bonds, starting in October and

ending in June 2012.

Economic News

Analyst Recommendations

23-Sep 30-Sep Change Change % Change Change %

^DJI 10,771.48 10,913.38 141.90 1.32% (78.75) -0.72%

^IXIC 2,483.23 2,415.40 (67.83) -2.73% (52.59) -2.13%

^GSPC 1,136.43 1,131.42 (5.01) -0.44% (22.81) -1.98%

^RUT 652.43 644.16 (8.27) -1.27% (29.80) -4.42%

DRI 46.06 $ 42.75 $ ($3.31) -7.19% (0.62) -1.43%

EAT 21.73 $ 20.92 $ ($0.81) -3.73% 0.91 4.55%

RT 7.02 $ 7.16 $ $0.14 1.99% (0.12) -1.65%

CAKE 26.49 $ 24.65 $ ($1.84) -6.95% (0.95) -3.71%

BWLD 59.34 $ 59.80 $ $0.46 0.78% 0.10 0.17%

http://www.marketwatch.com/story/sales-of-new-us-homes-dip-in-august-2011-09-26

http://www.marketwatch.com/story/consumer-confidence-ticks-higher-2011-09-27

http://www.marketwatch.com/story/second-quarter-gdp-revised-up-to-show-13-growth-2011-09-29

http://www.marketwatch.com/story/us-jobless-claims-sink-37000-to-391000-2011-09-29

http://money.cnn.com/2011/09/24/markets/geithner_debt/index.htm?iid=Popular

Company Specific News

Weekly Since 1/14

The U.S. economy expanded at a slightly faster pace than previously thought in the second

quarter of 2011, led by a pickup in consumer and construction spending, government data

showed Thursday. Gross domestic product rose at an annual rate of 1.3% in the second

quarter, the Commerce Department said.The rate of GDP growth was faster than the

governments prior reading of 1.0%. This is the third and final revision in the governments

estimate of second-quarter growth in goods and services. The government provides three

estimates of economic growth each reflecting more complete information than the previous

one. This consensus forecast belies the fact that many analysts are concerned the economy

could be losing steam. Economists continue to debate whether the economy might slip into a

double-dip recession.Even if an outright recession is avoided, the pace of growth isnt

expected to be fast enough to make a serious dent in the nations persistently high

unemployment rate.Late Wednesday, Fed chief Ben Bernanke called the weak labor market

a national crisis. The central bank last week launched a new plan to effectively twist the yield

The sale of new single-family homes fell in August for the fourth month in a row, indicating that

the depressed U.S. housing market shows no signs of recovery. Sales dropped 2.3% last

month to an annual rate of 295,000, the lowest level since February, the Commerce

Department said Monday. After peaking in 2011 at a paltry 316,000 in April, new-home sales

have retreated. The housing market is likely to remain in the dumps until hiring improves and

the U.S. grows faster, economists say.

As expectations slightly gained, consumer confidence ticked higher in September while

remaining at low levels, the Conference Board reported Tuesday. The nonprofit organization

said its consumer-confidence index rose to 45.4 in September from 45.2 in August, when it

had plunged on worries about jobs and the U.S. debt, among other factors. Generally when

the economy is growing at a good clip, confidence readings are at 90 and above. Consumer

spending is the backbone of the economy, and economists watch confidence readings to get

a feel for the direction of spending.

Economic News

U.S. Treasury Secretary Tim Geithner warned Saturday that the sovereign debt and banking

crisis in Europe represents "the most serious risk now confronting the world economy." In an

official statement to the International Monetary Fund, Geithner also discussed the need to both

support the U.S. economy in the short term and take steps to lower the nation's long-term

deficits. But his strongest comments were directed at Europe, where the specter of a default

by the Greek government has upset financial markets around the world. The nation's long-

standing debt problems are threatening to spill over into the European banking system, with

possible repercussions for the fragile U.S. economy.

The number of Americans who filed applications for unemployment benefits sank last week to

the lowest level since early spring, but the surprising drop may have stemmed from technical

issues not captured by normal seasonal adjustments.Jobless claims fell by 37,000 to 391,000

in the week ended Sept. 24, putting them at the lowest level since April 2, the Labor

Department reported Thursday. Initial claims from two weeks ago were revised up to 428,000

from an original reading of 423,000. Yet hiring is not expected to pick up anytime soon,

particularly given renewed fears of another recession and fresh worries about a financial crisis

in Europe. Economists say hiring would have to average 250,000 a month for several years to

pull the nations jobless rate back down to pre-recession levels. About 6.98 million people

received some kind of state or federal benefit in the week of Sept. 10, up 95,242 from the prior

week. Total claims are reported with a two-week lag.

The federal government offers extended compensation to millions of Americans whose state

benefits have already expired. Benefits in most states last six months.

http://www.marketwatch.com/story/sales-of-new-us-homes-dip-in-august-2011-09-26

http://www.marketwatch.com/story/consumer-confidence-ticks-higher-2011-09-27

http://www.marketwatch.com/story/second-quarter-gdp-revised-up-to-show-13-growth-2011-09-29

http://www.marketwatch.com/story/us-jobless-claims-sink-37000-to-391000-2011-09-29

http://money.cnn.com/2011/09/24/markets/geithner_debt/index.htm?iid=Popular

30-Sep 7-Oct Change Change % Change Change %

^DJI 10,913.38 11,103.12 189.74 1.74% 110.99 1.01%

^IXIC 2,415.40 2,479.35 63.95 2.65% 11.36 0.46%

^GSPC 1,131.42 1,155.46 24.04 2.12% 1.23 0.11%

^RUT 644.16 656.21 12.05 1.87% (17.75) -2.63%

DRI 42.75 $ 44.12 $ $1.37 3.20% 0.75 1.73%

EAT 20.92 $ 20.99 $ $0.07 0.33% 0.98 4.90%

RT 7.16 $ 7.16 $ $0.00 0.00% (0.12) -1.65%

CAKE 24.65 $ 24.99 $ $0.34 1.38% (0.61) -2.38%

BWLD 59.80 $ 56.96 $ ($2.84) -4.75% (2.74) -4.59%

Cramer likes Buffalo Wild Wings, as its story is intact, and it has good growth. As of

October 6, it has a P/E ratio of 24.3, and a forward P/E ratio of 18.2. Five-year annual EPS

growth forecast is 19.8%. Profit margin (6.5%) is below the industry average of 10.5%, while it

pays no dividend.

Analyst Recommendations

August jobs report: Hiring grinds to a halt

Economists typically estimate the nation needs to add about 150,000 jobs each month to keep

up with population growth alone. It needs even stronger growth to recover the 8.8 million jobs

lost during the financial crisis.Weak hiring in August was hardly a surprise. The month started

with Congress haggling about the debt ceiling, Standard & Poor's downgrading the United

States credit rating and the stock market zigzagging. The economy added no jobs in August,

the Labor Department said Friday. They also expect job growth to remain weak for the rest of

the year, with the economy adding an average of 110,000 jobs each month and the

unemployment rate barely ticking down to 8.9%.The White House said yesterday that it

predicts the unemployment rate will remain stubbornly high, not falling below 6% until 2017.

August wholesale inventories rise 0.4%

Inventories at U.S. wholesalers rose 0.4% in August, and were up 14.4% from the prior year,

the Commerce Department reported Friday. Sales of wholesalers rose 1% in August, while the

inventory-to-sales ratio was 1.16.

BJ's Treads Expansion Path

BJs is well positioned to sustain its growth momentum while generating improved earnings

spurred by operating efficiencies and innovative offerings. These also help the company to

drive traffic and post robust same-store sales growth. The company also boasts a debt-free

balance sheet and plans to enhance pricing to mitigate input cost pressure. Additionally, the

core Californian market, which had been badly hit during the housing downturn, has also

begun to turnaround. The gradual development of this market, which is one of the major

operational locations for the company, is an important tailwind for BJ. However, cost inflation

and stiff competition make us cautious.

Company Specific News

ISM reading picks up in September to 51.6%

WASHINGTON (MarketWatch) -- The Institute for Supply Management's manufacturing index

picked up a bit in September, rising to 51.6% from a 50.6% reading in August. Economists

polled by MarketWatch had anticipated an unchanged reading. Of key components, the new

orders reading stayed at 49.6%, production rose 2.6 points to 51.2% and employment rose 2

points to 53.8%

Weekly Since 1/14

WASHINGTON (MarketWatch) -- The Institute for Supply Management's manufacturing index

picked up a bit in September, rising to 51.6% from a 50.6% reading in August. Economists

polled by MarketWatch had anticipated an unchanged reading. Of key components, the new

orders reading stayed at 49.6%, production rose 2.6 points to 51.2% and employment rose 2

points to 53.8%.

Consumer credit drops for first time in 11 months

U.S. consumers shed debt for the first time in 11 months in August, the Federal Reserve

reported Friday. Consumers lowered their debt by a seasonally adjusted $9.5 billion, or at a

4.6% annual rate, in August. This is the biggest decline since April 2010. The decline was

unexpected. Wall Street economists had forecast an increase of about $8 billion in consumer

credit in August. Both categories of credit declined in the month. The non-revolving category

such as auto loans, personal loans, and student loans fell $7.2 billion or 5.2% in August.

Revolving credit, which tracks credit-card debt, fell $2.3 billion or 3.5% in the month.

Earnings on deck as Europe eyed

Investors tiring of the euro zone's debt crisis dragging the market all over the place are hoping

to focus on something else next week -- earnings.

The unofficial start of earnings season begins on Tuesday, when Dow component Alcoa Inc

(AA - News) reports third-quarter results after the close of trading. That level now sits around

1,178.

This week's sharp gains were built on improved hopes that European officials will get a handle

on the euro-zone debt crisis. That fed a massive bout of short-covering as those betting

against stocks were forced to buy shares to avoid losing money.

The benchmark S&P 500 index (^SPX - News; ^INX - News) rose 2.1 percent for the week,

buoyed by a 6 percent jump mid-week, as it appeared plans in the euro zone to get a grip on

the debt crisis were moving forward. The region remains a wild card, which could cause any

gains to quickly vanish.

Economic News

Is the Rally Real or Fake? Should You Chase Stocks?

Take a look at the chart below and you can't help but wonder if this bounce is doomed to fail

like the previous four September/October fake out rallies.

Since the August 9 lows, the S&P (SNP: ^GSPC), along with the Dow (DJI: ^DJI) and Nasdaq

(Nasdaq: ^IXIC), has staged four seemingly powerful rallies. Each time, the S&P gained about

100 points. Each time, the S&P erased all or nearly all the gains and ultimately fell to new

lows.

Just last week, stocks rallied on Monday and Tuesday (September 26 and 27). The media got

all giddy and after Monday's (Sep. 26) close, the Associated Press (AP) claimed that, 'Stocks

jump on hopes for a Europe fix.' On Tuesday (Sep. 27) Reuters reported that, 'Stocks pop on

Europe hope.'

The S&P tumbled 120 points from Reuter's hope-filled Tuesday headline to this week's lows.

Yesterday once again, the AP exclaimed that: 'Stocks rise on hopes for European banks.' Is

7-Oct 14-Oct Change Change % Change Change %

^DJI 11,103.12 11,644.49 541.37 4.88% $652.36 5.93%

^IXIC 2,479.35 2,667.85 188.50 7.60% $199.86 8.10%

^GSPC 1,155.46 1,224.58 69.12 5.98% $70.35 6.09%

^RUT 656.21 712.46 56.25 8.57% $38.50 5.71%

DRI 44.12 $ 46.66 $2.54 5.76% $3.29 7.59%

EAT 20.99 $ 22.29 $1.30 6.19% $2.28 11.39%

RT 7.16 $ 7.71 $0.55 7.68% $0.43 5.91%

CAKE 24.99 $ 27.01 $2.02 8.08% $1.41 5.51%

BWLD 56.96 $ 58.72 $1.76 3.09% ($0.98) -1.64%

While Darden reported revenue growth of over 7% this quarter. Darden reported 17% higher

food costs this quarter, and gross margin dropped two full points. While the company did a

laudable job of controlling corporate expenses, operating income fell about 8% and the

company saw a one-and-a-half point erosion in operating margin. The company is not exactly

in a position to shift away from seafood, steak or poultry and if the company gets too

aggressive on passing through prices, at least one among rivals like Brinker (NYSE:EAT),

DineEquity (NYSE:DIN), Ruby Tuesday (NYSE:RT). Likewise, there is not much that the

company can do to change the dining experience overnight. Customers may be somewhat

less price sensitive at Cheesecake Factory (Nasdaq:CAKE) but Darden is not going to change

its brand image fast enough to benefit.$1.7 billion in debt on the balance sheet today is more

than enough.

Darden has historically generated free cash flow margins around 1.5%, many sell-side

analysts are projecting forward margins in the 7% range. Now it's fair to assume that Darden

will see positive leverage from reduced capital expenditures. Even if the company can boost

free cash flow production to over 7% of sales, subtracting a large chunk of the debt from the

valuation renders the stock undervalued by less than 20%. So, less than 20% discount to fair

value on the basis of aggressive cash flow improvement in an environment of intense margin

pressure.

The Cheesecake Factory (CAKE) operates upscale, casual, and full-service dining restaurants

in the United States. There was strong put option activity, specifically in the Oct $23, $24, and

$25 strike prices. The stock shows some reasonable value at 17.6x P/E, .9x EV/S, and 7.7x

EV/EBITDA. This stock is a reasonable buy here right near its 52-week low.

Weekly Since 1/14

Initial jobless claims inch down to 404,000

Applications for unemployment benefits reflect little change in hiring

Slightly more than 400,000 people filed new applications last week for unemployment benefits,

keeping claims at a level typically associated with weak hiring trends, U.S. government data

showed Thursday.Initial jobless claims inched down by 1,000 last week to 404,000, the Labor

Department reported. Initial claims from two weeks ago were revised up to 405,000 from an

original reading of 401,000.

Consumers not motivated to spend more. Consumers kept a firm grip on their wallets in

August, threatening to stall further the already slowing economic recovery.

Retail sales were unchanged in August, less than the 0.2% increase that economists were

expecting, according to consensus estimates from Briefing.com.

Also, the boost in retail sales reported in July was revised to be slightly less than originally

reported. Retail sales in July were cut to up 0.3% from the 0.5% gain initially posted.

A small-business optimism index rose slightly in September, marking the first gain after six

months of declines. The National Federation of Independent Business small-business

optimism index rose 0.8 points to 88.9. Twenty-eight percent of small-business owners

reported that poor sales is still their top business problem -- as it has been the last three

years. The net percent of owners expecting better business conditions in six months was a

negative 22%, up 4 points from August, but 32 percentage points lower than January. The

gauge hasn't been above 100 since Oct. 2006

U.S. retail sales jump 1.1% in September

Biggest increase in seven months as auto purchases lead way.

Higher purchases of autos, clothing and furniture in September fueled the biggest

increase in U.S. retail sales in seven months, government data showed Friday. The

spring back in consumer spending is the latest evidence to suggest the U.S. economy

Economic News

October UMich consumer sentiment falls to 57.5

Company Specific News

Eddie Vs Restaurants Inc. and Wildfish Seafood has been sold to Darden Restaurants Inc.,

executives announced Wednesday.The deal is valued at $59 million and includes the

Scottsdale-based Eddie Vs Restaurants Inc. brands of Eddie Vs Prime Seafood and Wildfish

Seafood Grille restaurants.

The transaction includes eight Eddie Vs locations in Arizona, California and Texas; and three

Wildfish locations in Arizona, California and Texas. The Roaring Fork brands are not part of

the transaction.

The 10 Highest Potential Returns in Restaurant Stocks

Company| Dividend Return*| Earnings Growth Return Valuation Return

Implied Cumulative Annual ReturnRuby Tuesday 0% 7% 4% 11%

Brinker International 3% 8% 4% 15%

Darden Restaurants:4% 8% 4% 15%

EAT: McDonald's Ups Dividend by 15%Oak Brook, Illinois-based McDonald's Corp. (NYSE:

MCD - News) recently increased its quarterly dividend by 15% from 61 cents per share paid

previously. This equates to an annual pay out of $2.80 per share. The increased dividend will

be paid on December 15, 2011, to stockholders of record as of December 1, 2011.

Darden Restaurants, Inc. (DRI) operates a number of well known restaurants such as Red

Lobster and The Olive Garden. With the economy looking like it is entering a recession and

consumer confidence down, it seems that earnings and guidance could disappoint investors. I

would sell the recent rebound off the lows. However, Cramer gives this stock a buy rating. A

director bought 20,000 shares in the past couple of weeks:

Current share price: $46.68

The 52-week range is $40.69 to $53.81

Earnings estimates for 2011: $3.78 per share

Earnings estimates for 2012: $4.28 per share

Annual dividend: $1.72 per share, which yields 3.8%

14-Oct 21-Oct Change Change % Change Change %

^DJI 11,644.49 11,808.79 164.30 1.41% 816.66 7.43%

^IXIC 2,667.85 2,637.46 (30.39) -1.14% 169.47 6.87%

^GSPC 1,224.58 1,238.25 13.67 1.12% 84.02 7.28%

^RUT 712.46 712.42 (0.04) -0.01% 38.46 5.71%

DRI 46.66 $ 47.17 $0.51 1.09% 3.80 8.76%

EAT 22.29 $ 22.73 $0.44 1.97% 2.72 13.59%

RT 7.71 $ 7.88 $0.17 2.20% 0.60 8.24%

CAKE 27.01 $ 27.33 $0.32 1.18% 1.73 6.76%

BWLD 58.72 $ 62.88 $4.16 7.08% 3.18 5.33%

http://www.thestreet.com/_yahoo/story/11022867/1/citigroup-medassets-analysts-new-ratings.html?cm_ven=YAHOO&cm_cat=FREE&cm_ite=NA

Cheesecake Factory (CAKE) upgraded at Sterne Agee from Neutral to Buy, Sterne Agee said.

$36 price target.

Analyst Recommendations

Weekly Since 1/14

Inflation mellowed out a little bit at the Consumer level in September. The Consumer Price

Index (CPI) rose by 0.3% in September, down from a 0.4% increase in August, and from a

July increase of 0.5%. In June the CPI actually fell by 0.2%. The increase matched consensus

expectations. Year over year, it is up 3.9%.They rose 0.4% in September, down from a rise of

0.5% in August, and matching the July increase.

U.S. jobless claims fall slightly to 403,000 The number of Americans who filed new

applications for jobless benefits barely changed last week, government data showed

Thursday, indicating that a weak U.S. jobs market shows few signs of improvement.

U.S. housing starts jump 15%, hit 17-month high

Apartments lead September gain; single-family starts rise 1.7%

Economic News

U.S. leading indicators climb 0.2% in September. Although the index has risen five straight

months, the board also said the data shows weakening growth, with only five of the 10

indicators posting an increase.

Company Specific News

Form 8-K for CHEESECAKE FACTORY INC

In a press release dated October 21, 2011, The Cheesecake Factory Incorporated announced

Darden Restaurants Inc (DRI.N) said it will beef up promotions to lure diners to its Olive

Garden, Red Lobster and LongHorn Steakhouse restaurants, hoping to reverse a spending

pullback that hurt quarterly results. "Fewer appetizers, drinks and desserts were purchased,"

Chief Financial Officer Bradford Richmond said.

Cheesecake Factory Inc., which operates its namesake and Grand Lux Cafe restaurant

chains, said its fiscal third-quarter profit fell 6.3 percent as Hurricane Irene hurt business.

The results fell short of Wall Street's expectations and shares fell in after-hours trading

Wednesday.

http://www.thestreet.com/_yahoo/story/11022867/1/citigroup-medassets-analysts-new-ratings.html?cm_ven=YAHOO&cm_cat=FREE&cm_ite=NA

21-Oct 28-Oct Change Change % Change Change %

^DJI 11,808.79 12,231.11 422.32 3.58% 1,238.98 11.27%

^IXIC 2,637.46 2,737.15 99.69 3.78% 269.16 10.91%

^GSPC 1,238.25 1,285.09 46.84 3.78% 130.86 11.34%

^RUT 712.42 761.00 48.58 6.82% 87.04 12.91%

DRI 47.17 $ 48.50 $ $1.33 2.82% 5.13 11.83%

EAT 22.73 $ 23.28 $ $0.55 2.42% 3.27 16.34%

RT 7.88 $ 8.52 $0.64 8.12% 1.24 17.03%

CAKE 27.33 $ 28.36 $ $1.03 3.77% 2.76 10.78%

BWLD 62.88 $ 65.60 $ $2.72 4.33% 5.90 9.88%

Pending home sales slide 4.6% in September

The final sentiment reading for October reached 60.9, compared with a preliminary October

reading of 57.5, and a September level of 59.4. Despite the modest improvement, consumers

remain concerned about personal finances, and with widespread distrust of Washington,

D.C., politicians their gloom is likely to remain, according to Richard Curtin, chief economist

for the consumer survey.

Sales of new single-family U.S. homes rose by 5.7% in September as prices fell to the lowest

level in nearly a year, The Commerce Department said Wednesday.

Jobless claims fell yet again.

Company Specific News

Although business headlines still tout earnings numbers, many investors have moved past net

earnings as a measure of a company's economic output. That's because earnings are very

often less trustworthy than cash flow, since earnings are more open to manipulation based on

dubious judgment calls.

Compensation costs for civilian workers edged up a seasonally adjusted 0.3% in the third

quarter to take the year-on-year rate to 2%, the Labor Department said Friday. Wages and

salaries rose 0.3% while benefits rose 0.1%

Eat got 5 outta 5 stars but 4 overall.

Analyst Recommendations

Weekly Since 1/14

The Conference Board Consumer Confidence Index, which had slightly improved in

September, declined in October. The Index now stands at 39.8 (1985=100), down from 46.4 in

September. The Present Situation Index decreased to 26.3 from 33.3. The Expectations Index

declined to 48.7 from 55.1 last month. lowest since march of 2009.

Home prices in July climbed for the fourth month in a row, but are still down from a year ago.

According to the latest S&P/Case-Shiller home price index of 120 major cities, prices rose

0.9% in July compared with June, but they're still 4.1% lower than 12 months ago.

Lower demand for autos and aircraft triggered a decline in durable-good orders in September,

but bookings for a variety of other manufactured products rose in a sign the U.S. economy

continues to grow at a modest pace as it enters the fourth quarter.

Economic News

Economic growth remained very weak in the second quarter, but was slightly better than

previously thought, according to the government's final reading on U.S. economic health.

Gross domestic product, the broadest measure of the nation's economy, grew at a 1.3% rate

in the three months ending in June, the Commerce Department reported Thursday.

Consumers spend more, save less in September

PCE inflation gauge up 0.2% on the month, 2.9% annualized

28-Oct 4-Nov Change Change % Change Change %

^DJI 12,231.11 11,983.24 (247.87) -2.03% 991.11 9.02%

^IXIC 2,737.15 2,686.15 (51.00) -1.86% 218.16 8.84%

^GSPC 1,285.09 1,253.23 (31.86) -2.48% 99.00 8.58%

^RUT 761.00 746.49 (14.51) -1.91% 72.53 10.76%

DRI 48.50 $ 47.36 $ ($1.14) -2.35% 3.99 9.20%

EAT 23.28 $ 22.78 ($0.50) -2.15% 2.77 13.84%

RT 8.52 $ 7.85 $ ($0.67) -7.86% 0.57 7.83%

CAKE 28.36 $ 27.36 $ ($1.00) -3.53% 1.76 6.87%

BWLD 65.60 $ 64.34 $ ($1.26) -1.92% 4.64 7.77%

Analyst Recommendations

Weekly Since 1/14

The U.S. added 80,000 jobs in October and the unemployment rate edged down to 9.0% from

9.1%, the Labor Department reported Friday. Economists surveyed by MarketWatch had

forecast a 90,000 increase in employment and no change in the jobless rate. Although the

increase in employment fell short of Wall Street expectations, government revisions showed

sharply higher job growth in September and August. Hiring in September was revised up to

158,000 from 103,000 and job growth in August was revised up to 104,000 from 57,000. In

October, companies in the private sector hired 104,000 workers, but government cut 24,000

jobs to reduce the overall gain to 80,000, the Labor Department said. Hourly earnings rose

0.2% last month and the workweek was unchanged at 34.3 hours. The broader U6

unemployment rate fell to 16.2% from 16.5% in September.

Hiring was stronger than expected in September, a rare piece of good news amid growing

worries of a weakening U.S. economy.Employers added 103,000 jobs in the month, the Labor

Department reported Friday. And July and August were both revised higher, showing an

additional gain of 99,000 jobs over the summer.

The Institute for Supply Management said its manufacturing gauge dropped to 50.8% last

month, just slightly above a 2011 low, from 51.6% in September.

Economic News

U.S. productivity rises 3.1% in third quarter

Workers produce more, but wages, hours worked dont keep up

Company Specific News

4-Nov 11-Nov Change Change % Change Change %

^DJI 11,983.24 12,153.68 170.44 1.42% 1,161.55 10.57%

^IXIC 2,686.15 2,678.75 (7.40) -0.28% 210.76 8.54%

^GSPC 1,253.23 1,263.85 10.62 0.85% 109.62 9.50%

^RUT 746.49 744.64 (1.85) -0.25% 70.68 10.49%

DRI 47.36 $ 47.41 $ $0.05 0.11% 4.04 9.32%

EAT 22.78 $ 22.92 $ $0.14 0.61% 2.91 14.54%

RT 7.85 $ 7.47 $ ($0.38) -4.84% 0.19 2.61%

CAKE 27.36 $ 27.59 $ $0.23 0.84% 1.99 7.77%

BWLD 64.34 $ 63.99 $ ($0.35) -0.54% 4.29 7.19%

The company is a favorite pick of Ken Griffins Citadel Investment Group and Jim Simons

Renaissance Technologies. The company recently announced its third-quarter earnings: Total

revenue increased 30.7% to $197.8 million, net earnings increased 32.5% to $11.3 million

from $8.5 million, and earnings per diluted share increased 29.8% to $0.61 from $0.47.

Analyst Recommendations

Weekly Since 1/14

Fewer Americans filed for their first week of unemployment benefits last week, marking

continued -- but still slow -- improvement in the job market.

About 390,000 people filed for initial unemployment benefits in the week ended Nov. 5, the

Labor Department said Thursday. The number of claims fell 10,000 from the revised 400,000

in the prior week, and is now at the lowest level since April 2.

Economists are terrified about the chaos they expect if some countries decide to stop using

the euro. But one person thinks there may be a way to jump ship safely -- and he's got a

$400,000 bounty for anyone who can figure out how to do it.

Economic News

Last year, Black Friday sales totaled $11.8 billion, according to a report by research firm

IBISWorld. This year, sales are expected to increase by only 1.2% to just under $12 billion.

Company Specific News

Thanks to the generosity of guests and restaurant team members nationwide and in Puerto

Rico , Chili's Grill & Bar eighth annual Create-A-Pepper to Fight Childhood Cancer

campaign raised more than $5 million to help kids like Emma receiving lifesaving care at St.

Jude.

11-Nov 18-Nov Change Change % Change Change %

^DJI 12,153.68 11,796.16 (357.52) -2.94% 804.03 7.31%

^IXIC 2,678.75 2,572.50 (106.25) -3.97% 104.51 4.23%

^GSPC 1,263.85 1,215.65 (48.20) -3.81% 61.42 5.32%

^RUT 744.64 719.42 (25.22) -3.39% 45.46 6.75%

DRI 47.41 $ 46.47 $ ($0.94) -1.98% 3.10 7.15%

EAT 22.92 $ 23.20 $ $0.28 1.22% 3.19 15.94%

RT 7.47 $ 7.15 ($0.32) -4.28% (0.13) -1.79%

CAKE 27.59 $ 26.75 $ ($0.84) -3.04% 1.15 4.49%

BWLD 63.99 $ 63.61 ($0.38) -0.59% 3.91 6.55%

Weekly Since 1/14

CPI-Inflation took a bigger bite out of consumers' wallets over the last 12 months, with

September marking the biggest rise in three years.But at the same time, monthly price

increases are starting to slow.The Consumer Price Index, the government's key measure of

inflation at the retail level, jumped 3.9% in September from the year before. Higher food and

energy prices again were the biggest culprits, with food 4.7% more expensive than a year

earlier, and energy prices jumping 19.3%.

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food

services sales for October, adjusted for seasonal variation and holiday and trading-day

differences, but not for price changes, were $397.7 billion, an increase of 0.5 percent (0.5%)*

from the previous month and 7.2 percent (0.7%) above October 2010. Total sales for the

August through October 2011 period were up 7.6 percent (0.5%) from the same period a

year ago. The August to September 2011 percent change was unrevised from +1.1 percent

(0.3%).

Retail trade sales were up 0.6 percent (0.5%) from September 2011, and 7.3 percent

(0.7%) above last year. Gasoline stations sales were up 15.6 percent (1.7%) from October

2010 and nonstore retailers sales were up 11.1 percent (2.3%) from last year.Retail sales-

The number of Americans filing for their first week of unemployment benefits dipped for the

third straight week, breaking another seven-month low. About 388,000 people filed for initial

unemployment benefits in the week ended Nov. 12, the Labor Department said Thursday. It

marked the lowest level since April 2 and a drop from the revised 393,000 claims in the prior

week.

The output of the nations factories, mines and utilities rose 0.7% in October, the Federal

Reserve said Wednesday in another sign the manufacturing industry is still expanding.

Economic News

Social Security recipients should get a cost of living adjustment of about 3.5% to 3.7% starting

in January. The exact amount should be released Wednesday, when the government unveils

the inflation index upon which the COLA is based.

You might also like

- Loan ComparisonDocument15 pagesLoan ComparisonijkendrickNo ratings yet

- Recaudo Mensual 2018 - 2023 ConsorcioDocument7 pagesRecaudo Mensual 2018 - 2023 Consorcioangie.espinozaNo ratings yet

- Taller Calificable VPN-TIRDocument11 pagesTaller Calificable VPN-TIRMario MarinNo ratings yet

- Avid Cost of Venture Debt With Warrants and Net Interest TemplateDocument13 pagesAvid Cost of Venture Debt With Warrants and Net Interest TemplateSeemaNo ratings yet

- Balones Voleibol: España, Calle Cornejo #50 TEL 787 567 8909Document6 pagesBalones Voleibol: España, Calle Cornejo #50 TEL 787 567 8909AdrianNo ratings yet

- Simulacion Credito JFKDocument2 pagesSimulacion Credito JFKnicolas pardoNo ratings yet

- Npvtab 2Document5 pagesNpvtab 2mudassar saeedNo ratings yet

- Ya 2 RR LB 9 e 2 FWAXN2 Te LTRTD WDocument8 pagesYa 2 RR LB 9 e 2 FWAXN2 Te LTRTD WSaray MontillaNo ratings yet

- Fun OrsaDocument17 pagesFun OrsaMaria SanchezNo ratings yet

- Guidelines 2022Document6 pagesGuidelines 2022Ry SmithNo ratings yet

- SMDVDocument12 pagesSMDVAashna AhujaNo ratings yet

- Cooperativa 16 de Julio PrestamoDocument4 pagesCooperativa 16 de Julio PrestamoGeovanny GabrielNo ratings yet

- Budget Forecast Sheet Futura Restaurant and BarDocument4 pagesBudget Forecast Sheet Futura Restaurant and BarRaviNo ratings yet

- Island Homes Sold - 2024Document1 pageIsland Homes Sold - 2024Louis CutajarNo ratings yet

- Island Properties Sold - ComparisonDocument1 pageIsland Properties Sold - Comparisoncutty54No ratings yet

- Island Properties Sold - ComparisonDocument1 pageIsland Properties Sold - Comparisoncutty54No ratings yet

- Island Properties Sold - ComparisonDocument1 pageIsland Properties Sold - Comparisoncutty54No ratings yet

- Customizable Daily Growth Plan TemplateDocument8 pagesCustomizable Daily Growth Plan TemplateMwiro PeterNo ratings yet

- Cuent AsDocument2 pagesCuent AsBrian Adrian Saucedo GómezNo ratings yet

- ECCreamery Data For Students CSCMPDocument14 pagesECCreamery Data For Students CSCMPJhony Mejia CruzadoNo ratings yet

- Qwetu Analytical TestDocument16 pagesQwetu Analytical TestIndresh Singh SalujaNo ratings yet

- Casestudy1 Bizmetrics 101453172Document34 pagesCasestudy1 Bizmetrics 101453172rajvihari98No ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Properties Sold - ComparisonDocument1 pageIsland Properties Sold - Comparisoncutty54No ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Spring Lake Charts and Data For Q2 2011Document10 pagesSpring Lake Charts and Data For Q2 2011kellymulroyNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- OTB Forecast Model AnswerDocument3 pagesOTB Forecast Model Answervidyasagarmithirmala24No ratings yet

- Simple Loan Calculator: Loan Values Loan SummaryDocument11 pagesSimple Loan Calculator: Loan Values Loan Summaryaswath ventraNo ratings yet

- Article 20 Salary Scales 10-Month Teachers 2019-2020 (Effective July 1, 2019)Document10 pagesArticle 20 Salary Scales 10-Month Teachers 2019-2020 (Effective July 1, 2019)Robert MaglocciNo ratings yet

- Water Well Valuation ExampleDocument25 pagesWater Well Valuation ExamplePwint ShweNo ratings yet

- Practice Time Value of MoneyDocument7 pagesPractice Time Value of Moneymohamed00007No ratings yet

- Graphs & ChartsDocument8 pagesGraphs & ChartsToni Francesca MarquezNo ratings yet

- Taller - Amortización y Mat Financiera-Primer EvidenciaDocument39 pagesTaller - Amortización y Mat Financiera-Primer EvidenciaXimena Leguizamon MartinezNo ratings yet

- Sample Data Sets For Linear Regression1Document3 pagesSample Data Sets For Linear Regression1Ahmad Haikal0% (1)

- HR - Analytics - Dashboard - 2017Document11 pagesHR - Analytics - Dashboard - 2017Senol TunaNo ratings yet

- Detailed Guidelines 2023Document6 pagesDetailed Guidelines 2023Domingo DunkoNo ratings yet

- Bybot Projeto Primeiro Milhã - oDocument5 pagesBybot Projeto Primeiro Milhã - oAnimes ComNo ratings yet

- 100 Year Worldwide Financial PlanDocument163 pages100 Year Worldwide Financial PlanAbel YagoNo ratings yet

- Financial Freedom CalculatorDocument11 pagesFinancial Freedom CalculatorDue TorriNo ratings yet

- HR - Analytics - Dashboard - 2017Document10 pagesHR - Analytics - Dashboard - 2017fransiskus matondangNo ratings yet

- Island Homes Sold - 2022Document7 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document7 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Island Homes Sold - 2022Document4 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- Addressing ExerciseDocument5 pagesAddressing ExerciseKaranveer Singh GahuniaNo ratings yet

- Moha Daily GrowthDocument13 pagesMoha Daily GrowthMostNo ratings yet

- Excel Loan CalculatorDocument11 pagesExcel Loan CalculatorramcharanNo ratings yet

- Simple Loan Calculator: Loan Values Loan SummaryDocument11 pagesSimple Loan Calculator: Loan Values Loan SummaryramcharanNo ratings yet

- Tutorial Work BankingDocument12 pagesTutorial Work BankingJose Ortega CarrionNo ratings yet

- 2021 Percentage Poverty ToolDocument10 pages2021 Percentage Poverty Tooljoseph monteNo ratings yet

- Island Homes Sold - 2022Document7 pagesIsland Homes Sold - 2022Louis CutajarNo ratings yet

- JUROS SkinnnDocument2 pagesJUROS SkinnndurzackNo ratings yet

- AustinHomePricevs Salary 1994-2016 RevDocument4 pagesAustinHomePricevs Salary 1994-2016 RevAnonymous Pb39klJNo ratings yet

- Historical and Projected Income For The Comfort Inn Douglasville, GADocument3 pagesHistorical and Projected Income For The Comfort Inn Douglasville, GAsanthoshtm 76No ratings yet

- Yubaraj Finance PAEDocument10 pagesYubaraj Finance PAEYubraj ThapaNo ratings yet

- US National Debt 1929-2008Document6 pagesUS National Debt 1929-2008Rich100% (4)

- Actividad ExcelDocument17 pagesActividad ExcelMauricio RiveraNo ratings yet

- 187M BWP Budget Vs 192M Budget CFDocument53 pages187M BWP Budget Vs 192M Budget CFJoven CastilloNo ratings yet

- New Comp Model Rate SheetDocument2 pagesNew Comp Model Rate SheetVisual SyncNo ratings yet

- Historical Development of AccountingDocument25 pagesHistorical Development of AccountingstrifehartNo ratings yet

- Powerpoint Presentation: Calcium Sulphate in Cement ManufactureDocument7 pagesPowerpoint Presentation: Calcium Sulphate in Cement ManufactureDhruv PrajapatiNo ratings yet

- Test & Drain Valve Model 1000Document2 pagesTest & Drain Valve Model 1000saifahmed7No ratings yet

- G.R. No. 185449, November 12, 2014 Del Castillo Digest By: DOLARDocument2 pagesG.R. No. 185449, November 12, 2014 Del Castillo Digest By: DOLARTheodore DolarNo ratings yet

- The Art of Blues SolosDocument51 pagesThe Art of Blues SolosEnrique Maldonado100% (8)

- Lockbox Br100 v1.22Document36 pagesLockbox Br100 v1.22Manoj BhogaleNo ratings yet

- General Diesel Engine Diagnostic Guide PDFDocument3 pagesGeneral Diesel Engine Diagnostic Guide PDFan0th3r_0n3No ratings yet

- PCDocument4 pagesPCHrithik AryaNo ratings yet

- Internship ReportDocument46 pagesInternship ReportBilal Ahmad100% (1)

- Polytropic Process1Document4 pagesPolytropic Process1Manash SinghaNo ratings yet

- As 60068.5.2-2003 Environmental Testing - Guide To Drafting of Test Methods - Terms and DefinitionsDocument8 pagesAs 60068.5.2-2003 Environmental Testing - Guide To Drafting of Test Methods - Terms and DefinitionsSAI Global - APACNo ratings yet

- Uppsc Ae GSDocument18 pagesUppsc Ae GSFUN TUBENo ratings yet

- How Yaffs WorksDocument25 pagesHow Yaffs WorkseemkutayNo ratings yet

- BASUG School Fees For Indigene1Document3 pagesBASUG School Fees For Indigene1Ibrahim Aliyu GumelNo ratings yet

- Manufacturing StrategyDocument31 pagesManufacturing Strategyrajendra1pansare0% (1)

- DC Servo MotorDocument6 pagesDC Servo MotortaindiNo ratings yet

- Ts Us Global Products Accesories Supplies New Docs Accessories Supplies Catalog916cma - PDFDocument308 pagesTs Us Global Products Accesories Supplies New Docs Accessories Supplies Catalog916cma - PDFSRMPR CRMNo ratings yet

- Danby Dac5088m User ManualDocument12 pagesDanby Dac5088m User ManualElla MariaNo ratings yet

- JAZEL Resume-2-1-2-1-3-1Document2 pagesJAZEL Resume-2-1-2-1-3-1GirlieJoyGayoNo ratings yet

- IEC Blank ProformaDocument10 pagesIEC Blank ProformaVanshika JainNo ratings yet

- Dissertation On Indian Constitutional LawDocument6 pagesDissertation On Indian Constitutional LawCustomPaperWritingAnnArbor100% (1)

- L1 L2 Highway and Railroad EngineeringDocument7 pagesL1 L2 Highway and Railroad Engineeringeutikol69No ratings yet

- Epidemiologi DialipidemiaDocument5 pagesEpidemiologi DialipidemianurfitrizuhurhurNo ratings yet

- ST JohnDocument20 pagesST JohnNa PeaceNo ratings yet

- HandloomDocument4 pagesHandloomRahulNo ratings yet

- LOG-2-8-FLEETWAREHOUSE-TEMPLATE-Waybill-Delivery Note-IFRCDocument1 pageLOG-2-8-FLEETWAREHOUSE-TEMPLATE-Waybill-Delivery Note-IFRCMNo ratings yet

- Ishares Core S&P/TSX Capped Composite Index Etf: Key FactsDocument2 pagesIshares Core S&P/TSX Capped Composite Index Etf: Key FactsChrisNo ratings yet

- Basic of An Electrical Control PanelDocument16 pagesBasic of An Electrical Control PanelJim Erol Bancoro100% (2)

- TEVTA Fin Pay 1 107Document3 pagesTEVTA Fin Pay 1 107Abdul BasitNo ratings yet

- The Electricity Act - 2003Document84 pagesThe Electricity Act - 2003Anshul PandeyNo ratings yet

- Workin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherFrom EverandWorkin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherNo ratings yet

- When Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfFrom EverandWhen Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfRating: 5 out of 5 stars5/5 (36)

- Life at the Bottom: The Worldview That Makes the UnderclassFrom EverandLife at the Bottom: The Worldview That Makes the UnderclassRating: 5 out of 5 stars5/5 (30)

- Not a Crime to Be Poor: The Criminalization of Poverty in AmericaFrom EverandNot a Crime to Be Poor: The Criminalization of Poverty in AmericaRating: 4.5 out of 5 stars4.5/5 (37)

- High-Risers: Cabrini-Green and the Fate of American Public HousingFrom EverandHigh-Risers: Cabrini-Green and the Fate of American Public HousingNo ratings yet

- The Meth Lunches: Food and Longing in an American CityFrom EverandThe Meth Lunches: Food and Longing in an American CityRating: 5 out of 5 stars5/5 (5)

- Fucked at Birth: Recalibrating the American Dream for the 2020sFrom EverandFucked at Birth: Recalibrating the American Dream for the 2020sRating: 4 out of 5 stars4/5 (173)

- Hillbilly Elegy: A Memoir of a Family and Culture in CrisisFrom EverandHillbilly Elegy: A Memoir of a Family and Culture in CrisisRating: 4 out of 5 stars4/5 (4284)

- Nickel and Dimed: On (Not) Getting By in AmericaFrom EverandNickel and Dimed: On (Not) Getting By in AmericaRating: 3.5 out of 5 stars3.5/5 (197)

- The Great Displacement: Climate Change and the Next American MigrationFrom EverandThe Great Displacement: Climate Change and the Next American MigrationRating: 4.5 out of 5 stars4.5/5 (32)

- Heartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthFrom EverandHeartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthRating: 4 out of 5 stars4/5 (188)

- This Is Ohio: The Overdose Crisis and the Front Lines of a New AmericaFrom EverandThis Is Ohio: The Overdose Crisis and the Front Lines of a New AmericaRating: 4 out of 5 stars4/5 (37)

- Same Kind of Different As Me Movie Edition: A Modern-Day Slave, an International Art Dealer, and the Unlikely Woman Who Bound Them TogetherFrom EverandSame Kind of Different As Me Movie Edition: A Modern-Day Slave, an International Art Dealer, and the Unlikely Woman Who Bound Them TogetherRating: 4 out of 5 stars4/5 (686)

- Same Kind of Different As Me Movie Edition: A Modern-Day Slave, an International Art Dealer, and the Unlikely Woman Who Bound Them TogetherFrom EverandSame Kind of Different As Me Movie Edition: A Modern-Day Slave, an International Art Dealer, and the Unlikely Woman Who Bound Them TogetherRating: 4 out of 5 stars4/5 (645)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyFrom EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyRating: 4.5 out of 5 stars4.5/5 (263)

- How the Poor Can Save Capitalism: Rebuilding the Path to the Middle ClassFrom EverandHow the Poor Can Save Capitalism: Rebuilding the Path to the Middle ClassRating: 5 out of 5 stars5/5 (6)

- Fresh Fruit, Broken Bodies: Migrant Farmworkers in the United StatesFrom EverandFresh Fruit, Broken Bodies: Migrant Farmworkers in the United StatesRating: 4.5 out of 5 stars4.5/5 (18)

- A World of Three Zeroes: the new economics of zero poverty, zero unemployment, and zero carbon emissionsFrom EverandA World of Three Zeroes: the new economics of zero poverty, zero unemployment, and zero carbon emissionsRating: 4 out of 5 stars4/5 (16)

- Walking the Bowl: A True Story of Murder and Survival Among the Street Children of LusakaFrom EverandWalking the Bowl: A True Story of Murder and Survival Among the Street Children of LusakaRating: 4.5 out of 5 stars4.5/5 (2)

- Heartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthFrom EverandHeartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthRating: 4 out of 5 stars4/5 (269)

- Dark Days, Bright Nights: Surviving the Las Vegas Storm DrainsFrom EverandDark Days, Bright Nights: Surviving the Las Vegas Storm DrainsNo ratings yet

- Nickel and Dimed: On (Not) Getting By in AmericaFrom EverandNickel and Dimed: On (Not) Getting By in AmericaRating: 4 out of 5 stars4/5 (186)

- When Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfFrom EverandWhen Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfRating: 4 out of 5 stars4/5 (126)

- The Great Displacement: Climate Change and the Next American MigrationFrom EverandThe Great Displacement: Climate Change and the Next American MigrationRating: 4 out of 5 stars4/5 (21)