Professional Documents

Culture Documents

Pawn Agreement & Disclosure

Uploaded by

olboy92Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pawn Agreement & Disclosure

Uploaded by

olboy92Copyright:

Available Formats

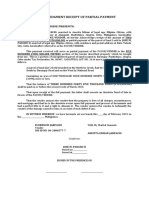

Pawn Agreement & Disclosure

Dated: ________________________________

Transaction number: ___________________

CUSTOMER: _____________________________

_______________________________________

_______________________________________

1. AMOUNT FINANCED (the amount of credit provided you or on your behalf):

$_____(______________ ______________ & _____/100 dollars)

2.

***FINANCE CHARGE*** (the dollar amount the credit will cost you):

$_____(______________________________ & ____/100 dollars)

3. ***ANNUAL PERCENTAGE RATE*** (the cost of your credit as a yearly rate) ______

%

4. Total amount of payments (the amount you will have paid when you have made all

scheduled payments): $____(_______________________________

& _____/100

dollars)

PAYMENT TERMS

This loan is payable in ___ payments each ______ of $_____(__________ & ____/100

dollars) each.

Security interest. This loan is secured by a pledge of personal property described as

follows:

____________________________________________________________.

The pledge will remain in the possession of pawnbroker until this loan is determined. In

the event the customer has not paid in full the Total of Payments indicated above within

__________ months, or this loan has not been renewed within such period of time as

provided for below, the pledge described herein may be forfeited and sold.

PREPAYMENT OF LOAN

Customer may prepay without penalty the unpaid balance of this loan. On prepayment in

full, customer will be entitled to a refund of the unearned FINANCE CHARGE under the

Rule of 78s.

THIS PAWN TICKET MUST ACCOMPANY ALL PAYMENTS. Notify pawnbroker at once

if this ticket is lost.

CUSTOMER HEREBY ACKNOWLEDGES

STATEMENT.

_______________________________

Customer

_______________________________

Pawn Broker

RECEIPT

OF

A COPY

OF

THIS

Pawn Agreement & Disclosure

Review List

This review list is provided to inform you about this document in question and assist you

in its preparation. A Pawn agreement has negative connotations for most people.

However, having said that, it provides ideal collateral for small loans should someone

want one. If you are the borrower, you should be willing to offer portable collateral of this

type; if you are the lender, this gives you ideal portable collateral to sell to liquidate

unpaid debt.

1. Make multiple copies.

transaction file.

_

Give one to each signatory.

Keep one with the

You might also like

- Amount Financed 2. Finance Charge 3. Monthly Rate 4. Total Amount of PaymentsDocument1 pageAmount Financed 2. Finance Charge 3. Monthly Rate 4. Total Amount of PaymentsGlass Eyes100% (1)

- Rental ReceiptDocument11 pagesRental ReceiptGladys Sibi LuceroNo ratings yet

- Contract To SellDocument5 pagesContract To SellMarkJoven LagramaNo ratings yet

- Affidavit of Refund of Money: Engineering Consultancy Services (ELC Builders For Brevity), Which Is Owned and Operated byDocument1 pageAffidavit of Refund of Money: Engineering Consultancy Services (ELC Builders For Brevity), Which Is Owned and Operated byJames PeregrinoNo ratings yet

- Acknowledgment Receipt of Partial PaymentDocument2 pagesAcknowledgment Receipt of Partial PaymentClint M. MaratasNo ratings yet

- Acknowledgement Receipt VENDEE PROTECTIONDocument1 pageAcknowledgement Receipt VENDEE PROTECTIONmirielle soncio25% (4)

- Affidavit of Loss-Diploma-abaricoDocument1 pageAffidavit of Loss-Diploma-abaricoAnonymous FJk4lkWNo ratings yet

- DEED OF ABSOLUTE SALE (Pag-Ibig Lot)Document2 pagesDEED OF ABSOLUTE SALE (Pag-Ibig Lot)Bong Roque100% (5)

- Cancellation of Deed of Absolute SaleDocument5 pagesCancellation of Deed of Absolute SaleNicolo Jay PajaritoNo ratings yet

- DEED OF CONDITIONAL SALE - EscrowDocument2 pagesDEED OF CONDITIONAL SALE - EscrowBernadette Luces Beldad100% (1)

- 2 Contract To Sell TemplateDocument3 pages2 Contract To Sell TemplateSamuel Kwon100% (1)

- Deed of Sale SampleDocument2 pagesDeed of Sale SampleCheenee VehementeNo ratings yet

- Special Power of Attorney (SPA, HQP-HLF-064, V02)Document2 pagesSpecial Power of Attorney (SPA, HQP-HLF-064, V02)Rpadc CauayanNo ratings yet

- Deed of Sale of Motor Vehicle With Assumption of Mortgage - UBANOS-CABALSE BlankDocument2 pagesDeed of Sale of Motor Vehicle With Assumption of Mortgage - UBANOS-CABALSE BlankRichard Barnuevo0% (1)

- Memorandum of Agreement VillamorDocument2 pagesMemorandum of Agreement Villamorjosef93% (14)

- Affidavit For LoanDocument1 pageAffidavit For LoanMiko Caralde Dela CruzNo ratings yet

- Buaya Ii 4103 Imus Cavite Philippines and An Active Subscriber of SMARTDocument1 pageBuaya Ii 4103 Imus Cavite Philippines and An Active Subscriber of SMARTAnneCanapiNo ratings yet

- Acknowledgement Receipt - FormatDocument1 pageAcknowledgement Receipt - FormatLancelot Dela Torre Jr.No ratings yet

- Conditional Deed of Sale of Motor VehicleDocument2 pagesConditional Deed of Sale of Motor VehicleStella Bertillo100% (1)

- Deed of Absolute Sale of A Parcel of LandDocument1 pageDeed of Absolute Sale of A Parcel of LandJohny VillanuevaNo ratings yet

- Deed of Sale - Sps Dela CruzDocument3 pagesDeed of Sale - Sps Dela CruzCristopher ReyesNo ratings yet

- Saint JohnDocument3 pagesSaint JohnWhendy Del Pilar Sales100% (1)

- Deed of Sale of Motor Vehicle With Assumption of MortgageDocument2 pagesDeed of Sale of Motor Vehicle With Assumption of MortgageMaan Galang100% (1)

- Affidavit of Loss OrcrDocument2 pagesAffidavit of Loss OrcrJ CNo ratings yet

- Property Caretakers AgreementDocument2 pagesProperty Caretakers AgreementAra Abulencia100% (3)

- DEED-OF-ABSOLUTE-SALE-OF-A-CAR (Car)Document1 pageDEED-OF-ABSOLUTE-SALE-OF-A-CAR (Car)Manny Sandicho100% (1)

- Affidavit DiscrepancyDocument6 pagesAffidavit DiscrepancyJames DecolongonNo ratings yet

- Memorandum of Agreement Moa Dela Cruz and Popular Purchase of Bulacan Lot With Estate Draft For EmailDocument5 pagesMemorandum of Agreement Moa Dela Cruz and Popular Purchase of Bulacan Lot With Estate Draft For EmailAgatha Angeles0% (1)

- Contract To SellDocument2 pagesContract To SellCharitoNo ratings yet

- "Paluwagan Agreement": No Back Out No Cancellation Unit - No To Delay/Slow Payor - No Pass Over UnitDocument2 pages"Paluwagan Agreement": No Back Out No Cancellation Unit - No To Delay/Slow Payor - No Pass Over UnitMarjun Milla Del Rosario100% (4)

- Affidavit of Warranty: Republic of The Philippines) S.S. City of Batangas)Document2 pagesAffidavit of Warranty: Republic of The Philippines) S.S. City of Batangas)Leandra Alethea Morales100% (3)

- Contract To Sell (Motor Vehicle)Document4 pagesContract To Sell (Motor Vehicle)Laurice Pocais0% (1)

- Contract To Sell - Copy2Document3 pagesContract To Sell - Copy2Daddy ni YanisTVeeNo ratings yet

- Authorization Letter For Claiming IDDocument8 pagesAuthorization Letter For Claiming IDstef fanieNo ratings yet

- Deed of Transfer of Rights With Assumption of ObligationDocument2 pagesDeed of Transfer of Rights With Assumption of Obligationreuben Olivo78% (9)

- Moa - Sanglaan NG LupaDocument2 pagesMoa - Sanglaan NG LupaVon Baysan100% (1)

- Vii. Deed of Sale of Large CattleDocument2 pagesVii. Deed of Sale of Large CattleClaudine Ann Manalo100% (1)

- Affidavit of AcknowledgmentDocument1 pageAffidavit of AcknowledgmentTet Legaspi100% (1)

- ACKNOWLEDGEMENT RECEIPT - Marie Dominique PerfectoDocument1 pageACKNOWLEDGEMENT RECEIPT - Marie Dominique PerfectoLizanne GauranaNo ratings yet

- Deed of Sale (Motor Vehicle) SampleDocument2 pagesDeed of Sale (Motor Vehicle) SampleRj Bengil75% (4)

- Joint Affidavit For FPADocument1 pageJoint Affidavit For FPAmutedchildNo ratings yet

- Deed of Absolute Sale of A Parcel of Land-Pag-ibigDocument2 pagesDeed of Absolute Sale of A Parcel of Land-Pag-ibigJohn Mark Paracad50% (2)

- Deed of SaleDocument2 pagesDeed of Salegerotorres100% (1)

- Parking Space Lease AgreementDocument3 pagesParking Space Lease AgreementRuby Ann Navor100% (1)

- Deed of Sale With Assumption of Mortgage - de Sta. CruzDocument3 pagesDeed of Sale With Assumption of Mortgage - de Sta. CruzCoy Resurreccion CamarseNo ratings yet

- Certificate of Full PaymentDocument2 pagesCertificate of Full PaymentCarmila Claudette Bagay100% (1)

- Affidavit of Car Incident Catherine Casim DulotDocument1 pageAffidavit of Car Incident Catherine Casim DulotJj Langit100% (1)

- Undertaking Garage and Letter of SupportDocument2 pagesUndertaking Garage and Letter of SupportJM CamalonNo ratings yet

- Affidavit For Special Travel LTFRB SampleDocument1 pageAffidavit For Special Travel LTFRB SampleCARLO C. VILLANUEVA JR.100% (1)

- Affidavit of Disinterested SSSDocument1 pageAffidavit of Disinterested SSSsayNo ratings yet

- Special Power of Attorney Pag Ibig Housing LoanDocument2 pagesSpecial Power of Attorney Pag Ibig Housing LoanRnel Manalo100% (1)

- Simple LoanDocument2 pagesSimple LoanMark Rye100% (2)

- House Rental AgreementDocument1 pageHouse Rental Agreementdescuatan654No ratings yet

- Acknowledgement ReceiptDocument1 pageAcknowledgement ReceiptAve Mantalaba Spain-Italia50% (2)

- Special Power of Attorney NSO FormatDocument1 pageSpecial Power of Attorney NSO FormatAntoniette Maria Lucero60% (5)

- Aff of Cancelation - DtiDocument1 pageAff of Cancelation - DtiCharisma BernabeNo ratings yet

- Agreement For Pawning A Farm Lot PropertyDocument1 pageAgreement For Pawning A Farm Lot PropertyMasian Dick83% (6)

- Ricoh Legal Contract 2008102111114Document1 pageRicoh Legal Contract 2008102111114percha538No ratings yet

- Agreement For Purchase & Sale of Real Estate (Subject To Transaction)Document1 pageAgreement For Purchase & Sale of Real Estate (Subject To Transaction)Kapil Karoliya100% (1)

- GCAAR Sales Contract (1301)Document7 pagesGCAAR Sales Contract (1301)Mark Lyon100% (1)

- Ratification of Unauthorized SignatureDocument2 pagesRatification of Unauthorized SignaturethriveinsuranceNo ratings yet

- Pledge of StockDocument2 pagesPledge of StockthriveinsuranceNo ratings yet

- Mortgage Commitment LetterDocument3 pagesMortgage Commitment Letterolboy92No ratings yet

- Pledge of Life InsuranceDocument2 pagesPledge of Life Insuranceolboy92No ratings yet

- Promissory Note Default NoticeDocument2 pagesPromissory Note Default NoticethriveinsuranceNo ratings yet

- Security Interest, Acknowledgment of ReleaseDocument2 pagesSecurity Interest, Acknowledgment of ReleasethriveinsuranceNo ratings yet

- New Payment Amount NoticeDocument2 pagesNew Payment Amount NoticethriveinsuranceNo ratings yet

- Mortgage Broker AgreementDocument2 pagesMortgage Broker Agreementolboy92No ratings yet

- Guarantor, Trying To Collect FromDocument2 pagesGuarantor, Trying To Collect Fromolboy92No ratings yet

- Guarantee, TerminationDocument3 pagesGuarantee, Terminationolboy92No ratings yet

- Letter of Credit AgreementDocument2 pagesLetter of Credit AgreementthriveinsuranceNo ratings yet

- Guarantor, Final Letter Trying To CollectDocument2 pagesGuarantor, Final Letter Trying To Collectolboy92No ratings yet

- Judgment AssignmentDocument2 pagesJudgment Assignmentolboy92No ratings yet

- Discharge of GuarantorDocument2 pagesDischarge of GuarantorBar2012No ratings yet

- Debit Your Account, One Time AuthorizationDocument2 pagesDebit Your Account, One Time Authorizationyurets929No ratings yet

- Estoppel LetterDocument2 pagesEstoppel LetterBar2012No ratings yet

- Demand For Additional CollateralDocument2 pagesDemand For Additional CollateralthriveinsuranceNo ratings yet

- Debtor, Partial Payment On AccountDocument2 pagesDebtor, Partial Payment On Accountolboy92No ratings yet

- Credit Denial NoticeDocument2 pagesCredit Denial NoticethriveinsuranceNo ratings yet

- Deposit, Forfeit Due To No DeliveryDocument2 pagesDeposit, Forfeit Due To No Deliveryolboy92No ratings yet

- Debtor Request For Certified Statement From Secured PartyDocument3 pagesDebtor Request For Certified Statement From Secured PartythriveinsuranceNo ratings yet

- Credit ReferenceDocument2 pagesCredit Referenceyurets929No ratings yet

- Debit Your Account, Repetitive AuthorizationDocument2 pagesDebit Your Account, Repetitive AuthorizationthriveinsuranceNo ratings yet

- Creditor, Objection To Debtor OffsetDocument2 pagesCreditor, Objection To Debtor Offsetyurets929No ratings yet

- Banking Resolution of CorporationDocument2 pagesBanking Resolution of Corporationalin99No ratings yet

- Bad Check Notice., Final NoticeDocument2 pagesBad Check Notice., Final NoticeGeorge EllsNo ratings yet

- Collection Agency AgreementDocument2 pagesCollection Agency AgreementthriveinsuranceNo ratings yet

- Collateral Assignment of LeaseDocument3 pagesCollateral Assignment of Leaseyurets929No ratings yet

- Bad Check Notice., First NoticeDocument2 pagesBad Check Notice., First Noticeyurets929No ratings yet