Professional Documents

Culture Documents

17

Uploaded by

Serene Nicole VillenaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

17

Uploaded by

Serene Nicole VillenaCopyright:

Available Formats

17-1

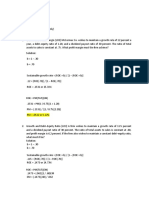

Carter corporations sales are expected to increase from $5 million in 2004 to $6 million in 2005 , or by 20 percent. Its assets totaled $3 million

at the end of 2004. Carter is at full capacity<so its assets must grow at same rate as pro-

Rejected sales. At the end of 2004, current liabilities were $1 million, consisting of $250.000 of accounts payable, $500.000of notes payable,

and $250.000 of accruals. The after-tax profit margin is forecasted to be 5 percent.

(17-1) Use the AFN formula to forecast Carter's additional funds needed for the coming year.

17-1 AFN = (A

*

/S0)S - (L

*

/S0)S - MS1(1 - d)

=

000 , 000 , 5 $

000 , 000 , 3 $

$1,000,000 -

000 , 000 , 5 $

000 , 500 $

$1,000,000 - 0.05($6,000,000)(1 - 0.7)

= (0.6)($1,000,000) - (0.1)($1,000,000) - ($300,000)(0.3)

= $600,000 - $100,000 - $90,000

= $410,000.

(17-2) What would be the additional funds needed if the company's year-end 2004 assets had been $4 million ? Assume that all other numbers

are the same . Why is this AFN different from the one you found in problem 14-1? Is the company's " capital intensity " the same or different?

17-2 AFN =

000 , 000 , 5 $

000 , 000 , 4 $

$1,000,000 (0.1)($1,000,000) ($300,000)(0.3)

= (0.8)($1,000,000) - $100,000 - $90,000

= $800,000 - $190,000

= $610,000.

(17-3) return to the assumption that the company had $3 million in assets at the end of 2004, but now assume that the company pays no

dividend. Under these assumption. What would be additional funds needed for the coming year? Why is this AFN different from the one you

found in problem 14-1?

17-3 AFN = (0.6)($1,000,000) - (0.1)($1,000,000) - 0.05($6,000,000)(1 - 0)

= $600,000 - $100,000 - $300,000

= $200,000.

Under this scenario the company would have a higher level of retained earnings which would reduce the amount of additional

funds needed.

17-4

PRO FORMA INCOME STATEMENT: Austin Grocers recently reported the following 2008 income statement (in

millions of dollars):

Sales $700

Operate ring cost including depreciation 500

EBIT 200

Interest 40

EBT $160

Taxes (40%) 64

Net Income $ 96

Dividends 32

Additional to retained earning $ 64

This year the company is forecasting a 25% increase in sales; and it expects that its year-end operating cost,

including depreciation, will equal 70% of sales. Austins tax rate, interest expense, and dividend payout ratio are all

expected to remain constant.

a. What is Austins projected 2009 net income?

b. What is the expected growth rate in Austins dividends?

a.

(Calculations in millions of dollar)

Net income 2009 = Sales - operating cost - interest espenses - taxes

EBIT = $875 (120% of $700) - $612.50 - $40 = $222.50

Net income = $222.50 - $89 (40% tax) = $133.5

b.

Since dividend payout ratio is same 33.33% ($32 / $96 in the year 2008), current year dividend is $44.49

(33.3333% of $133.5).

Hence growth in dividend = ($44.49 - $32) / $32 = 39.02%

17-5

Walter industries has $5 billion in sales and $1.7 billion in fixed assets. Currently, the company's fixed assets are

operating at 90% of capacity.

a) What level of sales would Walter Industries have obtained if it had been operating at full capacity?

b) What is Walter's Target fixed assets/Sales ratio?

c) If Walter's sales increase 12%, how large of an increase in fixed assets will the company need to meet its Target

fixed assets/sales ratio?

a) x(0.90) = $5 billion, where x equal sales if operating at full capacity

Divide $5 billion by 0.90 to obtain the answer = $5,555,555,555.56

b) Fixed assets/Sales = $1.7/5.0 = 0.34

c) Sales increase by 12% = $5.0 billion (1.12) = $5.6 billion

x/5.6 = 0.34

Solve for x = 0.34*5.6 = $1.904B

The question, however, asks for how large of an increase you will need in fixed assets. Currently you have $1.7

billion, so find the difference

$1.904 - $1.7 = $0.204B, or $204M increase in fixed assets

17-6

Jasper Furnishings has $300 million in sales. The companyexpects that its sales will increase 12 percent this year.Jaspers CFO

uses a simple linear regression to forecast thecompanys inventory level for a given level of projectedsales. On the basis of recent

history, the estimated relationshipbetween inventories and sales (in millions of dollars) is

Inventories = $25 +0.125 (Sales)

Given the estimated sales forecast and the estimatedrelationship between inventories and sales, what are your forecastsof the

companys year-end inventory level and the inventoryturnover ratio?

17-7

Pro forma income statement - At the end of last year, Roberts Inc. reported the following income statement (in

millions of dollars):

Sales $3,000

Operating costs excluding depreciation 2,450

EBITDA $550

Depreciation $250

EBIT $300

Interest $125

EBT $175

Taxes (40%) $70

Net income $105

Looking ahead to the following year, the company's CFO has assembled the following information:

Year-end sales are expected to be 10 percent higher than the $3 billion in sales generated last year.

Year-end operating costs, excluding depreciation, are expected to equal 80 percent of year-end sales.

Depreciation is expected to increase at the same rate as sales.

Interest costs are expected to remain unchanged.

The tax rate is expected to remain at 40 percent.

On the basis of this information, what will be the forecast for Robert's year-end net income?

Pro-forma income statement (forecast)

PRO FORMA INCOME STATEMENT

In million

Sales

3,300

Operating Cost

2,640

EBITDA

660

Depreciation

275

EBIT

385

Interest Cost

125

EBT

260

Taxes

104

Net Income

156

Sales $3,300 (3000 x 110%)

Operating costs excluding depreciation 2,640 (3300 x 80%)

EBITDA $660

Depreciation $275 (250 x 110%)

EBIT $385

Interest $125

EBT $260

Taxes (40%) $104

Net income $156

17-10: Regression and receivables: Edwards Industries has $320 million in sales. The

company expects that its sales will increase 12% this year. Edwards CFO uses a simple

linear regression to forecast the company s recievables level for a given level of

projected sales. On the basis of recent history, the estimated relationship between

receivables and sales (in millions of dollars) is as follows:

receivables=$9.25+0.07(sales) Given the estimated sales forecast and the estimated

relationship between receivables and sales, what are your forecasts of the companys

year end balance for receivables and it year end days sales outstanding (DSO) ratio?

Assume that DSO is calculated on the basis of a 365 day year. Please make both

problems original and in excel if possible.

YEAR END BALANCE OF RECEIVABLE

Sales = 320 X 1.12

336

Receivables =

$9.25+0.07(sales) 32.77

YEAR END DAYS SALES OUTSTANDING

DSO = 365 / Sales /

Receivable 36

17-11

Charlies Cycles Inc. has $110 million in sales. The company expects that its sales will increase 5% this year. Charlies CFO uses a

simple linear regression to forecast the companys inventory level for a given level of projected sales. On the basis of recent history,

the estimated relationship between inventories and sales (in millions of dollars) is as follows:

Inventories = $9 $ 0.0875(Sales)

Given the estimated sales forecast and the estimated relationship between inventories and sales, what are your forecasts of the

companys year-end inventory level and its inventory turnover ratio?

You might also like

- Assignment 2Document14 pagesAssignment 2Bryent GawNo ratings yet

- Final Future Union - The Rubicon Report - Conflict Capital (Full Report)Document100 pagesFinal Future Union - The Rubicon Report - Conflict Capital (Full Report)New York Post100% (2)

- Find Your Happy Daily Mantras ExcerptDocument47 pagesFind Your Happy Daily Mantras ExcerptDamla Nihan Yildiz100% (2)

- Finc5000 HWDocument4 pagesFinc5000 HWjessicasellers9528100% (2)

- 3-14 Free Cash Flow: Bailey Corporation's Financial Statements (Dollars and Shares Are in Millions) Are ProvidedDocument8 pages3-14 Free Cash Flow: Bailey Corporation's Financial Statements (Dollars and Shares Are in Millions) Are ProvidedCASTOR, Vincent Paul0% (1)

- FIN5FMA Tutorial 9 SolutionsDocument4 pagesFIN5FMA Tutorial 9 Solutionsmitul tamakuwalaNo ratings yet

- FIN 301 B Porter Rachna CH 11-1 Soln.Document1 pageFIN 301 B Porter Rachna CH 11-1 Soln.Nam TranNo ratings yet

- Bonus Assignment 2Document4 pagesBonus Assignment 2Zain Zulfiqar67% (3)

- POF Assignment 2Document6 pagesPOF Assignment 2Kai Shuen33% (3)

- Petron-Corporation SwotDocument25 pagesPetron-Corporation SwotAhnJello100% (3)

- Answer and Solution Chapter 9Document5 pagesAnswer and Solution Chapter 9Nur Rofiqoh Arini50% (2)

- FI515 Homework3Document4 pagesFI515 Homework3Afifuddin SuhaeliNo ratings yet

- M3 Activity 1Document6 pagesM3 Activity 1Ruffa May GonzalesNo ratings yet

- Fin Man HW1Document3 pagesFin Man HW1Carl Dhaniel Garcia SalenNo ratings yet

- Ch09 - Cost of Capital 12112020 125813pmDocument13 pagesCh09 - Cost of Capital 12112020 125813pmMuhammad Umar BashirNo ratings yet

- ANSWER: 4.375% or 4.38%: Stock Expected Return Standard Deviation BetaDocument2 pagesANSWER: 4.375% or 4.38%: Stock Expected Return Standard Deviation BetaMicon100% (2)

- Garlington Technologies IncDocument2 pagesGarlington Technologies IncRamarayo MotorNo ratings yet

- Chap 003Document12 pagesChap 003charlie simoNo ratings yet

- Case 2a - Flirting With Risk - SolutionDocument5 pagesCase 2a - Flirting With Risk - SolutionMahesh Satapathy67% (3)

- Capital Structure & Leverage - ExercisesDocument11 pagesCapital Structure & Leverage - ExercisesDrehfcie100% (1)

- AssignmentDocument3 pagesAssignmentFrancis Abuyuan100% (1)

- Financial Management Chapter 11 AnswerDocument14 pagesFinancial Management Chapter 11 Answerandrik_2091% (11)

- ExerciseDocument3 pagesExerciseHoang AnNo ratings yet

- Profile On Dairy Processing EquipmentDocument20 pagesProfile On Dairy Processing Equipmentbiniam meazaneh100% (1)

- CourseheroDocument2 pagesCourseheroSharjaaah50% (2)

- FINANCIAL MANAGEMENT AssignmentDocument2 pagesFINANCIAL MANAGEMENT Assignmentfinn mertensNo ratings yet

- Chapter 3 - Analysis of Financial Statements: True/FalseDocument37 pagesChapter 3 - Analysis of Financial Statements: True/FalseAnthony Tunying MantuhacNo ratings yet

- AC517Document11 pagesAC517Inaia ScottNo ratings yet

- Bonus Assignment 1Document4 pagesBonus Assignment 1Zain Zulfiqar100% (2)

- Ch18-11 Worksheet Syed Qamar Osama Raheel Shahrukh MughalDocument2 pagesCh18-11 Worksheet Syed Qamar Osama Raheel Shahrukh MughalSyed Qamar100% (2)

- Look Before You Leverage!Document2 pagesLook Before You Leverage!cws0829444367% (3)

- Quiz 5 Chapter 15: Working Capital and Current Asset Management Quiz InstructionsDocument6 pagesQuiz 5 Chapter 15: Working Capital and Current Asset Management Quiz InstructionsKyle EspinozaNo ratings yet

- Problem Set Capital StructureQADocument15 pagesProblem Set Capital StructureQAIng Hong100% (1)

- 3-9 FINANCIAL STATEMENTS The Davidson CorporationDocument3 pages3-9 FINANCIAL STATEMENTS The Davidson Corporationlai vivianNo ratings yet

- Mini CaseDocument5 pagesMini Caseanon_468658595100% (2)

- Chapter 12 SolutionsDocument10 pagesChapter 12 Solutionshassan.murad100% (2)

- Financial Management Gitman Chapter 15Document3 pagesFinancial Management Gitman Chapter 15Samuel Zefanya50% (2)

- Stock 1Document5 pagesStock 1IrinaHaqueNo ratings yet

- AMA Marketing Management Body of KnowledgeDocument19 pagesAMA Marketing Management Body of KnowledgeSerene Nicole VillenaNo ratings yet

- Chapter 22 Problem #1Document6 pagesChapter 22 Problem #1Lê Đặng Minh Thảo100% (1)

- Assignment 3 SolutionDocument7 pagesAssignment 3 SolutionAaryaAustNo ratings yet

- 14Document9 pages14Rudine Pak MulNo ratings yet

- Accounting and Finance Tugas Kelompok #3 Chapter 6 Financial Planning and ForecastingDocument10 pagesAccounting and Finance Tugas Kelompok #3 Chapter 6 Financial Planning and Forecastingbudiman100% (1)

- Assignement No 3Document2 pagesAssignement No 3Elina aliNo ratings yet

- Mississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisDocument1 pageMississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisRajib DahalNo ratings yet

- Chapter 5 FinmanDocument4 pagesChapter 5 FinmanGen LibertadNo ratings yet

- Long QuestionsDocument18 pagesLong Questionssaqlainra50% (2)

- Module - 3act2 - Financial ManagementDocument21 pagesModule - 3act2 - Financial ManagementAngelene Buenafe100% (1)

- Exercise Stock ValuationDocument2 pagesExercise Stock ValuationUmair ShekhaniNo ratings yet

- Ventura, Mary Mickaella R Chapter4 - p.112-118Document8 pagesVentura, Mary Mickaella R Chapter4 - p.112-118Mary VenturaNo ratings yet

- 22Document5 pages22Ashish Bhalla100% (1)

- Case No. 3 - Do You Want Pickled Beets With ThatDocument2 pagesCase No. 3 - Do You Want Pickled Beets With ThatNeil Dela Cruz Ammen0% (1)

- Chapter 8Document10 pagesChapter 8Vip BigbangNo ratings yet

- Case Study No 3. Fin MGTDocument1 pageCase Study No 3. Fin MGTJoynen Baldevarona100% (1)

- Chapter 13. Solution To End-Of-Chapter Spreadsheet ProblemDocument4 pagesChapter 13. Solution To End-Of-Chapter Spreadsheet ProblemPrem Kumar G67% (3)

- Lockbox SystemDocument7 pagesLockbox SystemYosua ManurungNo ratings yet

- BF2 AssignmentDocument3 pagesBF2 AssignmentIbaad KhanNo ratings yet

- DT 2Document8 pagesDT 2Janesene SolNo ratings yet

- Kelompok Ii Tugas Kelompok Manajemen Keuangan Lanjutan No. P9-4Document9 pagesKelompok Ii Tugas Kelompok Manajemen Keuangan Lanjutan No. P9-4RoyNo ratings yet

- Mantuhac, Anthony BSA-3Document3 pagesMantuhac, Anthony BSA-3Anthony Tunying MantuhacNo ratings yet

- 3 - Analysis of Financial Statements 2Document2 pages3 - Analysis of Financial Statements 2Axce1996No ratings yet

- BUS 635 Quiz3 Sum15 AnswersDocument5 pagesBUS 635 Quiz3 Sum15 AnswershnoamanNo ratings yet

- Financial Planning and Forecasting From Brigham & EhrhardtDocument52 pagesFinancial Planning and Forecasting From Brigham & EhrhardtAsif KhanNo ratings yet

- FS Analysis ExercisesDocument9 pagesFS Analysis ExercisesLizzy MondiaNo ratings yet

- Financial Planning and ForecastingDocument24 pagesFinancial Planning and ForecastingMikee Ballesteros ManzanoNo ratings yet

- Google Analytics Performance ReportDocument11 pagesGoogle Analytics Performance ReportSerene Nicole VillenaNo ratings yet

- Miguel Under The Marketing Department As An Assistant Brand Manager. I Am A GraduateDocument1 pageMiguel Under The Marketing Department As An Assistant Brand Manager. I Am A GraduateSerene Nicole VillenaNo ratings yet

- Japan Trip: 2,000 Pesos 2,824 Pesos (7,200 Yen) 118 Pesos (300 Yen)Document4 pagesJapan Trip: 2,000 Pesos 2,824 Pesos (7,200 Yen) 118 Pesos (300 Yen)Serene Nicole VillenaNo ratings yet

- Special CorporationsDocument1 pageSpecial CorporationsSerene Nicole Villena50% (2)

- SampleDocument1 pageSampleSerene Nicole VillenaNo ratings yet

- File 1Document1 pageFile 1Serene Nicole VillenaNo ratings yet

- Moving Average1Document3 pagesMoving Average1Serene Nicole VillenaNo ratings yet

- 2Document1 page2Serene Nicole VillenaNo ratings yet

- Agreements On Implementation of Article VI of The GeneralDocument19 pagesAgreements On Implementation of Article VI of The GeneralDewi agustin hasanahNo ratings yet

- Summer ProjectDocument21 pagesSummer ProjectDipesh PrajapatiNo ratings yet

- PACEDocument3 pagesPACEKimNo ratings yet

- Cfas Chapter 10Document16 pagesCfas Chapter 10Str PNo ratings yet

- Nike - See2Sea Poster - 2Document1 pageNike - See2Sea Poster - 2Aditi KumarNo ratings yet

- Maunda - Entrepreneurial Mind PrelimexamDocument2 pagesMaunda - Entrepreneurial Mind PrelimexamArafat MaundaNo ratings yet

- Making Olive Oil Competitive Through The Introduction of Local Value Chain Approach in OptDocument3 pagesMaking Olive Oil Competitive Through The Introduction of Local Value Chain Approach in OptSadeq NeiroukhNo ratings yet

- CIBSE Winners Brochure 2016 Lowres Final2Document23 pagesCIBSE Winners Brochure 2016 Lowres Final2lotszNo ratings yet

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- H2 English Maharashtra WZ PDFDocument108 pagesH2 English Maharashtra WZ PDFShashank ChoudharyNo ratings yet

- Ibt Midterm Reviewer QaDocument3 pagesIbt Midterm Reviewer QaMisshtaCNo ratings yet

- Initial Public Offering Investment: The General Investors' PerspectiveDocument12 pagesInitial Public Offering Investment: The General Investors' PerspectiveBickramNo ratings yet

- Customs BrochuresDocument21 pagesCustoms BrochuresDriss BenchekrounNo ratings yet

- Pricing Strategies CHAPTER 8Document12 pagesPricing Strategies CHAPTER 8Lbym LaudeNo ratings yet

- Axis Top Picks - Apr 2024 - Final - 01-04-2024 - 16Document82 pagesAxis Top Picks - Apr 2024 - Final - 01-04-2024 - 16RASHMIN GADHIYANo ratings yet

- Innovation: The Case of Samsung ElectronicsDocument13 pagesInnovation: The Case of Samsung ElectronicsYana AvramovaNo ratings yet

- Week 8 Lecture FINS3623Document59 pagesWeek 8 Lecture FINS3623826012442qq.comNo ratings yet

- Bank Guarantee For Tender SecurityDocument2 pagesBank Guarantee For Tender SecurityMSEB JVNo ratings yet

- Accounting Part 2 Test No 01Document1 pageAccounting Part 2 Test No 01Ayman ChishtyNo ratings yet

- Wise Transaction Invoice Transfer 751293515 1421066003 Fr-1Document2 pagesWise Transaction Invoice Transfer 751293515 1421066003 Fr-1Larbi doukara OussamaNo ratings yet

- ICICI SmartKid Brochure FinalDocument23 pagesICICI SmartKid Brochure FinalNiharika AnandNo ratings yet

- Analysing Cost in Search of Profit - Unit 1Document8 pagesAnalysing Cost in Search of Profit - Unit 1Vismaya SNo ratings yet

- Rachel Egondu Bus6100 Final ProjectDocument14 pagesRachel Egondu Bus6100 Final ProjectTRINITY GEMSNo ratings yet

- Chapter 1 QuizDocument9 pagesChapter 1 QuizRyan SalipsipNo ratings yet

- RM Group 7Document5 pagesRM Group 7Ravi KamaniNo ratings yet

- PhucLong SWOTDocument11 pagesPhucLong SWOTHieu LeNo ratings yet

- Bonds PayableDocument7 pagesBonds PayableCarl Yry BitengNo ratings yet