Professional Documents

Culture Documents

Ratio Analysis Formula

Uploaded by

Rajipah Osman0 ratings0% found this document useful (0 votes)

22 views2 pagesratio

Original Title

17217074 Ratio Analysis Formula

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentratio

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views2 pagesRatio Analysis Formula

Uploaded by

Rajipah Osmanratio

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

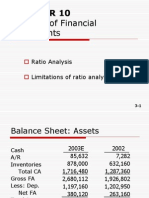

Ratio Analysis

-Relationship between items or groups of items in the financial statement.

-What is financial statement?

Income statement

Balance sheet

-expressed in terms of another figure

-mathematical yardstick- measures the relation ship between two figures

I

Balance Sheet Ratios:

1. Current Ratio

= Current Assets / Current Liabilities Std 2:1

2. Liquid Ratio

= Quick Assets / Quick Liabilities Std 1:1

3. Proprietary Ratio = Proprietors Fund* / Total Assets Std Neither be

too high or too low

*Equity + R.S + Pref+ Surplus - Miscellaneous

4.Stock working capital Ratio:= stock / Working capital

Std 1:1

Higher ratio indicates weak working capital

5. Capital Gearing Ratio = Fixed income bearing securities /Non fixed income

bearing securities

High geared = fixed interest bearing securities are greater than equity

shareholders fund

Low geared = just opposite to the above Std 1:4

6. Debt Equity Ratio = Long term debts / Shareholders Funds Std 2:1

7. Fixed Assets Ratio = Fixed Assets / Long term funds

II. Revenue Statement Ratios:

8.Gross Profit Ratio = Gross Profit / Net Sales 100

9.Operating Ratio = Operating Cost / Net Sales 100

Manufacturing Concern high

Other firms -low

10.Expenses Ratio = Concerned Expense / Net Sales 100

11.Net Profit Ratio = Net profit / Net Sales 100

12.Net Operating Profit Ratio = Operating Profit / Net Sales 100

Operating profit = GP- all expenses including finance

13.Stock Turnover Ratio = Cost of Goods Sold/ Average Stock

Std.: Seasonable based on nature of production

III Combined/ Composite Ratios:

14. Return on Capital Employed = NPBIT / Capital Employed 100

-indicate the management efficiency

- productivity of capital utilized

- overall efficiency.

15. Return on Proprietors Funds = NPAT / Proprietors Funds 100

16.Return on Equity Share capital = NPAT-Pref.Dividend / Equity share capital

17.Earnings per share = NPAT- Pref. Dividend / No of Equity Shares

18.Dividend / Payout Ratio = Divi. Per Equity share / EPS

19.Divi. Yield Ratio = Divi. Per share / Mkt price per share

20.Price Earning Ratio = Mkt. Price Per Share / EPS

21.Debt Service Ratio = NPBIT / Interest

( Interest coverage Ratio)

22.Creditors Turnover Ratio = Credit Purchase /Average Accounts Payable

C.P.Period = days/ months in a year / CTR

23.Debtors Turnover Ratio = Credit Sales / Average Accounts Receivable

D.C.Period = days/ months in a year / DTR

24.Fixed Assets Turnover Ratio = Sales / Fixed Assets

25.Total Assets Turnover Ratio = Sales / Total Assets

26.Working Capital Turnover Ratio = Sales / Working Capital

27.Capital Turnover Ratio = Sales/ Capital employed.

You might also like

- Data analysis and company ratiosDocument31 pagesData analysis and company ratiosAnonymous nTxB1EPvNo ratings yet

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocument12 pagesCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085No ratings yet

- Definition of 'Ratio Analysis'Document12 pagesDefinition of 'Ratio Analysis'VikasDoshiNo ratings yet

- Solutions Manual The Investment SettingDocument7 pagesSolutions Manual The Investment SettingQasim AliNo ratings yet

- 2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesDocument5 pages2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesowaishazaraNo ratings yet

- Categories of RatiosDocument6 pagesCategories of RatiosNicquainCTNo ratings yet

- University of Technology, Jamaica Fundamentals of Finance (FOF) Unit 3: Financial Statements AnalysisDocument6 pagesUniversity of Technology, Jamaica Fundamentals of Finance (FOF) Unit 3: Financial Statements AnalysisBarby AngelNo ratings yet

- Cheat Sheet, Ratio Analysis: Short-Term (Operating) Activity RatiosDocument5 pagesCheat Sheet, Ratio Analysis: Short-Term (Operating) Activity RatiosQaiser KhanNo ratings yet

- Chap 3Document5 pagesChap 3Tahir Naeem JattNo ratings yet

- Financial Statements, Cash Flows, and Taxes: Homework ForDocument9 pagesFinancial Statements, Cash Flows, and Taxes: Homework Foradarshdk1No ratings yet

- C 3 A F S: Hapter Nalysis of Inancial TatementsDocument27 pagesC 3 A F S: Hapter Nalysis of Inancial TatementskheymiNo ratings yet

- Ratio Analysis: Dividend Cover Max Div That Could Be Paid Actual DivDocument3 pagesRatio Analysis: Dividend Cover Max Div That Could Be Paid Actual DivSheikh WickyNo ratings yet

- Accumulated Profits Lecture NotesDocument5 pagesAccumulated Profits Lecture NotesAlejandrea LalataNo ratings yet

- Ratio Analysis: OV ER VIE WDocument40 pagesRatio Analysis: OV ER VIE WSohel BangiNo ratings yet

- ASSETS AND LIABILITIES SUMMARYDocument11 pagesASSETS AND LIABILITIES SUMMARYAmelia Butan50% (2)

- FIN621 Final solved MCQs under 40 charsDocument23 pagesFIN621 Final solved MCQs under 40 charshaider_shah882267No ratings yet

- Case #84 Risk and Rates of Return - Filmore EnterprisesDocument9 pagesCase #84 Risk and Rates of Return - Filmore Enterprises3happy3100% (5)

- Ratio AnalysisDocument13 pagesRatio AnalysisKamran Ali AnsariNo ratings yet

- Final - Company Analysis and Stock ValuationDocument57 pagesFinal - Company Analysis and Stock ValuationSaad KhanNo ratings yet

- Asset Allocation (Sharpe)Document28 pagesAsset Allocation (Sharpe)mjvicunaNo ratings yet

- Porter SM Ch. 11 - 3ppDocument53 pagesPorter SM Ch. 11 - 3ppmfawzi010No ratings yet

- ROA and ROEDocument20 pagesROA and ROEPassmore DubeNo ratings yet

- Ratio Analysis FormulaDocument7 pagesRatio Analysis FormulaHozefadahodNo ratings yet

- Return On Assets (ROA) - Meaning, Formula, Assumptions and InterpretationDocument4 pagesReturn On Assets (ROA) - Meaning, Formula, Assumptions and Interpretationakashds16No ratings yet

- RATIO ANALYSIS QUESTIONS FOR MANAGEMENT ACCOUNTING CHAPTERDocument7 pagesRATIO ANALYSIS QUESTIONS FOR MANAGEMENT ACCOUNTING CHAPTERnavin_raghuNo ratings yet

- Cooperative Banking Operations – Credit Management - Ratio Analysis & Break Even AnalysisDocument6 pagesCooperative Banking Operations – Credit Management - Ratio Analysis & Break Even AnalysisNitin SharmaNo ratings yet

- Ch24 Full Disclosure in Financial ReportingDocument31 pagesCh24 Full Disclosure in Financial ReportingAries BautistaNo ratings yet

- Financial Ratios for Capital Structure and Risk AssessmentDocument17 pagesFinancial Ratios for Capital Structure and Risk Assessmentsamuel_dwumfourNo ratings yet

- Evaluating The Performance of An Investment CenterDocument16 pagesEvaluating The Performance of An Investment Centeribrahim toksoyNo ratings yet

- Problems: Third Group Finance-MoellerDocument4 pagesProblems: Third Group Finance-MoellerEvan BenedictNo ratings yet

- Comparative Financial Analysis of Prism Cement and Ambuja CementDocument55 pagesComparative Financial Analysis of Prism Cement and Ambuja Cementsauravv7No ratings yet

- Discussion Questions: Foundations of Fin. Mgt. 6/E Cdn. - Block, Hirt, ShortDocument32 pagesDiscussion Questions: Foundations of Fin. Mgt. 6/E Cdn. - Block, Hirt, ShortElvis169No ratings yet

- Analyzing Financial Ratios of a CompanyDocument35 pagesAnalyzing Financial Ratios of a Companyfrasatiqbal100% (1)

- MAS FS Analysis 40pagesDocument50 pagesMAS FS Analysis 40pageskevinlim186No ratings yet

- Financial Statement Analysis GuideDocument20 pagesFinancial Statement Analysis GuideAashray RjNo ratings yet

- Analyzing Financial Performance of Bata BangladeshDocument54 pagesAnalyzing Financial Performance of Bata BangladeshCarbon_AdilNo ratings yet

- Investemnts Answers To Problem Set 6Document6 pagesInvestemnts Answers To Problem Set 6chu chenNo ratings yet

- MBA711 - Answers To Book - Chapter 3Document17 pagesMBA711 - Answers To Book - Chapter 3noisomeNo ratings yet

- CH 9: General Principles of Bank ManagementDocument45 pagesCH 9: General Principles of Bank ManagementkunjapNo ratings yet

- ADM3352 - Final (Fall 2008)Document10 pagesADM3352 - Final (Fall 2008)Tony536No ratings yet

- Risk and Rates of ReturnDocument22 pagesRisk and Rates of ReturnJollybelleann MarcosNo ratings yet

- UNIT-3: Accounting or Profitability AccountingDocument4 pagesUNIT-3: Accounting or Profitability AccountingVrinda KaushalNo ratings yet

- Warren Adaptasi Edisi 2 - Ch01Document89 pagesWarren Adaptasi Edisi 2 - Ch01RodihAl-BatawiehNo ratings yet

- Nse Research Analysis 2020Document53 pagesNse Research Analysis 2020Anuj ThapaNo ratings yet

- FM StudyguideDocument18 pagesFM StudyguideVipul SinghNo ratings yet

- Analyzing financial statements of Kingston, IncDocument5 pagesAnalyzing financial statements of Kingston, Inclucano350% (1)

- Chapter 23 Ratio Analysis: 1. ObjectivesDocument26 pagesChapter 23 Ratio Analysis: 1. Objectivessamuel_dwumfourNo ratings yet

- CH02 ProblemsDocument10 pagesCH02 ProblemsHaley Ann Martens100% (1)

- Viney7e SM Ch06Document16 pagesViney7e SM Ch06eternitystarNo ratings yet

- Financial Ratio's ComentsDocument7 pagesFinancial Ratio's ComentsradislamyNo ratings yet

- Fin 310 Lecture 5 - Risk & Return Diversification Portfolio Theory CAPM APTDocument92 pagesFin 310 Lecture 5 - Risk & Return Diversification Portfolio Theory CAPM APTYaonik HimmatramkaNo ratings yet

- Risk and Return 1-1Document13 pagesRisk and Return 1-1hero66No ratings yet

- KSE 100 Executive Summary of CFA Level 1 reading on Security Market IndexesDocument6 pagesKSE 100 Executive Summary of CFA Level 1 reading on Security Market IndexesRana HaiderNo ratings yet

- W 10 Midterm1 SolutionDocument13 pagesW 10 Midterm1 SolutionSehoon OhNo ratings yet

- Chapter 2 Lecture Notes: Consolidation of Financial Information - Date of AcquisitionDocument7 pagesChapter 2 Lecture Notes: Consolidation of Financial Information - Date of AcquisitionAbraham Maharba BaezaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- 13 - Manufacturing Resource Planning: Dr. Ron Tibben-LembkeDocument67 pages13 - Manufacturing Resource Planning: Dr. Ron Tibben-LembkeHCL222111No ratings yet

- International Harmonization of Financial ReportingDocument8 pagesInternational Harmonization of Financial ReportingRajipah Osman100% (1)

- The Convergence To IFRS - Reasons, Implications, Applicability, and ConcernsDocument10 pagesThe Convergence To IFRS - Reasons, Implications, Applicability, and ConcernsRajipah OsmanNo ratings yet

- Asean 1Document25 pagesAsean 1Rajipah OsmanNo ratings yet

- Adam ZakariaDocument28 pagesAdam ZakariaRajipah OsmanNo ratings yet

- Adam ZakariaDocument28 pagesAdam ZakariaRajipah OsmanNo ratings yet

- Translation Methods: - Current/Noncurrent Method - Monetary/Nonmonetary Method - Temporal Method - Current Rate MethodDocument29 pagesTranslation Methods: - Current/Noncurrent Method - Monetary/Nonmonetary Method - Temporal Method - Current Rate MethodRajipah OsmanNo ratings yet

- Nguyen Thi Phuong ThaoDocument114 pagesNguyen Thi Phuong ThaoRajipah OsmanNo ratings yet

- Need For Positive Self-Image and Respect and RecognitionDocument5 pagesNeed For Positive Self-Image and Respect and RecognitionRajipah OsmanNo ratings yet

- ISA705Document25 pagesISA705Rajipah OsmanNo ratings yet

- Nguyen Thi Phuong ThaoDocument114 pagesNguyen Thi Phuong ThaoRajipah OsmanNo ratings yet

- Audit Sampling: IS IS IS ISA A A A 530 530 530 530Document16 pagesAudit Sampling: IS IS IS ISA A A A 530 530 530 530Gan Tzer PiauNo ratings yet

- ISA320Document11 pagesISA320Rajipah Osman0% (1)

- Asean 2Document140 pagesAsean 2Rajipah OsmanNo ratings yet

- ISA700Document28 pagesISA700Rajipah OsmanNo ratings yet

- Accounting Theory Development in MalaysiaDocument24 pagesAccounting Theory Development in MalaysiaRajipah OsmanNo ratings yet

- What is Corporate Governance and Why Does it MatterDocument34 pagesWhat is Corporate Governance and Why Does it MatterHarry PariharNo ratings yet

- Freeleansite - The Kaizen Attitude 2 PgsDocument3 pagesFreeleansite - The Kaizen Attitude 2 Pgskishanth1985No ratings yet

- Asian CrisisDocument8 pagesAsian CrisisRajipah OsmanNo ratings yet

- 13 - Manufacturing Resource Planning: Dr. Ron Tibben-LembkeDocument67 pages13 - Manufacturing Resource Planning: Dr. Ron Tibben-LembkeHCL222111No ratings yet

- Ucd Seminar DirectorsDocument15 pagesUcd Seminar DirectorsRajipah OsmanNo ratings yet

- Barney EmeryDocument2 pagesBarney EmeryRajipah OsmanNo ratings yet

- Ratio Analysis FormulaDocument2 pagesRatio Analysis FormulaRajipah OsmanNo ratings yet

- Accounting Theory Development in MalaysiaDocument24 pagesAccounting Theory Development in MalaysiaRajipah OsmanNo ratings yet

- FELDADocument93 pagesFELDACj Lee100% (2)

- Control of international joint ventures: an integrative perspectiveDocument53 pagesControl of international joint ventures: an integrative perspectiveRajipah OsmanNo ratings yet

- Improve SME Batik Company PerformanceDocument2 pagesImprove SME Batik Company PerformanceSyafika SuhaimiNo ratings yet

- Ucd Seminar DirectorsDocument15 pagesUcd Seminar DirectorsRajipah OsmanNo ratings yet

- Basic DefinitionsDocument4 pagesBasic DefinitionsRajipah OsmanNo ratings yet

- Music DepartmentDocument21 pagesMusic DepartmentRajipah OsmanNo ratings yet