Professional Documents

Culture Documents

Agency Collateralized Mortgage Obligations

Uploaded by

Wilmar Laforga Cimatu0 ratings0% found this document useful (0 votes)

7 views2 pagesSummarized.

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSummarized.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesAgency Collateralized Mortgage Obligations

Uploaded by

Wilmar Laforga CimatuSummarized.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

AGENCY COLLATERALIZED

MORTGAGE OBLIGATIONS

Resulting securities when the

cash flows of pools of mortgage

pass-through securities are

redistributed to different bond

classes.

NONAGENCY MBS

Represents MBS issued other

than Ginnie Mae, Fannie Mae,

and Freddie Mac.

Issued by conduits of:

Key innovations in CMO market

1. Sequential-Pay Tranches

2. Accrual tranches

3. Planned Amortization Class

Bonds

PLANNED AMORTIZATION CLASS

TRANCHES

Prepayments are within

specified range.

Cash flow pattern is known.

Greater predictability of the

cash flows.

Has par value

Investors prefer fast

prepayments.

Inverse relationship

to interest.

1. Commercial Banks

2. Investment Banking Firms

3. Entities not associated with

either CB or IBF

Credit Enhancement

Credit support for

Nonagency CMO

Non-PAC classes

Companion

Bonds/support

AGENCY STRIPPED MORTGAGEBACKED SECURITIES

Alters the cash flow division of

mortgage pass-through.

CLASSES

1. Interest-Only Class or IO

Class

Receives only

interest

No par value

Investor prefers slow

prepayments

Direct relationship to

interest.

2. Principal-Only Class or PO

Class

Receives only

principal

Needed to

absorb

expected

losses from

underlying

loan pool

due to

defaults.

Four forms of Credit Enhancement:

1. Senior-subordinate structure

2. Excess Spread

The interest from the

collateral that is not

being used to satisfy (i.e.,

the interest payments to

the tranches in the

structure) and the fees

(such as mortgage

servicing and

administrative fees).

3. Overcollateralization

Excess over liabilities

Can absorb losses

4. Monoline insurance

An insurance which only

provide financial

guarantees.

You might also like

- Title LJKHKHDocument1 pageTitle LJKHKHWilmar Laforga CimatuNo ratings yet

- Fitness Filipino TrainersDocument4 pagesFitness Filipino TrainersWilmar Laforga CimatuNo ratings yet

- ,XMXN, NDocument1 page,XMXN, NWilmar Laforga CimatuNo ratings yet

- Title: HeadingDocument1 pageTitle: HeadingWilmar Laforga CimatuNo ratings yet

- Title HFHGDocument1 pageTitle HFHGWilmar Laforga CimatuNo ratings yet

- Title L KDSLFJLDocument1 pageTitle L KDSLFJLWilmar Laforga CimatuNo ratings yet

- Title 1FNDocument1 pageTitle 1FNWilmar Laforga CimatuNo ratings yet

- Title 4Document1 pageTitle 4Wilmar Laforga CimatuNo ratings yet

- G ADocument3 pagesG AWilmar Laforga CimatuNo ratings yet

- Title 8Document1 pageTitle 8Wilmar Laforga CimatuNo ratings yet

- Title 6Document1 pageTitle 6Wilmar Laforga CimatuNo ratings yet

- Title 7Document1 pageTitle 7Wilmar Laforga CimatuNo ratings yet

- Title 8Document1 pageTitle 8Wilmar Laforga CimatuNo ratings yet

- Title 3Document1 pageTitle 3Wilmar Laforga CimatuNo ratings yet

- Title 5Document1 pageTitle 5Wilmar Laforga CimatuNo ratings yet

- Title: HeadingDocument1 pageTitle: HeadingWilmar Laforga CimatuNo ratings yet

- Title 2Document1 pageTitle 2Wilmar Laforga CimatuNo ratings yet

- G ADocument3 pagesG AWilmar Laforga CimatuNo ratings yet

- Get Started Right AwayDocument3 pagesGet Started Right AwayWilmar Laforga CimatuNo ratings yet

- Statement of The ProblemDocument1 pageStatement of The ProblemWilmar Laforga CimatuNo ratings yet

- PartnershipDocument27 pagesPartnershipRomel Gregg TorresNo ratings yet

- Beam Design Formulas With Shear and MomentDocument20 pagesBeam Design Formulas With Shear and MomentMuhammad Saqib Abrar100% (8)

- Statement of The ProblemDocument1 pageStatement of The ProblemWilmar Laforga CimatuNo ratings yet

- AustraliaDocument3 pagesAustraliaWilmar Laforga CimatuNo ratings yet

- IBALOIDocument38 pagesIBALOIWilmar Laforga Cimatu72% (29)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Soal PPMDocument3 pagesSoal PPMpresti.dewi.intan-2021No ratings yet

- Aperon Real Estate Services: IndiaDocument6 pagesAperon Real Estate Services: IndiabhavikkbNo ratings yet

- Finance Ratios of ToyotaDocument4 pagesFinance Ratios of ToyotaMaryam KhalidNo ratings yet

- Memo in Support, Shawn RiceDocument30 pagesMemo in Support, Shawn Riceajeocci100% (1)

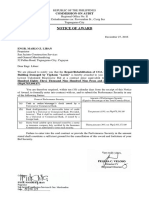

- NOA 12272016 San Jacinto ConstDocument1 pageNOA 12272016 San Jacinto ConstMarky MaligmatNo ratings yet

- FSA Ch13 Bamber PDFDocument50 pagesFSA Ch13 Bamber PDFThameem Ul AnsariNo ratings yet

- Shareholder's EquityDocument31 pagesShareholder's EquityAmmie Lemie100% (2)

- Investment and Portfolio Chapter 1Document24 pagesInvestment and Portfolio Chapter 1MarjonNo ratings yet

- Capstone Round 3Document43 pagesCapstone Round 3Vatsal Goel100% (1)

- Market EfficiencyDocument32 pagesMarket Efficiencyrobi atmajayaNo ratings yet

- Vishwas's ProjectDocument71 pagesVishwas's ProjectRAMJI VISHWAKARMANo ratings yet

- Mutual Funds ProjectDocument89 pagesMutual Funds Projectharini67% (3)

- 2017 Al Accounting Marking Scheme Sinhala Medium Alevelapi. Com PDFDocument25 pages2017 Al Accounting Marking Scheme Sinhala Medium Alevelapi. Com PDFIma LiyanageNo ratings yet

- Trimegah FN 20170911 Digital - E-Commerce PerformanceDocument13 pagesTrimegah FN 20170911 Digital - E-Commerce PerformanceAnonymous XoUqrqyuNo ratings yet

- To Download The TCPro Application-1Document42 pagesTo Download The TCPro Application-1Shahrizan Abdul RahmanNo ratings yet

- Chartians Thread TivitikoDocument8 pagesChartians Thread TivitikoPawan ChaturvediNo ratings yet

- Accounting Theory - Revenue RecognitionDocument5 pagesAccounting Theory - Revenue RecognitionHeather Hudson100% (1)

- Ni Hsin - Annual Report 2019Document116 pagesNi Hsin - Annual Report 2019Goh Zai PengNo ratings yet

- Daftar Akun Toko Harum RotiDocument2 pagesDaftar Akun Toko Harum Rotisusanti agustinaNo ratings yet

- UTI MF Common Application FormDocument32 pagesUTI MF Common Application Formrkdgr87880100% (1)

- Travel Insurance Final Project Yash NaikDocument57 pagesTravel Insurance Final Project Yash NaikVedant Mahajan80% (5)

- RM Gtu TheoryDocument4 pagesRM Gtu TheoryAtibAhmedNo ratings yet

- Differences Between Trading and NonDocument2 pagesDifferences Between Trading and NonEdcel Joy Fernandez Zolina100% (1)

- Chapter 8Document4 pagesChapter 8rcraw87No ratings yet

- Export Overdues Export Overdues: Prepared By: Hina MukarramDocument24 pagesExport Overdues Export Overdues: Prepared By: Hina MukarramAnonymous NM8Ej4mONo ratings yet

- Vseed Capital Partners Overview of Vseed Capital's Micro-Venture StrategyDocument3 pagesVseed Capital Partners Overview of Vseed Capital's Micro-Venture StrategyGordon ComfortNo ratings yet

- GWSB Graduate Resume Template: Finance - Basic Format: EducationDocument1 pageGWSB Graduate Resume Template: Finance - Basic Format: Educationmikewang001No ratings yet

- Complaint Against Blue Ocean CapitalDocument19 pagesComplaint Against Blue Ocean CapitalthecryptoupdatesNo ratings yet

- Stamp Dury ManualDocument320 pagesStamp Dury ManualPeter James MacGregorNo ratings yet

- Exchange Rates ExercisesDocument8 pagesExchange Rates Exercisesarupkalita_aecNo ratings yet