Professional Documents

Culture Documents

M Part I Quicksheet V

Uploaded by

Vaibhav Goyal0 ratings0% found this document useful (0 votes)

44 views6 pagesFRM P1

Original Title

2011.FRM.part.I.quicksheet.V

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFRM P1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

44 views6 pagesM Part I Quicksheet V

Uploaded by

Vaibhav GoyalFRM P1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

PART 1_ SCHWESER’

FOUNDATIONS OF RISK

Nel ae

Risk and Return of Portfolios of

Risky Assets

Fora portfolio of I securities, the expected

portfolio return is

ren)

The variance of recurs for a portfolio of evo

risky securities isnot simple weighted average

of the variances ofthe wo securities. Te depends

on how the returns on the securities move

together, which is measured by the covariance of

the reruns on the two securities.

of = who} + who} +20 qmgCovRy Ry)

EIRp)

since cottelation equals = py,

vatiance can alo be writen as

of = whok + whoh + 2WawpPA.BOAoR

Diversifiable and Systematic Risk

‘The part ofthe volatility of a single security’

returns that i uncorrelated with the volaticy

ofthe market porfli is that secuiy’s

dlvesfable risk,

‘The part ofan individual security’ risk that

arises because ofthe postive covariance of that

security's reeuras with overall market returns is

called its systematic rik

A standardized messue of systematic tsk is bet

ber = CMB aD)

oe

Capital Asset Pricing Model (CAPM)

In equltvium al investors hold a porfalio

of sky ase that has the same weights a the

market portfolio, The CAPM is expressed in the

equation of the security market line (SML). For

any single security of portfolio of securities, the

‘expected rerum in equilibrium i=

E{R))=Rp + beta ERyq)—Re]

CAPM Assumptions

"Investors seco maimize the expected uty

cf thei wealth athe end ofthe psig, and all

inveorshave th same invenment horizon.

Investors atk wen

Investor only consider the mean and standard

deviation of rer (which impli astume the

ase run ar normaly disbuted).

+ Tver can borrow and lend a the ame fie

Investors have the same expectations concerning

+ Thereate neither tres nor trnacions cos, and

ase at infinitely vile. This often sefered

toss esc martes”

Price and Quantity of Risk

“The sk premium of an asset is [E(Ry) ~ Ry.

‘The quantity of risks 3. eo

‘The price of tisk isthe market risk premi

(ER -Ry)

Firm Value Using CAPM

firm cash low

T+ CAPM rere

current value of equity =

If the im reduces ite systematic tsk though

financial markers, the decrease in cashflows (the

‘hedging costs) will be just offset by the lower

required rate of return, and the value of the firm

is unchanged,

‘Measures of Performance

‘The Treynor measure is equal ro the risk

premium divided by besa, or systematic risk:

‘Treynor measure = | (Rr) Re

%

“The Sharpe measure i qual tthe risk

premium divided by the standard deviation, or

‘al risk:

‘The Jensen measure (a. Jensen alpha or just,

alpha) isthe ase exces rerrn over the return

predicted by the CAPM:

Jensen measure =

cap =E(Rp) ~ (Ry +89(E(Ry) Rel)

‘The information ratio i esenilly the alpha of

the managed pordolio slave its benchmark

divided by the tracking enor.

ip — [ERE

‘wackingerot

‘The Sorin ratio is similar ro the Sharpe

rato except we replace the rk Fie rate with a

minimum accepabl recurn, denoted Rand

we replace the standard deviation with a ype of

semistandard deviation.

Sorin ratio = ERP) = Rain

‘emi-standard devistion

Arbitrage Pricing Theory (APT)

‘The APT assumes that returns can be modeled

with a mulkifcror regression model ofthe

following form:

Ry =RptXqy Xb; +--+ Kg Xby tay

Factor exposure for stock

earn for factor &

iosyncrati return for stock

‘The APT defines the structure of returns but

does not define which factors should be used in

the model. The CAPM is special case of APT

with only one factor exposure—the market risk

premium.

Case Studies

‘Metalgeselichfe:shore-serm futures contacts

‘used to hedge long-term exposure inthe

pevroleum matkes stack-and-rll hedging

strategy; marking to market on futures caused

hhuge cash flow problems.

Sumitomo: trader attempted to corner the copper

‘marker by buying larg quantities of physical

copper and log futures positions copper prices

plunged, causing huge loses; lesson isthe lack

of operational and risk controls chat allowed this

scheme to go undetected.

Long-Term Capital Management: bedge fund

‘that used relative value stratepes with enormous

amounts of leverage; when Russia defaulted on

its debt in 1998, the increase in yield spreads

caused huge loses and enormous cashflow

problems from realising masking wo market

losses: lesions include lack of diversification,

model risk, leverage, and funding and trading

liquiiry risks

Barings: rogue tradet, Nick Leeson, took

speculative derivative positions (Nikkei 225

atures) in an attempt to cover trading loses,

Leeson had dual responsibilities of trading and

supervising setlement operations allowing him

to hide trading loses lessons include separation

of duties and management oversight.

Drdale Sect: borrowed $300 million in

tuasecured funds from Chase Manhattan by

exploiting a law inthe system for computing

the value of collateral

Kidder Peabods: Joseph Jet, reported substantial

artificial profits after the fake profits were

‘detected, $350 million in previously eported

fins had wo be reversed.

Allied Irish Bank: acusrency wade, John

Rasnak, hid $691 million in loses; Rusnak

bullied back-ofie workers into not following-

up on trade confirmations for fake trades

Bankers Tru: developed derivative sructures

that were intentionally complex in aped phone

‘convenations sta bragged about how badly

they fooled cen.

Enterprise Risk Management

+ Integrated risk management at opposed to

managing individual risk separately

+ Big-picrure approach that postively impacts

decision making throughout the organization

‘+ ERM famewor coves four types of isk

(1) hazard risk, (2) financial isk, (3) operational

risks, and (4) seg ks.

Role of Risk Management

1. Assesall rks faced bythe frm.

2. Communicate thes sks to risk-taking

decision makers

3. Monitor and manage these rss

‘Objective of risk management isto recognize

that large loises ae posible and to develop

contingeney plans that deal with such loses if

they should aca

GARP Code of Conduct

‘The Code of Conduct es forth principles

seated o ethic behavior within the

agement profesion, I sree ethical

behavior inthe following aes:

Principles

1, Profesional inepriy and ethical conduct.

2, Confit of ners

3. Confidential

Professional Standards

1. Fundamencl responsibil.

2 Adherence wo hex practices

Violtions ofthe Code of Condit may result

in temporary suspension or permanent removal

from GARP membership. In addition, velations

‘could lead to 3 revocation ofthe right to we the

FRM designation

CAULEY Ain)

Expected Value

‘The expected vale is the weighted average of

the posible outcomes ofa rnd viable,

whee the weights ate che probabliies that the

outcomes will occur.

EO) =

Plaids; = Pla +P): +. +POo

Variance

The variance provide measure ofthe extent

ofthe dsperon inthe values ofthe random

‘arable sound the mean The square oo ofthe

‘variance is called the standard deviation.

varianee(X) = E((X —)"]

Covariance

Covariance isthe expected value of the product

‘of the deviations of two random variables from.

their respective expected vals

Cov(Ri Rj) = EMR; ~ ECR )1R; ECR)

‘Sums of Random Variables

IfXand Yaze any random vatiables:

E(X + Y) = E(X) + EY)

1Xand Yareindependent random vasiables

‘Var(X + ¥) » Var(X) + Var(Y)

1Xand Yare NOT independent

‘Var(X + ¥) = Var(X) + Var(¥) + 2 x CoviX.Y)

Simple Random Sampling

+ Selecting a sample otha exch item in che

population as te same likelihood of beng

included inthe sample.

+ The individual items drawn forthe sample

ae known 3s independently and identically

dlisted (iid) random variables,

+ Sampling cor it the difference beeen 3

sample sai and is coesponding population

parameter.

Desirable Properties of an Estimator

+ An unbiied estimator is one for which the

expected vale ofthe extimator sual the

parameter you ae tying to cximate,

+ An unbiased eximaoris also efcienif the

variance of it sapling disibaton i smaller

than ll the other unbiased estimator ofthe

parameter you are tying 0 eximat

+ Remain eximator sone for which the

accuracy ofthe parameter eximate increases 8 the

sample sie increases.

Population and Sample Variance

‘The population variance is defined as the

average of the squared deviations from the mean.

‘The population standard deviation isthe square

108 a the population variance

‘

So -w?

=

‘The sample variance, i the measure of

dispersion cha applies when we ae evaluating

4 sample of» observations from a population.

Using a— 1 instead of nin the denominator

impro he nil rope oan

Qa

Skewness and Kurtosis

Skewness, or skew, refers tothe extent t0 which

a distbution i noe symmetrical. The skewness

oF normal distribution sequal to zero.

1A pitied skewed ssbution i characte by

many utes in the uppe eon, right

+ A regal seved dsbuton has

0

Tiled tea: es whether valu is diferent

fiom another value. For example

Hy y= Overs Hy we

‘Type I and Type II Errors

“Typed err Rejection ofthe nul hypothesis

when iis actualy tre. The significance lee is

the probability of making a Type lear

Type Il exo. Flue eject the null

hypothesis when itis actualy fale. The power

4 tris one minus the probaly of making a

Typell eno.

‘The Binomial Distribution

Evaluates random variable with wo posible

outcomes ove a sete of wal. The probability

of succes on ech ial equal:

po =

{umber of ways to choot from a) — p)"*

Fora binomial nndom varie:

expected value= np

vafnee = mp(l—p)

‘The Poisson Distribution

Poisson random variable X ees to the number

of saccees per unit. The parameter lambda (X)

refers vo the average numberof success per

unt For the disbucon, both ee mean and

vatiance are equal tothe paramett

Mem

PX=2)=

Simple Linear Regression

YinB,+B,xX,+6,

whet:

Y, = dependent or explained variable

X, = independent or explanatory variable

8, = imecep coef

B= slope coefcene

Total Sum of Squares

Fo the dependent viable in a represion mode,

theres total sm of quaes (TSS) around the

sample mean,

total sum of quares =

explained sum of squares +

sum of squared residuals

TSS = ESS «SSR

Dou De-W Dou

Coefficient of Determination

Represented by R?, itis a measure of the

scan esa ga

pn ESS

Ts

ethan ete serene

of isc cation octane (errs X

tnd, te lon poe ee

eve

Linear Regression Assumptions

* Alina relatonsip cts beween the dependent

tnd te independen able.

+ Theindependent vale is uncoreltd withthe

+The expected vale ofthe ror emis,

+ The vatane of he ror em constant forall

independent vals

+ No seal conraton ofthe eor ems.

+ The mode is corey specified (does nor omit

variables)

Regression Assumption Violations

ecrrkedsict occurs when the variance ofthe

revi not the same acros all observations in

the sample

‘Mukiclineeriy refers tothe condition when two

cor more ofthe independent variables, o linear

combinations ofthe independent variables, in

multiple regression ae highly corelated with

cach other.

Seal corlavion refers to the seston in which

the residual terms are correlated with one another.

Standard Error of Estimate (SEE)

Measuces the degre of varisility ofthe staal

Yaalues relative ta the estimated Y-vahes from

4 regression equation. The SEE gauges the “t"

ofthe regression line. The smaller che standard

‘ero; the better the fi

‘Multiple Linear Regression

Asinple egesions the two-variable regesion

with one dependent variable, Y, and one

independent vaiale, X.A multivariate mreaion

has more than one independent variable

9 +B, XX +B) Xp +E,

‘The F-statistic

“The Ftatisicallows fr the vesting ofthe joint

hypothesis that multiple slope coefficients equal

‘ero, Ie can be calculated 35:

Adjusted R-Squared

“AdjnedR? i acd wo analyze the importance of

fan added independent variable ro a epresion,

adjusted R?=1= = R?)

ak

EWMA Model

‘The exponentially weighted moving average

(EWMA) model assumes weights decline

exponentially back through time. This

sumption reals in a specific relationship for

variance in the mode:

of =X + 0h,

Soo Sasi

(Gemecn so andone)

High values of \ will minimize the effec of daily

percentage returns, whereas low vals of wil

tend wo increase the efecto daly peeenage

recuns on the cutentvolaity estimate

ARCH Model

AGARCH(,1) model incorporates the most

recent esimates of variance and squared return,

bt also a variable chat accounts for lange-eun

average level of variance.

oh =u tard, +Boh.4

‘a. = weighting on previous period's return

weighting on previous volatility estimate

weighted long-run vatiance

long-run average variance

+8<1 for stability

i-a-6

“The EWMA is nothing othe than a speci case

of GARCH(1.) volatility proces, wich = 0

ae l-dvandB =X

The sum a+ is called the perisenc, and ifthe

‘model isto be stationary overtime (with evesion

to the mean), che sum must be les han ve

Monte Carlo Simulation

Sup I: Choose a stochastic proces and it

paramcten (eg, an approximation w

Brownian motion),

‘Sup 2: Generates pseudosequence of random

‘aviables (using aandom number

generator oF bootstrapping) and use these

inputs to the model simulate price

path

‘Sue 3 Calelae thease value foe this price pach

at the end ofthe investment horizon

Sec 4 Rn lage numberof rations of steps

2and

aL VE EU Ce Ly

PRODUCTS

Futures Market Participants

“Hedge lock-in a fined pice in advance,

Spent: accept the pice sk hat hedges ate

unwilling to beat,

Avbirageurtsnerested in markt ineciencies

brain less profit

Option and Forward Contract Payofs

‘The payoff on all option tothe option buyers

calculated as follows:

C,=max(0, $,-X)

The price paid for the cll option, Cis feed

toasthe all premium. Thus, he profit othe

option buyer is calcuated a follows

profir= C.-C,

The payoff on a pu option i calculated a follows

Ps max(0,X-5))

“The payoff to a long psion ina forward

contac iscaleulaed a allows

aol =S,

where:

spt price at matutiny

K = dalvery price

Basis

“The bats ina hedge defined athe diffrence

brerween the spor price ona hedged act and

the future pice ofthe hedging instrument

(eg fatuzes contra), When the hedged set

and the se underlying the hedging insument

ate the same, the basis wil be zto at maturity

‘Minimum Variance Hedge Ratio

"The hedge ratio minimizes the variance ofthe

‘combined hedge position. Ths is als the beca of

spor prices with respect co Futures contact prices.

teks ye

*

Hedge Effectiveness

“Measutes the variance thats reduced by

implementing the optimal hedge. This

cffecivness can be evaluated with a coefficient of

determination (R?) term where the independent

variable is the change in futures prices, nd the

dependent variable isthe change in spc prices.

Hedging With Stock Index Futures

porrfolio value

futures price x

ccontrace multiplier

Adjusting Portfolio Beta

If he bea of the capital asset pricing models

used asthe systematic risk measure, chen hedging

bolls down toa reduction ofthe portfolio beta.

# of contracts =

(anger beta— portfolio ber) Pomtolio vale.

undedying asset,

Forward Interest Rates

Forward rates ae interest rates implied by the

spor curve fora specified Future period. The

forward rte berween T, and T, can be calculated

# of contracts= (bp x|

RoI -RiT,

Boh

2 +R -a»{ 3]

7-7

Forward Rate Agreement (FRA)

Cash Flows

‘An FRA ie forward contac obligating two

patties o agre hata cereain interes ete will

apply to principal amount duing a specified

future ime. The cash low of an FRA that

promises the receipe or payment of Ri

‘ash low (if receiving Rx) =

TxiRy “Rx Tt

athflow Gf paving Ry) =

Lx(R-Rq)»(T3— 1)

where

LS principal

annualized rate on L

annualized accual rate

time j expressed in years

Cost-of-Carry Model

Forward pice when underlying asset does not

have cath lowe:

R=Se7

Forward price when underlying asset has cash

flow:

Fy=Gy—DeT

Forward price with continuous dividend yield)

Hast

Forwatd price with storage costs:

Foe asthe

Fy = Gy + UT oF = Se

Forward pice with convenience yield

Rose

Forward foreign exchange rate sng interest rte

parity (RP):

Bose

Arbirge: Remember to buy lo, sll high

“+ If Fy > Sye™, borrow, buy spor, sll forward

today deliver set repay lan tend

IF Fy max(Xe"T —$,,0)

Rules for Exercising American

Options

+ Tes neve opcimal exerci an American cll ona

non-dividend paying ack before is expntion cate

+ American prs can be optimally exerced eaey if

they ae sulin n-the-money

+ An American cll on dividend-paying stock

may be exeried erly ifthe dividend exceeds the

amount of forgone intrest.

Put-Call Parity

p+Sp=ctXe"T

Covered Call and Protective Put

Covered call Long stock pus shor cal

Proective pur Long stock plus long, put. Also

YTM, bond price will be greater

than par value: premium bond.

[feoupon rate < YTM, bond price will be les

than par value: dicount bond

fcoupon rate = YTM, bond price will be equal

to parvalue: par bond.

Dollar Value of a Basis Point

The price value ofa basis point (PVBP) or

the dollar value of basis poine (DVO) isthe

absolute change in bond price from a one bass

point change in yield

DVO1 =| price at YTM — price at YTM, |

YTM, = YTM one basis point bove or

below YTMp

DV01 Hedge with Options

(option value) DVOl(option position) =

‘DVOI(bond postion) x (bond value)

Effective Duration and Convexity

Duration: fst deivave ofthe prcelyeld

relationship; most widely used measure of bond

price volatility the longer shorter) che duration,

the moe (es) sensi the bond! price to

changes in interes rates can be used for linar

estimates of bond price changes.

BV_ay ~BVeay

fective duratios

2BVy Ay

Convevty measure ofthe degree of curvature

(Gecond derivative) ofthe priceyield

relationship; accounts for eror in price change

esimates fom duration. Convexity always ha

favorable impact on bond

BV_g, +BV,,

BVo x Ay?

Bond Price Changes With Duration

and Convexity

percentage bond price change = duration effect +

convexity effect

convexity

AB 1 2

SF =~ uration Ay +5 xconveniyx y*

Bonds With Embedded Options

allable boa issuerhas the right buy back

the bond inthe future a a sex price; as yields fal,

bond is likely eo be called: prices wll se ata

decreasing rate—negative convey

Putable bend: bondbolder has the right to sll

bond back tothe issuer at a set pric.

Binomial Option Pricing Model

‘A one-step binomial mode is best described within

aurworstate world where the price of a stock wil

either go up once or down once, and the change

will occur one step ahead atthe end of the

holding petiod

Inthe tae-peried binomial model and mult

petiod models, the tree is expanded to provide for

a greater numberof potential outcomes

Siep 1: Calealate option payofls tend in all sates.

‘Siep 2 Calculate option Vales using risk-neutral

probabilities.

sizeof up mov

size of down move =D

3

©" U-D

Sup 3: Discount ro today wsing rikfie rate

Black-Scholes-Merton Model

XNG))—XeFTNG,)

HN (-d2)—S)Nd)

S+fet05xo%fer

oxiT

time to maturity

asset price

cereise price

cfree rate

stock return volailicy

cumulative normal probability

ele: estimates the change inva for an option

for aonc-uni change in stock pric.

+ Call deka berweenO and +1; nese as tok

+ Cal del eer 0 for faroueof the money lls

lose to 1 for dep inthe-money ells

+ Purdetaberween =I and Ot ineresies fom —1 100

as rock rice increase

+ Pardee one 0 for fr ou-ofhe-money puts

close t~1 for deep in-the money pus.

+ The deka of forward contact equal 1

1+ The dla of furore contrac is gual 0

+ When the weyng ae pay a dividend the

dela mus be adja dividend yi xi,

dela ofl equal ex N(), dof pur equals

ex IN(d) =I, dla of forward equa and

dela cf fires equal €,

Ther sie decay change in value ofan option

fora one unt change in time; mos negative

when option is at-the-money and dose to

cxpiation.

Gama ate of change in dle underlying

crock price changes largest when option is aahe-

sone

Vege: change in value of an option fra one-unit

«hang in voaily legs when option i a-

themoney ose oO when option i deep in- or

utofthe- money.

‘Bbe:sestvy of options pric to changes inthe

tsk ate; large for in-the money options

Delta-Neutral Hedging

+ To comple hedge ong ocho cal

poston, purchase sare of wack qual wo deka x

umber of options sod.

Only appropriate fr small change in the value of

the undedying ase.

Gama can correct hedging err by protecting

span large moverents a set pc.

Garant potions ae ected by entching

ortolo gamma with an ofeting optom

postion.

‘Value at Risk (VAR)

Minimum amount one could expect wo oe with

a given probably over a specif peiod of time.

VAR(X%)= 2390

Use the square 0 of ime to change daly 0

‘monthly or annual VAR

VAR(X®) an = VARCKY dy VF

VAR Methods

‘The delta-normal method (a.k.a. the variance-

covariance method for estimating VAR requires

the astumption of «normal dtibution, The

rncthod ules the expected return and standard

deviation of eeurns

“The historical simulation meted for eximating

‘VAR uses historical dia or example, 0

calealte the 5% daily VAR, you accumulate a

numberof pst daly reruns, rank the retune

from highest to lowest, and then identify the

lowest 59% of rer

“The Monte Care simulation method lee

co computer sofware that generates many

posible outcome from the disribuion of

Inputs specified by the wer. All ofthe examined

portfolio resume wil form a dissibuion, which

vil approximate the noomal disbution, VAR i

then eluted inthe sme way a withthe dlt-

oral method

Stress Testing.

YAR tel the probably of exceeding given loss

‘but fails to incorporate the possible amount of a

Jos that esl from an exteme amount.

Se eng complements VAR by providing

information about the magnitude of loses that

‘may oscur in extreme market conditions

Expected Shorefall (ES)

* Arrage or expected vale fl lowes greater han

the VAR Ely > VAR

+ Popular easier epor along with VAR.

+ ESis alo known as conditional VAR or expected

sai los

+ Unlike VAR, ES has the bili to sai the

propery of subadeiiiy.

Linear vs. Nonlinear Derivatives

* A detvative i decibed elmer when the

‘eationhip eoween an undeying factor

andthe derivate’ vale re near in aaa.

VAR, = AVAR,

+ Anontnarderiratives vale i function ofthe

change in the value ofthe undying se nd is

dependent onthe ate of the undying ase.

Operational Risk

Operational sis defined at: “The rik of direct

and indirect loss resulting from inadequate or filed

ime pea, peopl and eno fom

Operational Risk Capital Requirements

asc indictrepproac: capital charge measured

on a frmwide bts at a percentage of annual gos

+ Stndardized approach banks divide activin

among basis lines capital charge = sum for

cach busines ln. Capital foreach busines line

decrmined with bes factor snd anal gross

+ Advanced measurement approach baaks ws het

own methodologies for aesing operations

fic Capital locations Based on the banks

opertionl VAR.

Loss Frequency and Loss Severity

Operational sk losses ae cased along two

independent dimensions:

Los frequen: the number of losses over specific

time peed (typically one year). Often modeled

with the Pozon dcribaion a diseibution that

‘models random evens)

Loss orig vale of Sania os sured.

‘Ofen modeled with the lognormal distribution

(distribution is asymmetrical and has fat tals).

Classifications of Operational Risk

High frequency low-severty (HFLS) rks occu

feequeney bu resale in small asses.

Low-fiequeny bigh-sevrty (LEHI) sss ate

the greats are of concer for operational rk

managers Because hey are rare, there ide

svilbl data to analyze sch rhs, and their cot

othe frm could be catastopic.

‘Top-Down and Bottom-Up Models

Top-down mode examines aggregite impact

cof operational flrs, macro view: lis on

historia data

+ Advantages simple to ue, not dat intensive.

+ Disadvantages doesnot dtingush berween

HELS evens and LFHS evens cannot dagnose

specie area of wekne; backward looking

PN: 32000730

IsBN-13: 9781427730947

ISBN-10. 1427730046,

9!781427!'730947!

Us. $4940 ©201 Kaplan, in. Al Rights es

Botom-up mode soalyaes si individual

1 eta isioglshes brween HLS events

sand LFHS events can diagnose weds in

procedures and spges cotectins forward

looking

+ Disadvantages: complex and dts nts.

Methods for Hedging Operational

Risk

+ Insurance

SeFinsurance.

+ Desvtive ects

Catastrophe Options and Bonds

Ga options: publly waded; pay linked ro

index (i. underweting oss inthe insurance

industry); spread option that has limited upside.

Cat bonds bond contract with embedded

‘options cae can be rigged by internal events,

‘external events, othe value ofan index.

Internal Credit

Acche pine approach goal isto predic he cede.

‘quality over a elatvey short hotzon ofa few

months of, more generally, a yest.

Through-the-oele approach: focuses ona

Jonge ime horizon and includes the ects of

forecasted jes.

Contingent Claims Analysis (OCA)

+ Acontngeat chim is any nancial ase whore

fucare ayo depends onthe vale of another

undelyingaset ot proces

+ When dealing with cei rit CCA is commonly

known athe Meron model

+ CCA\isable wo caprate the tue economic risk fa

sovereign enti

Merton Model

+ Valiebasedl model, wher the value of he Bem’

outstanding debt (D) and equity (E) are eq

the vale ofthe Semi ast (V.

Given an eimate of anyewo ofthe hee vals

(V,E,0rD), we know the vale ofthe tied

‘component.

Can be sed to vale the contingent claim on

sovereign’ local currency lblts.

Expected Loss

‘The expected lo (EL) represent the decrease in

value of an asset (portfolio) with a given exposure

subject to a posiive probability of deal.

‘expected loss = exponute xls given default «

probably of default

expected los «adjusted exposute los given

default x EDF,

‘Outstandings and Commitments

Ouztandings (OS) denote the credit extended 9

the borrower through bonds, loans, or receivables

ve.

“The commitment (COM) represents the total

amount che bank is prepared ro lend vo the

borrower (commitment » oustanding + unused

portion of commitment

“adjusted exposure (AB) = OS + wage given defo

COM,

Unexpected Loss

Unexpected los represents the variably of

potential losses and can be modeled using the

definition of standard deviation.

UL= Abx {EDFxafgp + UGD? xobpe

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Choudhry Basis Trade Jul06 LogoDocument13 pagesChoudhry Basis Trade Jul06 LogoJaphyNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

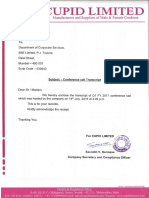

- Conference Call Transcript (Company Update)Document24 pagesConference Call Transcript (Company Update)Shyam SunderNo ratings yet

- V Guide To FX Fowards PDFDocument5 pagesV Guide To FX Fowards PDFVaibhav GoyalNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- FRM Imp PointsDocument3 pagesFRM Imp PointsVaibhav GoyalNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- FRM Exam Preparation Handbook 2012 PDFDocument15 pagesFRM Exam Preparation Handbook 2012 PDFDennis LoNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Micrsoft Excel TrainingDocument19 pagesMicrsoft Excel TrainingdombipinNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 8 Keys Ratios To Look at Before Buying A ShareDocument7 pages8 Keys Ratios To Look at Before Buying A ShareVaibhav GoyalNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- FRM Exam Preparation Handbook 2012 PDFDocument15 pagesFRM Exam Preparation Handbook 2012 PDFDennis LoNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Glossary of Terms Used in Mutual Fund IndustryDocument10 pagesGlossary of Terms Used in Mutual Fund IndustryVaibhav GoyalNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Customer Value in BanksDocument6 pagesCustomer Value in BanksVaibhav GoyalNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Railroads: Indian RailwaysDocument4 pagesRailroads: Indian RailwaysVaibhav GoyalNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Warehouse Receipt LoansDocument4 pagesWarehouse Receipt LoansVaibhav GoyalNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)