Professional Documents

Culture Documents

Tabla ISC

Uploaded by

Melvin LorenzoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tabla ISC

Uploaded by

Melvin LorenzoCopyright:

Available Formats

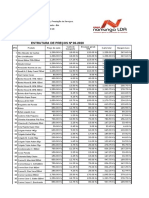

TABLA PARA EL CALCULO DEL IMPUESTO SELECTIVO AL CONSUMO POR VALOR ESPECIFICO

PRODUCTOS QUE CONTIENEN ALCOHOL

Producto Cantida P/Caj

d Cajas

a

Vodka

10,000

8,000

9,000

12,000

20,000

18,000

38,000

42,000

28,000

13,000

14,000

15,000

8

12

12

24

12

36

16

24

12

8

12

12

Grande

Pequea

44,000

48,000

10

20

Wisky

Vino

Ron

Cerveza

Ponche

Licor

Total

Botellas

80,000

96,000

108,000

288,000

240,000

648,000

608,000

1,008,000

336,000

104,000

168,000

180,000

CC

por

Botell

as

1,000

750

700

750

700

175

650

350

700

750

700

750

Total CC

1 Lit

Total Lit Grado 367 Base

(1,000 CC) Vendido Alcohol

LAA

80,000,000

72,000,000

75,600,000

216,000,000

168,000,000

113,400,000

395,200,000

352,800,000

235,200,000

78,000,000

117,600,000

135,000,000

CIGARRILLOS

1,000

80,000

1,000

72,000

1,000

75,600

1,000 216,000

1,000 168,000

1,000 113,400

1,000 395,200

1,000 352,800

1,000 235,200

1,000

78,000

1,000 117,600

1,000 135,000

EN PAQUETE

440,000

960,000

40%

40%

14%

12%

37%

32%

5%

4%

16%

18%

15%

40%

32,000.00

28,800.00

10,584.00

25,920.00

62,160.00

36,288.00

19,760.00

14,112.00

37,632.00

14,040.00

17,640.00

54,000.00

375

Monto

S/ Tabla

498.40

498.40

540.00

540.00

498.40

498.40

540.00

540.00

498.40

498.40

498.40

498.40

50

25

IFICO

ISC Especifico

15,948,800.00

14,353,920.00

5,715,360.00

13,996,800.00

30,980,544.00

18,085,939.20

10,670,400.00

7,620,480.00

18,755,788.80

6,997,536.00

8,791,776.00

26,913,600.00

22,000,000.00

24,000,000.00

You might also like

- Bebidas e Refeições HotelDocument22 pagesBebidas e Refeições HotelManuel TunguimutchumaNo ratings yet

- Cálices Walther Glass oferecem qualidade inigualávelDocument24 pagesCálices Walther Glass oferecem qualidade inigualáveljpmessiasNo ratings yet

- Plano de negócio para produção e venda de iogurte no UíjeDocument35 pagesPlano de negócio para produção e venda de iogurte no UíjeNINÍVIA PAULO NPNo ratings yet

- Catálogo Dayhome FoodService 2023 - 2024 - Google DriveDocument1 pageCatálogo Dayhome FoodService 2023 - 2024 - Google DriveRenan De Souza SouzaNo ratings yet

- Destilação 2017Document11 pagesDestilação 2017Thayse Cavalcante da RochaNo ratings yet

- Tabela CachaçaDocument5 pagesTabela CachaçaVinícius Assis De OliveiraNo ratings yet

- Resumen de ventas y costos de productos en un barDocument2 pagesResumen de ventas y costos de productos en un barMarko MezaNo ratings yet

- Determinação do álcool em volume em bebidas alcoólicasDocument56 pagesDeterminação do álcool em volume em bebidas alcoólicascrislianecamargoNo ratings yet

- Exercício Produção Conjunta IDocument1 pageExercício Produção Conjunta IMarks FFNo ratings yet

- Regulamento Técnico - CachaçaDocument6 pagesRegulamento Técnico - Cachaçaguilherme.patricioNo ratings yet

- Melhor Bar Sertanejo de AtibaiaDocument2 pagesMelhor Bar Sertanejo de AtibaiaGio LxzNo ratings yet

- Destilação EtanolDocument74 pagesDestilação EtanolDaniel FernandesNo ratings yet

- Bebidas aLCOÓLICASDocument6 pagesBebidas aLCOÓLICASgraziela.santos182No ratings yet

- 26 - Lista Precios Sist 23.07.18Document7 pages26 - Lista Precios Sist 23.07.18Miguel RamirezNo ratings yet

- Cardápio GauchoDocument2 pagesCardápio GauchoWarley Nino YuriNo ratings yet

- Vodka Pura Porcentagem de Álcool - Pesquisa GoogleDocument1 pageVodka Pura Porcentagem de Álcool - Pesquisa GooglekikaNo ratings yet

- Cardapio Atual para Bailes 2023Document2 pagesCardapio Atual para Bailes 2023lurdescouvesNo ratings yet

- Cardápio MesaDocument9 pagesCardápio Mesa9vinho DoTTNo ratings yet

- Tablas ISC Alcohol y Tabaco con ventas de productos, impuestos y totalesDocument2 pagesTablas ISC Alcohol y Tabaco con ventas de productos, impuestos y totalesJuanG18No ratings yet

- Lista de produtos com código, descrição, quantidade e custoDocument6 pagesLista de produtos com código, descrição, quantidade e custobernadoNo ratings yet

- Venda CupomDocument1 pageVenda CupomEvânioBatistaNo ratings yet

- 2exercicios Excel 2010 2022 2Document34 pages2exercicios Excel 2010 2022 2Tareca Miau MiauNo ratings yet

- Relatorio abcProdutosVendidos 19 07 2023 09 46Document3 pagesRelatorio abcProdutosVendidos 19 07 2023 09 46GM TabacariaNo ratings yet

- CatalogoDocument53 pagesCatalogoElizabete MartinsNo ratings yet

- Entregas de bebidas e pizzasDocument2 pagesEntregas de bebidas e pizzasHugo CastroNo ratings yet

- ZahilDocument2 pagesZahilAlexandre GuaranaNo ratings yet

- Variedade de cervejas da Läut BeerDocument11 pagesVariedade de cervejas da Läut BeerDairel Dos AnjosNo ratings yet

- CACHAÇA: QUALIDADE E COMPOSTOSDocument25 pagesCACHAÇA: QUALIDADE E COMPOSTOSjoseadelcioNo ratings yet

- Cardápio Beerland Delivery - Abril 2020Document4 pagesCardápio Beerland Delivery - Abril 2020Joel CesarioNo ratings yet

- Firma Namunga preçosDocument16 pagesFirma Namunga preçosRui Dance JūniorNo ratings yet

- Cáculo de Custo Depois Da Limpeza Do ProdutoDocument4 pagesCáculo de Custo Depois Da Limpeza Do ProdutoNádia SantosNo ratings yet

- Lista de precios al mayor con productos de alimentación y limpiezaDocument9 pagesLista de precios al mayor con productos de alimentación y limpiezaPedro GomezNo ratings yet

- Metodos de Análises de SalDocument8 pagesMetodos de Análises de SaldedenincaNo ratings yet

- Indústria da Cachaça em Morro AgudoDocument21 pagesIndústria da Cachaça em Morro AgudoFERNANDA FAGUNDES BRAGANo ratings yet

- Exportacao - Produtos - 2015 09 14 - 10 22 20Document78 pagesExportacao - Produtos - 2015 09 14 - 10 22 20Daniel FerreiraNo ratings yet

- Moqueca e Churrasco no CardápioDocument2 pagesMoqueca e Churrasco no CardápioCristiane Personalizados PersonalizadosNo ratings yet

- Determinação do teor alcoólicoDocument11 pagesDeterminação do teor alcoólicoAbdul Nunes100% (1)

- BEBIDAS23Document4 pagesBEBIDAS23postocaliforniancNo ratings yet

- Lista PreciosDocument34 pagesLista PreciosLB NLNo ratings yet

- STHEFSONDocument4 pagesSTHEFSONsthefson.pinheiroNo ratings yet

- Relatório de Entra e Saída de MateriaisDocument2 pagesRelatório de Entra e Saída de Materiaisnattana kelly dutra gomesNo ratings yet

- Receita Bock Cerveja ArtesanalDocument8 pagesReceita Bock Cerveja ArtesanalNilton RovedaNo ratings yet

- Cardapio 1Document2 pagesCardapio 1dannieli araujoNo ratings yet

- Cardapio Bar Atualizado - OrganizedDocument11 pagesCardapio Bar Atualizado - OrganizedWellington AlencarNo ratings yet

- Teste Excel IntermediárioDocument7 pagesTeste Excel IntermediárioMichael andradeNo ratings yet

- Lista de precios licores y bebidasDocument2 pagesLista de precios licores y bebidasJuanNo ratings yet

- Regulamento fixa padrões de identidade e qualidade para aguardente de cana e cachaçaDocument5 pagesRegulamento fixa padrões de identidade e qualidade para aguardente de cana e cachaçaJaqueline TresoldiNo ratings yet

- A - Pregao N - 7 2005 - 34 - BisDocument7 pagesA - Pregao N - 7 2005 - 34 - BisElias JonasNo ratings yet

- Exercicios de Balanço de EnergiaDocument3 pagesExercicios de Balanço de EnergiaRick MalandilaNo ratings yet

- Código RepsolDocument1 pageCódigo RepsolFernando HidalgoNo ratings yet

- Shopping China Pedro Juan Catalogo Ferias 2011 JulhoDocument5 pagesShopping China Pedro Juan Catalogo Ferias 2011 JulhocbetterNo ratings yet

- Relatorio Dge BAXI 250Document2 pagesRelatorio Dge BAXI 250Carla PereiraNo ratings yet

- Coleção GlamDocument21 pagesColeção GlamFagundes JuniorNo ratings yet

- Lista de precios al mayor con productos de alimentos y artículos de limpiezaDocument9 pagesLista de precios al mayor con productos de alimentos y artículos de limpiezaPedro GomezNo ratings yet

- Destilados AlcoólicosDocument2 pagesDestilados AlcoólicosAkumaaNo ratings yet