Professional Documents

Culture Documents

Break Up - A

Uploaded by

Anuj Pandey0 ratings0% found this document useful (0 votes)

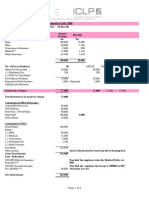

10 views1 pageThis document outlines an employee's compensation package (CTC) on a monthly and yearly basis. The monthly CTC amounts to Rs. 14,759 and includes components like basic pay, HRA, conveyance allowance, special allowance, LTA, medical allowance, and bonus. Rs. 748 is deducted each month as the employee's PF contribution. The yearly benefits include gratuity of 4.81% of the gross salary as per the Act after 5 years of service, totaling to Rs. 1048. The total fixed pay per year is Rs. 15,807 and the total CTC including any variable pay is Rs. 15,807.

Original Description:

fcfgj

Original Title

BREAK UP - A

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines an employee's compensation package (CTC) on a monthly and yearly basis. The monthly CTC amounts to Rs. 14,759 and includes components like basic pay, HRA, conveyance allowance, special allowance, LTA, medical allowance, and bonus. Rs. 748 is deducted each month as the employee's PF contribution. The yearly benefits include gratuity of 4.81% of the gross salary as per the Act after 5 years of service, totaling to Rs. 1048. The total fixed pay per year is Rs. 15,807 and the total CTC including any variable pay is Rs. 15,807.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageBreak Up - A

Uploaded by

Anuj PandeyThis document outlines an employee's compensation package (CTC) on a monthly and yearly basis. The monthly CTC amounts to Rs. 14,759 and includes components like basic pay, HRA, conveyance allowance, special allowance, LTA, medical allowance, and bonus. Rs. 748 is deducted each month as the employee's PF contribution. The yearly benefits include gratuity of 4.81% of the gross salary as per the Act after 5 years of service, totaling to Rs. 1048. The total fixed pay per year is Rs. 15,807 and the total CTC including any variable pay is Rs. 15,807.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Annexure A

COMPENSATION PACKAGE (CTC)

MONTHLY

S.NO.

COMPONENTS

PER MONTH (%age)

PER MONTH

(Amount in Rs.)

BASIC PAY

100%

6236

HRA

50%

3118

CONVEYANCE

25%

1559

SPECIAL ALLOWANCE

25%

1559

LTA

8.33%

519

MEDICAL

8.33%

519

BONUS

20%

1247

TOTAL (A+B+C+D+E+F+G)

237%

14759

PF (Employee's Contribution)

748

NET SALARY (Take Home)

(H-I)

14010

PF (Employer's Contribution)

748

REMARKS

( - Income Tax As Applicable)

YEARLY BENEFITS

L

GRATUITY

TOTAL (K+L)

4.81%

300

FIXED PAY

(Gross Salary) (I+J+M)

15807

TOTAL CTC (Including Variable Pay, As Applicable) (N+O)

15807

As per the Act (Payable After 5 Years)

1048

NOTE :

1. If an employee joins our company in mid of the year (other than starting of the financial year), he / she shall submit Form No. 16 / salary certificate

along with the Tax saving documents to the Finance and Accounts dept for Income Tax calculation purpose. If not submitted income tax may be

deducted based on the same income for full year.

You might also like

- Pay SlipDocument1 pagePay SlipKyle Cruz0% (1)

- Acca f6 Smart Notes Fa19 40 PagesDocument43 pagesAcca f6 Smart Notes Fa19 40 PagesAlex RomarioNo ratings yet

- ESI & PF CalculationsDocument2 pagesESI & PF Calculationsparavind67% (3)

- SalaryDocument66 pagesSalaryFurqan AhmedNo ratings yet

- Tutorial Chapter 8Document3 pagesTutorial Chapter 8fitrieyfiey0% (1)

- Keown Tif 10 FINALDocument18 pagesKeown Tif 10 FINALhind alteneijiNo ratings yet

- The Ultimate DIY BIR Tax Compliance Guide For Freelancers - November 2020 Version - 5 PDFDocument56 pagesThe Ultimate DIY BIR Tax Compliance Guide For Freelancers - November 2020 Version - 5 PDFKathrina BangayanNo ratings yet

- What Is Annualized Withholding TaxDocument7 pagesWhat Is Annualized Withholding TaxMarietta Fragata RamiterreNo ratings yet

- CTC Break-Up PDFDocument5 pagesCTC Break-Up PDFJatinder SadhanaNo ratings yet

- Income Tax Projection Statement As On Mar 14, 2014Document2 pagesIncome Tax Projection Statement As On Mar 14, 2014manotiwaNo ratings yet

- Arindam Das Salary For The Month of July 2008Document4 pagesArindam Das Salary For The Month of July 2008Bala MuruNo ratings yet

- Accounting Business CaseDocument3 pagesAccounting Business Case當真静花No ratings yet

- Salary Breakup Calculator ExcelDocument3 pagesSalary Breakup Calculator ExcelLaksHay JuggyNo ratings yet

- Auto CTC Salary CalculatorDocument1 pageAuto CTC Salary CalculatorSathvika SaaraNo ratings yet

- Intermediate Accounting FormulasDocument2 pagesIntermediate Accounting FormulasBlee13No ratings yet

- Salary Breakup Calculator ExcelDocument3 pagesSalary Breakup Calculator ExcelBabita KumariNo ratings yet

- Offer Letter TaskusDocument9 pagesOffer Letter TaskusAkshay SharmaNo ratings yet

- Examples Salary 2015Document44 pagesExamples Salary 2015Farhan JanNo ratings yet

- S-Curve: The Calculations, Parameters and FormulasDocument32 pagesS-Curve: The Calculations, Parameters and FormulasAlexandros KoutsantonisNo ratings yet

- Annexure V FDSSDocument5 pagesAnnexure V FDSSpmNo ratings yet

- Annual Income Tax Statement For The Financial Year 2013Document4 pagesAnnual Income Tax Statement For The Financial Year 2013Manoj SankaranarayanaNo ratings yet

- Salary1 2022 DisDocument45 pagesSalary1 2022 Disparinita raviNo ratings yet

- Tax Slab RatesDocument12 pagesTax Slab RatesTony JosephNo ratings yet

- Income Tax Calculator - FY 2011-12 (FINAL)Document16 pagesIncome Tax Calculator - FY 2011-12 (FINAL)hamzabashamNo ratings yet

- Income Tax StatementDocument2 pagesIncome Tax StatementgdNo ratings yet

- Compensation Break - Up: Gross RemunerationDocument1 pageCompensation Break - Up: Gross Remunerationmaakabhawan26No ratings yet

- SALARY Theory EnglishDocument17 pagesSALARY Theory EnglishDilip JaviyaNo ratings yet

- Taxation of Employment IncomeDocument7 pagesTaxation of Employment IncomeJamvy Jose FernandezNo ratings yet

- Pay & Leave Specification InformationDocument5 pagesPay & Leave Specification InformationdennisNo ratings yet

- katrinaBlairDirectsVolunteers2011 841141304 - 201112 - 990EZDocument13 pageskatrinaBlairDirectsVolunteers2011 841141304 - 201112 - 990EZuncleadolphNo ratings yet

- Annexes: S/N Description Schedule (TIME) Rates (N) Gross Salary PaymentDocument4 pagesAnnexes: S/N Description Schedule (TIME) Rates (N) Gross Salary PaymentSaheed Olamilekan AdebisiNo ratings yet

- Annexure C ExamplesDocument21 pagesAnnexure C ExamplesLee Ka FaiNo ratings yet

- MR - Vageesh ShuklaDocument8 pagesMR - Vageesh ShuklakittushuklaNo ratings yet

- 21 03 07 Budget Chapter 8Document32 pages21 03 07 Budget Chapter 8Ian KrebsNo ratings yet

- 35 - Salary Slip FormatDocument1 page35 - Salary Slip FormatNeeraj GuptaNo ratings yet

- Form16Document10 pagesForm16anon-263698No ratings yet

- Direct Tax Summary Notes For IPCC JKQK1AK0Document24 pagesDirect Tax Summary Notes For IPCC JKQK1AK0Vivek ShimogaNo ratings yet

- Taxability of Employer's Contribution To An Approved Superannuation Fund Vs NPSDocument7 pagesTaxability of Employer's Contribution To An Approved Superannuation Fund Vs NPSRaviteja GNo ratings yet

- Income Tax Statement Financial Year 2014-2015: Designation NameDocument1 pageIncome Tax Statement Financial Year 2014-2015: Designation NameAnandraojs JsNo ratings yet

- Pay Fixation 4200 To 4600Document5 pagesPay Fixation 4200 To 4600jayakumarbalajiNo ratings yet

- West Hempstead, NY Rotary Foundation IRS 990s, 2011-2013Document39 pagesWest Hempstead, NY Rotary Foundation IRS 990s, 2011-2013Peter M. HeimlichNo ratings yet

- 40 40 Income From Salary BTDocument55 pages40 40 Income From Salary BTkiranshingoteNo ratings yet

- Malaysian Taxation Lecture 2 Employment Income 1Document35 pagesMalaysian Taxation Lecture 2 Employment Income 1Hafizah Mat NawiNo ratings yet

- India Offer Letter 2024-02-07Document9 pagesIndia Offer Letter 2024-02-07jagdishkumawat22576No ratings yet

- Offer Letter: Mr. Lalit SharmaDocument3 pagesOffer Letter: Mr. Lalit SharmaDr. Bhasker Pratap ChoudharyNo ratings yet

- PFRS Updates 2013 PandA (Rodel Marqueses)Document120 pagesPFRS Updates 2013 PandA (Rodel Marqueses)Luzz LandichoNo ratings yet

- Excise Summary 09 10Document4 pagesExcise Summary 09 10KoolmindNo ratings yet

- Arindam Das-20080706 - 1Document4 pagesArindam Das-20080706 - 1Kavish JaggiNo ratings yet

- FORM No. 16Document31 pagesFORM No. 16sebastianksNo ratings yet

- Chapter 8 Solutions Cash Flow Statement: Account ClassificationDocument43 pagesChapter 8 Solutions Cash Flow Statement: Account Classificationmit111217No ratings yet

- Workshop 6 SOL Additional QuestionDocument5 pagesWorkshop 6 SOL Additional Questiontimlee38100% (1)

- CH 2.TaxSalary IncomeDocument13 pagesCH 2.TaxSalary IncomeSajid AhmedNo ratings yet

- Importance of Withholding Tax SystemDocument20 pagesImportance of Withholding Tax SystemJessNo ratings yet

- Income From SalariesDocument19 pagesIncome From SalariesVineeta WadhwaniNo ratings yet

- Annualized Witholding TaxDocument9 pagesAnnualized Witholding TaxShairaCerenoNo ratings yet

- UNIT 2 Income From SalaryDocument146 pagesUNIT 2 Income From Salaryeasy mailNo ratings yet

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNo ratings yet

- Year-End Adjustment NewDocument27 pagesYear-End Adjustment NewKyrzen Novilla0% (1)

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocument42 pages2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- Unit 4 - Inclusions & Exclusions To Gross Comp IncomeDocument8 pagesUnit 4 - Inclusions & Exclusions To Gross Comp IncomeJoseph Anthony RomeroNo ratings yet

- Sbi Cbs Screen Number Fee Type Sbi Cbs Screen Number Sbi Cbs Screen NumberDocument1 pageSbi Cbs Screen Number Fee Type Sbi Cbs Screen Number Sbi Cbs Screen NumberAnuj PandeyNo ratings yet

- Cheap Hotel 300-400 Rs Per Day in DelhiDocument4 pagesCheap Hotel 300-400 Rs Per Day in DelhiAnuj PandeyNo ratings yet

- Seismic ZoneDocument17 pagesSeismic ZoneAnuj PandeyNo ratings yet

- 25 Best Mindfuck Movies That Will Blow Your Mind!Document26 pages25 Best Mindfuck Movies That Will Blow Your Mind!Anuj PandeyNo ratings yet

- Nagda - 3-4Document2 pagesNagda - 3-4Anuj PandeyNo ratings yet

- Gross Domestic Product 5-8Document4 pagesGross Domestic Product 5-8Anuj PandeyNo ratings yet

- Sewing Machine - Wikipedia, The Free EncyclopediaDocument4 pagesSewing Machine - Wikipedia, The Free EncyclopediaAnuj PandeyNo ratings yet

- GRE Word List - 1300 Important WordsDocument9 pagesGRE Word List - 1300 Important WordsAnuj PandeyNo ratings yet

- All Products - Autodesk StoreDocument2 pagesAll Products - Autodesk StoreAnuj PandeyNo ratings yet

- LPTC - Joint Personnel Selection Exam 2014 PDFDocument33 pagesLPTC - Joint Personnel Selection Exam 2014 PDFAnuj PandeyNo ratings yet

- Project On MarketingDocument117 pagesProject On MarketingAnuj PandeyNo ratings yet

- Mis ppt-1Document92 pagesMis ppt-1meragaunNo ratings yet

- Acpa Mix Design PresentationDocument55 pagesAcpa Mix Design PresentationSubodh ChaturvediNo ratings yet

- Project Report: Jiwaji University GwaliorDocument2 pagesProject Report: Jiwaji University GwaliorAnuj PandeyNo ratings yet

- H. Tambunting Pawnshop vs. Commissioner, G.R. No. 173373Document10 pagesH. Tambunting Pawnshop vs. Commissioner, G.R. No. 173373Mae TrabajoNo ratings yet

- Intro To Regular Income TaxationDocument2 pagesIntro To Regular Income TaxationhotgirlsummerNo ratings yet

- Direct Taxation: Study NotesDocument610 pagesDirect Taxation: Study NotesAvneet SinghNo ratings yet

- Preparation of Income Tax Return IndividualDocument2 pagesPreparation of Income Tax Return IndividualFRAULIEN GLINKA FANUGAONo ratings yet

- Calm 20 - Test 2 Twenty-Something ProjectDocument3 pagesCalm 20 - Test 2 Twenty-Something Projectapi-350666556No ratings yet

- Deptals - Docx 1 PDFDocument34 pagesDeptals - Docx 1 PDFJoana MarieNo ratings yet

- Kanga & Palkhivala IT Act 10th Ed Vol I CH 4 Part IDocument119 pagesKanga & Palkhivala IT Act 10th Ed Vol I CH 4 Part IlokeshNo ratings yet

- Fin 623 Quiz # 04 Mega File Solved by AfaaqDocument35 pagesFin 623 Quiz # 04 Mega File Solved by AfaaqShahaan Zulfiqar100% (2)

- Filling Penalties and Remedies CparDocument7 pagesFilling Penalties and Remedies CparGelyn CruzNo ratings yet

- CIR V Solidbank CorporationDocument1 pageCIR V Solidbank CorporationFrancis Ray Arbon FilipinasNo ratings yet

- Business Taxation - Syllabus - BS Commerce - IUBDocument2 pagesBusiness Taxation - Syllabus - BS Commerce - IUBLabib ShahNo ratings yet

- 16 CIR vs. Philippine Daily Inquirer, Inc., (GR No. 213943 March 22, 2017)Document24 pages16 CIR vs. Philippine Daily Inquirer, Inc., (GR No. 213943 March 22, 2017)Alfred GarciaNo ratings yet

- 03 AGS General Principles of Taxation VI C PDFDocument10 pages03 AGS General Principles of Taxation VI C PDFGabriel Jhick SaliwanNo ratings yet

- Questionnaires 1Document143 pagesQuestionnaires 1Renz Joshua Quizon MunozNo ratings yet

- Chapter 8 VDocument28 pagesChapter 8 VAdd AllNo ratings yet

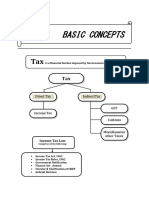

- Basic Concepts: Direct Tax Indirecttax GST Customs Miscellaneous Other Taxes Income TaxDocument227 pagesBasic Concepts: Direct Tax Indirecttax GST Customs Miscellaneous Other Taxes Income TaxRaj DasNo ratings yet

- Term Test-1 SolutionDocument6 pagesTerm Test-1 Solutionlalshahbaz57No ratings yet

- TAX Last Minute by HerculesDocument8 pagesTAX Last Minute by Herculesjanjan3256No ratings yet

- Income From House PropertyDocument24 pagesIncome From House PropertyIMRAN ALAMNo ratings yet

- Oregon Public Employees Retirement System Board Meeting PacketDocument99 pagesOregon Public Employees Retirement System Board Meeting PacketStatesman JournalNo ratings yet

- Madrigal Vs Rafferty G.R. No. L-12287 August 7, 1918Document5 pagesMadrigal Vs Rafferty G.R. No. L-12287 August 7, 1918kim zeus ga-anNo ratings yet

- P4 Taxation New Suggested CA Inter May 18Document27 pagesP4 Taxation New Suggested CA Inter May 18Durgadevi BaskaranNo ratings yet

- Ajit Kumar Panda, Internship ReportDocument63 pagesAjit Kumar Panda, Internship ReportAjit kumar pandaNo ratings yet

- 2018 Tax Case Digests - October 2019Document9 pages2018 Tax Case Digests - October 2019Dean CainilaNo ratings yet

- Declaration - Home Loan (Section 80EE) - 1Document2 pagesDeclaration - Home Loan (Section 80EE) - 1palanivelNo ratings yet

- The 400 Individual Income Tax Returns Reporting The Highest Adjusted Gross Incomes Each Year, 1992-2008Document13 pagesThe 400 Individual Income Tax Returns Reporting The Highest Adjusted Gross Incomes Each Year, 1992-2008GestaltUNo ratings yet

- CPAR Preweek LectureDocument31 pagesCPAR Preweek LectureNoroNo ratings yet